TIDMCRW

RNS Number : 8098R

Craneware plc

05 March 2019

Craneware plc

("Craneware" or the "Company" or the "Group")

Interim Results

5 March 2019 - Craneware (AIM: CRW.L), the market leader in

Value Cycle solutions for the US healthcare market, announces its

unaudited results for the six months ended 31 December 2018.

Financial Highlights (US dollars)

-- Revenue increased 15% to $35.8m (H1 2018: $31.1m)

-- Adjusted EBITDA(1) increased 20% to $11.6m (H1 2018: $9.7m)

-- Profit before tax increased 7% to $9.3m (H1 2018: $8.7m)

-- Adjusted basic EPS increased 19% to 30.2 cents per share (H1 2018: 25.4 cents per share)

-- Cash position of $38.7m (H1 2018: $52.2m), following

significant returns to shareholders and investments in the

period

-- Proposed interim dividend increased 10% to 11p (H1 2018: 10p per share)

1. Adjusted EBITDA refers to earnings before interest, tax,

depreciation, amortisation, share based payments and acquisition

and share transaction related costs.

Operational Highlights

-- Supportive market environment as the US healthcare market

evolves towards value-based care, with a critical dependency on

accurate financial and operating data

-- Strong sales activity and opportunities across the product

suite and across all classes of hospital providers

-- Increasing market engagement with our newly launched cloud-based platform, Trisus(TM):

o With 600 hospitals represented at the Craneware Healthcare

Summit, 50% of customers that attended are looking to transfer to

the Trisus platform within twelve months

-- First three Trisus products are now available on general

release with a fourth scheduled for release in the second half of

the financial year

Outlook

-- Strong sales pipeline for the current financial year

-- Total visible revenue over $70.0m for the current financial

year and $196.2m for the three-year period to June 2021 (H1 2018

same three year period: $174.3m)

-- Board confident in outlook for the current year and beyond

Keith Neilson, CEO of Craneware plc commented, "We are delighted

to report another strong set of results, delivering against our

growth strategy. The strength of our trading performance to date

and double-digit rate of growth demonstrate the ongoing momentum we

are experiencing in the business and the growing market opportunity

we see.

"As we enter the second half of the financial year we do so with

excitement as we continue to build the business in line with the

large market opportunity available to us. We believe that the

breadth of our customer base and the quantity and quality of data

within our solutions gives us the opportunity to sit at the heart

of the move to value-based economics; collating and analysing the

information that will support hospital-wide decision making and

ultimately have a positive impact on the quality of healthcare.

"Our growing market opportunity, the strength of our sales

pipeline and increasing long-term revenue visibility, mean we enter

the second half of the financial year with great confidence for the

future and the ongoing success of Craneware."

For further information, please contact:

Craneware plc Peel Hunt Investec Bank Alma

(NOMAD & Joint (Joint Broker) (Financial PR)

Broker)

+44 (0)131 550 +44 (0)20 7418 +44 (0)20 7597 +44 (0)203 405

3100 8900 5970 0212

Keith Neilson, Dan Webster Patrick Robb Caroline Forde

CEO

Craig Preston, George Sellar Sebastian Lawrence Hilary Buchanan

CFO

Guy Pengelley Henry Reast Helena Bogle

About Craneware

Craneware develops and provides financial improvement &

operational optimisation software that enables US healthcare

providers to improve margins and enhance patient outcomes so they

can continue to provide quality outcomes for all.

Craneware is the leader in automated Value Cycle solutions that

help US Healthcare provider organisations discover, convert and

optimise assets to achieve best clinical outcomes and financial

performance. Founded in 1999, Craneware is headquartered in

Edinburgh, Scotland with offices in Atlanta and Pittsburgh

employing over 320 staff. Craneware's market-driven, SaaS solutions

normalise disparate data sets, bringing in up-to-date regulatory

and financial compliance data to deliver value at the points where

clinical and operational data transform into financial

transactions, creating actionable insights that enable informed

tactical and strategic decisions. To learn more, visit

craneware.com and thevaluecycle.com.

