TIDMANP

RNS Number : 9983B

Anpario PLC

07 June 2023

The following amendment has been made to the 'Tender Offer'

announcement released on 2 June 2023 at 07:00 a.m. under RNS No

4215B.

The date included in the definition for the ' Tender Offer

Record Date or Record Date' has been corrected to 22 June 2023 from

2 June 2023.

All other details remain unchanged.

The full amended text is shown below.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF THAT JURISDICTION

Anpario PLC

("Anpario", the "Company" or the "Group")

Proposed Tender Offer of up to 4,000,000 Ordinary Shares at 225

pence per Ordinary Share

Anpario PLC (AIM: ANP), announces that it is proposing to return

up to GBP9 million to Shareholders by a Tender Offer pursuant to

which Qualifying Shareholders are invited to tender some or all of

their Ordinary Shares at the Tender Price of 225 pence per Ordinary

Share (the "Tender Price"). The Tender Offer is for a maximum of

4,000,000 Ordinary Shares. The Tender Price represents a premium of

approximately 16 per cent. to the closing price of 194 pence per

Ordinary Share on the Latest Practicable Date.

Qualifying Shareholders are not required to tender any or all of

their Ordinary Shares if they do not wish to do so. Qualifying

Shareholders who participate in the Tender Offer have a Guaranteed

Entitlement to tender approximately 16.6 per cent. of the Ordinary

Shares held by them at the Record Date, rounded down to the nearest

whole number.

The Company expects to post a circular to shareholders (the

"Circular") later today to provide information about the background

to, and reasons for, the Tender Offer and why the Board considers

that the Tender Offer is in the best interests of the Shareholders

as a whole and why the Board unanimously recommends that you vote

in favour of the Resolution to be proposed at the General

Meeting.

The implementation of the Tender Offer requires Shareholder

approval by way of a special resolution. The Resolution will be

proposed at the General Meeting of the Company to be held at the

offices of DLA Piper UK LLP at 160 Aldersgate Street, London, EC1A

4HT on 19 June 2023 at 11:00 a.m. (the "General Meeting").

The Circular also contains further details on the procedure that

should be followed by those Qualifying Shareholders wishing to

participate in the Tender Offer (with different procedures

depending on whether the Ordinary Shares are held in CREST or in

certificated form).

A copy of the Circular will be published on the Company's

website later today at www.anpario.com. A Form of Proxy and Tender

Form for use by Shareholders who hold their Ordinary Shares in

certificated form in connection with the Tender Offer is also being

despatched with the Circular. Capitalised terms used but not

defined in this announcement will have the same meaning given to

them in the Circular.

The Tender Offer is being made available to all Qualifying

Shareholders who are on the Register at the Record Date.

The Tender Offer is to be effected by Shore Capital Stockbrokers

Limited ("Shore Capital") (acting as principal and not as agent,

nominee or trustee) purchasing Ordinary Shares from Qualifying

Shareholders. Shore Capital, in turn, has the right to require the

Company to purchase from it, and can be required by the Company to

sell to it, such Ordinary Shares at the Tender Price under a

repurchase agreement (the "Repurchase Agreement"), details of which

are set out further below. All Ordinary Shares purchased by the

Company from Shore Capital pursuant to the Repurchase Agreement

will be cancelled.

The Board makes no recommendation to Qualifying Shareholders in

relation to participation in the Tender Offer itself. Whether or

not Qualifying Shareholders decide to tender all, or any, of their

Ordinary Shares will depend on, among other things, their view of

the Company's prospects and their own individual circumstances,

including their own financial and tax position. Shareholders are

required to take their own decision and are recommended to consult

with their duly authorised independent financial or professional

adviser.

This summary should be read in conjunction with the full text of

this announcement and the Circular.

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the UK version

of the EU Market Abuse Regulation (2014/596) which is part of UK

law by virtue of the European Union (Withdrawal) Act 2018, as

amended and supplemented from time to time ("Market Abuse

Regulation").

The person responsible for arranging the release of this

announcement on behalf of the Company is Richard Edwards, Chief

Executive Officer.

