TIDMCRW

RNS Number : 9681G

Craneware plc

10 March 2015

10 March 2015

Craneware plc

("Craneware", "the Group" or the "Company")

Interim Results

10 March 2015 - Craneware plc (AIM: CRW.L), the market leader in

automated revenue integrity solutions for the US healthcare market,

announces its unaudited results for the six months ended 31

December 2014.

Financial Highlights (US dollars)

-- Total contract value signed in the period increased 13%

-- Revenue increased 2% to $21.6m (H1 2014: $21.1m)

-- Adjusted EBITDA(1) increased 10% to $6.3m (H1 2014: $5.7m)

-- Profit before tax increased 10% to $5.3m (H1 2014: $4.8m)

-- Adjusted basic EPS increased 15% to 16.5 cents per share (H1 2014: 14.3cents per share)

-- Cash at period end $36.4m (H1 2014: $30.6m)

-- Proposed interim dividend of 6.3p per share (H1 2014: 5.7p per share)

(1.) Adjusted EBITDA refers to earnings before interest, tax,

depreciation, amortisation and share based payments that include

acquisition and share transaction related costs.

Operational Highlights

-- Continued sales momentum in H1

-- Strong performance in "2014 Best in KLAS Awards"

-- First sale by Craneware Health, previously Kestros Health

-- Continued product development and enhancement

Keith Neilson, CEO of Craneware commented:

"We have seen a continued increase in sales during the period,

building on the record year in 2014 and this, combined with

Craneware's strong product suite, clear strategic direction and

high levels of revenue visibility, means that we look to the future

with confidence."

For further information, please contact:

Craneware plc Peel Hunt Newgate

+44 (0)131 550 3100 +44 (0)20 7418 8900 +44 (0)20 7653 9850

Keith Neilson, CEO Dan Webster Tim Thompson

Craig Preston, CFO Richard Kauffer Edward Treadwell

About Craneware

Founded in 1999, Craneware has headquarters in Edinburgh,

Scotland with offices in Georgia, Arizona, Massachusetts and

Tennessee employing over 200 staff. Craneware is the leader in

automated revenue integrity solutions that improve financial

performance for healthcare organisations. Craneware's

market-driven, SaaS solutions help hospitals and other healthcare

providers more effectively price, charge, code and retain earned

revenue for patient care services and supplies. This optimises

reimbursement, increases operational efficiency and minimises

compliance risk. By partnering with Craneware, clients achieve the

visibility required to identify, address and prevent revenue

leakage. To learn more, visit craneware.com.

Chairman Statement

I am pleased to report that Craneware has delivered a positive

first half of the year; building on the record sales performance of

the prior year and securing sales within each strata of the market.

We have seen an increase of 13% in the total contract value signed

in the first half of the year, compared to the first half of the

prior year, reaffirming the increased confidence we have seen

within the healthcare market. These sales will primarily contribute

to revenue recognised in future periods in line with the Company's

revenue recognition policy.

We are an innovative business committed to supplying healthcare

providers with market leading tools to achieve the revenue

integrity required to support improved patient care and outcomes.

We were delighted to achieve increasing scores for our products

from the prestigious industry research house KLAS, at their annual

awards, announced recently. Our technological capabilities continue

to expand with the team from Kestros, acquired in August 2014,

having integrated well and securing their first contract as

'Craneware Health', to a NHS Trust. Our main focus for this

technology will be its use as a platform for entry into the high

growth Patient Access market - a market being driven by the

increasing levels of consumerism within US & UK healthcare. We

are seeing increased appetite for our revenue integrity solutions

as the US continues to develop multiple "Fee for Value" business

models in its ongoing evolution of healthcare.

The Company delivered a solid financial performance in the

period. Revenues increased by 2% to $21.6m (H1 2014: $21.1m),

adjusted EBITDA increased 10% to $6.3m (H1 2014: $5.7m) and

adjusted EPS increased by 15% to 16.5 cents (H1 2014: 14.3 cents).

Craneware continued to benefit from strong operational cash flow,

ending the period with a cash balance of $36.4m (31 December 2013:

$30.6m) having returned $2.9m to shareholders in dividends and

completed a share buy-back of $3.6m of shares in the period. This,

as previously reported, included the scheduled clearing of accrued

revenue balances relating to a third party contract. Renewal rates

amongst our customers remained high, at greater than 100% by dollar

value.

Looking forward we are confident that the high levels of

contracted revenue secured in prior periods coupled with the market

opportunities for our enhanced and expanding range of products and

solutions will enable us to deliver future sustainable growth.

I would like to take this opportunity to thank our employees for

their hard work and dedication, and our shareholders for your

support throughout the period.

George Elliott

Chairman

9 March 2015

Strategic Report: Operational & Financial Review

Our sales pipeline reported at the end of the prior period has

allowed us to enjoy a positive start to the year, with good levels

of sales to all segments of the US healthcare market, demonstrating

continued sales momentum and the benefits of a supportive market

environment. While revenue growth in the period has been modest we

have delivered adjusted EBITDA and EPS growth in excess of 10%

while continuing to invest in the future of the business. Continued

sales momentum during the period has resulted in an increase in

revenue to be recognised in future years, providing us with a

growing platform on which to build.

