0000040545false00000405452024-07-232024-07-230000040545us-gaap:CommonStockMember2024-07-232024-07-230000040545ge:A0.875NotesDue2025Member2024-07-232024-07-230000040545ge:A1.875NotesDue2027Member2024-07-232024-07-230000040545ge:A1.500NotesDue2029Member2024-07-232024-07-230000040545ge:A7.5GuaranteedSubordinatedNotesDue2035Member2024-07-232024-07-230000040545ge:A2.125NotesDue2037Member2024-07-232024-07-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) July 23, 2024

General Electric Company

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | |

| |

| New York | | 001-00035 | | 14-0689340 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | |

| 1 Neumann Way, | Evendale, | OH | | | | 45215 |

| (Address of principal executive offices) | | | | (Zip Code) |

| | | | | | |

(Registrant’s telephone number, including area code) (617) 443-3000

_______________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common stock, par value $0.01 per share | GE | New York Stock Exchange |

0.875% Notes due 2025 | GE 25 | New York Stock Exchange |

1.875% Notes due 2027 | GE 27E | New York Stock Exchange |

1.500% Notes due 2029 | GE 29 | New York Stock Exchange |

7 1/2% Guaranteed Subordinated Notes due 2035 | GE /35 | New York Stock Exchange |

2.125% Notes due 2037 | GE 37 | New York Stock Exchange |

| | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). | |

| Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 2.02 Results of Operations and Financial Condition.

On July 23, 2024, General Electric Company, operating as GE Aerospace (the "Company"), released its second-quarter 2024 financial results on its investor relations website at www.geaerospace.com/investor-relations. A copy of these is attached as Exhibit 99 and incorporated by reference herein.

The information provided pursuant to this Item 2.02, including Exhibit 99, is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 (the "Exchange Act") or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933 or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit Description

104 The cover page of this Current Report on Form 8-K formatted as Inline XBRL.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | General Electric Company | |

| | | (Registrant) | |

| | |

| |

| Date: July 23, 2024 | | /s/ Robert Giglietti | |

| | | Robert Giglietti Vice President - Chief Accounting Officer, Controller and Treasurer Principal Accounting Officer | |

GE AEROSPACE ANNOUNCES SECOND QUARTER 2024 RESULTS

Delivers strong second quarter with significant profit growth, raises full-year profit and cash guidance

Second quarter 2024:

•Total orders of $11.2B, +18%

•Total revenue (GAAP) of $9.1B, +4%; adjusted revenue* $8.2B, +4%

•Profit (GAAP) of $1.4B, (4)%; operating profit* $1.9B, +37%

•Profit margin (GAAP) of 15.9%, (130) bps; operating profit margin* 23.1%, +560 bps

•Continuing EPS (GAAP) of $1.20, +$0.11; adjusted EPS* $1.20, +$0.46

•Cash from Operating Activities (GAAP) of $1.0B, +$0.2B; free cash flow* $1.1B, +$0.2B

EVENDALE, Ohio — July 23, 2024 — GE Aerospace (NYSE:GE) announced results today for the second quarter ending June 30, 2024.

GE Aerospace Chairman and CEO H. Lawrence Culp, Jr. said, "The GE Aerospace team delivered another strong quarter marked by double-digit increases across orders, operating profit, and free cash flow. Given our performance year-to-date and momentum across our businesses we are raising our full-year profit and free cash flow guidance.”

Culp continued, “We are accelerating our actions and leveraging FLIGHT DECK to unlock supply constraints and fully meet customer demand. I am confident that advancing our strategic priorities for today, tomorrow and the future, will enable us to meet the needs of our customers and create exceptional value for shareholders."

GE Aerospace's key highlights included:

•Continued to execute on our action plan to address supply chain constraints at our top 15 suppliers by leveraging FLIGHT DECK and deploying engineering and supply chain resources, leading to progress at a majority of these supplier sites.

•Announced plans to meet the expected growth in shop visit demand through organic and inorganic investments of $1 billion over the next five years to expand and upgrade MRO facilities around the world, including a recent agreement to acquire a dedicated LEAP test cell.

