TIDMSTOB

RNS Number : 8013E

Stobart Group Limited

11 May 2017

11 May 2017

Stobart Group Limited

("Stobart Group", "Stobart" or the "Group")

Results for the year ended 28 February 2017

Stobart Group Limited, the support services and infrastructure

group, today announces its results for the year ended 28 February

2017.

Introduction

-- All divisions have made good progress towards their stated

objectives during the year and Stobart continues to demonstrate

strong value creation across the business

-- Post year-end IPO of Eddie Stobart Logistics plc valued the

Group's 49% investment at GBP184.8m, significantly ahead of the

year-end carrying value of GBP58.4m and realised cash of

GBP113.3m

-- 50% increase in dividends with a proposed final dividend of

4.5p per share (18.0p per share annualised), payable in July 2017,

with further progressive quarterly dividends from this newly

established level

-- Andrew Tinkler, CEO is to focus on further value creation for

shareholders through a new structure, Stobart Capital, handing over

the CEO role to Warwick Brady, following the AGM, to deliver on and

develop the existing business strategic plan

Financial Highlights

28 February 29 February Growth

2017 2016

GBPm GBPm

Revenue from continuing

operations 129.4 126.7 +2.1%

Underlying EBITDA(1) 35.0 30.0 +16.8%

Underlying PBT(1) 27.4 18.4 +48.9%

Underlying basic EPS(2) 8.04p 4.95p +62.4%

------------ ------------ -------

-- Underlying profit before tax(1) up by 48.9% to GBP27.4m

-- Underlying basic EPS(2) increased by 62.4% to 8.04p

-- Statutory loss before tax of GBP8.0m (2016: GBP10m profit),

after deduction of non-underlying items of GBP35.4m including a

non-cash impairment of goodwill/credit for business purchase of

GBP21.6m

-- Post year-end sale and leaseback of eight ATR 72-600 aircraft

for net proceeds of GBP46.4m

Operational Highlights

-- Energy: Widnes and Tilbury processing sites commenced

operations, and Widnes biomass power plant close to completing four

month commissioning period

-- Aviation: Established 11 new routes from London Southend

Airport under the Flybe brand, operated by Stobart Air, delivering

up to 300,000 additional passengers by 2018; acquisition of

regional airline and aircraft leasing company

-- Rail: Successful delivery of Gospel Oak to Barking railway

electrification scheme on programme and under budget

-- Infrastructure: Significant value added and realised at Speke

and other sites generating net cash proceeds of GBP52.7m (2016:

24.1m)

(1) Underlying EBITDA and Underlying PBT are before

non-underlying items. See Financial Review for reconciliation to

(loss)/profit before tax.

(2) See Financial Review for underlying basic EPS.

Outlook

Already in the new financial year we have completed the partial

disposal of the Group's investment in Eddie Stobart Logistics plc,

generating cash and a significant profit for the Group and

demonstrating the ability of the Group's management team to

continue to create value for shareholders.

We are confident that the year ahead will see further progress

towards the clear objectives for each of the Group's three growth

operating divisions of Energy, Aviation and Rail and further value

creating realisations from our Infrastructure and Investments

assets.

Chief Executive Andrew Tinkler, commented:

"This year we have delivered improved underlying profitability

across the Group and put in place the foundations, management and

organisational structure to achieve our objectives.

We are on track to deliver our strategy by 2018 and drive

shareholder value through our three growth operating divisions,

whilst generating cash through the exit of our infrastructure and

investment portfolios at the right time, allowing increasing

returns to shareholders."

Results Presentation

A presentation for analysts and investors will be held today at

9.30am at The Andaz Hotel, 40 Liverpool Street, London, attendance

is by invitation only.

Enquiries:

Stobart Group c/o Redleaf Communications

Andrew Tinkler, Chief Executive

Officer

Redleaf Communications +44 20 7382 4730

Charlie Geller Stobart@redleafpr.com

Elise Palmer

Sam Modlin

Influence Associates +44 20 7287 9610

Stuart Dyble

James Andrew

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

Notes to Editor:

Stobart is an entrepreneurial support services and

infrastructure business deriving income from energy, aviation,

civil engineering and investments. The Group has a strong heritage

in logistics, systems and a customer focus that continues to

support all of our divisions. The Group's strategy is to drive

growth and profitability in its core Energy, Aviation and Rail

Divisions whilst realising value for shareholders from its

Infrastructure and Investments Divisions.

Chief Executive's Statement

I have been CEO of Stobart Group for almost 10 years and during

that time we have generated a compound shareholder return of around

10% p.a. We have also developed Energy and Aviation platforms to

deliver our targets to 2018 and beyond. The Group is now uniquely

placed as an entrepreneurial public limited company that creates

value, supported by its strong heritage in logistics and systems

and with a real focus on delivering great customer service. With a

market capitalisation of close to GBP800m, a strong balance sheet

and a progressive dividend policy, the Group is well placed to

continue to deliver strong returns to shareholders for the

foreseeable future.

Where are we today?

Stobart Group now comprises three core operating divisions in

sectors with real growth opportunities. Our Energy, Aviation and

Rail civil engineering businesses are all well placed for

profitable growth over the next five years. Our Infrastructure and

Investments divisions continue their programme of divestment,

creating further value for shareholders.

Energy - this year has been about establishing the foundations

of infrastructure, logistics and people to ensure our ability to

deliver on our long-term fuel supply contracts into over 20 biomass

plants around the UK. Widnes and Tilbury storage processing sites

are now up and running and those plants are progressing towards

commissioning. Development of other processing sites at Port

Clarence and Rotherham is also underway. A full management team is

now in place, focused on professionalising the industry to deliver

long-term sustainable supply and management of predominantly

recycled wood under long-term index-linked contracts.

Aviation - a significant year for the Aviation division with

continued development of our airport, London Southend, which we

believe will play a key part in providing capacity for the

constrained London air travel market. A London airport that has

technical capacity to handle 10m+ passengers, 45 minutes from

London, will over time be a very valuable asset for the Group. We

have consolidated our regional airline and aircraft leasing

businesses, taking full ownership, and will continue to develop our

valuable long-term franchise with Aer Lingus as well as support

Flybe in the Isle of Man and from our London Southend Airport.

Rail - our Rail business continues to support speciality work

for Network Rail as well as being a tier 2 supplier to the

industry. We expect to see continued growth under the Stobart

brand. The non-rail business has also supported infrastructure

projects in our Energy and Aviation divisions by providing an

efficient low-cost value engineering construction solution.

Infrastructure - our plan to divest non-core infrastructure

assets continues and we have delivered against our plan this year.

The business is also very good at providing asset management

initiatives working alongside our Rail division, and delivering

on-time and to budget.

Investments - the post year-end IPO of Eddie Stobart Logistics

plc valued the Group's 49% investment at GBP184.8m, significantly

ahead of the year-end carrying value of GBP58.4m and realised cash

of GBP113.3m. This is a great example of how we have created

significant value for the Group and our shareholders.

People

One of my personal business beliefs is to employ people that are

better than yourself and I see this as a strength from a

shareholder perspective as well as CEO.

