TIDMCRW

RNS Number : 9553B

Craneware plc

11 March 2014

Craneware plc

("Craneware", "the Group" or the "Company")

Interim Results

11 March 2014 - Craneware plc (AIM: CRW.L), the market leader in

automated revenue integrity solutions for the US healthcare market,

announces its unaudited results for the six months ended 31

December 2013.

Financial Highlights (US dollars)

-- Revenue increased 5% to $21.1m (H1 2013: $20.1m)

-- Adjusted EBITDA(1) increased 6% to $5.7m (H1 2013: $5.4m)

-- Profit before tax increased 7% to $4.8m (H1 2013: $4.5m)

-- Adjusted basic EPS increased 8% to 14.3 cents per share (H1 2013: 13.2 cents per share)

-- Cash at period end $30.6m (H1 2013: $28.6m and $30.3m at 30 June 2013)

-- Proposed interim dividend of 5.7p per share (H1 2013: 5.2p per share)

(1.) Adjusted EBITDA refers to earnings before interest, tax,

depreciation, amortisation, share based payments, released deferred

consideration and transaction related costs

Operational Highlights

-- Good sales performance driven by incremental increases in the

number of deals, in the size of hospital groups, the overall deal

size and the number of longer-term contracts

-- 2013 Best in KLAS Awards: Chargemaster Toolkit and Bill Analyzer

-- Good growth in InSight Audit supporting the 'Gateway Products' strategy

-- Supportive market environment - The Affordable Care Act, new

billing models, healthcare consumerisation, RAC and third party

payor audits, market consolidation and affiliations

-- Strong revenue visibility over the remainder of the year and beyond

Keith Neilson, CEO of Craneware commented:

"Craneware remains at the forefront of providing solutions to US

healthcare providers so they can achieve the revenue integrity

required to support improved patient care and outcomes. We have

seen a continued increase in sales during the period, to

progressively larger hospital groups. The US Healthcare market

seems to be settling as strategies are developing to support the

need for change and deal with the uncertainties of the Affordable

Care Act. With a strong product suite, clear strategic direction

and high levels of revenue visibility, we are confident of

continued future growth."

For further information, please contact:

Craneware plc Peel Hunt Newgate Threadneedle

+44 (0)131 550 3100 +44 (0)20 7418 8900 +44 (0)20 7653 9850

Keith Neilson, CEO Dan Webster Caroline Evans-Jones

Craig Preston, CFO Richard Kauffer Fiona Conroy

Heather Armstrong

About Craneware

Craneware is the leader in automated revenue integrity solutions

that improve financial performance and mitigate risk for US

healthcare organisations. Founded in 1999, Craneware has its

headquarters in Edinburgh, Scotland with offices in Atlanta,

Boston, Nashville and Phoenix employing more than 200 staff.

Craneware's market-driven, SaaS solutions help hospitals and other

healthcare providers more effectively price, charge, code and

retain earned revenue for patient care services and supplies. This

optimises reimbursement, increases operational efficiency and

minimises compliance risk. By partnering with Craneware, clients

achieve the visibility required to identify, address and prevent

revenue leakage. To learn more, visit craneware.com and

stoptheleakage.com

Chairman's Statement

I am pleased to report that the first half of the year has seen

a continued increase in the level of signed sales contracts, with

the other underlying sales metrics trending in a positive

direction. Sales have been delivered across a mix of hospital

types, including, as predicted, increasingly larger hospital

groups, reflecting the natural progression of the sales cycle and

the ongoing investment we have made in our sales operation and its

growing maturity.

Revenues increased by 5% to $21.1m, adjusted EBITDA increased by

6% to $5.7m and adjusted EPS increased by 8% to 14.3 cents. The

Company continued to benefit from strong operational cash flow,

closing the period with a cash balance of $30.6m (31 December 2012:

$28.6m). Visibility over revenue for FY14 has increased to $41.7m

(31 December 2012: $36.7m), providing the Board with increased

confidence in continued growth.

We were pleased to welcome Ms Colleen Blye to the Board as

Non-Executive Director during the period. Ms Blye is the Executive

Vice President and Chief Financial Officer for Catholic Health

Systems of Long Island, an integrated healthcare delivery system

which incorporates six hospitals, three nursing homes, a

community-based agency for persons with special needs, and a

regional home care and hospice group. Ms Blye's greater than 20

years' experience across senior positions within the US healthcare

industry is providing us with valuable insight as we seek to

further develop our market positioning and long term strategy.

With an underlying base of annuity revenue, continued high

customer retention rates and a quarter of all US hospitals as

customers, we are confident that Craneware has a strong foundation

for success. Our products consistently outperform our competitors'

solutions, delivering transparent and highly measurable return on

investment, as well as efficiencies to our customers. With a high

proportion of the market still relying on manual processes and an

ever-increasing level of auditing pressure on hospitals, the Board

is confident of Craneware's ability to grow its revenues and

profits.

The commitment and enthusiasm of our staff continues to be the

basis of our success. I would like to thank them for their efforts

and our shareholders for their continued support during the

period.

George Elliott

Chairman

10 March 2014

Operational Review

Introduction

This has been a positive first half for Craneware. The sales

activity seen in recent periods has, as expected, translated into

increasing levels of new sales. While some of the revenue from

these long term contracts will flow through into the second half of

the current year, our revenue recognition policy means that the

majority of the impact will be felt in future years, adding to our

high levels of revenue visibility.

