TIDMPRS

RNS Number : 3059P

Paternoster Resources PLC

05 June 2015

5 June 2015

Paternoster Resources plc

("Paternoster" or the "Company")

Final results for the year ended 31 December 2014

Paternoster Resources plc (AIM: PRS), an investment company

focused on the natural resources sector, is pleased to announce its

audited final results for the year ended 31 December 2014.

Highlights:

-- Loss from continuing operations of GBP120,372 (2013: loss of GBP21,144).

-- Net asset value at 31 December 2014 of GBP2,758,784 (2013: GBP2,644,268).

-- Cash balances and highly liquid investments at 31 December

2014 of GBP576,639 (2013: GBP1,071,921)

Nicholas Lee, Chairman of Paternoster, commented: "The Company

has made good progress with its current portfolio, whilst seeking

to add more interesting and attractive investments. At the same

time, given the current market environment, the Company is keen to

ensure that it maintains a healthy cash balance or cash equivalents

in order to take advantage of new opportunities as they arise.

The current portfolio represents an exciting mix of companies, a

number of which are poised for significant further

developments."

For more information please visit www.PaternosterResources.com

or contact:

Paternoster Resources plc:

Nicholas Lee, Executive Chairman +44 (0) 20 7580 7576

Matt Lofgran, Non-Executive Director +1 480 993 8933 (US)

Nominated Adviser and Joint Broker: +44 (0) 20 7601 6100

Westhouse Securities

Antonio Bossi/David Coaten

Joint Broker: +44 (0) 20 7562 3351

Peterhouse Corporate Finance

Lucy Williams

Executive Chairman's statement

INTRODUCTION

The year ended 31 December 2014, has been a year of significant

progress for the Company within its existing investment portfolio,

with improving liquidity and value appreciation.

FINANCIAL

During 2014, the Company made a loss from continuing operations

of GBP120,372 (2013: loss of GBP21,144). The net asset value of the

Company as at 31 December 2014 was GBP2,758,784 (2013:

GBP2,644,268).

The Company's investment portfolio at 31 December 2014, is

divided into the following categories:

Category Principal investments Cost or valuation

(GBP)

---------------------- ------------------------------- ------------------

Bison Energy Services

Limited, Andiamo Exploration

Unlisted/pre Limited and Elephant

IPO Oil Limited 674,692

Metal Tiger plc, MX

Oil plc, Plutus Powergen

plc, Shumba Coal Limited

Listed special and Northcote Energy

situations plc 1,399,524

Investment portfolio 2,074,216

Cash and highly

liquid listed

investments 576,639

Total 2,650,855

------------------------------------------------------- ------------------

At 31 December 2014, the Company had cash balances and highly

liquid investments amounting to GBP576,639 (2013: GBP1,071,921).

However, it is important to note that a number of investments held

within the listed category can be moved into cash when additional

investment opportunities present themselves.

REVIEW OF THE YEAR

Details of the investments made in the year, together with

development of investments during the year and significant

developments since the year end are set out in the Strategic

Report.

In September 2014, the Board was strengthened with the

appointment of Matt Lofgran as a Director. Mr. Lofgran is also CEO

of AIM listed Nostra Terra Oil and Gas Company plc and brings

global experience in mining and oil and gas, both from the

investment and operational sides.

In December 2014, Paternoster raised gross proceeds of

GBP242,250 via a placing of 95,000,000 new ordinary shares at a

price of 0.255 pence per share, a 7.5% discount to the then

prevailing market price. As a consequence, the Board is very

pleased to welcome a number of investors as new shareholders in the

Company.

OUTLOOK

The Company has made good progress with its current portfolio,

whilst seeking to add more interesting and attractive investments.

At the same time, given the current market environment, the Company

is keen to ensure that it maintains a healthy cash balance or cash

equivalents in order to take advantage of new opportunities as they

arise.

The current portfolio represents an exciting mix of companies, a

number of which are poised for significant further

developments.

Strategic Report

The Directors present their Strategic Report on the Company for

the year ended 31 December 2014.

REVIEW OF THE BUSINESS AND FUTURE DEVELOPMENTS

INVESTMENTS/DISPOSALS MADE

During the year, Paternoster made an investment in Elephant Oil

Limited, an oil and gas exploration company focused on West Africa.

Its current asset is a 100% interest in Block B, onshore Benin, on

the prolific West Africa Transform Margin. Work is taking place in

preparation for a planned seismic acquisition program. Hunt Oil,

operator of Block 2 diagonally adjacent to Elephant Oil's Block B,

commenced drilling operations in October 2014. Shell and Petrobras

have also now begun drilling. Elephant Oil has continued to

progress its work programme in Bénin. The company has recently

begun the Environmental Impact Assessment ("EIA") covering the area

of interest where future surveys and drilling are to be targeted.

The EIA is a prerequisite to the new seismic acquisition programme

planned in 2016. The company has also identified further potential

acquisitions in West Africa and due diligence is being carried out

on selected assets.

The Company has continued to take profits on its investment in

Quadrise Fuels International plc during the year, and has now sold

its entire holding.