Enquiries:-

Anpario plc:

Richard Edwards, CEO +44(0)7776 417 129

Marc Wilson, Group Finance

Director +44(0)1909 537 380

Shore Capital:

(Nominated Adviser and Broker): +44 (0) 20 7408 4090

Stephane Auton Corporate Advisory

David Coaten

Tom Knibbs

Henry Willcocks Corporate Broking

Tender Offer

Background and reasons for the Tender Offer

Subject to the passing of the Resolution by Shareholders at the

General Meeting as a special resolution, the Directors will give

Qualifying Shareholders the opportunity to tender Ordinary Shares

through the Tender Offer for cash. The Resolution will give the

Directors authority to return a maximum amount of up to GBP9

million to Shareholders at a price of 225p per Ordinary Share.

Current trading and the outlook for the Company's 2023 financial

year remains in line with market expectations. The sales

performance since the start of the year has continued at the weaker

levels seen in the final quarter of 2022, reflecting the current

challenges facing the global agricultural industry. The Board

expects the Group's performance to improve as the year progresses

as some of the challenges dissipate and inflationary pressures

alleviate. In addition, concerns over supply chain risks and

logistics delays have begun to ease and as a result the Directors

have been able to reduce inventory and working capital levels. As

at 25 May 2023, cash and bank deposit balances were GBP16.4 million

(31 Dec 2022: GBP13.6 million).

The Board regularly reviews capital allocation to optimise

long-term returns for shareholders and, due to the Company's strong

cash position, has explored various options for returning cash to

Shareholders. In addition to the proposed return of value by way of

the final dividend of 7.35 pence per share to be recommended by the

Board at the upcoming AGM in June 2023, it has determined that the

Tender Offer would be the most suitable way of returning capital to

Shareholders in a quick and efficient manner, taking account of the

relative costs, complexity and timeframes of the possible methods

available, as well as the likely tax treatment for and equality of

treatment of Shareholders.

The Board considers the Tender Offer to be beneficial to

Shareholders as a whole, because, among other reasons:

-- the Tender Offer is available to all Qualifying Shareholders

regardless of the size of their holding;

-- the Tender Price represents a premium of 16 per cent. (16%)

to the closing price of the Ordinary Shares of 194p (on the Latest

Practicable Date);

-- the Tender Offer provides Qualifying Shareholders who wish to

reduce their holdings of Ordinary Shares with an opportunity to do

so at a market-driven price with a premium at the Latest

Practicable Date;

-- the Tender Offer enables Ordinary Shares to be sold free of

commissions or charges that would otherwise be payable if

Qualifying Shareholders were to sell their Ordinary Shares through

their broker;

-- the Tender Offer permits Shareholders who wish to retain

their current investment in the Company and their Ordinary Shares

to do so, as no Shareholder is required to participate in the

Tender Offer, and thus providing Shareholders with flexibility;

and

-- the Tender Offer will reduce the number of Ordinary Shares in

issue, and, assuming earnings stay the same, should therefore have

a positive impact on the Company's earnings per share as the

Company intends to cancel all of the Ordinary Shares acquired in

connection with the Tender Offer.

The Company intends to renew its general share buyback authority

at its next annual general meeting which is currently expected to

take place on 29 June 2023 (the "2023 AGM"). Therefore, the Tender

Offer is being made in addition to any share buyback programme

which may be announced by the Company following the 2023 AGM

assuming that the general share buyback authority is passed by

shareholders at the 2023 AGM (the "Buyback Programme"). To the

extent that the Company decides to undertake a Buyback Programme,

the Company would be entitled to repurchase Ordinary Shares of up

to a maximum of 2,406,313 Ordinary Shares to the extent that the

general authority to repurchase Ordinary Shares will be granted by

Shareholders at the 2023 AGM.

Principal Terms of the Tender Offer

Shore Capital Stockbrokers will implement the Tender Offer by

acquiring, as principal, the successfully tendered Ordinary Shares

at the Tender Price. Ordinary Shares purchased by Shore Capital

Stockbrokers pursuant to the Tender Offer will be purchased by

Shore Capital Stockbrokers as principal and such purchases will be

on-market purchases in accordance with the provisions of the AIM

Rules for Companies and the rules of the London Stock Exchange.

Immediately following completion of the Tender Offer, Shore Capital

Stockbrokers shall sell such Ordinary Shares to the Company, at a

price per Ordinary Share equal to the Tender Price, pursuant to the

Repurchase Agreement. Purchases of Ordinary Shares by the Company

pursuant to the Repurchase Agreement will also be on-market

purchases in accordance with the provisions of the AIM Rules for

Companies and the rules of the London Stock Exchange. All of the

Ordinary Shares purchased by the Company pursuant to the Repurchase

Agreement in connection with the Tender Offer will be

cancelled.