The period has seen a wealth of operational successes,

particularly focused around building the strength and value of our

product suite. In addition we will benefit from the recently

awarded higher scores within the KLAS industry awards for two of

our products. We have launched several enhancements to our existing

products and secured the first sales for the newly established

'Craneware Health' division. Product developments will see cloud

versions of our products launched as technology platforms in these

areas continue to strengthen and we develop out our Craneware

Application Framework for Enterprise (CAFÉ). We also secured the

exclusive US distribution rights to a data analytics platform

called Analytixagility developed by Aridhia, already highly thought

of in the UK market. This will add greater depth to our product

suite in future periods and allow us and our customers to leverage

both our own and their data assets.

The sales pipeline continues to be at a record high across all

strata of hospital, providing confidence that we are on the right

path towards accelerated revenue and profit growth in future

years.

Market Developments

The main priority of our customers continues to be providing

quality care to their patients against the background of continuing

cuts in Medicare reimbursements, imposed restructuring of their

business models and increased pressure from payor auditors. They

are seeking the means to manage the impact of consumerism of their

businesses (there are currently hundreds of billions of dollars of

self-pay debt sitting on hospitals balance sheets), which are no

longer solely B2B but now increasingly B2C in nature as well.

Of note during the period has been the cessation of the RAC

Audit re-tendering process while legal challenges to the new

procurement process progress, meaning the current incumbents have

resumed their auditing of hospitals with vigour. We anticipate this

to drive an uptick in sales of our audit product and associated

transactional revenue in the second half of the year and future

years.

During January 2015, Medicare and several large hospital systems

and insurers reaffirmed their commitment to Fee for Value business

models proposing targets and timelines for their adoption.

Sales and Marketing

The Group delivered a good sales performance in the period. The

increased level of total contract value in the period was also a

result of continued investments in the sales force through

increased capacity at a sales leadership level, training and a new

competitive incentive scheme to drive this performance.

The average length of new hospital contracts continues to be

in-line with our historical norms of approximately 5 years. Where

Craneware enters into new product contracts with its existing

customers, contracts are occasionally made co-terminus with the

customer's existing contracts, and as such, the average length of

these contracts remains greater than three years, in-line with our

expectations.

Renewal rates by dollar value is a financial metric which

specifically ties to the revenue visibility for future years. This

metric at greater than 100%, is within expected norms of 85-115%

including cross sell of further products to renewing customers.

Length of our average contract for renewals was stable in the

period.

The sales mix remained fairly constant throughout the period,

resulting in no change to the overall product attachment rate,

which remained steady at approximately 1.6 products per

customer.

We are today announcing that we have secured a distribution

partnership for a data analytics platform called Analytixagility,

from a UK based company Aridhia, which is highly regarded in the

NHS within the UK. Craneware is the exclusive distributor for the

solution set in the US.

We are now seeing acknowledgment across the Boards and

management teams of hospitals that financial and clinical

operations have to be aligned financially to drive better

healthcare and therefore better patient outcomes. In October 2014

we held our first Revenue Integrity Summit in Las Vegas. The Summit

brought Craneware customers together to share insights and

strategies on how health systems can master today's complex

challenges and achieve sustainable revenue integrity.

Dr. M. Jocelyn Elders, the sixteenth Surgeon General of the

United States, was the Summit's final speaker, bringing unique

insight into payor-provider relations and the role of the Federal

Government in healthcare.

Awards

Once again, two of our solutions ranked first in two distinct

revenue cycle categories in the annual "2014 Best in KLAS Awards:

Software & Services" report, published in January 2015. In this

new KLAS report, Craneware's flagship product, Chargemaster

Toolkit(R), earned the number one ranking in the "Revenue Cycle -

Chargemaster Management" market category for the ninth consecutive

year, and Craneware's Bill Analyzer software ranked number one in

the "Revenue Cycle - Charge Capture" category, winning a "Category

Leader" designation award for the fourth year in a row.

Product Development

Our strategy is to provide software and solutions that empower

healthcare providers to proactively manage their overall financial

performance. We accomplish this by monitoring the points in their

system where clinical and operational data transform into financial

transactions, delivering value in the discovery, conversion and

optimisation of these financial assets. Our solutions automate the

normalisation of disparate clinical, operational, and financial

data sets, enabling informed tactical and strategic decisions.

We consistently receive feedback from our customers that the

implementation of our software can have a profound effect on a

hospital's operations, enabling the rapid identification of

significant amounts of dollars in missed revenue, overspend on

their cost base or incorrect billing which could lead to lost

income and ultimately fines.

Through the distribution agreement with Aridhia, we are now in a

position to enhance these findings with data analytics that sit

alongside our products and draw benchmarks from underlying data

from our customer footprint and proprietary data sets and provide

insight into their hospital operations. Efforts will be focused

initially on the areas of Readmission identification and prevention

which is a key component of any Fee for Value based business

model.

The acquisition of Kestros Limited in August 2014, now renamed

Craneware Health, is enabling us to develop a new fourth Gateway

product in the Patient Access and consumerism area which is on

track for launch in the next financial year while we continue to

bring enhancements to this product for our domestic market.