DEVELOPMENTS ON INVESTMENTS

ANDIAMO

Andiamo Exploration Limited continues to progress its Yacob

Dewar deposit in Eritrea. During the year, funding of $1.5 million

has been provided by Ortac Resources Limited, an exploration and

mine development company listed on AIM. Assay results from the

trenching programme confirm high grade gold and oxide copper

mineralisation and the company is confident that it can develop a

commercial gold-copper project.

PLUTUS POWERGEN

Plutus PowerGen plc (formerly Plutus Resources plc) completed

the acquisition of Plutus Energy Limited, a company established for

the purpose of generating power from flexible stand-by power

generation farms and generating revenues through the sale of this

power to large energy supply companies during periods of peak

electricity demand or Grid instability. The company came back onto

the market and raised GBP800,000 to fund the working capital

requirements of the enlarged group. The company has also entered

into funding arrangements with Rockpool Investments to provide the

equity financing component for a number of the company's planned

sites. This would amount to around GBP34 million of equity. The

company is continuing to make good progress in developing 200MW of

flexible energy generation in the UK and now has connection offers

for 180MW of capacity on five sites. It is also in the process of

securing two management contracts which will generate some

immediate income and it has also received two offers of asset

finance for GBP2.5 million to complement equity funding from

Rockpool Investments.

NORTH AMERICAN PETROLEUM/NORTHCOTE ENERGY

North American Petroleum plc started the year by raising

$725,000 in February 2014 and acquiring additional acreage through

acquiring working interests in additional properties. Since then it

has agreed to sell its assets to Northcote Energy in return for

shares. This acquisition has now been completed with Northcote

Energy raising over GBP1.5 million in new funds. Paternoster will

be receiving shares in Northcote Energy in exchange for the shares

it holds in North American Petroleum. This transaction is a very

positive development providing enhanced liquidity for Paternoster's

investment as Northcote Energy is listed on AIM.

Recently, the company contracted a drilling rig for a new well

on its Shoats Creek prospect where it plans to drill shortly. In

addition to its exploration and production operations in the USA,

Northcote has also been increasing its exposure to the oil and gas

sector in Mexico. The company has appointed a new Executive Vice

President for Mexico and has also announced a partnership with Gaia

Ecologica S.A. DE C.V, a Mexican environmental service company in

order to look at new business opportunities together. In May 2015,

the company raised an additional GBP2.8 million and so is well

funded to pursue its current business plan. The Northcote Energy

share price has increased significantly since the announcement of

the acquisition of the North American Petroleum assets.

ASTAR MINERALS/MX OIL

MX Oil (formerly Astar Minerals plc) has made very good progress

in pursuing its strategy of focusing on oil and gas opportunities

in Mexico. In particular, it has raised over GBP3 million this year

and has entered into a joint venture with Geo Estratos, an

established Mexican oil and gas services company.

MX Oil is continuing to work towards securing onshore

conventional acreage in Mexico. The tender, known as Bid Round 1,

for mature onshore conventional fields in the states of Tabasco,

Veracruz and Tamaulipas will open shortly. Furthermore, a recent

announcement by the President of the National Hydrocarbons

Commission has said that for the third phase of Bid Round 1, those

companies that can demonstrate extensive experience in either

working with Pemex, the state owned oil company, or a proven track

record of developing onshore fields will be prioritized. Given the

track record of the company's partner, Geo Estratos, in working

with Pemex, this clearly enhances the likelihood of MX Oil being

able to secure a licence. As well as participating in Bid Round 1,

the company is also working alongside its partner Geo Estratos, to

secure existing fields operated by Pemex, via farm out agreements.

The share price of MX Oil has increased very significantly since

the placing at 1 pence per share in March 2014 when the company

adopted this revised focus and the board was strengthened.

BRADY EXPLORATION/METAL TIGER

Metal Tiger plc (formerly Brady Exploration plc) raised circa

GBP400,000 of new funds in May 2014 to focus on investment

opportunities in the mining sector in the South East Asia region.

Terry Grammer, a highly regarded geologist, has recently been

appointed as Chairman and the company has now entered into a

memorandum of understanding to enable it to access various gold

prospective properties in Thailand.

More recently, the company has revised its strategy and

established two distinct investment divisions. The Direct Equities

Investment division is focused on taking advantage of the low

valuations of many listed junior resource companies. This division

has made investments in companies such as Kibo, Eurasia and Ariana

and has already realised some significant profits. The Direct

Projects Investment division will continue to invest directly in

projects in the natural resources sector. This division has been

progressing a number of its projects - drilling has commenced at

its Lagrosan gold and tungsten project in Spain and operations have

also started at its gold project at Chanthaburi in Thailand. The

company has also raised some additional funding at the prevailing

market price underpinning the company's current valuation.

SHUMBA COAL

Shumba Coal, continues to progress its feasibility studies and

full environmental impact assessment in connection with its 1

billion tonnes JORC resource compliant coal asset in Botswana.

Recently completed mine preliminary feasibility studies have

indicated enough mine reserves to support over 30 years of low cost

mining to supply a 300MW power station. In the short term, it

expects to be able to start supplying coal to the Morupule area by

2016. It is also looking at the possibility of a power plant being

constructed on its site given the high demand for power in the

region, and also at exporting its coal - the Morupule mine is

already exporting coal to Europe via Durban and Maputo. The company

has now achieved its listing on the Stock Exchange of Mauritius and

it has also recently successfully raised $3.1 million from various

institutional investors including some major Mauritian

investors.

