TIDMITRK

RNS Number : 3900U

Intertek Group PLC

23 November 2023

TRADING STATEMENT

23 November 2023

ROBUST DEMAND FOR INTERTEK ATIC SOLUTIONS - ON TRACK TO DELIVER

2023 TARGETS

-- YTD revenue of GBP2.77bn, growth of 7.3% at CCY with broad-based LFL revenue growth of 6.3%

-- 5.2% LFL revenue growth at CCY in July-Oct : LFL of 6.9% in

Corporate Assurance, Health and Safety, Industry and

Infrastructure, and World of Energy combined; Consumer Products LFL

of 1%

-- Recent acquisitions in high growth, high margin segments

performing well ; YTD revenue contribution of GBP26m

-- Margin progression driven by pricing initiatives, good

operating leverage and disciplined cost controls

-- Disciplined performance management delivering strong cash flow and a robust balance sheet

-- Investing in organic and inorganic growth opportunities with

an accretive capital allocation policy

-- Confirming 2023 outlook : Mid-single digit LFL revenue growth

at CCY, margin progression and strong free cash flow

-- Intertek AAA differentiated growth strategy in place to

unlock the significant value growth opportunity ahead

Revenue Growth LFL Revenue Growth

YTD 23 YTD 23 Jul-Oct23 YTD 23

========== ========== ========== ==========

Change at Change at Change at Change at

CCY(1) AR(2) CCY(1) CCY(1)

========== ========== ========== ==========

Group 7.3% 5.1% 5.2% 6.3%

========== ========== ========== ==========

Consumer Products 1.1% (2.7%) 1.0% 1.1%

========== ========== ========== ==========

Corporate Assurance 10.5% 7.6% 6.6% 10.0%

========== ========== ========== ==========

Health and Safety 8.5% 7.8% 6.5% 6.5%

========== ========== ========== ==========

Industry and Infrastructure 8.5% 7.1% 5.7% 8.5%

========== ========== ========== ==========

World of Energy 12.1% 11.1% 8.7% 8.5%

========== ========== ========== ==========

(1. Constant currency 2. Actual rates)

André Lacroix: Chief Executive Officer statement

"The Group has delivered 7.3% revenue growth on a YTD basis at

CCY, driven by 8.5% LFL revenue growth in Corporate Assurance,

Health and Safety, Industry and Infrastructure, and the World of

Energy combined, while LFL for Consumer Products was 1.1%. Recent

acquisitions in high-growth, high-margin segments are performing

well, benefitting from the scale-up opportunities in our global

network. We are on-track to deliver our 2023 FY target of

mid-single digit LFL revenue growth at CCY, with margin accretion

and strong free cash flow performance enabling us to deliver an

excellent ROIC.

I would like to recognise my colleagues for their passion,

commitment and innovation, delivering a robust financial

performance in the first ten months of the year. We have delivered

the highest LFL revenue growth in the last 10 years at CCY,

benefitting from the robust demand for our ATIC solutions. We have

seen margin progression driven by our pricing initiatives, good

operating leverage and our disciplined cost approach. Our strong

free cash flow combined with our robust balance sheet enables us to

invest in growth and accelerate performance.

Our clients are increasing their focus on Risk-based Quality

Assurance to operate with higher standards on quality, safety and

sustainability in each part of their value chain, triggering a

higher demand for our ATIC solutions which are powered by our

Science-based Customer Excellence ATIC advantage. We have made

significant progress on our portfolio, which is poised for faster

growth with all our global business lines expected to benefit from

attractive structural growth drivers while the majority of our

local businesses are exposed to fast growth opportunities.

Earlier this year, we unveiled our Intertek AAA differentiated

growth strategy to capitalise on the best-in-class operating

platform we have built and target the areas where we have

opportunities to get better. Our passionate, innovative, and

customer-centric organisation is laser-focused to take Intertek to

greater heights putting our AAA strategy in action and deliver

sustainable growth and value for all stakeholders. We are targeting

mid-single digit LFL revenue growth, margin accretion to go back to

our 17.5% peak margin and beyond, and strong cash generation, while

pursuing disciplined investments in attractive growth and margin

sectors.

