TIDMBVS

RNS Number : 5034O

Bovis Homes Group PLC

09 March 2009

BOVIS HOMES GROUP PLC

PRELIMINARY RESULTS FOR THE YEAR ENDED 31 DECEMBER 2008

Issued 9 March 2009

The Board of Bovis Homes Group PLC today announced its preliminary results for

2008 which have been prepared in accordance with International Financial

Reporting Standards as adopted by the EU ('IFRS').

* Pre-exceptional pre-tax profit of GBP14.4* million (2007: GBP123.6 million)

* Pre-exceptional basic earnings per share of 9.2p* (2007: 72.4p per share)

* Pre-tax loss for the year of GBP78.7 million (2007: profit of GBP123.6 million)

* Successful renewal of Group's banking arrangements, with committed syndicated

facility in place until 2011, and revised covenant package in place

* GBP108 million of year end net debt** with modest year end gearing of 17% (2007:

GBP44 million of net debt; 6% gearing)

* Inventory provisions of GBP75.2 million, plus restructuring charges of GBP5.7

million and goodwill and other impairment charges of GBP12.2 million: totalling

GBP93.1 million of exceptional items

* Reduction in overhead to GBP42.0*** million following restructuring (2007:

GBP48.7 million), with further savings in 2009 expected to reduce overhead by

40-50% from 2008 starting point

* Total dividend for the year of 5.0p net per ordinary share (2007: 35.0p), with

final dividend passed, reflecting focus on cash generation

* 13,545 plots of land with planning consent (2007: 11,413 plots) and 18,972

potential plots of strategic land (2007: 24,868 potential plots)

* Before exceptional items of GBP93.1 million (2007: GBPnil)

** GBP100.1 million net debt including issue costs of GBP8.3 million

*** Before exceptional overhead items of GBP16.6 million (2007: GBPnil)

Commenting on the results, David Ritchie, the Chief Executive of Bovis Homes

Group PLC said:

"2008 has been an unprecedented year. Declining mortgage

finance availability and poor economic conditions, allied with low consumer

confidence, brought about the toughest trading environment for many years. In

response to this, during the year the Group has restructured its operations,

sharply reduced its expenditure on land and production, renegotiated its banking

agreements and focused its management on the need to manage cashflow in trading

conditions which lack good forward visibility.

The Group has positioned itself well with low year end net debt and commences

2009 with a good number of unsold finished stock homes which it can sell to

generate a strong cash margin. The Group will also benefit from a much lower

overhead cost base, limited cash commitments on land and an expectation of

positive tax cashflow.

Looking forward, the Group expects net debt to reduce, allowing the Group to

manage effectively the trading assets on its balance sheet. The Group's current

organisational structure retains capacity to manage greater levels of activity,

and through orderly trading during the current challenging conditions, the Group

anticipates being well placed to exploit land investment opportunities as

improved activity in the housing market emerges."

+------------+------------------------+----------------+----------------------------+

| Enquiries: | David Ritchie, Chief | Results issued | Andrew Best / Emily |

| | Executive | by: | Bruning |

+------------+------------------------+----------------+----------------------------+

| | Neil Cooper, Finance | | Shared Value Limited |

| | Director | | |

+------------+------------------------+----------------+----------------------------+

| | Bovis Homes Group PLC | | tel: 020 7321 5022/5027 |

+------------+------------------------+----------------+----------------------------+

| | On Monday 9 March - tel: 020 7321 5010 | |

+------------+-----------------------------------------+----------------------------+

| | Thereafter - tel: 01474 876200 | |

+------------+------------------------+----------------+----------------------------+

Certain statements in this press release are forward looking statements.

Forward looking statements involve evaluating a number of risks, uncertainties

or assumptions that could cause actual results to differ materially from those

expressed or implied by those statements. Forward looking statements regarding

past trends, results or activities should not be taken as a representation that

such trends, results or activities will continue in the future. Undue reliance

should not be placed on forward looking statements.

Developments in the wider economy have adversely impacted the housebuilding

marketplace during 2008. Mortgage availability for home purchase has fallen by

around 70%, transaction volumes and house prices have fallen, and consumer

confidence is low. Recognising this, the Group acted quickly and decisively

during 2008 to ensure that it is well placed to see through the downturn in an

orderly manner.

Results overview

For the year ended 31 December 2008, the Group achieved a pre-exceptional

pre-tax profit of GBP14.4 million, as against GBP123.6 million in 2007.

Pre-exceptional basic earnings per share was 9.2p in 2008 as compared to 72.4p

per share in 2007. Total revenue generated was GBP282.3 million (2007: GBP555.7

million), and the Group legally completed 1,817 homes (2007: 2,930 homes).

On a pre-exceptional basis, the Group's operating margin reduced to 7.5%

(2007: 22.4%). This reduction reflected a fall in private home sales prices, a

shift in the selling mix towards social homes and away from private homes and

the de-leveraging impact on cost recovery from the sharp fall in

revenues.

In the light of reductions in activity levels and falls in house

prices in the current market, the Group has reviewed its asset base, and is

charging provisions against the carrying value of some Group assets totalling

GBP77.4 million. Given provisions made against inventory acquired as part of

the Elite Homes acquisition in 2007 as well as the subsequent restructuring of

the Northern business, the Group is writing off the goodwill arising from its

acquisition of Elite Homes, totalling GBP10.0 million. Given the scale and

unusual nature of these charges, these costs have been disclosed as exceptional.

The Group has also charged GBP5.7 million relating to the restructuring

activities it has carried out in the year. Taken together, this has generated a

pre-tax exceptional charge of GBP93.1 million.

After taking into account this charge, the Group made a pre-tax loss of

GBP78.7 million and a basic loss per share of 49.1p in 2008.

Group net assets reduced by GBP91.4 million, from GBP723.7 million to GBP632.3

million, equivalent to GBP5.23 per share at the year end. This reduction in net

assets was driven primarily by the Group's retained loss in the year, inclusive

of exceptional items, and an adverse movement in value of the pension scheme of

GBP7.8 million.