We previously reported that in the second half of the last

financial year sales to small and medium individual hospitals

accounted for the majority of new contracts signed in that period

and that we anticipated that larger hospitals and hospital groups

would take longer to follow suit due to the comparative complexity

of their buying cycles. We are pleased to report that we have seen

this expected progression in the size of new deals, with an

increased level of sales to larger individual hospitals and

increasing sizes of hospital groups. A number of contracts were

signed in the period, which would previously have been considered

material due to their size, but no longer meet our announcement

criteria as a result of the increasing overall size of the

Company.

We fully expect this trend to continue as the longer buying

cycles of the larger hospital groups catch up with the rest of the

market in due course.

We enter the second half of the year in a strong position. The

Company has increased revenue visibility, strengthened the

management team and increased domain and industry expertise at

Board level which is keenly monitoring the building sales momentum

and future pipeline.

Our focus in the second half of the year will be on addressing

the growing number of opportunities we have to help our customers

address their challenges and continued sales execution.

Market Developments

Recent reports from the Centers for Medicare and Medicaid

Services state that US healthcare spending in 2012 showed its

fourth consecutive year of growth, albeit growing modestly slower

than the economy as a whole in 2012. Overall healthcare spending

increased at a rate of 3.7 percent to $2.8 trillion in 2012. The

share of the US economy devoted to healthcare was therefore 17.2

percent in 2012.

With six main trends affecting US healthcare reimbursement, the

main priority of our customers continues to be providing quality

care to their patients against the background of continuing cuts in

Medicare reimbursements, imposed restructuring of their business

models and increased pressure from payor auditors. These are

discussed in more detail below;

The Affordable Care Act

Although the Affordable Care Act may well evolve again in the

future, the first tangible signs of its implementation are already

being seen. The online Health Insurance Exchanges established under

the Act, which allow individuals and small businesses to purchase

private health insurance, saw very low levels of registration at

first. However, recent reports state that nearly 2.2 million people

have now signed up. December's enrollment (1.8 million) jumped

nearly five times from the number who enrolled in October and

November combined (364,000). Hospitals will shortly begin to see

large numbers of these patients in a setting that will be covered

by at least a basic level of insurance where previously many

hospitals would have been forced to see these patients and write

off much of the treatment costs as charity care. Future supply and

demand curves for hospitals are predicted to remove any current

perceived spare capacity in the industry.

New Billing Models

As part of the Affordable Care Act, healthcare providers and

payors have been asked to consider and implement many new business

models for reimbursement and to reduce their dependence on fee for

service only style payments. This new world may involve

reimbursement coming from a variety of business models alongside

Fee for Service such as Fee for Outcome, Bundled Payments,

Accountable Care organizations and Population Health Management

models. These multiple billing models, move risk more to the

Healthcare provider, therefore creating a greater dependency for

them to claim reimbursement correctly, requiring the accuracy of

data both clinically and financially within their systems to make

accurate assessment of the acquired risk.

Healthcare Consumerisation

With rising costs in Healthcare being transferred

disproportionately from the government and the employer to the

consumer, hospitals have seen more than a trebling of their

reimbursement coming directly from the consumer in the last ten

years. This drive to consumerism and the relative lack of certainty

of payment for the Provider that this brings with it has resulted

in a technology backed focus on correct and efficient patient

registration with payment collections before treatment has been

provided.

RAC and third party Payor Audits

The audit program looks to intensify in the near term with an

additional RAC created in the recent retendering process and the

imminent release of the names of the new successful RAC Auditors

who will carry out this work for the next five years reinforcing

how much pressure is on Healthcare Providers to make sure they are

running this non-core but critical area of their operations

correctly. New rules that state the number of medical chart

requests that a RAC can audit from any one hospital is reduced in

proportion to the number of denials that a hospital has had

historically will be introduced when the new RAC's are in place.

This is widely expected to drive technology solutions elsewhere in

the revenue cycle particularly in charge master and denials

management, to deal with revenue integrity and ultimately attempt

to mitigate the hospitals' exposure to RAC audit risk by correcting

things the first time around.

ICD 10 Coding Transition

From October 2014, hospitals will have to report their claims

with an International Classification of Diagnosis Code Version 10

(ICD 10) replacing the simpler US Version 9 which is currently

mandated. This conversion, although very large in its magnitude and

increased complication for providers, has been scheduled for a long

time (originally scheduled to be implemented 2013) and therefore

the majority of hospitals have detailed and advanced plans to deal

successfully with this conversion. Although getting these codes

wrong on a claim could have a catastrophic effect on a hospital's

reimbursement, the number of hospitals that appear to have not been

successfully testing their claims with this data set is limited and

therefore should not substantially result in a diversion for

hospitals, as long as the payor systems are equally robust. At the

recent Health Information Management Systems Society Annual

convention, ICD 10 conversion was likened to the Y2K problem.

Although potentially critical in nature, few people had a great

deal of remaining exposure to this risk.

Consolidation and Affiliation

As reported in previous periods the increasing trend for

healthcare providers to consolidate and affiliate to share

economies of scale has not abated.

The competitive landscape remains largely unchanged, with new

entrants to the market generally seeking to establish partnerships

or joint go-to-market strategies. Management believes Craneware has

the most extensive suite of revenue integrity solutions to address

the aforementioned healthcare trends and is confident of its

growing prominence within the US healthcare market as it continues

to further develop and enhance in the areas of Patient Access, Data

for Population Health and other business models, Revenue Cycle,

Supply chain and Audit.