•Reached agreements at Farnborough Airshow for four widebody wins including with British Airways for GEnx engines to power 6 787s, Japan Airlines for GEnx engines to power up to 20 787s, Turkish Airlines for 8 GE90 engines to power 4 777Fs, and National Airlines for 8 GE90 engines to power 4 777Fs.

•Further advanced CFM RISE technologies as we move from component-level evaluations to more module-level tests including the completion of more than 200 hours of wind tunnel tests with our partner Safran to demonstrate the aerodynamic and acoustic performance of the Open Fan. Additionally, GE Aerospace announced a new agreement with the U.S. Department of Energy on supercomputing, which will further advance Open Fan design.

•Achieved a significant milestone with the delivery of two T901 engines to the U.S. Army for the Improved Turbine Engine Program’s UH-60 Black Hawk integration and testing.

•Continued to execute the company's capital allocation priorities by initiating a quarterly dividend of $0.28 in April, and repurchasing approximately 13.9 million common shares for $2.3 billion in the second quarter. Of the total repurchase, 11.7 million of common shares were repurchased for $1.9 billion under the company's $15 billion share repurchase program announced in March 2024.

•Continued efforts to exit non-core assets including the completion of the sale of Electric Insurance, signing an agreement to sell the GE Licensing business, as well as a reinsurance agreement to exit a block of our life and health insurance business.

* Non-GAAP Financial Measure

1

Total Company Results

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30 | | Six months ended June 30 |

Dollars in millions; per-share amounts in dollars, diluted | 2024 | 2023 | Year on Year | | 2024 | 2023 | Year on Year |

| GAAP Metrics | | | | | | | |

| Cash from Operating Activities (CFOA) | $957 | $753 | 27 | % | | $2,586 | $1,564 | 65 | % |

| Continuing EPS | 1.20 | 1.09 | 10 | % | | 2.78 | 7.06 | (61) | % |

| Net EPS | 1.15 | (0.02) | F | | 2.55 | 6.68 | (62) | % |

Total Revenue | 9,094 | 8,755 | 4 | % | | 18,048 | 16,591 | 9 | % |

| Profit Margin | 15.9 | % | 17.2 | % | (130) bps | | 19.0 | % | 50.8 | % | (3,180) bps |

| Non-GAAP Metrics | | | | | | | |

Free Cash Flow (FCF)-a) | $1,098 | $942 | 17 | % | | $2,767 | $1,770 | 56 | % |

Adjusted EPS-b) | 1.20 | 0.74 | 62 | % | | 2.13 | 1.37 | 55 | % |

| Adjusted Revenue | 8,223 | 7,907 | 4 | % | | 16,298 | 14,952 | 9 | % |

Operating Profit-c) | 1,897 | 1,385 | 37 | % | | 3,447 | 2,632 | 31 | % |

Operating Profit Margin-c) | 23.1 | % | 17.5 | % | 560 bps | | 21.1 | % | 17.6 | % | 350 bps |

(a- Includes gross additions to PP&E and internal-use software. Excludes separation cash expenditures and Corporate & Other restructuring cash expenditures.

(b- Excludes Insurance, non-operating benefit cost (income), U.S tax equity, gains (losses) on retained and sold ownership interests and other equity securities, restructuring & other charges and other items

(c- Excludes Insurance, interest and other financial charges, U.S tax equity, non-operating benefit cost (income), gains (losses) on retained and sold ownership interests and other equity securities, restructuring & other charges and other items

GE Aerospace Full Year 2024 Guidance

Based on GE Aerospace's solid performance in the first half of the year and constructive outlook, the company is updating its full-year 2024 and business specific guidance, and now expects:

| | | | | | | | | | | |

| 2023 | April 2024 Guide | July 2024 Guide |

Adjusted Revenue* Growth Adjusted Revenue* | '+22% $32.0B | LDD+ | HSD |

Operating Profit* Operating profit margin* | '$5.6B 17.4% | $6.2B-$6.6B | $6.5B-$6.8B |

| Adjusted EPS* | $2.95 | $3.80 to $4.05 | $3.95-$4.20 |

Free Cash Flow* FCF* conversion-a) | $4.7B ~145% | '>$5B >100% | $5.3B-$5.6B >100% |

