TIDMSTOB

RNS Number : 6591H

Stobart Group Limited

21 May 2014

21 May 2014

Stobart Group Limited

("Stobart" or the "Group")

Preliminary Results for the year ended 28 February 2014

Stobart Group Limited, the infrastructure and support services

group, today announces its results for the year ended 28 February

2014.

Group Overview

-- The Group continued with its stated strategy by realising

good value from its mature assets during the year and post the year

end:

o The partial realisation of a significant proportion of the

Transport & Distribution division in April 2014 generated

significant value, including cash and loan notes of GBP195.6m.

o Property realisations generated GBP73.5m of cash and a 23%

return on investment.

o The significant net debt reduction during the year, with a net

cash position following the realisations, will materially reduce

future interest costs.

-- The growth divisions have made good progress, with attractive

returns from Estates and a solid performance from Infrastructure

and Civil Engineering.

Air

o Extended terminal completed at London Southend Airport with

capacity now to handle over 5 million passengers per annum.

o Passenger numbers through London Southend Airport increased by

38% during the year and now exceed 1 million.

o London Southend Airport is the fastest growing airport across

Europe's 368 airports for the second year running.(1)

o Rated best UK airport for customer satisfaction in Which?

Magazine.

Biomass

o Biomass tonnage supplied increased by 41% to over 900,000

tonnes.

o Major new long term contracts commenced but initial

commissioning issues delayed anticipated profit growth.

o Increasing supply to export markets pending future UK power

plant build out.

o Entered growing small scale market supported by the recent

Renewable Heat Incentive (RHI) legislation.

Infrastructure and Civil Engineering

o Completed London Southend Airport's terminal extension on time

and on budget.

o Revenue from external projects up 40% with an improving order

book.

Estates

o Good asset management initiatives and improving property

market has resulted in solid returns.

Transport & Distribution (Biomass)

o Biomass transport retained by the Group and will be integrated

into the fuel supply business to support long term contracts.

Transport & Distribution (Eddie Stobart Logistics)

o Realised 51% of the remaining transport operation on 10 April

2014, retaining a 49% interest. Reported as a discontinued

operation.

o New management introduced by DBAY Advisors to support William

Stobart and his existing team to take the business to its next

stage.

-- Impairment charge of GBP13.0m resulted from delays in

developments, intended recategorisation of property assets and

change of CGUs caused by the realisation.

Outlook

-- Clear focus on growth businesses with cash reserves available

to develop Energy and Aviation further.

-- A portfolio of property assets to realise at the right time.

The resulting cash flow and profits will contribute to dividend

payments in the short term.

-- Board strengthened with a new Chairman, Iain Ferguson, and

Senior Independent Director, Andrew Wood, appointed during the year

and three further Board members joining in July.

Financial Highlights

Note: The performance of the partially realised Transport and

Distribution operation is shown as a discontinued operation but the

balance sheet does not yet reflect the full impact of the

transaction.

Restated*

2014 2013

Revenue from continuing operations GBP99.2m GBP76.8m

Underlying EBITDA from continuing GBP22.6m GBP21.3m

operations

Depreciation on continuing operations GBP5.8m GBP5.0m

Net interest on continuing operations GBP11.5m GBP10.0m

Underlying profit before tax from GBP5.4m GBP6.3m

continuing operations

Profit for the year from continuing GBP11.3m GBP17.4m

and discontinued operations

Final dividend per share payable

on 4 July 2013 4.0p 4.0p

Total dividend for the year 6.0p 6.0p

Earnings per share from continuing

and discontinued operations 3.3p 5.1p

Net cash generated from continuing GBP33.9m GBP32.6m

and discontinued operations

Book value of property assets and GBP273.2m GBP351.7m

investments

Impairment of property, plant and GBP13.0m -

equipment

Net debt GBP127.9m GBP216.4m

*The results for the year end 28 February 2013 have been

restated to classify the part of the Transport & Distribution

business which was subject to the partial realisation transaction

as discontinued operations and the related assets and liabilities

are classified as held for sale.

Divisional summary - continuing operations

2014 Restated

2013

GBPm GBPm GBPm GBPm

------------------------------------ ----- ------ ----- ------

Earnings before interest, tax,

depreciation and amortisation

(EBITDA)

Biomass 4.4 4.1

Air 0.1 0.4

Infrastructure & Civil Engineering 3.5 4.9

Estates 17.7 17.0

Transport & Distribution 3.7 3.0

------------------------------------ ----- ------ ----- ------

Underlying divisional EBITDA 29.4 29.4

Central costs and eliminations (6.8) (8.1)

------------------------------------ ----- ------ ----- ------

Underlying EBITDA 22.6 21.3

------------------------------------ ----- ------ ----- ------

Andrew Tinkler, Chief Executive Officer, said:

"Looking back over 2013-14, we have made significant steps to

deliver value to our shareholders. Our strategy is now well set as

an infrastructure and support services Group. With capital to

invest and our executive team focused on our growth businesses in

Energy and Aviation, we are well placed to deliver good returns for

our shareholders over the next three years and on into the

future."

Enquiries:

Stobart Group +44 207 851 9090

Andrew Tinkler, Chief Executive

Officer

Ben Whawell, Chief Financial

Officer

Lansons

+44 20 7294 3617

Tony Langham (tonyl@lansons.com) +44 7979 692287

influence Associates +44 20 7287 9610

Stuart Dyble/James Andrew

Source

(1) Airline Network News & Analysis (anna aero).

Chairman's Statement

This is my first report to you as Chairman of Stobart Group. The

last twelve months have been a period of challenge, of change and

of progress for the Group. There have been several significant

developments including a number of well executed sales at good

prices from the Estates Division and the sale of a significant

proportion of the Transport & Distribution (T&D) Division.

There have also been a number of changes in Board membership

reflecting the evolving composition of the Group. Our strategy

remains as outlined in 2011 and is focussed on building and

realising shareholder value from our businesses. In this context we

regularly review divisional performances against market conditions

in order to make the right strategic decisions for each of our

businesses at the right time.

Results

The results for the year look very different from previous

years, as our part-realisation of the value in our T&D

Division, subsequent to the year end, means that this element is

shown as a discontinued operation. Stobart Group is now positioned

as a group with subsidiaries that operate infrastructure and

support services, together with a 49% associate in the formerly

100%-owned T&D Division, Eddie Stobart Logistics Ltd.

Operationally, the T&D Division and the Civil Engineering

Division delivered solid results in the year. The Air and Biomass

businesses achieved encouraging growth with just over 1 million

passengers using Southend Airport and nearly 1 million tonnes of

biomass supplied through the Biomass business. The Estates Division

had a good year with several strong value realisations.

Our part-realisation of the T&D Division has resulted in

certain assets undergoing revised impairment testing analysis and

we have recorded an impairment of GBP13m in the year.

The continuing business delivered an EBITDA of GBP22.6m (2013:

GBP21.3m), with net debt reducing significantly to GBP127.9m (2013:

GBP216.4m). EPS from all operations has fallen to 3.3p (2013: 5.1p)

due to the impairment charge.

The Board

There have been a number of Board changes over the past

year.

Avril Palmer-Baunack was appointed Executive Chairman on 21

January 2013 and stood down from this role on 2 April 2013, leaving

the Group on 15 May 2013.

Paul Orchard-Lisle took on the position of Interim Non-Executive

Chairman between 15 May 2013 and my arrival on 1 October 2013, when

he returned to his role as Non-Executive Director. Paul will stand

down from the Board at the AGM.

