TIDMBKY

RNS Number : 2490H

Berkeley Resources Limited

12 March 2015

BERKELEY RESOURCES LIMITED

INTERIM FINANCIAL REPORT

FOR THE HALF YEAR ENDED 31 DECEMBER 2014

DIRECTORS' REPORT

The Board of Directors of Berkeley Resources Limited present

their report on the consolidated entity of Berkeley Resources

Limited ('the Company' or 'Berkeley') and the entities it

controlled during the half year ended 31 December 2014

('Consolidated Entity' or 'Group').

DIRECTORS

The names of the Directors of Berkeley in office during the half

year and until the date of this report are:

Mr Ian Middlemas

Dr James Ross

Mr Robert Behets

Unless otherwise disclosed, Directors were in office from the

beginning of the half year until the date of this report.

REVIEW OF OPERATIONS AND ACTIVITIES

Berkeley is a uranium exploration and development company with a

quality resource base in Spain. The Company is currently focussed

on advancing its wholly owned flagship Salamanca Project.

The Salamanca Project comprises the Retortillo, Alameda, Zona 7

and Gambuta deposits, plus a number of other Satellite deposits

located in western Spain.

Highlights during the half year include:

-- Outstanding intercepts in 2014 drilling program at Zona 7:

Ø 2013 drilling program at Zona 7, the largest of the Retortillo

Satellite Deposits, recorded significant high grade intersections

at shallow depths and essentially doubled the strike extent of the

mineralised zone;

Ø 2014 drill program, completed in September, was aimed at

infilling the zone of mineralisation delineated by 2013 drilling

and extending it further to the south-west;

Ø High grade mineralisation was again intersected at shallow

depths (from surface to a maximum of 73 metres), with thicknesses

up to 25 metres;

Ø Outstanding intercepts from the 45 reverse circulation drill

holes include:

Ø 21 metres @ 3,101 ppm U(3) O(8)

Ø 19 metres @ 2,332 ppm U(3) O(8)

Ø 25 metres @ 2,005 ppm U(3) O(8)

Ø 21 metres @ 1,535 ppm U(3) O(8)

Ø 17 metres @ 1,517 ppm U(3) O(8)

Ø 20 metres @ 1,238 ppm U(3) O(8)

Ø Mineralisation remains open along the north-western margin,

and along strike to the southwest.

-- Substantial increase in Zona 7 Resource:

Ø Zona 7 Mineral Resource Estimate ('MRE') increased to 30.1

Mlbs U(3) O(8) (previously 3.6 Mlbs);

Ø Average grade of the MRE increased by 42% to 589 ppm U(3) O(8)

;

Ø 90% of the MRE within 50 metres of surface;

Ø Salamanca Project total resource base increased by 43% to 88.2

Mlbs U(3) O(8) ; and

Ø The successful exploration drilling at Zona 7 and subsequent

increase in resource highlights the significant exploration and

resource growth potential of the broader Salamanca Project.

-- Scoping Study commenced to determine the optimum integration

of Zona 7 with the development of Retortillo and Alameda, thereby

potentially increasing the scale and/or mine life of the

Project.

-- Key inputs for the Salamanca Project Definitive Feasibility Study ('DFS') advanced:

Ø The DFS is currently focussed on the integrated development of

Retortillo and Alameda however, Zona 7 will be incorporated

following completion of the abovementioned Scoping Study;

Ø The resource infill drilling program at Retortillo, aimed at

upgrading sections of the resource to the Measured category, was

completed. The data obtained from this infill drilling program will

form the basis for a revised MRE, which is anticipated to be

completed in the current quarter;

Ø Metallurgical column leaching testwork for Retortillo was

completed. Solvent extraction characterisation tests are now

underway; and

Ø Permeability and hydraulic conductivity tests were completed

at Retortillo. The results of these tests, along with the pumping

tests completed in the previous quarter, are currently being used

to update the Retortillo hydrogeological model for incorporation

into the DFS.

Operations

Zona 7

Zona 7 is located within 10 kilometres of the proposed

centralised processing plant at Retortillo andthere is scope to

integrate it with planned development of Retortillo and Alameda,

and potentially increase the level of production and/or mine life

of the Salamanca Project.

A review of all available data for the regional tenements

surrounding the existing resources in late 2012 identified the

potential extension of Zona 7 to the southwest as a priority drill

target. An 18 hole, 1,128 metre reverse circulation ('RC') drill

program was subsequently completed in mid-2013 to test this

priority target. This drilling, which was carried out on an

approximately 400 metre by 100 metre grid, resulted in the

mineralised zone being extended a further 1,200 metres to the

southwest of the previous resource area.

Drilling

The 2014 drilling program, which comprised 45 RC holes for 2,923

metres and five diamond core ('DD') holes for 391 metres, was aimed

at infilling the Zona 7 extension on a notional 100 metre by 100

metre grid.

The mineralisation intersected in the new infill holes showed

good continuity of both thickness and grade exists between the

previous broader spaced drill holes within the Zona 7 extension.