The maximum number of Ordinary Shares that may be purchased

under the Tender Offer will equate to approximately 16.6 per cent.

(16.6%) of the Issued Ordinary Share Capital at the Tender Offer

Record Date (excluding any Ordinary Shares held in treasury). As at

the Latest Practicable Date, there are 24,063,131 Ordinary Shares

in issue (excluding 440,388 Ordinary Shares being held in

treasury). The Tender Offer is conditional on, among other matters,

the receipt of valid tenders in respect of at least 240,631

Ordinary Shares (representing approximately 1.0 per cent. (1%) of

the Company's issued share capital as at the Latest Practicable

Date) (excluding any Ordinary Shares held in treasury). Assuming

the maximum number of Ordinary Shares is validly tendered, up to

4,000,000 Ordinary Shares may be purchased under the Tender Offer

for a maximum aggregate consideration of up to GBP9 million. If

such maximum number of Ordinary Shares that may be tendered is

repurchased by the Company for cancellation pursuant to the Tender

Offer, the total number of Ordinary Shares of the Company in issue

following such cancellation will be 20,063,131 (excluding the

440,388 Ordinary Shares being held in treasury). The Company also

intends to cancel all other Ordinary Shares held in treasury at the

same time.

Successfully tendered Ordinary Shares will be cancelled and will

not rank for any future dividends. However, assuming Shareholders

approve the Company's final dividend of 7.35p per share at the 2023

AGM, Shareholders on the register of members on 13 July 2023, being

the record date for the final dividend, will receive such final

dividend on 28 July 2023 in respect of the Ordinary Shares they

hold as at such record date.

Guaranteed Entitlement

Tenders in respect of approximately 16.6 per cent. (16.6%) of

the Ordinary Shares held by each Qualifying Shareholder on the

Record Date will be accepted in full at the Tender Price and will

not be scaled down even if the Tender Offer is oversubscribed. This

percentage is known as the "Guaranteed Entitlement". Qualifying

Shareholders may tender such number of Ordinary Shares in excess of

their Guaranteed Entitlement up to the total number of Ordinary

Shares held by each Qualifying Shareholder on the Record Date (the

"Excess Entitlement") and, to the extent that other Qualifying

Shareholders do not tender any of their Ordinary Shares or tender

less than their Guaranteed Entitlement, those Qualifying

Shareholders may be able to tender such Excess Entitlement through

the Tender Offer. However, if the Tender Offer is oversubscribed,

the tender of any such Excess Entitlement will only be successful

to the extent that other Shareholders have tendered less than their

Guaranteed Entitlement or tendered no Ordinary Shares and may be

subject to scaling-down.

Circumstances in which the Tender Offer may not proceed

There is no guarantee that the Tender Offer will take place. The

Tender Offer is conditional on the passing of the Resolution as set

out in the Notice of General Meeting and on the satisfaction of the

other Tender Conditions as set out in the Circular. In particular,

the Tender Offer is conditional on the receipt by 1:00 p.m. on the

Closing Date of valid tenders in respect of at least 240,631

Ordinary Shares (representing approximately one per cent. (1%) of

the Company's issued share capital (excluding any Ordinary Shares

held in treasury) as at the Latest Practicable Date).

The Company has reserved the right at any time prior to the

announcement of the results of the Tender Offer, with the prior

consent of Shore Capital Stockbrokers, to extend the period during

which the Tender Offer is open and/or vary the aggregate value of

the Tender Offer, based on market conditions and/or other factors,

subject to compliance with applicable legal and regulatory

requirements. The Company has also reserved the right, in certain

circumstances, to require Shore Capital Stockbrokers, not to

proceed with the Tender Offer. Any such decision will be announced

by the Company through a Regulatory Information Service.

To the extent that Qualifying Shareholders tender for

significantly less than the total amount that may be returned to

Shareholders pursuant to the Tender Offer, or where the Company

decides not to proceed with the Tender Offer, the Company will

consider alternative options regarding how best to deploy any such

cash surplus or to return these funds to Shareholders, including by

way of a share buyback programme or by way of a distribution of

dividends, taking into consideration the then prevailing market

conditions and other relevant factors at the relevant time.

