Tandem Group PLC Trading Update (5612W)

13 Dicembre 2023 - 8:00AM

UK Regulatory

TIDMTND

RNS Number : 5612W

Tandem Group PLC

13 December 2023

13 December 2023

Tandem Group plc

(the "Company" or "Group")

Trading Update

Tandem Group plc, designers, developers and distributors of

sports, leisure and mobility products, announces that the Company's

revenues for the year ended 31 December 2023 are expected to be

between GBP22m and GBP23m. The delivery of the higher end of this

range is subject to expected freight-on-board ("FOB") orders being

shipped in December.

As a result, the Company's losses before tax for the year ended

31 December 2023 are expected to be between GBP0.9m to GBP1.3m,

with this range again dependent on expected FOB orders being

shipped in December, below current market expectations.

The economic environment in the consumer sector continues to

pose significant challenges, reflecting the broader issues faced by

many UK businesses and in the closing months of the year, the

domestic sales market has proven to be more challenging than had

previously been anticipated, with the impact of suppressed consumer

spending further complicating the landscape.

As reported within the Company's Interim Results, declining

trends in our Toy sales and FOB sales have persisted for the

remainder of the year, significantly affecting overall profit

levels. This decline in FOB sales is a result of retailers adopting

a more cautious approach, maintaining lower stockholding levels

amid restrained consumer spending, which aligns with widespread

reports of retailers experiencing tough trading in the run-up to

Christmas, as many businesses try to navigate the challenging

market conditions amid the cost-of-living crisis.

Bicycle sales, including electric bikes, remain significantly

ahead of the prior year. The launch of our new range of electric

bikes has helped sales more than double against the prior year in

this area and reflects our commitment to innovation and meeting

evolving consumer preferences. Sales of our lightweight children's

Squish bikes also continue to outperform the prior year. These

results are despite a widely reported major downturn throughout the

bicycle market in the UK throughout this year, mirroring the

broader economic challenges and post COVID effects.

Our Home and Garden division has continued to face notable

challenges throughout 2023, largely attributed to the adverse

weather conditions that starkly contrasted with the more favourable

climate experienced in 2022. The unpredictable and unfavourable

weather conditions have presented unique challenges, affecting

various aspects of our Home and Garden division's activities.

Despite this, we remain dedicated to continued product development

and innovation to fortify the division's resilience in the face of

unpredictable climatic conditions.

Looking ahead, our confidence in the Group's resilience and

growth is bolstered by several factors, most notably the recent

securing of three new national retailer accounts. These

partnerships mark a significant achievement for us and contribute

to our optimistic outlook for the upcoming year. We are actively

pursuing operational efficiencies to enhance overall business

performance, with a specific focus on optimising the utilisation of

warehouse space to maximise returns.

While the Board is disappointed by the recent adverse change in

current trading and the outlook for the remainder of FY2023, the

Group retains a strong balance sheet, a well-managed current stock

position, and we expect to see a positive impact on pension fund

valuations as at 31 December 2023.

We believe that the Group's strategic focus on continued

investment in its people and capabilities, coupled with targeted

operating cost reductions, focus on new customer accounts and

innovation, positions the Group well for success as markets

improve. These measures affirm our commitment to long-term

sustainability and growth.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 (as amended), which forms

part of domestic UK law pursuant to the European Union (Withdrawal)

Act 2018. Upon publication of this announcement via a Regulatory

Information Service, this inside information is now considered to

be in the public domain.

- Ends -

Enquiries:

Tandem Group plc

Peter Kimberley, CEO

David Rock, Company Secretary

Telephone 0121 748 8075

Nominated Adviser

Cavendish Capital Markets Limited (Nominated Adviser and

Broker)

Ben Jeynes / Dan Hodkinson - Corporate Finance

Michael Johnson / Charlie Combe - Sales and Equity Capital

Markets

Telephone 0207 220 0500

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTGPGCCPUPWPGP

(END) Dow Jones Newswires

December 13, 2023 02:00 ET (07:00 GMT)

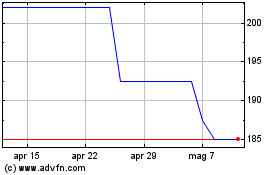

Grafico Azioni Tandem (LSE:TND)

Storico

Da Dic 2024 a Gen 2025

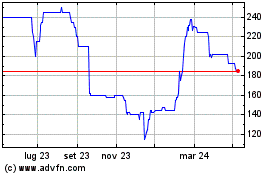

Grafico Azioni Tandem (LSE:TND)

Storico

Da Gen 2024 a Gen 2025