Chairman's Statement

We are delighted to confirm another very positive trading period

for the Group, delivering strong financial results and continued

execution of our growth strategy. Revenue increased 15% to $35.8m

(H1 2018: $31.1m) and adjusted EBITDA(1) increased 20% to $11.6m

(H1 2018: $9.7m). Compared to H1 2018, cash reserves have reduced

(albeit remain healthy) from $52m to $38.7m following a $15.4m

share buyback completed in January 2018 and further investments in

the period. Operating cash conversion of adjusted EBITDA remains

strong and was in line with the Company's target of 100% over a 12

month period, with a further $10m of the December 2018 outstanding

receivables collected post period end. Having completed the share

buy back in January 2018, $4.7m was returned to shareholders in

dividends, commission payments increased corresponding to the

previous record sales year and investments of $9.1m in research

& development (including $4.4m which has been capitalised) were

made, all within the period. Sales successes, combined with

renewals continuing above 100% (by dollar value) have delivered

high levels of revenue visibility that support our continued future

growth ambitions.

It is clear that Craneware has an exciting opportunity to

support healthcare providers in the transition to value-based care

and we continue to make good progress with the expansion of our

offering to facilitate the Value Cycle. Developments of note in the

half include the progress towards launch of two further products on

our cloud-based Trisus platform and continued positive results from

the first two customers for our Trisus Healthcare Intelligence

platform. With almost the entirety of our existing customer base

now able to access the power of our new cloud-based platform

alongside our existing on-premise solutions via the Trisus Bridge,

we are confident in the successful long-term transition of all our

products to the new platform.

We are continuing the expansion of our core product suite and

its move to Trisus. Combining these solutions with the data that

the Craneware software has collected over the past twenty years and

the strong relationships we have forged with our customers gives us

the opportunity to sit at the heart of the transition taking place

in the US healthcare industry. Our solutions are providing genuine

insight into the economics of healthcare provision.

Strict criteria continue to be applied to potential acquisition

targets to ensure they enhance our product roadmap and are

accretive to the financial strength of the Group. With our healthy

cash balance, financial position and a $50m funding facility, we

are in a strong position to execute upon our strategic vision.

Our expanding market opportunity, double digit growth rates,

strong sales pipeline and increasing long-term revenue visibility

provide the Board with confidence in achieving a successful outcome

to the current year and beyond.

George Elliott

Chairman

4 March 2019

Strategic Report

Once again, the investments we have made into our people,

products and operations have resulted in another strong trading

performance in the first half of the year. The combination of our

significant expertise and experience in the US healthcare industry,

the data that our solutions have gathered, and the continued

investment into the expansion of our product suite means we are

well positioned to provide the insight our customers need to thrive

in this new era of value-based care and make a meaningful impact on

the quality of US healthcare.

Market and Strategy

The ongoing evolution of the US healthcare industry towards the

provision of value-based care puts the emphasis onto the healthcare

provider to ensure they are delivering the right care, in the right

place and at the right cost for the best patient outcome. This is a

significant shift away from the historic fee-for-service

environment (transactional based per episode of care) and requires

every hospital to have a far greater understanding of their costs,

the value they provide and their impact on the total cost of

care.

The need to drive value in healthcare, and the challenges this

brings, provide an ongoing supportive environment for Craneware due

to our ability to help our customers meet these challenges.

Our strategy is to continue to build on our established

market-leading position in revenue cycle solutions to expand our

product suite coverage of the Value Cycle. The Value Cycle is the

process and culture by which healthcare providers pursue quality

patient outcomes and optimal financial performance, through the

management of clinical, operational and financial data assets. By

expanding our offerings into operational areas of the hospital,

incorporating cost management and combining this with data from the

revenue cycle, we will provide a comprehensive insight into the

management and analysis of clinical and operational data, providing

the best possible outcomes for all.

The expansion of our solutions is being achieved through a

combination of extensions to the current product set; building

products through internal development; targeting potential

acquisitions and partnering with other technology and services

companies.

The breadth of our offering, combined with 20 years of data

within a sophisticated cloud platform, provides us with a strong

competitive position across our target product areas.

Product Roadmap

We continue to make progress in all areas of our product

roadmap: the development of our cloud-based Trisus Enterprise Value

Platform; the continued evolution and support of our existing

market-leading product suite as we migrate to Trisus; and the

development of new products to sit upon the Trisus Platform

including the further development of our cost analytics software.

All of these solutions will increase our coverage of the key areas

of the Value Cycle and therefore increase our addressable

market.

Trisus Enterprise Value Platform

We are now more than a year into the launch of the Trisus

Enterprise Value platform and are experiencing growing levels of

interest across our market. This cloud-based platform provides a

suite of solutions for healthcare providers to identify and take

action on risks related to revenue, cost, and compliance. It is

designed to be versatile and expandable, growing alongside our

customers as the healthcare industry continues to evolve. The

platform provides an environment to gather, process, and deliver

data across the continuum of care with an open architecture and

common components, allowing for synergies between applications.