Results announcement and unconditional date

As set out in the expected timetable of principal events below,

it is expected that the results of the Tender Offer will be

announced on 23 June 2023, at which time the Tender Offer is

expected to become unconditional subject to the Tender Conditions

described in the Circular having been satisfied. The decision of

the Company as to the results of the Tender Offer (including,

without limitation, the basis on which tenders in excess of the

Guaranteed Entitlement are satisfied, scaled back or rounded down)

shall be final and binding on all Shareholders.

General Meeting to approve the Resolution

The Tender Offer requires the approval by Shareholders of the

Resolution at the General Meeting. For this purpose, the Company is

convening the General Meeting for 11:00 a.m. on 19 June 2023 to

consider and, if thought fit, pass the Resolution to authorise and

to approve the terms under which the Tender Offer will be

effected.

The Resolution must be passed on a poll by at least seventy-five

per cent. (75%) of those Shareholders present in person or by proxy

and entitled to vote at the General Meeting. The Company will not

purchase Ordinary Shares pursuant to the Tender Offer unless the

Resolution is duly passed.

Tax

Shareholders should be aware that there will be tax

considerations that they should take into account when deciding

whether or not to participate in the Tender Offer. Summary details

of certain UK taxation considerations are set out in Circular.

Shareholders who are subject to tax in a jurisdiction other than

the UK, or who are in any doubt as to the potential tax

consequences of tendering their Ordinary Shares under the Tender

Offer, are strongly recommended to consult their own independent

professional advisers before tendering their Ordinary Shares under

the Tender Offer.

Overseas Shareholders

The Tender Offer is not being made directly or indirectly in,

into or from or by use of the mail or by any means or

instrumentality (including, without limitation, facsimile

transmission, telex and telephone) of interstate or foreign

commerce, or of any facility of a national securities exchange, of

the United States or any other Restricted Jurisdiction and the

Tender Offer cannot be accepted by any such use, means,

instrumentality or facility or from within a Restricted

Jurisdiction.

Accordingly, copies of the Tender Form are not being and must

not be mailed or otherwise distributed or sent in, into, or from a

Restricted Jurisdiction, including to Shareholders with registered

addresses in a Restricted Jurisdiction, or to persons who are

custodians, nominees or trustees holding Ordinary Shares for

persons in a Restricted Jurisdiction.

Employee share incentive plans and impact of Tender Offer on

Dilution Limit Policy

The Company operates a number of different share incentive plans

for its employees, namely the Enterprise Management Incentive

("EMI") scheme; the Save As You Earn ("SAYE") scheme; the Company

Employees Joint Share Ownership Plan ("JSOP"); the Company Share

Option Plan ("CSOP"); the Company Performance Share Plan ("PSP")

and an Unapproved Share Option Plan ("USOP").

As previously announced by the Company on 16 March 2022, and

following a consultation process with shareholders, the Company

adopted a policy on dilution limits, in which whilst the potential

dilution limit (including all share awards granted under the

Company's employee share incentive plans since January 2015) was

increased to 18% per cent. (18%), this potential dilution limit was

expected to reduce by 2025 to 15% per cent. (15%) of the ordinary

share capital of the Company viewed over a 10-year rolling period

(the "Dilution Limit Policy").

The proposed Tender Offer and subsequent cancellation of

successfully tendered Ordinary Shares will impact the Dilution

Limit Policy, as this will reduce the issued ordinary share capital

upon which the Dilution Limit Policy is based. Specifically,

assuming the maximum number of Ordinary Shares is validly tendered

pursuant to the Tender Offer, this will have the effect of

increasing the potential dilution limit to 20% per cent. (20%)

(from 18% per cent. (18%)) in the short term, before subsequently

falling (by 2026; previously 2025) to a limit of 15% per cent.

(15%) of the ordinary share capital of the Company viewed over a

10-year rolling period.

Actions to be taken

General Meeting

Whether or not you intend to attend the General Meeting, you are

urged to complete, sign and return the Form of Proxy in accordance

with the instructions printed thereon and the notes to the Notice

of General Meeting. To be valid, a proxy appointment must be

received by post or by hand (during normal business hours only) by

the Company's Registrar at Share Registrars Limited, 3 The

Millennium Centre, Crosby Way, Farnham, Surrey, GU9 7XX, as soon as

possible and, in any event, not later than 11:00 a.m. on 15 June

2023 (or, in the case of an adjournment of the General Meeting, not

later than 48 hours (excluding non-Business Days) before the time

fixed for the holding of the adjourned meeting).