Alan Kelsey stood down from the Board on 23 April 2013.

Andrew Wood joined the Board on 1 November 2013 as

Senior-Independent Director. Rodney Baker-Bates stepped down from

the Board on 31 December 2013 having served with dedication and

loyalty for nearly six years, mainly as Chairman.

William Stobart stood down from the Board on 6 March 2014 and is

now the CEO of Eddie Stobart Logistics Ltd. Michael Kayser will

stand down from the Board at the AGM, having served as a

Non-Executive Director and Audit Committee Chairman for six

years.

On 1 July 2014 we will be appointing Richard Butcher to the

Board as an Executive Director and John Coombs and John Garbutt as

Non-Executive Directors. There will be an external review of Board

effectiveness this year.

Dividend

An interim dividend of 2.0p was paid on 6 December 2013. The

Board is proposing a final dividend of 4.0p per ordinary share,

giving a total dividend for the year of 6.0p. As indicated at the

time of the T&D partial disposal, we expect to maintain our

current level of dividend payment and in the short term will fund

it from property disposals.

Outlook

We coped well with a period of economic difficulty and are now

positioned to capitalise on growth. The recent partial disposal of

the T&D Division has enabled us to substantially repay our

debt, to return cash to shareholders through a share buy back

exercise and to address investment opportunities in our growth

divisions. Importantly, this transaction and the resulting changed

shape of our Group, with its revised structure, will allow the

senior team to focus their skills and energies on accelerating

growth in our Energy and Aviation businesses.

Our strong and diverse property portfolio delivers an attractive

income return. The Estates Division will continue to capitalise on

market-led opportunities to realise its capital and this, alongside

our 49% investment in Eddie Stobart Logistics Ltd, will continue to

deliver a solid return. The Rail Division's underpinning role in

value creation will also remain important.

We remain committed to our strategy and believe that we are

securely positioned to deliver further growth, return and value to

shareholders.

Iain Ferguson CBE

Chief Executive's Report

In this past year, we have made significant steps towards the

realisation of our strategy to deliver value to our shareholders.

We are now in a good shape to continue to do so through focusing

our attention on the key areas for growth; Energy and Aviation.

Coupled with the recent consolidation of operations and assets into

a new, streamlined structure following the partial realisation of a

significant proportion of the Transport & Distribution

Division, we are well placed to accelerate sustainable growth.

This year also provided us with the opportunity to strengthen

the Board. We were able to appoint Iain Ferguson as Chair in

October 2013 and subsequently Andrew Wood as Non-Executive Director

and Senior Independent Director in November 2013. On 1 July 2014 we

will be appointing Richard Butcher to the Board as an Executive

Director and John Coombs and John Garbutt as Non-Executive

Directors. The Board is now strong and has the requisite skill and

expertise profile to support the planned business growth through

the development of both Infrastructure and Support Services.

The part realisation of Transport & Distribution

The recent headline transaction for us has been the partial

realisation of our Transport & Distribution (T&D) Division

that completed in April 2014. This transaction enabled us to repay

the majority of our debt, buy back a proportion of shares and focus

on accelerating growth of the continuing Group. The transaction

valued the business at GBP280.8m comprising GBP195.6m in cash,

GBP44.1m in shares (giving the Group ownership of 49% of the

acquiring company, with 51% owned by funds managed by DBAY

Advisors) and approximately GBP41.1m in debt and debt-like items

assumed by the purchaser. Stobart Group has retained the Eddie

Stobart brand through a licence agreement, the biomass transport

operations (comprising 8% of the vehicle fleet), which is being

integrated into the Stobart Biomass fuel supply business, and three

freehold properties used by the T&D Division. In addition, the

partial disposal means our operating lease commitments have reduced

by GBP253.6m to GBP41.6m.

A number of other retained assets which had links to the T&D

Division had to be reviewed for impairment independently following

the transaction and we have recorded an impairment charge in the

year of GBP13m. We believe there is scope in the medium term to

recover this value.

Stobart Air

2013-14 has been another period of rapid growth at London

Southend Airport (LSA) with passenger numbers now exceeding 1

million. The recent completion and opening of the terminal

extension has increased both capacity to 5 million passengers and

our commercial offering. The new extension includes foreign

exchange bureaus, duty free retail, bars and restaurants.

The creation of a new partnership with Flybe will see our joint

venture airline, Stobart Air, using two branded Flybe aircraft to

launch six new routes into Europe. We understand the importance of

building new routes and new partnerships to help increase passenger

numbers in line with our predictions. We aim to grow again in the

year ahead and this passenger growth should drive our various

revenue streams at the airport. Despite our passenger growth, there

is still work to be done to improve profitability with renewed

focus on revenue per passenger and controlling costs.

We continue to develop plans for Carlisle Lake District Airport

but remain dogged by ongoing challenges around planning. The

airport remains a key priority for development by our Local

Authority partners who are aiming to increase inbound international

visitor numbers to Cumbria and the Lake District.

Stobart Biomass

This past year has seen the consolidation of some major long

term contracts for the Biomass Division, including those with

Iggesund and Helius. We have also signed 15 year fuel supply

agreements with biomass plants at Port Talbot and Evermore.

2013-14 saw tonnage supplied exceeding 900,000 tonnes for the

year (up from circa 650,000 in 2012-13) including Solid Recovered

Fuel (SRF) shipped to Denmark, and a substantial increase in road

exports to both Belgium and France. The year ahead will see us

consolidate our position within the biomass and renewable energy

sectors, making co-investments in targeted developments where we

can ensure solid and sustainable returns.

Mindful of the importance of the supply element of our Biomass

business, we have retained the biomass transport business following

the recent transaction. This means that our comprehensive offering

of fuel source and supply, matched with premier logistics

capability, remains fully intact and we are well placed to increase

our rate of growth of supply throughout the year.

Stobart Estates

This has been another busy year for the Group's Estates Division

which has delivered strong results against the backdrop of a very

challenging property market. Cash of GBP73.5m was generated from

sales, with a profit on disposal of GBP7.3m. The flagship 37 Soho

Square residential development was completed, with every flat

except one sold by year end. Terms have been agreed for the sale of

the final flat and this is expected to complete shortly. The total

profit on this development since the February 2012 acquisition is

GBP5.5m, representing a return on investment of over 43%.

Terms were agreed in the year with GE for substantial repayment

of the secured loan facility, with re-financing completed on 3

March 2014. As a result, GBP68.1m of debt has been repaid along

with associated costs, reducing the outstanding facility to

GBP10.7m, all on flexible variable rate terms.

In addition, the sale and leaseback of Appleton Thorn transport

and warehouse sites in the year delivered a profit on disposal of

GBP3.7m, whilst asset management initiatives and an improving

property market resulted in revaluation gains of GBP4.2m in the

year.

Stobart Estates includes the Group's airport properties. Rental

income from these sites is currently very low since charges are

linked to the Air Division's EBITDA.

Stobart Infrastructure & Civil Engineering

There has been an uplift of over 40% in divisional turnover to

external customers in this Division and the important terminal

extension at LSA was successfully completed on time and on budget.

This business remains key to our ability to drive up the value of

our investments by using our internal capacity to improve and build

assets. We will continue to grow our portfolio of external work,

principally in the rail infrastructure sector.