The first half of the year saw the launch of our hybrid solution

which combines services with some of our core products, enabling

them to be implemented on a services basis at smaller hospitals

that do not have their own internal revenue integrity teams. The

period also saw enhancement releases of CMT, Bill Analyzer and

Payment Analyzer giving greater levels of scalability and preparing

for the next evolution of these products in a cloud based

environment utilising the Craneware Application Framework for

Enterprise (CAFÉ) .

In conjunction with and in support of these initiatives, the

continued development of our common software framework, CAFÉ will

provide the foundation for our future development efforts,

significantly decreasing our time to market. Product development

continues to be focused on supporting this long term strategy,

innovative packaging of existing and new solutions as well as

utilising technology to further enhance options for products to

move further on to the cloud and mobile platforms.

Financial Review

For the six month period to 31 December 2014 we are reporting

revenues of $21.6m (H114: $21.1m), an increase of 2% over the same

period in the prior year. This combined with our continued focused

investment spend has delivered an increase of 10% in adjusted

EBITDA to $6.3m (H114: $5.7m) and ultimately a 15% increase in

adjusted basic earnings per share to 16.5 cents (H114: 14.3

cents).

A highlight of the period has been our cash generation, with our

adjusted EBITDA to operating cash conversion exceeding 180%

resulting in cash at the period end of $36.4m (H114: $30.6m).

Whilst it is expected that cash conversion will fluctuate year on

year, a focus on a long term average of 100% EBITDA to operating

cash conversion ensures the quality of underlying earnings. A large

partner contract signed in February 2012 saw the Group building up

accrued revenue balances from this date to 30 June 2014 as we

followed our standard revenue recognition policy, albeit not

collecting cash upfront (being guaranteed minimums this would not

be appropriate). As previously disclosed, protections and

performance in the contract meant it was appropriate for the Group

to recognise the revenue under our standard recognition policy

whilst recognising it would impact our cash conversion ratios in

those years. This accrued revenue was invoiced at 30 June 2014 and

has substantially cleared in the period (the remaining balance

relating to an outstanding project) and as such is a contributing

factor in this cash conversion performance.

The positive sales momentum has resulted in the total value of

contracts written in the period increasing by 13% as compared to

this same period last year. The Group's conservative Annuity SaaS

business model means the vast majority of the benefit from these

sales is not seen in the period under review, instead it adds to

'revenue visibility for future years' which support the future

growth of the Group. This is a result of software licence revenue

being recognised over the life of the underlying contract (which

for a new hospital sale is an average of 5 years) and any

associated professional services revenue is recognised as we

deliver the services. The benefit of the Annuity SaaS revenue

recognition model is it retains focus on the long term growth and

stability of the Group, rather than overly focusing on short term

KPI's and rewards.

At the end of each financial year, the Group reports its Three

Year Visible Revenue KPI. This KPI shows the strength of the

underlying annuity revenue stream that is building with each new

sale. At the subsequent half year reporting period, we report how

that metric for the same three year period has built. This

demonstrates both the effect of new sales and renewals in the

period, although it is only a three year 'snapshot'. The total

visible revenue for the three year period 1 July 2014 to 30 June

2017 has grown during this six month period to $119.9m from $112.8m

at 30 June 2014. This comprises $98.0m 'Revenue under Contract',

$20.1m 'Renewal Revenue' and $1.8m of 'Other Recurring

Revenue'.

'Revenue under Contract', relates to revenues that are supported

by underlying contracts. 'Renewal Revenue'; at each reporting date,

we 'look forward' and calculate the amount of revenue which is

potentially available and could be recognised in each fiscal year

of the three year period but that requires an underlying contract

to be renewed. In calculating this, we assume a 100% dollar value

renewal level. As the renewals occur, the aggregated related

revenue for all of the three years, moves from 'Renewal Revenue' to

'Revenue under Contract'. The final element is 'Other Recurring

Revenue, this relates to revenue that is not subject to long term

contracts, which can be billable 'per transaction' or a set monthly

amount and is usually invoiced on a monthly basis, however it is

reasonable to expect to be recurring in nature.

Due to the way we show our 'Renewal Revenue' in our revenue

visibility graph (i.e. at 100% of dollar value), we track our

renewal rate by dollar value KPI to ensure our 100% assumption in

producing our revenue visibility KPI is still appropriate. We

expect to see this KPI fluctuate year on year with our historic

range being 85% to 115% and in the period are reporting a renewal

rate by dollar value (including upsell and cross sell) of 104%.

On the 28 August, the Group announced the acquisition of Kestros

Limited for a maximum consideration of GBP1.25m, of which

GBP150,000 was paid in cash, the remainder saw 211,539 new ordinary

shares being allotted in favour of the vendor. Full details of the

provisional acquisition accounting for this acquisition are

detailed in note 5.

Shortly before this acquisition, on 16th July, the Group

completed a share buyback of 393,816 shares at a price of 527.5p

per share and these shares were immediately cancelled. The net

result of these two transactions has been to reduce the Company's

issued share capital by 182,277 ordinary shares.

We continue to target our investment as appropriate for the

future growth of the Group, whilst ensuring the efficiency of all

expenditures. This has contributed to our adjusted EBITDA margin

which for the period is 29% as compared to 27% in the same period

in the prior year. Ultimately the increase in EBITDA, as well as a

continued beneficial effect from the reduction in corporation tax

rates in the UK, has resulted in the adjusted basic EPS increasing

by 15% to 16.5 cents per share (H114: 14.3 cents) and adjusted

diluted EPS increasing to 16.4 cents (H114: 14.2 cents). The

adjustments we make to both these metrics are those normally

expected and include acquisition and share related costs in the

period.