If you hold Ordinary Shares in CREST, you may appoint a proxy by

completing and transmitting a CREST Proxy Instruction (in

accordance with the procedures set out in the CREST Manual) to the

Registrar, under CREST Participant ID number 7RA36. Proxies

appointed electronically must be completed online as soon as

possible and, in any event, so as to be received by no later than

11:00 a.m. on 15 June 2023 (or, in the case of an adjournment, not

later than 48 hours (excluding non-Business Days) before the time

fixed for the holding of the adjourned meeting).

Alternatively, you may appoint a proxy electronically by logging

on to www.shareregistrars.uk.com, clicking on the "Proxy Vote"

button and then following the on-screen instructions. Proxy votes

must be received no later than 11:00 a.m. on 15 June 2023 (or, in

the case of an adjournment, not later than 48 hours (excluding

non-Business Days) before the time fixed for the holding of the

adjourned meeting).

Completion and return of a Form of Proxy by post, the giving of

a CREST Proxy Instruction or submitting your online proxy vote via

the Registrars website, will not preclude Shareholders from

attending and voting in person at the General Meeting, or any

adjournment thereof, (in each case, in substitution for their proxy

vote) if they wish to do so and are so entitled.

Participation in the Tender Offer

If you are a Qualifying Shareholder and hold your Ordinary

Shares in certificated form and you wish to tender all or any of

your Ordinary Shares, you should complete the Tender Form in

accordance with the instructions printed on it and in the Circular

and return it by post in the accompanying reply-paid envelope (for

use in the UK only) or by hand (during normal business hours only)

to Share Registrars Limited, 3 The Millennium Centre, Crosby Way,

Farnham, Surrey, GU9 7XX, together with your share certificate(s)

in respect of the Ordinary Shares tendered.

If you are a Qualifying Shareholder and hold your Ordinary

Shares in Uncertificated Form and you wish to tender all or any of

your Ordinary Shares, you should arrange for the Ordinary Shares

tendered to be transferred into escrow by not later than 1:00 p.m.

on 22 June 2023 as described in the Circular/send the TTE

Instruction through CREST so as to settle by no later than 1:00

p.m. on 22 June 2023.

If you do not wish to sell any of your Ordinary Shares in the

Tender Offer, do not complete and return the Tender Form or submit

a TTE Instruction (as applicable).

Board intentions

Each of the Directors (with the exception of Kate Allum who is

not a Shareholder) has confirmed that they do not intend to tender

any of their current individual beneficial holding of Ordinary

Shares through the Tender Offer. In this regard, the Company has

received irrevocable undertakings from each of the Directors (with

the exception of Kate Allum who is not a Shareholder) that they

will each respectively not participate in the Tender Offer in

respect of any Ordinary Shares of which they are the registered or

beneficial holder, or otherwise hold on trust as trustees (as

applicable), and therefore, other Qualifying Shareholders will be

able to tender for more than their Guaranteed Entitlement.

Recommendation by the Board

The Directors consider that the Tender Offer is in the best

interests of the Shareholders as a whole. Accordingly, the Board

unanimously recommends that you vote in favour of the Resolution,

as the Directors (with the exception of Kate Allum who is not a

Shareholder) intend to do for their respective individual

beneficial holdings of, in aggregate, 347,392 Ordinary Shares,

representing approximately 1.4 per cent. (1.4%) of the Issued

Ordinary Share Capital of the Company as at the Latest Practicable

Date.

The Board makes no recommendation to Qualifying Shareholders in

relation to participation in the Tender Offer itself. Whether or

not Qualifying Shareholders decide to tender all, or any, of their

Ordinary Shares will depend on, among other things, their view of

the Company's prospects and their own individual circumstances,

including their own financial and tax position. Shareholders are

required to take their own decision and are recommended to consult

with their duly authorised independent financial or professional

adviser.

If you are in any doubt as to the action you should take, you

are recommended to seek your own independent advice. You are

advised to read all of the information contained in the Circular

before deciding on the course of action you will take in respect of

the General Meeting and the Tender Offer.

IMPORTANT NOTICE

This announcement does not constitute or form part of an offer

or invitation, or a solicitation of any offer or invitation, to

purchase any Ordinary Shares or other securities.

