TIDMTHS

RNS Number : 2912Z

Tharisa PLC

11 January 2024

Tharisa plc

(Incorporated in the Republic of Cyprus with limited

liability)

(Registration number HE223412)

JSE share code: THA

LSE share code: THS

A2X share code: THA

ISIN: CY0103562118

LEI: 213800WW4YWMVVZIJM90

('Tharisa' or the 'Company')

PRODUCTION REPORT FOR THE FIRST QUARTER FY2024ED 31 DECEMBER

2023

Tharisa, the mining, metals, and innovation company dual-listed

on the Johannesburg and London stock exchanges, announces its

production results for Q1 FY2024 ([1]) and cash balance as at

quarter end.

Quarter highlights

-- Lost Time Injury Frequency Rate ('LTIFR') of

-- 0.09 per 200 000-man hours worked at Tharisa Minerals

-- 0.13 per 200 000-man hours worked at Karo Platinum

-- Increased mill throughput of 8.7% at 1 424.4 kt, with

improvements in both grade and recovery for PGMs and chrome

concentrate leads to

-- PGM output increasing to 35.7 koz (Q4 FY2023: 30.7 koz)

-- Record quarterly chrome output at 462.8 kt (Q4 FY2023: 413.4 kt)

-- PGM basket price showed slight improvement of 1% to US$1

344/oz (6E basis) (Q4 FY2023: US$1 331/oz)

-- Average metallurgical grade chrome concentrate prices held

steady at US$291/t (Q4 FY2023: US$291/t)

-- Group cash on hand at US$221.5 million (30 September 2023:

US$268.8 million), and debt of US$126.6 million (30 September 2023:

US$142.2 million), resulting in a net cash position of US$94.9

million (30 September 2023: US$126.6 million)

-- Production guidance for FY2024 remains between 145 koz and

155 koz PGMs (6E basis) and 1.7 Mt to 1.8 Mt of chrome

concentrates

Key Operating Numbers

Quarter Quarter Quarter Quarter Year

ended ended on quarter ended ended

31 Dec 30 Sep movement 31 Dec 30 Sep

2023 2023 % 2022 2023

Reef mined kt 1 058.6 1 158.9 (8.7) 1 081.5 4 177.3

-------- -------- -------- ------------ -------- --------

Reef milled kt 1 424.4 1 310.2 8.7 1 427.4 5 409.8

-------- -------- -------- ------------ -------- --------

PGMs produced (6E) koz 35.7 30.7 16.3 42.7 144.7

-------- -------- -------- ------------ -------- --------

Chrome concentrates

produced (excluding

third party) kt 462.8 413.4 11.9 383.1 1 580.1

-------- -------- -------- ------------ -------- --------

Average PGM basket

price US$/oz 1 344 1 331 1.0 2 360 1 893

-------- -------- -------- ------------ -------- --------

Average metallurgical

grade chrome concentrate

price - 42% basis US$/t 291 291 - 223 263

-------- -------- -------- ------------ -------- --------

Phoevos Pouroulis, CEO of Tharisa, commented:

"A positive start to our new financial year in what is

traditionally a tough quarter with the festive season and inclement

weather typically causing challenges to operations. We have made

good operational improvements, with waste mining advances leading

to a better mining and plant performance, resulting in record

quarterly chrome production.

This performance is vital and underpins our development of the

Karo Platinum Project and sets the trajectory for the coming

decades at our multi-generational Tharisa Mine.

PGM prices remain subdued, negatively affecting many of the PGM

miners in South Africa, once again our co-product business model

continues to be operationally cash-generative, and the chrome

market continues to enjoy strong demand as we enter the Chinese New

Year.

This year we will be expanding and rolling out our R&D

projects in distinct stages of development and commercialisation.

With a solid foundation we can re-frame the operating context and

re-focus our energy on our key competencies ultimately unlocking

value to all stakeholders."