Net debt before issue costs was GBP108 million at the year end, and year

end gearing was a modest 17%, with net borrowing utilisation less than half of

the Group's committed loan facility.

The Group successfully refinanced its banking arrangements during 2008,

providing it with GBP220 million of committed funds, reducing over the life of

the agreement, which ends in March 2011, to GBP160 million. The covenant package

in this agreement has also been renegotiated, allowing the Group to focus on

managing its cashflow through the removal of an interest cover covenant, and its

replacement with a cashflow cover covenant.

Arising from this focus on managing cashflow, the Group reviewed its pricing

policies during the year, and was more aggressive in seeking to hit its internal

volume targets through discounting prices and agreeing bulk sales through the

Government's house buying programme over the second half of the year. Whilst

this has necessarily impacted both average sales price and profit margin, it has

been significantly cash generative.

The Group has also reduced its overhead

cost base, with assertive cost reduction and its regional structure rationalised

from five to three active regions. After starting the year with 1,039

employees, the Group reduced its headcount by circa 60% to 441 employees in

March 2009, through a recruitment freeze and two restructuring events. At

GBP42.0 million, pre exceptional items, Group overhead in 2008 has reduced by

14% from the prior year (2007: GBP48.7 million). Looking ahead, the Group

expects that its overhead during 2009 will be in a range 40%-50% lower than its

start point in 2008 following these actions. Notwithstanding this significant

saving in overheads, the Group has retained an organisational structure which

will facilitate growth in business activity levels as market conditions improve.

Finally, the Group has also reduced housing production sharply to limit the

level of working capital in this area. Despite starting the year with a build

programme designed to construct around 3,500 units of production, the Group was

able to reduce activity to only 1,782 units of production, less than the number

of homes legally completed and a 39% reduction on the previous year (2007: 2,923

units of production). New unit starts fell further, from 3,406 units in 2007 to

1,179 units in 2008, a 65% decrease in activity.Land purchasing activities have

also been reduced significantly, with only 173 plots added to the consented land

bank during 2008 through purchase in the consented land market.

Revenue

Total revenue for the Group was GBP282.3 million in 2008 as compared to GBP555.7

million in 2007. The key component of revenue for the Group is housing revenue,

which was GBP274.0 million for the year ended 31 December 2008, as compared to

GBP525.9 million for the prior year. The Group legally completed 1,817 homes in

2008 compared to 2,930 legal completions in 2007. Of these, 594 were social

homes (2007: 637) and 1,223 were private homes (2007: 2,293), a social mix of

33% as compared to 22% in 2007.

The average sales price of legal completions fell over the year, from GBP179,500

in 2007 to GBP150,800 in 2008. This fall was driven by a combination of

factors. Firstly, the average sales price of private homes fell by 12%, from

GBP206,200 to GBP181,000 as the Group responded to a weaker market to deliver

the Group's volume aspirations and as the average size of private homes legally

completed reduced. Secondly, there was a shift in selling mix towards social

housing, from 22% in 2007 to 33% of legal completions in 2008. With an average

sales price of GBP88,500 in 2008 (2007: GBP83,400), the increase in the mix of

this category diluted the overall average sales price achieved.

The average size of the Group's private homes fell by 5% in 2008 to 972 square

feet as compared to 1,023 square feet in 2007. Taking this into account, the

Group's private sales price per square foot fell by less than the average sales

price, an 8% fall from GBP202 per square foot to GBP186 per square foot.

Overall, the Group's legally completed homes reduced in size from 969 square

feet in 2007 to 909 square feet, a fall of 6%.

Given the dearth of activity in the consented land market and uncertainty over

achievable values, the Group limited disposals of land during 2008 to GBP4.9

million, as compared to GBP25.1 million in 2007. Other income at GBP3.4 million

for 2008 was slightly behind that of the prior year.

Pre exceptional operating profit

The Group achieved GBP21.3 million of operating profit, before exceptional

items, for the year ended 31 December 2008, at an operating margin of 7.5%.

This was a sharp reduction on the previous year's operating profit of GBP124.4

million and operating margin of 22.4%. Gross margins have fallen by around 9

ppts, reflective primarily of an underlying reduction in private home profit

margins as prices fell, but also of an increase in the social mix and a loss of

scale-benefits on strategic planning fees and other costs charged as incurred

against gross profit. Despite a 14% absolute reduction in overhead, from

GBP48.7 million in 2007 to GBP42.0 million in 2008, excluding exceptional

items, the operating margin was further impacted by the lower recovery of

overhead as the ratio to revenue grew from 8.7% in 2007 to 14.9% in 2008.

Profit from land sales, less option costs, was GBP1.3 million in 2008, as

compared with GBP10.0 million in 2007.

Exceptional and non-recurring costs

The Group discloses items as exceptional when the Board deems them material by

size or nature, non-recurring and of such significance that they require

separate disclosure.

The Group has reviewed the carrying value of its assets and liabilities as at 31

December 2008. Following this review, the Group has charged an exceptional

provision against the carrying value of inventory and an impairment charge for

available-for-sale financial assets and fixed assets. The Group has also

written off the goodwill arising from the acquisition of Elite Homes in 2007.

The Group has reviewed its inventory carrying values on a site by site basis,

taking into account local management and the Board's estimates of current

achievable pricing in local markets. Where this gave rise to a situation where

the current carrying costs of the asset were higher than the estimated net

realisable value, a provision has been recognised for the difference. This

provision includes allowance for both land and part-exchange assets. In total,

GBP75.2 million has been provided.