•Commercial Engines & Services: Now expect revenue growth of low-double-digits to mid-teens, driven by equipment growth of high-single-digits to low-double-digits. Continue to expect services growth of mid-teens. Increasing operating profit to a range of $6.3-$6.5 billion, up from our prior guidance in April of $6.1 to $6.4 billion

•Defense & Propulsion Technologies: Continue to expect revenue growth of mid-single-digits to high-single-digits and operating profit of $1.0 to $1.3 billion

* Non-GAAP Financial Measure

(a – FCF* conversion: FCF* / adjusted net income*

2

Results by Reporting Segment

The following discussions and variance explanations are intended to reflect management’s view of the relevant comparisons of financial results.

Commercial Engines & Services

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30 | | Six months ended June 30 |

(Dollars in millions) | 2024 | 2023 | Year on Year | | 2024 | 2023 | Year on Year |

| Orders | $9,152 | $6,653 | 38 | | % | | $17,466 | $12,847 | 36 | | % |

Revenue | 6,132 | 5,737 | 7 | | % | | 12,228 | 10,969 | 11 | | % |

Segment Profit/(Loss) | 1,679 | 1,389 | 21 | | % | | 3,098 | 2,603 | 19 | | % |

Segment Profit/(Loss) Margin | 27.4 | % | 24.2 | % | 320 | | bps | | 25.3 | % | 23.7 | % | 160 | | bps |

Orders of $9.2 billion increased 38% as both services and equipment were up over 30% with strong spare parts demand. Revenue of $6.1 billion grew 7% driven by services increasing 14% from internal shop visit growth, which outpaced spare parts. This more than offset equipment revenue, down 11% from lower shipments which was partially offset by customer mix and price. Profit of $1.7 billion was up 21%, with margins expanding 320 basis points driven by services volume, pricing, and mix. This more than offset lower spare engine deliveries and increased investments that impacted equipment profit.

Defense & Propulsion Technologies

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30 | | Six months ended June 30 |

(Dollars in millions) | 2024 | 2023 | Year on Year | | 2024 | 2023 | Year on Year |

| Orders | $2,334 | $3,092 | (25) | | % | | $5,364 | $5,358 | — | | % |

Revenues | 2,401 | 2,375 | 1 | | % | | 4,713 | 4,341 | 9 | | % |

Segment Profit/(Loss) | 344 | 201 | 71 | | % | | 600 | 402 | 49 | | % |

Segment Profit/(Loss) Margin | 14.3 | % | 8.5 | % | 580 | | bps | | 12.7 | % | 9.3 | % | 340 | | bps |

Orders of $2.3 billion were down (25)%, primarily due to timing of orders in Defense & Systems. Revenue increased 1%, driven by Propulsion & Additive Technologies revenue, which was up 16% with growth across several businesses. This was partially offset by Defense & Systems revenue, which was down (6)% due to lower engine deliveries, which more than offset services growth and price. Profit of $344 million, increased 71% year-over-year, with margins expanding 580 basis points, driven by mix, productivity, price and improved program performance.

* Non-GAAP Financial Measure

3

Financial Measures That Supplement GAAP

We believe that presenting non-GAAP financial measures provides management and investors useful measures to evaluate performance and trends of the total company and its businesses. This includes adjustments in recent periods to GAAP financial measures to increase period-to-period comparability following actions to strengthen our overall financial position and how we manage our business.

In addition, management recognizes that certain non-GAAP terms may be interpreted differently by other companies under different circumstances. In various sections of this report we have made reference to the following non-GAAP financial measures in describing our (1) revenues, specifically Adjusted revenues, (2) profit, specifically Operating profit and profit margin; Adjusted earnings (loss) and Adjusted earnings (loss) per share (EPS), (3) cash flows, specifically free cash flows (FCF), and (4) guidance, specifically 2024 Operating profit, 2024 Adjusted EPS and 2024 FCF.

