TIDMCRW

RNS Number : 1766N

Craneware plc

30 August 2011

Craneware plc

("Craneware", "the Group" or the "Company")

Final Results

30 August 2011 - Craneware plc (AIM: CRW.L), the market leader

in automated revenue integrity solutions for the US healthcare

market, announces its results for the year ended 30 June 2011.

Financial Highlights (US dollars)

-- Continued strong revenue and profit growth:

o Revenue increased 34% to $38.1m (2010: $28.4m)

o Adjusted EBITDA(1) increased 32% to $10.1m (2010: $7.6m)

o Adjusted profit before taxation increased 27% to $9.3m (2010:

$7.3m)

o Profit before tax increased 19% to $8.7m (2010: $7.3m)

o Basic adjusted EPS increased 17% to 25.6 cents (2010: 21.8

cents)

o Basic EPS increased 6% to 23.1 cents (2010: 21.8 cents)

-- Positive operational cash flow of $10.1m (2010: $8.9m)

-- Cash at year end $24.2m (2010: $29.4m) following $9m payment

to acquire ClaimTrust in February 2011

-- Proposed final dividend of 4.8p (7.7 cents) per share giving

total dividend for the year of 8.8p (14.2 cents) per share (2010:

8p (12 cents) per share)

(1.) Adjusted EBITDA refers to earnings before interest, tax,

depreciation, amortization, share based payments and transaction

related costs

Operational Highlights

-- Significantly increased market share; approx. 1,500 US

hospitals now use Craneware software

-- Integration of ClaimTrust as Craneware InSight, Inc.

proceeding ahead of plan

-- Leading indicator, the acceleration of the Recovery Audit

Contractor programme, now taking place and expected to increase

demand in future years

Keith Neilson, CEO of Craneware commented:

"This has been another year of strong growth for Craneware both

in operational and financial terms, highlighting the strength of

our product offering and business model.

"The financial challenges presented by today's economy and

healthcare reform mean it has never been more important for

hospitals to increase efficiency and protect revenue in order to

meet their objectives of providing increased levels of care to a

growing hospital population. We believe our suite of software

combined with our industry expertise uniquely positions us to help

hospitals protect themselves against this changing market

landscape, automating regulatory updates, increasing accuracy of

pricing, charging and coding for procedures, supplies and

pharmaceuticals and helping to manage the increasing number of

government led audits.

"Consequently with the market drivers, such as the Recovery

Audit Contractor programme, expected to increase in the year ahead,

the robust nature of our business model which provides for strong

cash generation and high levels of future revenue visibility,

together with our strong pipeline, we look to the future with

confidence."

For further information, please contact:

Craneware plc Peel Hunt Threadneedle Communications

+44 (0)131 550 +44 (0)20 7418

3100 8900 +44 (0)20 7653 9850

Keith Neilson, Dan Webster Caroline Evans-Jones

CEO

Craig Preston, Richard Kauffer Fiona Conroy

CFO

About Craneware

Founded in 1999, Craneware has headquarters in Edinburgh,

Scotland with offices in Atlanta, Boston, Nashville and Scottsdale

employing over 200 staff. Craneware is the leader in automated

revenue integrity solutions that improve financial performance for

healthcare organisations. Craneware's market-driven, SaaS solutions

help hospitals and other healthcare providers more effectively

price, charge, code and retain earned revenue for patient care

services and supplies. This optimises reimbursement, increases

operational efficiency and minimises compliance risk. By partnering

with Craneware, clients achieve the visibility required to

identify, address and prevent revenue leakage. To learn more, visit

craneware.com and stoptheleakage.com

Chairman's Statement

Craneware has continued to deliver against the backdrop of an

evolving marketplace. We have launched four new products during the

year, one of which we have developed organically, while three came

via the acquisition of ClaimTrust. We now count nearly 1,500

hospitals as our customers with some of the largest hospital groups

in the US amongst our growing band of software users. Through our

increased marketing efforts and continued commitment to customer

service, our reputation in the healthcare market as thought leaders

in the area of 'revenue integrity' has moved forward significantly

in the year.

With approximately 25% of hospitals in the US now using one or

more of Craneware's nine core products, the Company is an

established part of the fabric of the US healthcare industry. While

the US economy has been under much scrutiny in recent months and

the debate about healthcare reform continues, what is unavoidable

is that US healthcare facilities are being asked to provide a

higher level of patient care, to a greater number of people, at a

lower cost per patient. There is therefore a compelling case for

the implementation of software such as ours to efficiently protect

the revenue to which these healthcare facilities are entitled.

Following the acquisition of ClaimTrust in February, we have

been extremely encouraged by the response from our customers to the

newly launched Craneware InSight products in our "Audit Revenue and

Recovery" product family. The first sales of InSight products into

our existing customer base have taken place and we have built a

strong list of prospects. The expertise in the area of audits and

appeals brought to us by the ClaimTrust team has already proven to

be a valuable addition to the Group. We continue to assess

opportunities for similar acquisitions.

We see the increasing level of fines levied on hospitals from

the Recovery Audit Contractor (RAC) programme, as a leading

indicator of hospital demand for our unique solution set. In

addition, we expect other factors such as the anticipated McKesson

re-engagement in sales of their Horizon software, into which our

Revenue Cycle Management tools have been integrated, to help drive

forward customer decision making in the coming year.

We continue to have extremely high levels of revenue visibility

due to the multiyear nature of our contracts and our annuity

revenue recognition policy. At the end of the year under report

Craneware had visibility of over $105m of revenue for the next

three years, having increased from $83m at 30 June 2010.

I would like to take this opportunity to once again welcome the

Craneware InSight team and customers into Craneware and thank all

our customers, people and partners for their ongoing support.

The expansion of our market share, our strong financial position

and excellent sales pipeline provide the Board with a great deal of

confidence in our ability to continue to execute on our growth

strategy.

George Elliott

Chairman

29 August 2011

Operational Review

Introduction

This year has seen the business deliver our largest organic

increase in both revenues and EBITDA to date with revenues growing

organically by 25% and adjusted EBITDA growing by 32%. The

ClaimTrust acquisition resulted in an overall revenue growth rate

of 34%. Importantly, the business generated a high level of cash

from operating activities in the period, reaching $10m (a 100%

conversion of adjusted EBITDA), a fourfold increase since IPO. This

strong set of results continues to demonstrate the success of the

Craneware strategy in building out its unique product suite,

ensuring Craneware's market leading position as the strength of the

business model delivers growth into the long term.

Although sales to channel partners and large hospital systems

have not been at previous levels, we believe that this is a factor

of timing and not a long term or general market trend. The results

this year have been achieved despite this timing issue and the

significant strength of current pipeline opportunities compared to

historical norms gives us confidence that the growth opportunities

for Craneware remain strong. We continue to outperform our

competition in the majority of customer opportunities and believe

that as the RAC audit programme gathers pace so will the pressures

on hospitals to move towards automated systems in order to manage

these audits and protect revenue. Our acquisition of ClaimTrust in

particular means we believe we are well positioned to assist our

clients in this ever more pressing area.