Working together with our new Group CEO, Warwick Brady, whom I

have known for several years and worked closely alongside for the

last six months, I believe that we can bring extensive value to the

Group. I am strongly of the view that Warwick's industry-wide

knowledge and experience will help grow and support the entire

Group. I am confident that his business experience and

entrepreneurial approach will be a key part in the next chapter of

Stobart Group's value creation.

Energy - headed by Ben Whawell, CEO Stobart Energy and the

ex-Group CFO. We have worked together for the last 17 years and I

am confident that he has the skills and experience to move the

Energy business to the next level and create significant

shareholder value.

Aviation - this division includes airports, a regional airline

and an aircraft leasing company. These businesses all have

potential and are supported by our proven logistics expertise. The

teams within this division, led by Glyn Jones, will support Warwick

in delivery of our objectives.

Rail - Managing Director Kirk Taylor, of our Rail and non-rail

civil engineering business, has worked with me since 1994. He is

diligent and passionate about our business and can grow Rail to be

the number one specialist provider to the rail and construction

industry, as well as supporting the Group in any value-adding

infrastructure projects.

Whilst I am handing over the reins to lead and run Stobart Group

to Warwick, Ben, Glyn and Kirk, as the third largest shareholder, I

believe that we are now on the next stage of our journey that will

realise the significant potential of the Group over the coming

years.

As a key founder of Stobart Group, I am committed to remaining

on the Board for the foreseeable future and to supporting Warwick's

transition to Group CEO. I will support the Executive Management

team and the Board by devoting 50% of my time to the Group and the

delivery of further significant shareholder value.

The remainder of my time will be spent working with Richard

Butcher to deliver value in our Infrastructure and Investments

divisions and, in particular in launching and developing Stobart

Capital, bringing together the Group's investment activities under

a new value creation unit. This will be a platform, working

alongside external professionals and exploiting my entrepreneurial

skills and experience, to bring investment opportunities to the

Group that complement the strategy, and have the potential to

create further returns for shareholders.

I would like to thank Richard for his valued contribution to the

business over many years and also thank Mark for his work as

interim CFO over recent months.

Andrew Tinkler

Deputy Chief Executive's Statement

I am delighted to join Stobart Group at an exciting time when

the foundations in Energy, Aviation and Rail are ripe for further

development and growth.

I have worked with the Group since 2009 during the early stages

of developing London Southend Airport when I was Chief Operating

Officer at easyJet. My experience working with this entrepreneurial

team gave me insights into the value being created. This sparked my

interest and led me to follow the Group's progress over recent

years.

Over the years, I have forged a good working relationship with

Andrew Tinkler and once I left easyJet in September 2016, I spent

three months working very closely with Andrew and the Stobart Group

Board to understand the value of the Group but moreover, to see if

I could use my international experience from my early days in

Private Equity, through to my extensive aviation experience in

Europe, to support and lead the next chapter for the Stobart

Group.

I am particularly impressed by how the Group applies its

heritage in logistics and distribution across all the divisions as

well as how it embraces the customer service ethos. When combined

with being very entrepreneurial, culturally the Group fits with my

ambitions. I expect to use the foundations in Energy, Aviation and

Rail to continue creating value for shareholders over the

long-term.

Over the last six months I have very much enjoyed working with

the Board and Andrew but moreover believe there is a lot of

unlocked value and growth potential across our core divisions that

has yet to be realised. Whilst the foundations have been laid in

each division, with investment and a clear strategic direction, the

business can continue to grow. The Group has all the resources

available to support accelerated growth and then over time the

operating businesses will underpin the value creation for our

shareholders.

Energy Business

Having now toured several of the Group's processing sites and

plants, as well as spending time working with Ben and the team, I

can see that this business is all about logistics and distribution

so fits very well with the core expertise of the Group. With

several of the large energy plants coming on stream over the next

12 months, there will inevitably be a few challenges but I am

confident that the team will deliver on the overall targets. I

expect we will deliver 60% of the market's fuel supply into biomass

plants and this will underpin the financial returns for the next 20

years or so. I also see opportunities to grow the business through

operating and managing the energy plants and extending into other

forms of fuel that can leverage our current specialist transport

and logistics operation.

Aviation

Airport - The key to the value creation is our London airport

becoming part of the answer to London's travel growth within the

airport systems. The on-going London airport capacity constraints

will mean our London airport, with its great train links 45 minutes

from London, will be an opportunity for the Capital's travel market

to grow. London Southend Airport is London's best airport and the

infrastructure can support 10m+ passengers per year. The other

differentiator is that Stobart Group provides all the services

across the airport from operating the railway station, owning and

operating our 4* hotel under the Holiday Inn brand, our food and

beverage outlets, car parking and solar farm. These all create

additional value for the Group and will be an important part of

further developing London's best airport.

There is also a lot of space to develop our property assets at

the airport which could be used for maintenance and other

businesses. It is truly remarkable that we will be able to create a

London airport capable of delivering 10m+ passengers per year for

under GBP200m, so the capital efficiency is impressive.

Airline and Aircraft Leasing - Our regional airline, Stobart

Air, based in Dublin, operates under a valuable long-term franchise

with Aer Lingus which we believe will be an important support for

IAG's focus on growing its transatlantic traffic through the Dublin

hub. Stobart Air also operates for Flybe and, in the future, will

operate regional jets under the Flybe brand to support the growth

of our London airport. Our

aircraft leasing business, Propius, supports Stobart Air and

together they will be developed to create more value for the Group.

From my perspective, the UK and Europe's regional airline market

would benefit from some type of consolidation to ensure the

capacity supports profitable regional connectivity.

Ground Handling and Support Services - The Group already

provides ground handling services and given its expertise in

logistics, distribution and customer services, we plan to grow this

business in the UK and Europe.

Stobart Exec Jet Centre - With c.100,000 private jet movements

into the London market per year, our Exec Jet Centre is well placed

to offer a great service by connecting product into London. With a

clear plan to grow this business, we believe over time it will

become a key part of London's executive aviation offering. The

Group is well set-up for growing these small but established

businesses and capitalising on the current opportunities in the

market.

Rail

Our Stobart Rail team is highly regarded in the Industry and

provides valuable tier 2 specialist services to Network Rail and

its tier 1 partners. Its real competitive advantage is the team's

innovative approach to developing equipment, systems and people to

deliver significant value to the customer. Stobart Rail is renowned

for operating strongly under critical time constraints and

delivering quality work on time and to budget.

On the non-rail side, the team are specialists in building

distribution centres, airports, racecourses etc. Together with an

innovative approach, design capability, planning and low cost

execution, they provide value engineering across the Group. They

have supported the Group by building processing sites for Stobart

Energy as well as providing specialist infrastructure projects at

the airport including taxiways, runway works etc. This provides the

Group with a real competitive advantage by being able to deliver

infrastructure at competitive costs.

Overall, after a lot of due diligence and time spent within

Stobart Group, I see an opportunity to use the foundations to grow

the Group over the next few years. We will aim to remain a very

entrepreneurial team with Andrew Tinkler supporting as an Executive

Director to ensure we do not lose our "founders mentality" of

creating value and operating in an agile way. This will ensure that

we continue to grow the business to deliver sustainable and

progressive returns for shareholders for years to come.

Warwick Brady

Financial Review

We are pleased to report improved underlying profitability,

across the majority of our divisions, and further progress towards

delivering against our medium-term financial objectives.