Sales and Marketing

The Company delivered a good sales performance in the first half

of the year. This in part reflects the anticipated development of

the natural buying cycle, which saw initial sales to the smaller

more flexible, independent hospitals in the prior year, develop to

now include larger hospitals and larger sized hospital groups. As

previously stated we expect this development of hospital buying

cycles to continue, with the increasing engagement of larger

hospital groups and their inherently more complex buying

decisions.

An example of a hospital group signing in the period was Avera

Health, a large health network of hospitals and clinics in South

Dakota, North Dakota, Minnesota, Iowa and Nebraska, which purchased

InSight Medical Necessity(R) for implementation at 28 of their 33

hospital organisations to provide automated, real-time, validation

of medical necessity.

The investments made in the prior and current period to our

sales team have also added to the sales performance. Reinvigorated

sales management, with the support of the Operations Board, has

reorganised the sales incentivisation structures taking advantage

of recent market conditions to add additional high caliber people

across the sales organisation. These combined with the growing

maturity of the entire sales team leaves us well positioned to

respond to our increasing market opportunity.

The average length of new customer contracts continues to be

in-line with our historical norms of approximately five years,

although we have seen the return of 7 and 9 year contracts in the

period which is reflective of the increasing market confidence.

Where Craneware enters into new product contracts with its existing

customers, contracts are typically made co-terminus with the

customer's existing contracts, and as such, the average length of

these contracts is greater than three years, in-line with our

expectations.

'Renewal rates by dollar value' is a financial metric which

specifically ties to the revenue visibility for future years This

metric at 94%, is within the historical norms and is reviewed in

the Financial Review section.

The sales mix remained fairly constant throughout the period,

resulting in no change to the overall product attachment rate,

which remained steady at approximately 1.6 products per

customer.

Our Gateway product strategy continues to be positively

received. The increased focus on these products during initial

customer discussions has led to both new hospital sales as well as

the cross sell of the newer Gateway products to our original

customer base. We are seeing evidence that the successes of the

Gateway products leads to customers instigating sales discussions

for other products. In the second half of the prior Financial Year

we identified InSight Audit as the Gateway product for the Audit

and Recovery Product Family. This decision has been supported by

the continued increase of sales of this product, with the number of

products sold in the period now reaching the level of sales

achieved by our original Gateway Product 'Chargemaster Toolkit'. We

continue to look at options for a Gateway product in the Access

Management and Strategic Pricing family and continue to assess the

opportunities for this product family.

A focus of our marketing in the period has been to widen our

marketing to increasingly target the "C suite" and not just the

CFO. The importance of revenue integrity to all healthcare

providers is gaining increasing exposure at the top tier management

of these organisations. We are now seeing acknowledgment across the

"C Suite" that financial and clinical operations have to be aligned

to achieve better quality in healthcare and outcomes.

Awards

We are pleased to report that once again two of our solutions

ranked first in two distinct revenue cycle categories in the annual

"2013 Best in KLAS Awards: Software & Services" report,

published January 2014. In this new KLAS report, Craneware's

flagship product, Chargemaster Toolkit(R), earned the #1 ranking in

the KLAS "Revenue Cycle - Chargemaster Management" market category

for the eighth consecutive year, and Craneware's Bill Analyzer

software ranked #1 in the "Revenue Cycle - Charge Capture," winning

a Category Leader award for the third year running.

Product Development

Our strategy is to provide software solutions that help

customers at the points in their systems where clinical and

operational data transform into financial transactions. Our

solutions automate data normalisation, combining disparate data

sets while maintaining the localised context. This produces

valuable, actionable information and creates organisation-wide

visibility and accountability. We consistently receive feedback

from our customers that through the implementation of our software

they are able to rapidly identify significant amounts of dollars in

missed revenue, overspend or incorrect billing which could lead to

lost income and indeed fines.

Product development continues to be focused on supporting this

long term strategy. During the period we have progressed the

initiatives that were launched in the prior year. These include:

continuing to enhance the functionality of current products whilst

investigating the opportunities that integration of current

offerings into new innovative combinations could present;

maintaining the focus on external integration with Healthcare

Information Systems, such as the EPIC patient accounting system, to

ensure we can fully support all our Customers should they decide to

replace their current systems. In conjunction with and in support

of these initiatives we have continued development of our common

software framework, this will provide the foundation for our future

development efforts, significantly decreasing our time to market.

During the period we have neared completion of the development of a

set of hybrid solutions, which combine services with some of our

core products which enables them to be implemented at smaller

hospitals that do not have their own internal revenue integrity

teams. We expect these solutions to be released in the second

half of the year.

Financial Review

For the six month period to 31 December 2013, we are reporting a

5% growth in revenues to $21.1m (H113:$20.1m) and a resulting 6%

increase in adjusted EBITDA(1) to $5.7m (H113: $5.4m).

The majority of the Group's revenue is recognised under the

Annuity SaaS revenue recognition model. This model sees software

licence revenue recognised over the life of the underlying contract

(which as detailed earlier for new hospital sales is an average of

5 years) with any associated professional service revenue

recognised as we deliver the services. As a result of this

conservative revenue recognition model, sales made in any single

period will not contribute significantly to revenues in that

period, instead they will add to 'revenue visibility for future

years' i.e. support and add confidence to the future years growth

rates of the Group. The strategy behind the Group's business model

and revenue recognition policies are to ensure the long term growth

and stability of the Group.