Health & Safety

-- The health and safety of our stakeholders remains a core

value to the Group and Tharisa continues to strive for zero harm at

its operations

-- LTIFR of

-- 0.09 per 200 000-man hours worked at Tharisa Minerals

-- 0.13 per 200 000-man hours worked at Karo Platinum

Market Update

-- Continued strong demand was evident in the chrome market,

particularly in the lead up to, these days, a less disruptive

Chinese New Year period (official start date 10 February 2024),

with demand underpinned by economic fundamentals and continued

concerns about inland logistics in South Africa. Freight rates are

ticking up on the back of geo-political events impacting maritime

shipping routes

-- The PGM market has continued to suffer from pricing pressure,

however, a short-term reprieve towards the end of the quarter,

driven by technical short covering, saw some price spikes. The

effect of these low prices is evident on the PGM mines in South

Africa, with shaft and even mine closures underway. The major

pressure on PGM prices remains the (perceived) excess inventory in

the PGM pipeline. We expect this to be balanced once the real

demand we have seen from end users becomes evident, in particular

as further supply cuts are implemented and, on a macro level,

policy reduction of subsidies for EV vehicles influences demand

Operational Update

-- Total reef mined slightly down at 1 058.6 kt (Q4 FY2023: 1 158.9 kt)

-- Strategic ROM ore purchases supplemented own mine production

with Q1 FY2024 milling at 1 424.4 kt (Q4 FY2023: 1 310.2kt)

-- Quarterly chrome production at a record 462.8 kt (Q4 FY2023: 413.4 kt)

-- Grade of 19.1% Cr(2) O(3) (Q4 FY2023: 18.7%)

-- Recovery at 70.3% (Q4 FY2023: 70.0%)

-- Quarterly PGM production at 35.7 koz (Q4 FY2023: 30.7 koz)

-- Rougher feed grade of 1.60 g/t (Q4 FY2023: 1.57 g/t)

-- Recovery of 66.1% (Q4 FY2023: 62.7%)

Karo Platinum Update

-- The previously announced review of the commissioning timeline

of the Karo Platinum Project remains on track for first ore in mill

(FOIM) for June 2025

-- Funding solutions ring fenced to Karo Platinum are being

pursued in line with the revised production timeline

Cash Balance and Debt Position

-- Group cash on hand at US$221.5 million (30 September 2023:

US$268.8 million), and debt of US$126.6 million (30 September 2023:

US$142.2 million), resulting in a net cash position of US$94.9

million (30 September 2023: US$126.6 million)

Guidance

Production guidance for FY2024 is set between 145 koz and 155

koz PGMs (6E basis) and 1.7 Mt to 1.8 Mt of chrome

concentrates.

Any forward looking statements have not been reported on or

reviewed by Tharisa's auditors.

Quarter Quarter Quarter Quarter Year ended

ended ended on quarter ended 30 Sep

31 Dec 30 Sep movement 31 Dec 2023

2023 2023 % 2022

Reef mined kt 1 058.6 1 158.9 (8.7) 1 081.5 4 177.3

--------- -------- -------- ------------ -------- -----------

m(3)