Transport & Distribution

T&D had a consistent year, with revenues from most business

units in line with budget. New business was secured and, in part

through funding awarded by government, we are working to deliver

fuel and carbon reductions. With William Stobart at the helm,

alongside the DBAY team, the new business of Eddie Stobart

Logistics Ltd is in a great position to deliver future growth.

The Stobart Brand

Our recognition of the importance and value of the Stobart

brand, alongside the inherent values, underpinned our decision to

retain ownership of this as part of the transaction to dispose of

51% of Transport & Distribution. The Stobart brand remains an

important asset to the Group, but through the brand licence with

Eddie Stobart Logistics Ltd, of which we remain a 49% shareholder,

this business is still able to draw on its iconic status with

customers by continuing to operate under the same livery and

name.

Stobart Group's positive brand image also plays an extremely

important role in building employee engagement and loyalty. Our

team is happy and proud to be part of Stobart Group; we recognise

their support and reward it by helping every one of them to reach

their full potential within the business.

Our Stobart Group and Eddie Stobart brands have been officially

recognised as 'Business Superbrands', and in 2014 Eddie Stobart was

nominated as the leading brand in the 'Supply Chain, Distribution

and Freight Services' category. An accredited Superbrand is

considered to have established the best reputation in its market,

providing its customers with both tangible and intangible

advantages over its competitors. Eddie Stobart has gained this

premium status because it has the highest reputation for quality,

service, performance and sustainability; clearly marking it out

from the competition for this prestigious award. These values of

quality, service, performance and sustainability are those inherent

in our brands and bear a direct relationship to their value.

Outlook

Looking back over 2013-14, we have made significant steps to

deliver value to our shareholders. Our strategy is now well set as

an infrastructure and support services Group. With capital to

invest and our executive team focused on our growth businesses in

Energy and Aviation, we are well placed to deliver good returns for

our shareholders over the next three years and into the future.

Andrew Tinkler

Operational & Financial Review

Results Summary

This year's financial results look quite different compared with

last year's, with the results of a substantial proportion of

Transport & Distribution Division being included in

discontinued operations in the current year and the prior year

figures restated accordingly. The partial disposal was a

significant realisation for the Group, but at the same time

management was not distracted from the continuing business and

underlying profitability has held strong.

Group revenue from continuing operations increased to GBP99.2m,

from GBP76.8m in the previous year. Underlying EBITDA increased to

GBP22.6m from GBP21.3m and underlying operating profit was GBP16.9m

compared with GBP16.3m in 2013. Finance costs (net) increased to

GBP11.5m from GBP10.0m as the amount of capitalised interest

reduced by GBP1.0m and the average net debt was slightly higher

across the year. The recorded loss before tax from continuing

operations was GBP10.2m (2013: profit GBP3.0m) following a charge

of GBP13.0m for impairment of assets.

As we move forward we expect EBITDA to be a key financial

measure to our new Divisions. The divisional EBITDA figures (see

table below) show progress in the Divisions but there is more work

to do to drive further profitability from our assets and our

brands. There was another strong performance in our Estates

Division with several realisations at profitable values which

enabled the Group to reduce net debt significantly.

The prior year figures have been restated to classify the

disposed Transport & Distribution business as discontinued. The

Environmental Transport business, which comprises the fleet of

chipliner and walking floor vehicles, is retained and is included

in the Transport & Distribution result in the table below. This

business provides transport services for our Biomass fuel supply

business as well as third party customers. In addition there has

been a minor restatement in the accounting for the defined benefit

pension scheme as required by the revised accounting standard IAS

19.

Partial disposal of the Transport & Distribution

Division

After the year end, on 10 April 2014, the Group disposed of a

controlling interest in the Transport & Distribution business

for gross consideration of GBP239.7m. This was a mature business

comprising the Eddie Stobart branded transport and logistics

operations, the Stobart Automotive operations and the Widnes rail

freight terminal operation. The transaction leaves the Group with a

remaining 49% interest in this business, which we expect to account

for as an associate in future periods. The results of this disposed

business are classified in discontinued operations in the

Consolidated Income Statement. Revenue for the business was

GBP559.7m (2013: GBP495.6m) and underlying profit before tax was

GBP25.3m (2013: GBP25.9m).

The assets and liabilities in relation to this business at the

year end are classified in the Consolidated Statement of Financial

Position as 'held for sale'. The net assets of the business at the

year end were GBP193.5m including GBP165.7m of goodwill.

Impairment of Assets

As a result of the partial disposal of the Transport &

Distribution business, certain assets will be recategorised from

property, plant and equipment to investment properties and other

assets are included in different Cash Generating Units (CGUs) for

impairment testing purposes. This has resulted in an impairment

charge of GBP13.0m being recorded in arriving at loss before tax

from continuing operations. The impairment of GBP4.8m in respect of

the Ports Operation assets has been caused partly by the expected

changes in activities at the sites following the classification as

held for sale of a substantial part of the Transport &

Distribution Division, and partly due to the delayed timing of

development at the Widnes site. The impairment in respect of

Carlisle Lake District Airport of GBP4.3m amounted to a significant

proportion of the planning and interest costs which have been

capitalised to date. There have also been impairments of two other

property assets which, at the year end, were mostly occupied by the

Transport & Distribution Division, but following the partial

disposal of that Division, will be classified as investment

properties and will be carried at fair value.

Business Segments

The business segments reported in the financial statements for

the year are the same segments as reported in 2012-13 as this

reflects the way in which the Group was managed during the year.

Going forward for the current year to 28 February 2015 we expect to

report under revised segments which better represent the

operational and reporting structure of the business following the

part realisation of the Transport & Distribution business. The

Group is now positioned in Infrastructure and Support Services with

income derived from Infrastructure, Energy, Aviation, Rail and

Investments. We expect that EBITDA will continue to be a key

financial performance measure.

Earnings Per Share

Basic earnings per share from continuing and discontinued

operations were 3.3p (2013: 5.1p).

Taxation

The tax credit on continuing and discontinued activities of

GBP0.5m (2013: GBP0.8m charge) is at an effective rate of -4.8%

(2013: 4.4%). The effective rate has been reduced by GBP3.1m owing

to the impact of the change in corporation tax rate on deferred tax

balances and by GBP1.3m owing to profits on property disposals

which were not taxable but offset by non tax-deductible

amounts.

Statement of Financial Position

We have a strong balance sheet with net assets of GBP461.1m

(2013: GBP462.1m). The net asset position was improved by GBP8.6m

through the sale of treasury shares during the year but adversely

affected by the charge for impairment of assets.

Non-Current Assets

Property, plant and equipment of GBP246.6m (2013: GBP312.2m)

principally comprise the land and buildings at London Southend

Airport, Carlisle Airport and the development sites at Widnes

Multimodal Gateway and Runcorn Port of Weston, the latter two of

which are partly rented to the Transport & Distribution

business. The Group has retained three other freehold properties

used by the disposed Transport & Distribution business which

will be reclassified as investment properties after the

disposal.

Investments in associates and joint ventures of GBP15.8m (2013:

16.1m) comprise the equity investments in a company which leases

aircraft to Stobart Air, and also a green energy development. There

were also balances owed by associates and joint ventures of GBP5.1m

(2013: GBP4.9m) which at the year end represented balances due from

green energy investments.

Intangible assets of GBP120.2m (2013: GBP286.2m) comprise the

brands and remaining goodwill after a considerable proportion of

the goodwill in relation to the Transport & Distribution

Division has been included in assets held for sale. Following the

disposal the Group has retained ownership of all of the Stobart

brand names, trademarks and designs and the Eddie Stobart brands

are licensed to the disposed business under a licence agreement.