More recently, the company has reached an agreement for the

acquisition of the Mabesekwa Prospecting Licence in Botswana. The

estimated JORC in-situ coal resource is over 800 million tonnes,

predominately contained in one coal seam, with an average seam

thicknesses of greater than 18 metres with a flat and consistent

profile with the coal found at average depths of 50-60 metres, to

be accessed by open strip mining. Shumba has also executed an

agreement with Mulilo Renewable Project Developments for the joint

development of the Mabesekwa Export Independent Power Plant at the

Mabesekwa Coal Project. The company has also just raised US$2.75

million to finance this expansion at a 27% premium to the

prevailing share price, demonstrating a good level of support from

investors.

BISON ENERGY SERVICES LIMITED

This company is currently in the process of being reorganized in

order to be better positioned to explore the various options

available to it in order to capitalize on its deposit of frac sand

and associated permits in the US.

KEY PERFORMANCE INDICATORS

The key performance indicators are set out below:

COMPANY STATISTICS 31 December 31 December

2014 2013 Change %

-------------------------------- ------------ ------------ --------

Net asset value GBP2,758,784 GBP2,644,268 +4%

Net asset value - fully diluted

per share 0.404p 0.430p -6%

Closing share price 0.245p 0.340p -28%

Share price discount to net

asset value - fully diluted (39%) (21%)

Market capitalisation GBP1,648,500 GBP1,965,000 -16%

-------------------------------- ------------ ------------ --------

KEY RISKS AND UNCERTAINTIES

Early stage investments in the natural resources sector carry a

high level of risk and uncertainty, although the rewards can be

outstanding. At this stage there can be no certainty of outcome

and, in addition, there is often a lack of liquidity in the

Company's investments that are either unquoted or quoted on AIM,

such that the Company may have difficulty in realising the full

value in a forced sale. Accordingly, a commitment is only made

after thorough research into both the management and the business

of the target, both of which are closely monitored thereafter.

Furthermore, the Company limits the amount of each commitment, both

as to the absolute amount and percentage of the target company.

Details of other financial risks and their management are given in

Note 18 to the financial statements.

FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES

Details of the Company's financial risk management objectives

and policies are set out in Note 18 to these financial

statements.

GOING CONCERN

The Company's assets comprise mainly cash and quoted securities

and, accordingly, the Company has adequate financial resources to

continue in operational existence for the foreseeable future.

Therefore, the directors believe that as at the date of this report

it is appropriate to continue to adopt the going concern basis in

preparing the financial statements.

Statement of comprehensive income

2014 2013

*Restated

GBP GBP

------------------------------------------ --------- ---------

CONTINUING OPERATIONS:

Consultancy income 4,000 -

Net gains on investments 91,981 164,301

Investment income 25,263 74,110

------------------------------------------- --------- ---------

TOTAL INCOME 121,244 238,411

Operating expenses (241,616) (259,555)

LOSS BEFORE TAXATION (120,372) (21,144)

Taxation - -

------------------------------------------ --------- ---------

LOSS FOR THE YEAR AND TOTAL COMPREHENSIVE

EXPENSE (120,372) (21,144)

------------------------------------------- --------- ---------

EARNINGS PER SHARE

Basic and fully diluted loss per

share (0.021p) (0.004p)

------------------------------------------- --------- ---------

*The results for 2013 have been restated to reflect the results

only of the Company

Statement of changes in equity

Other

reserves

Share Share (Note Retained Total

capital premium 18) losses equity

GBP GBP GBP GBP GBP

-------------------------- ---------- ---------- ----------- ------------ ----------

BALANCE AT 1 JANUARY

2013 3,830,796 2,774,849 70,109 (4,031,415) 2,644,339

Loss for the year

and total comprehensive

expense - - - (21,144) (21,144)

-------------------------- ---------- ---------- ----------- ------------ ----------

Share based payment

costs - - 21,073 - 21,073

-------------------------- ---------- ---------- ----------- ------------ ----------

Transactions with

owners - - 21,073 - 21,073

-------------------------- ---------- ---------- ----------- ------------ ----------

BALANCE AT 31 DECEMBER

2013 3,830,796 2,774,849 91,182 (4,052,559) 2,644,268

Loss for the year

and total comprehensive

expense - - - (120,372) (120,372)

-------------------------- ---------- ---------- ----------- ------------ ----------

Share issue 95,000 147,250 - - 242,250

Share issue costs - (20,592) - - (20,592)

Share based payment

costs - - 13,230 - 13,230

-------------------------- ---------- ---------- ----------- ------------ ----------

Transactions with

owners 95,000 126,658 13,230 - 234,888

-------------------------- ---------- ---------- ----------- ------------ ----------

BALANCE AT 31 DECEMBER

2014 3,925,796 2,901,507 104,412 (4,172,931) 2,758,784

-------------------------- ---------- ---------- ----------- ------------ ----------

