SAVENCIA: 2023 Half-yearly results

14 Settembre 2023 - 6:00PM

SAVENCIA: 2023 Half-yearly results

Thursday,

September 14, 2023

PRESS RELEASE: 2023

half-yearly results

- Organic

sales growth of 14%

- Robust

current operating profit of €112 million

|

|

Key figures in €M |

June 2023 |

%

ofSales |

June 2022 |

%

ofSales |

Changes in % |

|

Total |

Structure |

Currency |

Organic |

|

Sales |

3,376 |

|

3,023 |

|

11.7 |

2.2 |

-4.9 |

14.4 |

|

- Cheese Products |

1,934 |

57.3 |

1,737 |

60.6 |

11.3 |

0.1 |

-0.3 |

11.5 |

|

- Other Dairy Products |

1,552 |

46.0 |

1,380 |

42.5 |

12.4 |

4.9 |

-11.5 |

19.0 |

|

- Unallocated (Intra-Group transactions) |

-110 |

-3.3 |

-94 |

-3.1 |

0.0 |

-12.0 |

0.0 |

28.5 |

|

Current operating profit |

112 |

3.3 |

126 |

5.2 |

|

|

|

Operating profit |

98 |

2.9 |

129 |

4.4 |

|

|

Financial result |

-15 |

|

-15 |

|

|

|

Corporate taxes |

-28 |

-36 |

|

|

Result for the period |

58 |

1.7 |

81 |

2.6 |

|

|

Net income, Group share |

51 |

1.5 |

71 |

2.5 |

|

|

Net debt (excluding IFRS 16) |

600 |

|

555 |

|

|

The limited review procedures on the half-yearly

financial statements have been performed by the Statutory

Auditors.Their limited review report is currently being

issued.Definitions and calculation methods for aggregates such as

structural effects, exchange rates, organic growth and net debt

have not changed.They are defined in the Group’s activity report

and in note 20 of the financial statements for net debt.

Results for the first half of

2023

At € 3,376 million, Savencia Fromage &

Dairy's sales as of June 30th, 2023 are up 11.7%, with an organic

growth of 14.4%. The 2.2% structural effect is due to the

consolidation of Williner in Argentina by April 3rd, 2023. The 4.9%

unfavourable currency effect is due to the devaluation of the

Argentine peso and the yuan.

In an environment of sustained inflation, Cheese

Products grew by 11.5%, driven by price effects on all world

markets. The Group's local brands continues to grow, despite the

pressure on the purchasing power of the consumers' who tend to turn

to the more affordable products.

Other Dairy Products sales grew by 19% or, with

both favourable price and volume-mix effects. The good momentum of

foodservice and the restarting of Corman's activities offset the

decline in industrial products.

At €112 million, current operating profit

contracted by 11%. It benefited from price increases and industrial

productivity gains but is penalized by the impact of decline in

global commodity prices of dairy ingredients.

Operating profit also includes the exceptional

effects of the closure of a Corman workshop and asset

impairment.

The Group's financial position is robust, with

shareholders' equity at €1,834 million and net debt excluding IFRS

16 at €600 million. This represents 33% of consolidated

shareholders’ equity, compared with 29% on June 30th, 2022.

CSR commitments

All the teams at Savencia Fromage & Dairy

are continuing to rally around the Oxygen CSR program’s main

directions. The decarbonisation trajectory validation by the SBTi

(Science Based Targets initiative) in March 2023 has given a

collective boost to ambitious actions in the short, medium, and

long term at our production sites and with our dairy farmer

partners.

Our industrial teams have initiated robust plans

to reduce energy and water consumption. At the same time, all over

the world, they have continued to work on converting energy mixes

and on projects to reuse water, particularly from milk.

On September 8th, Savencia Group and the “OP

SOL” producers' organization formalized their partnership on milk

collection. This partnership, a guarantee of sustainability for its

140 milk producers, contributes to securing dairy supplies for the

Fromagerie des Chaumes and saving of CO2.

Organization

On September 4th, Régis Massuyeau joined

Savencia Fromage & Dairy to assume the CFO position as of

January 1st, 2024.

Perspectives for the second half of

2023

Current economic and political uncertainties are

likely to continue to impact business in the second half of the

year, given:

- the situation of the French dairy

economy, characterised by high milk prices and declining industrial

product prices;

- the pressure on consumer demand in

an inflationary environment and a wait-and-see attitude on the part

of buyers of industrial products;

- the continuing rise in interest

rates and its impact on the global economy.

In this context, strengthened by the commitment

of its teams and the quality of its brands, Savencia Fromage &

Dairy shall focus on adapting its offer to new consumer demands,

and pursue its efforts in terms of industrial performance and the

development of its carbon footprint reduction projects.

|

Further information can be found on our website

savencia-fromagedairy.com |

- Savencia-SA-2023 half-yearly results

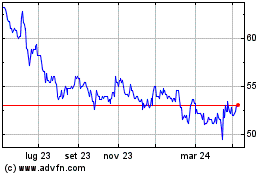

Grafico Azioni Savencia (EU:SAVE)

Storico

Da Dic 2024 a Gen 2025

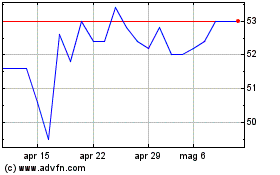

Grafico Azioni Savencia (EU:SAVE)

Storico

Da Gen 2024 a Gen 2025