We are particularly pleased to note how both our existing

customer base and the wider healthcare provider market have

responded positively to the technological evolution of the

Craneware solution set, delivered on the Trisus platform. The

Trisus Bridge, the connector layer linking their existing on

premise Craneware solutions to the advanced functionality of Trisus

in the cloud has proven a valuable introduction to customers on the

potential the Platform can offer them. After positive interactions

with the platform via the Trisus Bridge, available for all our

customers, of over 600 hospitals that were represented, 50% of

customers that recently attended the Craneware Healthcare Financial

Summit are looking to transfer to the Trisus platform within twelve

months. This provides us with confidence in the successful

long-term transition of all our products and customers to the cloud

platform. As we have seen other smaller cloud-vendors also making

good progress in the US healthcare market, we believe this

demonstrates that there is a growing acceptance by our industry for

the cloud.

Good levels of sales continued in the first half for Trisus

Claims Informatics. Having been released in an early adopter

version last year, Trisus Supply, was recently launched and will

join Trisus Pricing Analyzer(TM) and Trisus(R) Healthcare

Intelligence on the platform. With Trisus Supply, providers can

ensure their high-dollar medical devices and supplies are accounted

for, managed, and reimbursed properly increasing both compliance,

transparency of cost and revenue. While Trisus Pricing Analyzer(TM)

assists healthcare organisations to create transparent, defensible,

and competitive pricing strategies.

We are executing on a roadmap to migrate all our solutions onto

the Trisus platform, as well as continuing to look for innovative

combinations of our data sets into new unique product offerings. As

part of this roadmap we expect to see further hybrid solutions

combining: the best of existing software regardless of the

development origin, including outside of Craneware; elements of the

Trisus platform; new Trisus products; and new early adopter Trisus

enabled versions of other existing solutions.

Trisus(R) Healthcare Intelligence

Trisus(R) Healthcare Intelligence is a cost analytics decision

support tool that integrates revenue, cost, clinical, and hospital

operational information for each patient encounter, throughout the

journey of their medical condition, accumulating all patient costs

from patient activities and services consumed during their care.

The aim of the tool is to provide our customers with an

understanding of the true cost of every episode of care given to

their patients.

Most hospitals' accounting systems account for cost in aggregate

and average these, allocating cost on a volumetric basis. This

structure, while useful in a fee-for-service system, does not

adequately support the shift to quality-centric healthcare delivery

system that provides true value where a greater degree of insight

and thereby more granularity of the data is required.

Our initial customers for this solution are fully implemented

and using it to improve the operations of their hospitals. From the

pipeline of opportunities that have grown for this product we are

very pleased with the effectiveness of our investment in this

product area and believe that we will be able to report that we

will see a return on this investment within a relatively short

period of time.

This is a vital component within the emerging value cycle

solutions market, representing a market opportunity several times

larger than that of our existing product portfolio.

Sales and Marketing

We have seen positive sales momentum, securing new sales in the

period across all sizes, classes and types of hospital customer. We

continued to secure strong levels of sales for both our core

products, Chargemaster Toolkit and Pharmacy ChargeLink, and

encouraging sales of our first Trisus products. The sales activity

has continued into the second half of the year and the sales

pipeline continues to grow at record levels, all combining to

provide further confidence in continued long term growth.

The average length of contracts with new customers continues to

be in-line with our historical norms of approximately five years.

With the adoption of the Trisus Bridge by the majority of our

customer base, we are in a strong position to offer customers a

viable and secure method of transitioning to our cloud based

platform at a pace that suits them.

At the end of any contract term, we expect to see our renewal

rates remain at their current high levels (above 100% by dollar

value), along with additional sales, as customers move to the

improvements brought to them by the Trisus platform.

Financial Review

We are pleased to announce an increase in adjusted EBITDA of 20%

to $11.6m (H118: $9.7m) driven by an increase in revenues in the

period of 15% to $35.9m (H118: $31.1m). These results are

reflective of both our continued efficient approach to investments

across all areas of the company and our prudent approach to revenue

recognition, through our Annuity SaaS business model (described

below).

This has ultimately led to a 19% increase in adjusted earnings

per share to 30.2 cents per share compared with 25.4 cents per

share for this same period last year. All underlying metrics

continue to be in line with, or above, our historical norms.