Revenue 2017 2016

GBP'm GBP'm Growth

---------------- ------- ------- -------

Energy 67.7 73.4 -7.8 %

Aviation 28.1 22.9 +22.8%

Rail 48.1 46.2 +4.2%

Investments - - -

Infrastructure 6.0 4.3 +39.8%

Eliminations (20.5) (20.1) +2.2%

---------------- ------- ------- -------

129.4 126.7 +2.1%

---------------- ------- ------- -------

Revenue from continuing operations has grown by 2.1% to

GBP129.4m driven by increased revenue in our Aviation division,

following the acquisition of the airline, Stobart Air. External

revenue in our Rail division also increased by 6.1% to

GBP30.5m.

Profitability 2017 2016

GBP'm GBP'm Growth

----------------------------------- ------- ------ -------

Underlying EBITDA(1)

Energy 10.2 9.1 +12.7%

Aviation 0.1 3.6 -97.1%

Rail 3.9 3.4 +15.5%

Investments 9.4 9.8 -4.1%

Infrastructure 18.9 10.5 +81.0%

Central function and eliminations (7.5) (6.4) -18.1%

----------------------------------- ------- ------ -------

Underlying EBITDA 35.0 30.0 +16.8%

Impact of fuel swaps 1.4 (2.2)

Depreciation (9.4) (8.4)

Finance costs (net) 0.4 (1.0)

----------------------------------- ------- ------ -------

Underlying profit before

tax 27.4 18.4 +48.9%

Non-underlying items (35.4) (8.4)

----------------------------------- ------- ------ -------

(Loss)/profit before tax (8.0) 10.0

Tax (1.2) (1.2)

(Loss)/profit for the

year (9.2) 8.8

----------------------------------- ------- ------ -------

(1) Underlying EBITDA represents (loss)/profit before tax and

before fuel swaps, interest, depreciation, amortisation and

non-underlying items.

Underlying EBITDA

Underlying Group EBITDA is our key measure of profitability for

the business and has grown by 16.8% to GBP35.0m. The Energy

division has improved underlying profitability in spite of a

decline in revenue following a customer entering administration.

Infrastructure profitability increased by GBP8.4m, following the

successful disposal of our Speke site. The Aviation division made

two acquisitions during the latter part of the year, which had an

adverse impact on profitability due to the seasonal nature of the

airline industry.

Central function costs and eliminations have increased by 18.1%

partially due to an increase in the share-based payment charge and

professional fees.

Depreciation

Depreciation has increased by 11.2% to GBP9.3m, due to

investment in processing sites and equipment within the Energy

division.

Finance Costs

Finance costs (net) increased from GBP1.0m cost to GBP0.4m

income, with a higher level of interest received on loans to

associates and joint ventures.

Non-Underlying Items 2017 2016

GBP'm GBP'm

--------------------------------- ------ ------

Amortisation of brand 3.9 3.9

Transaction costs/restructuring

cost 2.1 0.4

Contract set up costs 3.0 1.2

Bad debt write-off 1.9 -

Impairment of goodwill/credit 21.7 -

for business purchase

Share of post-tax profits of

associates and JVs:

Amortisation of contracts 2.8 2.9

35.4 8.4

--------------------------------- ------ ------

The charges in relation to the non-cash amortisation of the

brands and contracts are expected to continue in future periods. We

incurred GBP3.0m of contract set-up costs in the Energy division.

GBP1.0m of these costs were incurred in prior periods and there

were other excess costs in connection with delayed commissioning of

biomass plants. The bad debt write-off relates to a customer that

entered administration in the Energy division. Transaction costs

and the impairment of goodwill relate to the acquisitions and

aborted transactions in the Aviation division.

Taxation

The tax charge of GBP1.2m (2016: GBP1.2m) reflects a negative

effective tax rate of 14.4% (2016: 12.0% positive). The effective

rate is lower than the standard rate of 20.0% mainly due to the

write-off of goodwill and income in respect of the Group's post-tax

share of joint venture results being treated as non-taxable, and

the effect of the change in corporate tax rate on deferred tax

balances.

Business Segments

The business segments reported in the financial statements are

unchanged from those reported in the prior year. The segments are

Energy, Aviation, Rail, Infrastructure and Investments,

representing the operational and reporting structure of the Group.

The results of our aircraft leasing business, Propius, have

transferred from Investments to Aviation following its acquisition,

and the prior year's figures have been restated.

Earnings per Share

Earnings per share from underlying continuing operations were

8.0p (2016: 5.0p). Total basic earnings per share were 2.7p loss

(2016: 2.7p profit).

Dividends and Share Disposals 2017 2016

Interim per share 9.0p 2.0p

Final per share 4.5p 4.0p

Total per share 13.5p 6.0p

------------------------------- ------ -----

The Board has proposed a final dividend of 4.5p per share which,

subject to the approval of shareholders at the AGM, will be payable

to investors on the record date of 16 June 2017, with an

ex-dividend date of 15 June 2017, and will be paid on 7 July

2017.

During the year, the Group sold 10.1m of its treasury shares for

a net amount of GBP15.0m to fund the Propius acquisition. At the

year end, there were no shares held in treasury.

Balance Sheet 2017 2016

GBP'm GBP'm

------------------------- -------- -------

Non-current assets 510.4 453.3

Current assets 155.5 109.3

Non-current liabilities (189.6) (94.4)

Current liabilities (88.8) (54.5)

Net assets 387.5 413.7

------------------------- -------- -------

The net asset position has decreased by GBP26.2m in the year to

GBP387.5m at 28 February 2017, mainly due to the non-cash write-off

of goodwill arising on the acquisition of Everdeal Holdings

Limited.

Non-Current Assets

Property, plant and equipment of GBP326.3m (2016: GBP218.0m) has

increased following the acquisition of Propius and assets acquired

for the new biomass processing sites. The net book value of the

eight aircraft owned by Propius at the year-end was GBP100.7m.

During the year GBP14.5m (2016: GBP49.1m) of asset investment

has been made, comprising the cash purchases of property, plant and

equipment and net advances to biomass plant investments.

Investment in associates and joint ventures of GBP59.2m (2016:

GBP62.7m) include the Group's 49% share of the Eddie Stobart

Logistics business. The reduction is due to Propius Holdings

Limited being classified as a subsidiary at the year end, following

its acquisition. Investment property of GBP3.2m (2016: GBP47.0m)

represents the holding of one (2016: four) property.

Amounts owed by associates and joint ventures of GBP13.4m (2016:

GBP13.4m) represents interest-bearing loans to renewable energy

plant investments in which we also hold equity interests.

Intangible assets of GBP108.4m (2016: GBP112.3m) include the

Stobart and Eddie Stobart brands and goodwill, which principally

relates to the Energy division.

Current Assets and Current Liabilities

Current assets include GBP60.0m (2016: GBP44.4m) of development

land assets. Excluding these assets, the net current assets at

year-end total GBP6.7m (2016: GBP10.3m).