In the period under review, we have seen increasing sales

momentum delivering incremental levels of sales together with a

sales mix which, when compared to last year, includes an increase

in sales to large hospitals and small to medium size hospital

groups and also includes contracts signed for up to 9 years. As a

result of our revenue recognition model, however, we do not see a

significant short term increase in revenue instead we will see the

vast majority of these sales convert to revenue in future years

providing the foundation for further growth in those years.

As a means of demonstrating the growth in this future years

revenue, at the end of each financial year, the Company reports its

'Three Year Visible Revenue' KPI which identifies the amount of

visible revenue either contracted or highly likely to be booked in

the next three year period. This KPI helps to demonstrate how the

underlying annuity base of revenue is building each year. This

though is a three year 'snapshot' and does not fully represent the

benefit of new contracts signed for up to 9 years.

At the interim reporting date, the Company reports how that

metric, for the same three year period has moved on i.e.

incorporating the results of the first six months of the three year

KPI. This shows both how renewals have flowed through and how sales

of new products have affected new contracted revenue across the

three years. The total visible revenue for the three year period 1

July 2013 to 30 June 2016 has grown during this six month period to

$114.4m from $109.5m at 30 June 2013. This comprises $79.5m revenue

under contract, $29.7m renewal revenue and $5.2m revenue identified

as recurring in nature (previously referred to as Claimtrust Legacy

Revenue) (at 30 June 2013: $60.6m, $40.8m and $8.1m

respectively).

'Revenue under contract'; relates to revenues that are supported

by underlying contracts. 'Renewal revenue'; at the start of the

year, we 'look forward' and calculate the amount of revenue which

is potentially available to be recognised in each of the three

years but that requires an underlying contract to be renewed. In

calculating this, we assume a 100% dollar value renewal level. As

the renewals occur, the aggregated related revenue for all of the

three years, moves from 'renewal revenues' to 'revenue under

contract'.

The final element is revenue identified as recurring in nature;

this was previously called 'Claimtrust Legacy Revenue' as it

related to our February 2011 acquisition. This was revenue that was

subject to long term contracts, but had shortterm break clauses and

was usually invoiced on a monthly basis, however due to the nature

of the underlying services provided, we expected it to be recurring

in nature. Since the integration of Claimtrust we have been, where

possible, refocussing these services towards annuity contracts. In

the period we implemented a significant step in this transition

redeploying the highly skilled healthcare consultants from more

traditional services work to 'contracted engagements' directly

supporting existing customers and potential new software sales.

This results in engagements which are shorter term in nature and

therefore this small element no longer appears in revenue

visibility for future periods. As discussed at the time of our FY13

results this element of revenue visibility will now be labeled

Other Recurring Revenue. This better aligns these consultants to

the long term strategic aims of the Group.

Our renewal rates by dollar value are subject to period to

period fluctuations, however over the course of a full year we

historically see these renewal rates return to over 100% by dollar

value. In the current period we have again seen our renewal rates

dip to 94%. We have witnessed this previously and we do not believe

this is representative of a longer term trend. The financial effect

of the periods renewal rate is fully reflected in each of the years

forming our 'three year visible revenue' KPI above.

Within our operating expenses we have continued to invest as

appropriate for the future growth of the Group. The increased level

of sales in the period combined with the changes made to the sales

incentive structure has and will have an impact on the gross profit

margins, however this investment has been balanced against

investments in other areas. As a result, our adjusted EBITDA margin

for the period is 27% as compared to 26.8% in the same period in

the prior year.

Ultimately the increase in EBITDA, as well as a small beneficial

effect from the reduction in corporation tax rates in the UK, has

resulted in the adjusted basic EPS increasing by 8% to $0.143 per

share (H113 : $0.132) and adjusted diluted EPS increasing to $0.142

(H113: $0.131).

The Group continues to maintain a strong balance sheet, with no

debt and significant cash reserves of $30.6m ($28.6m at 31 December

2012 and $30.3m at 30 June 2013). The cash levels reported are

after returning $2.8m to shareholders by way of dividends and tax

payments of $1.2m in the period. The increase in cash balances is

in contrast to prior years, where the combination of dividends and

tax payments combined with cash cycles in the run up to 31 December

has resulted in a reduction in the cash balances. Continued healthy

cash collections since the period end ensures the Group retains

healthy cash reserves which in turn provides for further future

investment including potential 'bolt on' acquisitions should such

opportunities arise.

We continue to report the results (and hold the cash reserves)

of the Group in US Dollars, whilst having approximately twenty five

percent of our costs, being our UK employees and purchases,

denominated in Sterling. The average exchange rate for the Company

during the reporting period was $1.58/GBP1 which was comparable to

the corresponding period last year.

Dividend

The Board has resolved to pay an interim dividend of 5.7p (9.44

cents) per ordinary share in the Company on 25 April 2014 to those

shareholders on the register as at 28 March 2014 (FY13 Interim

dividend 5.2p). The ex-dividend date is 26 March 2014.

The interim dividend of 5.7p per share is capable of being paid

in US dollars subject to a shareholder having registered to receive

their dividend in US dollars under the Company's Dividend Currency

Election, or who has registered to do so by the close of business

on 28 March 2014. The exact amount to be paid will be calculated by

reference to the exchange rate to be announced on 28 March 2014.