The remaining goodwill principally relates to the Biomass

business.

Current Assets

Current assets (excluding assets of disposal groups held for

sale) of GBP102.6m (2013: GBP166.9m) includes GBP10.7m of cash and

GBP68.1m of restricted cash. After the year end this restricted

cash was used to substantially repay the property loan held with GE

Real Estate Finance Ltd.

Disposal Groups

Assets of disposal groups held for sale of GBP342.5m comprise

GBP328.4m in respect of the disposed Transport & Distribution

business and GBP14.1m in respect of five properties which are being

marketed for sale. Liabilities of disposal groups held for sale of

GBP134.9m comprise the liabilities of the disposed Transport &

Distribution business.

Funding

The net debt of the Group at year end has decreased to GBP127.9m

(2013: GBP216.4m) plus GBP19.8m which is included in the disposal

group. The reduction in the year is principally due to the

realisation of proceeds from the disposal of six properties during

the year for proceeds of GBP73.5m.

Following the year end, the GBP100m development loan with

M&G Investment Management has been fully repaid from proceeds

of the Transport & Distribution transaction, and GBP68.1m of

the GE property loan has been repaid out of restricted cash. After

the part disposal the Group has a net cash position with over

GBP35m of borrowing facilities available.

The gearing ratio based on a percentage of net debt to net

assets at year-end is 27.7% (2013: 46.8%). The operating lease

commitments have reduced to GBP41.6m from GBP295.2m following the

disposal of the Transport & Distribution business.

Cashflow

Cash generated from continuing operations was GBP7.8m (2013:

GBP8.7m). Operating cash inflow from discontinued operations was

GBP26.1m (2013: GBP23.9m).

Cash outflow for capital expenditure in the year totalled

GBP17.0m (2013: GBP31.2m). This includes development expenditure at

London Southend Airport of GBP14.1m mainly for the new terminal

extension. Other capital expenditure includes GBP2.2m for

development of the investment property portfolio.

Cash received from the disposal of property, plant and equipment

and investment property was GBP71.0m (2013: GBP11.0m). This

includes GBP64.3m in respect of disposals of investment property

assets.

Finance costs paid in cash (net) totalled GBP13.7m (2013:

GBP10.8m) and was higher than expected as the negotiations with GE

to repay the property loan took longer than expected.

Dividends paid in cash totalled GBP20.5m (2013: GBP20.9m), the

reduction due to the partial uptake of a scrip option for the final

dividend but with the same annual dividend rate of 6p (2013:

6p).

Dividends

Dividends are expected to be maintained at the current level in

the foreseeable future and, in the short term, partly funded out of

proceeds from disposals of property assets. The Board proposes a

final dividend of 4.0p (2013: 4.0p) bringing the total dividend for

the year to 6.0p (2013: 6.0p). Subject to the approval of

shareholders the final dividend will be payable to investors on

record on 30 May 2014 with an ex-dividend date of 28 May 2014 and

will be paid on 4 July 2014.

Ben Whawell

Consolidated Income Statement

For the year to 28 February 2014

Restated

2014 2013

GBP'000 GBP'000

-------------------------------------- ---------- -----------------

Continuing operations

Revenue 99,179 76,787

Operating expenses - underlying (92,048) (66,222)

Share of post tax profits

of associates and joint ventures 460 871

Gain in value of investment

properties 4,223 5,173

Profit on disposal of investment

properties 6,427 -

(Loss)/profit on disposal

of assets held for sale (100) 495

Write-down in value of assets

held for sale (920) -

Share based payments (369) (808)

-------------------------------------- ---------- -----------------

Underlying operating profit 16,852 16,296

New territory and new business

set up costs - (1,020)

Transaction costs (480) (1,856)

Restructuring costs (1,905) (232)

Impairment of property, plant

and equipment (12,970) -

Amortisation of acquired intangibles (221) (221)

-------------------------------------- ---------- -----------------

Profit before interest and

tax 1,276 12,967

Finance costs (12,098) (10,049)

Finance income 635 76

-------------------------------------- ---------- -----------------

(Loss) / profit before tax (10,187) 2,994

Tax (393) 376

-------------------------------------- ---------- -----------------

(Loss) / profit from continuing

operations (10,580) 3,370

-------------------------------------- ---------- -----------------

Discontinued operation

Profit from discontinued operation,

net of tax 21,929 13,986

-------------------------------------- ---------- -----------------

Profit for the year 11,349 17,356

-------------------------------------- ---------- -----------------

Profit attributable to:

Owners of the company 11,339 17,353

Non-controlling interests 10 3

-------------------------------------- ---------- -----------------

Profit for the year 11,349 17,356

-------------------------------------- ---------- -----------------

Earnings per share - continuing

operations

Basic (3.06)p 0.98p

Diluted (3.06)p 0.98p

---------------------------------- ------- -----

Earnings per share

Basic 3.29p 5.06p

Diluted 3.28p 5.04p

---------------------------------- ------- -----

For an explanation of the restatement of the 2013 results,

please see notes.

Consolidated Statement of Comprehensive Income

For the year to 28 February 2014

Restated

2014 2013

GBP'000 GBP'000

------------------------------------- -------- --------

Profit for the year 11,349 17,356

Exchange differences on translation

of foreign operations 578 (445)

Cash flow hedge 880 476

Revaluation of property, plant

and equipment (781) 781

Tax on items relating to components

of other comprehensive income (19) (350)

Discontinued operations, net

of tax, relating to exchange

differences (872) 1,004

------------------------------------- -------- --------

Other comprehensive (expense)/income

to be reclassified to profit

or loss in subsequent periods,

net of tax (214) 1,466

------------------------------------- -------- --------

Remeasurement on defined benefit

plan (409) 53

Tax on items relating to components

of other comprehensive income 82 (54)

Discontinued operations, net

of tax, relating to remeasurement

of defined benefit pension

plan (41) 752

------------------------------------- -------- --------

Other comprehensive (expense)/income

not being reclassified to profit

or loss in subsequent periods,

net of tax (368) 751

------------------------------------- -------- --------

Other comprehensive (expense)/income

for the period, net of tax (582) 2,217

------------------------------------- -------- --------

Total comprehensive income

for the year 10,767 19,573

------------------------------------- -------- --------

Total comprehensive income

attributable to:

Owners of the company 10,757 19,570

Non-controlling interests 10 3

------------------------------------- -------- --------

Total comprehensive income

for the year 10,767 19,573

------------------------------------- -------- --------

Consolidated Statement of Financial Position

As at 28 February 2014

Restated

2014 2013

GBP'000 GBP'000

---------------------------------------------- ---------- ----------

Non-current Assets

Property, plant and equipment

* Land and buildings 219,864 247,497

* Plant and machinery 22,362 32,118

* Fixtures, fittings and equipment 1,885 5,338

* Commercial vehicles 2,535 27,215

---------------------------------------------- ---------- ----------

246,646 312,168

Investment in associates and

joint ventures 15,799 16,086

Investment property 30,890 89,526

Intangible assets 120,173 286,214

Other investments - 7

Amounts owed by associates

and joint ventures 5,083 4,930

---------------------------------------------- ---------- ----------

418,591 708,931

Current Assets

Inventories 962 4,251

Corporation tax 148 1,338

Trade and other receivables 22,637 128,869

Restricted cash 68,130 12,755

Cash and cash equivalents 10,720 19,733

Assets of disposal groups

classified as held for sale 342,550 10,700

---------------------------------------------- ---------- ----------

445,147 177,646

---------------------------------------------- ---------- ----------

Total Assets 863,738 886,577

---------------------------------------------- ---------- ----------

Non-current Liabilities

Loans and borrowings (176,681) (215,707)