In January 2018, we completed a share buyback returning $15.4m

to shareholders. In the period we have returned $4.7m to our

shareholders through dividends, invested $9.1m in research and

development (including $4.4m in new product development which has

been capitalised) and made the commission payments relating to the

sales announced in the prior year. We continue to maintain healthy

cash reserves which at the period end were $38.7m (H118: $52.2m),

meeting our 100% of adjusted EBITDA to operating cash over the

trailing 12 month period target. Following exceptionally high

levels of cash collection in the second half of the prior financial

year, cash conversion levels in the period were as anticipated,

with a further $10m of December 2018 outstanding receivables

collected since the period end.

In the period, the Group has, for the first time, adopted IFRS

15 "Revenue from Contracts with Customers", which has not resulted

in any material changes to our historical approach to revenue

recognition. To ensure compliance the Group has tested revenue

recognised under its Annuity SaaS business model against the

five-step model determined by the standard.

The five-step model is as follows

1) Identify the contract(s) with a customer

2) Identify the performance obligations in the contract

3) Determine the transaction price

4) Allocate the transaction price to the performance obligations in the contract

5) Recognise revenue when or as the entity satisfies its performance obligations

The Group's Annuity SaaS business model and associated revenue

recognition policy has always been designed to focus on the

long-term growth and stability of the Group. The main revenue

element of new sales relates to software licenses, where results in

performance obligations are being met over time and as such revenue

is being recognised over the period the license is provided to the

customer (which for a new hospital sale is an average of five

years). In addition, other revenue generated through new sales

relates to consulting services and training which are also

satisfied over time as the service is provided or the project is

delivered.

We have previously identified that there are a number of

benefits to this revenue recognition model including high levels of

cash conversion, high levels of future years' revenue visibility

and, by renewing our customer base at over 100% (by dollar value),

each new sale adds to the Group's annuity base of revenue. This

continues to be the case and having completed our assessment, we

did not identify any material differences between the requirements

of IFRS 15 and our existing revenue recognition policy.

To demonstrate the high levels of visible revenue generated as a

result of new sales under our business model the Group reports its

Three Year Visible Revenue KPI. This KPI also demonstrates the

underlying annuity revenue stream that is also building as a result

of sales and these revenue recognition policies.

Total visible revenue for the three year period 1 July 2018 to

30 June 2021 has grown 13% to $196.2m from $174.3m for the same

three year period at 31 December 2017. Of this $196.2m, $157.3m

relates to 'Revenue under Contract', $38.4m 'Renewal Revenue' and

$0.5m of 'Other Recurring Revenue'. 'Revenue under Contract',

relates to revenues that are supported by ongoing underlying

contracts. 'Renewal Revenue' relates to the amount of revenue which

is potentially available for renewal and will be recognised in that

fiscal year provided the underlying contracts are renewed. In

calculating this, we assume a 100% dollar value renewal level. As

we sign renewals the aggregated related revenue for the new

multi-year term moves from 'renewal revenues' to 'revenue under

contract'. The final element is 'Other Recurring Revenue', this

relates to revenue that is not subject to long term contracts,

which can be billable 'per transaction' or a set monthly amount and

is usually invoiced on a monthly basis, however it is reasonable to

expect it to be recurring in nature.

As we show our 'Renewal Revenue' in our revenue visibility graph

at 100% of dollar value, we track and publish our 'Renewal Rate by

dollar value KPI' to ensure our 100% assumption in producing our

revenue visibility KPI is still appropriate. This KPI measures the

average value of customers renewing in the relevant period

(including cross sell and upsell to those renewing customers) and

was 101% in this current period under review.

These high levels of visible revenue provide certainty in

investment decisions. These investments include our investment in

R&D of $9.1m (H118: $7.8m) of which $4.6m relates to products

currently available for sale and as such has been expensed in the

period. The balance of $4.4m (H118: $2.1m) relates to new product

development and as such has been capitalised. We continue to make

these and other investment decisions as appropriate for the future

growth of the Group, whilst consistently ensuring the efficiency of

all expenditures. This has contributed to our adjusted EBITDA

margin, which for the period is 32%. The adjustments we make to

both EBITDA and EPS are those normally expected and include costs

related to acquisition and share activity in the period.

We continue to report the results (and hold the cash reserves)

of the Group in US Dollars, whilst having approximately twenty five

percent of our costs, mainly our UK employees and UK purchases,

denominated in Sterling. The average exchange rate for the Company

during the reporting period was $1.30/GBP1 which compares to

$1.32/GBP1 in the corresponding period last year.