Debt and Gearing

2017 2016

Net debt - asset backed finance GBP109.5m GBP31.4m

- other GBP11.2m GBP16.6m

Underlying EBITDA/underlying

interest 92.5 31.2

Gearing 31.1% 11.6%

Operating lease commitments GBP45.8m GBP48.0m

as lessee

Operating lease rentals receivable GBP53.9m GBP41.5m

as lessor

------------------------------------ ---------- ---------

The Group acquired aircraft related debt of GBP70.7m following

the acquisition of Propius Holdings Limited. The debt at 28

February 2017 was GBP71.1m which was ringfenced and fully repaid

post year end.

During the year, the Group increased its variable rate committed

revolving credit facility with Lloyds Bank plc from GBP50.0m to

GBP65.0m until 31 March 2019, when the facility reduces back to

GBP50.0m until the end date of 31 January 2020. At the year end,

the Group has drawn GBP42.2m of the GBP65.0m facility.

Operating lease rentals receivable as lessor increased.

Cash Flow

2017 2016

GBP'm GBP'm

---------------------- ------- -------

Operating cash flow (1.7) 3.4

Investing activities 40.0 (13.6)

Financing activities (17.5) 14.3

---------------------- ------- -------

Increase in the year 20.8 4.1

At beginning of year 9.8 5.7

---------------------- ------- -------

Cash at end of year 30.6 9.8

---------------------- ------- -------

Net cash inflow from investing activities included the Speke

investment property disposal (GBP36.9m), acquisition of subsidiary

undertakings net of cash acquired (GBP7.7m) and net proceeds from

the disposal of two properties (GBP15.8m). These inflows were

offset by net cash outflows relating to purchase of property, plant

and equipment (GBP14.5m) and the equity investments in associates

and joint ventures (GBP12.5m).

Net cash outflow from financing activities included the

repayment of borrowing and finance leases (GBP10.9m) and dividends

paid on ordinary shares (GBP34.7m). These were offset by the net

draw down of GBP15.2m from the Lloyds RCF and net proceeds from the

disposal of treasury shares of GBP15.0m.

Economic Outlook

Following the UK's referendum vote to leave the membership of

the EU, management continues to monitor the implications for the

Group. The Group and its customers are predominantly UK based and

though there have been some effects on US dollar denominated costs

in the airline, this has been partly offset by the US dollar

denominated assets in the leasing company. The Group benefits from

diverse assets and sources of income, and its entrepreneurial

culture leaves it well placed to respond to future developments and

opportunities.

Post Balance Sheet Events

In April 2017, the Group entered an arrangement to sell and

leaseback eight ATR 72-600 aircraft. The Group received net

proceeds of $62.7m (GBP50.2m) after repayment of existing financing

in respect of the aircraft of $85.3m (GBP68.2m), including

refundable deposits withheld of $3.8m (GBP3.0m) and $1.0m (GBP0.8m)

in rental payments.

On 25 April 2017, the Group disposed of its 49% investment in

Greenwhitestar Holding Company 1 Limited and Greenwhitestar Finance

Limited for consideration comprising cash of GBP113.3m and a 12.5%

shareholding in Eddie Stobart Logistics plc. Eddie Stobart

Logistics plc was admitted to AIM on 25 April 2017 and the 12.5%

shareholding was valued at GBP71.5m on admission.

Consolidated Income Statement

For the year ended 28 February 2017

Year ended 28 February Year ended 29 February

2017 2016

Underlying Non-underlying Total Underlying Non-underlying Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 129,403 - 129,403 126,730 - 126,730

----------- --------------- ---------- ----------- --------------- ----------

Gain in value/profit

on disposal of

investment properties 14,614 - 14,614 8,441 - 8,441

Profit on disposal

of assets held

for sale 2,747 - 2,747 259 - 259

Profit on disposal

of property, plant

and equipment 3,480 - 3,480 183 - 183

Gain/(loss) on

fuel swaps 1,354 - 1,354 (2,184) - (2,184)

Impairment of

goodwill/credit

for business purchase - (21,646) (21,646) - - -

Other (134,355) (10,892) (145,247) (125,227) (5,547) (130,774)

Total operating

expenses (112,160) (32,538) (144,698) (118,528) (5,547) (124,075)

Share of post-tax

profits of associates

and joint ventures 9,715 (2,839) 6,876 11,130 (2,835) 8,295

----------- --------------- ---------- ----------- --------------- ----------

Operating profit/(loss) 26,958 (35,377) (8,419) 19,332 (8,382) 10,950

Finance costs (2,532) - (2,532) (2,302) - (2,302)

Finance income 2,925 - 2,925 1,343 - 1,343

----------- ---------------

Profit/(loss)

before tax 27,351 (35,377) (8,026) 18,373 (8,382) 9,991

Tax 255 (1,413) (1,158) (2,124) 927 (1,197)

----------- --------------- ----------

Profit/(loss)

for the year 27,606 (36,790) (9,184) 16,249 (7,455) 8,794

----------- --------------- ----------

Earnings/(loss) per share expressed in pence per

share

Basic 8.04p (2.67)p 4.95p 2.68p

Diluted 8.04p (2.67)p 4.94p 2.68p

----------- ---------- ----------- ----------

Consolidated Statement of Comprehensive Income

For the year ended 28 February 2017

Year ended Year ended

28 February 29 February

2017 2016

GBP'000 GBP'000

(Loss)/profit for the year (9,184) 8,794

Foreign currency translation

differences - equity accounted

joint ventures 1,848 1,564

Interest rate swap - equity

accounted associates 140 -

Foreign currency translation

differences - equity accounted

associates 878 (727)

Exchange differences on translation

of foreign operations 219 -

Other comprehensive income

to be reclassified to profit

or loss in subsequent years,

net of tax 3,085 837

Remeasurement of defined benefit

plan (3,270) (681)

Tax on items relating to components

of other comprehensive income 556 60

Other comprehensive expense

not being reclassified to

profit or loss in subsequent

years, net of tax (2,714) (621)

Other comprehensive income

for the year, net of tax 371 216

------------- -------------

Total comprehensive (expense)/income

for the year (8,813) 9,010

------------- -------------

Consolidated Statement of Financial Position

As at 28 February 2017

28 February 29 February

2017 2016

GBP'000 GBP'000

Non-current assets

Property, plant and equipment

- Land and buildings 156,458 169,327

- Plant and machinery 49,675 28,246

- Fixtures, fittings and

equipment 1,682 705

- Commercial vehicles and

aircraft 118,475 19,689

------------ ------------

326,290 217,967

Investment in associates

and joint ventures 59,198 62,699

Investment property 3,150 46,965

Intangible assets 108,358 112,296

Trade and other receivables 13,401 13,401

------------ ------------

510,397 453,328

------------ ------------

Current assets

Inventories 63,728 45,083

Trade and other receivables 48,066 48,950

Cash and cash equivalents 30,653 9,858

Assets held for sale 13,106 5,354

155,553 109,245

------------ ------------

Total assets 665,950 562,573

------------ ------------

Non-current liabilities

Loans and borrowings (133,072) (48,892)

Defined benefit pension

scheme (5,705) (2,708)

Other liabilities (21,600) (19,786)

Deferred tax (21,083) (18,290)

Provisions (8,176) (4,699)

------------ ------------

(189,636) (94,375)

------------ ------------

Current liabilities

Trade and other payables (61,487) (38,239)

Loans and borrowings (18,287) (8,958)

