RNS Number:6024E

Berkeley Resources Limited

27 September 2007

BERKELEY RESOURCES LIMITED

ANNUAL FINANCIAL REPORT

30 JUNE 2007

ABN 40 052 468 569

CORPORATE DIRECTORY

Directors Share Registry

Dr Robert Hawley - Chairman Australia

Mr Matthew Syme - Managing Director Computershare Investor Services Pty Ltd

Dr James Ross Level 2

Senor Jose Ramon Esteruelas 45 St Georges Terrace

Mr Sean James Perth WA 6000

Telephone: +61 8 9323 2000

Company Secretary Facsimile: +61 8 9323 2033

Mr Shane Cranswick

United Kingdom

Registered Office Computershare Investor Services Plc

Level 9, BGC Centre PO Box 82

28 The Esplanade The Pavillions

Perth WA 6000 Bridgwater Road

Australia Bristol BS99 7NH

Telephone: +61 8 9322 6322 Telephone: +44 870 889 3105

Facsimile: +61 8 9322 6558

Stock Exchange Listings

London Office Australia

Office 2.20 Australian Securities Exchange Limited

18 Hanover Square Home Branch - Perth

London W1S 1HX 2 The Esplanade

United Kingdom Perth WA 6000

Telephone: +44 20 3008 4776

Facsimile: +44 20 3008 8601 United Kingdom

London Stock Exchange - AIM

10 Paternoster Square

Auditor London EC4M 7LS

Stantons International

Level 1 ASX/AIM Code

1 Havelock Street BKY - Fully paid ordinary shares

West Perth WA 6005

Bankers

Website Australia and New Zealand Banking Group Ltd

www.berkeleyresources.com.au 77 St Georges Terrace

Perth WA 6000

Email

info@berkeleyresources.com.au

DIRECTORS' REPORT

30 JUNE 2007

The Directors of Berkeley Resources Limited submit their report on the

Consolidated Entity consisting of Berkeley Resources Limited ("Company" or "

Berkeley" or "Parent") and the entities it controlled at the end of, or during,

the year ended 30 June 2007 ("Consolidated Entity" or "Group").

Directors

The names of Directors in office at any time during the financial year or since

the end of the financial year are:

Dr Robert Hawley

Mr Matthew Syme

Dr James Ross

Senor Jose Ramon Esteruelas (appointed 16 November 2006)

Mr Sean James (appointed 28 July 2006)

Mr Ian Middlemas (resigned 16 November 2006)

Unless otherwise disclosed, Directors held their office from 1 July 2006 until

the date of this report.

Current Directors and Officers

Robert Hawley

Non-Executive Chairman

Qualifications - CBE, DSc, FRSE, FREng, Hon FIET, FIMechEng, FInstP

Dr Hawley is based in London and has extensive technical qualifications and

substantial expertise in the nuclear energy industry as well as broader public

company management. He was Chief Executive of British Energy Plc from 1995 to

1997, Chief Executive of Nuclear Electric Plc from 1992 to 1996 and prior to

this enjoyed a long career in senior engineering and management positions with

CA Parsons & Co Ltd, Northern Engineering Industries Plc and Rolls-Royce Plc. Dr

Hawley has been Managing Director of CA Parsons & Co Ltd, Managing Director of

Northern Engineering Industries Plc, a Director of Rolls-Royce Plc, Chairman of

Taylor Woodrow Plc, an Advisor Director of HSBC Bank Plc and is presently a

director of Colt Telecom Group Ltd, Rutland Trust Plc, Carron Acquisition Co Ltd

and Lister Petter Investment Holdings Ltd. He was awarded the CBE in 1997 for

services to the Energy Industry and to Engineering.

Dr Hawley's experience in managing Nuclear Electric Plc, the largest nuclear

generator in the United Kingdom, and British Energy Plc, the United Kingdom's

leading electricity supplier, gives him a unique understanding of the nuclear

generation sector in Europe and he is acknowledged as an international expert on

power generation and energy.

During the three year period to the end of the financial year, Dr Hawley has

held directorships in Rutland Trust Plc (September 2000 - July 2007), Colt

Telecom Group Ltd (August 1998 - present),Carron Acquisition Co Ltd (April 2006

- present) and Lister Petter Investment Holdings Ltd (September 2006 - present).