Dividend

The Board has resolved to pay an interim dividend of 11p (14.0

cents) per ordinary share on 11 April 2019 to those shareholders on

the register as at 15 March 2019 (FY18 interim dividend 10p). The

ex-dividend date is 14 March 2019.

The interim dividend of 11p per share is capable of being paid

in US dollars subject to a shareholder having registered to receive

their dividend in US dollars under the Company's Dividend Currency

Election, or who has registered to do so by the close of business

on 15 March 2019. The exact amount to be paid will be calculated by

reference to the exchange rate to be announced on 15 March 2019.

The interim dividend referred to above in US dollars of 14.0 cents

is given as an example only using the Balance Sheet date exchange

rate of $1.27/GBP1 and may differ from that finally announced.

Outlook

As we enter the second half of the financial year we do so with

excitement as we continue to build the business in line with the

large market opportunity available to us. The business continues to

deliver strong growth rates, powered by the expansion of our

product suite. We believe that the breadth of our customer base and

the quantity and quality of data within our solutions means we have

the opportunity to sit at the heart of the move to value-based

economics; collating and analysing the information that will

support hospital-wide decision making and ultimately have a

positive impact on the quality of healthcare.

Our growing market opportunity, the strength of our sales

pipeline and increasing long-term revenue visibility, mean we enter

the second half of the financial year with great confidence for the

future and the ongoing success of Craneware.

Keith Neilson Craig Preston

CEO CFO

4 March 2019 4 March 2019

Craneware PLC

Interim Results FY19

Consolidated Statement of Comprehensive

Income

H1 2019 H1 2018 FY 2018

Notes $'000 $'000 $'000

------------------------------------------ ------- --------- --------- ---------

Revenue 35,853 31,138 67,067

Cost of sales (2,292) (1,593) (3,407)

--------- --------- ---------

Gross profit 33,561 29,545 63,660

Net operating expenses (24,376) (21,048) (44,968)

--------- --------- ---------

Operating profit 9,185 8,497 18,692

Analysed as:

Adjusted EBITDA(1) 11,578 9,689 21,611

Share-based payments (740) (165) (663)

Depreciation of plant and equipment (308) (292) (578)

Amortisation of intangible assets (1,345) (735) (1,678)

--------------------------------------------------- --------- --------- ---------

Finance income 114 169 241

--------- --------- ---------

Profit before taxation 9,299 8,666 18,933

Tax charge on profit on ordinary

activities (1,590) (1,990) (3,136)

--------- --------- ---------

Profit for the period attributable

to owners of the parent 7,709 6,676 15,797

Other comprehensive income

Items that may be reclassified

subsequently to profit or loss

Currency Translation Reserve movement 22 (19) (10)

--------- --------- ---------

Total items that may be reclassified

subsequently to profit or loss 22 (19) (10)

--------------------------------------------------- --------- --------- ---------

Total comprehensive income attributable

to owners of the parent 7,731 6,657 15,787

--------------------------------------------------- --------- --------- ---------

(1) Adjusted EBITDA is defined as operating profit before,

share based payments, depreciation and amortisation.

Earnings per share for the period attributable to equity holders

- Basic ($ per share) 1a 0.289 0.248 0.590

- *Adjusted Basic ($ per share)(2) 1a 0.302 0.254 0.602

- Diluted ($ per share) 1b 0.283 0.242 0.579

- *Adjusted Diluted ($ per share)(2) 1b 0.296 0.248 0.591

------------------------------------------ ------- --------- --------- ---------

(2) Adjusted Earnings per share calculations allow for the tax

adjusted acquisition costs and share related transactions (if

applicable in the year) together with amortisation on acquired

intangible assets.

Craneware PLC

Interim Results FY19

Consolidated Statement of Changes in Equity

-------------------------------------------------------------------------------------------------------

Capital

Share Redemption Other Retained

Share Capital Premium Reserve Reserves Earnings Total

$'000 $'000 $'000 $'000 $'000 $'000

--------------------------- -------------- --------- ------------ ---------- ---------- ---------

At 1 July 2017 537 17,974 - 958 39,886 59,355

Total comprehensive

income - profit for

the period - - - - 6,676 6,676

Total other comprehensive

income - - - - (19) (19)

Transactions with owners

Share-based payments - - - 480 814 1,294

Impact of share options

exercised / lapsed - (2) - (7) - (9)