Corporation tax (7,098) (7,090)

Provisions (1,908) (242)

(88,780) (54,529)

------------ ------------

Total liabilities (278,416) (148,904)

------------ ------------

Net assets 387,534 413,669

============ ============

Capital and reserves

Issued share capital 35,434 35,434

Share premium 301,326 301,326

Foreign currency exchange

reserve 2,766 (179)

Reserve for own shares held

by employee benefit trust (330) (330)

Retained earnings 48,338 77,418

Group shareholders' equity 387,534 413,669

============ ============

Consolidated Statement of Changes in Equity

For the year ended 28 February 2017

Reserve

Foreign for own

Issued currency shares

share Share exchange held Retained Total

capital premium reserve by EBT earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- --------- --------- ---------- --------- ---------- ---------

Balance at 1

March 2016 35,434 301,326 (179) (330) 77,418 413,669

Loss for the

year - - - - (9,184) (9,184)

Other comprehensive

income/(expense)

for the year - - 2,945 - (2,574) 371

--------------------- --------- --------- ---------- --------- ---------- ---------

Total comprehensive

income/(expense)

for the year - - 2,945 - (11,758) (8,813)

Employee benefit

trust - - - - 587 587

Share-based

payment credit - - - - 1,000 1,000

Tax on share-based

payment credit - - - - 857 857

Sale of treasury

shares - - - - 15,042 15,042

Purchase of

treasury shares - - - - (81) (81)

Dividends - - - - (34,727) (34,727)

Balance at 28

February 2017 35,434 301,326 2,766 (330) 48,338 387,534

--------------------- --------- --------- ---------- --------- ---------- ---------

Consolidated Statement of Changes in Equity

For the year ended 29 February 2016

Reserve

for

Foreign own

Issued currency shares

share Share exchange held Retained Total

capital premium reserve by EBT earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- --------- --------- ---------- -------- ---------- ---------

Balance at 1

March 2015 35,434 301,326 (1,016) (330) 70,834 406,248

Profit for the

year - - - - 8,794 8,794

Other comprehensive

income/(expense)

for the year - - 837 - (621) 216

--------------------- --------- --------- ---------- -------- ---------- ---------

Total comprehensive

income/(expense)

for the year - - 837 - 8,173 9,010

Share-based payment

credit - - - - 648 648

Tax on share-based

payment credit - - - - 79 79

Sale of treasury

shares - - - - 17,360 17,360

Dividends - - - - (19,676) (19,676)

Balance at 29

February 2016 35,434 301,326 (179) (330) 77,418 413,669

--------------------- --------- --------- ---------- -------- ---------- ---------

Consolidated Statement of Cash Flows

For the year ended 28 February 2017

Year ended Year ended

28 February 29 February

2017 2016

GBP'000 GBP'000

Cash (used in)/generated

from continuing operations (1,720) 159

Income taxes refunded - 3,246

------------- -------------

Net cash (outflow)/inflow

from operating activities (1,720) 3,405

Purchase of property, plant

and equipment and investment

property (14,496) (45,283)

Proceeds from grants 3,925 -

Proceeds from the sale of

property, plant and equipment

and investment property 47,063 7,340

Proceeds from disposal of

assets held for sale 7,328 7,359

Acquisition of subsidiary

undertakings (net of cash

acquired and fees) 7,664 -

Proceeds from sale and leaseback

(net of fees) - 16,769

Refundable deposit advanced (1,618) -

Distributions from joint

ventures 2,926 4,264

Non-underlying transaction (400) -

costs

Equity investment in associates (12,455) -

and joint ventures

Net amounts advanced to joint

ventures - (3,768)

Other loans advanced - (300)

Interest received 302 29

Cash inflow from discontinued (235) -

operations

------------- -------------

Net cash inflow/(outflow)

from investing activities 40,004 (13,590)

------------- -------------

Dividend paid on ordinary

shares (34,727) (19,676)

Repayment of capital element

of finance leases (10,942) (8,402)

Net drawdown from revolving

credit facility 15,197 26,812

Sale of treasury shares,

net of costs 14,961 17,360

Interest paid (1,978) (1,767)

Net cash (outflow)/inflow

from financing activities (17,489) 14,327

------------- -------------

Increase in cash and cash

equivalents 20,795 4,142

------------- -------------

Cash and cash equivalents

at beginning of year 9,858 5,716

------------- -------------

Cash and cash equivalents

at end of year 30,653 9,858

------------- -------------

Notes to the Consolidated Financial Statements

For the year ended 28 February 2017

Accounting Policies of Stobart Group Limited

Basis of Preparation and Statement of Compliance

The principal accounting policies adopted in the preparation of

the financial statements are set out below. The policies have been

consistently applied to all the years presented, unless otherwise

stated.

These Group financial statements have been prepared in

accordance with International Financial Reporting Standards (IFRSs

and IFRIC interpretations) as adopted by the European Union

('adopted IFRSs').

The financial statements of the Group are also prepared in

accordance with the Companies (Guernsey) Law 2008.

Stobart Group Limited is a Guernsey registered company. The

Company's ordinary shares are traded on the London Stock

Exchange.

Going Concern

The Group's business activities, together with factors likely to

affect its future performance and position, are set out in the

Chief Executive's Statement and the financial position of the

Group, its cash flows and funding are set out in the Financial

Review.

The Group has considerable financial resources, together with

contracts with a number of customers and suppliers. The financial

forecasts show that the Group's remaining borrowing facilities are

adequate such that the Group can operate within these facilities

and meet its obligations when they fall due for at least 12

months.

After making enquiries, the Directors have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future. Accordingly, the

financial statements have been prepared on a going concern

basis.

Segmental Information

The reportable segment structure is determined by the nature of

operations and services. The operating segments are Stobart Energy,

Stobart Aviation, Stobart Rail, Stobart Investments and Stobart

Infrastructure.

The Stobart Energy segment specialises in the supply of

sustainable biomass for the generation of renewable energy.

The Stobart Aviation segment specialises in the operation of

commercial airports, airline operations and aircraft leasing.

The Stobart Rail segment specialises in delivering internal and

external civil engineering development projects including rail

network operations.

The Stobart Investments segment holds a non-controlling interest

in a transport and distribution business.

The Stobart Infrastructure segment specialises in management,

development and realisation of a portfolio of property assets as

well as investments in biomass energy plants.

The Executive Directors are regarded as the Chief Operating

Decision Maker. The Directors monitor the results of each business

unit separately for the purposes of making decisions about resource

allocation and performance assessment. The main segmental profit

measure is underlying EBITDA, which is calculated as profit/(loss)

before tax, interest, depreciation, amortisation and before fuel

swaps and non-underlying items. The aircraft leasing business joint

venture was included in the Investments segment in the prior year's

annual report segmental information note. This business became a

subsidiary during the year and has been included in the Aviation

segment in the segmental analysis in the current year. The prior

year figures for the aircraft leasing business, which were included

in the Investments segment in the prior year's annual report, have

been restated to be consistent. This is considered to better

reflect the management of the business.

Income taxes, finance costs and certain central costs are

managed on a Group basis and are not allocated to operating

segments.