Significant high grade intersections have been recorded at shallow

depths (from surface to a maximum depth of 73 metres), with

thicknesses up to 25 metres (Table 1).

Table 1: Zona 7 - 2014 Drilling Program - Select Intercepts

Hole No. Down Hole Intercept From Depth

(Down Hole)

---------- --------------------- -------------

21m @ 3,101 ppm

Z7R-102 U(3) O(8) 5m

---------- --------------------- -------------

25m @ 2,005 ppm

U(3) O(8)

17m @ 1,517 ppm 11m

Z7R-101 U(3) O(8) 50m

---------- --------------------- -------------

21m @ 1,535 ppm

Z7R-104 U(3) O(8) 2m

10m @ 501 ppm

U(3) O(8) 26m

-------------------------------- -------------

16m @ 1,014 ppm

Z7R-096 U(3) O(8) 5m

---------- --------------------- -------------

19m @ 2,332 ppm

Z7R-112 U(3) O(8) 30m

---------- --------------------- -------------

20m @ 1,238 ppm

Z7R-140 U(3) O(8) 13m

---------- --------------------- -------------

12m @ 1,422 ppm

Z7R-138 U(3) O(8) 32m

18m @ 825 ppm

U(3) O(8) 47m

-------------------------------- -------------

13m @ 1,067 ppm

Z7R-137 U(3) O(8) 20m

---------- --------------------- -------------

20m @ 607 ppm

Z7R-142 U(3) O(8) 16m

---------- --------------------- -------------

11m @ 652 ppm

Z7R-139 U(3) O(8) 26m

10m @ 1,033 ppm

U(3) O(8) 40m

-------------------------------- -------------

4m @ 1,633 ppm

Z7R-114 U(3) O(8) 20m

---------- --------------------- -------------

The mineralisation remains open along the north-western margin,

and along strike to the southwest. Both of these areas will be

targeted in subsequent drilling campaigns.

Mineral Resource Estimate

The Mineral Resource Estimate ('MRE') for Zona 7 was updated in

November 2014, incorporating additional drilling and sampling

information from the 2013 and 2014 drilling campaigns. The MRE was

classified as Inferred based on the guidelines recommended in the

JORC Code (2012).

The MRE is reported at a lower cut-off grade of 200 ppm U(3)

O(8) (Table 2), along with estimates showing the range of U(3) O(8)

cut-off grades that would span the range applicable to open pit

mining (Table 3).

Table 2: Zona 7 - Mineral Resource Estimate

Zona 7 - Inferred Mineral Resource Estimate

as at 25 November 2014

Reported at a lower cut-off grade of 200

ppm U(3) O(8)

-------------------------------------------------------

Domain Tonnage Grade Contained

U(3) O(8)

(million (U(3) O(8) (million

tonnes) ppm) pounds)

---------------- ---------- ------------ -----------

2 / 3 /

4 / 5 5.1 318 3.6

---------------- ---------- ------------ -----------

6 18.1 665 26.6

---------------- ---------- ------------ -----------

Total Inferred 23.2 589 30.1

---------------- ---------- ------------ -----------

All figures are rounded to reflect appropriate levels of

confidence. Apparent differences occur due to rounding.

Table 3: Zona 7 - Grade Tonnage Table

Zona 7 - Inferred Mineral Resource Estimate

as at 25 November 2014

-----------------------------------------------------

Lower Cut-off Tonnage Grade Contained

Grade U(3) O(8)

(U(3) O(8) (million (U(3) O(8) (million

ppm) tonnes) ppm) pounds)

-------------- ---------- ------------ -----------

100 35.7 434 34.2

-------------- ---------- ------------ -----------

200 23.2 589 30.1

-------------- ---------- ------------ -----------

300 15.7 754 26.1

-------------- ---------- ------------ -----------

400 11.9 882 23.2

-------------- ---------- ------------ -----------

500 9.4 1,001 20.7

-------------- ---------- ------------ -----------

Zona 7 - Scoping Study

Given the significant scale, high grade and shallow depth of the

Zona 7 deposit, the Company has commenced a Scoping Study to

determine the optimum integration of Zona 7 with the development of

Retortillo and Alameda, thereby potentially increasing the level of

production and/or mine life of the Project.

The key considerations for the Scoping Study will be preferred

mining and processing route, scale, throughput rate, mine life,

infrastructure, community and environmental impacts.

Retortillo / Alameda

The Company has completed a Preliminary Feasibility Study

('PFS') on the integrated development of Retortillo and Alameda,

which clearly demonstrated the Project's potential to support a

significant scale, long life uranium mining operation.