The reasons we use these non-GAAP financial measures and the reconciliations to their most directly comparable GAAP financial measures follow. Certain columns, rows or percentages within these reconciliations may not add or recalculate due to the use of rounded numbers. Totals and percentages presented are calculated from the underlying numbers in millions.

| | | | | | | | | | | | | | | | | | | | | | | |

OPERATING PROFIT AND PROFIT MARGIN (NON-GAAP) | Three months ended June 30 | | Six months ended June 30 |

| (Dollars in millions) | 2024 | 2023 | V% | | 2024 | 2023 | V% |

| Total revenues (GAAP) | $ | 9,094 | | $ | 8,755 | | 4 | % | | $ | 18,048 | | $ | 16,591 | | 9 | % |

| Less: Insurance revenues | 871 | | 847 | | | | 1,750 | | 1,639 | | |

| Adjusted revenues (Non-GAAP) | $ | 8,223 | | $ | 7,907 | | 4 | % | | $ | 16,298 | | $ | 14,952 | | 9 | % |

| | | | | | | |

| Total costs and expenses (GAAP) | $ | 7,584 | | $ | 7,742 | | (2) | % | | $ | 15,558 | | $ | 14,759 | | 5 | % |

| Less: Insurance cost and expenses | 701 | | 784 | | | | 1,380 | | 1,505 | | |

Less: U.S. tax equity cost and expenses | 5 | | — | | | | 5 | | — | | |

| Less: interest and other financial charges | 248 | | 249 | | | | 511 | | 497 | | |

| Less: non-operating benefit cost (income) | (204) | | (249) | | | | (421) | | (488) | | |

| Less: restructuring & other | 77 | | 45 | | | | 147 | | 86 | | |

| | | | | | | |

| Less: separation costs | 75 | | 163 | | | | 334 | | 327 | | |

| | | | | | | |

| | | | | | | |

| Add: noncontrolling interests | 2 | | 2 | | | | 4 | | 6 | | |

| | | | | | | |

| Adjusted costs (Non-GAAP) | $ | 6,684 | | $ | 6,754 | | (1) | % | | $ | 13,608 | | $ | 12,837 | | 6 | % |

| | | | | | | |

| Other income (loss) (GAAP) | $ | (63) | | $ | 496 | | U | | $ | 944 | | $ | 6,600 | | (86) | % |

Less: U.S. tax equity | (38) | | (41) | | | | (73) | | (74) | | |

| Less: gains (losses) on retained and sold ownership interests and other equity securities | (393) | | 360 | | | | 241 | | 6,265 | | |

| | | | | | | |

Less: gains (losses) on purchases and sales of business interests | 10 | | (54) | | | | 20 | | (108) | | |

| Adjusted other income (loss) (Non-GAAP) | $ | 359 | | $ | 231 | | 55 | % | | $ | 756 | | $ | 518 | | 46 | % |

| | | | | | | |

| Profit (loss) (GAAP) | $ | 1,447 | | $ | 1,509 | | (4) | % | | $ | 3,434 | | $ | 8,432 | | (59) | % |

| Profit (loss) margin (GAAP) | 15.9 | % | 17.2 | % | (130) bps | | 19.0 | % | 50.8 | % | (3,180) bps |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Operating profit (loss) (Non-GAAP) | $ | 1,897 | | $ | 1,385 | | 37 | % | | $ | 3,447 | | $ | 2,632 | | 31% |

Operating profit (loss) margin (Non-GAAP) | 23.1% | 17.5% | 560 bps | | 21.1% | 17.6% | 350 bps |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | |

| We believe that adjusting profit to exclude the effects of items that are not closely associated with ongoing operations provides management and investors with a meaningful measure that increases the period-to-period comparability. Gains (losses) and restructuring and other items are impacted by the timing and magnitude of gains associated with dispositions, and the timing and magnitude of costs associated with restructuring and other activities. We also use Operating profit* as a performance metric at the company level for our annual executive incentive plan for 2024. |