Statement of financial position

2014 2013

GBP GBP

----------------------------- ----------- -----------

NON-CURRENT ASSETS

Investments held for trading 2,291,761 2,028,984

------------------------------ ----------- -----------

2,291,761 2,028,984

----------------------------- ----------- -----------

CURRENT ASSETS

Trade and other receivables 172,626 245,481

Cash and cash equivalents 359,094 400,578

------------------------------ ----------- -----------

531,720 646,059

----------------------------- ----------- -----------

TOTAL ASSETS 2,823,481 2,675,043

------------------------------ ----------- -----------

CURRENT LIABILITIES

Trade and other payables 64,697 30,775

64,697 30,775

----------------------------- ----------- -----------

NET ASSETS 2,758,784 2,644,268

------------------------------ ----------- -----------

EQUITY

Share capital 3,925,796 3,830,796

Share premium account 2,901,507 2,774,849

Capital redemption reserve 27,000 27,000

Share option reserve 77,412 64,182

Retained losses (4,172,931) (4,052,559)

------------------------------ ----------- -----------

TOTAL EQUITY 2,758,784 2,644,268

------------------------------ ----------- -----------

Statement of cash flow

2014 2013

GBP GBP

----------------------------------- --------- -----------

CASH FLOWS FROM OPERATING

ACTIVITIES

Loss before tax - continuing

operations (120,372) (21,144)

Share based payment expense 13,230 21,073

Investment income (25,263) (74,110)

Net gains on investments (91,981) (164,301)

OPERATING CASH FLOWS BEFORE

MOVEMENTS IN WORKING CAPITAL (224,386) (238,482)

Decrease/(increase) in trade

and other receivables 12,855 (137,731)

Increase/(decrease) in trade

and other payables 33,922 (6,197)

NET CASH USED BY OPERATING

ACTIVITIES (177,609) (382,410)

------------------------------------ --------- -----------

INVESTING ACTIVITIES

Purchase of investments (722,826) (892,806)

Disposal of investments 552,030 227,731

Repayment of loans and receivables 60,000 -

Investment income received 25,263 6,886

------------------------------------ --------- -----------

NET CASH USED BY INVESTING

ACTIVITIES (85,533) (658,189)

------------------------------------ --------- -----------

FINANCINGACTIVITIES

Gross proceeds of share

issues 242,250 -

Share issue expenses (20,592) -

------------------------------------ --------- -----------

NET CASH FROM FINANCINGACTIVITIES 221,658 -

------------------------------------ --------- -----------

NET DECREASE IN CASH AND

CASH EQUIVALENTS (41,484) (1,040,599)

Cash and cash equivalents

at the beginning of the

year 400,578 1,441,177

CASH AND CASH EQUIVALENTS

AT THE END OF THE YEAR 359,094 400,578

------------------------------------ --------- -----------

Notes to the financial statements

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The principal accounting policies adopted

in the preparation of these financial statements

are set out below. These policies have been

consistently applied throughout all periods

presented in the financial statements.

As in prior periods, the Company financial

statements have been prepared in accordance

with International Financial Reporting Standards

(IFRS) as adopted by the European Union. The

financial statements have been prepared using

the measurement bases specified by IFRS for

each type of asset, liability, income and

expense. The measurement bases are more fully

described in the accounting policies below.

The financial statements are presented in

pounds sterling (GBP) which is the functional

currency of the Company.

At the year end Paternoster Resources plc

had one wholly owned subsidiary, Viridas Brasil

Agronegocios Ltd, a company incorporated in

Brazil which has not traded since incorporation

and which has no material assets or liabilities.

The Company's only other subsidiary, Viridas

GmbH, a company incorporated in Germany was

dissolved following the payment of a final

distribution to the Company in January 2014,

which was included in the accounts for 2013.

As such, no consolidated financial statements

have been prepared on the basis that in accordance

with section 405 of the Companies Act 2006

the inclusion of these two companies is not

material for the purpose of giving a true

and fair view. The 2013 financial statements

were prepared on a consolidated basis, so

on the income statement the comparative figures

for 2013 have been restated to reflect the

results only of the Company.

An overview of standards, amendments and interpretations

to IFRSs issued but not yet effective, and

which have not been adopted early by the Company

are presented below under 'Statement of Compliance'.

GOING CONCERN

The directors have, at the time of approving

the financial statements, a reasonable expectation

that the Company and the Group have adequate

resources to continue in existence for the

foreseeable future. Thus they continue to

adopt the going concern basis of accounting

in preparing the financial statements.

CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS

The preparation of financial statements in

conformity with IFRS requires the use of estimates

and assumptions that affect the reported amounts

of assets and liabilities at the date of the

financial statements and the reported amounts

of revenues and expenses during the reporting

year. These estimates and assumptions are

based upon management's knowledge and experience

of the amounts, events or actions. Actual

results may differ from such estimates.

Estimates and judgements are continually evaluated

and are based on historical experience and

other factors, including expectations of future

events that are believed to be reasonable

under the circumstances.

In certain circumstances, where fair value

cannot be readily established, the Company

is required to make judgements over carrying

value impairment, and evaluate the size of

any impairment required.