The interim dividend referred to above in US dollars of 9.44 cents

is given as an example only using the Balance Sheet date exchange

rate of $1.6563/GBP1 and may differ from that finally

announced.

Outlook

Craneware remains at the forefront of providing solutions to US

healthcare providers so they can achieve the revenue integrity

required to support improved patient care and outcomes.

We have seen a continued increase in sales during the period, to

progressively larger hospital groups. The US Healthcare market

seems to be settling as strategies are developing to support the

need for change and deal with the uncertainties of the Affordable

Care Act. With a strong product suite, clear strategic direction

and high levels of revenue visibility, we are confident of

continued future growth.

Keith Neilson Craig Preston

Chief Executive Officer Chief Financial Officer

10 March 2014 10 March 2014

Craneware PLC

Interim Results FY14

Consolidated Statement of Comprehensive

Income

H1 2014 H1 2013 FY 2013

Notes $'000 $'000 $'000

------------------------------------------ ------- ----------- ----------- -----------

Revenue 21,146 20,131 41,452

Cost of sales (1,199) (836) (2,071)

----------- ----------- -----------

Gross profit 19,947 19,295 39,381

Net operating expenses (15,182) (14,835) (28,881)

----------- ----------- -----------

Operating profit 4,765 4,460 10,500

Analysed as:

Adjusted EBITDA(1) 5,703 5,392 12,357

Share-based payments (96) (95) (181)

Depreciation of plant and equipment (303) (305) (621)

Amortisation of intangible assets (539) (532) (1,055)

--------------------------------------------------- ----------- ----------- -----------

Finance income 31 54 103

----------- ----------- -----------

Profit before taxation 4,796 4,514 10,603

Tax charge on profit on ordinary

activities (1,223) (1,241) (2,307)

----------- ----------- -----------

Profit for the period attributable

to owners of the parent 3,573 3,273 8,296

--------------------------------------------------- ----------- ----------- -----------

Total comprehensive income attributable

to owners of the parent 3,573 3,273 8,296

--------------------------------------------------- ------- ----------- -----------

(1) Adjusted EBITDA is defined as operating profit before,

share based payments, depreciation and amortisation.

Earnings per share for the period attributable to equity holders

- Basic ($ per share) 1a 0.132 0.121 0.307

- *Adjusted Basic ($ per share)(2) 1a 0.143 0.132 0.329

- Diluted ($ per share) 1b 0.132 0.121 0.306

- *Adjusted Diluted ($ per share)(2) 1b 0.142 0.131 0.328

----------- -------- ----------

(2) Adjusted Earnings per share calculations allow for the

amortisation on acquired intangible assets to form a better

comparison with previous periods.

Craneware PLC

Interim Results FY14

Consolidated Statement of Changes in Equity

--------------------------------------------------------------------------------------------------

Retained

Share Capital Share Premium Other Reserves Earnings Total

$'000 $'000 $'000 $'000 $'000

--------------------------- -------------- -------------- --------------- ---------- --------

At 1 July 2012 538 15,408 209 21,282 37,437

Total comprehensive

income - profit for

the period - - - 3,273 3,273

Transactions with owners

Share-based payments - - 95 52 147

Impact of share options

exercised - - (50) 50 -

Dividend - - - (2,482) (2,482)

--------------------------- -------------- -------------- --------------- ---------- --------

At 31 December 2012 538 15,408 254 22,175 38,375

--------------------------- -------------- -------------- --------------- ---------- --------

Total comprehensive

income - profit for

the period

Transactions with owners - - - 5,023 5,023

Share-based payments - - 86 (37) 49

Impact of share options

exercised 1 88 (128) 124 85

Dividend - - - (2,211) (2,211)

At 30 June 2013 539 15,496 212 25,074 41,321

--------------------------- -------------- -------------- --------------- ---------- --------

Total comprehensive

income - profit for

the period

Transactions with owners - - - 3,573 3,573

Share-based payments - - 97 - 97

Impact of share options

exercised - - (41) 41 -

Dividend - - - (2,783) (2,783)

At 31 December 2013 539 15,496 268 25,905 42,208

--------------------------- -------------- -------------- --------------- ---------- --------

Craneware PLC

Interim Results FY14

Consolidated Balance Sheet as at 31 December

2013

H1 2014 H1 2013 FY2013

Notes $'000 $'000 $'000

-------------------------------- ------- -------- -------- -------

ASSETS

Non-Current Assets

Plant and equipment 1,547 1,834 1,596

Intangible assets 14,812 15,481 15,291

Deferred Tax 1,564 1,673 1,615

17,923 18,988 18,502

-------- -------- -------

Current Assets

Trade and other receivables 2 17,347 13,195 15,128

Current tax assets 377 428 468

Cash and cash equivalents 30,628 28,623 30,277

48,352 42,246 45,873

-------- -------- -------

Total Assets 66,275 61,234 64,375

-------------------------------- ------- -------- -------- -------

EQUITY AND LIABILITIES

Non-Current Liabilities

Deferred income - - 30

- - 30

-------- -------- -------

Current Liabilities

Deferred income 18,362 15,999 16,419

Current tax liabilities 983 1,329 1,055

Trade and other payables 4,722 5,531 5,550

24,067 22,859 23,024

-------- -------- -------

Total Liabilities 24,067 22,859 23,054

-------- -------- -------

Equity

Called up share capital 3 539 538 539

Share premium account 15,496 15,408 15,496

Other reserves 268 254 212

Retained earnings 25,905 22,175 25,074

Total Equity 42,208 38,375 41,321

-------- -------- -------

Total Equity and Liabilities 66,275 61,234 64,375

-------------------------------- ------- -------- -------- -------

Craneware PLC

Interim Results FY14

Consolidated Statement of Cash Flow for the six months ended

31 December 2013

H1 2014 H1 2013 FY 2013

Notes $'000 $'000 $'000

----------------------------------------- ------ -------- -------- --------

Cash flows from operating activities

Cash generated from operations 4 4,601 4,396 9,891

Interest received 31 54 103

Tax paid (1,183) (209) (3,377)

