Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

29 Agosto 2023 - 10:13PM

Edgar (US Regulatory)

FORM

6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

dated August

29, 2023

Commission

File Number 1-15148

BRF

S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s

Name)

14401 AV. DAS NACOES UNIDAS 22ND FLOOR

CHAC SANTO ANTONIO 04730 090-São Paulo – SP, Brazil

(Address of principal executive

offices) (Zip code)

Indicate by

check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F x

Form 40-F o

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1):

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7):

Indicate by

check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o

No x

If “Yes”

is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

*

* *

This material

includes certain forward-looking statements that are based principally on current expectations and on projections of future events

and financial trends that currently affect or might affect the Company’s business, and are not guarantees of future performance.

These forward-looking statements are based on management’s expectations, which involve a number of known and unknown risks,

uncertainties, assumptions and other important factors, many of which are beyond the Company’s control and any of which could

cause actual financial condition and results of operations to differ materially fom those set out in the Company’s forward-looking

statements. You are cautioned not to put undue reliance on such forward-looking statements. The Company undertakes

no obligation, and expressly disclaims any obligation, to update or revise any forward-looking statements. The risks and

uncertainties relating to the forward-looking statements in this Report on Form 6-K, including Exhibit 1 hereto, include those

described under the captions “Forward-Looking Statements” and “Item 3. Key Information — D. Risk Factors”

in the Company’s annual report on Form 20-F for the year ended December 31, 2012.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| Date: August 29, 2023 |

|

| |

|

| |

BRF S.A. |

| |

|

| |

|

| |

By: |

/s/ Fabio Luis Mendes Mariano |

| |

|

Name: |

Fabio Luis Mendes Mariano |

| |

|

Title: |

Chief Financial and Investor Relations Officer

|

EXHIBIT INDEX

BRF S.A.

PUBLICLY HELD COMPANY

CNPJ 01.838.723/0001-27

NIRE 42.300.034.240

CVM 16269-2

ANNOUNCEMENT OF RELATED PARTY TRANSACTION

BRF S.A. (“BRF” or “Company”)

(B3: BRFS3; NYSE: BRFS), in accordance with item XXXII of article 33 of Instruction CVM No. 80/2022, informs its shareholders and the

market in general of the following related party transaction (“Transaction”):

| Related Party Names |

Al Wafi Food Products Factory – Sole Proprietorship LLC (“Al Wafi Factory”) and Marfrig Global Foods S.A. (“Marfrig”) |

| Relationship with the Company |

The Al Wafi Factory, a BRF’s subsidiary headquartered in

the United Arab Emirates that belongs to its Halal corporate structure.

Marfrig currently holds 33.31% (thirty-three-point thirty-one

percent) of the common shares issued by BRF and it is considered as a "related party" in accordance with BRF's Related Party

Transactions Policy ("Policy"). |

| Date of the Transaction |

08.29.2023 |

| Object, Main Terms and Conditions |

The agreement constitutes an amendment to the contract originally entered into by and between Al Wafi Factory and Marfrig on 08.19.2019, for the supply by Marfrig of raw materials (deboned and frozen beef) to BRF's factory in Abu Dhabi, which expired on 08.19.2023. The amendment extends the contract's term by 24 (twenty-four) months until 08.19.2025. The transaction represents a routine raw material supply operation, carried out within the normal course of BRF's business, with no exclusivity to either party, or a minimum volume to be supplied. The estimated total value of the contract is US $27,000,000.00 (twenty-seven million dollars) per annum. |

| Reasons why the Company's management deems the operation to be equitable |

The Company management considers that the contract in question

is entered into an arms’ length condition, given that:

(i) price quotations were requested, and negotiations were conducted

with Marfrig to obtain a competitive price;

(ii) BRF maintains a contract with another potential supplier

for the Abu Dhabi factory, wherein for each demand cycle, BRF will be able to select the supplier that presents the best correlation between

price and volume; and

(iii) the transaction was: (a) described in a technical memorandum

approved by the Compliance Department and the Corporate Legal Department of BRF; (b) reviewed by the Company's Audit and Integrity Committee

and the Finance and Risk Management Committee, in accordance with section 4.3.1, (iv) of the Policy; and (c) finally approved by the Board

of Directors. |

| Eventual involvement of the counterparty, its partners, or administrators in the Company's decision process regarding the Operation or in the negotiation of the Operation as representatives of the Company, describing these involvements |

There was no participation by Marfrig, its administrators, and/or its shareholders in the decision-making process by BRF regarding the operation, and such individuals also did not take part in the negotiation of the transaction as representatives of BRF. The negotiation was conducted between independent parties. |

São Paulo, August 29, 2023.

Fabio Luis Mendes Mariano

Chief Financial and Investor Relations Officer

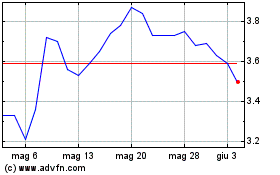

Grafico Azioni BRF (NYSE:BRFS)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni BRF (NYSE:BRFS)

Storico

Da Mag 2023 a Mag 2024