U.S. Dollar Falls Amid Fed Rate Cut Optimism

20 Novembre 2023 - 3:26AM

RTTF2

The U.S. dollar weakened against other major currencies in the

Asian session on Monday amid optimism that the U.S. Federal Reserve

may cut interest rates by a full percentage point by the end of

2024.

The soft U.S. labor market and inflation readings from last

week, boosted the traders' sentiments to bet on Fed's rate hike

pause. Some traders bet that the central bank could begin rate cut

by March 2024.

In the Middle East, the Israeli ambassador to the U.S. said he

is hopeful a deal for the release of a significant number of

hostages will be reached in the coming days.

In the Asian trading now, the U.S. dollar fell to nearly a

3-month low of 1.0936 against the euro and a 5-day low of 1.2496

against the pound, from Friday's closing quotes of 1.0907 and

1.2461, respectively. If the greenback extends its downtrend, it

may find support around 1.10 against the euro and 1.28 against the

pound.

Against the Swiss franc and the yen, the greenback dropped to

more than a 2-1/2-month low of 0.8831 and nearly a 1-1/2-month low

of 148.69 from last week's closing quotes of 0.8855 and 149.62,

respectively. The greenback may test support near 0.86 against the

franc and 146.00 against the yen.

The greenback slipped to a 4-day low of 1.3690 against the

Canadian dollar, from Friday's closing value of 1.3718. On the

downside, 1.34 is seen as the next support level for the

greenback.

Looking ahead, German PPI for October is slated for release at

2:00 am ET in the pre-European session.

In the European session, Eurozone construction output for

September is set to be published.

In the New York session, U.S. CB leading index for October is

slated for release.

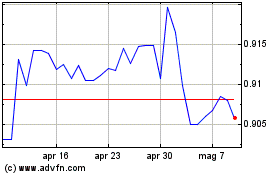

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Giu 2024 a Lug 2024

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Lug 2023 a Lug 2024