Our focus in the year ahead will be on the cross sale of our

increased product set to our extended customer base, the

integration of further ClaimTrust products into our offering and

the continued winning of market share. As we entered the current

financial year we had visibility of $105m in revenue for the next

three years and over $24m in cash.

Integration of ClaimTrust

We were delighted to have completed the acquisition of

ClaimTrust on 17 February 2011. This is the first acquisition for

Craneware and one which the Board believes to be strategically

valuable, bringing new areas of expertise into the Group, adding a

new product family and increasing our market share with the

addition of over 250 hospitals. All of ClaimTrust's products are

applicable to the Craneware customer base and target audience

providing for a significantly expanded market opportunity.

The first 90 day integration plan of ClaimTrust as Craneware

InSight Inc, has now been successfully completed. Both sales teams

have been crossed trained in the products and the management teams

aligned. In terms of marketing, the products have been given a

common branding and messaging under Craneware InSight and we have

established the foundation for new customers for the InSight

products to join on Craneware's traditional Annuity Software as a

Service revenue model. We are pleased to report that the uptake of

products by the Craneware customer base has been positive thus far,

securing our first customer, the Kingman Regional Medical Center,

in June 2011 and have made further sales since then supporting our

belief that the future for the products is extremely promising.

Market Developments

The US healthcare market continues to be impacted by the

introduction of new legislation and increased regulation as the

Government seeks to reduce the burden of healthcare on the state

whilst making healthcare available to a larger percentage of the

population. Cuts to Medicaid state budgets, the means-tested

programme for certain individuals and families with low incomes and

resources, have been as high as 20% across the US. Meanwhile the

number of people enrolling in the Medicaid programme continues to

increase by an additional 1% along with a 1.1% increase in the

uninsured for every 1% increase in the national unemployment rate.

These factors mean a growing number of hospitals are seeking

technology based solutions to help improve accuracy of billing and

reduce regulatory burdens, thereby protecting their slim profit

margins.

Two specific factors which have moved forward during the year

have been the introduction of the finalised RAC programme and the

movement in healthcare IT coding towards the use of ICD-10 (as

explained below).

RAC Programme

The Recovery Audit Contractors are tasked with detecting and

correcting past improper payments to hospitals, whether these are

overpayments which need to be recouped, or underpayments which need

to be reimbursed. Following a demonstration pilot of the RAC

programme in five states (California, Florida, New York,

Massachusetts and South Carolina) from 2004 to 2007, US Congress

authorised the nationwide expansion of the initiative through the

Tax Relief and Health Care Act of 2006, which regulated that it be

rolled out nationwide by January 1, 2010.

While the RACs identified and recouped $92.3m of corrections

from hospitals in its first 12 months of the programme to September

2010, this has increased significantly to $592.5m in the subsequent

9 month period*, placing a huge burden on hospitals. These

increasing amounts being levied on hospitals are creating a major

stimulus for hospital purchasing decisions for software such as

Craneware InSight's Audit and the Board believes are a leading

indicator of further Craneware product family sales.

*CMS - Centers for Medicare & Medicaid Services, June

2011

Craneware InSight Audit

Recovery Audit Contractors can request a maximum of 500 records

per 45 days from any individual healthcare provider over a 3-year

look back period. The volume of record requests and denials

initially overwhelmed healthcare providers, and still proves to be

a burden.

The InSight Audit product organises, manages and reports on all

audit requests, responses and appeal activities for all audit

types. It stores the relevant information and documents the steps

taken to appeal denials, whilst also identifying trends and areas

of exposure. InSight Audit manages (1) the patient record, (2) the

RAC audit workflow, and (3) reports on areas of risk.

InSight Audit can also be used to manage the RAC appeal process,

from the initial decision to appeal through to successful

resolution of the appeal; aiding hospitals recoup cash and reduce

the financial cost of doing so. The five levels of this process

take between 2 to 3 years to complete for each individual RAC

denial; costing in resources, tracking and reporting an estimated

$2,000 to appeal per record, if no technology solution has been

implemented. Therefore with RACs able to request up to 500 records

every 45 days, this can easily escalate to a significant cost.

ClaimTrust, having been based in the RAC demonstration catchment

area in 2007, prior to the Government's full roll-out of the

initiative, gained early insight into what was needed in terms of

product development; Craneware InSight appealed and won 84% of RAC

Medicare denials on behalf of its customers, when nationally only

8% of denials were appealed and won*.

* The Medicare Recovery Audit Contractor (RAC) Program: Update

to the Evaluation of the 3-year Demonstration June 2010, CMS

HIPAA 5010 & ICD-10

ICD-10 is a new, more detailed diagnosis and procedure code set

and logic. The goal of the introduction of this new coding is to

improve patient care, enhance claims processing, and improve data

collection. Due to the increased number of codes, the change in the

number of characters per code, and increased code specificity, this

transition will require significant planning, training,

software/system upgrades/replacements, as well as other necessary

investments. The HIPAA transaction standard 5010 is a transaction

format that allows for the additional field length and addition of

non-numeric characters to support ICD-10. All hospitals are

required to have moved to the use of 5010 by January 2012 with

ICD-10 coming into effect from 1 October 2013. Craneware

anticipates that the introduction of this coding will require

hospitals to reassess their current IT and data collection systems,

effectively mandating investment in this area. If physicians and

hospitals are not ready for these changes, they risk claim

rejections and interrupted cash flow. All of Craneware's software

is already ICD-10 compatible.

Sales and Marketing

Due to the expansion of our customer base in the year, we have

chosen to align our sales teams into three geographical regions,

with each region headed up by an experienced Regional Vice

President. We continue to build our separate Sales Support and

Marketing Teams in our Atlanta office. Each team will have a mix of

experience and skill sets, this combined with the closer

geographical alignment will, we believe, better place us to meet

the requirements of our current and future customers. We anticipate

further investment into these teams, in line with our revenue

growth, as we look to meet the market opportunity.

Following the acquisition of ClaimTrust in February this year,

we added over 250 hospitals to Craneware, many of these hospitals

having only one of the now nine 'core' products. As a result of

this larger customer base, our average product attachment rate per

customer is now 1.5 products as compared to 1.7 prior to the

acquisition. This represents an increased cross sell opportunity of

now 7.5 products per customer as we have broadened the product

solutions we can offer to meet our customers' needs.

At the half year period we advised that we were trialing a

system of 'auto renewals' in order to enable our sales people to

focus more on the sales of new products. However, having now

assessed this change of structure over some months, we do not

believe that this system generated the benefits anticipated for

either our customers or Craneware. As a result, we have therefore

reverted to our traditional active multi-year renewal policy,

commissioning the sales teams accordingly. This serves to provide a

greater level of revenue visibility for future years, whilst

retaining the administrative safeguard of the auto-renewal language

in our standard contract.

During the year we have seen our dollar value of renewals in the

year drop below our historical norms of over 100%. This was

exacerbated by the reduced number of hospitals due to renew and two

large hospital groups who, having given an indication they would

renew their original product sets in the period, subsequently

entered into discussions regarding the purchase of additional

products, leading to an extended period of negotiation. It is

important to note that both these large hospital groups are under

contract. In the period since the year end we have seen a return to

our historical norms of at least 100%.