Year ended 28 Adjustments

February 2017 Energy Aviation Rail Investments Infrastructure and eliminations Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue

External 60,811 27,499 30,527 - 5,532 5,034 129,403

Internal 6,905 599 17,547 - 493 (25,544) -

-------- --------- -------- ------------ --------------- ------------------ ---------

Total revenue 67,716 28,098 48,074 - 6,025 (20,510) 129,403

-------- --------- -------- ------------ --------------- ------------------ ---------

Underlying EBITDA 10,242 107 3,919 9,378 18,934 (7,598) 34,892

-------- --------- -------- ------------ --------------- ------------------ ---------

(Loss)/gain on

fuel swaps - (11) - - - 1,365 1,354

Depreciation (3,794) (4,186) (1,045) - (84) (269) (9,378)

Interest 8 (533) (179) - 1,613 (516) 393

-------- --------- -------- ------------ --------------- ------------------ ---------

Underlying profit/(loss)

before tax 6,456 (4,623) 2,695 9,378 20,463 (7,018) 27,351

-------- --------- -------- ------------ --------------- ------------------ ---------

New business and

new contract set

up costs (2,999) - - - - - (2,999)

Restructuring

costs (83) - - - - - (83)

Transaction costs - - - - - (2,003) (2,003)

Bad debt write-off (1,869) - - - - - (1,869)

Amortisation of

acquired intangibles (221) - - - - (3,717) (3,938)

Impairment of

goodwill/credit

for business purchase - - - - - (21,646) (21,646)

Non-underlying

items included

in share of post-tax

profits of associates

and joint ventures - - - (2,839) - - (2,839)

-------- --------- -------- ------------ --------------- ------------------ ---------

Profit/(loss)

before tax 1,284 (4,623) 2,695 6,539 20,463 (34,384) (8,026)

-------- --------- -------- ------------ --------------- ------------------ ---------

Restated

Year ended 29 Adjustments

February 2016 Energy Aviation Rail Investments Infrastructure and eliminations Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue

External 66,009 22,864 28,783 - 4,090 4,984 126,730

Internal 7,439 11 17,374 - 219 (25,043) -

-------- --------- -------- ------------ --------------- ------------------ --------

Total revenue 73,448 22,875 46,157 - 4,309 (20,059) 126,730

-------- --------- -------- ------------ --------------- ------------------ --------

Underlying EBITDA 9,085 3,665 3,393 9,780 10,459 (6,431) 29,951

-------- --------- -------- ------------ --------------- ------------------ --------

Loss on fuel swaps - - - - - (2,184) (2,184)

Depreciation (2,909) (3,957) (1,276) - (48) (245) (8,435)

Interest (22) (180) (216) - 1,006 (1,547) (959)

-------- --------- -------- ------------ --------------- ------------------ --------

Underlying profit/(loss)

before tax 6,154 (472) 1,901 9,780 11,417 (10,407) 18,373

-------- --------- -------- ------------ --------------- ------------------ --------

New business and

new contract set

up costs - (1,214) - - - - (1,214)

Transaction costs - - - - - (395) (395)

Amortisation of

acquired intangibles (221) - - - - (3,717) (3,938)

Non-underlying

items included

in share of post

tax profits of

associates and

joint ventures - - - (2,835) - - (2,835)

-------- --------- -------- ------------ --------------- ------------------ --------

Profit/(loss)

before tax 5,933 (1,686) 1,901 6,945 11,417 (14,519) 9,991

-------- --------- -------- ------------ --------------- ------------------ --------

No segmental assets or liabilities information is disclosed

because no such information is regularly provided to, or reviewed

by, the Chief Operating Decision Maker.

Inter-segment revenues are eliminated on consolidation. Included

in adjustments and eliminations are net central costs of

GBP6,754,000 (2016: GBP10,257,000) and an intra-group profit of

GBP264,000 (2016: GBP150,000). There is also external income within

adjustments and eliminations which comprises brand licence income,

merchandising income and income from other business services.

Business Combinations

On 24 February 2017, the Group acquired the remaining 33.3% of

the ordinary shares in Propius Holdings Limited (Propius). Propius

is registered in the Cayman Islands. The principal activity of

Propius is aircraft leasing. Together with the existing 66.7%

already owned by the Group prior to the acquisition, this gave the

Group control over Propius.

Control was only deemed to be obtained on 24 February 2017, due

to the existence of a previously held shareholder agreement.

The primary reason for the acquisition was to give the Group

more control over its ability to grow and develop its aviation

operations across the UK, Ireland and Europe.

The provisional fair values of the identifiable assets and

liabilities of Propius as at the date of acquisition are as

follows:

Provisional

fair value

recognised

on

acquisition Book Value

GBP000 GBP000

Property, plant and equipment 100,135 100,135

Trade and other receivables 933 933

Cash and cash equivalents 14,406 14,406

Loans and borrowings (70,742) (66,797)

Trade and other payables (818) (818)

Maintenance deposits - (11,704)

Deferred tax liabilities (2,651) (1,691)

Net identifiable assets

and liabilities 41,263 34,464

============ ==========

Consideration paid:

Cash 11,763

Fair value of existing equity

interest 28,149

Total consideration 39,912

============

Excess fair value of net

assets over consideration 1,351

============

The consideration comprised cash of GBP11,763,000 and the

existing owned proportion of the fair value of the net assets at

acquisition date of GBP28,149,000. There was no contingent

consideration as defined in IFRS 3 'Business Combinations' in

connection with this acquisition. The Group incurred

acquisition-related transaction costs of GBP1,402,000. These costs

have been included in non-underlying other operating expenses in

the Group's Consolidated Income Statement.

Immediately prior to this acquisition, the Group owned 66.7% of

Propius which was disclosed as an equity accounted joint venture

with a carrying value of GBP22,771,000.

The difference of GBP5,378,000, between this carrying value of

GBP22,771,000 and the existing owned proportion of the net assets

at acquisition date of GBP28,149,000, has been recognised in the

Consolidated Income Statement within impairment of goodwill/credit

for business purchase.

The excess of fair value of net assets over consideration of

GBP1,351,000 has been taken to the Consolidated Income Statement,

and is disclosed within impairment of goodwill/credit for business

purchase. Due to fair value adjustments and the transaction being

completed at a later date than the price being agreed, net assets

exceeded consideration.

In the four days to 28 February 2017, the subsidiary contributed

net profit of GBP34,000 to the consolidated loss for the year. If

the acquisition had occurred on the first day of the accounting

period, Group revenue would have been an estimated GBP12,152,000

higher before elimination of intra-group trading and net profit

would have been an estimated GBP1,811,000 higher, excluding share

of profits already recognised.

Acquisition of Everdeal Holdings Limited

On 8 February 2017, the Group acquired the remaining 19% of the

ordinary shares in Everdeal Holdings Limited (Everdeal). Everdeal

is registered in Ireland. The principal activity of Everdeal is the

operation of an airline. Eight of the aircraft in the Everdeal

fleet are leased from the group headed by Propius Holdings

Limited.

Control was only deemed to be obtained on 8 February 2017, due

to clauses within the Articles of Association.

The primary reason for the acquisition was to give the Group

more control over its ability to grow and develop its aviation

operations across the UK, Ireland and Europe. Although Everdeal had

book value net liabilities of GBP26.9m on acquisition, the

Directors are satisfied that their future actions can have a

positive impact on the financial position and performance of this

business.

