TIDMTND

RNS Number : 9882M

Tandem Group PLC

20 September 2023

Tandem Group plc

(the 'Company' or 'Group')

Interim results for the six months ended 30 June 2023

The Board of Tandem Group plc (AIM: TND), designers, developers,

distributors and retailers of sports, leisure and mobility

equipment, announces its unaudited interim results for the six

months to 30 June 2023.

Summary

-- Successful completion of the Group's purpose built, solar powered warehouse

-- Continued focus on efficient inventory management

-- Group revenue in the six months to 30 June 2023 of GBP9.8

million (H1 2022: GBP12.9 million)

-- Gross profit of GBP2.5 million (H1 2022: GBP4.0 million),

with a decrease in gross margin, to 25.9%, primarily as a result of

foreign exchange movements

-- Loss before taxation of GBP0.9 million (H1 2022: profit of GBP0.3 million)

-- Postponement of the interim dividend taking into account performance in H1

-- Cash and cash equivalents of GBP2.0 million as at 30 June 2023

-- Net assets at 30 June 2023 increased to GBP25.9 million (H1 2022: GBP23.0 million)

-- Net debt as at 30 June 2023 of GBP3.1 million (30 June 2022: GBP1.5 million)

-- Amidst a difficult economic environment, there have been

encouraging signs, with the Group's resilient performance driven by

the continued success of our initiatives within eMobility, a

strategic focus of the Group.

-- Turnover in the Group's eMobility segment was 53% higher than in the comparative period.

Enquiries:

Tandem Group plc

Peter Kimberley, CEO

David Rock, Company Secretary

Telephone 0121 748 8075

Nominated Adviser

Cavendish Securities plc (Nominated Adviser and Broker)

Ben Jeynes / Dan Hodkinson - Corporate Finance

Michael Johnson - Sales

Telephone 0207 220 0500

CHAIRMAN'S STATEMENT

The Group has continued to experience a challenging trading

environment resulting from macroeconomic factors and a transition

of buying behaviour from a Freight On Board (FOB) to Direct

Delivery (DD) basis within the Toy side of the business, altering

the pattern of our sales, aligning it closer to the end customer

buying behaviour. We continue to be well placed to service the

movement to DD in Toys following the completion of our brand new,

fully operational warehouse.

Notwithstanding the current trading environment, we are

extremely pleased by both the Group's resilient trading performance

when compared to industry peers and to see strong growth in our

eMobility category resulting from our strategic focus on our

product range in this sector.

Results

The Group revenue in the six months to 30 June 2023 decreased by

approximately 24% to GBP9.8 million compared to GBP12.9 million in

the six months to 30 June 2022.

There was a 37% decrease in gross profit from GBP4.0 million to

GBP2.5 million. Gross profit margin decreased to 25.9% compared to

31.0% in the prior period primarily as a result of favourable

foreign exchange variances in the prior period.

Despite inflationary pressures, operating expenses maintained

their level at GBP3.4 million in the six months to 30 June 2023,

with inflationary pressures offset by the ongoing careful

management of costs.

As a result of the above, operating profit before exceptional

expenses in the prior period of GBP0.6 million became an operating

loss of GBP0.9 million in the current period.

We have substantially mitigated the increasing interest rate

effect on our borrowing costs with the interest rate hedge

instrument we put in place in June 2022, which is effective until

May 2029. Finance costs were GBP0.15 million in the six months to

30 June 2023. This compared to a cost of GBP0.12 million in the

prior year period and is the result of drawdowns on agreed loan

facilities to fund the completion of the new warehouse from June

2022.

Exceptional costs were GBP0.1 million, primarily in relation to

employment related expenses and costs relating to the consolidation

of operations of the Group.

Cash and cash equivalents were GBP2.0 million at 30 June 2023

which compared to GBP3.2 million at 30 June 2022. The reduction is

a combination of warehouse completion costs, offset in part by the

diligent management of inventory, which over the 12 month period

has decreased to GBP5.9 million compared to GBP8.6 million at 30

June 2022.

Net debt after borrowings was GBP3.1 million compared to GBP1.5

million at 30 June 2022. The movement was the result of loan

facility drawdowns to fund the completion of the new warehouse.

Net assets at 30 June 2023 increased to GBP25.9 million against

GBP23.0 million at 30 June 2022, supported by an uplift in our

property values.