----------------------------------------- ------ -------- -------- --------

Net cash from operating activities 3,449 2,431 6,617

Cash flows from investing activities

Purchase of plant and equipment (254) (112) (190)

Capitalised intangible assets (61) (4) (336)

----------------------------------------- ------ -------- -------- --------

Net cash used in investing activities (315) (116) (526)

Cash flows from financing activities

Dividends paid to company shareholders (2,783) (2,482) (4,693)

Proceeds from issuance of shares - - 89

----------------------------------------- ------ -------- -------- --------

Net cash used in financing activities (2,783) (2,482) (4,604)

Net (decrease)/increase in cash

and cash equivalents 351 (167) 1,487

Cash and cash equivalents at the

start of the period 30,277 28,790 28,790

Cash and cash equivalents at the

end of the period 30,628 28,623 30,277

----------------------------------------- ------ -------- -------- --------

Craneware PLC

Interim Results FY14

Notes to the Financial Statements

1. Earnings per Share

(a) Basic

Basic earnings per share is calculated by dividing the profit

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the period.

----------------------------------------------------------------------------

H1 2014 H1 2013 FY 2013

---------------------------------------------- -------- -------- --------

Profit attributable to equity holders

of the Company ($'000) 3,573 3,273 8,296

Weighted average number of ordinary

shares in issue (thousands) 27,009 26,992 26,998

Basic earnings per share ($ per share) 0.132 0.121 0.307

-------- -------- --------

Profit attributable to equity holders

of the Company ($'000) 3,573 3,273 8,296

Amortisation of acquired intangibles

($'000) 287 287 574

-------- -------- --------

Adjusted Profit attributable to equity

holders ($'000) 3,860 3,560 8,870

-------- -------- --------

Weighted average number of ordinary

shares in issue (thousands) 27,009 26,992 26,998

Adjusted Basic earnings per share ($

per share) 0.143 0.132 0.329

-------- -------- --------

(b) Diluted

For diluted earnings per share, the weighted average number

of ordinary shares calculated above is adjusted to assume

conversion of all dilutive potential ordinary shares. The

Group has one category of dilutive potential ordinary shares,

being those granted to Directors and employees under the share

option scheme.

----------------------------------------------------------------------------

H1 2014 H1 2013 FY 2013

---------------------------------------------- -------- -------- --------

Profit attributable to equity holders

of the Company ($'000) 3,573 3,273 8,296

Weighted average number of ordinary

shares in issue (thousands) 27,009 26,992 26,998

Adjustments for: - share options (thousands) 141 91 69

Weighted average number of ordinary

shares for diluted earnings per share

(thousands) 27,150 27,083 27,067

Diluted earnings per share ($ per share) 0.132 0.121 0.306

-------- -------- --------

1. Earnings per Share (Cont.)

H1 2014 H1 2013 FY 2013

---------------------------------------------- -------- -------- --------

Profit attributable to equity holders

of the Company ($'000) 3,573 3,273 8,296

Amortisation of acquired intangibles

($'000) 287 287 574

Adjusted Profit attributable to equity

holders ($'000) 3,860 3,560 8,870

-------- -------- --------

Weighted average number of ordinary

shares in issue (thousands) 27,009 26,992 26,998

Adjustments for: - share options (thousands) 141 91 69

Weighted average number of ordinary

shares for diluted earnings per share

(thousands) 27,150 27,083 27,067

Adjusted Diluted earnings per share

($ per share) 0.142 0.131 0.328

-------- -------- --------

2. Trade and other receivables

H1 2014 H1 2013 FY 2013

$'000 $'000 $'000

----------------------------------------- -------- -------- --------

Trade Receivables 9,215 6,690 8,448

Less: provision for impairment of trade

receivables (616) (422) (607)

-------- -------- --------

Net trade receivables 8,599 6,268 7,841

Other Receivables 186 193 203

Prepayments and accrued income 8,562 6,734 7,084

-------- -------- --------

Trade and other receivables 17,347 13,195 15,128

-------- -------- --------

------There is no material difference between the fair value of

trade and other receivables and the book value stated above.