Using only the current MRE for Retortillo and Alameda, which

total 34.5 million pounds U(3) O(8) (36.9 million tonnes at 424

ppm; 200 ppm U(3) O(8) cut-off grade), as a base case scenario, the

PFS showed that the Project can support an average annual

production of 3.3 million pounds of U(3) O(8) during the seven

years of steady state operation and 2.7 million pounds of U(3) O(8)

over a minimum eleven year mine life (refer ASX announcement dated

26 September 2013).

Definitive Feasibility Study

The DFS for the Project commenced in 2014, with the key areas of

focus including:

-- Resource infill drilling programs aimed at upgrading the

classification of specific portions of the current Retortillo and

Alameda MRE's to the Measured category;

-- Further metallurgical testwork programs, including additional

column leach work (six metre columns), in combination with ion

exchange ('IX') at Alameda and solvent extraction ('SX') and

ammonium diuranate ('ADU') precipitation at Retortillo to generate

more detailed information relating to the pH and acid consumption

optimisation, design and sizing of the IX and SX units, and final

product specification;

-- Development of a Geo-Met model which will incorporate

additional geological and metallurgical parameters into the

resource block model to support metallurgical process modelling and

mine planning and optimisation;

-- Open pit optimisation, detailed mine design and production

scheduling using the upgraded MRE block models;

-- Enhanced design of the project infrastructure and site facilities;

-- Undertaking engineering studies to support capital and

operating cost estimates for the Project to a level of accuracy of

nominally +/-10%; and

-- Undertaking an evaluation of the various alternatives for

funding the development of the Project and the sale of future

uranium production (including uranium marketing and off-take

arrangements).

During the half year a number of work programs providing key

inputs to the DFS, including the resource infill drilling program

at Retortillo, the metallurgical testwork program and

hydrogeological studies for both sites, were advanced.

Drilling

An infill drilling program at Retortillo, aimed at upgrading the

resource classification of the areas to be mined during the initial

two years of the PFS production schedule to the Measured category,

was completed during the half year.

The program was designed to close the existing drill pattern

down to a notional 35 metre by 35 metre pattern within the areas

targeted while the core obtained from the DD drilling will

facilitate enhanced geological and structural understanding of the

deposit.

Following completion of the RC component of the program in

September, the DD program was completed in November. In total, 69

RC holes for 4,693 metres and four DD holes for 291 metres were

drilled.

The data obtained from this infill drilling program will form

the basis for a revised MRE, which is anticipated to be completed

and reported in April 2015.

Metallurgical Testwork

The metallurgical testwork program being undertaken for three

master composite samples, representative of various mining phases

at Retortillo, commenced during the half year at the Mintek

facilities in Johannesburg. The six metre column leaching testwork

was completed and SX characterisation tests are now underway.

Whilst final results are pending, the leaching characteristics

observed are generally in line with expectation.

Preparation for the master composite samples for Alameda was

completed however, the six metre column leaching testwork remain on

hold pending completion of the higher priority Zona 7 Scoping

Study.

Hydrogeology

Hydrogeology testwork during the half year included four 72 hour

pumping tests in the southern pit area at Retortillo which were

designed to:

-- Identify groundwater flows in non-fractured and fractured areas;

-- Identify groundwater flow in sandstone; and

-- Identify groundwater flow in a productive area.

The results will be used to update the hydrogeological model for

the site.

Permeability and hydraulic conductivity tests were also carried

out using the four DD holes at Retortillo. Data obtained from these

tests are currently being used to update the Retortillo

hydrogeological model.

At Alameda, work on updating the hydrogeological model for the

site was completed and confirmed the outcome of the previous model

included in the PFS.

Permitting

Following the grant of the Mining Licence in April 2014, the

approval processes associated with other key permits including the

Initial Authorisation of the process plant as a radioactive

facility and the Authorisation for Exceptional Use of the Land

(application for reclassification from rural to industrial use) of

the affected surface land area at Retortillo, continued to be the

focus of permitting related activities during the half year.

All documentation required for the Initial Authorisation of the

process plant as a radioactive facility, including the Radiological

Analytical Study and Pre-Operational Surveillance Plan have been

submitted by Berkeley and reviewed by technical staff within the

Nuclear Safety Council ('NSC'). The Company has subsequently

provided responses to all queries/requests for clarification put

forward by the NSC technical staff. The Initial Authorisation is

now pending review and approval of the documentation by the NSC

Board.

The Company submitted additional documentation pertaining to the

application for Exceptional Use of the Land at Retortillo to the

municipalities of Retortillo and Villavieja de Yeltes in November,

as requested by the Commission of Environment and Urbanism of

Salamanca. A number of follow-up meetings have been held with the

relevant authorities and Berkeley's application will be placed on

the agenda of a meeting of the Commission of Environment and

Urbanism of Salamanca (the substantive authority) in the coming

months.

The permitting process for Alameda also continued, with the

Exploitation Plan and Rehabilitation and Closure Plan being

submitted to the Ministry of Industry of the Central Government in

October. The Environmental Scoping Document was also submitted to

the Ministry of Industry in December and an introductory meeting

held with the Environment Department of the Central Government

following the submission. All key documentation associated with the

Initial Authorisation of the processing facilities at Alameda as a

radioactive facility has now been drafted. These documents will be

finalised once feedback is received on the Environmental Scoping

Document.

A stand-alone permitting process is required for Zona 7 however,

the substantive regulatory authorities are the same as those

involved in the Retortillo process. The documents required to

commence the Environmental and Mining Licence processes will be

prepared and submitted following completion of the Zona 7 Scoping

Study and initial Environmental and Radiological Protection

baseline studies.