Trading update and outlook

Stubbornly high inflation coupled with persistent increases in

interest rates have had a direct impact on consumers' disposable

income, leading to reduced spending across certain categories. This

has been further impacted by persistent unfavourable weather

conditions. As a result, group revenue to 15 September 2023 was

approximately GBP15.1 million compared to GBP19.1 million for the

same period in the prior year.

Toy sales, typically considered recession-proof, have slumped in

Britain this year, according to a market analyst, particularly the

outdoor toy market due to the poor weather. This decline has

impacted our revenue in Toys, Sports and Leisure which has reduced

44% in H1 against H1 in the prior year.

The declining trend in FOB sales within our Toys, Sports and

Leisure segment has continued to impact our overall turnover and

the timing of realising sales, however we continue to see an uptake

in DD business as more customers transition away from FOB.

We are perfectly placed to handle this shift in the anticipated

sales pattern following the successful completion of our purpose

built, solar powered warehouse, removing our reliance and cost of

3(rd) party warehouse facilities, helping us realise operational

efficiencies through consolidating our operations across a single

site, allowing us to easily cross sell product on single shipments,

and importantly providing capacity for future growth.

The Board maintain a high level of optimism regarding the

performance of both new and existing licenses. Notably, Barbie

continues to contribute to our positive outlook. We are also

pleased to report that we have reached agreement to renew existing

licences including Marvel, CoComelon, LOL, Bluey, Disney, and Peppa

Pig, where will continue our strategy to innovate new products.

In our bicycle division, we are delighted that we continue to

outperform the market, and our turnover, including electric bikes,

is ahead of our prior year turnover level for H1 by 19%, despite

published market data showing that the total bicycle market value

is down compared with the first six months of 2022, mechanical

bicycles in particular have fallen further having already hit a 20

year low last year.

Our lightweight children bike brand, Squish, continues to see

success and is also ahead of the prior year. We are also pleased to

have partnered this year with children's cycle training

organisation, Bikeability. The fourth quarter of 2023 will see the

release of new product additions across our core bike brands,

Dawes, Claud Butler, Falcon and Squish.

One of our key strategic focuses continues to be electric bikes,

and we are pleased that this is yielding substantial returns. Our

electric bike sales have surged to more than 2.5 times the figures

of the previous year during H1, and continues to grow at that level

to date, a testament to the effectiveness of our strategy. The

development of our new ranges of electric bikes has been met with

resounding success, garnering strong popularity among our bike

dealers. Turnover in our eMobility segment is 53% higher in H1 for

2023 against H1 for 2022.

Our continued focus on eMobility aligns with the UK Government

who continue to promote their commitment to encouraging sustainable

travel methods. This resolute effort towards reduced carbon

emissions has culminated in the expansion of the Ultra Low Emission

Zone (ULEZ) program. As the ULEZ boundaries extend, the expectation

is that this initiative will serve as a powerful catalyst in

encouraging greater adoption of electric methods of travel, which

the Group is well placed to benefit from.

Both our physical retail shop and the ElectricLife website are

exceeding expectations with the introduction of market leading

eBike brands Orbea, Whyte, Quella, Pure and we are continuing to

talk to a number of other leading brands. These channels remain

integral to our operational success and our commitment to meeting

the evolving needs of our customers. Our social media Instagram

followers have grown 38% year to date, with our Return on

Advertising spend increasing 267% underpinned by an improved

conversation rate of 178% year to date compared to the same period

last year.

Our Home and Garden division has been particularly impacted by

the poor weather experienced in 2023 compared to 2022, having

recorded some of the wettest months on record this summer. Turnover

has declined 27% in H1 against the same period in the prior year.

We are seeing continued growth in our visitor numbers, conversion

rates to improve this position, our website conversion rate has

increased +36% compared to the same period last year

(January-August), aligning with our strategic integration of our

standalone garden and leisure websites onto Jack Stonehouse. We

have further optimised and managed our marketing activity, reducing

our Pay Per Click investment by 24% compared to the same period

last year, which in turn has delivered +17% improvement in our

Return on Advertising Spend. Our social media followers across our

Instagram channel has increased by over 25% year to date.

We remain focussed in ensuring that we offer the latest

innovative products in this category, and will be introducing an

exciting range of new products, due for launch in the coming months

and in time for the Christmas and Winter period where we anticipate

high demand for these products.

Our management team have been actively engaged in several key

strategies around the management of our inventory which has been

pivotal in ensuring healthy cash balances and being able to offer

fresh exciting ranges to customers. Consequently, we have refined

our demand forecasting models to adapt to the changing market

conditions as we have seen the transition from FOB to DD

buying.