3. Called up share capital

H1 2014 H1 2013 FY 2013

Number $'000 Number $'000 Number $'000

---------------------------- ----------- ------ ----------- ------ ----------- ------

Authorised

Equity share capital

Ordinary shares of 1p

each 50,000,000 1,014 50,000,000 1,014 50,000,000 1,014

Allotted called-up and

fully paid

Equity share capital

Ordinary shares of 1p

each 27,008,763 539 26,998,408 538 27,008,763 539

4. Consolidated Cash Flow generated from operating

activities

Reconciliation of profit before taxation to

net cash inflow from operating activities:

H1 2014 H1 2013 FY 2013

$'000 $'000 $'000

-------------------------------------- -------- -------- --------

Profit before taxation 4,796 4,514 10,603

Finance income (31) (54) (103)

Depreciation on plant and equipment 303 305 621

Amortisation on intangible assets 539 532 1,055

Share-based payments 96 95 181

Movements in working capital:

(Increase)/decrease in trade

and other receivables (2,693) (787) (2,721)

(Decrease)/increase in trade

and other payables 1,591 (209) 255

Cash generated from operations 4,601 4,396 9,891

-------------------------------------- -------- -------- --------

5. Basis of Preparation

The interim financial statements are unaudited and do not

constitute statutory accounts as defined in S435 of the Companies

Act 2006. These statements have been prepared applying accounting

policies that were applied in the preparation of the Group's

consolidated accounts for the year ended 30th June 2014. Those

accounts, with an unqualified audit report, have been delivered to

the Registrar of Companies.

6. Segmental Information

The Directors consider that the Group operates in one business

segment, being the creation of software sold entirely to the US

Healthcare Industry, and that there are therefore no additional

segmental disclosures to be made in these financial statements.

7. Significant Accounting Policies

The significant accounting policies adopted in the preparation

of these statements are set out below.

Reporting Currency

The Directors consider that as the Group's revenues are

primarily denominated in US dollars the principal functional

currency is the US dollar. The Group's financial statements are

therefore prepared in US dollars.

Currency Translation

Transactions denominated in foreign currencies are translated

into US dollars at the rate of exchange ruling at the date of the

transaction. Monetary assets and liabilities expressed in foreign

currencies are translated into US dollars at rates of exchange

ruling at the Balance Sheet date ($1.6563/GBP1). Exchange gains or

losses arising upon subsequent settlement of the transactions and

from translation at the Balance Sheet date, are included within the

related category of expense where separately identifiable, or in

general and administrative expenses.

Revenue Recognition

The Group follows the principles of IAS 18, "Revenue

Recognition", in determining appropriate revenue recognition

policies. In principle revenue is recognised to the extent that it

is probable that the economic benefits associated with the

transaction will flow into the Group.

Revenue is derived from sales of, and distribution agreements

relating to, software licenses and professional services (including

installation). Revenue is recognised when (i) persuasive evidence

of an arrangement exists; (ii) the customer has access and right to

use our software; (iii) the sales price can be reasonably measured;

and (iv) collectability is reasonably assured.

Revenue from standard licensed products which are not modified

to meet the specific requirements of each customer is recognised

from the point at which the customer has access and right to use

our software. This right to use software will be for the period

covered under contract and, as a result our annuity based revenue

model, recognises the licensed software revenue over the life of

this contract. This policy is consistent with the Company's

products providing customers with a service through the delivery

of, and access to, software solutions (Software-as-a-Service

("SaaS")), and results in revenue being recognised over the period

that these services are delivered to customers.

'White-labelling' or other 'Paid for development work' is

generally provided on a fixed price basis and as such revenue is

recognised based on the percentage completion or delivery of the

relevant project. Where percentage completion is used it is

estimated based on the total number of hours performed on the

project compared to the total number of hours expected to complete

the project. Where contracts underlying these projects contain

material obligations, revenue is deferred and only recognised when

all the obligations under the engagement have been fulfilled.

Revenue from all professional services is recognised as the

applicable services are provided. Where professional services

engagements contain material obligation, revenue is recognised when

all the obligations under the engagement have been fulfilled. Where

professional services engagements are provided on a fixed price

basis, revenue is recognised based on the percentage completion of

the relevant engagement. Percentage completion is estimated based

on the total number of hours performed on the project compared to

the total number of hours expected to complete the project.

Software and professional services sold via a distribution

agreement will normally follow the above recognition policies.

Should any contracts contain non-standard clauses, revenue

recognition will be in accordance with the underlying contractual

terms which will normally result in recognition of revenue being

deferred until all material obligations are satisfied.

The excess of amounts invoiced over revenue recognised are

included in deferred income. If the amount of revenue recognised

exceeds the amount invoiced the excess is included within accrued

income.

Business combinations

The acquisition of subsidiaries is accounted for using the

purchase method. The cost of the acquisition is measured at the

aggregate of the fair values, at the acquisition date, of assets

given, liabilities incurred or assumed, and the equity issued by

the Group. The consideration transferred includes the fair value of

any assets or liability resulting from a contingent consideration

and acquisition costs are expensed as incurred.

Any contingent consideration to be transferred by the Group is

recognised at fair value at the acquisition date. Subsequent

changes to the fair value of the contingent consideration that is

deemed to be an asset or liability is recognised in accordance with

IAS 39 in the Statement of Comprehensive Income. Contingent

consideration that is classified as equity is not re-measured and

its subsequent settlement is accounted for within equity.

Goodwill arising on the acquisition is recognised as an asset

and initially measured at cost, being the excess of fair value of

the consideration over the Group's assessment of the net fair value

of the identifiable assets and liabilities recognised.

If the Group's assessment of the net fair value of a

subsidiary's assets and liabilities had exceeded the fair value of

the consideration of the business combination then the excess

('negative goodwill') would be recognised in the Statement of

Comprehensive Income immediately. The fair value of the

identifiable assets and liabilities assumed on acquisition are

brought onto the Balance Sheet at their fair value at the date of

acquisition.

