Craneware plc Issue of Consideration Shares (5593Q)

01 Settembre 2014 - 6:20PM

UK Regulatory

TIDMCRW

RNS Number : 5593Q

Craneware plc

01 September 2014

Craneware plc

("Craneware", "the Group" or the "Company")

Issue of Consideration Shares

1 September 2014 - Craneware (AIM: CRW.L), announces that it has

issued and allotted 211,539 ordinary shares of 1p each as vendor

consideration in connection with the acquisition of Kestros

Limited.

Application has been made to the London Stock Exchange for the

shares to be admitted to trading on AIM and it is expected that

admission will become effective on 03 September 2014.

Following this notification, the Company has 26,826,486 Ordinary

Shares in issue.

For further information, please contact:

Craneware plc Peel Hunt Newgate Threadneedle

+44 (0)131 550 3100 +44 (0)20 7418 8900 +44 (0)20 7653 9850

Keith Neilson, CEO Dan Webster Caroline Forde

Craig Preston, CFO Richard Kauffer Fiona Conroy

Heather Armstrong

About Craneware

Founded in 1999, Craneware has headquarters in Edinburgh,

Scotland with offices in Atlanta, Arizona, Massachusetts and

Tennessee employing over 200 staff. Craneware is the leader in

automated revenue integrity solutions that improve financial

performance for healthcare organisations. Craneware's

market-driven, SaaS solutions help hospitals and other healthcare

providers more effectively price, charge, code and retain earned

revenue for patient care services and supplies. This optimises

reimbursement, increases operational efficiency and minimises

compliance risk. By partnering with Craneware, clients achieve the

visibility required to identify, address and prevent revenue

leakage. To learn more, visit craneware.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IOEQKDDDABKDACK

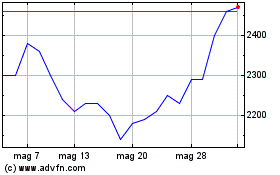

Grafico Azioni Craneware (LSE:CRW)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Craneware (LSE:CRW)

Storico

Da Lug 2023 a Lug 2024