The Group continues to maintain a strong balance sheet, with no

debt and significant cash reserves of $36.4m ($30.6m at 31 December

2013 and $32.6m at 30 June 2014). The cash levels reported are

after returning $2.9m to shareholders by way of dividends, $3.6m

related to the share buyback and tax payments of $1.2m in the

period. Continued cash collections since the period end ensures the

Group retains healthy cash reserves which in turn provides for

further future investment including potential 'bolt on'

acquisitions should such opportunities arise.

We continue to report the results (and hold the cash reserves)

of the Group in US Dollars, whilst having approximately twenty five

percent of our costs, being our UK employees and purchases,

denominated in Sterling. The average exchange rate for the Company

during the reporting period was $1.63/GBP1 which was compares to

$1.58/GBP1 in the corresponding period last year.

Dividend

The Board has resolved to pay an interim dividend of 6.3p (9.8

cents) per ordinary share in the Company on 24 April 2015 to those

shareholders on the register as at 27 March 2015 (FY14 Interim

dividend 5.7p). The ex-dividend date is 26 March 2015.

The interim dividend of 6.3p per share is capable of being paid

in US dollars subject to a shareholder having registered to receive

their dividend in US dollars under the Company's Dividend Currency

Election, or who has registered to do so by the close of business

on 27 March 2015. The exact amount to be paid will be calculated by

reference to the exchange rate to be announced on 27 March 2015.

The interim dividend referred to above in US dollars of 9.8 cents

is given as an example only using the Balance Sheet date exchange

rate of $1.56/GBP1 and may differ from that finally announced.

Outlook

Craneware's opportunity lies in our ability to capitalise on the

wealth of knowledge contained within our data sets and client base

to produce innovative solutions that help hospitals stay

financially healthy so that they can improve the health of their

patients. To support this vision, we will continue to listen to our

customers and the issues they face, investigate further the

implications of consumerism and ensure we are developing

effectively and efficiently.

Objectives for the second half of the year will be the migration

of the first of our products fully onto our CAFÉ architecture, and

the building out of the Craneware Health product set for market

entry in the next financial year.

We have seen a continued increase in sales during the period,

building on the record year in 2014 and this, combined with

Craneware's strong product suite, clear strategic direction and

high levels of revenue visibility means that we look to the future

with confidence.

Keith Neilson Craig Preston

Chief Executive Officer Chief Financial Officer

9 March 2015 9 March 2015

Craneware PLC

Interim Results FY15

Consolidated Statement of Comprehensive

Income

H1 2015 H1 2014 FY 2014

Notes $'000 $'000 $'000

------------------------------------------- ------- ----------- ----------- -----------

Revenue 21,573 21,146 42,574

Cost of sales (1,181) (1,199) (1,943)

----------- ----------- -----------

Gross profit 20,392 19,947 40,631

Net operating expenses (15,179) (15,182) (29,407)

----------- ----------- -----------

Operating profit 5,213 4,765 11,224

Analysed as:

Adjusted EBITDA(1) 6,293 5,703 13,069

Acquisition costs and share related

transactions (154) - -

Share-based payments (117) (96) (198)

Depreciation of plant and equipment (259) (303) (575)

Amortisation of intangible assets (550) (539) (1,072)

---------------------------------------------------- ----------- ----------- -----------

Finance income 41 31 66

----------- ----------- -----------

Profit before taxation 5,254 4,796 11,290

Tax charge on profit on ordinary

activities (1,260) (1,223) (2,680)

----------- ----------- -----------

Profit for the period attributable

to owners of the parent 3,994 3,573 8,610

---------------------------------------------------- ----------- ----------- -----------

Total comprehensive income attributable

to owners of the parent 3,994 3,573 8,610

---------------------------------------------------- ------- ----------- -----------

(1) Adjusted EBITDA is defined as operating profit before,

share based payments, depreciation, amortisation, acquisition

costs and share related transactions.

Earnings per share for the period attributable to equity holders

- Basic ($ per share) 1a 0.149 0.132 0.319

- *Adjusted Basic ($ per share)(2) 1a 0.165 0.143 0.340

- Diluted ($ per share) 1b 0.148 0.132 0.317

- *Adjusted Diluted ($ per share)(2) 1b 0.164 0.142 0.338

----------- -------- ----------

(2) Adjusted Earnings per share calculations allow for the tax

adjusted acquisition costs and share related transactions together

with amortisation on acquired intangible assets to form a better

comparison with previous periods.