Intangible Assets

(a) Goodwill

Goodwill arising on consolidation represents the excess of the

cost of acquisition over the fair value of the identifiable assets

and liabilities of a subsidiary at the date of acquisition.

Goodwill is capitalised and recognised as a non-current asset in

accordance with IFRS 3 and is tested for impairment annually, or on

such occasions that events or changes in circumstances indicate

that the value might be impaired.

Goodwill is allocated to cash-generating units for the purpose

of impairment testing. The allocation is made to those

cash-generating units that are expected to benefit from the

business combination in which the goodwill arose.

(b) Proprietary software

Proprietary software acquired in a business combination is

recognised at fair value at the acquisition date. Proprietary

software has a finite life and is carried at cost less accumulated

amortisation. Amortisation is calculated using the straight-line

method to allocate the associated costs over their estimated useful

lives of 5 years.

(c) Contractual Customer relationships

Contractual customer relationships acquired in a business

combination are recognised at fair value at the acquisition date.

The contractual customer relations have a finite useful economic

life and are carried at cost less accumulated amortisation.

Amortisation is calculated using the straight-line method over the

expected life of the customer relationship which has been assessed

as 10 years.

(d) Research and Development Expenditure

Expenditure associated with developing and maintaining the

Group's software products are recognised as incurred. Where,

however, new product development projects are technically feasible,

production and sale is intended, a market exists, expenditure can

be measured reliably, and sufficient resources are available to

complete such projects, development expenditure is capitalised

until initial commercialisation of the product, and thereafter

amortised on a straight-line basis over its estimated useful life,

which has been assessed as 5 years. Staff costs and specific third

party costs involved with the development of the software are

included within amounts capitalised.

(e) Computer software

Costs associated with acquiring computer software and licensed

to-use technology are capitalised as incurred. They are amortised

on a straight-line basis over their useful economic life which is

typically 3 to 5 years.

Impairment of non-financial assets

At each reporting date the Group considers the carrying amount

of its tangible and intangible assets including goodwill to

determine whether there is any indication that those assets have

suffered an impairment loss. If there is such an indication, the

recoverable amount of the asset is estimated in order to determine

the extent of the impairment loss (if any) through determining the

value in use of the cash generating unit that the asset relates to.

Where it is not possible to estimate the recoverable amount of an

individual asset, the Group estimates the recoverable amount of the

cash generating unit to which the asset belongs.

If the recoverable amount of an asset is estimated to be less

than its carrying amount, the impairment loss is recognised as an

expense.

Where an impairment loss subsequently reverses, the carrying

amount of the asset is increased to the revised estimate of its

recoverable amount, but so that the increased carrying amount does

not exceed the carrying amount that would have been determined had

no impairment loss been recognised for the asset. A reversal of an

impairment loss is recognised as income immediately. Impairment

losses relating to goodwill are not reversed.

Cash and Cash Equivalents

Cash and cash equivalents include cash in hand, deposits held

with banks and short term highly liquid investments. For the

purpose of the Statement of Cash flow, cash and cash equivalents

comprise of cash on hand, deposits held with banks and short term

high liquid investments.

Share-Based Payments and Taxation Implications

The Group grants share options to certain employees. In

accordance with IFRS 2, "Share-Based Payments" equity-settled

share-based payments are measured at fair value at the date of

grant. Fair value is measured by use of the Black-Scholes pricing

model as appropriately amended. The fair value determined at the

date of grant of the equity-settled share-based payments is

expensed on a straight-line basis over the vesting period, based on

the Group's estimate of the number of shares that will eventually

vest. Non-market vesting conditions are included in assumptions

about the number of options that are expected to vest. At the end

of each reporting period, the entity revises its estimates of the

number of options that are expected to vest based on the non-market

vesting conditions. It recognises the impact of the revision to

original estimates, if any, in the Statement of Comprehensive

Income, with a corresponding adjustment to equity. When the options

are exercised the Company issues new shares. The proceeds received

net of any directly attributable transaction costs are credited to

share capital and share premium.

The share-based payments charge is included in net operating

expenses and is also included in 'Other reserves'.

In the UK and the US, the Group is entitled to a tax deduction

for amounts treated as compensation on exercise of certain employee

share options under each jurisdiction's tax rules. A compensation

expense is recorded in the Group's Statement of Comprehensive

Income over the period from the grant date to the vesting date of

the relevant options. As there is a temporary difference between

the accounting and tax bases a deferred tax asset is recorded. The

deferred tax asset arising is calculated by comparing the estimated

amount of tax deduction to be obtained in the future (based on the

Company's share price at the Balance Sheet date) with the

cumulative amount of the compensation expense recorded in the

Statement of Comprehensive Income. If the amount of estimated

future tax deduction exceeds the cumulative amount of the

remuneration expense at the statutory rate, the excess is recorded

directly in equity against retained earnings.

8. Availability of announcement and Half Yearly Financial

Report

Copies of this announcement are available on the Company's

website, www.craneware.com. Copies of the Interim Report will be

posted to shareholders, downloadable from the Company's website and

available from the registered office of the Company shortly.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR URABRSAAOAAR

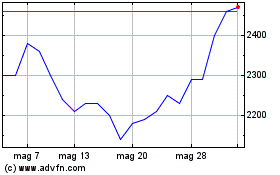

Grafico Azioni Craneware (LSE:CRW)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Craneware (LSE:CRW)

Storico

Da Lug 2023 a Lug 2024