We operate a differentiated, high-quality growth business with

excellent fundamentals and intrinsic defensive characteristics,

giving our customers the Intertek Science-based ATIC advantage to

strengthen their businesses. Our leading ATIC solutions are

mission-critical for the world to operate safely and the growth in

our end-markets is accelerating. The implementation of our Intertek

AAA differentiated growth strategy will capitalise on our

high-quality earnings and cash compounder model to unlock the

significant value growth opportunity ahead."

Intertek Group plc ("Intertek" or "the Group"), a leading Total

Quality Assurance provider to industries worldwide, today releases

its November Trading Update for the period from 1 January to 31

October 2023 ("period"). All comparative comments in this statement

reflect comparisons with the corresponding period during 2022. The

Group's full year results to 31 December 2023 will be announced on

5 March 2024.

Revenue Performance - 5 divisions

10 months - January to October 4 months - July to October

=========================================================

2023 2022 Change Change 2023 2022 Change Change

GBPm GBPm at at constant GBPm GBPm at at constant

actual currency actual currency

rates rates

========== ========== =========== ========================= =========== ========== ========== ====================

Group

Revenue 2,765.7 2,632.4 5.1% 7.3% 1,125.7 1,140.7 (1.3%) 5.9%

========== ========== =========== ========================= =========== ========== ========== ====================

Like-for-like

revenue 2,739.8 2,632.4 4.1% 6.3% 1,118.1 1,140.7 (2.0%) 5.2%

========== ========== =========== ========================= =========== ========== ========== ====================

Consumer products

Revenue 779.5 801.3 (2.7%) 1.1% 311.6 338.4 (7.9%) 1.0%

========== ========== =========== ========================= =========== ========== ========== ====================

Like-for-like

revenue 779.5 801.3 (2.7%) 1.1% 311.6 338.4 (7.9%) 1.0%

========== ========== =========== ========================= =========== ========== ========== ====================

Corporate Assurance

Revenue 391.9 364.3 7.6% 10.5% 160.1 160.1 - 7.6%

========== ========== =========== ========================= =========== ========== ========== ====================

Like-for-like

revenue 390.4 364.3 7.2% 10.0% 158.6 160.1 (0.9%) 6.6%

========== ========== =========== ========================= =========== ========== ========== ====================

Health and Safety

Revenue 269.6 250.1 7.8% 8.5% 112.9 107.7 4.8% 9.3%

========== ========== =========== ========================= =========== ========== ========== ====================

Like-for-like

revenue 264.6 250.1 5.8% 6.5% 110.0 107.7 2.1% 6.5%

========== ========== =========== ========================= =========== ========== ========== ====================

Industry and infrastructure

Revenue 721.8 674.2 7.1% 8.5% 294.8 299.0 (1.4%) 5.7%

========== ========== =========== ========================= =========== ========== ========== ====================

Like-for-like

revenue 721.8 674.2 7.1% 8.5% 294.8 299.0 (1.4%) 5.7%

========== ========== =========== ========================= =========== ========== ========== ====================

World of Energy

Revenue 602.9 542.5 11.1% 12.1% 246.3 235.5 4.6% 10.2%

========== ========== =========== ========================= =========== ========== ========== ====================

Like-for-like

revenue 583.5 542.5 7.6% 8.5% 243.1 235.5 3.2% 8.7%

========== ========== =========== ========================= =========== ========== ========== ====================

Revenue Performance - PTR

10 months - January to October 4 months - July to October

===========================================================

2023 2022 Change Change 2023 2022 Change Change

GBPm GBPm at at constant GBPm GBPm at at constant

actual currency actual currency

rates rates

========== ========== ========== ========================= =========== ========== ========== ======================

Group

Revenue 2,765.7 2,632.4 5.1% 7.3% 1,125.7 1,140.7 (1.3%) 5.9%

========== ========== ========== ========================= =========== ========== ========== ======================

Like-for-like

revenue 2,739.8 2,632.4 4.1% 6.3% 1,118.1 1,140.7 (2.0%) 5.2%

========== ========== ========== ========================= =========== ========== ========== ======================

Products

Revenue 1,721.4 1,674.6 2.8% 5.0% 698.4 723.6 (3.5%) 3.8%

========== ========== ========== ========================= =========== ========== ========== ======================