Defined benefit pension scheme (2,398) (4,794)

Other liabilities (11,578) (18,363)

Deferred tax (22,621) (26,905)

Provisions (2,985) (2,985)

---------------------------------------------- ---------- ----------

(216,263) (268,754)

Current Liabilities

Trade and other payables (21,123) (122,542)

Loans and borrowings (30,028) (33,194)

Provisions (250) -

Liabilities of disposal groups (134,936) -

classified as held for sale

---------------------------------------------- ---------- ----------

(186,337) (155,736)

---------------------------------------------- ---------- ----------

Total Liabilities (402,600) (424,490)

---------------------------------------------- ---------- ----------

Net Assets 461,138 462,087

---------------------------------------------- ---------- ----------

Consolidated Statement of Financial Position, Continued

As at 28 February 2014

2014 2013

GBP'000 GBP'000

----------------------------------- --------- ----------

Capital and reserves

Issued share capital 35,434 35,397

Share premium 301,326 300,788

Foreign currency exchange reserve (506) (212)

Reserve for own shares held

by employee benefit trust (408) (386)

Hedge reserve (327) (1,032)

Revaluation reserve - 781

Retained earnings 125,606 126,748

Group Shareholders' Equity 461,125 462,084

Non-controlling interest 13 3

----------------------------------- --------- ----------

Total Equity 461,138 462,087

----------------------------------- --------- ----------

Consolidated Statement of Changes in Equity

For the year to 28 February 2014

Reserve

for

Foreign Own

Issued Currency Shares

Share Share Exchange held Hedge Revaluation Retained Non-controlling Total

capital Premium Reserve by EBT Reserve Reserve Earnings Total interests Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ -------- -------- --------- -------- -------- ------------ --------- --------- ---------------- ---------

Balance at 1

March 2013 35,397 300,788 (212) (386) (1,032) 781 126,748 462,084 3 462,087

Profit for the

year - - - - - - 11,339 11,339 10 11,349

Other

comprehensive

income /

(expense)

for the year - - (294) - 705 (781) (212) (582) - (582)

------------------ -------- -------- --------- -------- -------- ------------ --------- --------- ---------------- ---------

Total

comprehensive

income/(expense)

for the year - - (294) - 705 (781) 11,127 10,757 10 10,767

Proceeds on share

issues 37 277 - (22) - - - 292 - 292

Share-based

payment

credit - - - - - - 434 434 - 434

Tax on

share-based

payment - - - - - - (108) (108) - (108)

Sale of treasury

shares - 261 - - - - 8,560 8,821 - 8,821

Dividends paid

to minority

interest - - - - - - (312) (312) - (312)

Dividends - - - - - - (20,843) (20,843) - (20,843)

------------------ -------- -------- --------- -------- -------- ------------ --------- --------- ---------------- ---------

Balance at

28 February 2014 35,434 301,326 (506) (408) (327) - 125,606 461,125 13 461,138

------------------ -------- -------- --------- -------- -------- ------------ --------- --------- ---------------- ---------

Consolidated Statement of Changes in Equity

For the year to 28 February 2013 (Restated)

Reserve

for

Foreign Own

Issued Currency Shares

Share Share Exchange held Hedge Revaluation Retained Non-controlling Total

capital Premium Reserve by EBT Reserve Reserve Earnings Total interests Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- -------- -------- --------- -------- -------- ------------ --------- --------- ---------------- ---------

Balance at

1 March 2012 35,397 300,788 (771) (488) (1,423) - 137,457 470,960 - 470,960

Profit for the

year - - - - - - 17,353 17,353 3 17,356

Other

comprehensive

income for

the

year - - 559 - 391 781 486 2,217 - 2,217

--------------- -------- -------- --------- -------- -------- ------------ --------- --------- ---------------- ---------

Total

comprehensive

income for

the

year - - 559 - 391 781 17,839 19,570 3 19,573

Employee

benefit

trust shares

vested - - - 102 - - - 102 - 102

Share-based

payment

credit - - - - - - 1,544 1,544 - 1,544

Tax on

share-based

payment - - - - - - 278 278 - 278

Purchase of

treasury

shares - - - - - - (9,519) (9,519) - (9,519)

Dividends - - - - - - (20,851) (20,851) - (20,851)

--------------- -------- -------- --------- -------- -------- ------------ --------- --------- ---------------- ---------

Balance at

28 February

2013 35,397 300,788 (212) (386) (1,032) 781 126,748 462,084 3 462,087

--------------- -------- -------- --------- -------- -------- ------------ --------- --------- ---------------- ---------

Consolidated Cash Flow Statement

For the year to 28 February 2014

Restated

2014 2013

GBP'000 GBP'000

------------------------------------- --------- ---------

Cash generated from continuing

operations 7,787 8,695

Cash inflow from discontinued

operations 26,074 23,927

Income taxes paid (1,668) (2,631)

------------------------------------- --------- ---------

Net cash flow from operating

activities 32,193 29,991

------------------------------------- --------- ---------

Transaction costs (80) -

Purchase of property, plant

and equipment and investment

property (17,009) (31,164)

Proceeds from the sale of property,

plant and equipment and investment

property 17,237 105

Proceeds from disposal of assets

held for sale 1,925 10,225

VAT outflow in relation to

disposal of property - (4,583)

Equity investment in joint

ventures (8,846) (2,147)

Net loans repaid by/( advanced

to) associates and joint ventures 2,362 (4,891)

Interest received 511 75

Cash inflow / (outflow) from

discontinued operations 12,018 (6,314)

------------------------------------- --------- ---------

Net cash flow from investing

activities 8,118 (38,694)

------------------------------------- --------- ---------

Issue costs paid on ordinary

shares (21) -

Dividend paid on ordinary shares (20,509) (20,851)

Proceeds from new finance leases - 4,923

Repayment of capital element

of finance leases (2,183) (1,903)

Proceeds from new borrowings 14,965 38,625

Repayment of borrowings (13,419) (16,034)

Sale / (purchase) of treasury

shares, net of costs 8,821 (9,519)

Proceeds from grant 2,766 3,000

Interest paid (13,421) (10,827)

Other finance and transaction

costs (400) -

Net cash transferred to restricted

cash (894) (349)

Cash outflow from discontinued

operations (6,688) (4,605)

------------------------------------- --------- ---------

Net cash flow from financing

activities (30,983) (17,540)

------------------------------------- --------- ---------

Consolidated Cash Flow Statement, Continued

For the year to 28 February 2014

Restated

2014 2013

GBP'000 GBP'000

------------------------------------------ --------- ---------

Increase / (decrease) in cash

and cash equivalents 9,328 (26,243)