The acquisition had the following effect on the Group's assets

and liabilities:

Provisional

fair value

recognised

on Book

acquisition value

GBP000 GBP000

Property, plant and equipment 1,158 1,158

Inventory 3,066 3,282

Trade and other receivables 6,256 6,256

Cash and cash equivalents 7,188 7,188

Loans and borrowings (7,843) (7,843)

Trade and other payables (27,530) (27,530)

Maintenance reserve liability (3,728) (6,813)

Deferred tax liabilities (386) -

Provisions (5,992) (2,584)

Net identifiable assets

and liabilities (27,811) (26,886)

============ ========

Consideration paid:

Cash 564

Fair value of existing

equity interest -

Total consideration 564

============

Goodwill 28,375

============

The consideration comprised cash of GBP564,000 and the existing

owned proportion of the fair value of the net assets at acquisition

date of GBPnil. There was no contingent consideration as defined in

IFRS 3 'Business Combinations' in connection with this acquisition.

The Group incurred acquisition-related transaction costs of

GBP200,000. These costs have been included in non-underlying other

operating expenses in the Group's Consolidated Income

Statement.

Immediately prior to this acquisition, the Group owned 81% of

Everdeal which was disclosed as an equity accounted associate with

a carrying value of GBPnil. There was no resulting gain or loss

taken to the income statement following remeasurement of this

investment.

In the 20 days to 28 February 2017, the subsidiary contributed a

net loss of GBP1,064,000 to the consolidated loss for the year. If

the acquisition had occurred on the first day of the accounting

period, Group revenue would have been an estimated GBP111,364,000

higher and net profit would have been an estimated GBP1,177,000

higher.

Following an impairment review, during which the future

forecasts of the business were reviewed, the goodwill arising on

acquisition was written off in full in the Consolidated Income

Statement and disclosed within impairment of goodwill/credit for

business purchase.

Non-Underlying Items

Non-underlying items included in the Consolidated Income

Statement comprise the following:

Operating expenses 2017 2016

GBP'000 GBP'000

-------------------------------------- -------- --------

New business and new contract

set up costs 2,999 1,214

Transaction costs 2,003 395

Restructuring costs 83 -

Bad debt write-off 1,869 -

Amortisation of acquired intangibles 3,938 3,938

Impairment of goodwill/credit 21,646 -

for business purchase

-------------------------------------- -------- --------

32,538 5,547

-------------------------------------- -------- --------

Share of post-tax profits of 2017 2016

associates and joint ventures

GBP'000 GBP'000

-------------------------------------- -------- --------

Amortisation of acquired intangibles 2,839 2,835

-------------------------------------- -------- --------

2,839 2,835

-------------------------------------- -------- --------

New business and new contract set up costs comprise costs of

investing in major new business areas or major new contracts to

commence or accelerate development of our business presence. The

costs in the current year were in relation to the development of

the Energy business, principally pre-contract costs and excess

costs incurred due to delays in customer plants becoming

operational.

Transaction costs comprise costs of making investments or costs

of financing transactions that are not permitted to be debited to

the cost of investment or as issue costs. These costs include costs

of any aborted transactions.

Restructuring costs comprise costs of integration plans and

other business reorganisation and restructuring undertaken by

management. Costs include cost rationalisation, site closure costs,

certain short-term duplicated costs and other costs related to the

reorganisation and integration of businesses. These are principally

expected to be one-off in nature.

The bad debt write-off relates to a significant receivable,

written off due to the customer entering administration.

Amortisation of acquired intangibles comprises the amortisation

of intangible assets including those identified as fair value

adjustments in acquisition accounting. The charge in the year is

principally in connection with amortisation of the brand

assets.

Impairment of goodwill/credit for business purchase comprises

the following:

2017 2016

GBP'000 GBP'000

------------------------------------- -------- --------

Everdeal goodwill 28,375 -

Propius credit for business purchase (1,351) -

Revaluation gain on equity accounted (5,378) -

investment in Propius

------------------------------------- -------- --------

21,646 -

------------------------------------- -------- --------

Non-underlying items included in the share of post-tax profits

of associates and joint ventures all relate to the investment in

Greenwhitestar Holding Company 1 Limited. Amortisation of acquired

intangibles includes amortisation of the customer

relationships.

Dividends

Dividends paid on ordinary 2017 2017 2016 2016

shares

Rate Rate

p GBP'000 p GBP'000

---------------------------- ----- -------- ----- --------

Interim dividend paid

20 January 2017 3.0 10,630 - -

Interim dividend paid

7 October 2016 3.0 10,327 - -

Final dividend for 2016

paid 8 July 2016 4.0 13,770 - -

Interim dividend paid

4 December 2015 - - 2.0 6,559

Final dividend for 2015

paid 3 July 2015 - - 4.0 13,117

---------------------------- ----- -------- ----- --------

10.0 34,727 6.0 19,676

---------------------------- ----- -------- ----- --------

An interim dividend of 3.0p per share totalling GBP10,630,000

was paid on 7 April 2017. A final dividend of 4.5p per share

totalling GBP15,945,000 was declared on 11 May 2017 and subject to

shareholder approval will be paid on 7 July 2017. Neither of these

dividends are recognised as a liability as at 28 February 2017.

Financial Assets and Liabilities

Loans and borrowings 2017 2016

GBP'000 GBP'000

----------------------------------------------------------- -------- --------

Non-current

Fixed rate:

* Obligations under finance leases and hire purchase

contracts 7,847 6,608

64,269 -

* Bank loans

Variable rate:

* Obligations under finance leases and hire purchase

contracts 19,252 15,902

* Bank loans 41,704 26,382

----------------------------------------------------------- -------- --------

133,072 48,892

----------------------------------------------------------- -------- --------

Current

Fixed rate:

* Obligations under finance leases and hire purchase

contracts 1,401 2,295

6,975 -

* Bank loans

Variable rate:

* Obligations under finance leases and hire purchase

contracts 9,911 6,663

18,287 8,958

----------------------------------------------------------- -------- --------

Total loans and borrowings 151,359 57,850

----------------------------------------------------------- -------- --------

Cash 30,653 9,858

----------------------------------------------------------- -------- --------

Net debt 120,706 47,992

----------------------------------------------------------- -------- --------

The obligations under finance leases and hire purchase contracts

are taken out with various lenders at fixed or variable interest

rates prevailing at the inception of the contracts.

During the year, the GBP50,000,000 variable rate committed

revolving credit facility with a facility end date of January 2019

was amended to GBP65,000,000 and extended to an end date of January

2020. This facility was drawn at GBP42,200,000 (2016:

GBP27,000,000) at the year end.

The Group was in compliance with financial covenants throughout

both the current and prior year.