Dividend - - - - (4,066) (4,066)

--------------------------- -------------- --------- ------------ ---------- ---------- ---------

At 31 December 2017 537 17,972 - 1,431 43,291 63,231

--------------------------- -------------- --------- ------------ ---------- ---------- ---------

Total comprehensive

income - profit for

the period - - - - 9,121 9,121

Total other comprehensive

income - - - - 9 9

Transactions with owners

Company share movement

in employee benefit

trust - - - - (4,248) (4,248)

Buyback and cancellation

of shares (9) - 9 - (15,378) (15,378)

Share-based payments - - - 1,023 (180) 843

Impact of share options

exercised / lapsed 6 1,805 - (370) 378 1,819

Dividend - - - - (3,751) (3,751)

At 30 June 2018 534 19,777 9 2,084 29,242 51,646

--------------------------- -------------- --------- ------------ ---------- ---------- ---------

Total comprehensive

income - profit for

the period - - - - 7,709 7,709

Total other comprehensive

income - - - - 22 22

Transactions with owners

Share-based payments - - - 740 607 1,347

Impact of share options

exercised / lapsed 1 244 - - - 245

Dividend - - - - (4,713) (4,713)

--------------------------- -------------- --------- ------------ ---------- ---------- ---------

At 31 December 2018 535 20,021 9 2,824 32,867 56,256

--------------------------- -------------- --------- ------------ ---------- ---------- ---------

Craneware PLC

Interim Results FY19

Consolidated Balance Sheet as at 31 December

2018

H1 2019 H1 2018 FY2018

Notes $'000 $'000 $'000

-------------------------------- ------- -------- -------- -------

ASSETS

Non-Current Assets

Plant and equipment 1,351 1,264 1,223

Intangible assets 26,359 21,542 23,267

Trade and other receivables 2 5,253 4,683 5,275

Deferred Tax 4,599 4,073 3,831

37,562 31,562 33,596

-------- -------- -------

Current Assets

Trade and other receivables 2 20,852 22,356 12,503

Cash and cash equivalents 38,668 52,205 52,833

59,520 74,561 65,336

-------- -------- -------

Total Assets 97,082 106,123 98,932

-------------------------------- ------- -------- -------- -------

EQUITY AND LIABILITIES

Non-Current Liabilities

Deferred income - 48 -

- 48 -

-------- -------- -------

Current Liabilities

Deferred income 33,094 32,173 35,371

Current tax liabilities 420 1,531 80

Trade and other payables 3 7,312 9,140 11,835

40,826 42,844 47,286

-------- -------- -------

Total Liabilities 40,826 42,892 47,286

-------- -------- -------

Equity

Called up share capital 4 535 537 534

Share premium account 20,021 17,972 19,777

Capital redemption reserve 9 - 9

Other reserves 2,824 1,431 2,084

Retained earnings 32,867 43,291 29,242

Total Equity 56,256 63,231 51,646

-------- -------- -------

Total Equity and Liabilities 97,082 106,123 98,932

-------------------------------- ------- -------- -------- -------

Craneware PLC

Interim Results FY19

Consolidated Statement of Cash Flow for the six months ended

31 December 2018

H1 2019 H1 2018 FY 2018

Notes $'000 $'000 $'000

----------------------------------------- ------ --------- -------- ---------

Cash flows from operating activities

Cash generated from operations 5 (3,527) 6,046 33,110

Interest received 114 169 227

Tax paid (1,413) (821) (3,349)

----------------------------------------- ------ --------- -------- ---------

Net cash from operating activities (4,826) 5,394 29,988

Cash flows from investing activities

Purchase of plant and equipment (436) (183) (434)

Capitalised intangible assets (4,435) (2,110) (4,258)

----------------------------------------- ------ --------- -------- ---------

Net cash used in investing activities (4,871) (2,293) (4,692)

Cash flows from financing activities

Dividends paid to company shareholders (4,713) (4,066) (7,817)

Proceeds from issuance of shares 245 - 1,810

Company shares acquired by employee

benefit trust - - (4,248)

Buy back of ordinary shares - - (15,378)

----------------------------------------- ------ --------- -------- ---------

Net cash used in financing activities (4,468) (4,066) (25,633)

Net (decrease)/increase in cash

and cash equivalents (14,165) (965) (337)

Cash and cash equivalents at the

start of the period 52,833 53,170 53,170

Cash and cash equivalents at the

end of the period 38,668 52,205 52,833

----------------------------------------- ------ --------- -------- ---------

Craneware PLC

Interim Results FY19

Notes to the Financial Statements

1. Earnings per Share

(a) Basic

Basic earnings per share is calculated by dividing the profit

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the period.