SHARE BASED PAYMENTS

The calculation of the fair value of equity-settled

share based awards and the resulting charge

to the statement of comprehensive income requires

assumptions to be made regarding future events

and market conditions. These assumptions include

the future volatility of the Company's share

price. These assumptions are then applied

to a recognised valuation model in order to

calculate the fair value of the awards.

FAIR VALUE OF FINANCIAL INSTRUMENTS

The Company holds investments that have been

designated as held for trading on initial

recognition. Where practicable the Company

determines the fair value of these financial

instruments that are not quoted (Level 3),

using the most recent bid price at which a

transaction has been carried out. These techniques

are significantly affected by certain key

assumptions, such as market liquidity. Other

valuation methodologies such as discounted

cash flow analysis assess estimates of future

cash flows and it is important to recognise

that in that regard, the derived fair value

estimates cannot always be substantiated by

comparison with independent markets and, in

many cases, may not be capable of being realised

immediately.

STATEMENT OF COMPLIANCE

The financial statements comply with IFRS

as adopted by the European Union. At the date

of authorisation of these financial statements

the following Standards and Interpretations

affecting the Company, which have not been

applied in these financial statements, were

in issue, but not yet effective. The company

does not plan to adopt these standards early.

-- IFRS 9 Financial Instruments

-- IFRS 15 Revenue from Contracts with Customers

-- IFRS 11 (amendments) Accounting for Acquisitions

of Interests in Joint Operations

-- IAS 16 and IAS 38 (amendments) Clarification

of Acceptable Methods of Depreciation and

Amortisation

-- IAS 19 (amendments) Defined Benefit Plans:

Employee Contributions

-- IAS 27 (amendments) Equity Method in Separate

Financial Statements

-- IFRS 10 and IAS 28 (amendments) Sale or

Contribution of Assets between an Investor

and its Associate or Joint Venture

-- Annual Improvements to IFRSs: 2010-2012

Amendments to: IFRS 2 Share-based Payment,

IFRS 3 Business Combinations, IFRS 8 Operating

Segments, IFRS 13 Fair Value Measurement,

IAS 16 Property, Plant and Equipment, IAS

24 Related Party Disclosures and IAS 38 Intangible

Assets

-- Annual Improvements to IFRSs: 2011-2013

Amendments to: IFRS 3 Business Combinations,

IFRS 13 Fair Value Measurement and IAS 40

Investment Property

-- Annual Improvements to IFRSs: 2012-2014

Cycle Amendments to: IFRS 5 Non-current Assets

Held for Sale and Discontinued Operations,

IFRS 7 Financial Instruments: Disclosures,

IAS 19 Employee Benefits and IAS 34 Interim

Financial Reporting

The Directors anticipate that the adoption

of the above Standards and Interpretations

in future periods will have little or no impact

on the financial statements of the Company.

REVENUE RECOGNITION

INVESTMENT INCOME

Dividend income from financial assets at fair

value through profit or loss is recognised

in the statement of comprehensive income on

an ex-dividend basis. Interest on fixed interest

debt securities is recognised using the effective

interest rate method. Bank deposit interest

is recognised on an accruals basis.

CONSULTANCY INCOME

Consultancy fees are recognised over the period

that the services are provided.

TAXATION

Current taxation is the taxation currently

payable on taxable profit for the year.

Deferred income taxes are calculated using

the liability method on temporary differences.

Deferred tax is generally provided on the

difference between the carrying amounts of

assets and liabilities and their tax bases.

However, deferred tax is not provided on the

initial recognition of an asset or liability

unless the related transaction is a business

combination or affects tax or accounting profit.

Temporary differences include those associated

with shares in subsidiaries and joint ventures

and are only not recognised if the Company

controls the reversal of the difference and

it is not expected for the foreseeable future.

In addition, tax losses available to be carried

forward as well as other income tax credits

to the Company are assessed for recognition

as deferred tax assets.

Deferred tax liabilities are provided in full,

with no discounting. Deferred tax assets are

recognised to the extent that it is probable

that the underlying deductible temporary differences

will be able to be offset against future taxable

income. Current and deferred tax assets and

liabilities are calculated at tax rates that

are expected to apply to their respective

period of realisation, provided they are enacted

or substantively enacted at the statement

of financial position date. Changes in deferred

tax assets or liabilities are recognised as

a component of tax expense in the income statement,

except where they relate to items that are

charged or credited to equity in which case

the related deferred tax is also charged or

credited directly to equity.

SEGMENTAL REPORTING

The accounting policy for identifying segments

is now based on internal management reporting

information that is regularly reviewed by

the chief operating decision maker, which

is identified as the Board of Directors.

In identifying its operating segments, management

generally follows the Company's service lines

which represent the main products and services

provided by the Company. The Directors believe

that the Company's continuing investment operations

comprise one segment.

FINANCIAL ASSETS

The Company's financial assets comprise investments

held for trading, associated undertakings,

cash and cash equivalents and loans and receivables.

INVESTMENTS HELD FOR TRADING

All investments determined upon initial recognition

as held at fair value through profit or loss

were designated as investments held for trading.