Like-for-like

revenue 1,719.9 1,674.6 2.7% 5.0% 696.9 723.6 (3.7%) 3.5%

========== ========== ========== ========================= =========== ========== ========== ======================

Trade

Revenue 550.6 523.9 5.1% 6.8% 224.9 224.3 0.3% 6.6%

========== ========== ========== ========================= =========== ========== ========== ======================

Like-for-like

revenue 545.6 523.9 4.1% 5.8% 222.0 224.3 (1.0%) 5.3%

========== ========== ========== ========================= =========== ========== ========== ======================

Resources

Revenue 493.7 433.9 13.8% 16.7% 202.4 192.8 5.0% 13.0%

========== ========== ========== ========================= =========== ========== ========== ======================

Like-for-like

revenue 474.3 433.9 9.3% 12.1% 199.2 192.8 3.3% 11.2%

========== ========== ========== ========================= =========== ========== ========== ======================

Contacts

For further information, please contact:

Denis Moreau, Investor Relations

Telephone: +44 (0) 20 7396 3415 investor@intertek.com

Jonathon Brill/James Styles, Dentons Global Advisors

Telephone: +44 (0)7510 385 554 intertek@dentonsglobaladvisors.com

Analysts' Call

A live audiocast for analysts and investors will be held today

at 7.45am UK time; +44 (0) 33 0551 0200 ( Link to audiocast ).

Details can be found at http://www.intertek.com/investors/ together

with a pdf copy of this report. A recording of the audiocast will

be available later in the day.

Intertek is a leading Total Quality Assurance provider to industries worldwide.

Our network of more than 1,000 laboratories and offices in more than 100

countries, delivers innovative and bespoke Assurance, Testing, Inspection

and Certification solutions for our customers' operations and supply chains.

Intertek is a purpose-led company to Bring Quality, Safety and Sustainability

to Life. We provide 24/7 mission-critical quality assurance solutions to

our clients to ensure that they can operate with well-functioning supply

chains in each of their operations.

Our Customer Promise is: Intertek Total Quality Assurance expertise, delivered

consistently, with precision, pace and passion, enabling our customers

to power ahead safely.

intertek.com

Consumer Products Division

In the four-month period to end October 2023, our Consumer

Products-related business delivered LFL revenue of GBP311.6m, up

YoY by 1% at CCY enabling us to deliver a LFL revenue of GBP779.5m

on YTD basis, up YoY at CCY by 1.1% and down YoY by 2.7% at actual

rates.

-- Our Softlines business delivered a low-single digit negative

LFL revenue in the period resulting in a stable LFL revenue

performance YTD as ATIC investments by our clients in e-commerce,

risk-based Quality Assurance and end-to-end sustainability have

been offset by a slow-down in new product development given that

most retailers in North America and Europe remain focused on

reducing inventory.

-- Hardlines reported a low-single digit negative revenue

performance in the period and stable LFL revenue growth on a YTD

basis as ATIC investments by our clients in e-commerce and

sustainability have been offset by lower investments in new product

development from our major customers in North America and

Europe

-- With increased ATIC activities driven by greater regulatory

standards in energy efficiency, more demand for medical devices and

5G investments, our Electrical & Connected World business

delivered high-single digit LFL revenue growth in the period

resulting in a mid-single digit LFL revenue growth YTD.

-- Our Government & Trade Services business provides

certification services to governments in the Middle East and Africa

to facilitate the import of goods in their markets, based on

acceptable quality and safety standards. The business reported

double-digit negative LFL revenue growth both in the period and YTD

as increasing client supply chain activities were offset by the

non-renewal of two major contracts last year.

Full Year growth outlook

In 2023, we expect our Consumer Products division to deliver

low-single digit LFL revenue growth at constant currency.

Mid to long-term growth outlook

Our Consumer Products division will benefit from growth in new

brands, SKUs & ecommerce, increased regulation, a greater focus

on sustainability and technology, as well as a growing middle

class.

Our mid to long-term guidance at CCY for Consumer Products is

low to mid-single digit.

Corporate Assurance Division

In the four-month period to end October 2023, our Corporate

Assurance-related business delivered a LFL revenue of GBP158.6m, up

YoY by 6.6% at CCY enabling us to deliver a LFL revenue of

GBP390.4m on a YTD basis, up YoY at CCY by 10.0% and up by 7.2% YoY

at actual rates.