Craneware PLC

Interim Results FY15

Consolidated Statement of Changes in Equity

--------------------------------------------------------------------------------------------------

Retained

Share Capital Share Premium Other Reserves Earnings Total

$'000 $'000 $'000 $'000 $'000

--------------------------- -------------- -------------- --------------- ---------- --------

At 1 July 2013 539 15,496 212 25,074 41,321

Total comprehensive

income - profit for

the period - - - 3,573 3,573

Transactions with owners

Share-based payments - - 97 - 97

Impact of share options

exercised - - (41) 41 -

Dividend - - - (2,783) (2,783)

--------------------------- -------------- -------------- --------------- ---------- --------

At 31 December 2013 539 15,496 268 25,905 42,208

--------------------------- -------------- -------------- --------------- ---------- --------

Total comprehensive

income - profit for

the period

Transactions with owners - - - 5,037 5,037

Share-based payments - - 101 146 247

Impact of share options

exercised - - (134) 134 -

Dividend - - - (2,576) (2,576)

At 30 June 2014 539 15,496 235 28,646 44,916

--------------------------- -------------- -------------- --------------- ---------- --------

Total comprehensive

income - profit for

the period

Transactions with owners - - - 3,994 3,994

Share-based payments - - 117 - 117

Impact of share options

exercised - 40 (54) 54 40

Issue of Ordinary shares

related to business

combination 4 1,820 - - 1,824

Buy back of Ordinary

shares (7) (3,572) - - (3,579)

Dividend - - - (2,864) (2,864)

At 31 December 2014 536 13,784 298 29,830 44,448

--------------------------- -------------- -------------- --------------- ---------- --------

Craneware PLC

Interim Results FY15

Consolidated Balance Sheet as at 31 December

2014

H1 2015 H1 2014 FY2014

Notes $'000 $'000 $'000

-------------------------------- ------- -------- -------- -------

ASSETS

Non-Current Assets

Plant and equipment 1,147 1,547 1,329

Intangible assets 15,956 14,812 14,325

Trade and other receivables 2 2,193 - 1,890

Deferred Tax 1,810 1,564 1,644

21,106 17,923 19,188

-------- -------- -------

Current Assets

Trade and other receivables 2 16,041 17,347 20,946

Current tax assets 110 377 110

Cash and cash equivalents 36,374 30,628 32,613

52,525 48,352 53,669

-------- -------- -------

Total Assets 73,631 66,275 72,857

-------------------------------- ------- -------- -------- -------

EQUITY AND LIABILITIES

Non-Current Liabilities

Deferred income 1,355 - 2,077

1,355 - 2,077

-------- -------- -------

Current Liabilities

Deferred income 22,254 18,362 19,355

Current tax liabilities 1,351 983 1,136

Trade and other payables 4,223 4,722 5,373

27,828 24,067 25,864

-------- -------- -------

Total Liabilities 29,183 24,067 27,941

-------- -------- -------

Equity

Called up share capital 3 536 539 539

Share premium account 13,784 15,496 15,496

Other reserves 298 268 235

Retained earnings 29,830 25,905 28,646

Total Equity 44,448 42,208 44,916

-------- -------- -------

Total Equity and Liabilities 73,631 66,275 72,857

-------------------------------- ------- -------- -------- -------

Craneware PLC

Interim Results FY15

Consolidated Statement of Cash Flow for the six months ended

31 December 2014

H1 2015 H1 2014 FY 2014

Notes $'000 $'000 $'000

------------------------------------------- ------ -------- -------- --------

Cash flows from operating activities

Cash generated from operations 4 11,772 4,601 10,197

Interest received 41 31 66

Tax paid (1,218) (1,183) (2,154)

------------------------------------------- ------ -------- -------- --------

Net cash from operating activities 10,595 3,449 8,109

Cash flows from investing activities

Purchase of plant and equipment (74) (254) (308)

Acquisition of subisidiary, net

of cash acquired 5 (247) - -

Capitalised intangible assets (110) (61) (106)

------------------------------------------- ------ -------- -------- --------

Net cash used in investing activities (431) (315) (414)

Cash flows from financing activities

Dividends paid to company shareholders (2,864) (2,783) (5,359)

Buy back of Ordinary shares (3,579) - -

Proceeds from issuance of shares 40 - -

------------------------------------------- ------ -------- -------- --------

Net cash used in financing activities (6,403) (2,783) (5,359)

Net increase in cash and cash equivalents 3,761 351 2,336

Cash and cash equivalents at the

start of the period 32,613 30,277 30,277

Cash and cash equivalents at the

end of the period 36,374 30,628 32,613

------------------------------------------- ------ -------- -------- --------

Craneware PLC

Interim Results FY15

Notes to the Financial Statements

1. Earnings per Share

(a) Basic

Basic earnings per share is calculated by dividing the profit

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the period.

----------------------------------------------------------------------------

H1 2015 H1 2014 FY 2014

---------------------------------------------- -------- -------- --------

Profit attributable to equity holders

of the Company ($'000) 3,994 3,573 8,610

Weighted average number of ordinary

shares in issue (thousands) 26,797 27,009 27,009

Basic earnings per share ($ per share) 0.149 0.132 0.319

-------- -------- --------

Profit attributable to equity holders

of the Company ($'000) 3,994 3,573 8,610

Tax adjusted acquisition costs, share

related transactions and amortisation

of acquired intangibles ($'000) 422 287 574

-------- -------- --------

Adjusted Profit attributable to equity

holders ($'000) 4,416 3,860 9,184

-------- -------- --------

Weighted average number of ordinary

shares in issue (thousands) 26,797 27,009 27,009

Adjusted Basic earnings per share ($

per share) 0.165 0.143 0.340

-------- -------- --------

(b) Diluted

For diluted earnings per share, the weighted average number

of ordinary shares calculated above is adjusted to assume

conversion of all dilutive potential ordinary shares. The

Group has one category of dilutive potential ordinary shares,

being those granted to Directors and employees under the share

option scheme.

