4 Underlying operating profit and separately disclosed items

Underlying operating profit

Underlying operating profit is a non GAAP measure. A

reconciliation of underlying operating profit is set out below:

Restated

Six months Six months Year ended

ended 31 ended 31 28 February

August 2014 August 2013 2014

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Operating profit as reported 691 7,250 1,276

Other separately disclosed

items:

Group:

* New business and new contract set up costs 113 - -

* Transaction costs - 416 480

* Restructuring costs 952 323 1,905

* Impairment of property, plant and equipment - - 12,970

* Amortisation of acquired intangibles 1,969 111 221

Included in share of post-tax

profits of associates and

joint ventures:

700 - -

* Transaction costs

* Amortisation of acquired intangibles 1,193 - -

-------------- ------------- --------------

Underlying operating profit 5,618 8,100 16,852

-------------- ------------- --------------

Separately disclosed items

New business and new contract set up costs comprise costs of

investing in major new business areas or major new contracts to

commence or accelerate development of our business presence. These

costs include marketing costs, establishment costs, legal and

professional fees, losses and certain staff and training costs. The

costs in the current period were in relation to the development of

business at London Southend Airport.

Transaction costs comprise costs of making investments or costs

of financing transactions that are not permitted to be debited to

the cost of investment or as issue costs. These costs include costs

of any aborted transactions.

Restructuring costs comprise costs of integration plans and

other business reorganisation and restructuring undertaken by

management. Costs include cost rationalisation, brand

harmonisation, site closure costs, certain short term duplicated

costs, asset write downs and other costs related to the

reorganisation and integration of businesses. These are principally

expected to be one off in nature. The costs in the current period

were principally in relation to site restructuring in Stobart

Energy.

Impairment of property, plant and equipment charges are

considered to be non-recurring, due to their nature, and outside of

the normal activities of the Group.

Amortisation of acquired intangibles comprises the amortisation

of intangible assets identified as fair value adjustments in

acquisition accounting.

Separately disclosed finance costs of GBP8,096,000 comprise the

costs associated with early repayment of debt balances. Costs

include repayment fees, associated issue costs written off and

directly related professional fees. The costs in the period were

incurred in connection with the repayment of a GBP100,000,000

variable rate loan with M&G Investment Management Limited and

repayment of a substantial proportion of a property loan with GE

Real Estate Finance Limited (see note 10).

5 Partial disposal of the transport & distribution division

The Group disposed of a controlling interest in a substantial

proportion of the transport and distribution division on 10 April

2014. The Group has retained a 49% interest in the business, which

is accounted for as an associate in the period. The environmental

transport business unit, which was previously part of the transport

& distribution division, was also retained.

The results of the disposed business have been reported

separately as a single amount presented within discontinued

operations. The operation represented a separate major line of

business.

The consideration received for disposal of the business was

GBP239,700,000, comprising of cash of GBP190,600,000, including

GBP13,700,000 for the issue of a licence premium, loan notes of

GBP5,000,000 and fair value of the remaining 49% of the business of

GBP44,100,000. The loan notes were repaid on 24 April 2014. The

profit on disposal recorded within discontinued operations was

GBP10,436,000 after deducting fees and other costs directly related

to the disposal.

The accounting for the Group's share of the results of the

remaining 49% of the business requires identification of the fair

value of the investee's identifiable assets and liabilities

including intangible assets. The accounting for the share of the

associate is provisional in this Interim Statement.

The share of the results of the associate of GBP1,083,000,

included in the Condensed Consolidated Income Statement total of

GBP1,360,000, includes a share of transaction costs of GBP700,000

and a share of amortisation of intangible assets of GBP1,193,000.

These costs are separately disclosed items in accordance with the

policies set out in note 4.

6 Taxation

Taxation on profit on ordinary activities

Total tax charged in the income Restated

statement from continuing and Six months Six months

discontinued operations ended 31 ended 31 Year ended

August August 28 February

2014 2013 2014

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Current income tax:

UK Corporation tax 443 2,434 2,925

Overseas tax - 127 536

Adjustment in respect of prior

years 745 - (1,001)

------------- ------------ --------------

Total current tax 1,188 2,561 2,460

------------- ------------ --------------

Deferred tax:

Origination and reversal of

temporary differences (1,793) (111) (581)

Impact of change in rate - (1,302) (3,700)

Adjustment in respect of prior

years - 35 1,300

------------- ------------ --------------

Total deferred tax (1,793) (1,378) (2,981)

------------- ------------ --------------

Total (credit)/charge in the

income statement from continuing

and discontinued operations (605) 1,183 (521)

============= ============ ==============

Included in the above tax charge for the current period is a

total current tax charge on continuing operations of GBP745,000

(2013: GBP2,434,000), total deferred tax credit on continuing

operations of GBP1,793,000 (2013: GBP750,000) and total tax credit

on continuing operations in the income statement of GBP1,048,000

(2013: GBP1,684,000 charge).

A reduction in the UK corporation tax rate from 23% to 21%

(effective from 1 April 2014) was substantively enacted on 2 July

2013. The March 2013 Budget announced that the UK corporation tax

rate will further reduce to 20% by 2015. The reduction in the rate

to 20% (effective from 1 April 2015) was substantively enacted on 2

July 2013.

This will reduce the Group's future current tax charge

accordingly. The deferred tax liability at 31 August 2014 has been

calculated based on the rate of 20% substantively enacted at the

balance sheet date.

7 Dividends

A final dividend of 4.0p per share (2013: 4.0p) totalling

GBP13,249,153 (2013: GBP13,890,703 paid on 6 July 2013) was

declared on 21 May 2014 and was paid on 4 July 2014. GBP13,249,153

was paid in cash and GBPnil (2013: GBP334,478) was satisfied by

issue of shares under a scrip offer.

An interim dividend of 2.0p (2013: 2.0p) per share totalling

GBP6,558,517 (2013: GBP6,952,711 paid on 6 December 2013) was

declared on 23 October 2014 and will be paid on 5 December 2014.

This is not recognised as a liability at 31 August 2014.

8 Earnings per share

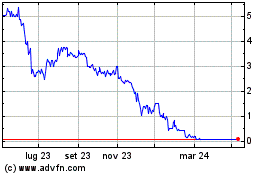

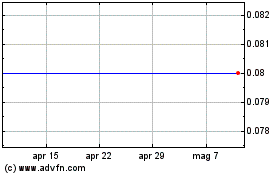

Grafico Azioni Esken (LSE:ESKN)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Esken (LSE:ESKN)

Storico

Da Lug 2023 a Lug 2024