Corporate

At 31 December 2014, the Company had cash reserves of A$16.1

million.

During the period, the Group completed an internal group

restructure resulting in the merger of Spanish subsidiary entities,

Berkeley Minera Espana, S.L. ('BME') and Minera de Rio Alagon,

S.L., with BME the surviving entity. The merger consolidates all of

the Salamanca Project licences under BME's ownership and is

expected to provide significant advantages to the Group in

permitting, stakeholder engagement, financing and reduction in

administration/compliance costs. There is no impact on the

Consolidated Entity from an accounting perspective.

Operating Results

The net operating loss after tax for the half year ended 31

December 2014 was $3,995,289 (2013: $4,186,622).

The loss for the period includes $3,557,219 (2013: $3,953,140)

in exploration and evaluation expenditure and share based payment

expenses of $186,616 (2013: $526,778) were also recognised during

the half year.

SIGNIFICANT POST BALANCE DATE EVENTS

At the date of this report there were no significant events

occurring after balance date requiring disclosure.

AUDITOR'S INDEPENDENCE DECLARATION

Section 307C of the Corporations Act 2001 requires our auditors,

Stantons International, to provide the Directors of Berkeley

Resources Limited with an Independence Declaration in relation to

the review of the half year financial report. This Independence

Declaration is on page 19 and forms part of this Directors'

Report.

Signed in accordance with a resolution of Directors.

Robert Behets

Non-Executive Director

12 March 2015

Competent Persons Statement

The information in this report that relates to 2014 Mineral

Resources for Zona 7 is extracted from the report entitled

'Salamanca Project Total Resource Increased By 43% to 88.2 Mlbs

U(3) O(8) following Substantial Increase In Zona 7 Resource' dated

26 November 2014 and is available to view on Berkeley's website at

www.berkeleyresources.com.au. The information in the original ASX

Announcement that relates to the 2014 Mineral Resources for Zona 7

was based on information compiled by Malcolm Titley, a Competent

Person who is a Member of The Australasian Institute of Mining and

Metallurgy. Mr Titley is employed by Maja Mining Limited, an

independent consulting company. Mr Titley has sufficient experience

which is relevant to the style of mineralisation and type of

deposit under consideration and to the activity which he is

undertaking to qualify as a Competent Person as defined in the 2012

Edition of the 'Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves'. The Company confirms

that it is not aware of any new information or data that materially

affects the information included in the original market

announcement and, in the case of estimates of Mineral Resources

that all material assumptions and technical parameters underpinning

the estimates in the relevant market announcement continue to apply

and have not materially changed. The Company confirms that the form

and context in which the Competent Person's findings are presented

have not been materially modified from the original market

announcement.

The information in this report that relates to 2014 Exploration

Results is extracted from the reports entitled 'Thick, High Grade

Mineralisation Intersected at Zona 7' dated 18 August 2014 and

'Further Thick, High Grade Drill Intersections at Zona 7' dated 10

November 2014 which are available to view on Berkeley's website at

www.berkeleyresources.com.au. The information in the original ASX

Announcements that relate to the 2014 Exploration Results is based

on information compiled by Robert Behets, a Competent Person who is

a Fellow of The Australasian Institute of Mining and Metallurgy. Mr

Behets is a holder of shares, options and performance rights in,

and is a director of, Berkeley Resources Limited. Mr Behets has

sufficient experience which is relevant to the style of

mineralisation and type of deposit under consideration and to the

activity which he is undertaking to qualify as a Competent Person

as defined in the 2012 Edition of the 'Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves'. The Company confirms that it is not aware of any new

information or data that materially affects the information

included in the original market announcement. The Company confirms

that the form and context in which the Competent Person's findings

are presented have not been materially modified from the original

market announcement.

The information in this report that relates to earlier

Exploration Results and Mineral Resources is extracted from

Berkeley's ASX announcements dated 31 July 2012 (June 2012

Quarterly Report), 31 October 2012 (September 2012 Quarterly

Report), 7 August 2013 and 26 September 2013 which are available to

view on Berkeley's website at www.berkeleyresources.com.au. The

information in the original ASX announcements was based on

information compiled by Craig Gwatkin, who is a Member of The

Australian Institute of Mining and Metallurgy and was an employee

of Berkeley Resources Limited. Mr Gwatkin has sufficient experience

which is relevant to the style of mineralisation and type of

deposit under consideration and to the activity which he is

undertaking to qualify as a Competent Person as defined in the 2004

Edition of the 'Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves'. Mr Gwatkin consents

to the inclusion in the report of the matters based on his

information in the form and context in which it appears. This

information was prepared and first disclosed under the JORC Code

2004. It has not been updated since to comply with the JORC Code

2012 on the basis that the information has not materially changed

since it was last reported.