Stripping ratio : m(3) 12.0 14.0 (14.3) 10.6 12.8

--------- -------- -------- ------------ -------- -----------

Reef milled kt 1 424.4 1 310.2 8.7 1 427.4 5 409.8

--------- -------- -------- ------------ -------- -----------

PGM flotation feed kt 1 048.0 970.6 8.0 1 115.3 4 122.0

--------- -------- -------- ------------ -------- -----------

PGM rougher feed grade g/t 1.60 1.57 1.9 1.66 1.64

--------- -------- -------- ------------ -------- -----------

PGM recovery % 66.1 62.7 5.4 71.7 66.5

--------- -------- -------- ------------ -------- -----------

6E PGMs produced koz 35.7 30.7 16.3 42.7 144.7

--------- -------- -------- ------------ -------- -----------

Platinum koz 20.5 17.3 18.5 23.2 80.3

--------- -------- -------- ------------ -------- -----------

Palladium koz 5.2 5.2 - 7.5 24.8

--------- -------- -------- ------------ -------- -----------

Rhodium koz 3.3 3.0 10.0 4.2 13.5

--------- -------- -------- ------------ -------- -----------

Average PGM basket price US$/oz 1 344 1 331 1.0 2 360 1 893

--------- -------- -------- ------------ -------- -----------

Platinum US$/oz 914 940 (2.8) 967 981

--------- -------- -------- ------------ -------- -----------

Palladium US$/oz 1 090 1 227 (11.2) 1 952 1 594

--------- -------- -------- ------------ -------- -----------

Rhodium US$/oz 4 216 3 841 9.8 12 951 8 992

--------- -------- -------- ------------ -------- -----------

Average PGM basket price ZAR/oz 25 189 24 842 1.4 41 682 34 107

--------- -------- -------- ------------ -------- -----------

Cr(2) O(3) ROM grade % 19.1 18.7 2.1 17.0 17.9

--------- -------- -------- ------------ -------- -----------

Chrome recovery % 70.3 70.0 0.4 65.7 67.6

--------- -------- -------- ------------ -------- -----------

Chrome yield % 32.5 31.6 2.8 26.8 29.2

--------- -------- -------- ------------ -------- -----------

Chrome concentrates

produced (excluding

third party) kt 462.8 413.4 11.9 383.1 1 580.1

--------- -------- -------- ------------ -------- -----------

Metallurgical grade kt 389.9 338.4 15.2 347.2 1 356.9

--------- -------- -------- ------------ -------- -----------

Specialty grades kt 72.9 75.0 (2.8) 35.9 223.2

--------- -------- -------- ------------ -------- -----------

Third party chrome production kt 45.4 58.9 (22.9) 40.9 201.9

--------- -------- -------- ------------ -------- -----------

Average metallurgical

grade chrome concentrate US$/t

contract price - 42% CIF

basis China 291 291 - 223 263

--------- -------- -------- ------------ -------- -----------

Metallurgical grade ZAR/t

chrome concentrate contract CIF

price China 5 445 5 273 3.3 3 932 4 840

--------- -------- -------- ------------ -------- -----------

Average exchange rate ZAR:US$ 18.7 18.7 - 17.6 18.2

--------- -------- -------- ------------ -------- -----------

Paphos, Cyprus

11 January 2024

JSE Sponsor

Investec Bank Limited

Connect with us on LinkedIn to get further news and updates

about our business.

Investor Relations Contacts:

Ilja Graulich (Head of Investor Relations and

Communications)

+27 11 996 3500

+27 83 604 0820

igraulich@tharisa.com

Broker Contacts:

Peel Hunt LLP (UK Joint Broker)

Ross Allister / Georgia Langoulant

+44 207 418 8900

BMO Capital Markets Limited (UK Joint Broker)

Thomas Rider / Nick Macann

+44 207 236 1010

Berenberg (UK Joint Broker)

Matthew Armitt / Jennifer Lee / Detlir Elezi

+44 203 207 7800

About Tharisa

Tharisa is an integrated resource group critical to the energy

transition and decarbonisation of economies. It incorporates

exploration, mining, processing and the beneficiation, marketing,

sales, and logistics of PGMs and chrome concentrates, using

innovation and technology as enablers. Its principal operating

asset is the Tharisa Mine, located in the south-western limb of the

Bushveld Complex, South Africa. The mine has a 13-year open pit

life and is strategically advancing the vast mechanised underground

resource which extends for over 60 years. Tharisa is developing the

Karo Platinum Project, a low-cost, open-pit PGM asset located on

the Great Dyke in Zimbabwe. The Company is committed to reducing

its carbon emissions by 30% by 2030 and the development of a

roadmap to become net carbon neutral by 2050. As part of this

energy transition, the 40 MW solar project adjacent to the Tharisa

Mine is well advanced. Redox One is accelerating the development of

a proprietary iron chromium redox flow long duration battery

utilising the commodities we mine. Tharisa plc is listed on the

Johannesburg Stock Exchange (JSE: THA) and the Main Board of the

London Stock Exchange (LSE: THS).

[1] Tharisa's financial year is from 01 October to 30

September

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCMZGMMDGLGDZM

(END) Dow Jones Newswires

January 11, 2024 02:00 ET (07:00 GMT)

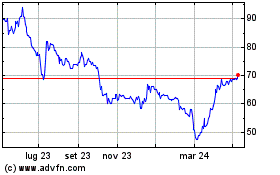

Grafico Azioni Tharisa (LSE:THS)

Storico

Da Ott 2024 a Nov 2024

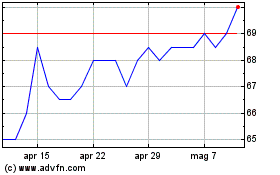

Grafico Azioni Tharisa (LSE:THS)

Storico

Da Nov 2023 a Nov 2024