Business Assurance delivered high-single digit LFL revenue

growth in the period and double-digit LFL revenue growth on YTD

basis driven by increased investments by our clients to improve the

resilience of their supply chains, the continuous focus on ethical

supply and the greater need for sustainability assurance.

The Assuris business reported negative mid-single digit LFL

revenue performance in the period due a base-line effect in 2022.

However, LFL revenue is stable on a YTD basis as we continue to

benefit from improved demand for our regulatory assurance solutions

and from increased corporate investment in ESG.

Full Year growth outlook

In 2023, we expect our Corporate Assurance division to deliver

high-single digit LFL revenue growth at constant currency.

Mid to long-term growth outlook

Our Corporate Assurance division will benefit from a greater

corporate focus on sustainability, the need for increased supply

chain resilience, enterprise cyber-security, People Assurance

services and regulatory assurance.

Our mid to long-term LFL guidance at CCY for Corporate Assurance

is high-single digit to double-digit.

Health and Safety Division

In the four-month period to end October 2023, our Health and

Safety-related business delivered LFL revenue of GBP110.0m, up YoY

by 6.5% at CCY. YTD LFL revenue of GBP264.6m is up YoY at CCY by

6.5% and up YoY by 5.8% at actual rates.

-- AgriWorld provides inspection activities to ensure that the

global food supply chain operates fully and safely. The business

reported mid-single digit LFL revenue growth both in the period and

on YTD basis as we continue to see an increase in demand for

inspection activities driven by sustained growth in the global food

industry.

-- Our Food business registered mid-single digit LFL revenue

growth in the period and high-single digit LFL revenue growth on

YTD basis as we continue to benefit from higher demand for food

safety testing activities as well as hygiene and safety audits in

factories.

-- In Chemicals & Pharma we saw mid-single digit LFL revenue

growth in the period and on YTD basis reflecting improved demand

for regulatory assurance and chemical testing and from the

increased R&D investments of the pharma industry.

Full Year growth outlook

In 2023, we expect our Health and Safety division to deliver

mid-single digit LFL revenue growth.

Mid to long-term growth outlook

Our Health and Safety division will benefit from the demand for

healthier and more sustainable food to support a growing global

population, increased regulation, and new R&D investments in

the pharma industry.

Our mid to long-term LFL guidance at CCY for Health and Safety

division is mid to high-single digit.

Industry and Infrastructure Division

In the four-month period to end October 2023, our Industry and

Infrastructure-related business delivered LFL revenue of GBP294.8m,

YoY growth of 5.7% at CCY enabling us to deliver a LFL revenue of

GBP721.8m on YTD basis, up YoY at CCY by 8.5% and up YoY by 7.1% at

actual rates.

Industry Services includes our Capex Inspection services and

Opex Maintenance services. The Capex Inspection business delivered

double-digit LFL revenue growth in the period and on YTD basis as

we benefitted from increased capex investment in traditional Oil

and Gas exploration and production as well as in renewables. With

our clients increasing their maintenance efforts to increase the

productivity of existing production assets, we delivered

double-digit LFL revenue growth in the period and on YTD basis in

Opex Maintenance.

The continuing high demand for testing and inspection activities

drove high-single digit LFL revenue growth in the period and

double-digit LFL revenue growth on YTD basis in our Minerals

business.

Growing demand for more environmentally friendly buildings and

the increased number of infrastructure projects in North America

produced low-single digit LFL revenue growth in the period and on

YTD basis for our Building & Construction business.

Full Year growth outlook

In 2023, we expect our Industry & Infrastructure related

businesses to deliver high-single digit LFL revenue performance at

constant currency.

Mid to long-term growth outlook

Our Industry & Infrastructure division will grow in the mid

to long-term, benefitting from increased global energy consumption,

the transition to greener energy, population growth, large scale

infrastructure investment, and demand for Greener buildings.

Our mid to long-term LFL guidance at CCY for Industry and

Infrastructure is mid to high-single digit.