Internally Craneware continues to target a revenue split of no

more than 50% from any one product by the start of FY14 (1 July

2013) and we remain confident that we are achieving the correct

additional balance of non-Chargemaster sales to achieve this,

whilst continuing to add to our Chargemaster customer base.

The average length of new customer contracts continues to be

stable at approximately five years. Where we enter into new product

contracts with our existing customers, these contracts are

typically made co-terminus with the customer's existing contracts,

and as such the average length of these contracts is three years,

in line with our expectations. Annualised new facility value dipped

slightly as a result of the new customer mix in the year, it is

anticipated this will stabilise or increase in future years.

We continue to actively engage with some of the largest

multi-hospital groups in the US and have several potential new

deals in the pipeline. Due to the size of these groups these types

of contracts naturally take longer to close but we are confident we

will continue to see success in this area, as we continue to grow

our market share.

In addition to our internal sales teams, Craneware continues to

partner with numerous industry-leading hospital information

systems, patient accounting systems and GPOs. These alliances both

extend Craneware's market reach and the range of solutions we offer

clients. Sales from the McKesson partnership, whereby Craneware's

Revenue Cycle Management software is integrated into McKesson's

healthcare IT platform, Horizon, have been slower this year than

anticipated as McKesson delayed the roll-out of its new platform.

However, there are strong indications that they intend to move

forward from January 2012 which should benefit Craneware. We

continue to further develop our GPO partnerships with Premier and

Amerinet.

Product Development

Product development continues to sit at the heart of Craneware's

success as we build our portfolio of products sitting in and around

the point where clinical data turns into financial data. This year

saw the successful launch and first sale of our second product

within our Strategic Pricing family, Value-based Pricing Analyzer,

helping hospitals more effectively, accurately and sustainably

manage their pricing strategies for services, drugs and supplies,

optimising their financial performance while making strategic

decisions in both a transparent and defensible manner.

New Product Family - Audit Revenue and Recovery

Since February our focus has been on the integration of the

first three of the ClaimTrust products into our core offering under

the newly developed "Audit and Revenue Recovery" product family.

These products are InSight Audit(TM), InSight Payment Variance

Analyzer(TM) and InSight Denials(TM). Each of these three products

has the potential to be used by customers alongside any of the

current Craneware product suite to help manage and protect against

the increasing number of audits being carried out under the

Medicare Recovery RAC programme introduced as part of healthcare

reform. We therefore believe the potential for these products to be

significant as the RAC programme gathers pace in 2012 and 2013.

Our focus this year will be on the integration of the remaining

3 ClaimTrust products, fully integrating them within the product

suite and into Craneware branding and finding new innovative ways

of leveraging the strengths of the combined data sets of the two

companies.

Customers

Approximately 1,500 hospital facilities across all States in the

US utilise one or more of our software products, representing

nearly a quarter of all US hospital facilities. We continue to win

market share and believe our reputation for customer support and

product innovation, combined with our strong industry partnerships

mean we will continue to do so in the year ahead.

Our customer base continues to cover a broad range of

facilities, from small community hospitals to some of the largest

healthcare networks such as Intermountain Healthcare, Cleveland

Clinic and many of the other faith based charity hospital networks.

We were delighted to begin working this year with Shriners

Hospitals for Children(R), a national 20 hospital group

headquartered in Florida representing our largest children's

hospital customer to date.

During the year our core product, Chargemaster Toolkit(R) was

awarded the number one position in its category by the prestigious

U.S. industry research house KLAS for the fifth consecutive year,

demonstrating Craneware's commitment to continually enhancing our

software to meet current conditions and delivering unparalleled

customer service and support to healthcare facilities across the

country.

Financial Review

The financial results for the current year represent another

significant milestone in Craneware's evolution. Following the

completion of the ClaimTrust acquisition on 17 February 2011, the

results for the first time include a contribution, albeit four

months, from our new subsidiary Craneware InSight Inc ("InSight").

The financial detail underlying this acquisition, the accounting

treatments adopted and how we have adapted our reporting as a

consequence is explained below.

Revenue

Revenues in the year have grown by 34% to $38.1m (2010: $28.4m)

of which the original Craneware business pre the acquisition (the

"Core" business) generated organic growth of 25% to $35.5m (2010:

$28.4m) with InSight delivering revenues of $2.6m in the period

since its acquisition. Of this total revenue $33.4m (2010: $24.7m)

has been delivered from licence revenues generated through our

customers' use of the software, the remainder $4.7m (2010: $3.7m)

has been delivered from our Professional Services organisation

through their work implementing the software and consulting

services provided to hospitals in the Revenue Integrity area,

primarily ensuring they generate the maximum value from our

software solutions.

We continue to generate 100% of our revenue from software and

associated professional services to hospitals in the US. Following

the acquisition we have nine core products that are equally

applicable to our hospital customer base and have cross trained our

sales force to meet this opportunity. As such we still define our

revenue as being derived from one market segment in the financial

statements.

Earnings

As a result of the acquisition, the Group is now reporting an

'Adjusted' earnings before interest, taxation, share based

payments, depreciation, and amortisation ("EBITDA"). This EBITDA is

calculated in accordance with the prior years but also adjusts for

the impact of the one-off costs related to the acquisition such as

the legal and due diligence costs, which amounted to $516,796.

Reporting an 'Adjusted' EBITDA is consistent with other acquisitive

companies as it allows for a more accurate understanding of the

underlying profit generated from operations and for a direct

comparison year on year.

EBITDA for the year has grown to $10.1m (2010: $7.6m) an

increase of 32% in the period. As expected, as a result of our

increased investment and integration spend in InSight, all of the

EBITDA growth is organic with InSight being EBITDA neutral in its

contributing period.

Organic EBITDA margins have increased to 28.5% (2010: 26.8%). It

was anticipated that the InSight business would dilute the Core

margins for a period of time until sufficient operating leverage

could be gained as a result of the acquisition. As a result, the

overall Group margin for the year was 26.5%.

Revenue - Recognition and Visibility

Craneware Core business continues to recognise revenue primarily

through its annuity revenue recognition model. This model sees

software licence revenue recognised over the life of the contracts

we sign (which during the year has remained stable for new

customers at an average contract life of 5 years), with any

associated professional services revenue recognised as we deliver

the services. As a result of this revenue recognition model, the

maximum value of an average contract that can be recognised as

revenue in the current year is 20% plus the value of associated

professional services that have been delivered. This leaves the

remaining 80% of the licence revenue being contracted but not

recognised until future reporting periods.

InSight has historically adopted a different revenue model, with

monthly invoicing and recognition. Whilst this revenue is classed

as 'recurring' it does not meet the strict criteria the Company has

applied to call it 'contracted'. Over time it is our intention to

migrate InSight to the core business model.

As a result of the combined business models, the Company has

identified the "Three Year Visible Revenue" metric as the primary

KPI to assess the medium term growth prospects. This metric

includes:

-- InSight revenue identified as recurring in nature (subject to

an estimated churn rate of 8% per year);

-- Future revenue under contract;

-- Revenue generated from renewals (calculated at 100%).