Prior to the expiry of the 12 month review period for fair value adjustments

relating to the acquisition of Elite Homes in October 2007, the Group revised

its fair value estimates downwards by GBP0.8 million, reflecting finalisation of

estimates for liabilities existing at the point of acquisition. This adjustment

increased the cost of acquired goodwill by GBP0.8 million, to GBP10.0 million in

total. Subsequently at the year end, the Group has reviewed the goodwill it is

carrying and, given the fact that provisions have been recognised relating to

the carrying value of land acquired by the Group as part of the Elite

acquisition and given that the Group has restructured its Northern regional

business, the Group has fully impaired this goodwill reflecting the Board's

current view of the value of this intangible asset.

The Group has reviewed the carrying values of its available-for-sale

financial assets, revisiting the long term growth assumptions built into its

valuation model, and in particular the likelihood of a short-term decline in

pricing, with a longer term return to trend. This has given rise to an

impairment charge of GBP1.2 million. An impairment charge of GBP1.0 million has

also been made relating to the Group's freehold offices, given the fall in

commercial property values during 2008.

The Group has also charged restructuring costs of GBP5.7 million reflecting

the one-off costs of two restructuring events that took place during the year.

These costs include redundancies as well as costs relating to office

closures.

Pre-tax loss and loss per share

Together with GBP21.3 million of pre-exceptional operating profit (2007:

GBP124.4 million), the Group incurred GBP6.9 million of net financing charges

(2007: GBP0.8 million) and GBP93.1 million of exceptional items (2007: GBPnil),

resulting in a pre-tax loss of GBP78.7 million (2007: pre-tax profit of GBP123.6

million).

Before exceptional items, the Group delivered basic earnings per share of 9.2p.

However, after exceptional items, basic loss per share was 49.1p. This is as

compared to basic earnings per share of 72.4p in 2007.

Land

The Group's consented land bank grew by 2,132 plots from 11,413 plots at 1

January 2008 to 13,545 plots at 31 December 2008, a closing land bank

representing 7.5 years of supply at 2008 activity levels. The vast majority of

land bank additions during the year related to successful transfers from the

strategic land bank, including 2,200 plots at Filton near Bristol and the first

900 plots at Wellingborough. The Group limited acquisitions in the consented

land market to 173 plots during the year.The strategic land bank as at 31

December 2008 was 18,972 potential plots (2007: 24,868 potential plots). The

Group transferred 3,830 plots into the consented land bank during 2008 and saw a

further net movement of 2,066 potential plots reflecting updated views on the

likelihood of or quantum of viable residential planning consents being achieved

given current conditions in the housing market.Prior to the inventory provision

taken in 2008, the average consented land plot cost was GBP40,200 with the

equivalent figure for 2007 being GBP43,400. Adjusting for the inventory

provision, the average plot cost reduced to GBP35,000.

Financing & cashflow

Net financing charges were GBP6.9 million in 2008 (2007: GBP0.8 million). Net

bank interest charges for 2008 were GBP5.6 million, which included the

amortisation of arrangement fees and commitment fee charges. This was as

compared to GBP2.4 million of net income in 2007. On average during 2008, the

Group had GBP97 million of net debt, as compared to an average net cash in hand

of GBP49 million in 2007. The Group incurred a GBP2.5 million finance charge

(2007: GBP4.1 million), reflecting the difference between the cost and nominal

price of land bought on deferred terms and which is charged to the income

statement over the life of the deferral of the consideration payable. This year

over year reduction was largely driven by a corresponding fall in land

creditors.

The Group benefited from a GBP1.1 million net pension financing credit during

2008. This credit arose as a result of the expected return on scheme assets

being in excess of the interest on the scheme obligations. The equivalent credit

in 2007 was GBP0.9 million. The Group also benefited from a finance credit of

GBP0.1 million arising from the unwinding of the discount on its

available-for-sale financial assets during 2008.

Over the year, the Group managed to limit the net cash outflow from operations

to only GBP4 million, reflecting positively on the actions of the Group in

reducing cash outflows, despite sharply falling revenues. The Group's net

debt before issue costs increased by GBP64 million, from GBP44 million to GBP108

million, the bulk of this increase arising during the first half of 2008. In

addition to the modest cash outflow from operations, the Group paid GBP17

million of tax largely relating to 2007's profits, GBP27 million of dividends

and GBP17 million of interest and related charges, including GBP8.3 million of

arrangement fees and related costs linked to its successful bank facility

refinancing.

As at 31 December 2008, the Group had GBP11.6 million of cash in hand, and

borrowings of GBP120 million. The Group has in place a GBP220 million committed

syndicated banking facility, which steps down to GBP180 million in February 2010

and to GBP160 million in September 2010 and which matures in March 2011.

Looking ahead, the Group anticipates around GBP50 million of net debt by the end

of 2009.

Taxation

The Group has accounted for a tax credit of GBP19.7 million in 2008 (2007: tax

charge of GBP36.7 million). Of this, a GBP3.3 million charge has arisen on

pre-exceptional pre-tax profits of GBP14.4 million, and a GBP23.0 million tax

credit has arisen on pre tax exceptional items of GBP93.1 million.This equates

to an effective tax rate of 25.1% (2007: 29.7%). The major contributor to this

lowered effective rate has been the GBP10.0 million impairment of goodwill

arising on acquisition which is a non-deductible charge. The Group has also

benefited from a GBP1.0 million overprovision of tax charge relating to prior

years.

As a result of the tax credit arising from the exceptional items taken in 2008,

the Group has recognised a tax asset of GBP23.6 million on its closing balance

sheet as at 31 December 2008.

Pensions

At the start of 2008, the Group enjoyed a surplus on its pension scheme of

GBP1.0 million, but following a roll-forward of the valuation, with latest

estimates provided by the Group's actuarial advisors, the Group's pension scheme

had a deficit of GBP6.8 million at 31 December 2008. This adverse movement has

arisen from a combination of a reduction in value of the scheme's assets,

partially offset by a favourable movement in the discount rate applicable to the

scheme's liabilities.

Net assets

The Group's net assets at 31 December 2008 were GBP632.3 million, GBP91.4

million lower than the net asset position as at 31 December 2007. This was

primarily as a result of an GBP86.0 million retained loss, together with a

movement in the value of the pension scheme reserve by GBP6.4 million.