World of Energy Division

In the four-month period to end October 2023, our World of

Energy-related business delivered LFL revenue of GBP243.1m, up YoY

by 8.7% at CCY. YTD LFL revenue of GBP583.5m is up YoY at CCY by

8.5% and up 7.6% at actual rates.

Caleb Brett, the global leader in the Crude Oil and Refined

products global trading markets, benefitted from improved momentum

driven by increased global mobility and higher testing activities

for biofuels with double-digit LFL revenue growth in the period and

on a YTD basis.

Transportation Technologies delivered a low-single digit LFL

revenue growth in the period and mid-single digit LfL revenue

growth on YTD basis driven by increased investment in new

powertrains to lower CO2/NOx emissions and in traditional

combustion engines to improve fuel efficiency.

Our CEA business continued to benefit from the increased

investments in solar panels which is the fastest growing form of

renewable energy and delivered a double-digit LFL revenue growth in

the period and YTD.

Full Year growth outlook

In 2023, we expect our World of Energy division to deliver

high-single digit LFL revenue growth at constant currency.

Mid to long-term growth outlook

The World of Energy division will benefit from increased

investment from energy companies to meet growing demand and

consumption of energy from the growing global population, the

scaling up of Renewables, increase R&D investments that OEMs

are making in EV/Hybrid vehicles and from the development greener

fuels.

Our mid to long-term LFL guidance at CCY for the World of Energy

division is low to mid-single digit.

Innovation

True to our pioneering spirit, we continue to lead the industry

and innovate to meet the emerging needs of our customers with

winning ATIC solutions.

We are constantly learning from our customers, using extensive

feedback they provide us every month with our extensive NPS

research programme to help us deliver ever better solutions to

their evolving requirements.

We believe that successful innovation starts with investing in

the insight advantage, which means having a deep understanding of

what our customers need and want. With the ability to access

world-class customer intelligence site-by-site from anywhere across

our global network, we have a continuous stream of data that

enables us to build on our insights and use this to develop new

ATIC solutions.

Recently we launched a new certification mark that aims to give

consumers transparency regarding the claims made by the

manufacturers and marketers of vegan foods. This is a timely

introduction given the exponential global growth in the number of

consumers who are exploring a plant-based diet as part of a

healthier lifestyle with a reduced environmental impact.

Sustainability-related innovations include Intertek EcoCheck, a

tourism solution that audits management systems and is supported by

our capabilites to deliver accessibility, circularity and carbon

emission accounting services.

Launched earlier this year, Global Market Access (GMA) is

designed to help retailers and brands of soft goods, hard goods and

personal protective equipment to understand and comply with the

different regulations in force in different markets across the

world. GMA is a one-stop digital knowledge portal, developed with

the aim of increasing compliance for improved consumer safety and

protecting corporate reputations in today's interconnected

world.

Earlier this month, we launched an exciting digital innovation

iCare in Turkey. This new pioneering one-stop digital platform

delivers customer excellence to fashion manufacturers in a few

clicks. In today's increasingly digital world, manufacturers expect

seamless and efficient communication with testing service

providers. iCare fulfils this expectation by providing customers

with full transparency and real-time information about the status

and progress of their submitted samples. Through iCare, customers

can effortlessly manage all their testing projects on one

centralised platform, accessible 24/7.

Sustainability

Sustainability is the movement of our time and is central to

everything we do at Intertek, anchored in our Purpose, our Vision,

our Values and our strategy.

Sustainability is important to all stakeholders in society who

are consistently demanding faster progress and greater transparency

in sustainability reporting. Companies everywhere therefore

continuously need to upgrade and reinvent how they manage their

sustainability agenda, particularly with regard to how they

disclose their performance.

This is why, under our global Total Sustainability Assurance

(TSA) programme, we provide our clients with proven independent,

systemic and end-to-end assurance on all aspects of their

sustainability strategies, activities and operations.

The TSA programme comprises three elements:

-- Intertek Operational Sustainability Solutions

-- Intertek ESG Assurance

-- Intertek Corporate Sustainability Certification

For ourselves at Intertek, we focus on 10 highly demanding TSA

sustainability standards which are truly end-to-end and

systemic.

You can read in detail about our Sustainability Excellence

agenda and results in our 2022 Sustainability Report, which

included:

-- Continuous progress on Health and Safety with a reduction of

7bps in our Total Recordable Incident Rate vs 2021.