Cash and cash equivalents at

beginning of year 158 26,401

------------------------------------------ --------- ---------

Cash and cash equivalents at

end of year 9,486 158

------------------------------------------ --------- ---------

Restricted cash movements

Cash and cash equivalents at

beginning of year 12,755 -

Proceeds from the sale of property,

plant and equipment and investment

property 54,357 10,904

Proceeds from disposal of assets

held for sale - 1,502

Interest received 124 -

Net cash transferred from unrestricted

cash 894 349

------------------------------------------ --------- ---------

Increase in cash and cash equivalents 55,375 12,755

------------------------------------------ --------- ---------

Restricted cash at end of year 68,130 12,755

------------------------------------------ --------- ---------

Total cash and cash equivalents

at end of year, including Restricted

cash 77,616 12,913

------------------------------------------ --------- ---------

Cash (includes Restricted cash

of GBP68,130,000 (2013: GBP12,755,000))

- Continuing 78,850 32,488

Cash - Reclassified as held

for sale 11,797 -

Overdraft - Continuing (4,522) (19,575)

Overdraft - Reclassified as

held for sale (8,509) -

------------------------------------------ --------- ---------

Cash and cash equivalents at

end of year, including Restricted

cash 77,616 12,913

------------------------------------------ --------- ---------

Notes to the Consolidated Financial Statements

For the year to 28 February 2014

Accounting Policies of Stobart Group Limited

Basis of preparation and statement of compliance

The financial information set out in this preliminary

announcement is derived from but does not constitute the Group's

statutory accounts for the year ended 28 February 2014 and year

ended 28 February 2013 and, as such, does not contain all

information required to be disclosed in the financial statements

prepared in accordance with International Financial Reporting

Standards ("IFRS"). The financial information has been extracted

from the Group's audited consolidated statutory accounts upon which

the auditors issued an unqualified opinion.

The preliminary announcement has been prepared on the same basis

as the accounting policies set out in the previous year's financial

statements, except as noted below.

The financial statements of the Group are also prepared in

accordance with the Companies (Guernsey) Law 2008.

Stobart Group Limited is a Guernsey registered company. The

Company's ordinary shares are traded on the London Stock

Exchange.

Going Concern

The Group's business activities, together with factors likely to

affect its future performance and position, are set out in the

Chief Executive Officer's Report and the financial position of the

Group, its cash flows and funding are set out in the Operational

and Financial Review.

Following the partial disposal of a significant proportion of

the Transport & Distribution business, a significant amount of

the Group's loans and borrowings were repaid.

The Group has considerable financial resources, together with

contracts with a number of customers and suppliers. The financial

forecasts show that the Group's remaining borrowing facilities are

adequate such that the Group can operate within these facilities

and meet its obligations when they fall due for the foreseeable

future. As a consequence, the Directors believe that the Group is

well placed to manage its business risks successfully despite the

current economic climate. The Group actively manages its short and

long term funding requirement through various forecasting

procedures.

After making enquiries, the Directors have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the forseeable future. Accordingly, the

financial statements have been prepared on a going concern

basis.

Restatement of 28 February 2013 Financial Information

The results for the year ended 28 February 2013, of the part of

the Transport & Distribution business which was disposed of

post year end, have been restated as discontinued operations and

the related assets and liabilities are reclassified as held for

sale. This is required by IFRS to be consistent with the treatment

in the current year. See note 4 for further details.

A restricted cash balance of GBP68,130,000 (2013: GBP12,755,000)

has been reclassified to show it separately on the face of the

Consolidated Statement of Financial Position, and the Consolidated

Cash Flow Statement has been restated accordingly. This change has

made no difference to the net assets or net debt at either year

end.

With effect from 1st March 2013, the Group was required to take

account of the revised accounting standard, IAS 19 - 'Employee

Benefits'. This change impacts the Group by amending disclosure

requirements and replacing the expected return on plan assets and

interest cost on plan obligations with net interest on the net

defined benefit liability based upon the discount rate. The

specific lines affected by this restatement in the Consolidated

Income Statement for the year ended 28 February 2013 are finance

costs, which increased by GBP113,000, finance income, which

decreased by GBP103,000, and the tax charge which decreased by

GBP50,000. The effect of the restatement on the Consolidated

Statement of Financial Position is not deemed to be material and as

such the presentation of a third balance sheet as indicated by IAS

1 is not considered necessary.

Certain liabilities which were previously classified as 'other

liabilities' have been classified as 'provisions' to better reflect

the uncertain nature of these liabilities. This has had the impact

of reducing other liabilities at 28 February 2013 by GBP2,985,000

and increasing provisions by the same amount, with no change to net

assets. See Note 25 for further details.

Separately Disclosed Items

The Group presents separately on the face of the income

statement material items of income and expense, which because of

their nature, infrequency or occurrence, or the events giving rise

to them, merit separate presentation to allow shareholders to

better understand the financial performance of the year. Underlying

operating profit is stated before separately disclosed items and

share based payments.

Segmental information

The operating segments reported during the year within

continuing operations are Stobart Transport & Distribution,

Stobart Estates, Stobart Infrastructure & Civil Engineering,

Stobart Air and Stobart Biomass.

During the year the Stobart Transport & Distribution segment

specialised in contract logistics. A substantial proportion of the

Transport & Distribution division has been included in

discontinued operations in the current year, following the disposal

post year end of the Group's controlling interest of part of this

business. The remaining continuing Transport & Distribution

segment comprises principally the Environmental Transport

operation, which has been retained post disposal of the rest of the

Transport & Distribution operation.

The Stobart Estates segment specialises in the management,

development and realisation of land and buildings assets for owner

occupied and third party tenanted properties

The Stobart Infrastructure & Civil Engineering segment

specialises in delivering internal and external infrastructure and

development projects including rail network operations.

The Stobart Air segment specialises in the operation of

commercial airports.

The Stobart Biomass segment specialises in the supply of

sustainable biomass for the generation of renewable energy.

The Executive Directors are regarded as the Chief Operating

Decision Maker (CODM). The Directors monitor the results of each

business unit separately for the purposes of making decisions about

resource allocation and performance assessment. The main segmental

profit measures are earnings before interest, tax, depreciation and

amortisation and also profit before tax, both shown before

separately disclosed items.

Income taxes, non-fleet finance costs and certain central costs

are managed on a Group basis and are not allocated to operating

segments. These costs are included in adjustments and

eliminations.

Period ended Stobart Stobart

28 February Transport Infrastructure

2014 & Stobart & Civil Stobart Stobart Adjustments

Distribution Estates Engineering Air Biomass and eliminations Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ -------------- --------- ---------------- -------- --------- ------------------ ---------

Revenue

External 25,839 6,014 15,579 20,342 28,104 3,301 99,179

Internal 5,281 1,622 13,208 - - (20,111) -

------------------ -------------- --------- ---------------- -------- --------- ------------------ ---------

Total revenue 31,120 7,636 28,787 20,342 28,104 (16,810) 99,179

------------------ -------------- --------- ---------------- -------- --------- ------------------ ---------

Depreciation (372) (2,623) (1,394) (743) (294) (343) (5,769)

Net finance

costs (59) (8,843) (212) (306) (44) (1,999) (11,463)

Share of profit

of associates

and joint

ventures - 1,127 - - - (667) 460

Gain in value

of investment

properties - 4,223 - - - - 4,223

Profit on

disposal of

investment

properties - 6,427 - - - - 6,427

Loss on disposal

of and write

downs in assets

held for sale - (1,020) - - - - (1,020)

Share based

payments - - - - - (369) (369)

------------------ -------------- --------- ---------------- -------- --------- ------------------ ---------

Segment EBITDA 3,714 17,695 3,490 71 4,450 (6,799) 22,621

------------------ -------------- --------- ---------------- -------- --------- ------------------ ---------