Note to the Consolidated Cash Flow Statement

Year ended Year ended

28 February 29 February

2017 2016

GBP'000 GBP'000

---------------------------------------- ------------- -------------

(Loss)/profit before tax (8,026) 9,991

Adjustments to reconcile (loss)/profit

before tax to net cash flows:

Non-cash:

Gain in value of investment

properties (2,898) (8,441)

Realised profit on sale of

property, plant and equipment

and investment properties (15,196) (183)

Share of post-tax profits of

associates and joint ventures

accounted for using the equity

method (6,876) (8,295)

(Profit)/loss on disposal of/loss

in value of assets held for

sale (2,747) 16

Profit on sale and leaseback - (1,893)

Release of deferred profit (772)

on sale and leaseback -

Depreciation of property, plant

and equipment 9,378 8,435

Finance income (2,925) (1,343)

Finance costs 2,532 2,302

Release of grant income (313) (302)

Release of deferred premiums (3,045) -

Impairment of goodwill/credit 21,646 -

for business purchase

Amortisation of intangibles 3,938 3,938

Charge for share based payments 1,000 648

(Gain)/loss on fuel swaps mark

to market valuation (1,820) 1,497

Working capital adjustments:

Decrease in inventories 215 1,535

Decrease/(increase) in trade

and other receivables 5,767 (3,747)

Decrease in trade and other

payables (1,578) (3,999)

Cash (used)/generated from

continuing operations (1,720) 159

---------------------------------------- ------------- -------------

Related Parties

Relationships of Common Control or Significant Influence

WA Developments International Limited is owned by W A Tinkler.

During the year, the Group made purchases of GBP344,000 (2016:

GBPnil) relating to the provision of passenger transport and the

Group levied recharges of GBP38,000 (2016: GBP41,000) relating to

the recovery of staff costs and expenses to WA Developments

International Limited. GBPnil (2016: GBPnil) was due from and

GBPnil (2016: GBPnil) was due to WA Developments International

Limited at the year end.

Apollo Air Services Limited is owned by W A Tinkler. During the

year, the Group made purchases of GBP388,000 (2016: GBP525,000)

relating to the provision of passenger transport and sales of

GBP35,000 (2016: GBP19,000) relating to fuel to Apollo Air Services

Limited. GBPnil (2016: GBPnil) was owed by the Group and GBP7,000

(2016: GBPnil) was owed to the Group by this company at the year

end.

During the year, the Group made purchases of GBP2,000 (2016:

GBP4,000) and sales of GBP9,000 (2016: GBP54,000) to WA Tinkler

Racing, a business owned by W A Tinkler, relating to car hire.

GBP2,000 (2016: GBPnil) was owed to the Group and GBPnil (2016:

GBPnil) was owed by the Group at the year end.

During the year, a number of close family members of W A Tinkler

were employed by the Group. The total emoluments of those close

family members, including benefits provided as part of their

employment, amounted to GBP33,000 (2016: GBP53,000).

Associates and Joint Ventures

The Group headed by Greenwhitestar Holding Company 1 Limited,

which owns Eddie Stobart Logistics Limited, is an associate

undertaking. During the year, the Group made sales of GBP4,138,000

(2016: GBP11,962,000), mainly relating to cost recharges (see

below), and purchases of GBP1,006,000 (2016: GBP5,160,000), mainly

relating to haulage costs and cost recharges (see below). A balance

of GBP156,000 (2016: GBP475,000) was owed by the Group and

GBP741,000 (2016: GBP684,000) was owed to the Group at the year

end. These balances are shown within current trade and other

receivables/payables. The Group has guaranteed certain obligations

under leases for properties operated by Eddie Stobart

Logistics.

Significant examples of cost recharges are time apportioned

staff costs, truck and trailer hire costs, property leases, office

space rental charges, fuel and car costs, IT hardware and software

costs and payroll processing costs.

On 8 February 2017, the Group acquired a controlling interest in

Everdeal Holdings Limited which was previously classified as a

joint venture. Prior to acquisition, the Group had loans, not part

of the net investment, outstanding from companies within the group

headed by Everdeal Holdings Limited, with a book value of

GBP6,538,000 (2016: GBP6,538,000). The loans were unsecured and due

for repayment within one year. Prior to acquisition, the Group made

sales of GBP693,000 (2016: GBPnil) to the Group headed by Everdeal

Holdings Limited, mainly relating to the provision of aircraft,

fuel and landing charges, and purchases of GBP75,000 (2016:

GBPnil).

The Group had loans, not part of the net investment, outstanding

from its associate interest, Shuban Power Limited, of GBP5,250,000

(2016: GBP5,250,000) at the year end, disclosed within trade and

other receivables in non-current assets. The interest outstanding

at the year end was GBP1,475,000 (2016: GBP1,055,000) and is

disclosed within trade and other receivables. The loans are

unsecured, will be settled in cash and have no fixed repayment

date.

The Group had loans, not part of the net investment, outstanding

from its associate interest, Shuban 6 Limited, of GBP849,000 (2016:

GBP849,000) at the year end, disclosed within trade and other

receivables in non-current assets. The interest outstanding at the

year end was GBP112,000 (2016: GBP45,000) and is disclosed within

trade and other receivables. The loans are unsecured, will be

settled in cash and have no fixed repayment date.

The Group had loans, not part of the net investment, outstanding

from its associate interest, Mersey Bioenergy Holdings Limited, of

GBP7,302,000 (2016: GBP7,302,000) at the year end. This balance is

disclosed within trade and other receivables in non-current assets.

The interest outstanding at the year end was GBP1,967,000 (2016:

GBP838,000) and is disclosed within trade and other receivables.

The loans are unsecured, have a ten-year term ending in November

2024 and will be settled in cash.

There were no other balances between the Group and its joint

ventures and associates during the current or prior year.

All loans are unsecured and all sales and purchases are settled

in cash on the Group's standard commercial terms.

Post Balance Sheet Events

In April 2017, the Group entered an arrangement to sell and

leaseback eight ATR 72-600 aircraft. The Group received net

proceeds of $62.7m (GBP50.2m) after repayment of existing financing

in respect of the aircraft of $85.3m, including refundable deposits

withheld of $3.8m (GBP3.0m) and $1.0m (GBP0.8m) in rental payments.

The leases are for a ten-year term with an option to terminate

after six years. Aggregate payments under the leases will amount to

$15.4m (GBP12.3m) per annum. The Group will continue to operate all

eight aircraft within its airline, primarily providing flights

under the Aer Lingus franchise agreement.

On 25 April 2017, the Group disposed of its 49% investments in

Greenwhitestar Holding Company 1 Limited and Greenwhitestar Finance

Limited for consideration comprising cash of GBP113.3m and a 12.5%

shareholding in Eddie Stobart Logistics plc. Eddie Stobart

Logistics plc was admitted to AIM on 25 April 2017 and the 12.5%

shareholding was valued at GBP71.5m on admission.

There were no other events after the reporting period that are

material for disclosure in the financial statements.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR ABMITMBMBMLR

(END) Dow Jones Newswires

May 11, 2017 02:01 ET (06:01 GMT)

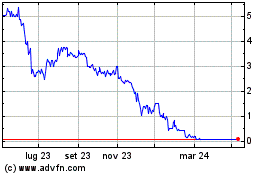

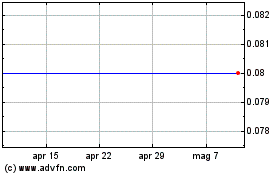

Grafico Azioni Esken (LSE:ESKN)

Storico

Da Set 2024 a Ott 2024

Grafico Azioni Esken (LSE:ESKN)

Storico

Da Ott 2023 a Ott 2024