----------------------------------------------------------------------------

H1 2019 H1 2018 FY 2018

---------------------------------------------- -------- -------- --------

Profit attributable to equity holders

of the Company ($'000) 7,709 6,676 15,797

Weighted average number of ordinary

shares in issue (thousands) 26,682 26,962 26,790

Basic earnings per share ($ per share) 0.289 0.248 0.590

-------- -------- --------

Profit attributable to equity holders

of the Company ($'000) 7,709 6,676 15,797

Tax adjusted acquisition costs, share

related transactions and amortisation

of acquired intangibles ($'000) 353 165 329

-------- -------- --------

Adjusted Profit attributable to equity

holders ($'000) 8,062 6,841 16,126

-------- -------- --------

Weighted average number of ordinary

shares in issue (thousands) 26,682 26,962 26,790

Adjusted Basic earnings per share ($

per share) 0.302 0.254 0.602

-------- -------- --------

(b) Diluted

For diluted earnings per share, the weighted average number

of ordinary shares calculated above is adjusted to assume

conversion of all dilutive potential ordinary shares. The

Group has one category of dilutive potential ordinary shares,

being those granted to Directors and employees under the share

option scheme.

----------------------------------------------------------------------------

H1 2019 H1 2018 FY 2018

---------------------------------------------- -------- -------- --------

Profit attributable to equity holders

of the Company ($'000) 7,709 6,676 15,797

Weighted average number of ordinary

shares in issue (thousands) 26,682 26,962 26,790

Adjustments for: - share options (thousands) 561 613 492

Weighted average number of ordinary

shares for diluted earnings per share

(thousands) 27,243 27,575 27,282

Diluted earnings per share ($ per share) 0.283 0.242 0.579

-------- -------- --------

1. Earnings per share (Cont.)

H1 2019 H1 2018 FY 2018

---------------------------------------------- -------- -------- --------

Profit attributable to equity holders

of the Company ($'000) 7,709 6,676 15,797

Tax adjusted acquisition costs, share

related transactions and amortisation

of acquired intangibles ($'000) 353 165 329

Adjusted Profit attributable to equity

holders ($'000) 8,062 6,841 16,126

-------- -------- --------

Weighted average number of ordinary

shares in issue (thousands) 26,682 26,962 26,790

Adjustments for: - share options (thousands) 561 613 492

Weighted average number of ordinary

shares for diluted earnings per share

(thousands) 27,243 27,575 27,282

Adjusted Diluted earnings per share

($ per share) 0.296 0.248 0.591

-------- -------- --------

2. Trade and other receivables

H1 2019 H1 2018 FY 2018

$'000 $'000 $'000

----------------------------------------- -------- -------- --------

Trade Receivables 16,670 19,556 9,215

Less: provision for impairment of trade

receivables (1,172) (1,630) (1,072)

-------- -------- --------

Net trade receivables 15,498 17,926 8,143

Other Receivables 521 288 230

Prepayments and accrued income 2,487 2,212 1,904

Deferred Contract Costs 7,599 6,613 7,501

-------- -------- --------

26,105 27,039 17,778

Less non-current receivables: Deferred

Contract Costs (5,253) (4,683) (5,275)

-------- -------- --------

Trade and other receivables 20,852 22,356 12,503

-------- -------- --------

------There is no material difference between the fair value of

trade and other receivables and the book value stated above.

3. Trade and other payables

H1 2019 H1 2018 FY 2018

$'000 $'000 $'000

-------- -------- --------

Trade Payables 841 493 824

Social Security and PAYE 425 327 461

Other Payables 215 124 41

Accruals 5,831 8,196 10,509

------ ------ -------

Trade and other payables 7,312 9,140 11,835

------ ------ -------

Derivatives held for hedging have been measured at fair value.

The inputs used in determining the fair value are based on

observable market data therefore the balances are categorised as

level 2 under IFRS 13. No derivatives have been entered into in the

current reporting period. No other assets or liabilities have been

measured at fair value.