The continuous focus has led us to a reduced inventory level of

GBP5.9 million compared to the end of the comparable prior year

period level of GBP8.6 million. At the end of August 2023, this had

reduced further to GBP4.8 million.

We are continuously improving our sourcing strategy, driving

down costs and reducing lead times by working closely with our

suppliers and logistics partners, and have consolidated the overall

number of suppliers we use leading to greater efficiencies going

forward.

As part of our strategy on driving new independent and national

accounts across all sectors, we are pleased that this year we have

opened 3 new large national accounts, 54 new golf accounts, 81

independent bike dealer accounts and a leisure experience

account.

In recent months we have faced escalating carriage costs,

particularly on bicycles following the collapse of Tuffnells who

were our primary partner. However, logistical costs have now

returned to historical levels following re-establishment of trade

with a new logistics partner.

Despite inflationary pressures on many areas in the business,

particularly energy, management have committed to ensuring

reductions in operating expenses, as a result, they have remained

in line with the prior year.

Given the challenges mentioned, the Board anticipate that the

Group's sales for the FY23 full year will reduce between 11 and 13%

against market expectations and that the Group will be

approximately break-even at an underlying Profit Before Tax (PBT)

level for FY23.

We are pleased that we continue to build for the future in

challenging times. We are grateful to all of our colleagues who are

continuing to work hard and helping to build for the future.

Tandem Group maintains a robust balance sheet, fortified by

substantial property values. Our cash balances remain healthy,

reflecting our commitment to financial stability. We remain

steadfast in our commitment to our strategic objectives, and the

challenging market conditions have not deterred us from pursuing

avenues for growth and exciting innovation.

Borrowings

As at 30 June 2023, the Group had net debt of GBP3.1 million,

with gross cash balances of GBP2.0 million and borrowings including

fully drawn mortgage secured loan facilities of GBP5.1 million of

which GBP4.0, are loans (the "Loans"). These Loans mature at

various dates between April 2024 and January 2025 and, given the

near-term maturities, the Company has been in early discussions

with its lender to secure the refinancing of these historical Loans

in the form of a single term loan on terms attractive to the Group.

During the period ended 30 June 2023, the Company and its lender

have become aware of technical breaches of the existing Loans which

first came into being on the draw down of the majority of the

balance of the Loans in 2022.

Notwithstanding this technical breach and the Company's

currently anticipated level of profitability for the full year

ended 31 December 2023, the Group continues to have the ongoing

support from its banking partner - with whom the Company remains in

discussion for the refinancing of the Loans in the ordinary course.

On this basis, the directors are confident that the Group remains a

going concern.

Further details of the Group's borrowings are provided at note 3

to the interim financial statements.

Dividend

Due to the performance in the first half of the year and the

expected position for the full year, we are not proposing to pay an

interim dividend (2022 - 3.43p per share). We will continue to

review our dividend strategy and will pay a dividend where profits

permit.

Investor presentation

The interim results presentation for investors will be posted on

the Company's website in due course. Investors are encouraged to

contact the Company with any questions about the business by

emailing our dedicated shareholder email address

investorrelations@tandemgroup.co.uk or contacting our Nominated

Advisors.

Change of Name of Nominated Adviser and Broker

The Company also announces that its Nominated Adviser and Broker

has changed its name to Cavendish Securities plc following

completion of its own corporate merger.

Steve Grant

Chairman

20 September 2023

CONDENSED CONSOLIDATED INCOME STATEMENT

For the 6 months ended 30 June 2023

6 months ended 6 months ended Year ended 31 December 2022

30 June 2023 30 June 2022 (restated) Audited

Unaudited Unaudited GBP'000

GBP'000 GBP'000

Revenue 9,752 12,913 26,683

Cost of sales (7,228) (8,912) (18,887)

--------------- ------------------------ --------------------------------

Gross profit 2,524 4,001 7,796

Operating expenses (3,381) (3,407) (6,484)

--------------- ------------------------ --------------------------------

Operating (loss)/profit

before exceptional

costs (857) 594 1,312

Exceptional costs (98) (172) (223)

--------------- ------------------------ --------------------------------

Operating (loss)/profit

after exceptional

costs (955) 422 1,089

Finance costs (150) (115) (237)

(Loss)/profit before

taxation (1,105) 307 852

Tax creditexpense 147 - (178)

Net (loss)/profit for

the period (958) 307 674

=============== ======================== ================================

Pence Pence Pence

Earnings per share

Basic 2 (17.5) 5.8 12.5

=============== ======================== ================================

Diluted 2 (17.5) 5.6 12.3

=============== ======================== ================================

All figures relate to continuing operations.