Net assets per share as at 31 December 2008 was GBP5.23 as compared to GBP5.99

at 31 December 2007.

+--------------------------------------------+---+-+--------+-+--------+-+--------+-+

| Analysis of net assets | | |

+--------------------------------------------+----------------+---------------------+

| | | | 2008 | 2007 |

+--------------------------------------------+-----+----------+----------+----------+

| | | | GBPm | GBPm |

+--------------------------------------------+-----+----------+----------+----------+

| | | | | | | | | |

+--------------------------------------------+---+-+--------+-+--------+-+--------+-+

| Net assets at 1 January | | | | | 723.7 | | 677.8 | |

+--------------------------------------------+---+-+--------+-+--------+-+--------+-+

| Pre-exceptional profit after tax for the | | | | | 11.1 | | 86.9 | |

| year | | | | | | | | |

+--------------------------------------------+---+-+--------+-+--------+-+--------+-+

| Exceptional charges net of tax | | | | | (70.1 | )| - | |

+--------------------------------------------+---+-+--------+-+--------+-+--------+-+

| Dividends | | | | | (27.0 | )| (45.0 | )|

+--------------------------------------------+---+-+--------+-+--------+-+--------+-+

| Share capital issued | | | | | 0.5 | | 1.4 | |

+--------------------------------------------+---+-+--------+-+--------+-+--------+-+

| Net actuarial movement on pension scheme | | | | | (6.4 | )| 2.4 | |

| through reserves | | | | | | | | |

+--------------------------------------------+---+-+--------+-+--------+-+--------+-+

| Deferred tax on other employee benefits | | | | | - | | (0.8 | )|

+--------------------------------------------+---+-+--------+-+--------+-+--------+-+

| Current tax recognised directly in equity | | | | | 0.5 | | - | |

+--------------------------------------------+---+-+--------+-+--------+-+--------+-+

| Adjustment to the fair value of cash flow | | | | | - | | 0.1 | |

| hedges | | | | | | | | |

+--------------------------------------------+---+-+--------+-+--------+-+--------+-+

| Adjustment to reserves for share based | | | | | - | | 0.9 | |

| payments | | | | | | | | |

+--------------------------------------------+---+-+--------+-+--------+-+--------+-+

| Net assets at 31 December | | | | | 632.3 | | 723.7 | |

+--------------------------------------------+---+-+--------+-+--------+-+--------+-+

Dividends

During 2008, the Group paid the 2007 final dividend of 17.5p per share and the

2008 interim dividend of 5.0p per share. In total, this equated to GBP27.0

million (2007: GBP45.0 million). As previously announced, the Board has decided

not to recommend payment of a final dividend for 2008, having regard to trading

conditions.

Employees and the Board

2008 has been a difficult year for the employees, suppliers and sub-contractors

of the Group. The Group has seen two restructuring events leading to more than

half its employees leaving the business during the year. The Board took these

necessary and essential decisions after consideration of alternative courses of

action, and recognises the significant impact its decisions have had on many

individuals, which is regrettable. The Board would also like to recognise the

commitments and contribution of those colleagues who have been made redundant

during the year and would like to wish them every success in their future

employment.

Whilst distressing for those individuals leaving, it is often also difficult for

those employees remaining, who may have to take on additional tasks in a more

uncertain environment. In reducing production activity and seeking savings

throughout the business, the Group also recognises that this has been very

challenging for the many suppliers and sub-contractors who provide services to

the business.

The Board would like to thank its employees, suppliers and sub-contractors for

their continued hard work and commitment during a year that has been very

challenging for a great many individuals connected to the Group in many

respects.

The Board would also like to thank Mr Geoff Coleman, the regional Managing

Director of South East region, who retired during the year after more than 20

years service.

During a year of major changes in the marketplace, the Group was pleased that

the retiring Chief Executive, Mr Malcolm Harris, remained a member of the Board

and became non-executive Chairman in July 2008. On this date, Mr David Ritchie

was appointed Chief Executive, having previously been Group Managing Director, a

role which was not thereafter retained. As part of these changes, Mr Alastair

Lyons joined the Group as non-executive Deputy Chairman and Senior Independent

Director in October 2008.

Market conditions & prospects

As has been well reported, the current market for housebuilders is exceedingly

weak, and accordingly, the Group's priorities are to manage through the current

downturn in an orderly way. The Group commenced 2009 with a healthy number of

unsold finished stock homes which it can sell to generate a strong cash margin,

preserving the value in the balance sheet whilst continuing to maintain a

relatively low level of indebtedness.Through its efforts to date, as at 6 March

2009, the Group has secured 772 net reservations for legal completion in 2009,

as compared to 1,262 net reservations at the same point in 2008. Whilst this

represents a decrease year over year of 39%, the 330 private net reservations

achieved in the first nine weeks of the year represents a 22% increase on the

prior year's comparative of 271 net reservations.

Looking ahead, the Group expects that transaction volumes will begin to improve

as lower house prices and lower mortgage interest rates feed through into the

marketplace. This pick up in activity does, however, depend on the credit market

being capable of funding increased transactional growth. With improved volume,

market pricing will begin to stabilise. However, visibility on the timing of

these likely market developments is not good and for the present, the Group is

positioning itself assuming a continuation in 2009 of current market conditions.

With low levels of debt and a largely strategically sourced and long consented

land bank the Group anticipates being well placed in terms of balance sheet

capability for this eventuality.

