LUMIBIRD: ANNUAL RESULTS 2023

Lannion, 12/03/2024 - 17h45

ANNUAL RESULTS 2023

-

EBITDA margin(1)

of 17% (reported basis) and 18% excluding Convergent,

higher than previously announced targets

-

Last year of the transformation plan, with the

modernisation and rationalisation of our industrial facilities.

After 3 years of heavy investment and structuring, adjustments to

expenses have been made at the end of 2023 with the closure of the

Ottawa (Canada) and Leigh (UK) sites.

-

Growth trajectory reaffirmed, with the aim of improving

operational efficiency and profitability

The Lumibird Group, European leader in

laser technologies, improved its reported EBITDA by 10% to €34.5m

(+15% to €36.1m excluding the acquisition of Convergent). This

performance reflects tight cost control against a backdrop of sales

growth. As the Group is positioned and structured to continue to

absorb growth in its markets, the improvement in profitability

should continue in the years ahead.

Extract from the condensed consolidated

annual financial statements approved by the Board of

Directors on 12 March 2024

|

at 31 December (in €m) |

2022 |

2023reported |

|

Change |

| |

% |

|

Sales figures |

191.0 |

203.6 |

+12.6 |

+6.6% |

|

EBITDA(1)%

SALES |

31.316.4% |

34.517.0% |

+3.2 |

+10% |

|

Profit from recurring operations% SALES |

16.48.6% |

18.59.1% |

+2.1 |

+13% |

|

Operating profit |

17.3 |

12.2 |

(5.1) |

-29% |

|

Profit before tax |

14.4 |

7.5 |

(6.9) |

-48% |

|

Net income |

11.4 |

7.1 |

(4.3) |

-38% |

(1) EBITDA corresponds to recurring operating

income adjusted for charges to provisions and depreciation, net of

reversals, and expenses covered by such reversals.

Dynamic markets in a complex economic

context

Business in 2023 was buoyant across all the

markets addressed by Lumibird, particularly in the Defence/Space

segment, which saw strong growth. However, growth was held back at

the beginning of the year by reduced production capacity due to

site redevelopments, and at the end of the year by postponed sales

for regulatory or administrative reasons affecting the Medical

division.

The Photonics division grew by +7.8% (+7.4%

excluding Convergent and at constant exchange rates).

The Defence/Space segment, driven by growing

demand and an attractive range of very high-tech products,

including a majority of active components produced within the

Group, grew by 30.9% to €39.4m (+34.5% at constant exchange rates).

A significant 3-year contract worth €20 million was signed in

September 2023 for the supply of laser rangefinders for airborne

applications.

The Lidar segment fell by 7.5% to €24.1m (down

6.1% at constant exchange rates). Lidar activities continue to grow

strongly in the wind energy sub-segment, where Lumibird sells its

Lidar systems directly, while there has been a one-off downturn in

the 3D Scan sub-segment, although this does not call into question

the strong growth prospects for this market.

In Industrial and Scientific activities, the

Group ended the year at €37.4m, stable at -0.1% (-5.0% excluding

Convergent and at constant exchange rates). Sales generated by the

Convergent business acquired at the end of August 2023 are included

in Industrial and Scientific activities. They amounted to €2.7m in

2023 over 4 months.

The Medical division reported sales growth of

5.5% over the year to €102.8m (up 7.6% at constant exchange rates),

held back by the postponement of sales to 2024 for regulatory

reasons (delay in marketing authorisations) and administrative

reasons (new purchasing policy for public hospitals in China). The

breakdown of sales between diagnostics (23%) and treatment (77%) is

similar to previous years.

The currency effect had a negative impact on

sales of €4.5m over 2023, split between Photonics (€2.4m) and

Medical (€2.1m).