Dr Hawley was appointed a director of Berkeley Resources Limited on 20 April

2006.

Matthew Syme

Managing Director

Qualifications - B.Com, CA

Mr Syme is a Chartered Accountant and has over 20 years experience as a senior

executive of a number of companies in the Australian resources and media

sectors. He was a Manager in a major international Chartered Accounting firm

before spending 3 years as an equities analyst in a large stockbroking firm. He

was then Chief Financial Officer of Pacmin Mining Limited, a successful

Australian gold mining company, as well as a number of other resources

companies.

Mr Syme was appointed a director of Berkeley Resources Limited on 27 August

2004. Mr Syme has not held any other directorships of listed companies in the

last three years.

DIRECTORS' REPORT (continued)

James Ross

Technical Director

Qualifications - B.Sc. (Hons.), PhD, FAusIMM, FAICD

Dr Ross is a leading international geologist whose technical qualifications

include an honours degree in Geology at UWA and a PhD in Economic Geology from

UC Berkeley. He first worked with Western Mining Corporation Limited for 25

years, where he held senior positions in exploration, mining and research.

Subsequent appointments have been at the level of Executive Director, Managing

Director and Chairman in a number of small listed companies in exploration,

mining, geophysical technologies, renewable energy and timber. His considerable

international experience in exploration and mining includes South America,

Africa, South East Asia and the Western Pacific.

Dr Ross chairs the Boards of two geosciences research centres and two

foundations concerned with geosciences education in Western Australia.

He was appointed a director of Berkeley Resources Limited on 4 February 2005 and

has not been a director of another listed company in the three years prior to

the end of the financial year.

Senor Jose Ramon Esteruelas

Non-Executive Director

Senor Esteruelas is an experienced Spanish executive whose senior executive

roles have included Director General of Correos y Telegrafos (the Spanish postal

service), President of Minas de Almaden y Arrayanes SA (formerly the world's

largest mercury producer) and Chief Executive Officer of Compania Espanola de

Tabaco en Rama S.A., the leading tobacco transforming company in Spain.

Senor Esteruelas was appointed a Director of Berkeley Resources Limited on 16

November 2006. Senor Esteruelas has not held any other directorships of listed

companies in the last three years.

Sean James

Non-Executive Director

Qualifications - B.Sc. (Hons.)

Mr James is a mining engineer and was formerly the Managing Director of the

Rossing Uranium Mine in Namibia which is the world's largest low grade, open pit

uranium mine. After 16 years at Rossing, he returned to London as a Group Mining

Executive at Rio Tinto Plc in London.

Mr James' experience in managing the Rossing mine is ideally suited for the type

of uranium mining operations the Company aims to develop in the Iberian

Peninsula.

Mr James was appointed a Director of Berkeley Resources Limited on 28 July 2006.

Mr James has not held any other directorships of listed companies in the last

three years.

Shane Cranswick

Company Secretary

Qualifications - B.Com, CA, ACIS, SA Fin

Mr Cranswick gained a Bachelor of Commerce degree from the University of Western

Australia and is a member of the Institute of Chartered Accountants, the

Institute of Chartered Secretaries and the Financial Services Institute of

Australasia. He commenced his career with an international Chartered Accounting

firm and has since worked in the role of Company Secretary for a number of

listed companies that operate in the resources sector.

Mr Cranswick was appointed Company Secretary of Berkeley Resources Limited on 30

July 2004.

DIRECTORS' REPORT (continued)

Principal Activities

The principal activities of the Consolidated Entity during the year consisted of

mineral exploration. There was no significant change in the nature of those

activities.

Employees

2007 2006

The number of full time equivalent people employed by the Consolidated

Entity at balance date 20 6

Dividends

No dividends have been declared, provided for or paid in respect of the

financial year ended 30 June 2007 (2006: nil).

Earnings Per Share

2007 2006

Cents Cents

Basic loss per share (7.48) (7.33)

Diluted loss per share (7.48) (7.33)

Corporate Structure

Berkeley Resources Limited is a company limited by shares that is incorporated

and domiciled in Australia. The Company has prepared a consolidated financial

report including the entities it acquired and controlled during the financial

year.

