M&G's Fund provides GBP100m to Stobart Group

01 Giugno 2010 - 10:42AM

UK Regulatory

TIDMSTOB

RNS Number : 8287M

Stobart Group Limited

01 June 2010

Stobart Group Limited

("Stobart" or the "Group")

M&G's UK Companies Financing Fund provides GBP100m term loan to Stobart Group

Limited

1 June 2010

M&G Investments ("M&G") has arranged for the UK Companies Financing Fund

("UKCFF") to provide a GBP100million, 10 year term loan to Stobart Group. The

loan will be used to repay existing bank debt and to provide additional funds

which can be used to invest in a range of projects across the Group.

The loan will be used in part to finance the further development of Southend

Airport, which Stobart Group acquired in 2008 and whose application for a runway

extension received ministerial consent in March of this year. In addition there

is headroom to invest in further capital projects.

The loan will have a final maturity date of May 2020 and is structured very

flexibly to permit the Group to maximise the development of its businesses and

asset base, and to create additional value to shareholders, while providing

UKCFF with an attractive and secure term lending opportunity.

This loan is the first disbursement for UKCFF.

Panmure Gordon & Co. introduced M&G/UKCFF to Stobart and acted as financial

advisor to M&G/UKCFF.

BDO LLP acted as financial advisor to Stobart.

Ben Whawell, Chief Financial Officer of Stobart Group, said:

"We are delighted to partner with M&G and see them as providing the core part of

our term borrowing needs and as a reliable partner for the future development of

the Group. We are particularly pleased that we have access to long term debt

with maturities well beyond what is usually available in the bank market. In

addition, the facility gives us the flexibility to fulfil the strategic

development of our business and assets."

Mark Hutchinson, Head of Alternative Credit at M&G, said:

"We are pleased to be making this investment for UKCFF and working with Stobart

in future. This fund was set up to lend long-term debt monies to UK companies

and we are actively in discussion with a number of companies to make further

investments."

-END-

Contacts:

+------------------------------+------------------------------+

| Stobart Group Limited | 01925 605 400 |

+------------------------------+------------------------------+

| Andrew Tinkler | |

+------------------------------+------------------------------+

| Ben Whawell | |

+------------------------------+------------------------------+

| | |

+------------------------------+------------------------------+

| M&G | |

+------------------------------+------------------------------+

| Richard Miles | 020 7548 3653 / 07833 481 |

| | 923 |

+------------------------------+------------------------------+

| David Butcher | 07920 823 701 |

+------------------------------+------------------------------+

| | |

+------------------------------+------------------------------+

| | |

+------------------------------+------------------------------+

| Panmure Gordon & Co. | 020 7459 3600 |

+------------------------------+------------------------------+

| Richard Gray | |

+------------------------------+------------------------------+

| Mark Gomar | |

| | |

| BDO Stoy Hayward LLP | 020 7486 5888 |

+------------------------------+------------------------------+

| Neil McDaid | |

+------------------------------+------------------------------+

Notes to editors:

About Stobart Group

Stobart Group is listed on the London Stock Exchange in the FTSE250 (LSE:STOB),

and is the UK leader in multimodal transport and logistics solutions. It is one

of the most recognised and strongest brands in Britain, best known for its

iconic Eddie Stobart trucks. Today, Eddie Stobart is the name behind a road

haulage fleet totaling 1,850 trucks and some seven million square feet of

cutting-edge warehousing facilities. By size, Eddie Stobart has the best

vehicle utilisation in the industry, helping to maximise efficiency and

environmental benefits.

The Group has pioneered several environmental initiatives in the industry such

as modal shift from road to rail with the Stobart Rail low-carbon service that

brings fresh produce into the UK from southern Europe via the Channel Tunnel.

Stobart is also innovating with the creation of Stobart Biomass Products

Limited, a new venture with A. W. Jenkinson - the UK Leader in biomass fuels.

This positions the Group at the heart of the fast growing and transport

intensive market for renewable energy.

Stobart Group employs over 5,000 people in 40 different locations, offering

multimodal logistics solutions to customers across Europe through the Stobart

Rail, Stobart Ports, Stobart Air and Eddie Stobart Divisions. The Group is fast

developing these divisions into industry leaders, and by developing assets such

as London Southend Airport, Carlisle Lake District Airport and Mersey Multimodal

Gateway in Widnes is creating new business for the Group's core transport and

logistics operations.

www.stobartgroup.com

About M&G Investments

M&G, part of the Prudential plc group of companies, is one of the largest and

most experienced fixed income and credit investors in Europe with nearly

GBP100bn of fixed income assets under management, as at 31 December 2009. M&G is

active across a range of debt products and has been investing in private

corporate debt for almost 20 years.

About M&G's UK Companies Financing Fund

UKCFF was launched in July 2009 by M&G as a response to the contraction in

lending that arose from the consequences of the banking crisis and is looking to

become an active sole lender to mid-market UK companies. The fund has raised

over GBP1.6bn in commitments from institutional investors, principally UK

pension funds, and is targeting strong, growth companies in the UK. As the fund

makes investments these commitments are drawn down on a pro rata basis.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCEAPKFEDPEEEF

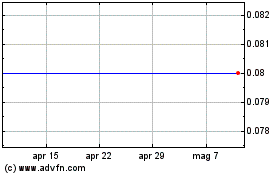

Grafico Azioni Esken (LSE:ESKN)

Storico

Da Ago 2024 a Set 2024

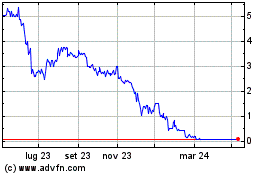

Grafico Azioni Esken (LSE:ESKN)

Storico

Da Set 2023 a Set 2024