----------------------------------------------------------------------------

H1 2015 H1 2014 FY 2014

---------------------------------------------- -------- -------- --------

Profit attributable to equity holders

of the Company ($'000) 3,994 3,573 8,610

Weighted average number of ordinary

shares in issue (thousands) 26,797 27,009 27,009

Adjustments for: - share options (thousands) 162 141 162

Weighted average number of ordinary

shares for diluted earnings per share

(thousands) 26,959 27,150 27,171

Diluted earnings per share ($ per share) 0.148 0.132 0.317

-------- -------- --------

1. Earnings per Share (Cont.)

H1 2015 H1 2014 FY 2014

---------------------------------------------- -------- -------- --------

Profit attributable to equity holders

of the Company ($'000) 3,994 3,573 8,610

Tax adjusted acquisition costs, share

related transactions and amortisation

of acquired intangibles ($'000) 422 287 574

Adjusted Profit attributable to equity

holders ($'000) 4,416 3,860 9,184

-------- -------- --------

Weighted average number of ordinary

shares in issue (thousands) 26,797 27,009 27,009

Adjustments for: - share options (thousands) 162 141 162

Weighted average number of ordinary

shares for diluted earnings per share

(thousands) 26,959 27,150 27,171

Adjusted Diluted earnings per share

($ per share) 0.164 0.142 0.338

-------- -------- --------

2. Trade and other receivables

H1 2015 H1 2014 FY 2014

$'000 $'000 $'000

----------------------------------------- -------- -------- --------

Trade Receivables 11,975 9,215 16,589

Less: provision for impairment of trade

receivables (778) (616) (658)

-------- -------- --------

Net trade receivables 11,197 8,599 15,931

Other Receivables 95 186 175

Prepayments and accrued income 4,128 8,562 4,382

Deferred Contract Costs 2,814 - 2,348

-------- -------- --------

18,234 17,347 22,836

Less non-current receivables: Deferred

Contract Costs (2,193) - (1,890)

-------- -------- --------

Trade and other receivables 16,041 17,347 20,946

-------- -------- --------

------There is no material difference between the fair value of

trade and other receivables and the book value stated above.

3. Called up share capital

H1 2015 H1 2014 FY 2014

Number $'000 Number $'000 Number $'000

--------------------------------- -------------- ------ ----------- ------ ------------- ---------

Authorised

Equity share capital

Ordinary shares of 1p

each 50,000,000 1,014 50,000,000 1,014 50,000,000 1,014

Allotted called-up and

fully paid

Equity share capital

Ordinary shares of 1p

each 26,832,582 536 27,008,763 539 27,008,763 539

4. Consolidated Cash Flow generated from operating

activities

Reconciliation of profit before taxation to

net cash inflow from operating activities:

H1 2015 H1 2014 FY 2014

$'000 $'000 $'000

--------------------------------------------- ---------- ----------- -------------

Profit before taxation 5,254 4,796 11,290

Finance income (41) (31) (66)

Depreciation on plant and equipment 259 303 575

Amortisation on intangible assets 550 539 1,072

Share-based payments 117 96 198

Movements in working capital:

Decrease/(increase) in trade

and other receivables 4,635 (2,693) (7,708)

Increase in trade and other

payables 998 1,591 4,836

Cash generated from operations 11,772 4,601 10,197

--------------------------------------------- ---------- ----------- -------------

5. Acquisition of subsidiary: Kestros Ltd

On 26(th) August 2014, the Company acquired 100% of the issued

share capital of Kestros Ltd. The total consideration for the

acquisition along with the fair value of the identified assets and

assumed liabilities is shown below:

Fair Value

Adjustments Provisional

Book Value 31-Dec-14 Fair Value

Recognised amounts of identifiable

assets acquired and liabilities $'000 $'000 $'000

assumed

-------------------------------------- ------------- ------------- --------------

2 - 2

101 1,720 1,821

33 - 33

43 - 43

(35) - (35)

------------- ------------- --------------

144 1,720 1,864

------------- ------------- --------------

250

--------------

2,114

--------------

Tangibles fixed assets

Plant and Equipment

Intangibles assets

Proprietary Software

Other assets and liabilities

Trade and other receivables

Bank and cash balances

Trade and other payables

Goodwill

Fair Value

Satisfied by $'000

------------------------------------------------------------- ------

Cash 290

Ordinary Shares issued - 211,539 shares at $8.623 (GBP5.20) 1,824

------

2,114

------

Bank balances and cash acquired 43

Cash consideration (290)

------------------------------------------------------------- ------

Net Cash on acquisition (247)

------------------------------------------------------------- ------

The value of the equity consideration is subject to revenue

performance criteria through to 31 July 2016 and in the unlikely

event that these Revenue targets are not meet then a proportion of

the consideration is repayable. Management believe that the revenue

targets are easily achievable and as such the Fair Value of the

transaction is deemed to be equal to the amount paid at

acquisition. The acquisition costs, including all due diligence

costs that relate to the transaction have been expensed as

operating costs in compliance with IFRS 3 (revised). Had Kestros

Ltd been consolidated from 1 July 2014, the consolidated statement

of comprehensive income would be materially unaffected.