-- Since 2015, we have used the Net Promoter Score ('NPS')

process to listen to our customers that has enabled us to improve

our customer service over the years consistently.

-- We are driving environmental performance across our

operations through new science-based reduction targets to 2030 as

well as site-by-site action plans. Our rigorous monthly performance

management of our net zero plans against emission reduction targets

has delivered total CO2e emissions (market-based) reductions of

7.8% vs 2021.

-- We recognise the importance of employee engagement in driving

sustainable performance for all stakeholders, and we measure

employee engagement against our Intertek ATIC Engagement Index. Our

2022 score was 80.

-- Our voluntary permanent employee turnover was at a low rate of 14%.

At the end of August, we were pleased to announce that the

Group's near-term greenhouse gas (GHG) emissions reduction targets

have been approved by the Science Based Targets initiative (SBTi).

Through the validation of its scope 1, scope 2 and scope 3 targets,

the SBTi found Intertek to be in line with the ambition to limit

global temperature increases to 1.5degC above pre-industrial

levels.

Intertek is committed to:

-- reducing absolute scope 1 and 2 GHG emissions by 50% by 2030 from a 2019 base year;

-- reducing absolute scope 3 GHG emissions from business travel

and employee commuting by 50% within the same timeframe;

-- ensuring 70% of its suppliers by spend will have science-based targets by 2027.

This achievement serves to reconfirm Intertek's commitment to

sustainable growth and acknowledges the Group's ongoing efforts to

limit the effects of climate change as part of the Race to

Zero.

M&A

We are investing inorganically to seize the attractive growth

opportunities in the global Quality Assurance market and to

strengthen our ATIC portfolio in high-margin, high-growth

areas.

Our recent acquisitions, SAI Global Assurance, JLA Brasil

Laboratório de Análises de Alimentos S.A. and Clean Energy

Associates LLC and Controle Analtico have been successfully

integrated and are performing well and in line with our

expectations.

In August, we announced the acquisition of US-based PlayerLync,

a leading provider of high-quality mobile-first training and

learning content to frontline workforces at some of the world's

leading consumer brands, strengthening our position as a leader in

SaaS-based, technology- enabled People Assurance services. We

invested in our People Assurance business with the acquisition of

Alchemy/Wisetail in 2018, and PlayerLync provides a compelling

opportunity to further enhance our differentiated TQA proposition

and customer excellence advantage in what is a fast-evolving

landscape. As the deskless frontline workforce continues to grow,

software-based technology solutions that deliver learning,

communications and engagement are ever more important and the

combination of Wisetail and PlayerLync are exceptionally

well-placed to address those needs.

We will continue to look at M&A opportunities in attractive

high-margin and high-growth areas to broaden our ATIC portfolio of

solutions with new services we can offer to our clients and to

expand our regional coverage.

Outlook 2023

In 2023, we continue to expect the Group will deliver mid-single

digit LFL revenue growth at constant currency, with margin

progression year-on-year and a strong free cash flow

performance.

Our mid-single digit LFL revenue growth at constant currency

will be driven by the following contribution from our

divisions:

-- Consumer Products: Low-single digit

-- Corporate Assurance: High-single digit

-- Health and Safety: Mid-single digit

-- Industry and Infrastructure: High-single digit

-- World of Energy: High-single digit

Our financial guidance for 2023 is that we expect:

-- Capital expenditure in the range of GBP115-125m

-- Net Finance costs in the GBP40-42m range

-- Effective Tax Rate in the 25%-26% range

-- Minority interests of between GBP22-23m

-- FY23 financial net debt to be in the range of GBP630-680m

Currency has remained volatile, and we are updating our FY forex

guidance. The average Sterling rate since the beginning of the year

applied to our FY 2022 results, would reduce our FY revenue by

300bps and FY Earnings by 500bps.

Significant value growth opportunity

We have made strong progress in the last eight years, delivering

sustainable growth and value for our stakeholders and we are very

excited about the significant growth value opportunity ahead,

capitalising on our Science-based Customer Excellence ATIC

advantage. Our clients understand the mission-critical nature of

risk-based quality assurance to make their businesses stronger and

we have seen the demand for our ATIC solutions accelerate in the

last few years.