*Non-GAAP Financial Measure

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ADJUSTED EARNINGS (LOSS) (NON-GAAP) | Three months ended June 30 | | Six months ended June 30 | | | | | | | | |

| (In millions, Per-share amounts in dollars) | 2024 | | 2023 | | 2024 | | 2023 | | | | | | | |

| Earnings | EPS | | Earnings | EPS | | Earnings | EPS | | Earnings | EPS | | | | | | | | | | | |

| Earnings (loss) from continuing operations (GAAP) | $ | 1,320 | | $ | 1.20 | | | $ | 1,195 | | $ | 1.09 | | | $ | 3,061 | | $ | 2.78 | | | $ | 7,747 | | $ | 7.06 | | | | | | | | | | | | |

| Insurance earnings (loss) (pre-tax) | 171 | | 0.16 | | | 64 | | 0.06 | | | 371 | | 0.34 | | | 135 | | 0.12 | | | | | | | | | | | | |

| Tax effect on Insurance earnings (loss) | (36) | | (0.03) | | | (15) | | (0.01) | | | (79) | | (0.07) | | | (31) | | (0.03) | | | | | | | | | | | | |

| Less: Insurance earnings (loss) (net of tax) | 134 | | 0.12 | | | 50 | | 0.05 | | | 292 | | 0.27 | | | 104 | | 0.09 | | | | | | | | | | | | |

| U.S. tax equity earnings (loss) (pre-tax) | (52) | | (0.05) | | | (53) | | (0.05) | | | (95) | | (0.09) | | | (96) | | (0.09) | | | | | | | | | | | | |

| Tax effect on U.S. tax equity earnings (loss) | 61 | | 0.06 | | | 66 | | 0.06 | | | 119 | | 0.11 | | | 119 | | 0.11 | | | | | | | | | | | | |

| Less: U.S. tax equity earnings (loss) (net of tax) | 9 | | 0.01 | | | 13 | | 0.01 | | | 24 | | 0.02 | | | 23 | | 0.02 | | | | | | | | | | | | |

| Non-operating benefit (cost) income (pre-tax) (GAAP) | 204 | | 0.19 | | | 249 | | 0.23 | | | 421 | | 0.38 | | | 488 | | 0.44 | | | | | | | | | | | | |

| Tax effect on non-operating benefit (cost) income | (43) | | (0.04) | | | (52) | | (0.05) | | | (88) | | (0.08) | | | (102) | | (0.09) | | | | | | | | | | | | |

| Less: Non-operating benefit (cost) income (net of tax) | 161 | | 0.15 | | | 197 | | 0.18 | | | 333 | | 0.30 | | | 385 | | 0.35 | | | | | | | | | | | | |

Gains (losses) on purchases and sales of business interests (pre-tax) | 10 | | 0.01 | | | (54) | | (0.05) | | | 20 | | 0.02 | | | (108) | | (0.10) | | | | | | | | | | | | |

| Tax effect on gains (losses) on purchases and sales of business interests | (2) | | — | | | 2 | | — | | | 5 | | — | | | 3 | | — | | | | | | | | | | | | |

| Less: Gains (losses) on purchases and sales of business interests (net of tax) | 8 | | 0.01 | | | (52) | | (0.05) | | | 25 | | 0.02 | | | (105) | | (0.10) | | | | | | | | | | | | |

Gains (losses) on retained and sold ownership interests and other equity securities (pre-tax) | (393) | | (0.36) | | | 360 | | 0.33 | | | 241 | | 0.22 | | | 6,265 | | 5.71 | | | | | | | | | | | | |

Tax effect on gains (losses) on retained and sold ownership interests and other equity securities(a)(b) | — | | — | | | — | | — | | | (1) | | — | | | — | | — | | | | | | | | | | | | |

| Less: Gains (losses) on retained and sold ownership interests and other equity securities (net of tax) | (393) | | (0.36) | | | 359 | | 0.33 | | | 240 | | 0.22 | | | 6,265 | | 5.71 | | | | | | | | | | | | |