Improved profitability in both divisions

Summary of results by division

|

In €M |

Photonics |

Medical |

|

2022 |

2023 |

Change (%) |

2022 |

2023 |

Change (%) |

|

Sales figures |

93,5 |

100.8 |

+7.8% |

97,4 |

102,8 |

+5,5% |

|

Gross margin% |

58,162,2% |

63.262.7% |

+8.7% |

59,861,3% |

62,460,7% |

+4,3% |

|

EBITDA(1)% |

14,215,2% |

15.915.8% |

+12.2% |

17,117,6% |

18,618,1% |

+8,4% |

|

ROC% |

4,75,1% |

5.95.8% |

+24.2% |

11,611,9% |

12,612.3% |

+8,4% |

(1) EBITDA corresponds to recurring operating

income adjusted for charges to provisions and depreciation, net of

reversals, and expenses covered by such reversals.

Against a backdrop of persistent inflationary

pressures, the Group's gross margin is stable in 2023, to 61.7%

from 61.8% a year earlier (slight increase to 62.1% excluding

Convergent). The use of purchases via brokers in 2022 to secure

supplies still had a significant residual impact this year,

particularly for the Medical division. By the end of 2023, this

residual impact had been fully absorbed.

. On a reported basis, including the recent

acquisition of Convergent, EBITDA rose by 10% to €34.5m, i.e. 17.0%

of revenues. Convergent contributed negatively by -€1.6m to EBITDA.

EBITDA margin excluding Convergent rose by almost +2 pts (from

16.4% to 18.0%). This increase was achieved by controlling external

and personnel costs in both divisions.

For the moment, the improvement in profitability

is more marked in the Photonics division (EBITDA margin of 17.9%

excluding Convergent, compared with 15.2% in 2022) than in the

Medical division (18.1% compared with 17.6% in 2022), which is

still impacted by the residual additional purchasing costs

associated with the shortages in 2022.

The currency effect had a negative impact on

EBITDA of €0.9m over 2023, split between Photonics (€0,5m) and

Medical (€0,4m).

On a reported basis, recurring operating income

stands at €18.5m, compared with €16.4m in 2022. Convergent's

contribution to recurring operating income is negative at -€2.4m.

Excluding Convergent, recurring operating income stands at

€20.9m.

For Lumibird, 2023 was the last year of the

transformation plan, with the modernisation and rationalisation of

its industrial facilities. After 3 years of strong investment and

structuring, at the end of 2023, Lumibird entered an optimisation

phase through a programme to adjust its workload structure.

Lumibird has repatriated the activities of its Ottawa (Canada) and

Leigh (UK) sites to Lannion. Operating profit includes

non-recurring expenses relating to this reorganisation of the Lidar

division, the relocation of the Les Ulis site and changes in the

scope of consolidation totalling €6.3m (compared with non-recurring

income of €0.9m in 2022). Against a backdrop of rising interest

rates, net financial income, restated for the non-cash foreign

exchange impact of the revaluation of current accounts, amounts to

€3.5m, stable compared with 2022 (€3.2m) thanks to the optimisation

of financial income. After corporation tax of €0.3m (compared with

€3.1m in 2022), reported net profit is €7,1m. Excluding Convergent,

it stands at €9.2m.

Cash flow: continued high levels of

investment

| In

€M |

2022 |

2023 |

| Cash

flow from operating activities |

1,4 |

20,7 |

|

Of which MBA before tax and finance costs |

30,1 |

26,9 |

|

Of which Change in WCR |

(29,2) |

(4,8) |

|

Of which tax paid |

0,5 |

(1,5) |

|

Cash flow from investing activities |

(29,3) |

(46,2) |

|

Of which Industrial investment1 |

(20,7) |

(25,3) |

|

Of which external growth |

(8,1) |

(20,6) |

|

Of which other financial assets |

(0,6) |

(0,3) |

|

Cash flow from financing activities |

(7,9) |

21,7 |

|

Of which capital increase |

- |

- |

|

Of which net new financing |

(3,6) |

28,7 |

|

Of which debt servicing |

(2,9) |

(3,9) |

|

Of which other changes |

(1,4) |

(3,2) |

| CHANGE

IN CASH AND CASH EQUIVALENTS2 |

(35,8) |

(3,8) |

Against a backdrop of continuing growth but

easing tensions over supplies, working capital requirements were

kept under particularly tight control over the year, increasing by

just €4.8m.

2023 was again a year of heavy investment in

industrial facilities, in particular for the completion of the

fibre optic manufacturing unit at Lannion. Net capital expenditure

in 2023 amounted to €25.3m, compared with €20.7m the previous year.