Segment PBT 3,283 6,229 1,884 (978) 4,112 (9,141) 5,389

------------------ -------------- --------- ---------------- -------- --------- ------------------ ---------

Transaction

costs written

off (480)

Restructuring

costs (1,905)

Impairment

of property,

plant and

equipment (12,970)

Amortisation

of acquired

intangibles (221)

------------------ -------------- --------- ---------------- -------- --------- ------------------ ---------

Loss on continuing operations before tax (10,187)

------------------------------------------------------------------------------------ ------------------ ---------

Period ended Stobart Stobart

28 February Transport Infrastructure

2013 & Stobart & Civil Stobart Stobart Adjustments

Restated Distribution Estates Engineering Air Biomass and eliminations Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- -------------- --------- ---------------- -------- --------- ------------------ ----------

Revenue

External 18,101 14,845 11,062 14,938 16,402 1,439 76,787

Internal 2,753 1,234 19,800 - - (23,787) -

------------------- -------------- --------- ---------------- -------- --------- ------------------ ----------

Total revenue 20,854 16,079 30,862 14,938 16,402 (22,348) 76,787

------------------- -------------- --------- ---------------- -------- --------- ------------------ ----------

Depreciation (249) (1,448) (1,469) (921) (109) (824) (5,020)

Net finance

costs (28) (9,112) (250) (193) (70) (320) (9,973)

Share of profit

of associates

and joint

ventures - 1,312 - - - (441) 871

Gain in value

of investment

properties - 5,173 - - - - 5,173

Profit on

disposal of

assets held

for sale - 495 - - - - 495

Share based

payments - - - - - (808) (808)

------------------- -------------- --------- ---------------- -------- --------- ------------------ ----------

Segment EBITDA 3,032 16,962 4,876 441 4,132 (8,127) 21,316

------------------- -------------- --------- ---------------- -------- --------- ------------------ ----------

Segment PBT 2,755 6,402 3,157 (673) 3,953 (9,271) 6,323

------------------- -------------- --------- ---------------- -------- --------- ------------------ ----------

New territory

and new business

set-up costs (1,020)

Transaction

costs written

off (1,856)

Restructuring

costs (232)

Amortisation

of acquired

Intangibles (221)

------------------- -------------- --------- ---------------- -------- --------- ------------------ ----------

Profit on continuing operations

before tax 2,994

---------------------------------------------------------------- -------- --------- ------------------ ----------

No segmental assets or liabilities information is disclosed

because no such information is regularly provided to, or reviewed

by, the Chief Operating Decision Maker.

Inter-segment revenues are eliminated on consolidation.

Included in adjustments and eliminations are central costs of

GBP8,599,000 (2013: GBP7,514,000) and intra-group profit of

GBP542,000 (2013: GBP1,758,000).

Discontinued Operations

The group disposed of a controlling interest in a substantial

proportion of the Transport & Distribution division on 10 April

2014. The group has retained a 49% interest in the business, which

is expected to be accounted for as an associate in future periods.

The Environmental Transport business unit, which was previously

part of the Transport & Distribution division, was also

retained.

The chilled pallet network business unit, which was closed in

the prior year, and reported as a discontinued operation in that

year, previously formed part of the Transport & Distribution

business. These businesses have been reported separately as a

single amount presented within discontinued operations. The

operations both represented separate major lines of business.

Restated

2014 2013

Results of discontinued operations GBP'000 GBP'000

-------------------------------------- --------- ---------

Revenue 559,661 540,644

Operating expenses - underlying (533,307) (530,337)

Share based payments (65) (520)

Profit on disposal of business - 8,511

Transaction costs (391) (903)

Restructuring costs (3,221) (561)

Amortisation of acquired intangibles (76) (160)

Net finance costs (1,586) (1,510)

-------------------------------------- --------- ---------

Profit before tax 21,015 15,164

-------------------------------------- --------- ---------

Tax 914 (1,178)

-------------------------------------- --------- ---------

Profit for the year from discontinued

operations, net of tax 21,929 13,986

-------------------------------------- --------- ---------

Basic earnings per share 6.35p 4.08p

-------------------------------------- --------- ---------

Diluted earnings per share 6.34p 4.06p

-------------------------------------- --------- ---------

Restated

Cash flows used in discontinued 2014 2013

operations GBP'000 GBP'000

----------------------------------- -------- --------

Net cash from operating activities 26,074 23,927

Net cash from/(used in) investing

activities 12,018 (6,314)

Net cash used in financing

activities (6,688) (4,605)

----------------------------------- -------- --------

Net cash flows for the year 31,404 13,008

----------------------------------- -------- --------

The profit from discontinued operations of GBP21,929,000 (2013:

GBP13,986,000) is attributable to the owners of the Company, with

the exception of GBP10,000 (2013: GBP3,000) that is attributable to

the minority interest. There was no loss recorded on remeasurement

to fair value less costs to sell.

Dividends

2014 2014 2013 2013

Dividends paid on Ordinary

Shares Rate Rate

p GBP'000 p GBP'000

---------------------------- ----- -------- ----- --------

Final dividend for 2013

paid 5 July 2013 4.0 13,891 - -

Interim dividend paid

6 December 2013 2.0 6,952 - -

Final dividend for 2012

paid 6 July 2012 - - 4.0 13,921

Interim dividend paid

7 December 2012 - - 2.0 6,930

---------------------------- ----- -------- ----- --------

Dividends paid 6.0 20,843 6.0 20,851

---------------------------- ----- -------- ----- --------

A final dividend of 4.0p per share was declared on 21 May 2014

and subject to approval of shareholders will be paid on 4 July

2014. This is not recognised as a liability as at 28 February

2014.

Of the GBP13,891,000 dividend in July 2013, GBP334,000 was

settled by the issue of shares under a scrip offer.

Financial assets and liabilities

Loans and borrowings 2014 2013

GBP'000 GBP'000

----------------------------------------------------------- --------- ---------

Non-current

Fixed rate

* Obligations under finance leases and hire purchase

contracts 10,009 27,181

* Loan notes - 3,745

* Bank loans 69,828 68,659

Variable rate

* Obligations under finance leases and hire purchase

contracts - 379

* Bank loans 96,844 115,743

176,681 215,707

----------------------------------------------------------- --------- ---------

Current

Fixed rate

* Obligations under finance leases and hire purchase

contracts 2,652 10,353

* Bank loans - 1,400

2,820 -

* Loan notes

Variable rate

* Obligations under finance leases and hire purchase

contracts - 1,120

* Overdrafts 4,522 3,157

* Invoice Discounting Facility - 16,418

* Bank loans 20,034 746

----------------------------------------------------------- --------- ---------

30,028 33,194

----------------------------------------------------------- --------- ---------

Total loans and borrowings 206,709 248,901

----------------------------------------------------------- --------- ---------

Cash 10,720 19,733

Restricted cash 68,130 12,755

----------------------------------------------------------- --------- ---------

Net debt 127,859 216,413

----------------------------------------------------------- --------- ---------

The obligations under finance leases and hire purchase contracts

are taken out with various lenders at fixed or variable interest

rates prevailing at the inception of the contracts.

The bank loans at the year end include a GBP100,000,000 variable

rate group finance arrangement. The terms of this loan were amended

in May 2013 such that it would be repayable in GBP5,000,000

quarterly instalments as from 31 May 2014. This loan was fully

repaid on 11 April 2014. Also included in bank loans is a

GBP74,864,000 (2013: GBP77,286,000) property loan. The property

loan was originally due for repayment in quarterly installments

ending April 2017. This loan had fixed and variable elements of

GBP69,828,000 (2013: GBP72,328,000) and GBP5,036,000 (2013:

GBP4,958,000) respectively at 28 February 2014. The bank loans also

include GBP15,000,000 drawn on a GBP20,000,000 variable rate

committed revolving credit facility with a facility end date of

February 2016.