The results for the 6 months to 30 June 2022 have been restated.

Carriage outward costs have been included in cost of sales, having

previously been disclosed in operating expenses of GBP385,000.

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the 6 months ended 30 June 2023

6 months 6 months

ended ended Year ended 31 December

30 June 2023 30 June 2022 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

(Loss)/profit for the period (958) 307 674

Other comprehensive income:

Items that will be reclassified subsequently to profit and loss:

Foreign exchange differences on translation of overseas

subsidiaries (25) 23 96

Cashflow hedging contracts 44 261 540

Items that will not be reclassified subsequently to profit or

loss:

Revaluation of property, plant and equipment - - 2,189

Actuarial gain on pension schemes - - 1,472

Movement in pension schemes' deferred tax provision - - (214)

------------- ------------- ----------------------

Other comprehensive income for the period 19 284 4,083

Total comprehensive income attributable to equity shareholders

of Tandem Group plc (939) 591 4,757

============= ============= ======================

All figures relate to continuing operations.

CONDENSED CONSOLIDATED BALANCE SHEET

As at 30 June 2023

At 31

At 30 June At 30 June December

2023 2022 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Non current assets

Intangible fixed assets 5,598 5,454 5,525

Property, plant and equipment 14,884 10,003 14,700

Deferred taxation 854 1,323 854

Pension schemes' surplus 98 - -

---------- ---------- ---------

21,434 16,780 21,079

Current assets

Inventories 5,881 8,577 4,757

Trade and other receivables 6,038 6,065 6,633

Derivative financial asset held at fair value 323 319 279

Cash and cash equivalents 1,993 3,229 3,288

---------- ---------- ---------

14,235 18,190 14,957

Total assets 35,669 34,970 36,036

========== ========== =========

Current liabilities

Trade and other payables (4,711) (5,050) (4,200)

Borrowings 3 (5,083) (897) (1,085)

Current tax liabilities - (201) (149)

---------- ---------- ---------

(9,794) (6,148) (5,434)

Non current liabilities

Borrowings 3 - (3,867) (3,754)

Pension schemes' deficits - (1,920) (60)

---------- ---------- ---------

- (5,787) (3,814)

Total liabilities (9,794) (11,935) (9,248)

========== ========== =========

Net assets 25,875 23,035 26,788

========== ========== =========

Equity

Share capital 1,503 1,503 1,503

Shares held in treasury (135) (151) (137)

Share premium 729 647 716

Other reserves 7,322 5,080 7,303

Profit and loss account 16,456 15,956 17,403

---------- ---------- ---------

Total equity 25,875 23,035 26,788

========== ========== =========

CONDENSED Consolidated statement of changes in equity

As at 30 June 2023

Cash

Shares flow Capital Profit

Share held Share hedge Merger redemption Revaluation Translation and loss

capital in treasury premium reserve reserve reserve reserve reserve account Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2022 1,503 (192) 474 225 1,036 1,427 1,671 605 15,990 22,739

Net profit for

the period - - - - - - - - 307 307

Retranslation of

overseas

subsidiaries - - - - - - - 23 - 23

Forward contracts - - - 261 - - - - - 261

--------- ------------- ---------- --------- --------- ----------- ------------ ----------- ---------- -------

Total

comprehensive

income for

period

attributable to

equity

shareholders - - - 261 - - - 23 307 591

Share based

payments - - - - - - - - 13 13

Exercise of share

options - 41 173 - - - - - - 214

Reclassified to

cost of

inventory - - - (168) - - - - - (168)

Dividends paid - - - - - - - - (354) (354)

--------- ------------- ---------- --------- --------- ----------- ------------ ----------- ---------- -------

Total

transactions

with owners - 41 173 (168) - - - - (341) (295)

--------- ------------- ---------- --------- --------- ----------- ------------ ----------- ---------- -------

At 30 June 2022 1,503 (151) 647 318 1,036 1,427 1,671 628 15,956 23,035

Net profit for

the period - - - - - - - - 367 367

Retranslation of

overseas

subsidiaries - - - - - - - 73 - 73

Revaluation of

property, plant

and equipment - - - - - - 2,189 - - 2,189

Forward contracts - - - 279 - - - - - 279

Net actuarial

gain on pension

schemes - - - - - - - - 1,258 1,258

--------- ------------- ---------- --------- --------- ----------- ------------ ----------- ---------- -------