Consolidated Results

2007 2006

$ $

Loss of the Consolidated Entity before income tax expense (7,430,597) (3,741,426)

Income tax expense - -

Net loss (7,430,597) (3,741,426)

Net loss attributable to minority interest 1,116,026 -

Net loss attributable to members of Berkeley Resources Limited (6,314,571) (3,741,426)

Review of Operations AND ACTIVITIES

The net loss of the Consolidated Entity after minority interests for the year

ended 30 June 2007 was $6,314,571 (2006:$3,741,426). Included in this loss was

an amount of $2,357,250 (2006:$1,515,234) representing share based incentive

options and an expense of $845,912 in relation to the acquisition of ENUSA's

exploration database for the Salamanca I project.

During the year the Company continued its focus on developing its uranium

exploration projects in Spain. This included further review of its exploration

databases and the database for the Salamanca I project acquired from the Spanish

national uranium company, ENUSA in October 2006. Drilling commenced in December

2006 at the Salamanca I project with a particular focus on the Retortillo

deposit. At the Caceres III project, the main focus was on the Saguazal prospect

where initial drill testing was completed in the June 2007 quarter.

In April 2007 Berkeley calculated an initial JORC compliant inferred resource

for the Retortillo and Zona 7 uranium deposits totalling 11.9 million pounds of

U3O8 at an average grade of 723ppm. This estimate was based on verification

and re-interpretation of the ENUSA database together with the aid of an eighteen

hole drilling programme completed by Berkeley. Further drilling is currently

under way at and around Retortillo.

DIRECTORS' REPORT (continued)

Berkeley is also currently reviewing other uranium exploration opportunities in

Europe and elsewhere.

The Company sold its Strelley and Kangan North properties in the Pilbara region

of Western Australia for cash and share consideration, resulting in a gain on

sale of $1m.

In December 2006, the Company's securities commenced trading on the Alternative

Investment Market (AIM) of the London Stock Exchange.

Mr Sean James, former Managing Director of the Rossing Uranium Mine in Namibia,

and Senor Jose Ramon Esteruelas, a very experienced Spanish executive, were

appointed to the Board of Directors during the year.

Corporate and Financial Position

The following material corporate events occurred during the year:

* On 28 July 2006, Mr Sean James was appointed as an Executive Director

of the Company (see Current Directors and Officers above for further details).

* On 26 September 2006, the Company announced it was proceeding with the

admission of its ordinary shares to trading the Alternative Investment Market

(AIM) of the London Stock Exchange. The Company's securities commenced trading

on AIM on 6 December 2006;

* On 16 November 2006, Senor Jose Ramon Esteruelas was appointed a

Director of the Company and Mr Ian Middlemas resigned as a Director of the

Company;

* On 29 November 2006 the Company announced the sale of its Strelley and

Kangan North properties in the Pilbara region of Western Australia to Atlas Iron

Limited. In consideration for the sale the Company received $350,000 cash and

1.3 million Atlas Iron Limited ordinary shares then valued at $650,000,

resulting in a gain on sale of $1 million; and

* During the period to 30 November 2006, 12,111,374 Listed Options and

4,850,000 Unlisted Options were exercised which raised approximately $3.4

million. 157,000 Listed Options were not exercised as at the expiry date of 30

November 2006.

* On 10 April 2007, Berkeley announced that the Company had completed an

initial JORC compliant resource estimate for the Retortillo and Zona 7 uranium

deposits totalling 11.9 million pounds of U3O8 at an average grade of 723ppm.

* On 26 April 2007, the Company completed the placement of 12.5 million

shares at a price of $1.85 per share with institutional investors raising

$23.1million before expenses.

* During the financial year Berkeley increased its interest in its main

Spanish operating subsidiary, Minera de Rio Alagon SL (''Rio Alagon''), from 51%

to 77.5%.

Business Strategies and Prospects

The Consolidated Entity currently has the following business strategies and

prospects over the medium to long term:

* To increase its resources at and around Retortillo and commence

pre-feasibility studies;

* Complete the 100% acquisition of the Spanish uranium projects; and

* Continue to examine new opportunities in mineral exploration.