The information in this report that relates to the

Pre-Feasibility Study is extracted from Berkeley's ASX announcement

dated 26 September 2013 which is available to view on Berkeley's

website at www.berkeleyresources.com.au. The information in the

original ASX announcement was based on information compiled by Neil

Senior of SENET (Pty) Ltd. Mr Senior is a Fellow of The South

African Institute of Mining and Metallurgy and has sufficient

experience which is relevant to the style of mineralisation and

type of deposit under consideration and to the activity which he is

undertaking to qualify as a Competent Person as defined in the 2004

Edition of the 'Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves'. Mr Senior consents to

the inclusion in the report of the matters based on his information

in the form and context in which it appears. This information was

prepared and first disclosed under the JORC Code 2004. It has not

been updated since to comply with the JORC Code 2012 on the basis

that the information has not materially changed since it was last

reported.

Production Target

The Production Target stated in this Report is based on the

Company's Pre-Feasibility Study ('PFS') for the Salamanca Project

as released to the ASX on 26 September 2013. The information in

relation to the Production Target that the Company is required to

include in a public report in accordance with ASX Listing Rule 5.16

was included in the Company's June 2014 Quarterly Report released

to the ASX on 24 July 2014.

The Company confirms that the material assumptions underpinning

the PFS and Production Target referenced in the 26 September 2013

and 24 July 2014 releases continue to apply and have not materially

changed.

Forward Looking Statement

Statements regarding plans with respect to the Company's mineral

properties are forward-looking statements. There can be no

assurance that the Company's plans for development of its mineral

properties will proceed as currently expected. There can also be no

assurance that the Company will be able to confirm the presence of

additional mineral deposits, that any mineralisation will prove to

be economic or that a mine will successfully be developed on any of

the Company's mineral properties.

DIRECTORS' DECLARATION

In accordance with a resolution of the Directors of Berkeley

Resources Limited, I state that:

In the opinion of the Directors:

(a) the financial statements and notes, as set out on pages 10

to 18, are in accordance with the Corporations Act 2001,

including:

(i) complying with Accounting Standard AASB 134: Interim

Financial Reporting and the Corporations Regulations 2001; and

(ii) giving a true and fair view of the consolidated entity's

financial position as at 31 December 2014 and of its performance

for the half year ended on that date.

(b) there are reasonable grounds to believe that the Company

will be able to pay its debts as and when they become due and

payable.

On behalf of the Board

Robert Behets

Non-Executive Director

12 March 2015

CONDENSED CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER

COMPREHENSIVE INCOME

FOR THE HALF YEAR ENDED 31 DECEMBER 2014

Note Half Year Ended Half Year Ended

31 December 31 December

2014 2013

$ $

Revenue from continuing

operations 5 314,580 806,487

Exploration and evaluation

costs (3,557,219) (3,953,140)

Corporate and administration

costs (566,034) (513,191)

Share based payments

expense (186,616) (526,778)

-------------------------------- ----- ---------------- ----------------

Loss before income tax (3,995,289) (4,186,622)

Income tax expense - -

-------------------------------- ----- ---------------- ----------------

Loss for the half year

attributable to Members

of Berkeley Resources

Limited (3,995,289) (4,186,622)

-------------------------------- ----- ---------------- ----------------

Other comprehensive

income, net of income

tax:

Items that will not - -

be reclassified subsequently

to profit or loss

Items that may be reclassified

subsequently to profit

or loss

Exchange differences

arising on translation

of foreign operations 264,586 877,694

-------------------------------- ----- ---------------- ----------------

Other comprehensive

income/(loss) for the

period, net of income

tax 264,586 877,694

-------------------------------- ----- ---------------- ----------------

Total comprehensive

loss for the half year

attributable to Members

of Berkeley Resources

Limited (3,730,703) (3,308,928)

================================ ===== ================ ================

Earnings per share

Basic loss per share

(cents per share) (2.22) (2.33)

Diluted loss per share

(cents per share) (2.22) (2.33)

-------------------------------- ----- ---------------- ----------------

The above Condensed Consolidated Statement of Profit or Loss and

Other Comprehensive Income should be read in conjunction with the

accompanying notes.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2014

Note 31 December 30 June 2014

2014

$ $

ASSETS

Current Assets

Cash and cash equivalents 16,162,995 20,245,401

Trade and other receivables 783,610 549,183

----------------------------- ----- ------------- -------------

Total Current Assets 16,946,605 20,794,584

----------------------------- ----- ------------- -------------

Non-current Assets

Exploration expenditure 6 14,523,864 14,268,990

Property, plant and

equipment 1,773,060 1,785,251

Other financial assets 125,769 132,003

----------------------------- ----- ------------- -------------

Total Non-current Assets 16,422,693 16,186,244

----------------------------- ----- ------------- -------------

TOTAL ASSETS 33,369,298 36,980,828

----------------------------- ----- ------------- -------------

LIABILITIES

Current Liabilities

Trade and other payables 1,047,736 1,130,791

Other financial liabilities 283,641 268,029

----------------------------- ----- ------------- -------------

Total Current Liabilities 1,331,377 1,398,820

----------------------------- ----- ------------- -------------

TOTAL LIABILITIES 1,331,377 1,398,820

----------------------------- ----- ------------- -------------

NET ASSETS 32,037,921 35,582,008

----------------------------- ----- ------------- -------------

EQUITY

Issued capital 7 119,358,591 119,358,591

Reserves 8 (955,127) (1,180,339)