Bovis Homes Group PLC

Group income statement

+----------------------------+-------------+-+-------------+-+-------------+-+-----------+-+

| For the year ended 31 | Before | | Exceptional | | Continuing | | | |

| December 2008 | exceptional | | items | | operations | | | |

| | items | | | | | | | |

+----------------------------+-------------+-+-------------+-+-------------+-+-----------+-+

| | 2008 | | 2008 | | 2008 | | 2007 | |

+----------------------------+-------------+-+-------------+-+-------------+-+-----------+-+

| | GBP000 | | GBP000 | | GBP000 | | GBP000 | |

+----------------------------+-------------+-+-------------+-+-------------+-+-----------+-+

| | | | | | | | | |

+----------------------------+-------------+-+-------------+-+-------------+-+-----------+-+

| Revenue - continuing | 282,326 | | - | | 282,326 | | 555,702 | |

| operations | | | | | | | | |

+----------------------------+-------------+-+-------------+-+-------------+-+-----------+-+

| Cost of sales | (219,011 | )| (76,487 | )| (295,498 | )| (382,659 | )|

+----------------------------+-------------+-+-------------+-+-------------+-+-----------+-+

| Gross profit / (loss) | 63,315 | | (76,487 | )| (13,172 | )| 173,043 | |

+----------------------------+-------------+-+-------------+-+-------------+-+-----------+-+

| Administrative expenses | (42,018 | )| (16,641 | )| (58,659 | )| (48,653 | )|

+----------------------------+-------------+-+-------------+-+-------------+-+-----------+-+

| Operating profit / (loss) | 21,297 | | (93,128 | )| (71,831 | )| 124,390 | |

| before financing costs | | | | | | | | |

+----------------------------+-------------+-+-------------+-+-------------+-+-----------+-+

| Financial income | 1,389 | | - | | 1,389 | | 6,158 | |

+----------------------------+-------------+-+-------------+-+-------------+-+-----------+-+

| Financial expenses | (8,292 | )| - | | (8,292 | )| (6,962 | )|

+----------------------------+-------------+-+-------------+-+-------------+-+-----------+-+

| Net financing costs | (6,903 | )| - | | (6,903 | )| (804 | )|

+----------------------------+-------------+-+-------------+-+-------------+-+-----------+-+

| Profit / (loss) before tax | 14,394 | | (93,128 | )| (78,734 | )| 123,586 | |

+----------------------------+-------------+-+-------------+-+-------------+-+-----------+-+

| Income tax | (3,319 | )| 23,058 | | 19,739 | | (36,727 | )|

+----------------------------+-------------+-+-------------+-+-------------+-+-----------+-+

| Profit / (loss) for the | 11,075 | | (70,070 | )| (58,995 | )| 86,859 | |

| period attributable to | | | | | | | | |

| equity holders of the | | | | | | | | |

| parent | | | | | | | | |

+----------------------------+-------------+-+-------------+-+-------------+-+-----------+-+

| | | | | | | | | |

+----------------------------+-------------+-+-------------+-+-------------+-+-----------+-+

| Basic earnings/(loss) per | 9.2p | | (58.3p | )| (49.1p | )| 72.4p | |

| ordinary share | | | | | | | | |

+----------------------------+-------------+-+-------------+-+-------------+-+-----------+-+

| Diluted earnings/(loss) | 9.2p | | (58.3p | )| (49.1p | )| 72.2p | |

| per ordinary share | | | | | | | | |

+----------------------------+-------------+-+-------------+-+-------------+-+-----------+-+

Bovis Homes Group PLC

Group balance sheet

+---------------------------------+----------+--+-----------+--+-----------+--+

| At 31 December 2008 | | | 2008 | | 2007 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| | | | GBP000 | | GBP000 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| | | | | | Restated | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Assets | | | | | | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Goodwill | | | - | | 10,036 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Property, plant and equipment | | | 12,347 | | 14,451 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Available for sale financial | | | 6,030 | | 1,085 | |

| assets | | | | | | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Investments | | | 22 | | 22 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Deferred tax assets | | | 5,548 | | 3,568 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Trade and other receivables | | | 2,418 | | 2,589 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Retirement benefit asset | | | - | | 1,010 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Total non-current assets | | | 26,365 | | 32,761 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Inventories | | | 780,808 | | 869,355 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Trade and other receivables | | | 37,947 | | 52,725 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Cash | | | 11,634 | | 346 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Current tax assets | | | 23,550 | | - | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Total current assets | | | 853,939 | | 922,426 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Total assets | | | 880,304 | | 955,187 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Equity | | | | | | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Issued capital | | | 60,497 | | 60,415 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Share premium | | | 157,127 | | 156,734 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Retained earnings | | | 414,654 | | 506,594 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Total equity attributable to | | | 632,278 | | 723,743 | |

| equity holders of the parent | | | | | | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| | | | | | | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Liabilities | | | | | | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Bank loans | | | 111,730 | | 25,000 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Trade and other payables | | | 24,907 | | 28,816 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Retirement benefit obligations | | | 6,790 | | - | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Provisions | | | 1,623 | | 1,463 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Total non-current liabilities | | | 145,050 | | 55,279 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Bank overdraft | | | - | | 3,588 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Bank loans | | | - | | 16,000 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Trade and other payables | | | 101,964 | | 142,291 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Provisions | | | 1,012 | | 500 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Current tax liabilities | | | - | | 13,786 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Total current liabilities | | | 102,976 | | 176,165 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Total liabilities | | | 248,026 | | 231,444 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| | | | | | | |

+---------------------------------+----------+--+-----------+--+-----------+--+

| Total equity and liabilities | | | 880,304 | | 955,187 | |

+---------------------------------+----------+--+-----------+--+-----------+--+

These accounts were approved by the Board of directors on 6 March 2009.

