Stobart Group Limited Interim Results for the six -11-

23 Ottobre 2014 - 8:01AM

UK Regulatory

method (1,360) (150) (460)

Loss on disposal of/loss in

value of assets held for sale 68 750 1,020

Depreciation of property, plant

and equipment 3,127 2,826 5,769

Impairment of assets - - 12,970

Finance income (258) (245) (635)

Interest expense 1,459 6,265 12,098

Finance costs - separately disclosed

items 8,096 - -

Release of grant income (131) (164) (240)

Non-operating transaction costs - 416 480

Amortisation of intangibles 1,969 111 221

Share option charge 250 268 369

Working capital adjustments:

Decrease/(increase) in inventories (239) 612 529

Decrease/(increase) in trade

and other receivables (20,047) 2,469 3,906

(Decrease)/increase in trade

and other payables 15,790 (3,071) (6,433)

Cash (used in)/generated from

continuing operations (590) 6,956 7,787

-------------- ------------- --------------

14 Related parties

Associates and joint ventures

Since the partial disposal of the transport and distribution

division, there have been a number of transactions with the group

headed by Greenwhitestar Holding Company 1 Limited, an associate

interest. From the date of disposal to the period end, the Group

made sales of GBP2,575,000, mainly relating to cost recharges, (see

below) and purchases of GBP9,787,000, mainly relating to haulage

costs and cost recharges (see below).

The Group and members of the group headed by Greenwhitestar

Holding Company 1 Limited are operating under a transitional

services agreement for a period following the partial disposal.

This agreement details recharges for shared services; significant

examples are time apportioned staff costs, truck and trailer hire

costs, property leases, office space rental charges, fuel and car

costs, IT hardware and software costs and payroll processing

costs.

During the period to 31 August 2014 the Group made loans under a

revolving credit facility to a 100% subsidiary of Everdeal Holdings

Limited, an associate interest, of GBP1,992,000.

During the period to 31 August 2014 the Group made additional

loans to its associate interest, Shuban Power Limited, of

GBP1,054,000.

Key management personnel

Details of bonuses paid to Executive Directors during the period

are included in the Directors' remuneration section of the Half

Year Review.

Full details of key management remuneration will be reported in

the Annual Report for the year ending 28 February 2015.

INDEPENDENT REVIEW REPORT TO STOBART GROUP LIMITED

Introduction

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 31 August 2014 which comprises the Condensed

Consolidated Income Statement, the Condensed Consolidated Statement

of Comprehensive Income, the Condensed Consolidated Statement of

Financial Position, the Condensed Consolidated Statement of Changes

in Equity and the Condensed Consolidated Cash Flow Statement and

the related explanatory notes. We have read the other information

contained in the half-yearly financial report and considered

whether it contains any apparent misstatements or material

inconsistencies with the information in the condensed set of

financial statements.

This report is made solely to the company in accordance with the

terms of our engagement to assist the company in meeting the

requirements of the Disclosure and Transparency Rules ("the DTR")

of the UK's Financial Conduct Authority ("the UK FCA"). Our review

has been undertaken so that we might state to the company those

matters we are required to state to it in this report and for no

other purpose. To the fullest extent permitted by law, we do not

accept or assume responsibility to anyone other than the company

for our review work, for this report, or for the conclusions we

have reached.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the DTR of the UK FCA.

As disclosed in note 1, the financial statements of the group

are prepared in accordance with IFRSs as adopted by the EU. The

condensed set of financial statements included in this half-yearly

financial report has been prepared in accordance with IAS 34

Interim Financial Reporting as adopted by the EU.

Our responsibility

Our responsibility is to express to the company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity issued by the Auditing Practices Board for use in the

UK. A review of interim financial information consists of making

enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures. A review is substantially less in scope than an audit

conducted in accordance with International Standards on Auditing

(UK and Ireland) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 31

August 2014 is not prepared, in all material respects, in

accordance with IAS 34 as adopted by the EU and the DTR of the UK

FCA.

Nicola Quayle

for and on behalf of KPMG LLP

Chartered Accountants

St James' Square, Manchester, M2 6DS

23 October 2014

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR FMMZGZZKGDZZ

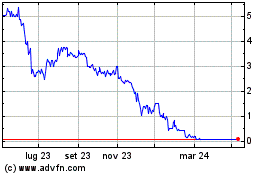

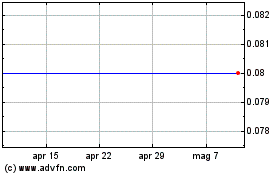

Grafico Azioni Esken (LSE:ESKN)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Esken (LSE:ESKN)

Storico

Da Lug 2023 a Lug 2024