Accumulated losses (86,365,543) (82,596,244)

----------------------------- ----- ------------- -------------

TOTAL EQUITY 32,037,921 35,582,008

----------------------------- ----- ------------- -------------

The above Condensed Consolidated Statement of Financial Position

should be read in conjunction with the accompanying notes.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE HALF YEAR ENDED 31 DECEMBER 2014

Issued Capital Share Based Foreign Accumulated Total

Payments Currency Losses

Reserve Translation

Reserve

$ $ $ $ $

As at 1 July 2014 119,358,591 1,240,193 (2,420,532) (82,596,244) 35,582,008

Total comprehensive loss for the

period:

Net loss for the period - - - (3,995,289) (3,995,289)

Other comprehensive income:

Exchange differences arising on

translation of foreign operations - - 264,586 - 264,586

---------------------------------------- --------------- ------------- ------------- -------------- -------------

Total comprehensive income/(loss) - - 264,586 (3,995,289) (3,730,703)

---------------------------------------- --------------- ------------- ------------- -------------- -------------

Transactions with owners, recorded

directly in equity

Transfer from share based payments

reserve - (225,990) - 225,990 -

Share based payments - 186,616 - - 186,616

---------------------------------------- --------------- ------------- ------------- -------------- -------------

As at 31 December 2014 119,358,591 1,200,819 (2,155,946) (86,365,543) 32,037,921

---------------------------------------- --------------- ------------- ------------- -------------- -------------

As at 1 July 2013 119,061,813 2,623,721 (2,593,048) (76,955,886) 42,136,600

Total comprehensive loss for the

period:

Net loss for the period - - - (4,186,622) (4,186,622)

Other comprehensive income:

Exchange differences arising on

translation of foreign operations - - 877,694 - 877,694

---------------------------------------- --------------- ------------- ------------- -------------- -------------

Total comprehensive income/(loss) - - 877,694 (4,186,622) (3,308,928)

---------------------------------------- --------------- ------------- ------------- -------------- -------------

Transactions with owners, recorded

directly in equity

Transfer from share based payments

reserve 299,112 (1,181,095) - 881,983 -

Share based payments - 526,778 - - 526,778

---------------------------------------- --------------- ------------- ------------- -------------- -------------

As at 31 December 2013 119,360,925 1,969,404 (1,715,354) (80,260,525) 39,354,450

---------------------------------------- --------------- ------------- ------------- -------------- -------------

The above Condensed Consolidated Statement of Changes in Equity

should be read in conjunction with the accompanying notes.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE HALF YEAR ENDED 31 DECEMBER 2014

Half Year Ended Half Year Ended

31 December 2014 31 December 2013

$ $

Cash flows from operating activities

Payments to suppliers and employees (4,368,135) (4,921,978)

Interest received 358,670 331,069

Rebates received - 328,583

Net cash outflow from operating activities (4,009,465) (4,262,326)

-------------------------------------------------------------- ----------------- -----------------

Cash flows from investing activities

Payments for property, plant and equipment (68,413) (271,690)

Payments for exploration and evaluation (4,606) -

-------------------------------------------------------------- ----------------- -----------------

Net cash outflow from investing activities (73,019) (271,690)

-------------------------------------------------------------- ----------------- -----------------

Cash flows from financing activities

Proceeds from issue of securities - -

Transaction costs from issue of shares and options - -

-------------------------------------------------------------- ----------------- -----------------

Net cash inflow from financing activities - -

-------------------------------------------------------------- ----------------- -----------------

Net decrease in cash and cash equivalents held (4,082,484) (4,534,016)

Cash and cash equivalents at the beginning of the period 20,245,401 27,736,790

Effects of exchange rate changes on cash and cash equivalents 78 2,076

-------------------------------------------------------------- ----------------- -----------------

Cash and cash equivalents at the end of the period 16,162,995 23,204,850

-------------------------------------------------------------- ----------------- -----------------

The above Condensed Consolidated Statement of Cash Flows should

be read in conjunction with the accompanying notes.

CONDENSED NOTES TO THE FINANCIAL STATEMENTS

FOR THE HALF YEAR ENDED 31 DECEMBER 2014

1. REPORTING ENTITY

Berkeley Resources Limited (the "Company") is a company

domiciled in Australia. The interim financial report of the Company

is as at and for the six months ended 31 December 2014.

The annual financial report of the Company as at and for the

year ended 30 June 2014 is available upon request from the

Company's registered office.

2. STATEMENT OF COMPLIANCE

The interim financial report is a general purpose financial

report which has been prepared in accordance with Accounting

Standard AASB 134: Interim Financial Reporting and the Corporations

Act 2001.

This interim financial report does not include all the

information of the type normally included in an annual financial

report. Accordingly, this report is to be read in conjunction with

the annual report of Berkeley Resources Limited for the year ended

30 June 2014 and any public announcements made by Berkeley

Resources Limited during the interim reporting period in accordance

with the continuous disclosure requirements of the Corporations Act

2001.