Bovis Homes Group PLC

Group statement of cash flows

+----------------------------------------+---+--+----------+--+----------+--+

| For the year ended 31 December 2008 | | | | | | |

+----------------------------------------+---+--+----------+--+----------+--+

| | | | 2008 | | 2007 | |

+----------------------------------------+---+--+----------+--+----------+--+

| | | | GBP000 | | GBP000 | |

+----------------------------------------+---+--+----------+--+----------+--+

| | | | | | Restated | |

+----------------------------------------+---+--+----------+--+----------+--+

| Cash flows from operating activities | | | | | | |

+----------------------------------------+---+--+----------+--+----------+--+

| (Loss) / profit for the year | | | (58,995 | )| 86,859 | |

+----------------------------------------+---+--+----------+--+----------+--+

| Depreciation | | | 1,168 | | 1,421 | |

+----------------------------------------+---+--+----------+--+----------+--+

| Impairment of goodwill | | | 10,036 | | - | |

+----------------------------------------+---+--+----------+--+----------+--+

| Impairment of assets | | | 2,241 | | - | |

+----------------------------------------+---+--+----------+--+----------+--+

| Financial income | | | (1,389 | )| (6,158 | )|

+----------------------------------------+---+--+----------+--+----------+--+

| Financial expense | | | 8,292 | | 6,962 | |

+----------------------------------------+---+--+----------+--+----------+--+

| Profit on sale of property, plant and | | | (146 | )| (43 | )|

| equipment | | | | | | |

+----------------------------------------+---+--+----------+--+----------+--+

| Equity-settled share-based payment | | | (22 | )| 133 | |

| (credit) / expense | | | | | | |

+----------------------------------------+---+--+----------+--+----------+--+

| Income tax (credit) / expense | | | (19,739 | )| 36,727 | |

+----------------------------------------+---+--+----------+--+----------+--+

| Write-down of inventories | | | 75,202 | | - | |

+----------------------------------------+---+--+----------+--+----------+--+

| Other non-cash items | | | - | | 996 | |

+----------------------------------------+---+--+----------+--+----------+--+

| Operating profit before changes in | | | 16,648 | | 126,897 | |

| working capital and provisions | | | | | | |

+----------------------------------------+---+--+----------+--+----------+--+

| | | | | | | |

+----------------------------------------+---+--+----------+--+----------+--+

| Decrease / (increase) in trade and | | | 8,924 | | (29,821 | )|

| other receivables | | | | | | |

+----------------------------------------+---+--+----------+--+----------+--+

| Decrease / (increase) in inventories | | | 13,345 | | (42,195 | )|

+----------------------------------------+---+--+----------+--+----------+--+

| Decrease in trade and other payables | | | (43,444 | )| (44,149 | )|

+----------------------------------------+---+--+----------+--+----------+--+

| Increase / (decrease) in provisions | | | 702 | | (1,671 | )|

| and employee benefits | | | | | | |

+----------------------------------------+---+--+----------+--+----------+--+

| Cash generated from operations | | | (3,825 | )| 9,061 | |

+----------------------------------------+---+--+----------+--+----------+--+

| | | | | | | |

+----------------------------------------+---+--+----------+--+----------+--+

| Interest paid | | | (8,769 | )| (4,812 | )|

+----------------------------------------+---+--+----------+--+----------+--+

| Income taxes paid | | | (16,924 | )| (39,052 | )|

+----------------------------------------+---+--+----------+--+----------+--+

| Net cash from operating activities | | | (29,518 | )| (34,803 | )|

+----------------------------------------+---+--+----------+--+----------+--+

| | | | | | | |

+----------------------------------------+---+--+----------+--+----------+--+

| Cash flows from investing activities | | | | | | |

+----------------------------------------+---+--+----------+--+----------+--+

| Interest received | | | 187 | | 5,420 | |

+----------------------------------------+---+--+----------+--+----------+--+

| Acquisition of property, plant and | | | (143 | )| (879 | )|

| equipment | | | | | | |

+----------------------------------------+---+--+----------+--+----------+--+

| Proceeds from sale of plant and | | | 214 | | 106 | |

| equipment | | | | | | |

+----------------------------------------+---+--+----------+--+----------+--+

| Acquisition of subsidiary net of cash | | | - | | (73,304 | )|

| acquired | | | | | | |

+----------------------------------------+---+--+----------+--+----------+--+

| Net cash from investing activities | | | 258 | | (68,657 | )|

+----------------------------------------+---+--+----------+--+----------+--+

| | | | | | | |

+----------------------------------------+---+--+----------+--+----------+--+

| Cash flows from financing activities | | | | | | |

+----------------------------------------+---+--+----------+--+----------+--+

| Dividends paid | | | (27,049 | )| (44,990 | )|

+----------------------------------------+---+--+----------+--+----------+--+

| Proceeds from the issue of share | | | 475 | | 1,367 | |

| capital | | | | | | |

+----------------------------------------+---+--+----------+--+----------+--+

| Drawdown of borrowings | | | 79,000 | | 1,000 | |

+----------------------------------------+---+--+----------+--+----------+--+

| Costs associated with refinancing | | | (8,290 | )| - | |

+----------------------------------------+---+--+----------+--+----------+--+

| Net cash from financing activities | | | 44,136 | | (42,623 | )|

+----------------------------------------+---+--+----------+--+----------+--+

| | | | | | | |

+----------------------------------------+---+--+----------+--+----------+--+

| Net increase / (decrease) in cash and | | | 14,876 | | (146,083 | )|

| cash equivalents | | | | | | |

+----------------------------------------+---+--+----------+--+----------+--+

| Cash and cash equivalents at 1 January | | | (3,242 | )| 142,841 | |

+----------------------------------------+---+--+----------+--+----------+--+

| Cash and cash equivalents at 31 | | | 11,634 | | (3,242 | )|

| December | | | | | | |

+----------------------------------------+---+--+----------+--+----------+--+

Bovis Homes Group PLC

Group statement of recognised income and expense

+--------------------------------------+----------+--+----------+--+----------+--+

| For the year ended 31 December 2008 | | | | |

+----------------------------------------------------+----------+--+----------+--+

| | | | 2008 | | 2007 | |

+--------------------------------------+----------+--+----------+--+----------+--+

| | | | GBP000 | | GBP000 | |

+--------------------------------------+----------+--+----------+--+----------+--+

| | | | | | | |

+--------------------------------------+----------+--+----------+--+----------+--+

| Effective portion of changes in fair value of | - | | 160 | |

| interest rate cash flow hedges | | | | |

+----------------------------------------------------+----------+--+----------+--+