Goodwill of $250,000 has been recognised on acquisition and is

attributable to future software and the assembled workforce.

The initial accounting for the business combination is

incomplete as at 31 December 2014 and is based on provisional

amounts.

6. Basis of Preparation

The interim financial statements are unaudited and do not

constitute statutory accounts as defined in S435 of the Companies

Act 2006. These statements have been prepared applying accounting

policies that were applied in the preparation of the Group's

consolidated accounts for the year ended 30th June 2014. Those

accounts, with an unqualified audit report, have been delivered to

the Registrar of Companies.

7. Segmental Information

The Directors consider that the Group operates in predominantly

one business segment, being the creation of software sold entirely

to the US Healthcare Industry, and that there are therefore no

additional segmental disclosures to be made in these financial

statements.

8. Significant Accounting Policies

The significant accounting policies adopted in the preparation

of these statements are set out below.

Reporting Currency

The Directors consider that as the Group's revenues are

primarily denominated in US dollars the principal functional

currency is the US dollar. The Group's financial statements are

therefore prepared in US dollars.

Currency Translation

Transactions denominated in foreign currencies are translated

into US dollars at the rate of exchange ruling at the date of the

transaction. Monetary assets and liabilities expressed in foreign

currencies are translated into US dollars at rates of exchange

ruling at the Balance Sheet date ($1.5593/GBP1). Exchange gains or

losses arising upon subsequent settlement of the transactions and

from translation at the Balance Sheet date, are included within the

related category of expense where separately identifiable, or in

general and administrative expenses.

Revenue Recognition

The Group follows the principles of IAS 18, "Revenue

Recognition", in determining appropriate revenue recognition

policies. In principle revenue is recognised to the extent that it

is probable that the economic benefits associated with the

transaction will flow into the Group.

Revenue is derived from sales of, and distribution agreements

relating to, software licenses and professional services (including

installation). Revenue is recognised when (i) persuasive evidence

of an arrangement exists; (ii) the customer has access and right to

use our software; (iii) the sales price can be reasonably measured;

and (iv) collectability is reasonably assured.

Revenue from standard licensed products which are not modified

to meet the specific requirements of each customer is recognised

from the point at which the customer has access and right to use

our software. This right to use software will be for the period

covered under contract and, as a result our annuity based revenue

model, recognises the licensed software revenue over the life of

this contract. This policy is consistent with the Company's

products providing customers with a service through the delivery

of, and access to, software solutions (Software-as-a-Service

("SaaS")), and results in revenue being recognised over the period

that these services are delivered to customers.

'White-labelling' or other 'Paid for development work' is

generally provided on a fixed price basis and as such revenue is

recognised based on the percentage completion or delivery of the

relevant project. Where percentage completion is used it is

estimated based on the total number of hours performed on the

project compared to the total number of hours expected to complete

the project. Where contracts underlying these projects contain

material obligations, revenue is deferred and only recognised when

all the obligations under the engagement have been fulfilled.

Revenue from all professional services is recognised as the

applicable services are provided. Where professional services

engagements contain material obligation, revenue is recognised when

all the obligations under the engagement have been fulfilled. Where

professional services engagements are provided on a fixed price

basis, revenue is recognised based on the percentage completion of

the relevant engagement. Percentage completion is estimated based

on the total number of hours performed on the project compared to

the total number of hours expected to complete the project.

Software and professional services sold via a distribution

agreement will normally follow the above recognition policies.

Should any contracts contain non-standard clauses, revenue

recognition will be in accordance with the underlying contractual

terms which will normally result in recognition of revenue being

deferred until all material obligations are satisfied.

The excess of amounts invoiced over revenue recognised are

included in deferred income. If the amount of revenue recognised

exceeds the amount invoiced the excess is included within accrued

income.

Business combinations

The acquisition of subsidiaries is accounted for using the

purchase method. The cost of the acquisition is measured at the

aggregate of the fair values, at the acquisition date, of assets

given, liabilities incurred or assumed, and the equity issued by

the Group. The consideration transferred includes the fair value of

any assets or liability resulting from a contingent consideration

and acquisition costs are expensed as incurred.

Any contingent consideration to be transferred by the Group is

recognised at fair value at the acquisition date. Subsequent

changes to the fair value of the contingent consideration that is

deemed to be an asset or liability is recognised in accordance with

IAS 39 in the Statement of Comprehensive Income. Contingent

consideration that is classified as equity is not re-measured and

its subsequent settlement is accounted for within equity.

Goodwill arising on the acquisition is recognised as an asset

and initially measured at cost, being the excess of fair value of

the consideration over the Group's assessment of the net fair value

of the identifiable assets and liabilities recognised.

If the Group's assessment of the net fair value of a

subsidiary's assets and liabilities had exceeded the fair value of

the consideration of the business combination then the excess

('negative goodwill') would be recognised in the Statement of

Comprehensive Income immediately. The fair value of the

identifiable assets and liabilities assumed on acquisition are

brought onto the Balance Sheet at their fair value at the date of

acquisition.

Intangible Assets

(a) Goodwill

Goodwill arising on consolidation represents the excess of the

cost of acquisition over the fair value of the identifiable assets

and liabilities of a subsidiary at the date of acquisition.