Total

comprehensive

income for

period

attributable to

equity

shareholders - - - 279 - - 2,189 73 1,625 4,166

Share based

payments - - - - - - - - 8 8

Exercise of share

options - 14 69 - - - - - - 83

Reclassified to

cost of

inventory - - - (318) - - - - - (318)

Dividends paid - - - - - - - - (186) (186)

--------- ------------- ---------- --------- --------- ----------- ------------ ----------- ---------- -------

Total

transactions

with owners - 14 69 (318) - - - - (178) (413)

--------- ------------- ---------- --------- --------- ----------- ------------ ----------- ---------- -------

At 1 January 2023 1,503 (137) 716 279 1,036 1,427 3,860 701 17,403 26,788

Net loss for the

period - - - - - - - - (958) (958)

Retranslation of

overseas

subsidiaries - - - - - - - (25) - (25)

Forward contracts - - - 44 - - - - - 44

--------- ------------- ---------- --------- --------- ----------- ------------ ----------- ---------- -------

Total

comprehensive

income for

period

attributable to

equity

shareholders - - - 44 - - - (25) (958) (939)

Share based

payments - - - - - - - - 11 11

Exercise of share

options - 2 13 - - - - - - 15

Total

transactions

with owners - 2 13 - - - - - 11 26

--------- ------------- ---------- --------- --------- ----------- ------------ ----------- ---------- -------

At 30 June 2023 1,503 (135) 729 323 1,036 1,427 3,860 676 16,456 25,875

========= ============= ========== ========= ========= =========== ============ =========== ========== =======

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

For the 6 months ended 30 June 2023

At 31

At 30 June At 30 June December

2023 2022 2022

Unaudited Unaudited Audited

GBP'000 GBP '000 GBP'000

Cash flows from operating activities

(Loss)/profit for the period (958) 307 674

Adjustments:

Depreciation of property, plant and

equipment 135 78 141

Amortisation of intangible fixed assets 5 - 22

(Loss)/profit on sale of property,

plant and equipment 9 - (11)

Contributions to defined benefit pension

schemes (210) (225) (651)

Finance costs 150 115 237

Tax (credit)/expense (147) - 178

Share based payments 11 13 21

------- ------- -------

Net cash flow from operating activities

before movements in working capital (1,005) 288 611

Change in inventories (1,124) (513) 3,307

Change in trade and other receivables 595 4,178 3,610

Change in trade and other payables 511 (5,283) (6,133)

Cash flows from operations (1,023) (1,330) 1,395

Interest paid (100) (57) (139)

Tax paid - (51) (26)

Net cash flow from operating activities (1,123) (1,438) 1,230

======= ======= =======

Cash flows from investing activities

Purchase of intangible fixed assets (78) - (93)

Purchase of property, plant and equipment (328) (2,307) (4,880)

Sale of property, plant and equipment - - 13

Net cash flow from investing activities (406) (2,307) (4,960)

======= ======= =======

Cash flows from financing activities

(Loan repayments)/new loans (254) 2,005 2,013

Finance lease repayments - (37) (54)

Movement in invoice financing 498 (1,244) (1,161)

Exercise of share options 15 214 297

Dividends paid - (354) (540)

Net cash flow from financing activities 259 584 555

======= ======= =======

Net change in cash and cash equivalents (1,270) (3,161) (3,175)

Cash and cash equivalents at beginning

of period 3,288 6,367 6,367

Effect of foreign exchange rate changes (25) 23 96

------- ------- -------

Cash and cash equivalents at end of

period 1,993 3,229 3,288

======= ======= =======

NOTES TO THE HALF YEARLY REPORT

1 General information

Tandem Group plc is a public limited company incorporated and

domiciled in the United Kingdom with its shares listed on AIM, the

market of that name operated by the London Stock Exchange.

The principal activity of the Group is the design, development,

distribution and retail of sports, leisure and mobility

equipment.

The ultimate parent company of the Group is Tandem Group plc

whose principal place of business and registered office address is

35 Tameside Drive, Castle Bromwich, Birmingham,

B35 7AG.

The interim financial statements for the period ended 30 June

2023 (including the comparatives for the period ended 30 June 2022

and the year ended 31 December 2022) were approved by the Board of

Directors on 19 September 2023.