During the year, the Three Year Visible Revenue has increased

26.5% from $83m to $105m. The breakdown of this total is as

follows:

-- InSight contributed $16.5m.

-- Future revenue under contract contributed $62.6m of which

$28.1m will be recognised in FY12, $20.1m in FY13 and $14.4m in

FY14.

-- Revenue generated from renewal activities contributed $25.9m

(i.e. customers coming to the end of their existing multi-year

contracts) being $3.1m in FY12, $8.6m in FY13 and $14.2m in

FY14.

Operating Expenses

We have continued our planned investment during the year. In

relation to the Core Business we have increased our Client

Servicing spend by 19% to $4.8m (2010: $4.0m) and have made

investments in our infrastructure to support our future growth

(including new offices in Atlanta and an office move to Edinburgh)

resulting in our G&A costs increasing by 15% to $3.8m from

$3.3m). Where we have made investments in prior years, we have

continued to grow in these areas, albeit at lower rates with sales

and marketing spend increasing by 11% to $7.8m (2010: $7.1m) and

product development by 16% to $4.4m after capitalising $0.2m of

costs relating to new products (2010: $3.8m after capitalising

$0.5m of costs relating to new products). These investments

combined with the InSight cost base included since the acquisition

date of $2.6m has resulted in net operating expenses (before

acquisition costs, share based payment, depreciation and

amortisation) of $23.4m (2010: $18.8m). This represents a growth in

our operating costs of 24% as compared to a revenue growth of

34%.

Acquisition of ClaimTrust, Inc

On the 17 February 2011, the Company acquired the entire share

capital of ClaimTrust Inc. for an initial consideration of $15m.

This initial consideration was formed of $9m cash and $6m of new

shares issued. The acquisition is subject to a further contingent

consideration payment of up to a further $4.5m (payable in cash and

shares) depending on financial over-performance in both revenue and

EBITDA for the 12 months to 30 June 2012. The $6m of new shares

issued by Craneware plc represents an additional 641,917 shares (of

which 617,731 have been issued by 30 June 2011).

The acquisition was completed via a newly formed 100% owned

subsidiary Craneware InSight Inc. Following the acquisition, the

ClaimTrust business was consolidated into Craneware InSight Inc. In

presenting these consolidated financial statements the financial

results (including the balance sheet) of Craneware InSight have

been included since the date of acquisition.

On consolidation, International Accounting Standards require the

Company to estimate the fair value of the contingent consideration

and separately identify intangible assets and their Fair Value.

Taking these values into account along with the net assets acquired

results in consolidated goodwill being recognised in the

Consolidated Balance Sheet.

The Company (with the assistance of an external independent

advisor) has estimated, based on industry standard modelling

methodologies, the fair value of contingent consideration to be

$0.95m. Intangible assets relating to the 'attributable value' of

existing customers and proprietary software have been separately

identified and have been recorded on consolidation with a fair

value of $3.0m and $1.2m respectively. As a result, consolidated

goodwill recorded on the balance sheet as a result of the

acquisition is $12.3m.

Cash

We continue to measure the quality of these earnings through our

ability to convert them into operating cash. We are pleased to

report that for the third successive year we have collected at

least 100% of our EBITDA as operating cash. This has resulted in

the Group's cash balance being $24.2m (2010: $29.4m) despite paying

out $9m in relation to the acquisition of ClaimTrust and returning

$3.0m to our shareholders by way of dividend payments.

Balance Sheet

The Group maintains a strong balance sheet position, not only

through our significant cash balance but with rigorous controls

over working capital and no debt.

Currency

The reporting currency for the Group (and cash reserves) is US

Dollars. Whilst the majority of our cost base is US located and

therefore US Dollar denominated we do have approximately one

quarter of the cost base based in the UK relating primarily to our

UK employees (and therefore denominated in Sterling). As a result,

we continue to closely monitor the Sterling to US Dollar exchange

rate, and where appropriate consider hedging strategies. During the

year, we have not seen a significant impact through exchange rate

movements, with the average exchange rate throughout the year being

$1.5906 as compared to $1.5821 in the prior year.

Taxation

As expected, we have seen an increase in our expected rate of

taxation this year to a more normalised level of 30.5% (2010:

23.9%). The Group's effective rate of taxation is dependent on the

ratio of profits generated in the UK and overseas (which will

change following the acquisition) and the applicable tax rates in

the respective jurisdictions. In the two immediately preceding

years, we have seen lower effective rates of taxation due primarily

to agreeing enhanced Research and Development tax relief in respect

of financial years 2002 to 2009.

EPS

As with EBITDA, the Group is now reporting an adjusted EPS

figure. This adjusted EPS figure has also been adjusted for amounts

relating to the acquisition i.e. $516,796 relating to one-off

acquisition related expenses and $147,302 relating to the

amortisation on acquired intangibles. Reporting an adjusted EPS

figure and how this has been calculated, is again consistent with

other acquisitive companies and allows for a more accurate direct

comparison year on year.

Adjusted basic EPS has increased by 17% to $0.256 (2010: $0.218)

and adjusted diluted EPS has increased by 20% to $0.253 (2010:

$0.21). The growth rates for both these metrics has been affected

by the higher tax effective rate detailed above and the increased

number of shares in issue as a result of both the acquisition and

share options exercised in the year.

Dividend

The Board recommends a final dividend of 4.8p (7.7 cents) per

share giving a total dividend for the year of 8.8p (14.14 cents)

per share (2010: 8.0p (11.99 cents) per share). Subject to

confirmation at the Annual General Meeting, the final dividend will

be paid on 9 December 2011 to shareholders on the register as at 11

November 2011, with a corresponding ex-Dividend date of 9 November

2011.

The final dividend of 4.8p per share is capable of being paid in

US dollars subject to a shareholder having registered to receive

their dividend in US dollars under the Company's Dividend Currency

Election, or who register to do so by the close of business on 11

November 2011. The exact amount to be paid will be calculated by

reference to the exchange rate to be announced on 11 November 2011.

The final dividend referred to above in US dollars of 7.7 cents is

given as an example only using the Balance Sheet date exchange rate

of $1.6055/GBP1 and may differ from that finally announced.

Outlook

This has been another year of strong growth for Craneware both

in operational and financial terms, highlighting the strength of

our product offering and business model.

The financial challenges presented by today's economy and

healthcare reform mean it has never been more important for

hospitals to increase efficiency and protect revenue in order to

meet their objectives of providing increased levels of care to a

growing hospital population. We believe our suite of software

combined with our industry expertise uniquely positions us to help

hospitals protect themselves against this changing market

landscape, automating regulatory updates, increasing accuracy of

pricing, charging and coding for procedures, supplies and

pharmaceuticals and helping to manage the increasing number of

government led audits.

Consequently with the market drivers, such as the Recovery Audit

Contractor programme, expected to increase in the year ahead, the

robust nature of our business model which provides for strong cash

generation and high levels of future revenue visibility, together

with our strong pipeline, we look to the future with

confidence.