The full terms and conditions of the Tender Offer will be set

out in the Circular, which Shareholders are advised to read in

full. Any response to the Tender Offer should be made only on the

basis of the information in the Circular.

Shore Capital and Corporate Limited ("Shore Capital") and Shore

Capital Stockbrokers which are authorised and regulated in the UK

by the FCA, are acting for the Company and no-one else in

connection with the Tender Offer, and will not be responsible to

anyone other than the Company for providing the protections

afforded to customers of Shore Capital and Corporate and Shore

Capital Stockbrokers or for providing advice in relation to the

matters described in this announcement.

Apart from the responsibilities and liabilities, if any, which

may be imposed on Shore Capital and Shore Capital Stockbrokers

under FSMA or the regulatory regime established thereunder: (i)

none of Shore Capital or Shore Capital Stockbrokers or any persons

associated or affiliated with either of them accepts any

responsibility whatsoever or makes any warranty or representation,

express or implied, in relation to the contents of this

announcement, including its accuracy, completeness or verification

or for any other statement made or purported to be made by, or on

behalf of it, the Company or the Directors, in connection with the

company and/or the Tender Offer; and (ii) each of Shore Capital and

Shore Capital Stockbrokers accordingly disclaims, to the fullest

extent permitted by law, all and any liability whatsoever, whether

arising in tort, contract or otherwise (save as referred to above)

which they might otherwise be found to have in respect of this

announcement or any such statement.

Cautionary statement regarding forward-looking statements

This announcement includes statements that are, or may be deemed

to be, forward-looking statements. These forward-looking statements

can be identified by the use of forward-looking terminology,

including the terms anticipates, believes, could, estimates,

expects, intends, may, plans, projects, should or will, or, in each

case, their negative or other variations or comparable terminology,

or by discussions of strategy, plans, objectives, goals, future

events or intentions. By their nature, forward-looking statements

involve risk and uncertainty because they relate to future events

and circumstances. Forward-looking statements may, and often do,

differ materially from actual results. Any forward-looking

statements in this announcement reflect Whitbread's current view

with respect to future events and are subject to risks relating to

future events and other risks, uncertainties and assumptions

relating to the Group and its operations, results of operations and

growth strategy. Other than in accordance with its legal or

regulatory obligations (including under the Disclosure Guidance and

Transparency Rules, the Market Abuse Regulation and the rules of

the London Stock Exchange), the Company is not under any obligation

and the Company expressly disclaims any intention or obligation (to

the maximum extent permitted by law) to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Overseas Shareholders

The availability of the Tender Offer to Shareholders who are not

resident in the United Kingdom may be affected by the laws of the

relevant jurisdiction in which they are located. Shareholders who

are not resident in the United Kingdom should read paragraph 5 of

Part IV (headed "Overseas Shareholders") of the Circular and should

inform themselves about, and observe, any applicable legal or

regulatory requirements. The Tender Offer is not being made,

directly or indirectly, in or into, or by use of the mails of, or

by any means or instrumentality (including, without limitation,

facsimile transmission, telex, telephone and e-mail) of interstate

or foreign commerce of, or any facilities of a national securities

exchange of, any Restricted Jurisdiction and the Tender Offer

cannot be accepted by any such use, means, instrumentality or

facility or from within any Restricted Jurisdiction. Accordingly,

unless otherwise determined by the Company and permitted by

applicable law and regulation, neither the Circular nor the Tender

Form nor any related document is being, nor may it be, directly or

indirectly, mailed, transmitted or otherwise forwarded,

distributed, or sent in, into or from any Restricted Jurisdiction,

and persons receiving the Circular, the Tender Form and/or any

related document (including, without limitation, trustees, nominees

or custodians) must not mail or

otherwise forward, distribute or send it in, into or from such

Restricted Jurisdiction, as to do so may invalidate any purported

acceptance of the Tender Offer. Any person (including, without

limitation, trustees, nominees or custodians) who would or

otherwise intends to, or who may have a contractual or legal

obligation to, forward the Circular, the Tender Form and/or any

related document to any jurisdiction outside the United Kingdom,

should seek appropriate advice before taking any action.