Investment transactions are accounted for

on a trade date basis. Assets are de-recognised

at the trade date of the disposal. Assets

are sold at their fair value, which comprises

the proceeds of sale less any transaction

cost. The fair value of the financial instruments

in the balance sheet is based on the quoted

bid price at the balance sheet date, with

no deduction for any estimated future selling

cost. Unquoted investments are valued by the

directors using primary valuation techniques

such as recent transactions, last price and

net asset value. Changes in the fair value

of investments held at fair value through

profit or loss and gains and losses on disposal

are recognised in the consolidated statement

of comprehensive income as "Net gains on investments".

Investments are initially measured at fair

value plus incidental acquisition costs. Subsequently,

they are measured at fair value in accordance

with IAS 39. This is either the bid price

or the last traded price, depending on the

convention of the exchange on which the investment

is quoted.

ASSOCIATED UNDERTAKINGS

Associated undertakings are those entities

in which the Company has significant influence,

but not control, over the financial and operating

policies. Investments that are held as part

of the Company's investment portfolio are

carried in the statement of financial position

at fair value even though the Company may

have significant influence over those companies.

This treatment is permitted by IAS 28 "Investment

in Associates", which requires investments

held by a company as a venture capital provider

to be excluded from its scope where those

investments are designated, upon initial recognition,

as at fair value through profit or loss and

accounted for in accordance with IAS 39, with

changes in fair value recognised in the statement

of comprehensive income in the period of the

change. The Company has no interests in associates

through which it carries on its business.

CASH AND CASH EQUIVALENTS

Cash and cash equivalents comprise cash on

hand and demand deposits, together with other

short-term, highly liquid investments that

are readily convertible into known amounts

of cash and which are subject to an insignificant

risk of changes in value.

LOANS AND RECEIVABLES

Loans and receivables from third parties are

initially recognised at fair value and subsequently

carried at amortised cost using the effective

interest rate method.

FINANCIAL LIABILITIES

The Company's financial liabilities comprise

trade payables. Financial liabilities are

obligations to pay cash or other financial

assets and are recognised when the Company

becomes a party to the contractual provisions

of the instruments.

TRADE PAYABLES

Trade payables are initially measured at fair

value and are subsequently measured at amortised

cost, using the effective interest rate method.

SHARE-BASED PAYMENTS

All share based payments are accounted for

in accordance with IFRS 2 - "Share-based payments".

The Company issues equity-settled share based

payments in the form of share options to certain

directors and employees. Equity settled share

based payments are measured at fair value

at the date of grant. The fair value determined

at the grant date of equity-settled share

based payments is expensed on a straight line

basis over the vesting period, based on the

Company's estimate of shares that will eventually

vest.

Fair value is estimated using the Black-Scholes

valuation model. The expected life used in

the model has been adjusted, on the basis

of management's best estimate for the effects

of non-transferability, exercise restrictions

and behavioural considerations. At each balance

sheet date, the Company revises its estimate

of the number of equity instruments expected

to vest as a result of the effect of non-market

based vesting conditions. The impact of the

revision of the original estimates, if any,

is recognised in profit or loss such that

the cumulative expense reflects the revised

estimate, with a corresponding adjustment

to retained earnings.

DIVIDENDS

Dividend distributions payable to equity shareholders

are included in "current financial liabilities"

when the dividends are approved in general

meeting prior to the statement of financial

position date.

EQUITY

Equity comprises the following:

* "Share capital" represents the nominal value of

equity shares.

* "Share premium" represents the excess over nominal

value of the fair value of consideration received for

equity shares, net of expenses of the share issue.

* "Capital redemption reserve" represents the nominal

value of shares repurchased or redeemed by the

Company.

* "Option reserve" represents the cumulative cost of

share based payments.

* "Retained losses" represents retained losses.

SEGMENTAL INFORMATION

The Company is organised around business class

and the results are reported to the Chief

Operating Decision Maker according to this

class. There is one continuing class of business,

being the investment in the natural resources

sector.

Given that there is only one continuing class

of business, operating within the UK no further

segmental information has been provided.

NET GAINS ON INVESTMENTS

2014 2013

GBP GBP

-------------------------------------- -------- -------

Net realised gains on disposal

of investments 124,383 33,641

Movement in fair value of investments (32,402) 130,660

Net gain on investments 91,981 164,301

-------------------------------------- -------- -------

INVESTMENT INCOME

2014 2013

GBP GBP

-------------------------------- ------ ------

Dividends from investments 6,975 5,491

Deposit interest receivable - 1,395

Other interest receivable 18,288 59,027

Final distribution from Viridas

GmbH - 8,197

-------------------------------- ------ ------

25,263 74,110

-------------------------------- ------ ------

OPERATING EXPENSES

2014 2013

GBP GBP

------------------------------------- -------- -------

Operating expenses include:

Wages and salaries 126,504 141,173

Share based payment expense 13,230 21,073

------------------------------------- -------- -------

AUDITOR'S REMUNERATION

During the year the Company obtained the following

services from the Company's auditor:

2014 2013

GBP GBP

------------------------------------- -------- -------

Fees payable to the Company's

auditor for the audit of the

parent company and the Company

financial statements 10,000 10,000

Fees payable to the Company's

auditor and its associates

for other services:

Other services relating to

taxation 2,000 2,000

------------------------------------- -------- -------

12,000 12,000

------------------------------------- -------- -------

INCOME TAX EXPENSE

2014 2013

GBP GBP

---------------------------------------- ----------- ---------

Current tax - continuing operations - -

---------------------------------------- ----------- ---------

The tax on the Company's profit before tax

differs from the theoretical amount that would

arise using the weighted average rate applicable

to profits of the Consolidated entities as

follows:

2014 2013

GBP GBP

---------------------------------------- ----------- ---------

Loss before tax from continuing

operations (120,372) (21,144)

---------------------------------------- ----------- ---------

Loss before tax multiplied by

rate of corporation tax in the

UK of 20% (2013: 20%) (24,074) (4,229)

Expenses not deductible for tax

purposes 523 800

Unrelieved tax losses carried

forward 23,551 3,429

Total tax - -

---------------------------------------- ----------- ---------

Unrelieved tax losses of GBP3,582,000 (2012:

GBP3,555,000) remain available to offset against

future taxable trading profits. No deferred

tax asset has been recognised in respect of

the losses as recoverability is uncertain.

EARNINGS PER SHARE

The basic earnings per share is based on the

profit/(loss) for the year divided by the

weighted average number of shares in issue

during the year. The weighted average number

of ordinary shares for the year ended 31 December

2013 assumes that all shares have been included

in the computation based on the weighted average

number of days since issue.

2014 2013

GBP GBP

---------------------------------------- ----------- -----------

(Loss)/profit attributable to

equity holders of the Company:

(Loss)/profit from continuing

operations (120,372) (21,144)

(Loss)/profit for the year attributable

to equity holders of the Company (120,372) (21,144)

---------------------------------------- ----------- -----------

Weighted average number of ordinary

shares in issue for basic earnings 579,940,148 577,857,956

Weighted average number of ordinary

shares in issue for fully diluted

earnings* 579,940,148 577,857,956

(LOSS)/EARNINGS PER SHARE

BASIC:

- Basic (loss)/earnings per

share from continuing and total

operations (0.021p) (0.004p)

FULLY DILUTED:

- Fully diluted (loss)/earnings

per share from continuing and

total operations (0.021p) (0.004p)

---------------------------------------- ----------- -----------

For 2014 and 2013 the share options in issue

are anti-dilutive in respect of the loss per

share calculation and have therefore not been

included.

INVESTMENTS HELD FOR TRADING

2014 2013

GBP GBP

-------------------------------------- --------- ---------

At 1 January - fair value 2,028,984 1,199,608

Acquisitions 722,826 892,806

Disposal proceeds (552,030) (227,731)

Net gain on disposal of investments 124,383 33,641

Movement in fair value of investments (32,402) 130,660

-------------------------------------- --------- ---------

.At 31 December - fair value 2,291,761 2,028,984

-------------------------------------- --------- ---------

Categorised as:

Level 1 - Quoted investments 1,617,069 1,554,292

Level 2 - Unquoted investments - 100,000

Level 3 - Unquoted investments 674,692 374,692

-------------------------------------- --------- ---------

2,291,761 2,028,984

-------------------------------------- --------- ---------

ASSOCIATED UNDERTAKINGS

MX OIL PLC

At the year end, the Company held 4.3% of the issued share

capital of MX Oil plc, a company of which Nicholas Lee is a

director.

ELEPHANT OIL LIMITED

At the year end, the Company held 5.5% shareholding in Elephant

Oil Limited, a company of which Matt Lofgran is a director and a

significant shareholder.

The table of investments sets out the fair

value measurements using the IFRS 7 fair value

hierarchy. Categorisation within the hierarchy

has been determined on the basis of the lowest

level of input that is significant to the

fair value measurement of the relevant asset

as follows:

Level 1 - valued using quoted prices in active

markets for identical assets.

Level 2 - valued by reference to valuation

techniques using observable inputs other than

quoted prices included within Level 1.

Level 3 - valued by reference to valuation

techniques using inputs that are not based

on observable market data.

The valuation techniques used by the company

are explained in the accounting policy note,

"Investments held for trading".

LEVEL 2 FINANCIAL ASSETS

Level 2 financial assets comprise a convertible

instrument valued by reference to the bid

price of the underlying equity and taking

into account the contractual arrangements

in place regarding the asset.

LEVEL 3 FINANCIAL ASSETS

Reconciliation of Level 3 fair value measurement

of financial assets

2014 2013

GBP GBP

Brought forward 374,692 170,597

Purchases 300,000 204,095

--------------------------- ------------- ------------

Carried forward 674,692 374,692

--------------------------- ------------- ------------

Level 3 valuation techniques used by the Company

are explained on page 17 (Fair value of financial

instruments)

TRADE AND OTHER RECEIVABLES

2014 2013

GBP GBP

------------------------------- ------- -------

Other receivables 108,630 178,043

Prepayments and accrued income 63,996 67,438

------------------------------- ------- -------

172,626 245,481

------------------------------- ------- -------

Other receivables include short term loans made on normal market

terms. The Directors consider that the carrying amount of short

term loans and other receivables is approximately equal to their

fair value.