Keith Neilson Craig Preston

Chief Executive Officer Chief Financial Officer

29 August 2011 29 August 2011

Consolidated Statement of Comprehensive Income

For the year ended 30 June 2011

Continuing

Operations Acquisition Total Total

17/2/11

2011 - 30/6/11 2011 2010

Notes $'000 $'000 $'000 $'000

--------------------- ------ ----------- ------------ --------- ---------

Revenue 35,511 2,613 38,124 28,397

Cost of sales (4,554) (142) (4,696) (2,553)

----------- ------------ --------- ---------

Gross profit 30,957 2,471 33,428 25,844

Net operating

expenses 3 (22,197) (2,677) (24,874) (18,781)

----------- ------------ --------- ---------

Operating profit 8,760 (206) 8,554 7,063

Analysed as:

Adjusted EBITDA* 10,074 3 10,077 7,622

Acquisition costs on

business

combination (517) - (517) -

Share based payments (139) - (139) (114)

Depreciation of

plant and

equipment (266) (46) (312) (192)

Amortisation of

intangible assets (392) (163) (555) (253)

--------------------- ------ ----------- ------------ --------- ---------

Finance income 99 - 99 195

----------- ------------ --------- ---------

Profit before

taxation 8,859 (206) 8,653 7,258

Tax on profit on

ordinary

activities 4 (2,719) 81 (2,638) (1,733)

----------- ------------ --------- ---------

Profit for the year

attributable to

owners of the

parent 6,140 (125) 6,015 5,525

--------------------- ------ ----------- ------------ --------- ---------

*Adjusted EBITDA is defined as operating profit before

acquisition costs, share based payments, depreciation and

amortisation.

Earnings per share for the period attributable to equity

holders

Notes 2011 2010

------------------------------- ------ ------ ------

Basic ($ per share) 6a 0.231 0.218

*Adjusted Basic ($ per share) 6a 0.256 0.218

Diluted ($ per share) 6b 0.228 0.210

*Adjusted Diluted ($ per

share) 6b 0.253 0.210

------------------------------- ------ ------ ------

*Adjusted Earnings per share calculations allow for acquisition

costs and amortisation on acquired intangible assets to form a

better comparison with the previous year.

Statements of Changes in Equity for the year ended 30 June

2011

Share

Share Premium Other Retained Total

Capital Account Reserves Earnings Equity

Group $'000 $'000 $'000 $'000 $'000

-------------------------- -------- -------- --------- --------- --------

At 1 July 2009 512 9,250 3,123 5,790 18,675

Total comprehensive

income - profit for the

year - - - 5,525 5,525

Transactions with owners:

Share-based payments - - 114 730 844

Dividends (Note 5) - - - (2,992) (2,992)

--------------------------

At 30 June 2010 512 9,250 3,237 9,053 22,052

Total comprehensive

income - profit for the

year - - - 6,015 6,015

Transactions with owners:

Share-based payments - - 139 1,249 1,388

Impact of share options

exercised 13 - (3,074) 3,074 13

Issue of ordinary shares

related to business

combination 11 5,989 - - 6,000

Dividends (Note 5) - - - (3,063) (3,063)

--------------------------

At 30 June 2011 536 15,239 302 16,328 32,405

-------------------------- -------- -------- --------- --------- --------

Consolidated Balance Sheet as at 30 June 2011

Notes 2011 2010

$'000 $'000

---------------------------------- ------ ------- -------

ASSETS

Non-Current Assets

Plant and equipment 2,167 281

Intangible assets 7 17,728 1,474

Deferred tax - 1,521

19,895 3,276

------- -------

Current Assets

Trade and other receivables 13,121 8,596

Cash and cash equivalents 24,176 29,442

37,297 38,038

------- -------

Total Assets 57,192 41,314

---------------------------------- ------ ------- -------

EQUITY AND LIABILITIES

Non-Current Liabilities

Contingent consideration 8 954 -

Deferred tax 52 -

Deferred income 250 218

1,256 218

------- -------

Current Liabilities

Deferred income 15,638 13,660

Corporation tax 288 392

Trade and other payables 7,605 4,992

23,531 19,044

------- -------

Total Liabilities 24,787 19,262

------- -------

Equity

Called up share capital 9 536 512

Share premium account 15,239 9,250

Other reserves 302 3,237

Retained earnings 16,328 9,053

Total Equity 32,405 22,052

------- -------

Total Equity and Liabilities 57,192 41,314

---------------------------------- ------ ------- -------

Statements of Cash Flows for the year ended 30 June 2011

Group

-------------------

Notes 2011 2010

$'000 $'000

---------------------------------------- ------ --------- --------

Cash flows from operating activities

Cash generated/(used) from operations 10 10,089 8,906

Interest received 99 195

Tax paid (1,595) (2,188)

---------------------------------------- ------ --------- --------

Net cash from operating activities 8,593 6,913

Cash flows from investing activities

Purchase of plant and equipment (1,790) (127)

Acquistion of subsidiary, net of cash

acquired 8 (8,772) -

Capitalised intangible assets 7 (247) (521)

---------------------------------------- ------ --------- --------

Net cash used in investing activities (10,809) (648)

Cash flows from financing activities

Dividends paid to company shareholders 5 (3,063) (2,992)

Proceeds from issuance of shares 13 -

---------------------------------------- ------ --------- --------

Net cash used in financing activities (3,050) (2,992)

Net (decrease)/increase in cash and cash

equivalents (5,266) 3,273

Cash and cash equivalents at the start

of the year 29,442 26,169

Cash and cash equivalents at the end

of the year 24,176 29,442

---------------------------------------- ------ --------- --------

Notes to the Financial Statements

General Information

Craneware plc (the Company) is a public limited company

incorporated and domiciled in Scotland. The Company has a primary

listing on the AIM stock exchange. The address of its registered

office and principal place of business is disclosed on page 10 of

the financial statements. The principal activity of the Company is

described in the directors' report.

Basis of preparation

The financial statements are prepared in accordance with

International Financial Reporting Standards, as adopted by the

European Union (IFRS), IFRIC interpretations and with those parts

of the Companies Act 2006 applicable to companies reporting under

IFRS. The consolidated financial statements have been prepared

under the historic cost convention. The applicable accounting

policies are set out below, together with an explanation of where

changes have been made to previous policies on the adoption of new

accounting standards in the year, if relevant.

The preparation of financial statements in conformity with IFRS

requires the use of estimates and assumptions that affect the

reported amounts of assets and liabilities at the date of the

financial statements and the reported amounts of revenues and

expenses during the reporting period. Although these estimates are

based on management's best knowledge of the amount, event or

actions, actual results ultimately may differ from those

estimates.

The Company and its subsidiary undertakings are referred to in

this report as the Group.

1. Selected Principal accounting policies

The principal accounting policies adopted in the preparation of

these accounts are set out below. These policies have been

consistently applied, unless otherwise stated.

Reporting currency

The Directors consider that as the Group's revenues are

primarily denominated in US dollars the Company's principal

functional currency is the US dollar. The Group's financial

statements are therefore prepared in US dollars.

