Binance Hits $8.3B Open Interest High—Here’s What It Signals For the Crypto Market

08 Novembre 2024 - 5:00AM

NEWSBTC

Binance, one of the world’s largest crypto exchanges, has achieved

a new milestone as its open interest (OI) surged to an all-time

high (ATH) of $8.3 billion, according to a report by CryptoQuant

analyst Burak Kesmeci. This increase, representing a 10.24% growth

over the past 24 hours, emphasizes Binance’s substantial share of

global crypto futures positions. The surge in OI also highlights

Binance’s influence on market trends, given that it now accounts

for roughly 35% of all open futures positions across all exchanges

globally. The total OI across exchanges, including Binance, reached

$23.3 billion, setting a record in the sector, Kesmeci reveals.

Implications Of Binance High Open Interest To understand what the

increase in Binance open interest means for the crypto market, it

is worth first looking into what the term ‘open interest’ means.

Notably, open interest (OI) refers to the total number of

outstanding contracts in the futures market, encompassing both long

and short positions. A rise in this metric often suggests increased

trading activity and interest, making it a crucial indicator for

market participants. Binance OI Reaches New ATH of $8.3 Billion

“Open Interest across all exchanges—including Binance—stands at

$23.3 billion, marking a new ATH. This means Binance alone accounts

for around 35% of all global futures positions.” – By

@burak_kesmeci Link 👇https://t.co/zfnGiGUtKL

pic.twitter.com/DfWbZH3tfN — CryptoQuant.com (@cryptoquant_com)

November 6, 2024 Kesmeci explained that a significant jump in open

interest such as that of Binance—particularly when it exceeds a 3%

increase within a 24-hour period—frequently precedes heightened

market volatility and potential liquidations. This means that both

bullish and bearish positions could come under increased pressure

as market dynamics shift, creating potential for major moves across

the crypto landscape. The CryptoQuant analyst particularly wrote:

Remember, the OI metric represents the total number of open long

and short positions in the market. Sharp increases in OI suggest

that, as volatility spikes, both long and short positions could

face increased pressure, potentially leading to liquidations. BNB’s

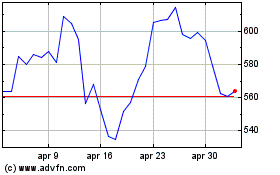

Price Movement Amid Broader Market Trends Binance’s native token

BNB, has also experienced a notable price movement, mirroring the

broader uptrend within the crypto market led by Bitcoin’s

resurgence. Related Reading: Binance Coin Breaks $600! Is There

More Upside Ahead For BNB? Earlier today, BNB breached the $600

mark, reaching a 24-hour high of $610 before experiencing a slight

pullback to $595, at the time of writing. Despite this correction,

the asset remains up 2% over the past 24 hours. This price action

brings BNB closer to its previous ATH of $717, recorded on June 6

of this year, with the current price reflecting a 17.3% decrease

from that peak. Featured image created withe DALL-E, Chart from

TradingView

Grafico Azioni Binance Coin (COIN:BNBUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Binance Coin (COIN:BNBUSD)

Storico

Da Dic 2023 a Dic 2024