| Deferred tax on changes in fair value of interest | - | | (48 | )|

| rate cash flow hedges | | | | |

+----------------------------------------------------+----------+--+----------+--+

| Actuarial (loss) / gain on defined benefits | (8,820 | )| 3,750 | |

| pension scheme | | | | |

+----------------------------------------------------+----------+--+----------+--+

| Deferred tax on actuarial movements on defined | 2,470 | | (1,325 | )|

| benefits pension scheme | | | | |

+----------------------------------------------------+----------+--+----------+--+

| Current tax on share-based payments recognised | 498 | | - | |

| directly in equity | | | | |

+----------------------------------------------------+----------+--+----------+--+

| Deferred tax on other employee benefits | (22 | )| (790 | )|

+----------------------------------------------------+----------+--+----------+--+

| Net (expense) / income recognised directly in | (5,874 | )| 1,747 | |

| equity | | | | |

+----------------------------------------------------+----------+--+----------+--+

| (Loss) / profit for the period | (58,995 | )| 86,859 | |

+----------------------------------------------------+----------+--+----------+--+

| Total recognised income and expense for the period | (64,869 | )| 88,606 | |

| attributable to equity holders of the parent | | | | |

+--------------------------------------+----------+--+----------+--+----------+--+

Notes to the accounts

1 Basis of preparation

Bovis Homes Group PLC ('the Company') is a company domiciled in the United

Kingdom. The consolidated financial statements of the Company for the year ended

31 December 2008 comprise the Company and its subsidiaries (together referred to

as 'the Group') and the Group's interest in associates.

The consolidated financial statements were authorised for issue by the directors

on 6 March 2009. The accounts were audited by KPMG Audit Plc.

The financial information included within this statement does not constitute the

Company's statutory accounts for the year ended 31 December 2007 or 2008. The

information contained in this statement has been extracted from the statutory

accounts of Bovis Homes Group PLC for the year ended 31 December 2008, which

have not yet been filed with the Registrar of Companies, on which the auditors

have given an unqualified audit report, not containing statements under section

237(2) or (3) of the Companies Act 1985.

The consolidated financials statements have been prepared in accordance with

IFRS as adopted by the EU, and the accounting policies have been applied

consistently for all periods presented in the consolidated financial

statements.

The preparation of financial statements in conformity with IFRS requires

management to make judgements, estimates and assumptions that affect the

application of policies and reported amounts of assets and liabilities, income

and expenses. The estimates and associated assumptions are based on historical

experience and various other factors that are believed to be reasonable under

the circumstances, the results of which form the basis of making judgements

about carrying values of assets and liabilities that are not readily apparent

from other sources. Actual results may differ from these estimates.

2

Basis of consolidation

The consolidated financial statements incorporate the accounts of the Company

and entities controlled by the Company (its subsidiaries) made up to 31

December. Control is achieved where the Company has the power to govern the

financial and operating policies of an entity so as to obtain benefits from its

activities. The existence and effect of potential voting rights that are

currently exercisable or convertible are considered when assessing whether the

Group controls another entity.

Associates are those entities in which the Group has significant influence, but

not control, over the financial and operating policies. The consolidated

financial statements include the Group's share of the total recognised gains and

losses of associates on an equity accounted basis, from the date that

significant influence commences until the date that significant influence

ceases.

3 Accounting policies

There have been no changes to the Group's accounting policies. These accounting

policies will be disclosed in full within the Group's forthcoming financial

statements.

4 Prior year restatements

In 2007, the cashflow statement movement in

trade and other payables was understated by GBP4,630,000 and the movement in

provisions and employee benefits was overstated by an equal and opposite amount.

In the 2008 Report and Accounts, in the prior year cashflow statement

comparatives, the movement in trade and other payables is now GBP44,149,000

(previously GBP39,519,000) and the movement in provisions and other employee

benefits is now GBP1,671,000 (previously GBP6,301,000).

Finalisation of

the fair valuation exercise arising on acquisition of Elite Homes Group Ltd in

2007 has now taken place. This has had the effect of increasing goodwill arising

on acquisition as at 31 December 2007 from the previously reported GBP9,176,000

to GBP10,036,000, reducing inventories to GBP869,355,000 (previously reported

GBP870,550,000) and increasing deferred tax to GBP3,568,000 (previously

GBP3,233,000).

5 Exceptional items

Write-down of inventories

The Group has

reviewed the carrying costs of its inventory items, comparing the carrying costs

of the asset against estimates of net realisable value. Net realisable value has

been arrived at using the Board's estimates of achievable selling prices taking

into account current market conditions, and after deduction of an appropriate

amount for selling costs. This has given rise to a land write-down totalling

GBP69.9 million and a write-down of GBP5.3 million on unsold part-exchange

properties: a provision of GBP75.2 million in total.

Impairment of goodwill

At 31 December 2008 the Group conducted an impairment review of its goodwill.

This resulted in a GBP10.0 million write-down, reflecting the write-off of all

goodwill held at the balance sheet date.

Restructuring costs

During the year ended 31 December 2008 the Group incurred GBP5.7 million (2007:

GBPnil) of costs in relation to reorganising and restructuring the Group. Of

this total, GBP4.6 million related to staff redundancies.

Other exceptional items

The Group has reviewed the carrying value of its fixed assets, and has made a

GBP1.0 million provision to reflect the impairment to carrying values of its

freehold offices following a fall in commercial property values during 2008. The

Group has also taken an impairment charge to income relating to the impairment

of its available-for-sale financial assets, totalling GBP1.2 million.