Restructuring & other (pre-tax) | (77) | | (0.07) | | | (45) | | (0.04) | | | (147) | | (0.13) | | | (86) | | (0.08) | | | | | | | | | | | | |

| Tax effect on restructuring & other | 16 | | 0.01 | | | 9 | | 0.01 | | | 31 | | 0.03 | | | 18 | | 0.02 | | | | | | | | | | | | |

| Less: Restructuring & other (net of tax) | (61) | | (0.06) | | | (35) | | (0.03) | | | (116) | | (0.11) | | | (68) | | (0.06) | | | | | | | | | | | | |

Separation costs (pre-tax) | (75) | | (0.07) | | | (163) | | (0.15) | | | (334) | | (0.30) | | | (327) | | (0.30) | | | | | | | | | | | | |

| Tax effect on separation costs | 216 | | 0.20 | | | 14 | | 0.01 | | | 251 | | 0.23 | | | (3) | | — | | | | | | | | | | | | |

| Less: Separation costs (net of tax) | 141 | | 0.13 | | | (149) | | (0.14) | | | (84) | | (0.08) | | | (330) | | (0.30) | | | | | | | | | | | | |

| Less: Excise tax and accretion of preferred share redemption | — | | — | | | — | | — | | | — | | — | | | (30) | | (0.03) | | | | | | | | | | | | |

| Adjusted earnings (loss) (Non-GAAP) | $ | 1,321 | | $ | 1.20 | | | $ | 812 | | $ | 0.74 | | | $ | 2,347 | | $ | 2.13 | | | $ | 1,503 | | $ | 1.37 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| (a) Includes tax benefits available to offset the tax on gains (losses) on equity securities. |

| (b) Includes related tax valuation allowances. |

| | | | | | | | | | | | | | | | | | | | | | |

| Earnings-per-share amounts are computed independently. As a result, the sum of per-share amounts may not equal the total. |

The service cost for our pension and other benefit plans are included in Adjusted earnings*, which represents the ongoing cost of providing pension benefits to our employees. The components of non-operating benefit costs are mainly driven by capital allocation decisions and market performance. We believe the retained cost in Adjusted earnings* provides management and investors a useful measure to evaluate the performance of the total company and increases period-to-period comparability. We also use Adjusted EPS* as a performance metric at the company level for our performance stock units granted in 2024. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FREE CASH FLOWS (FCF) (NON-GAAP) | Three months ended June 30 | | Six months ended June 30 | | |

| (In millions) | 2024 | 2023 | V$ | | 2024 | 2023 | V$ | | | | |

| Cash flows from operating activities (CFOA) (GAAP) | $ | 957 | | $ | 753 | | $ | 204 | | | $ | 2,586 | | $ | 1,564 | | $ | 1,022 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Add: gross additions to property, plant and equipment and internal-use software | (295) | | (205) | | | | (499) | | (390) | | | | | | |

Less: separation cash expenditures | (407) | | (319) | | | | (572) | | (489) | | | | | | |

Less: Corporate & Other restructuring cash expenditures | (29) | | (75) | | | | (108) | | (108) | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Free cash flows (Non-GAAP) | $ | 1,098 | | $ | 942 | | $ | 156 | | | $ | 2,767 | | $ | 1,770 | | $ | 996 | | | | | |

| | | | | | | | | | | |

|

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| We believe investors may find it useful to compare free cash flows* performance without the effects of separation cash expenditures and Corporate & Other restructuring cash expenditures (associated with the separation-related program announced in October 2022). We believe this measure will better allow management and investors to evaluate the capacity of our operations to generate free cash flows. We also use FCF* as a performance metric at the company level for our annual executive incentive plan and performance stock units granted in 2024. | | | | |

