TIDMSTOB

RNS Number : 6302X

Stobart Group Limited

21 November 2014

21 November 2014

Stobart Group Limited

("Stobart" or the "Group")

Financial Close and Long Term Supply Agreement on 20.2MW CHP

biomass plant

The Board of Stobart Group Limited, the Support Services and

Infrastructure group, is pleased to announce financial close on a

project to construct a GBP110m, 20.2MWe/ 7.8MWth combined heat and

power biomass plant ("CHP Plant") at the Group's site in Widnes. In

conjunction with the project the Group has signed a 16 year

index-linked fuel supply agreement.

The project will be the largest waste wood renewable energy

plant in the North West.

Highlights

The CHP plant is scheduled to commence operations in December

2016 and will generate returns for the Group's complementary

Energy, Infrastructure and Rail (Civil Engineering) divisions.

-- Stobart Energy will supply 146,000 tonnes p.a. of recycled

waste wood to the CHP Plant over 16 years (initial revenue of

GBP5.7m p.a., index linked over the life of the agreement, equating

to an estimated GBP108m)

-- Stobart Energy will operate an adjacent wood drying facility

using the heat from the CHP Plant. This facility will dry 140,000

tonnes p.a. of virgin wood material and produce an output of 90,000

tonnes p.a. for sale into the small scale market (expected revenue

of over GBP200m during the life of the agreement)

-- These volumes represent 24% of the increase required to

achieve Stobart Energy's fuel supply target of 2m tonnes p.a. by

2017/18

-- Stobart Infrastructure is investing GBP7.5m for a 40%

interest in the plant's holding company and will realise GBP2m from

the sale of the 4 acre site on which the CHP Plant and the wood

drying facility will be built

-- Stobart Rail (Civil Engineering) expects to generate around

GBP15m of civil engineering revenue from the project

Overview

Stobart Infrastructure is making an equity investment of GBP7.5m

for a 40% interest in the CHP Plant's holding company, Mersey

Bioenergy Ltd ("MBL"). The Green Investment Bank will provide 49%

of the equity (via its Foresight-managed fund) and Burmeister &

Wain Scandinavian Contractor A/S ("BWSC"), the project's

engineering, procurement and construction contractor, will take an

11% stake

Stobart and BWSC have been working together on the development

of the CHP Plant for a period of almost two years. BWSC will manage

the facility under a long-term operation and maintenance contract.

BWSC is a Danish company with an impressive track record of

delivering biomass plant projects around the world.

Investec Bank plc and Eksport Kredit Fonden are providing a

Senior Debt Facility of GBP42.5m to MBL for the development of the

plant. Mezzanine finance of GBP41.9m will be provided to MBL by GIB

and Gravis Capital Partners.

Stobart Energy

Stobart Energy will supply the CHP Plant with 146,000 tonnes of

waste wood material p.a. over a 16-year contractual period, with

initial revenue of GBP5.7m p.a., index-linked, equating to a

revenue stream of GBP108m over the life of the contract.

The plant will also produce 7.8MWth of heat, which Stobart

Energy has contracted to use in an adjacent wood drying facility.

This facility will be constructed by Stobart Rail at a cost of

GBP5m, and will receive 140,000 tonnes p.a. of virgin wood material

and dry this material to produce an output of 90,000 tonnes p.a.

Stobart Energy intends to sell this material into the

rapidly-expanding small scale wood chip and pellet market. The

expected revenue from drying facility operation will be over

GBP200m over the life of the agreement.

Stobart Infrastructure

Stobart Infrastructure will own the Group's investment in MBL.

The plant will be built on 4 acres of Stobart Infrastructure's

90-acre logistics hub in Widnes. The 4-acre site will be sold by

Stobart Infrastructure to MBL for GBP2m.

Stobart Rail (Civil Engineering)

Stobart Rail, which has a proven track record in construction

and engineering, will construct the dryer facility, procure the

equipment and install it. Stobart Rail also expects to generate

revenue as a civil works sub-contractor to BWSC for the

construction of the CHP Plant. The value of these two civil

construction contracts will be approximately GBP15m.

Richard Butcher, CEO Stobart Energy & Infrastructure

commented,

"This agreement secures an attractive energy investment for the

Group and will contribute 24% of the growth we need to achieve our

target of supplying 2m tonnes of fuel per annum into the UK biomass

market by 2017/18 from 1m tonnes per annum at present . It also

demonstrates the strength of our integrated infrastructure, energy

and engineering capabilities.

This CHP Plant will generate a strong return on investment in

the plant's equity as well as providing the Group with a 16 year

biomass fuel supply contract, a long-term wood drying income stream

and valuable engineering revenue on the development.

Increasingly, we are seen as being a very reliable fuel supplier

and so the partner of choice, which is why we are already the

leading UK supplier of biomass, a position which we anticipate

strengthening further"

A call for analysts with Stobart Group will be hosted at 9.30am

on Friday 21 November 2014. For dial in details contact

Stobart@redleafpr.com.

Enquiries:

Stobart Group +44 20 7851 9090

Andrew Tinkler, Group Chief Executive

Officer

Richard Butcher, CEO Energy & Infrastructure

Redleaf PR +44 20 7382 4730

Emma Kane Stobart@redleafpr.com

Rebecca Sanders-Hewett

Charlie Geller

influence Associates +44 20 7287 9610

Stuart Dyble

James Andrew

Notes to Editors

-- Focus on Energy and Aviation: Stobart Group is an

Infrastructure and Support Services business deriving income from

Energy, Aviation, Civil Engineering and Investments. Its strategy

is to drive growth and profitability in Energy and Aviation.

-- Growing volumes: Stobart sources, processes and delivers fuel

to power plants for third parties under long-term contracts.

Revenue growth comes from the ongoing increase in tonnages

supplied, which exceeded 900,000 tonnes in the year to February

2014.

-- Growing passenger numbers: Capital expenditure to develop

London Southend Airport is largely complete with the extension of

the terminal increasing capacity from one to five million

passengers. Growing passenger numbers from a broadly fixed cost

base will drive profitability.

-- Realising value: Stobart will continue to maximise value from

its property Investments to support maintained dividends.

-- Value creation: The Group realised a 51% interest in its

Transport & Distribution business and used the proceeds to

reduce its debt significantly, invest in its Infrastructure and

Energy divisions and return funds to shareholders.

-- Investing for growth: Stobart plans to invest in minority

stakes in sustainable CHP and anaerobic digestion plants over the

next two years.

-- Strengthened board:Stobart has significantly strengthened its

board with the appointment of former Tate & Lyle CEO Iain

Ferguson CBE as its new chairman and three new Non-Executive

Directors.

This information is provided by RNS

The company news service from the London Stock Exchange

END

AGRBCBDBIBDBGSG

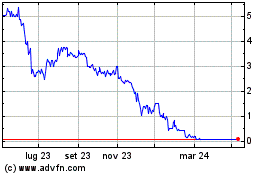

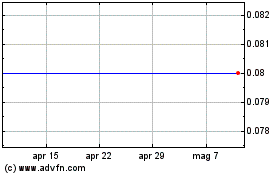

Grafico Azioni Esken (LSE:ESKN)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Esken (LSE:ESKN)

Storico

Da Lug 2023 a Lug 2024