EXPECTED TIMETABLE OF PRINCIPAL EVENTS Publication of the Circular and the Notice of General 2 June 2023

Meeting

Tender Offer opens 2 June 2023

Latest time and date for receipt of Forms of Proxy 11:00 a.m. on 15 June 2023

General Meeting 11:00 a.m. on 19 June 2023

Announcement of results of the General Meeting 19 June 2023

Latest time and date for receipt of Tender Forms and share 1:00 p.m. on 22 June 2023

certificates in relation to the

Tender Offer (i.e. close of Tender Offer)

Latest time and date for receipt of TTE Instructions in 1:00 p.m. on 22 June 2023

relation to the Tender Offer (i.e.

close of Tender Offer)

Tender Offer Record Date 6:00 p.m. on 22 June 2023

Announcement of results of the Tender Offer 23 June 2023

Purchase of Ordinary Shares under the Tender Offer 23 June 2023

CREST accounts credited for revised, uncertificated by 7 July 2023

holdings of Ordinary Shares

Cheques despatched in respect of Tender Offer proceeds for by 7 July 2023

certificated Ordinary Shares

Return of share certificates in respect of unsuccessful by 7 July 2023

tenders of certificated Ordinary Shares

Despatch of balancing share certificates (in respect of by 7 July 2023

certificated Ordinary Shares) for

revised, certificated holdings in the case of partially

successful tenders

All times are references to London (UK) times. Each of the above

times and dates are indicative only and based on the Company's expectations

as at the date of this announcement. If any of the above times and/or

dates change, the revised times and/or dates will be notified to

Shareholders by an announcement through a Regulatory Information

Service.

DEFINITIONS

The following definitions apply throughout this announcement

unless the context requires otherwise:

2023 AGM the Company's next annual general

meeting, expected to be held on

29 June 2023

Act the Companies Act 2006, as amended

from time to time

AIM AIM, a market operated by the

London Stock Exchange

AIM Rules for Companies the AIM Rules for Companies of

the London Stock Exchange as amended

from time to time

Board or Board of Directors the directors of the Company

or Directors of the Company

Business Day any day other than a Saturday,

Sunday or public holiday on which

banks are open in the City of

London for the transaction of

general commercial business

certificated form or certificated in relation to a share, a share,

title to which is recorded in

the relevant register of the share

concerned as being held in certificated

form (that is, not in CREST)

Circular the Company's circular to Shareholders,

to be published on 2 June 2023

Closing Date 22 June 2023 or such other date

as may be determined in accordance

with the Circular in relation

to the Tender Offer

Company or Anpario Anpario plc, a public limited

company incorporated in England

with registered number 3345857

and registered office Unit 5,

Manton Wood, Enterprise Park,

Worksop, S80 2RS

CREST the paperless settlement procedure

operated by Euroclear enabling

system securities to be evidenced

otherwise than by certificates

and transferred otherwise than

by written instrument

CREST Manual the rules governing the operation

of CREST as published by Euroclear

CREST Member a person who has been admitted

by Euroclear as a system member

(as defined in the CREST Regulations)

CREST Participant a person who is, in relation to

CREST, a system participant (as

defined in the CREST Regulations)

CREST Proxy Instruction a proxy appointment or instruction

made via CREST authenticated in

accordance with Euroclear's specifications

and containing the information

set out in the CREST manual

CREST Regulations the Uncertificated Securities

Regulations 2001 (SI 2001 No.

