ABVC BioPharma Executes a Definitive Agreement to Receive License Fees of $3M and Royalties of 2% on Future Revenues

15 Febbraio 2024 - 2:30PM

via NewMediaWire -- ABVC BioPharma, Inc. (NASDAQ: ABVC)

("Company"), a clinical-stage biopharmaceutical company developing

therapeutic solutions in Oncology/Hematology, Neurology, and

Ophthalmology, announced today that it signed a definitive

agreement to license certain of its healthcare-related expertise

("Know-How") to Senior Paradise, Inc. ("SPI"), who will also lease

certain of the Company's properties (the "Land") for further

development related to the healthcare industry. The lease, SPI may

build a long-term care center for the elderly, plant factories, and

good agricultural practices (GAP) for botanical drug products and

dietary supplements.

ABVC agrees to grant SPI a license to use the Know-How for the

healthcare industry. Specifically, ABVC's Know-How will be

strategically applied to develop the Land. The Company believes

that by integrating its Know-How and Land with SPI's abilities,

SPI's healthcare-related endeavors on the Land may achieve

tremendous success. Under the agreement, SPI shall pay ABVC $3M as

the license fee for the Know-How, in cash or stock, and royalties

of 2% on SPI's revenues earned from projects on the Land.

"We hope the Land will provide a new revenue stream for ABVC.

The Land can be repurposed for commercial or residential

development, which we believe will allow ABVC to maximize its

value. This strategic initiative optimizes the utilization of

available resources," said Dr. Uttam Patil, ABVC's Chief Executive

Officer.

As per a report by Greg Hyland, Head of Capital Markets, Asia

Pacific at CBRE, in 2020, life sciences-real estate transactions

accounted for just under 4% of global commercial real estate

volume, higher than the long-term average of 1.4%, according to

RCA, with the U.S. accounting for the bulk of deals. In Asia

Pacific, US$675 million worth of life sciences real estate changed

hands in the first three quarters of 2021, though up from a low

base of less than USD 100 million in 2018, still represents a

fraction of the overall total.1

Erik Hill, Managing Director and National Sector Lead of

Healthcare and Life Science at Partner Valuation Advisory, pointed

out that Investors have come to appreciate the recession-resistant

returns offered by healthcare real estate.2

ABVC urges its shareholders to sign up for the latest

news alerts on the Company's website.

https://abvcpharma.com/?page_id=17707

About ABVC BioPharma

ABVC BioPharma is a clinical-stage biopharmaceutical company

with an active pipeline of six drugs and one medical device

(ABV-1701/Vitargus®) under development. For its drug products, the

Company utilizes in-licensed technology from its network of

world-renowned research institutions to conduct proof-of-concept

trials through Phase II of clinical development. The Company's

network of research institutions includes Stanford University, the

University of California at San Francisco, and Cedars-Sinai Medical

Center. For Vitargus®, the Company intends to conduct global

clinical trials through Phase III.

About Senior Paradise, Inc.

Senior Paradise, Inc. is a Cayman registered Company working on

real estate development in the healthcare sector for senior care.

We will work with ABVC on this collaborative project in the Asian

Special Economic Zone to develop good agricultural practices for

the raw material of new botanical drugs to supply the global

markets.

Forward-Looking Statements

This press release contains "forward-looking statements." The

words may precede such statements "intends," "may," "will,"

"plans," "expects," "anticipates," "projects," "predicts,"

"estimates," "aims," "believes," "hopes," "potential," or similar

words. Forward-looking statements are not guarantees of future

performance, are based on certain assumptions, and are subject to

various known and unknown risks and uncertainties, many of which

are beyond the Company's control, and cannot be predicted or

quantified, and, consequently, actual results may differ materially

from those expressed or implied by such forward-looking statements.

None of the outcomes expressed herein are guaranteed. Such risks

and uncertainties include, without limitation, risks and

uncertainties associated with (i) our inability to manufacture our

product candidates on a commercial scale on our own, or in

collaboration with third parties; (ii) difficulties in obtaining

financing on commercially reasonable terms; (iii) changes in the

size and nature of our competition; (iv) loss of one or more key

executives or scientists; and (v) difficulties in securing

regulatory approval to proceed to the next level of the clinical

trials or to market our product candidates. More detailed

information about the Company and the risk factors that may affect

the realization of forward-looking statements is set forth in the

Company's filings with the Securities and Exchange Commission

(SEC), including the Company's Annual Report on Form 10-K and its

Quarterly Reports on Form 10-Q. Investors are urged to read these

documents free of charge on the SEC's website at

http://www.sec.gov. The Company assumes no obligation to publicly

update or revise its forward-looking statements as a result of new

information, future events or otherwise.

Contact:Leeds ChowEmail: leedschow@ambrivis.com

[1]

https://www.scmp.com/presented/business/topics/apac-life-sciences-opportunities/article/3157871/life-sciences-real

[2]

https://www.globest.com/2023/11/13/healthcare-real-estate-opportunities-beyond-medical-offices-and-hospitals/?slreturn=20240105041457

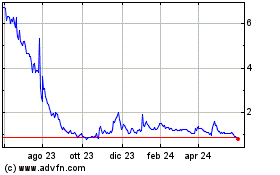

Grafico Azioni ABVC BioPharma (NASDAQ:ABVC)

Storico

Da Dic 2024 a Gen 2025

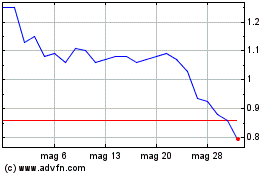

Grafico Azioni ABVC BioPharma (NASDAQ:ABVC)

Storico

Da Gen 2024 a Gen 2025