Included in cash is GBP68,130,000 (2013: GBP12,755,000) of

'Restricted cash' which is held in an asset proceeds account and at

28 February 2014 its use was restricted to reinvestment in new

property assets or repayment of the property loan. This Restricted

cash was used to repay a substantial proportion of the

GBP74,864,000 property loan on 3 March 2014.

The loan notes were issued in connection with the acquisition of

Stobart Biomass Products Limited on 19 May 2011. These loan notes

were fully repaid on 5 March 2014.

The Group was in compliance with financial covenants throughout

the year and the previous year.

Notes to the consolidated cash flow statement

Cash generated from continuing Restated

operations 2014 2013

GBP'000 GBP'000

----------------------------------- -------- --------

(Loss)/profit before tax from

continuing operations (10,187) 2,994

Adjustments to reconcile (loss)

/ profit before tax to net

cash flows

Non-cash:

Gain in value of investment

properties (4,223) (5,173)

Realised profit on sale of

property, plant and equipment

and investment properties (7,397) 175

Share of post tax profits of

associates & joint ventures

accounted for using the equity

method (460) (871)

Loss / (profit) on disposal

of/write-down in value of assets

held for sale 1,020 (495)

Depreciation of property, plant

and equipment 5,769 5,020

Impairment of assets 12,970 -

Finance income (635) (76)

Interest expense 12,098 10,049

Release of grant income (240) (199)

Non-operating transaction costs 480 1,856

Amortisation of intangible

assets 221 221

Share option charge 369 808

Working capital adjustments:

Decrease/(increase) in inventories 529 (1,152)

Decrease/(increase) in trade

and other receivables 3,906 (6,843)

(Decrease)/increase in trade

and other payables (6,433) 2,381

Cash generated from continuing

operations 7,787 8,695

----------------------------------- -------- --------

Related Parties

Relationships of Common Control or Significant Influence

WA Developments International Limited is owned by WA Tinkler.

During the year, the Group paid rent of GBP20,000 (2013: GBP78,000)

and levied recharges of GBP119,000 relating to the recovery of

staff costs and expenses (2013: GBP537,000) to WA Developments

International Limited. GBP48,000 (2013: GBP990,000) was due from

and GBP11,000 (2013: GBP340,000) was due to WA Developments

International Limited at the year end.

In addition, the group received rent of GBPnil (2013:

GBP281,100) from WA Developments International Limited under a rent

guarantee arrangement. This guarantee was a term of the acquisition

by the Group of WADI Properties Limited from WA Developments

International Limited on 28 February 2012 and expired on 28

February 2013.

Apollo Air Services Limited is owned by WA Tinkler. During the

year, the Group made purchases of GBP407,000 (2013: GBPnil) from

Apollo Air Services Limited relating to the provision of passenger

transport. GBP29,000 (2013: GBPnil) was owed by the Group to this

company at the year end.

VLL Limited is owned by WA Tinkler. During the year, the Group

made sales of GBP20,000 (2013: GBP17,000) relating to fuel and made

purchases of GBP434,000 (2013: GBP826,000) relating to the

provision of passenger transport. GBPnil (2013: GBP193,000) was

owed to the Group at the year end and GBPnil (2013: GBP100,000) was

owed by the Group at the year end.

During the year the Group made purchases of GBP254,000 (2013:

GBP550,000), relating to the provision of branded products and

vehicle advertising, from Ast Signs Limited, a company in which W

Stobart holds a 27% shareholding. A balance of GBP40,000 (2013:

GBP61,000) was owed by the Group at the year end.

Associates and Joint Ventures

The Group had loans outstanding from its joint venture interest,

Convoy Limited of GBP2,132,000 (2013: GBP2,132,000) at the year

end.

The Group had loans outstanding from its joint venture interest,

Westbury Fitness Hull Limited of GBP471,000 (2013: GBP471,000) at

the year end, of which GBP471,000 (2013: GBP471,000) has been

provided for.

The Group had loans outstanding from companies within the group

headed by its joint venture interest, Everdeal Holdings Limited, of

GBP782,000 (2013: GBP3,031,000) at the year end. During the year,

the Group made sales of GBP615,000 (2013: GBP1,692,000) to a 100%

subsidiary of Everdeal Holdings Limited. A balance of GBP202,000

(2013: GBP262,000) was owed to the Group at the year end. The

interest receivable during the year was GBP174,000 (2013:

GBP494,000).

The Group had loans outstanding from its associate interest,

Shuban Power Limited, of GBP4,281,000 (2013: GBP1,570,000) at the

year end. The interest receivable during the year was GBP264,000

(2013: GBPnil).

The Group had loans outstanding from its associate interest,

Shuban 6 Limited, of GBP802,000 (2013: GBPnil) at the year end. The

interest receivable during the year was GBP28,000 (2013:

GBPnil).

The Group had loans outstanding from its joint venture interest,

Stobart Barristers Limited of GBP567,000 (2013: GBP306,000) at the

year end of which GBP500,000 (2013: GBPnil) has been provided for.

During the year, the Group made purchases of GBP88,000 (2013:

GBP80,000) from Stobart Barristers Limited of which GBP9,000 (2013:

GBP54,000) was owed at the year end.

The Group made sales of GBP3,155,000 (2013: GBP1,684,000) and

purchases of GBPnil (2013: GBP2,000) to its joint venture interest,

Vehicle Logistics Corporation BV of which GBP136,000 (2013:

GBP368,000) was owed to the Group at the year end. All balances

outstanding at 28 February 2014 were included within the disposal

group classified as held for sale.

Post Balance Sheet Events

On 10 April 2014 the Group completed the disposal of a

controlling interest in a substantial proportion of the Transport

& Distribution division, to funds managed by DBAY Advisors, for

proceeds of around GBP195,600,000 before transaction costs. The

Environmental Transport business unit has been retained. The Group

retains an economic interest of 49% in the business, which is

expected to be accounted for as an associate in future periods. The

Group has retained the ownership of the Eddie Stobart brand and the

business will continue to use these brands under a licence

agreement. The Group has also retained a number of freehold

properties which have been leased to the business on an arms-length

basis.

Following the disposal, on 11 April 2014, the GBP100,000,000

variable rate loan with M&G Investment Management Limited was

fully repaid and the facility terminated.

On 3 March 2014, GBP68,130,000 of the Restricted Cash held at 28

February 2014 was used to repay a substantial proportion of the

property loan with GE Real Estate Finance Limited, plus payment of

fees. At the same time the terms of the remaining debt were

renegotiated and the facility was reduced commensurately.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR ABMATMBATMTI

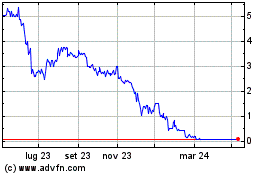

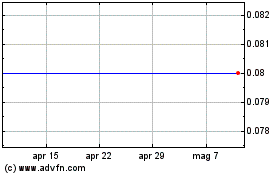

Grafico Azioni Esken (LSE:ESKN)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Esken (LSE:ESKN)

Storico

Da Lug 2023 a Lug 2024