6

Reconciliation of net cash flow to net debt

+----------------------------------------+---+--+-----------------+-+-----------+-+

| | | | 2008 | | 2007 | |

+----------------------------------------+---+--+-----------------+-+-----------+-+

| | | | GBP000 | | GBP000 | |

+----------------------------------------+---+--+-----------------+-+-----------+-+

| | | | | | | |

+----------------------------------------+---+--+-----------------+-+-----------+-+

| Net increase / (decrease) in net cash | | | 14,876 | | (146,083 | )|

| and cash equivalents | | | | | | |

+----------------------------------------+---+--+-----------------+-+-----------+-+

| Drawdown of borrowings after issue | | | (70,730 | )| (1,000 | )|

| costs | | | | | | |

+----------------------------------------+---+--+-----------------+-+-----------+-+

| Fair value adjustments to interest | | | - | | 160 | |

| rate swaps | | | | | | |

+----------------------------------------+---+--+-----------------+-+-----------+-+

| Net (debt)/cash at start of period | | | (44,242 | )| 102,681 | |

+----------------------------------------+---+--+-----------------+-+-----------+-+

| Net debt at end of period | | | (100,096 | )| (44,242 | )|

+----------------------------------------+---+--+-----------------+-+-----------+-+

| | | | | | | |

+----------------------------------------+---+--+-----------------+-+-----------+-+

| Analysis of net debt: | | | | | | |

+----------------------------------------+---+--+-----------------+-+-----------+-+

| Cash and cash equivalents | | | 11,634 | | (3,242 | )|

+----------------------------------------+---+--+-----------------+-+-----------+-+

| Unsecured bank loan | | | (120,000 | )| (41,000 | )|

+----------------------------------------+---+--+-----------------+-+-----------+-+

| Issue Costs | | | 8,270 | | - | |

+----------------------------------------+---+--+-----------------+-+-----------+-+

| Net debt | | | (100,096 | )| (44,242 | )|

+----------------------------------------+---+--+-----------------+-+-----------+-+

7 Income taxes

Income tax is the expected tax payable or receivable on the taxable income or

loss for the year, calculated using a corporation tax rate of 28.5% applied to

the pre-tax income or loss, adjusted to take account of deferred taxation

movements and any adjustments to tax payable for previous years. Tax receivable

for current and prior years is classified as a current asset.

8 Dividends

The following dividends were paid by the Group.

+---------------------------------------------+----+-----+----------+--+-----------+

| | | | 2008 | | 2007 |

+---------------------------------------------+----+-----+----------+--+-----------+

| | | | GBP000 | | GBP000 |

+---------------------------------------------+----+-----+----------+--+-----------+

| | | | | | |

+---------------------------------------------+----+-----+----------+--+-----------+

| Prior year final dividend per share of | | | 21,031 | | 23,976 |

| 17.5p (2007: 20.0p) | | | | | |

+---------------------------------------------+----+-----+----------+--+-----------+

| Current year interim dividend per share of | | | 6,018 | | 21,014 |

| 5.0p (2007: 17.5p) | | | | | |

+---------------------------------------------+----+-----+----------+--+-----------+

| Dividend cost | | | 27,049 | | 44,990 |

+---------------------------------------------+----+-----+----------+--+-----------+

The Board has decided not to propose a final dividend in respect of 2008.

9 Earnings or Loss per share

Basic earnings per ordinary share before exceptional items for the year ended

31 December 2008 is calculated on profit after tax of GBP11,075,000 (year ended

31 December 2007 profit: GBP86,859,000) over the weighted average of 120,268,986

(year ended 31 December 2007: 119,984,811) ordinary shares in issue during the

period.

Basic loss per ordinary share on exceptional items for the year

ended 31 December 2008 is calculated on an exceptional loss after tax of

GBP70,070,000 for 2008 (2007: GBPnil) over the weighted average of 120,268,986

(year ended 31 December 2007: 119,984,811) ordinary shares in issue during the

period.

Basic loss per ordinary share for the year ended 31 December 2008

is calculated on loss after tax of GBP58,995,000 (year ended 31 December 2007

profit: GBP86,859,000) over the weighted average of 120,268,986 (year ended 31

December 2007: 119,984,811) ordinary shares in issue during the period.

Diluted earnings per ordinary share before exceptional items for the year ended

31 December 2008 is calculated on profit after tax of GBP11,075,000 (year ended

31 December profit: GBP86,859,000) expressed over the diluted weighted average

of 120,314,451 (year ended 31 December 2007: 120,244,911) ordinary shares

potentially in issue during the period. Diluted loss per ordinary share on

exceptional items for the year ended 31 December 2008 is calculated on an

exceptional loss after tax of GBP70,070,000 for 2008 (2007: GBPnil) and diluted

loss per ordinary share is calculated on loss after tax of GBP58,995,000 (year

ended 31 December 2007 profit: GBP86,859,000) both expressed over the weighted

average of 120,268,986 ordinary shares in issue during the period. The average

number of shares is diluted in reference to the average number of potential

ordinary shares held under option during the period. This dilutive effect

amounts to the number of ordinary shares which would be purchased using the

aggregate difference in value between the market value of shares and the share

option exercise price. The market value of shares has been calculated using the

average ordinary share price during the period. Only share options which have

met their cumulative performance criteria have been included in the dilution

calculation.A loss per share cannot be further reduced through dilution.

10 Circulation to shareholders

The consolidated financial statements will be sent to shareholders on or about 3

April 2009. Further copies will be available on request from the Company

Secretary, Bovis Homes Group PLC, The Manor House, North Ash Road, New Ash

Green, Longfield, Kent DA3 8HQ.

Further information on Bovis Homes Group PLC can be found on the Group's

corporate website www.bovishomes.co.uk/plc, including the slide presentation

document which will be presented at the Group's results meeting on 9 March 2009.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR ILFERVLITIIA

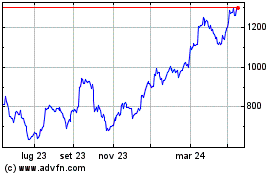

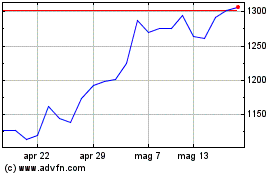

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Set 2024 a Ott 2024

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Ott 2023 a Ott 2024