No Ties To OpenAI: Worldcoin Drops 9% As Top Trader Issues Warning

14 Maggio 2024 - 10:00AM

NEWSBTC

Worldcoin (WLD) has seen its value plummet by nearly 9% in just 24

hours, with the price settling at around $5.20. This decline aligns

with a critical analysis issued by DeFi^2 (@DefiSquared), the

current top trader on the crypt exchange Bybit, who has raised

concerns about the potential for substantial inflationary pressures

and misleading marketing associated with Worldcoin. Notably, the

WLD plunge comes just after OpenAI, the creator of ChatGPT,

announced on Monday its plans to unveil a cutting-edge AI model

named GPT-4o. This advanced model boasts the ability to engage in

lifelike voice conversations and seamlessly interact across text

and images. Worldcoin is usually a beneficiary of OpenAI

announcements, but this time WLD price plunged. Why Worldcoin Is

Plummeting In his analysis shared on X, DeFi^2 expounded on the

mechanics behind the rapid devaluation of Worldcoin, emphasizing

that the token is suffering from significant daily depreciation due

to both emissions and strategic sales maneuvers by the Worldcoin

Foundation. Specifically, the token’s value is deteriorating at a

rate of 0.6% each day, driven by the emissions related to grant and

operator claims. These tokens, as per DeFi^2’s observation of

on-chain analytics, are predominantly sold off almost immediately

upon issuance, adding to the downward pressure on Worldcoin’s

price. Related Reading: Brace For Impact: Worldcoin Team Plans To

Sell 1.5 Million WLD Tokens Every Week For 6 Months Adding to the

supply concerns, the Worldcoin Foundation recently declared its

intention to offload $200 million worth of Worldcoin to trading

firms. This move will effectively increase the circulating supply

by an additional 18%. DeFi^2 criticized this decision, pointing out

that the tokens, misleadingly attributed to a “Community”

allocation, are being sold at a discount to entities that may not

prioritize the broader community’s interests, potentially diluting

the value for existing holders. The most critical issue highlighted

by DeFi^2, however, pertains to the near future, when unlocks for

venture capital and team-related tokens are set to begin. He

forecasts that in just 70 days, the supply of Worldcoin will start

to inflate at an alarming rate of 4% per day due to these unlocks

combined with ongoing emissions. This scenario could unleash nearly

$50 million worth of sell pressure daily, profoundly impacting the

token’s market price and stability. DeFi^2’s analysis did not shy

away from addressing the perceived misconceptions surrounding

Worldcoin’s affiliation with notable tech personalities and

organizations. He clarified that Sam Altman, known for his role

with OpenAI, has no active involvement with Worldcoin, which

operates as a completely separate entity. This point addresses a

common misconception that potentially misled investors about the

nature and backing of the token. Related Reading: Worldcoin Faces

$1.2 Million Fine In Argentina For Law Violations; WLD’s Price

Reacts Moreover, DeFi^2 drew parallels between Worldcoin’s

tokenomics and what he describes as “predatory” economic models

that are engineered to disproportionately benefit early investors

and insiders at the expense of general retail investors. He noted

that similar strategies had been used in the past in the crypto

industry, where the manipulation of token supply and market

conditions facilitated significant gains for insiders while leaving

regular investors exposed to heightened risks and losses.

“Worldcoin realistically might become the greatest transfer of

wealth of this entire cycle. Unfortunately, this wealth transfer

isn’t in the form of universal basic income as their mission

suggests, but instead to the pockets of the team and insiders,”

DeFi^2 stated. He added that “the manipulative low float / high FDV

design is straight out of the SBF playbook, and directly enriches

insiders as they hedge their locked allocations at high valuations

pre-unlock via perps / OTC; yet retail somehow sadly still think

they’re beating the system trying to push the price up.” As the

crypto community digests DeFi^2’s stark warnings, the immediate

reaction has been a surge in trading activity to $666 million (up

104% in the last 24 hours), with investors and speculators likely

reassessing their positions in Worldcoin in light of these

revelations. At press time, WLD traded at $5.24. Featured image

from It-daily.net, chart from TradingView.com

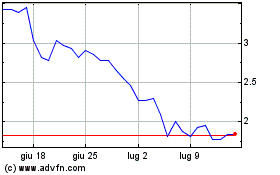

Grafico Azioni Worldcoin (COIN:WLDUSD)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Worldcoin (COIN:WLDUSD)

Storico

Da Gen 2024 a Gen 2025