Currency Translation

Transactions denominated in foreign currencies are translated

into US dollars at the rate of exchange ruling at the date of the

transaction. Monetary assets and liabilities expressed in foreign

currencies are translated into US dollars at rates of exchange

ruling at the balance sheet date $1.6055/GBP1 (2010 :

$1.4961/GBP1). Exchange gains or losses arising upon subsequent

settlement of the transactions and from translation at the balance

sheet date, are included within the related category of expense

where separately identifiable, or in general and administrative

expenses.

Revenue recognition

The Group follows the principles of IAS 18, "Revenue

Recognition", in determining appropriate revenue recognition

policies. In principle revenue is recognised to the extent that it

is probable that the economic benefits associated with the

transaction will flow into the Group.

Revenue is derived from sales of, and distribution agreements

relating to, software licenses and professional services (including

installation). Revenue is recognised when (i) persuasive evidence

of an arrangement exists; (ii) the customer has access and right to

use our software; (iii) the sales price can be reasonably measured;

and (iv) collectability is reasonably assured.

Revenue from standard licensed products which are not modified

to meet the specific requirements of each customer is recognised

from the point at which the customer has access and right to use

our software. This right to use software will be for the period

covered under contract and, as a result our annuity based revenue

model, recognises the licensed software revenue over the life of

this contract. This policy is consistent with the Company's

products providing customers with a service through the delivery

of, and access to, software solutions (Software-as-a-Service

("SaaS")), and results in revenue being recognised over the period

that these services are delivered to customers.

Revenue from all professional services is recognised as the

applicable services are provided. Where professional services

engagements contain material obligation, revenue is recognised when

all the obligations under the engagement have been fulfilled. Where

professional services engagements are provided on a fixed price

basis, revenue is recognised based on the percentage completion of

the relevant engagement. Percentage completion is estimated based

on the total number of hours performed on the project compared to

the total number of hours expected to complete the project.

Software and professional services sold via a distribution

agreement will normally follow the above recognition policies.

Should any contracts contain non-standard clauses, revenue

recognition will be in accordance with the underlying contractual

terms which will normally result in recognition of revenue being

deferred until all material obligations are satisfied.

The excess of amounts invoiced over revenue recognised are

included in deferred income. If the amount of revenue recognised

exceeds the amount invoiced the excess is included within accrued

income.

Intangible Assets

(a) Goodwill

Goodwill arising on consolidation represents the excess of the

cost of acquisition over the fair value of the identifiable assets

and liabilities of a subsidiary at the date of acquisition.

Goodwill is capitalised and recognised as a non-current asset in

accordance with IFRS 3 and is tested for impairment annually, or on

such occasions that events or changes in circumstances indicate

that the value might be impaired.

Goodwill is allocated to cash-generating units for the purpose

of impairment testing. The allocation is made to those

cash-generating units that are expected to benefit from the

business combination in which the goodwill arose.

(b) Proprietary software

Proprietary software acquired in a business combination is

recognised at fair value at the acquisition date. Proprietary

software has a finite life and is carried at cost less accumulated

amortisation. Amortisation is calculated using the straight-line

method to allocate the associated costs over their estimated useful

lives of 5 years.

(c) Contractual Customer relationships

Contractual customer relationships acquired in a business

combination are recognised at fair value at the acquisition date.

The contractual customer relations have a finite useful economic

life and are carried at cost less accumulated amortisation.

Amortisation is calculated using the straight-line method over the

expected life of the customer relationship which has been assessed

as 10 years.

(d) Research and Development Expenditure

Expenditure associated with developing and maintaining the

Group's software products are recognised as incurred. Where,

however, new product development projects are technically feasible,

production and sale is intended, a market exists, expenditure can

be measured reliably, and sufficient resources are available to

complete such projects, development expenditure is capitalised

until initial commercialisation of the product, and thereafter

amortised on a straight-line basis over its estimated useful life.

Staff costs and specific third party costs involved with the

development of the software are included within amounts

capitalised.

(e) Computer software

Costs associated with acquiring computer software and licensed

to-use technology are capitalised as incurred. They are amortised

on a straight-line basis over their useful economic life which is

typically 3 to 5 years.

Impairment of non-financial assets

At each reporting date the Group considers the carrying amount

of it tangible and intangible assets including goodwill to

determine whether there is any indication that those assets have

suffered an impairment loss. If there is such an indication, the

recoverable amount of the asset is estimated in order to determine

the extent of the impairment loss (if any) through determining the

value in use of the cash generating unit that the asset relates to.

Where it is not possible to estimate the recoverable amount of an

individual asset, the Group estimates the recoverable amount of the

cash-generating unit to which the asset belongs.

If the recoverable amount of an asset is estimated to be less

than its carrying amount, the impairment loss is recognised as an

expense.

Where an impairment loss subsequently reverses, the carrying

amount of the asset is increased to the revised estimate of its

recoverable amount, but so that the increased carrying amount does

not exceed the carrying amount that would have been determined had

no impairment loss been recognised for the asset. A reversal of an

impairment loss is recognised as income immediately. Impairment

losses relating to goodwill are not reversed.

Taxation

The charge for taxation is based on the profit for the period

and takes into account deferred taxation. Taxation is computed

using the liability method. Under this method, deferred tax assets

and liabilities are determined based on temporary differences

between the financial reporting and tax bases of assets and

liabilities and are measured using enacted rates and laws that will

be in effect when the differences are expected to reverse. The

deferred tax is not accounted for if it arises from initial

recognition of an asset or liability in a transaction that at the

time of the transaction affects neither accounting nor taxable

profit or loss. Deferred tax assets are recognised to the extent

that it is probable that future taxable profits will arise against

which the temporary differences will be utilised.

Deferred tax is provided on temporary differences arising on

investments in subsidiaries except where the timing of the reversal

of the temporary difference is controlled by the Group and it is

probable that the temporary difference will not reverse in the

foreseeable future. Deferred tax assets and liabilities arising in

the same tax jurisdiction are offset.

In the UK and the US, the Group is entitled to a tax deduction

for amounts treated as compensation on exercise of certain employee

share options under each jurisdiction's tax rules. As explained

under "Share-based payments" below, a compensation expense is

recorded in the Group's statement of comprehensive income over the

period from the grant date to the vesting date of the relevant

options. As there is a temporary difference between the accounting

and tax bases a deferred tax asset is recorded. The deferred tax

asset arising is calculated by comparing the estimated amount of

tax deduction to be obtained in the future (based on the Company's

share price at the balance sheet date) with the cumulative amount

of the compensation expense recorded in the statement of

comprehensive income. If the amount of estimated future tax

deduction exceeds the cumulative amount of the remuneration expense

at the statutory rate, the excess is recorded directly in equity

against retained earnings.

Cash and Cash Equivalents

Cash and cash equivalents include cash in hand, deposits held

with banks and short term highly liquid investments. For the

purpose of the statements of cash flows, cash and cash equivalents

comprise of cash on hand, deposits held with banks and short term

high liquid investments.

