BOLLORÉ : INCREASE IN THE PRICE AND EXCHANGE RATIO OF PUBLIC BUYOUT OFFERS FOLLOWED BY MANDATORY SQUEEZE-OUTS ON THE SHARES OF COMPAGNIE DU CAMBODGE, FINANCIÈRE MONCEY AND SOCIÉTÉ INDUSTRIELLE ET FINANCIÈRE DE L’ARTOIS

23 Dicembre 2024 - 3:43PM

UK Regulatory

BOLLORÉ : INCREASE IN THE PRICE AND EXCHANGE RATIO OF PUBLIC

BUYOUT OFFERS FOLLOWED BY MANDATORY SQUEEZE-OUTS ON THE SHARES OF

COMPAGNIE DU CAMBODGE, FINANCIÈRE MONCEY AND SOCIÉTÉ INDUSTRIELLE

ET FINANCIÈRE DE L’ARTOIS

BOLLORÉ

PRESS RELEASE

December 23, 2024

INCREASE IN THE PRICE AND EXCHANGE RATIO

OF PUBLIC BUYOUT OFFERS FOLLOWED BY MANDATORY SQUEEZE-OUTS ON THE

SHARES OF COMPAGNIE DU CAMBODGE, FINANCIÈRE MONCEY AND SOCIÉTÉ

INDUSTRIELLE ET FINANCIÈRE DE L’ARTOIS

Bolloré SE decided today to raise the price and

the exchange ratio in Universal Music Group (UMG) shares of the

public buyout offers followed by mandatory squeeze-outs announced

on September 12, 2024, for Compagnie du Cambodge, Financière Moncey

and Société Industrielle et Financière de l’Artois shares as

follows:

- for Bolloré SE’s tender offer on

Compagnie du Cambodge:

- Cash offer: EUR

110 per Compagnie du Cambodge share, representing an

increase of 18.28% compared to the initial price of EUR 93;

- Exchange offer:

4.69 UMG shares for 1 Compagnie du Cambodge share,

compared to the initial exchange ratio of 4.07;

- for Bolloré SE’s tender offer on

Financière Moncey:

- Cash offer: EUR

133 per Financière Moncey share, representing an increase

of 12.71% compared to the initial price of EUR 118;

- Exchange offer:

5.67 UMG shares for 1 Financière Moncey share,

compared to the initial exchange ratio of 5.17;

- for Bolloré SE’s tender offer on

Société Industrielle et Financière de l’Artois:

- Cash offer: EUR

10,627 per Société Industrielle et Financière de

l’Artois share, representing an increase of 14.27% compared to the

initial price of EUR 9,300;

- Exchange offer:

453 UMG shares for 1 Société Industrielle et

Financière de l’Artois share, compared to the initial exchange

ratio of 407.

This increase does not impact in any way the

other details of the tender offers, as stated in the draft issue

notes filed with the French Financial Markets Authority (AMF) on

September 13, 2024.

The revised terms of these tender offers will be

communicated to BM&A, represented by Mr. Pierre Béal, the

independent expert appointed with the approval of the AMF by the

three target companies, so that they are taken into account in its

assessment of the fairness of the price and exchange ratio proposed

as part of these offers.

- Salinger - PR increase in offer price - with exchange ratio

(23.12.24) vf

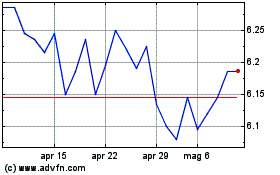

Grafico Azioni Bollore (EU:BOL)

Storico

Da Dic 2024 a Gen 2025

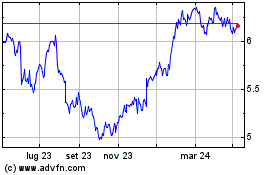

Grafico Azioni Bollore (EU:BOL)

Storico

Da Gen 2024 a Gen 2025