UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2023

Commission File Number 001-15148

BRF S.A.

(Exact name of registrant as specified in its charter)

N/A

(Translation of registrant’s name into English)

Av. das Nações Unidas, 14,401 –

22nd to 25th. Floors, Torre Jequitiba

Condomínio Parque da Cidade, Chácara

Santo Antônio – 04730-090

São Paulo – SP Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F [X]

Form 40-F [_]

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [_]

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [_]

* * *

This Current Report on Form 6-K, including

Exhibit 1 hereto, includes certain forward-looking statements that are based principally on current expectations and on projections of

future events and financial trends that currently affect or might affect the Company’s business, and are not guarantees of future

performance. These forward-looking statements are based on management’s expectations, which involve a number of known and unknown

risks, uncertainties, assumptions and other important factors, many of which are beyond the Company’s control and any of which could

cause the Company’s actual financial condition and results of operations to differ materially from those set out in the Company’s

forward-looking statements. You are cautioned not to put undue reliance on such forward-looking statements. The Company undertakes no

obligation, and expressly disclaims any obligation, to update or revise any forward-looking statements, whether because of new information,

future events or otherwise. The risks and uncertainties relating to the forward-looking statements in this Current Report on Form 6-K,

including Exhibit 1 hereto, include those described under the captions “Forward-Looking Statements” and “Item 3. Key

Information—D. Risk Factors” in the Company’s annual report on Form 20-F for the year ended December 31, 2022.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 5, 2023

BRF S.A.

By: /s/ Fabio Luis Mendes Mariano

Name: Fabio Luis Mendes Mariano

Title: Chief Financial and Investor Relations Officer

EXHIBIT INDEX

Exhibit Description of Exhibit

Exhibit 1

BRF

S.A. announces the expiration of its cash tender offers for (A) the 4.350% Senior Notes due 2026 issued by BRF GmbH and

guaranteed by BRF S.A. and (B) the 4.875% Senior Notes due 2030 issued by BRF S.A., and the completion of the make-whole redemption in

full of its 4.75% Senior Notes due 2024

São Paulo, Brazil – October

5, 2023 – BRF S.A. (“BRF”) today announces (i) the expiration of its previously announced offers to purchase

for cash for its own account and, in the case of the 2026 Notes, on behalf of BRF GmbH, a limited liability company (Gesellschaft mit

beschränkter Haftung) organized under the law of the Republic of Austria, and a wholly-owned subsidiary of BRF (the “Subsidiary

Issuer”), up to the maximum combined aggregate principal amount of US$200,000,000 (“Maximum Amount”)

of the outstanding: (A) 4.350% Senior Notes due 2026 (the “2026 Notes”) issued by the Subsidiary Issuer and

guaranteed by BRF (the “2026 Notes Offer”), and (B) 4.875% Senior Notes due 2030 (the “2030 Notes”

and, together with the 2026 Notes, the “Notes”) issued by BRF (the “2030 Notes Offer”

and, together with the 2026 Notes Offer, the “Offers” and each, an “Offer”), and (ii)

the completion of its previously announced make-whole redemption in full of the aggregate principal amount of its outstanding 4.75% Senior

Notes due 2024 (the “2024 Notes”).

The Offers

The Offers were made upon the terms

and subject to the conditions set forth in the offer to purchase dated September 6, 2023 (the “Offer to Purchase”).

Capitalized terms used but not otherwise defined herein have the meanings ascribed to them in the Offer to Purchase. As previously announced,

on September 21, 2023, BRF purchased, on a prorated basis, an aggregate principal amount of US$200,000,000 2026 Notes validly tendered

and not validly withdrawn on or prior to the Early Tender Date, and no 2030 Notes. The Offers expired at 5:00 p.m. (New York City time)

on October 4, 2023. According to information received from D.F. King & Co., Inc., the information and tender agent for the Offers,

no additional Notes were tendered after the Early Tender Date in the Offers.

BRF has retained BofA Securities, Inc.

and Santander US Capital Markets LLC to serve as dealer managers and D.F. King & Co., Inc. to serve as information and tender agent

for the Offers. The full details of the Offers are included in the Offer to Purchase. Holders of Notes are strongly encouraged to carefully

read the Offer to Purchase, because it contains important information. Requests for the Offer to Purchase and any related supplements

may be directed to D.F. King & Co., Inc. by telephone at +1 (212) 269-5550 or +1 (866) 416-0577 (US toll free) or in writing at brf@dfking.com.

Documents relating to the Offers, including the Offer to Purchase, are also available at www.dfking.com/brf. Questions about the Offers

may be directed to BofA Securities, Inc by telephone at +1 (646) 855-8988 (collect) or +1 (888) 292-0070 (U.S. toll free) and Santander

US Capital Markets LLC by telephone at +1 (212) 940-1442 (collect) or +1 (855) 404-3636 (U.S. toll free) or by e-mail at Usdcmlm@santander.us.

The 2024 Notes Make-Whole Redemption

On this date, all outstanding 2024

Notes have been redeemed at 100% of their principal amount of US$295,363,000.00 plus accrued and unpaid interest in the aggregate amount

of US$5,183,210.42 from May 22, 2023 to, but excluding, the date hereof, pursuant to the terms and conditions of the indenture governing

the 2024 Notes. Accordingly, all 2024 Notes have been cancelled.

DISCLAIMER

This press release shall not constitute

an offer to purchase or a solicitation of acceptance of an offer to purchase. Neither the U.S. Securities and Exchange Commission, any

U.S. state securities commission nor any regulatory authority of any other country has approved or disapproved of the Offers, passed upon

the merits or fairness of the Offers or passed upon the adequacy or accuracy of the disclosure in the Offer to Purchase.

ABOUT BRF

BRF is a sociedade anônima

(corporation) organized under the laws of the Federative Republic of Brazil. Our principal executive offices are located at Avenida das

Nações Unidas, 14,401 – 22nd to 25th Floors, Torre Jequitiba, Condomínio Parque da Cidade, Chácara Santo

Antônio, 04730-090, in the city of São Paulo, State of São Paulo, Brazil. The telephone number of our investor relations

department is +55-11-2322-5377 and our investor relations e-mail address is acoesri@brf.com.

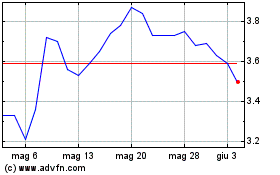

Grafico Azioni BRF (NYSE:BRFS)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni BRF (NYSE:BRFS)

Storico

Da Mag 2023 a Mag 2024