Share-Based Payments

The Group grants share options to certain employees. In

accordance with IFRS 2, "Share-Based Payments" equity-settled

share-based payments are measured at fair value at the date of

grant. Fair value is measured by use of the Black-Scholes pricing

model as appropriately amended. The fair value determined at the

date of grant of the equity-settled share-based payments is

expensed on a straight-line basis over the vesting period, based on

the Group's estimate of the number of shares that will eventually

vest. Non-market vesting conditions are included in assumptions

about the number of options that are expected to vest. At the end

of each reporting period, the entity revises its estimates of the

number of options that are expected to vest based on the non-market

vesting conditions. It recognises the impact of the revision to

original estimates, if any, in the statement of comprehensive

income, with a corresponding adjustment to equity. When the options

are exercised the Company issues new shares. The proceeds received

net of any directly attributable transaction costs are credited to

share capital and share premium.

The share-based payments charge is included in net operating

expenses and is also included in 'Other reserves'.

2 Critical accountingestimates and judgements

The preparation of financial statements in accordance with

international financial reporting standards requires the directors

to make critical accounting estimates and judgements that affect

the amounts reported in the financial statements and accompanying

notes. The estimates and assumptions that have a significant risk

of causing material adjustment to the carrying value of assets and

liabilities within the next financial year are discussed

below:-

-- Investment in Subsidiary/Purchase Price Allocation:- the

Group determines whether investments in subsidiaries and the

related Intangible assets acquired are impaired at least on an

annual basis and measures the recoverable amount of the investment

whenever there is an indication that the investment may be

impaired. This requires an estimation of the value in use of the

applicable cash generating unit. Estimating the value in use

requires the Group to make an estimate of the expected future

cashflows from the subsidiary and also to choose a suitable

discount rate in order to calculate the present value of those

cashflows. Where there is an indication of impairment, management

perform an impairment review to determine the level of provision

required.

-- Calculation of goodwill and contingent consideration:-

Goodwill is calculated based on estimated consideration payable to

the former shareholders of the acquired subsidiary. This

consideration includes a contingent element which is based on

future estimated profits. This requires an initial assessment as to

the probability of whether the full amount of the purchase

consideration will be payable. These accounting estimates and

judgements are based on assumptions that management and the Board

of Directors believe are reasonable under the circumstances and are

disclosed in more detail in note 8. The Group also make estimates

and judgements concerning the future and the resulting estimates

may, by definition, vary from the related actual results.

-- Provision for impairment of trade receivables:- the Group

assesses trade receivables for impairment which requires the

directors to estimate the likelihood of payment forfeiture by

customers.

-- Revenue recognition:- the Group assesses the economic benefit

that will flow from future milestone payments in relation to

sub-licensing partnership arrangements. This requires the directors

to estimate the likelihood of the Group, its partners, and

sub-licensees meeting their respective commercial milestones and

commitments.

-- Capitalisation of development expenditure:- the Group

capitalises development costs provided the conditions laid out

previously have been met. Consequently the directors require to

continually assess the commercial potential of each product in

development and its useful life following launch.

-- Provisions for income taxes:-the Group is subject to tax in

the UK and US and this requires the directors to regularly assess

the applicability of its transfer pricing policy.

-- Share-based payments:-the Group requires to make a charge to

reflect the value of share-based equity-settled payments in the

period. At each grant of options and balance sheet date, the

Directors are required to consider whether there has been a change

in the fair value of share options due to factors including number

of expected participants.

3 Net operating expenses

Net operating expenses are comprised of

the follows:-

2011 2010

$'000 $'000

------------------------------------------- ------- -------

Sales and marketing expenses 8,368 7,102

Client servicing 5,775 4,037

Research and development 5,024 3,785

Administrative expenses 4,143 3,314

Acquisition costs on business combination 517 -

Share-based payments 139 114

Depreciation of plant and equipment 312 192

Amortisation of intangible assets 555 253

Exchange loss/(gain) 41 (16)

Net operating expenses 24,874 18,781

------------------------------------------- ------- -------

4 Tax on profit on ordinary activities

2011 2010

$'000 $'000

------------------------------------------------------ ------ -----

Profit on ordinary activities before tax 8,653 7,258

Current tax

Corporation tax on profits of the year 3,257 2,005

Foreign exchange on taxation in the year 42 58

Adjustments for prior years 68 (257)

------------------------------------------------------ ------ -----

Total current tax charge 3,367 1,806

------------------------------------------------------ ------ -----

Deferred tax

Origination & reversal of timing differences (749) (73)

Change in tax rate 20 -

------------------------------------------------------ ------ -----

Total deferred tax (credit) (729) (73)

Tax on profit on ordinary activities 2,638 1,733

------------------------------------------------------ ------ -----

The difference between the current tax charge on ordinary

activities for the year, reported in the consolidated statement

of comprehensive income, and the current tax charge that would

result from applying a relevant standard rate of tax to the

profit on ordinary activities before tax, is explained as

follows:

Profit on ordinary activities at the UK tax

rate 27.5% (2010: 28%) 2,380 2,032

Effects of

Adjustment in respect of prior years:

Current tax 68 (257)

Change in tax rate 20 -

State tax 60 49

Additional US tax on profits 34% (2010: 34%) 76 59

Foreign Exchange 34 (33)

Expenses not deductible for tax purposes 13 (1)

Tax deduction on share plan charges (13) (116)

------------------------------------------------------ ------ -----

Total tax charge 2,638 1,733

------------------------------------------------------ ------ -----

5 Dividends

The dividends paid during the year were as follows:-

2011 2010

$'000 $'000

---------------------------------------------- ------ ------

Final dividend, re 30 June 2010 - 5.31 cents

(3.3 pence)/share 1,333 1,220

Interim dividend, re 30 June 2011 - 6.44

cents (4.0 pence)/share 1,730 1,772

Total dividends paid to company shareholders

in the year 3,063 2,992

---------------------------------------------- ------ ------

The proposed final dividend for 30 June 2011 is subject to

approval by the shareholders at the Annual General Meeting and has

not been included as a liability in these accounts.

6 Earnings per share

a) Basic

Basic earnings per share is calculated by dividing the profit

attributable to equity holders of the Company by the weighted

average number of shares in issue during the year.

2011 2010

Profit attributable to equity holders of the

Company ($'000) 6,015 5,525

Weighted average number of ordinary shares in

issue (thousands) 26,079 25,315

----------------------------------------------- ------- -------

Basic earnings per share ($ per share) 0.231 0.218

----------------------------------------------- ------- -------

Adjusted Basic earnings per share is calculated under the same

method as shown above except that the profit attributable to equity

holders of the Company is increased by $664,098 which represents

the total acquisition costs expensed during the year and

amortisation of acquired intangible assets. This gives rise to an

adjusted basic earnings per share of $0.256 per share.

b) Diluted

For diluted earnings per share, the weighted average number of

ordinary shares calculated above is adjusted to assume conversion

of all dilutive potential ordinary shares. The Group has one

category of dilutive potential ordinary shares, being those share

options granted to directors and employees under the share option

scheme.