Cash flow from external growth amounted to €20.6m. The 2023

investment programme was financed both by cash generated by

operations and by bank loans.

Balance sheet position

As a result of the investments made, net

financial debt rose from €52.5m at 31.12.22 to €88.9m at 31.12.23.

It comprised €145.1m in gross financial debt and €56.2m in cash and

cash equivalents.

Lumibird retains a solid financial position,

with gearing of 46% and a leverage ratio of 2.6.

| Extract

from the consolidated balance sheet (in

€m) |

31.12.2022 |

31.12.2023 |

|

Goodwill |

69,9 |

72,6 |

|

Non-current assets (excluding goodwill) |

114,9 |

135,3 |

|

Current assets (excluding cash) |

125,5 |

141,1 |

|

Cash and cash equivalents |

61,7 |

56,2 |

| TOTAL

ASSETS |

372,0 |

405,2 |

|

Equity (including minority interests) |

193,4 |

193,3 |

|

Financial liabilities3 non-current |

48,6 |

128,6 |

|

Other non-current liabilities |

10,1 |

9,2 |

|

Current financial liabilities |

65,6 |

16,5 |

|

Current liabilities |

54,3 |

57,6 |

| TOTAL

LIABILITIES |

372,0 |

405,2 |

Outlook

After 3 years of heavy investment, Lumibird is

better positioned than ever to take advantage of the buoyant trends

in its markets, with an adapted product offering and a capacity for

innovation and production strengthened by the growing integration

of key technologies. The maturity achieved in terms of organisation

also means that the Group can continue to work on adjusting its

cost structure, to optimise profitability.

Against this backdrop, the Group expects to

achieve growth at constant perimeter in excess of 8% and to

continue improving its profitability.

Next

publication: Q1 2024 sales on 22/04/2024, after

close of trading.

LUMIBIRD is one of the world's leading laser

specialists. With 50 years' experience and expertise in

solid-state, diode and fibre laser technologies, the Group designs,

manufactures and distributes high-performance laser solutions for

scientific (research laboratories, universities), industrial

(production, defence/space, Lidar sensors) and medical

(ophthalmology, ultrasound diagnosis) applications.The result of

the merger in October 2017 between the Keopsys and Quantel Groups,

LUMIBIRD, with more than 1,000 employees and over €203.6m in sales

by 2023 is present in Europe, America and Asia.LUMIBIRD

shares are listed in compartment B of Euronext Paris. FR0000038242

-

LBIRD www.lumibird.comLUMIBIRD

has been a member of Euronext Tech

Leaders since 2022.

Contacts

|

LUMIBIRDMarc Le FlohicChairman and Chief Executive OfficerTel.

+33(0) 1 69 29 17 00info@lumibird.com |

LUMIBIRDSonia Rutnam Chief Financial and Transformation OfficerTel.

+33(0) 1 69 29 17 00info@lumibird.com |

CalyptusMathieu CalleuxInvestor RelationsTel. +33(0) 1 53 65 37

91lumibird@calyptus.net |

1 This amount includes €12.4m of research and development

expenditure capitalised in accordance with IAS 36.2 Cash

corresponds to "cash and cash equivalents" on the assets side of

the balance sheet, net of bank overdrafts (passive cash) included

in current financial liabilities on the liabilities side. It is

presented before currency change impact.3 Financial liabilities

(current and non-current) correspond to financial debts and include

lease debts in accordance with IFRS16.

- 240312_LUMIBIRD_RA_2023_EN

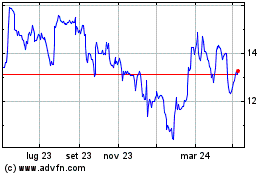

Grafico Azioni Lumibird (EU:LBIRD)

Storico

Da Ott 2024 a Nov 2024

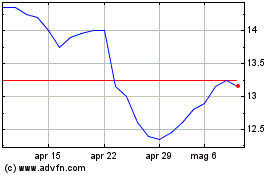

Grafico Azioni Lumibird (EU:LBIRD)

Storico

Da Nov 2023 a Nov 2024