On 3 May 2023, at our Capital Markets event in London, we

announced our Intertek 30 AAA Growth Strategy to unlock the

significant value growth opportunity ahead.

True to our high performance 10X Culture, our Intertek AAA

differentiated growth strategy is about being the best and creating

significant value for every stakeholder, all the time. We want to

be the most trusted TQA partner for our customers, the employer of

choice with our employees, to demonstrate sustainability excellence

everywhere in our community and deliver significant growth and

value for our shareholders.

To seize the significant growth value opportunity ahead we will

be laser-focused on three strategic priorities and three strategic

enablers. Our Strategic Priorities are defined as Science-based

Customer Excellence TQA, Brand Push & Pull and Winning

Innovations, and our three Strategic Enablers are based on 10X

Purpose-based Engagement, Sustainability Excellence and Margin

Accretive Investments. We will both further improve where we are

already strong and address the areas where we can get better.

Our high-quality portfolio is poised for faster growth:

-- The depth and breadth of our ATIC solutions positions us well

to seize the increased opportunities arising from corporate needs

for Risk-based Quality Assurance

-- All of our global business lines have plans in place to seize

the exciting growth drivers in each of our divisions

-- At the local level, our local portfolio is strong, with the

majority of our revenues exposed to fast growth segments

-- Geographically we have the right exposure to the structural

growth opportunities across our global markets

We have improved our segmental disclosures to better reflect the

growth drivers in our businesses reporting revenue, operating

profit and margin in five divisions:

-- Consumer Products

-- Corporate Assurance

-- Health and Safety

-- Industry and Infrastructure

-- World of Energy

In terms of LFL revenue growth we are targeting Group mid-single

digit LFL revenue growth at constant currency with the following

expectations by division:

-- Low- to mid-single digit in Consumer Products

-- High-single digit to double digit in Corporate Assurance

-- Mid- to high-single digit in Health and Safety

-- Mid- to high-single digit in Industry and Infrastructure

-- Low- to mid-single digit in the World of Energy

Margin accretive revenue growth is central to the way we deliver

value, and we are confident that over time we will return to our

17.5% peak margin performance and go beyond from there. Our

confidence is based on three simple reasons: we have the proven

tools and processes in place, we operate with a span of

performance, and we pursue a disciplined accretive portfolio

strategy.

To deliver sustainable growth and value we will stay focused on

our Intertek Virtuous Economics based on the compounding effect

year after year of mid-single digit LFL revenue growth, margin

accretive revenue growth, strong free cash-flow and disciplined

investments in high growth and high margin sectors.

We believe in the value of accretive disciplined capital

allocation and pursue the following priorities:

-- Our first priority is to support organic growth through

capital expenditure and investments in working capital (target

circa 5% of turnover in capex).

-- The second priority is to deliver sustainable returns for our

shareholders through the payment of progressive dividends and we

target a pay-out ratio of circa 50%.

-- The third priority is to pursue M&A activities that

strengthen our portfolio in attractive growth and margin areas,

provided we can deliver good returns.

-- And our fourth priority is to maintain an efficient balance

sheet with flexibility to invest in growth. Our leverage target is

1.3 - 1.8 net debt to EBITDA with the potential to return excess

capital to shareholders subject to our future requirements and

prevailing macro environment.

Our good to great journey continues to unlock the significant

value growth opportunity ahead.

-ENDS-

The 2023 November Trading Statement Audiocast CEO Script will be

available after the call at www.intertek.com/investors/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTKLLFLXFLXFBV

(END) Dow Jones Newswires

November 23, 2023 02:00 ET (07:00 GMT)

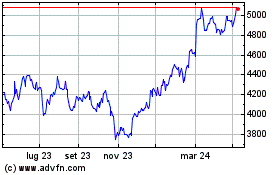

Grafico Azioni Intertek (LSE:ITRK)

Storico

Da Ott 2024 a Nov 2024

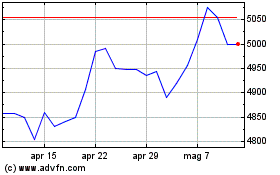

Grafico Azioni Intertek (LSE:ITRK)

Storico

Da Nov 2023 a Nov 2024