Risk Management

The Board is responsible for the oversight of the Consolidated Entity's risk

management and control framework. Responsibility for control and risk management

is delegated to the appropriate level of management with the Managing Director

having ultimate responsibility to the Board for the risk management and control

framework.

Arrangements put in place by the Board to monitor risk management include

monthly reporting to the Board in respect of operations and the financial

position of the Group.

DIRECTORS' REPORT (continued)

Significant Changes in the State of Affairs

Other than as disclosed below, there were no significant changes in the state of

affairs of the Consolidated Entity during the year.

* In November 2006 the Company disposed of its Strelley and Kangan North

Properties in Western Australia to Atlas Iron Limited. In consideration for the

sale the Company received $350,000 cash and 1.3 million Atlas Iron Limited

ordinary shares valued at $650,000 resulting in a gain of $1 million.

* During the year Berkeley earned a further 22.5% in Rio Alagon to take

its holding to 77.5% at 30 June 2007.

* In April 2007 the Company completed a placement of 12.5 million new

ordinary shares at a price of $1.85 per share, with institutional investors in

Europe, the USA, Canada and Australia. The issue raised $23.1 million before

expenses.

The Company had the following securities on issue at 30 June 2007:

Issued and Paid Up Shares Listed Unlisted Director Director Unlisted

Options - Options - Incentive Incentive Options -

Capital $0.20 $0.20 Options - $1.00 Options - $0.70

$various

Balance at 30 June 2006 71,130,321 12,268,374 4,850,000 - 3,000,000 10,600,000

Share placement 12,500,000 - - - - -

Director Incentive Options

Issue - - - 2,250,000 - -

Exercise of Options 17,961,374 (12,111,374) (4,850,000) - (1,000,000) -

Expiry of Options - (157,000) - - - -

Total at 30 June 2007 101,591,695 - - 2,250,000 2,000,000 10,600,000

Since 30 June 2007 the only movement in securities on issue to 28 September 2007

has been the issue of 2,970,000 employee options exercisable at $1.86 per share

under the Employee Option Scheme on 6 August 2007.

Significant Post Balance Date Events

As at the date of this report there are no matters or circumstances, which have

arisen since 30 June 2007 that have significantly affected or may significantly

affect:

(a) the operations, in financial years subsequent to 30 June

2007, of the Consolidated Entity;

(b) the results of those operations, in financial years

subsequent to 30 June 2007, of the Consolidated Entity; or

(c) the state of affairs, in financial years subsequent to 30

June 2007, of the Consolidated Entity.

Environmental Regulation and Performance

The Consolidated Entity's operations are subject to various environmental laws

and regulations under the relevant government's legislation. Full compliance

with these laws and regulations is regarded as a minimum standard for all

operations to achieve.

Instances of environmental non-compliance by an operation are identified either

by external compliance audits or inspections by relevant government authorities.

There have been no significant known breaches by the Consolidated Entity during

the financial year.

DIRECTORS' REPORT (continued)

Likely Developments and Expected Results

It is the Board's current intention that the Consolidated Entity will continue

with development of its Spanish uranium projects and will seek to complete the

100% acquisition of Rio Alagon.The Company will also continue to examine new

opportunities in mineral exploration, including uranium.

All of these activities are inherently risky and the Board is unable to provide

certainty that any or all of these activities will be able to be achieved. In

the opinion of the Directors, any further disclosure of information regarding

likely developments in the operations of the Consolidated Entity and the

expected results of these operations in subsequent financial years may prejudice

the interests of the Company and accordingly no further information has been

disclosed.

To view the financial tables please view the link below

http://www.rns-pdf.londonstockexchange.com/rns/6024e_-2007-9-27.pdf

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UBVWRBKRKURR

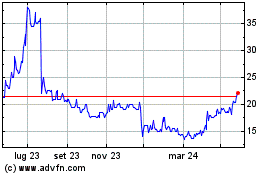

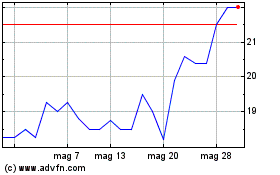

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Lug 2023 a Lug 2024