Goodwill is capitalised and recognised as a non-current asset in

accordance with IFRS 3 and is tested for impairment annually, or on

such occasions that events or changes in circumstances indicate

that the value might be impaired.

Goodwill is allocated to cash-generating units for the purpose

of impairment testing. The allocation is made to those

cash-generating units that are expected to benefit from the

business combination in which the goodwill arose.

(b) Proprietary software

Proprietary software acquired in a business combination is

recognised at fair value at the acquisition date. Proprietary

software has a finite life and is carried at cost less accumulated

amortisation. Amortisation is calculated using the straight-line

method to allocate the associated costs over their estimated useful

lives of 5 years.

(c) Contractual Customer relationships

Contractual customer relationships acquired in a business

combination are recognised at fair value at the acquisition date.

The contractual customer relations have a finite useful economic

life and are carried at cost less accumulated amortisation.

Amortisation is calculated using the straight-line method over the

expected life of the customer relationship which has been assessed

as 10 years.

(d) Research and Development Expenditure

Expenditure associated with developing and maintaining the

Group's software products are recognised as incurred. Where,

however, new product development projects are technically feasible,

production and sale is intended, a market exists, expenditure can

be measured reliably, and sufficient resources are available to

complete such projects, development expenditure is capitalised

until initial commercialisation of the product, and thereafter

amortised on a straight-line basis over its estimated useful life,

which has been assessed as 5 years. Staff costs and specific third

party costs involved with the development of the software are

included within amounts capitalised.

(e) Computer software

Costs associated with acquiring computer software and licensed

to-use technology are capitalised as incurred. They are amortised

on a straight-line basis over their useful economic life which is

typically 3 to 5 years.

Impairment of non-financial assets

At each reporting date the Group considers the carrying amount

of its tangible and intangible assets including goodwill to

determine whether there is any indication that those assets have

suffered an impairment loss. If there is such an indication, the

recoverable amount of the asset is estimated in order to determine

the extent of the impairment loss (if any) through determining the

value in use of the cash generating unit that the asset relates to.

Where it is not possible to estimate the recoverable amount of an

individual asset, the Group estimates the recoverable amount of the

cash generating unit to which the asset belongs.

If the recoverable amount of an asset is estimated to be less

than its carrying amount, the impairment loss is recognised as an

expense.

Where an impairment loss subsequently reverses, the carrying

amount of the asset is increased to the revised estimate of its

recoverable amount, but so that the increased carrying amount does

not exceed the carrying amount that would have been determined had

no impairment loss been recognised for the asset. A reversal of an

impairment loss is recognised as income immediately. Impairment

losses relating to goodwill are not reversed.

Cash and Cash Equivalents

Cash and cash equivalents include cash in hand, deposits held

with banks and short term highly liquid investments. For the

purpose of the Statement of Cash flow, cash and cash equivalents

comprise of cash on hand, deposits held with banks and short term

high liquid investments.

Share-Based Payments and Taxation Implications

The Group grants share options to certain employees. In

accordance with IFRS 2, "Share-Based Payments" equity-settled

share-based payments are measured at fair value at the date of

grant. Fair value is measured by use of the Black-Scholes pricing

model as appropriately amended. The fair value determined at the

date of grant of the equity-settled share-based payments is

expensed on a straight-line basis over the vesting period, based on

the Group's estimate of the number of shares that will eventually

vest. Non-market vesting conditions are included in assumptions

about the number of options that are expected to vest. At the end

of each reporting period, the entity revises its estimates of the

number of options that are expected to vest based on the non-market

vesting conditions. It recognises the impact of the revision to

original estimates, if any, in the Statement of Comprehensive

Income, with a corresponding adjustment to equity. When the options

are exercised the Company issues new shares. The proceeds received

net of any directly attributable transaction costs are credited to

share capital and share premium.

The share-based payments charge is included in net operating

expenses and is also included in 'Other reserves'.

In the UK and the US, the Group is entitled to a tax deduction

for amounts treated as compensation on exercise of certain employee

share options under each jurisdiction's tax rules. A compensation

expense is recorded in the Group's Statement of Comprehensive

Income over the period from the grant date to the vesting date of

the relevant options. As there is a temporary difference between

the accounting and tax bases a deferred tax asset is recorded. The

deferred tax asset arising is calculated by comparing the estimated

amount of tax deduction to be obtained in the future (based on the

Company's share price at the Balance Sheet date) with the

cumulative amount of the compensation expense recorded in the

Statement of Comprehensive Income. If the amount of estimated

future tax deduction exceeds the cumulative amount of the

remuneration expense at the statutory rate, the excess is recorded

directly in equity against retained earnings.

9. Availability of announcement and Half Yearly Financial

Report

Copies of this announcement are available on the Company's

website, www.craneware.com. Copies of the Interim Report will be

posted to shareholders, downloadable from the Company's website and

available from the registered office of the Company shortly.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UGUWUWUPAPGB

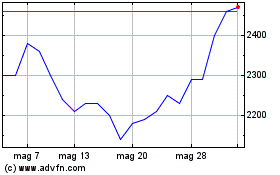

Grafico Azioni Craneware (LSE:CRW)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Craneware (LSE:CRW)

Storico

Da Lug 2023 a Lug 2024