*Non-GAAP Financial Measure

| | | | | | | | | | | | | | | | | | | | |

2024 GUIDANCE: 2024 OPERATING PROFIT (NON-GAAP) |

| | | | | | |

| We cannot provide a reconciliation of the differences between the non-GAAP expectations and corresponding GAAP measure for Operating profit* in 2024 without unreasonable effort due to the uncertainty of timing of any gains or losses related to acquisitions & dispositions, the timing and magnitude of the financial impact related to the mark-to-market of our remaining investment in GE HealthCare and the timing and magnitude of restructuring expenses. Although we have attempted to estimate the amount of gains and restructuring charges for the purpose of explaining the probable significance of these components, this calculation involves a number of unknown variables, resulting in a GAAP range that we believe is too large and variable to be meaningful. |

| | | | | | | | | | | | | | | | | | | | |

2024 GUIDANCE: 2024 ADJUSTED EPS (NON-GAAP) |

| | | | | | |

We cannot provide a reconciliation of the differences between the non-GAAP expectations and corresponding GAAP measure for Adjusted EPS* in 2024 without unreasonable effort due to the uncertainty of timing of any gains or losses related to acquisitions & dispositions, the timing and magnitude of the financial impact related to the mark-to-market of our remaining investment in GE HealthCare and the timing and magnitude of restructuring expenses. Although we have attempted to estimate the amount of gains and restructuring charges for the purpose of explaining the probable significance of these components, this calculation involves a number of unknown variables, resulting in a GAAP range that we believe is too large and variable to be meaningful. |

| | | | | | | | | | | | | | | | | |

2024 GUIDANCE: 2024 FCF (NON-GAAP) |

| | | | |

| We cannot provide a reconciliation of the differences between the non-GAAP expectations and corresponding GAAP measure for free cash flows* in 2024 without unreasonable effort due to the uncertainty of timing for separation and restructuring related cash expenditures. |

*Non-GAAP Financial Measure

Caution Concerning Forward Looking Statements:

This release and certain of our public communications and SEC filings may contain statements related to future, not past, events. These forward-looking statements often address our expected future business and financial performance and financial condition, and often contain words such as "expect," "anticipate," "intend," "plan," "believe," "seek," "see," "will," "would," "estimate," "forecast," "target," "preliminary," or "range." Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the impacts of macroeconomic and market conditions and volatility on our business operations, financial results and financial position and on the global supply chain and world economy; our expected financial performance, including cash flows, revenues, margins, earnings and earnings per share; planned and potential transactions; our credit ratings and outlooks; our funding and liquidity; our businesses’ cost structures and plans to reduce costs; restructuring, impairment or other financial charges; or tax rates.

For us, particular areas where risks or uncertainties could cause our actual results to be materially different than those expressed in our forward-looking statements include:

•changes in macroeconomic and market conditions and market volatility, including risk of recession, inflation, supply chain constraints or disruptions, interest rates, the value of securities and other financial assets, oil, jet fuel and other commodity prices and exchange rates, and the impact of such changes and volatility on our business operations and financial results;

•global economic trends, competition and geopolitical risks, including impacts from the ongoing conflict between Russia and Ukraine and related sanctions and risks related to conflict in the Middle East; demand or supply shocks from events such as a major terrorist attack, war, natural disasters or actual or threatened public health pandemics or other emergencies; or an escalation of sanctions, tariffs or other trade tensions between the U.S. and China or other countries;

•market or other developments that may affect demand or the financial strength and performance of airframer, airline and other customers we serve, such as demand for air travel, supply chain or other production constraints, shifts in U.S. or foreign government defense programs and other aerospace and defense sector dynamics;

•pricing, cost, volume and the timing of sales, investment and production by us and our customers, suppliers or other industry participants, as well as technology developments and other dynamics that could shift the demand or competitive landscape for our products and services;

•the impact of actual or potential safety or quality issues or failures of our products or third-party products with which our products are integrated, including design, production, performance, durability or other issues, and related costs and reputational effects;

•operational execution, including our performance amidst market growth and ramping newer product platforms, meeting delivery and other contractual obligations, improving turnaround times in our services businesses and reducing costs over time;