3755), as amended from time to

time

Disclosure and Transparency the Disclosure Guidance and Transparency

Rules or DTRs Rules of the FCA made under Part

VI of FSMA, as amended from time

to time

Euroclear Euroclear UK & International Limited,

the operator of CREST

Excess Entitlement has the meaning given to that

term in this announcement

FCA the Financial Conduct Authority

of the United Kingdom

Form of Proxy (a) the hard copy proxy form accompanying

the Circular; or (b) the electronic

proxy form to appoint a proxy

electronically by logging on to

www.shareregistrars.uk.com, clicking

on the "Proxy Vote" button and

then following the on-screen instructions,

as the case may be, in each case,

to be used in connection with

the General Meeting and to be

completed and submitted in accordance

with the instructions thereof

and the terms and conditions of

the Circular

FSMA the Financial Services and Markets

Act 2000, as amended from time

to time

General Meeting the general meeting of the Company

to be held at the offices of DLA

Piper UK LLP at 160 Aldersgate

Street, EC1A 4HT, London, United

Kingdom, at 11:00 a.m. on 19 June

2023, or any adjournment thereof,

notice of which will be set out

in the Circular

Group the Company and its Subsidiaries

and Subsidiary undertakings

Guaranteed Entitlement has the meaning given to that

term in this announcement

Issued Ordinary Share Capital the issued Ordinary Shares at

the Tender Offer Record Date

Latest Practicable Date 1 June 2023, being the latest

practicable date prior to the

publication of this announcement

London Stock Exchange London Stock Exchange plc

Member account ID the identification code or number

attached to any member account

in CREST

Notice of General Meeting the notice of the General Meeting

which will appear in the Circular

Ordinary Shares the ordinary shares of 23 pence

each in the capital of the Company

Overseas Shareholders a Shareholder who is a resident

in, or a national or citizen of,

a jurisdiction outside the United

Kingdom

Participant ID the identification code or membership

number used in CREST to identify

a particular CREST Member or other

CREST Participant

Qualifying Shareholder Shareholders who are entitled

to participate in the Tender Offer,

being those who are on the Register

on the Tender Offer Record Date

and excluding those with a registered

address in a Restricted Jurisdiction

Repurchase Agreement the Repurchase Agreement dated

2 June 2023, between Shore Capital

Stockbrokers and the Company,

the terms of which will be summarised

in the Circular

Register the Company's register of members

Registrar or Receiving Agent Share Registrars Limited of 3

The Millennium Centre, Crosby

Way, Farnham, Surrey, GU9 7XX,

as Registrar and Receiving Agent

Regulatory Information Service a service approved by the FCA

for the distribution to the public

of regulatory announcements and

included within the list maintained

on the FCA's website

Resolution the special resolution to be proposed

at the General Meeting, as set

out in the Notice of General Meeting

Restricted Jurisdictions each and any of Australia, Canada,

Japan, New Zealand, the United

States, Singapore, the Republic

of South Africa and any other

jurisdiction where the mailing

of the Circular or the accompanying

documents, or the extension of

the Tender Offer, in the manner

contemplated by the Circular into

or inside such jurisdiction would

constitute a violation of the

laws of such jurisdiction

Shareholders the holders of the Ordinary Shares

from time to time

Share Registrars Limited Share Registrars Limited, 3 The

Millennium Centre, Crosby Way,

Farnham, Surrey, GU9 7XX, as Registrar

and Receiving Agent

Shore Capital Stockbrokers Shore Capital Stockbrokers Limited

Subsidiary a subsidiary as that term is defined

in section 1159 of the Companies

Act 2006

Tender Conditions shall have the meaning given in

the Circular

Tender Form the form enclosed with the Circular

for use by Shareholders who hold

Ordinary Shares in certificated

form in connection with the Tender

Offer

Tender Offer the invitation to Shareholders

to tender Ordinary Shares on the

terms and conditions set out in

the Circular and also, in the

case of certificated Ordinary

Shares only, the Tender Form (and,

where the context so requires,

the associated repurchase of such

Ordinary Shares by the Company

from Shore Capital Stockbrokers)

Tender Offer Record Date close of business (6:00 p.m.,

or Record Date UK time) on 22 June 2023 or such

other time and date as may be

determined by the Company in its

sole discretion

Tender Price 225p being the price per ordinary

share at which the Ordinary Shares

will be purchased pursuant to

the Tender Offer

TTE Instruction a transfer to escrow instruction

(as defined by the CREST Manual)

Uncertificated Form recorded on the Register as being

held in uncertificated form in

CREST and title to which, by virtue

of the Uncertified Securities

Regulations, may be transferred

by means of CREST

United Kingdom or UK United Kingdom of Great Britain

and Northern Ireland, its territories

and dependencies

United States or USA United States of America, its

territories, its possessions,

any state of the United States

and the District of Columbia

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TENUPUMAQUPWGCM

(END) Dow Jones Newswires

June 07, 2023 11:09 ET (15:09 GMT)

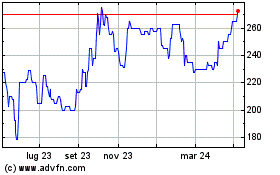

Grafico Azioni Anpario (LSE:ANP)

Storico

Da Ott 2024 a Nov 2024

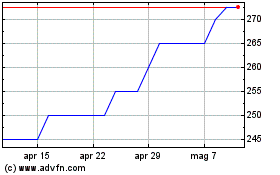

Grafico Azioni Anpario (LSE:ANP)

Storico

Da Nov 2023 a Nov 2024