CASH AND CASH EQUIVALENTS

2014 2013

GBP GBP

---------------------------- ------- -------

Cash and cash equivalents 359,094 400,578

---------------------------- ------- -------

The Directors consider the carrying amount of cash and cash

equivalents approximates to their fair value.

TRADE AND OTHER PAYABLES

2014 2013

GBP GBP

-------------------------------- ------ ------

Trade payables 29,278 11,406

Social security and other taxes - -

Accrued expenses 35,419 19,369

-------------------------------- ------ ------

64,697 30,775

-------------------------------- ------ ------

The Directors consider that the carrying amount of trade

payables approximates to their fair value.

SHARE CAPITAL

Number of shares Share capital Share

Deferred Ordinary Deferred Ordinary premium

GBP GBP GBP

----------------- ------------ ----------- ---------- ---------- ---------

ISSUED AND FULLY

PAID:

At 1 January

2013:

Deferred shares

of 9.9p each 32,857,956 - 3,252,938 -

Ordinary shares

of 0.1p each - 577,857,956 - 577,858 2,774,849

----------------- ------------ ----------- ---------- ---------- ---------

At 31 December

2013 32,857,956 577,857,956 3,252,938 577,858 2,774,849

Issue of shares 95,000,000 95,000 147,250

Share issue

costs (20,592)

----------------- ------------ ----------- ---------- ---------- ---------

At 31 December

2014 32,857,956 95,000,000 3,252,938 672,858 2,901,507

----------------- ------------ ----------- ---------- ---------- ---------

On 23 December 2014 the Company issued 95,000,000 new ordinary

shares for cash at 0.255p per share, raising GBP242,250 before

expenses.

OTHER RESERVES

Capital Share Total

redemption option Other

reserve reserve reserves

GBP GBP GBP

--------------------------- ------------ --------- ----------

Balance at 1 January 2013 27,000 43,109 70,109

Share based payment costs - 21,073 21,073

Balance at 31 December

2013 27,000 64,182 91,182

Share based payment costs - 13,230 13,230

Balance at 31 December

2014 27,000 77,412 104,412

--------------------------- ------------ --------- ----------

FINANCIAL INSTRUMENTS

The Company uses financial instruments, other

than derivatives, comprising cash to provide

funding for the Company's operations.

CATEGORIES OF FINANCIAL INSTRUMENTS

The IAS 39 categories of financial asset included

in the statement of financial position and

the headings in which they are included are

as follows:

2014 2013

GBP GBP

----------------------------------- --------- ---------

FINANCIAL ASSETS:

Cash and cash equivalents 359,094 400,578

Loans and receivables 108,630 178,043

Investments held for trading 2,291,761 2,028,984

----------------------------------- --------- ---------

FINANCIAL LIABILITIES AT AMORTISED

COST:

The IAS 39 categories of financial liabilities

included in the statement of financial position

and the headings in which they are included

are as follows:

2014 2013

GBP GBP

----------------------------------- --------- ---------

Trade and other payables 29,278 11,406

----------------------------------- --------- ---------

RELATED PARTY TRANSACTIONS

Transactions between the company and its subsidiaries,

which are related parties, have been eliminated

on consolidation and are not disclosed in

this note.

The compensation payable to Key Management

personnel comprised GBP118,400 (2013: GBP131,000)

paid by the Company to the Directors in respect

of services to the Company. Full details of

the compensation for each Director are provided

in Note 7.

Nicholas Lee is a director and controlling

shareholder of ACL Capital Limited which invoiced

the Company GBP19,000 in respect of consultancy

fees due for the year (2013: GBP42,000). GBP2,000

of this amount was invoiced and paid after

the year end. No other amounts were owed at

31 December 2014.

Nicholas Lee is also a director of MX Oil

plc ("MX Oil"), in which the Company has a

4.3% shareholding. During the year, the Company

invoiced MX Oil plc GBP2,000 (2013: GBPnil)

for consultancy services.

The loan to Brady Exploration plc (subsequently

renamed Metal Tiger plc) of GBP60,000 which

was outstanding at 31 December 2013 was settled

partly in cash and partly in shares during

the year. In June 2014, Nicholas Lee resigned

as a director of Metal Tiger plc. At the year

end, the Company had a 10.8% shareholding

in Metal Tiger plc.

In September 2014, the Company acquired a

5.5% shareholding in Elephant Oil Limited,

a company of which Matt Lofgran is a director

and a significant shareholder. Subsequent

to Paternoster's acquisition of its shareholding

Matt Lofgran was appointed a director of the

Company.

A copy of the annual report and of the notice

of AGM to be held at the offices Adams & Remers

LLP, Dukes Court, 32 Duke Street St James's,

London SW1Y 6DF on 29 June 2015 at 11.30 am

is available from the Company's website at

www.paternosterresources.com and is being

posted to shareholders today.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR EAXKLEFPSEFF

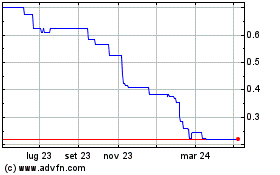

Grafico Azioni Riverfort Global Opportu... (LSE:RGO)

Storico

Da Ago 2024 a Set 2024

Grafico Azioni Riverfort Global Opportu... (LSE:RGO)

Storico

Da Set 2023 a Set 2024