This interim financial report was approved by the Board of

Directors on 11 March 2015.

(a) Basis of Preparation of Half Year Financial Report

The principal accounting policies adopted in the preparation of

the financial report have been consistently applied to all the

periods presented, unless otherwise stated.

Historical cost convention

These financial statements have been prepared under the

historical cost convention, as modified where applicable by the

revaluation of available-for-sale financial assets, financial

assets and liabilities (including derivative instruments) at fair

value through profit or loss.

3. SIGNIFICANT ACCOUNTING POLICIES

Accounting policies applied by the Consolidated Entity in this

consolidated interim financial report are the same as those applied

by the Consolidated Entity in its consolidated financial report for

the year ended 30 June 2014.

In the current period, the Group has adopted all of the new and

revised Standards and Interpretations issued by the Australian

Accounting Standards Board (the AASB) that are relevant to its

operations and effective for annual reporting periods beginning on

or after 1 July 2014. The adoption of these new and revised

standards has not resulted in any significant changes to the

Group's accounting policies or to the amounts reported for the

current or prior periods.

New and revised Standards and amendments thereof and

Interpretations effective for the current half-year that are

relevant to the Group include:

-- AASB 132 Financial Instruments: Presentation and AASB 2012-3

Amendments to Australian Accounting Standards arising from AASB

132;

-- AASB 136 Impairment of Assets and AASB 2013-3 Amendments to

Australian Accounting Standards arising from AASB 136; and

-- AASB 1031 Materiality and AASB 2013-9 (Part B) Amendments to

Australian Accounting Standards to delete references to AASB

1031.

4. SEGMENT INFORMATION

AASB 8 requires operating segments to be identified on the basis

of internal reports about components of the Consolidated Entity

that are regularly reviewed by the chief operating decision maker

in order to allocate resources to the segment and to assess its

performance.

The Consolidated Entity operates in one operating segment, being

exploration for mineral resources within Spain. This is the basis

on which internal reports are provided to the Directors for

assessing performance and determining the allocation of resources

within the Consolidated Entity.

5. REVENUE FROM CONTINUING OPERATIONS

Consolidated Consolidated

31 December 31 December

2014 2013

$ $

Interest revenue 314,580 477,904

R&D rebate received - 328,583

314,580 806,487

--------------------- -------------- --------------

6. NON-CURRENT ASSETS - EXPLORATION EXPENDITURE

Consolidated Consolidated

31 December 30 June

2014 2014

$ $

The group has mineral exploration

costs carried forward in

respect of areas of interest:

Areas in exploration at cost:

Salamanca Uranium Project

Balance at the beginning

of period 14,268,990 14,173,930

Net additions/ (disposals) 4,606 (68,457)

Foreign exchange differences 250,268 163,517

------------------------------------- -------------- -------------

Balance at end of period 14,523,864 14,268,990

------------------------------------- -------------- -------------

The value of the exploration interests is dependent upon the

discovery of commercially viable reserves and the successful

development or alternatively sale, of the respective tenements. An

amount of EUR6m (A$8.94m) relates to the capitalisation of the fees

paid to ENUSA under the Co-operation Agreement relating to the

tenements within the State Reserves. The Company reached agreement

with ENUSA in July 2012 in the form of an Addendum to the

Consortium Agreement signed in January 2009. The Addendum includes

the following terms:

-- The Consortium now consists of the Addendum Reserves (State Reserves Salamanca 28 and 29);

-- Berkeley's stake in the Consortium has increased to 100%;

-- ENUSA will remain the owner of State Reserves 28 and 29,

however the exploitation rights have been assigned to Berkeley,

together with authority to submit all applications for the

permitting process;

-- The Company is now the sole and exclusive operator in the

Addendum Reserves, with the right to exploit the contained uranium

resources and have full ownership of any uranium produced;

-- ENUSA will receive a production fee equivalent to 2.5% of the

net sale value (after marketing and transport costs) of any uranium

produced within the Addendum Reserves;

-- Berkeley has waived its rights to mining in State Reserves

2,25, 30, 31, Hoja 528-1 and the Saelices El Chico Exploitation

Concession, and has waived any rights to management of the Quercus

plant; and

-- The Co-operation Agreement with ENUSA, signed on 29 January 2009, has been terminated.