The financial information set out in this interim report does

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. The Group's statutory financial statements for

the year ended 31 December 2022, prepared under International

Financial Reporting Standards ("IFRS"), have been filed with the

Registrar of Companies. The auditor's report on those financial

statements was unqualified and did not contain statements under

Sections 498(2) and 498(3) of the Companies Act 2006.

This interim financial information has been prepared using the

accounting policies set out in the Group's 2022 statutory accounts.

Copies of the annual statutory accounts and the interim report may

be obtained by writing to the Company Secretary of Tandem Group

plc, 35 Tameside Drive, Castle Bromwich, Birmingham, B35 7AG and

can be found on the Company's website at www.tandemgroup.co.uk.

The net retirement benefit obligation recognised at 30 June 2023

is based on the actuarial valuation under IAS19 at 31 December 2022

updated for movements in net defined benefit pension income and

contributions paid during the half year period. A full valuation

for IAS19 financial reporting purposes will be carried out for

incorporation in the audited financial statements for the year

ending 31 December 2023.

Exceptional costs include redundancy, termination and

professional costs relating to the consolidation of operations of

the Group.

2 earnings per share

The calculation of earnings per share is based on the net result

and ordinary shares in issue during the period as follows:

Year

6 months 6 months ended 31

ended ended December

30 June 2023 30 June 2022 2022

GBP '000 GBP'000 GBP'000

(Loss)/profit for the period (958) 307 674

============= ================ =========

Number Number Number

Weighted average shares in issue used

for basic earnings per share 5,469,721 5,323,089 5,375,128

Weighted average dilutive shares under

option 119,933 160,461 100,733

Average number of shares used for diluted

earnings per share 5,589,654 5,483,550 5,475,861

============= ================ =========

Pence Pence Pence

Basic earnings per share (17.5) 5.8 12.5

============= ================ =========

Diluted earnings per share (17.5) 5.6 12.3

============= ================ =========

Loss per share is calculated based on the share capital of

Tandem Group plc and the earnings of the Group for all periods.

There are options in place at 30 June 2023. These options were

anti-dilutive at the period end but may dilute future earnings per

share.

3 Borrowings

At 31

At 30 June At 30 June December

2023 2022 2022

Unaudited Unaudited Audited

GBP'000 GBP '000 GBP'000

Invoice finance liability (1,074) (493) (576)

Current borrowings maturing in less

than one year

-other borrowings (4,009) (387) (509)

-assets held under leasing arrangements - (17) -

------- ------- -------

Total current borrowings (5,083) (897) (1,085)

Non current borrowings with contractual

maturities between one and two years

-other borrowings - (1,625) (3,141)

Non current borrowings with contractual

maturities between two and five years

-other borrowings - (2,242) (613)

Total non current borrowings - (3,867) (3,754)

Total borrowings (5,083) (4,764) (4,839)

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 (as amended), which forms

part of domestic UK law pursuant to the European Union (Withdrawal)

Act 2018. Upon publication of this announcement via a Regulatory

Information Service, this inside information is now considered to

be in the public domain.

Forward Looking Statements

This announcement contains forward-looking statements relating

to expected or anticipated future events and anticipated results

that are forward-looking in nature and, as a result, are subject to

certain risks and uncertainties, such as general economic, market

and business conditions, competition for qualified staff, the

regulatory process and actions, technical issues, new legislation,

uncertainties resulting from potential delays or changes in plans,

uncertainties resulting from working in a new political

jurisdiction, uncertainties regarding the results of exploration,

uncertainties regarding the timing and granting of prospecting

rights, uncertainties regarding the Company's or any third party's

ability to execute and implement future plans, and the occurrence

of unexpected events. Actual results achieved may vary from the

information provided herein as a result of numerous known and

unknown risks and uncertainties and other factors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKCBKDBKBOCD

(END) Dow Jones Newswires

September 20, 2023 02:00 ET (06:00 GMT)

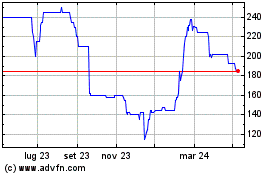

Grafico Azioni Tandem (LSE:TND)

Storico

Da Dic 2024 a Gen 2025

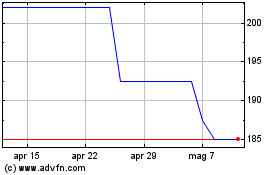

Grafico Azioni Tandem (LSE:TND)

Storico

Da Gen 2024 a Gen 2025