4. Called up share capital

H1 2019 H1 2018 FY 2018

Number $'000 Number $'000 Number $'000

---------------------------- ----------- ------ ----------- ------ ----------- ------

Authorised

Equity share capital

Ordinary shares of 1p

each 50,000,000 1,014 50,000,000 1,014 50,000,000 1,014

Allotted called-up and

fully paid

Equity share capital

Ordinary shares of 1p

each 26,681,612 535 26,961,709 537 26,662,271 534

5. Consolidated Cash Flow generated from operating

activities

Reconciliation of profit before taxation to

net cash inflow from operating activities:

H1 2019 H1 2018 FY 2018

$'000 $'000 $'000

------------------------------------- -------- -------- --------

Profit before taxation 9,299 8,666 18,933

Finance income (114) (169) (241)

Depreciation on plant and equipment 308 292 578

Amortisation on intangible assets 1,345 735 1,678

Share-based payments 740 165 663

Movements in working capital:

(Increase)/Decrease in trade

and other receivables (8,327) (7,380) 1,881

Increase/(Decrease) in trade

and other payables (6,778) 3,737 9,608

Cash generated from operations (3,527) 6,046 33,110

------------------------------------- -------- -------- --------

6. Basis of Preparation

The interim financial statements are unaudited and do not

constitute statutory accounts as defined in S435 of the Companies

Act 2006. These statements have been prepared applying accounting

policies that were applied in the preparation of the Group's

consolidated accounts for the year ended 30th June 2018. Those

accounts, with an unqualified audit report, have been delivered to

the Registrar of Companies.

7. Segmental Information

The Directors consider that the Group operates in predominantly

one business segment, being the creation of software sold entirely

to the US Healthcare Industry, and that there are therefore no

additional segmental disclosures to be made in these financial

statements.

8. Changes to Significant Accounting Policies

Except as described below, the accounting policies applied in

these interim financial statement are the same as those applied in

the Group's consolidated financial statements as at and for the

year ended 30 June 2018.

The changes in accounting policy set out below will also be

reflected in the Group's consolidated financial statements for the

year ended 30 June 2019.

IFRS 15 Revenue from contracts with Customers

The Group has adopted IFRS 15 Revenue from Contracts with

Customers from 1 July 2018 using the cumulative effect transition

method. Under the cumulative effect method, the impact of initially

applying the standard will be reflected as an adjustment to the

opening balance of retained earnings as of 1 July 2018 and the

comparative period will not be restated.

The new standard requires revenue to be recognised using a

five-step model which requires the transaction price for each

contract to be apportioned to separate performance obligations

arising under the contract either when the performance obligation

in the contract has been performed (point in time recognition) or

over time as control of the performance obligation is transferred

to the customer. The five-step model is as follows

1) Identify the contract(s) with a customer

2) Identify the performance obligations in the contract

3) Determine the transaction price

4) Allocate the transaction price to the performance obligations in the contract

5) Recognise revenue when or as the entity satisfies its performance obligations

The Group's main revenue category is the sale of software

licenses which results in performance obligations being met over

time, with revenue recognised over the period the license is

provided to the customer. Other revenue relates to consulting

services and training which are also satisfied over time as the

service is provided or the project is delivered.

The Group has completed its assessment of IFRS 15 and has not

identified any material differences between the requirements of

IFRS 15 and the previous revenue recognition policy. Accordingly no

financial restatement has been made.

IFRS 9 Financial Instruments

The Group has adopted IFRS 9 Financial Instruments from 1 July

2018, replacing IAS 39 Financial Instrument: Recognition and

Measurement.

IFRS 9 replace the existing credit loss model with a forward

looking expected credit loss model for assessing the impairment of

financial assets. Adopting this new model has not had a material

impact and accordingly no financial restatement has been made. The

new standard has not had a significant effect on the Group's

accounting policy.

IFRS 9 largely retains the existing requirements in IAS 39 for

the classification and measurement of financial liabilities and has

not had a significant effect on the Group's accounting policy.

9. Availability of announcement and Half Yearly Financial

Report

Copies of this announcement are available on the Company's

website, www.craneware.com. Copies of the Interim Report will be

posted to shareholders, downloadable from the Company's website and

available from the registered office of the Company shortly.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR EAEDLEFKNEAF

(END) Dow Jones Newswires

March 05, 2019 02:01 ET (07:01 GMT)

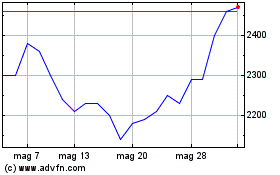

Grafico Azioni Craneware (LSE:CRW)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Craneware (LSE:CRW)

Storico

Da Lug 2023 a Lug 2024