2011 2010

Profit attributable to equity holders of the

Company ($'000) 6,015 5,525

Weighted average number of ordinary shares in

issue (thousands) 26,079 25,315

Adjustment for:

- Share options (thousands) 324 1,005

Weighted average number of ordinary shares for

diluted

earnings per share (thousands) 26,403 26,320

------------------------------------------------ ------- -------

Diluted earnings per share ($ per share) 0.228 0.210

Adjusted diluted earnings per share is calculated under the same

method as shown above except that the profit attributable to equity

holders of the Company is increased by $664,098 which represents

the total acquisition costs expensed during the year and

amortisation of acquired intangible assets. This gives rise to an

adjusted diluted earnings per share of $0.253 per share.

7 Intangible assets

Goodwill and Other Intangible assets

Group

Goodwill Customer Proprietary Development Computer

Relationships Software Costs Software Total

$'000 $'000 $'000 $'000 $'000 $'000

-------------- --------- -------------- ------------ ------------ --------- -------

Cost

At 1 July

2010 - - - 2,385 293 2,678

Additions - - - 199 48 247

Additions

acquired at

Fair Value 12,264 2,964 1,222 - 112 16,562

At 30 June

2011 12,264 2,964 1,222 2,584 453 19,487

-------------- --------- -------------- ------------ ------------ --------- -------

Amortisation

At 1 July

2010 - - - 944 260 1,204

Charge for

the year - 66 82 364 43 555

At 30 June

2011 - 66 82 1,308 303 1,759

NBV at 30

June 2011 12,264 2,898 1,140 1,276 150 17,728

-------------- --------- -------------- ------------ ------------ --------- -------

Cost

At 1 July

2009 - - - 1,886 271 2,157

Additions - - - 499 22 521

At 30 June

2010 - - - 2,385 293 2,678

-------------- --------- -------------- ------------ ------------ --------- -------

Amortisation

At 1 July

2009 - - - 725 226 951

Charge for

the year - - - 219 34 253

At 30 June

2010 - - - 944 260 1,204

NBV at 30

June 2010 - - - 1,441 33 1,474

-------------- --------- -------------- ------------ ------------ --------- -------

The additions acquired in the year are all in respect of the 17

February 2011 acquisition of Craneware InSight Inc (see Note 8).

Future anticipated payments arising from earn-outs are based on the

Directors best estimates of these contingent obligations. The

earn-out is dependent on the future performance of the relevant

business and a continued assessment of the liability arising is

performed at least twice yearly.

In accordance with the Group's accounting policy, the carrying

values of goodwill and other intangibles assets are reviewed for

impairment annually or more frequently if events or changes in

circumstances indicate that the asset might be impaired.

For goodwill the recoverable amount of the applicable

cash-generating unit, which relates to the acquisition in the

period (see Note 8), has been determined on the basis of fair value

less costs to sell, determined by the binding contract for the sale

of the ClaimTrust Inc. business to Craneware plc, as enacted on 17

February 2011.

The consideration for the sale supports the valuation of

goodwill, as does the proximity of the applicable impairment review

date to this agreement.

8 Acquisition of subsidiary: Craneware InSight Inc

On 17 February 2011, the Company acquired 100% of the issued

share capital of ClaimTrust Inc. On the date of acquisition the

assets and liabilities of ClaimTrust Inc. were merged into the

newly created entity, Craneware InSight Inc. The total

consideration for the acquisition along with the fair value of the

identified assets and assumed liabilities is shown below:

Fair Value

Recognised amounts of

identifiable Book Value Adjustments Fair Value

assets acquired and liabilities

assumed $'000 $'000 $'000

Tangible fixed assets

Plant and equipment 408 - 408

Intangible assets

Computer software 112 - 112

Customer relationships - 2,964 2,964

Proprietary software - 1,222 1,222

Other assets and liabilities

Trade and other receivables 1,171 - 1,171

Bank and cash balances 228 - 228

Trade and other payables (741) - (741)

Deferred tax - (1,674) (1,674)

1,178 2,512 3,690

----------- ------------ -----------

Goodwill 12,264

Fair Value 15,954

-----------

Satisfied by: $'000

Cash 9,000

Ordinary shares issued - 641,917

shares at $9.347 (GBP5.83) 6,000

Fair value of contingent deferred

consideration 954

15,954

-----------

Bank balances and cash

acquired 228

Cash consideration (9,000)

Net cash on acquisition (8,772)

-----------

The contingent consideration is subject to performance criteria,

including revenue and profit targets, set for the next financial

year and consequently the actual consideration is payable following

the respective year end. The maximum potential deferred

consideration payable is an additional $4.5m subject to meeting all

the performance criteria. The acquisition costs, including all due

diligence costs that related to the transaction amounted to

$516,796 and these have been expensed as operating costs in

compliance with IFRS 3 (revised).

Goodwill of $12,263,819 has been recognised on acquisition and

is attributable to future customers, future software and the

assembled workforce.

In the period following the acquisition, Craneware InSight Inc.

contributed $2,612,624 to Group revenue and $3,016 to adjusted

EBITDA* which has been included with the consolidated statement of

comprehensive income for the year. Had Craneware InSight Inc. been

consolidated from 1 July 2010, the consolidated statement of

comprehensive income would show revenue of $42,958,489 and adjusted

EBITDA* of $10,235,219.

The initial accounting for the business combination is

incomplete as at 30 June 2011 and is based on provisional amounts.

In particular, the directors are still to determine if there is a

deferred tax asset in relation to 'net operating losses' carried

forward from the acquired business that can be recognised.

*Adjusted EBITDA is defined as operating profit before

acquisition costs, share based payments, depreciation and

amortisation.

9 Called up share capital

Authorised

2011 2010

Number $'000 Number $'000

---------------------------- ----------- ------ ----------- ------

Equity share capital

Ordinary shares of 1p each 50,000,000 1,014 50,000,000 1,014

---------------------------- ----------- ------ ----------- ------

Allotted called-up and fully paid

2011 2010

Number $'000 Number $'000

---------------------------- ----------- ------ ----------- ------

Equity share capital

Ordinary shares of 1p each 26,792,681 536 25,365,850 512

---------------------------- ----------- ------ ----------- ------

The movement in share capital during the year is represented as

follows:

-- 809,100 Ordinary Share options were exercised in the

year.

-- 617,731 Ordinary Shares were issued at the balance sheet date

as equity in respect of the consideration for the Craneware InSight

Inc acquisition at price of $9.347 (GBP5.83).

10 Cash flow generated from operating activities

Reconciliation of profit before tax to net cash inflow from

operating activities

Group

2011 2010

---------------------------------------- ------- -------

$'000 $'000

Profit before tax 8,653 7,258

Finance income (99) (195)

Depreciation on plant and equipment 312 192

Amortisation on intangible assets 555 253

Share-based payments 139 114

Movements in working capital:

Increase in trade and other receivables (3,353) (3,385)

Increase in trade and other payables 3,882 4,669

---------------------------------------- ------- -------

Cash generated from operations 10,089 8,906

---------------------------------------- ------- -------

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR DBGDIIBDBGBC

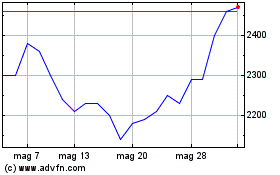

Grafico Azioni Craneware (LSE:CRW)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Craneware (LSE:CRW)

Storico

Da Lug 2023 a Lug 2024