7. CONTRIBUTED EQUITY

(a) Issued and Paid Up Capital

Consolidated Consolidated

31 December 30 June

2014 2014

$ $

180,361,323 (30 June 2014:

180,361,323) fully paid ordinary

shares 119,358,591 119,358,591

----------------------------------- -------------- -------------

(b) Movements in Ordinary Share Capital During the Six Month Period ended 31 December 2014:

Number Issue Price

Date Details of Shares $ $

---------- ----------------- ------------ ------------ ------------

1 Jul 14 Opening Balance 180,361,323 119,358,591

31 Dec

14 Closing Balance 180,361,323 119,358,591

---------- ----------------- ------------ ------------ ------------

(c) Movements in Options and Performance Rights During the Six

Month Period ended 31 December 2014:

Date Details Number of Incentive Number of Fair Value Share based payments

Options Performance Rights reserve

$ $

1 Jul 14 Opening Balance 8,250,000 4,194,000 1,240,193

Performance rights

31 Dec 14 expired - (1,118,000) (225,990)

Share based payments

31 Dec 14 expense(1) - - 186,616

31 Dec 14 Closing Balance 8,250,000 3,076,000 1,200,819

----------- ---------------------- ---------------------- --------------------- ----------- ---------------------

Note:

(1) The value of Incentive Options granted is recognised over

the vesting period of the grant, in accordance with Australian

Accounting Standards.

The following options and performance rights have been issued

over unissued capital as at 31 December 2014:

Performance Rights

-- 1,478,000 performance rights at no exercise price that expire on 31 December 2016; and

-- 1,598,000 performance rights at no exercise price that expire on 31 December 2017.

Unlisted Options

-- 1,750,000 unlisted options at an exercise price of $0.475

each that expire on 22 December 2015;

-- 1,000,000 unlisted options at an exercise price of $0.41 each

that expire on 21 September 2015; and

-- 5,500,000 unlisted options at an exercise price of $0.45 each

that expire on 30 June 2016.

8. RESERVES

31 December 30 June 2014

2014

$ $

(a) Reserves

Share based payments reserve

(note 7(c)) 1,200,819 1,240,193

Foreign exchange reserve (2,155,946) (2,420,532)

(955,127) (1,180,339)

------------------------------ ------------ -------------

9. SUBSIDIARIES

The consolidated financial statements include the financial

statements of the Company and the subsidiaries listed in the

following table:

Name of Controlled Place

Entity of Incorporation Equity Interest Investment

31 December 30 31 December 30

2014 2014

% June $ June

2014

% 2014

$

Berkeley Exploration

Ltd UK 100(1) 100 - -

Minera de Rio Alagon.

S.L. Spain -(2) 100 - 5,481,411

Berkeley Minera

Espana, S.L. Spain 100(3) 100 5,481,411 -

Geothermal Energy

Sources, S.L. Spain 100(4) 100 - -

5,481,411 5,481,411

------------------------------------------- ------------ ------- ------------ ----------

Notes

(1) Berkeley Exploration Ltd is a 100% owned subsidiary of

Berkeley Resources Limited. Berkeley Exploration Ltd's issued and

paid up capital is GBP8,298,972 (30 June 2014: GBP2).

(2) Minera de Rio Alagon, S.L. was a wholly owned subsidiary of

Berkeley Resources Limited until 31 October 2014 when it merged

with Berkeley Minera Espana, S.L. as part of an internal group

restructure. Berkeley Minera Espana, S.L. was the surviving entity

and assumed all of Minera de Rio Alagon, S.L.'s assets and

liabilities.

(3) Berkeley Minera Espana, S.L. was incorporated on 12 May 2009

and is a wholly owned subsidiary of Berkeley Exploration Limited.

Berkeley Minera Espana, S.L.'s issued and paid up capital is

EUR56,917,363 (30 June 2014: EUR44,388,218).

(4) Berkeley Exploration Limited acquired 100% of the issued

shares in Geothermal Energy Sources, S.L. on 15 May 2009.

Geothermal Energy Sources, S.L.'s issued and paid up capital is

EUR20,000 (30 June 2014: EUR20,000).

(5) In the opinion of the Directors, the above named investments

in controlled entities have a carrying value in the Company at

balance date of $5,481,411 (30 June 2014: $5,481,411), being the

cost of the investment less provision for impairment.

(a) Ultimate Parent

Berkeley Resources Limited is the ultimate parent of the

Group.

10. CONTINGENT LIABILITIES AND COMMITMENTS

There was no material change in contingent liabilities or

commitments from those previously disclosed at the last reporting

period.

11. DIVIDENDS PAID OR PROVIDED FOR

No dividend has been paid or provided for during the half

year.

12. FAIR VALUE OF FINANCIAL INSTRUMENTS

The Group's financial instruments consist of those which are

measured at amortised cost including trade and other receivables,

security bonds, trade and other payables and other financial

liabilities. The carrying amount of these financial assets and

liabilities approximate their fair value.

13. SUBSEQUENT EVENTS AFTER BALANCE DATE

As at the date of this report there were no significant events

occurring after balance date requiring disclosure.

AUDITOR'S INDEPENDENCE DECLARATION AND REVIEW REPORT

The Auditor's Independence Declaration and the Independent

Auditor's Review Report are available in the full version of the

Interim Financial Report on Berkeley Resources Limited's website

at:

www.berkeleyresources.com.au

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR GLGDXISBBGUD

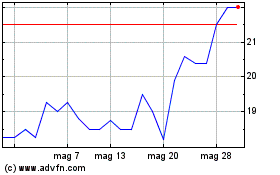

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Set 2024 a Ott 2024

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Ott 2023 a Ott 2024