•the amount and timing of our earnings and cash flows, which may be impacted by macroeconomic, customer, supplier, competitive, contractual, financial or accounting (including changes in estimates) and other dynamics and conditions;

•our capital allocation plans, including the timing and amount of dividends, share repurchases, acquisitions, organic investments and other priorities;

•our decisions about investments in research and development or new products, services and platforms, and our ability to launch new products in a cost-effective manner;

•our success in executing planned and potential transactions, including the timing for such transactions, the ability to satisfy any applicable pre-conditions and the expected benefits;

•downgrades of our credit ratings or ratings outlooks, or changes in rating application or methodology, and the related impact on our funding profile, costs, liquidity and competitive position;

•capital or liquidity needs associated with our run-off insurance operations and mortgage portfolio in Poland (Bank BPH), the amount and timing of any required future capital contributions and any strategic options that we may consider;

•changes in law, regulation or policy that may affect our businesses, such as trade policy and tariffs, government defense budgets, regulation, incentives and emissions offsetting or trading regimes related to climate change, and the effects of tax law changes;

•the impact of regulation; government investigations; regulatory, commercial and legal proceedings or disputes; environmental, health and safety matters; or other legal compliance risks, including the impact of shareholder and related lawsuits, Bank BPH and other proceedings that are described in our SEC filings;

•the impact related to information technology, cybersecurity or data security breaches at GE Aerospace or third parties; and

•the other factors that are described in the "Risk Factors" section in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, as such descriptions may be updated or amended in any future reports we file with the SEC.

These or other uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements. This document includes certain forward-looking projected financial information that is based on current estimates and forecasts. Actual results could differ materially.

GE Aerospace’s Investor Relations website at www.geaerospace.com/investor, as well as GE Aerospace’s LinkedIn and other social media accounts, contain a significant amount of information about GE Aerospace, including financial and other information for investors. GE Aerospace encourages investors to visit these websites from time to time, as information is updated and new information is posted.

Additional Financial Information

Additional financial information can be found on the Company’s website at: www.geaerospace.com/investor-relations under Events and Reports.

Conference Call and Webcast

GE Aerospace will discuss its results during its investor conference call today starting at 7:30 a.m. ET. The conference call will be broadcast live via webcast, and the webcast and accompanying slide presentation containing financial information can be accessed by visiting the Events and Reports page on GE Aerospace’s website at: www.geaerospace.com/investor-relations. An archived version of the webcast will be available on the website after the call.

About GE Aerospace

GE Aerospace is a global aerospace propulsion, services, and systems leader with an installed base of approximately 44,000 commercial and 26,000 military aircraft engines. With a global team of 52,000 employees building on more than a century of innovation and learning, GE Aerospace is committed to inventing the future of flight, lifting people up, and bringing them home safely. Learn more about how GE Aerospace and its partners are defining flight for today, tomorrow and the future at www.geaerospace.com.

GE Aerospace Investor Contact:

Blaire Shoor, 857.472.9659

blaire.shoor@ge.com

GE Aerospace Media Contact:

Nicole Sizemore, 203.945.9783

nicole.sizemore@ge.com

v3.24.2

Cover Page

|

Jul. 23, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 23, 2024

|

| Entity Registrant Name |

General Electric Co

|

| Entity Central Index Key |

0000040545

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

NY

|

| Entity File Number |

001-00035

|

| Entity Tax Identification Number |

14-0689340

|

| Entity Address, Address Line One |

1 Neumann Way,

|

| Entity Address, City or Town |

Evendale,

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

45215

|

| City Area Code |

617

|

| Local Phone Number |

443-3000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.01 per share

|

| Trading Symbol |

GE

|

| Security Exchange Name |

NYSE

|

| 0.875% Notes Due 2025 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.875% Notes due 2025

|

| Trading Symbol |

GE 25

|

| Security Exchange Name |

NYSE

|

| 1.875% Notes Due 2027 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.875% Notes due 2027

|

| Trading Symbol |

GE 27E

|

| Security Exchange Name |

NYSE

|

| 1.500% Notes Due 2029 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.500% Notes due 2029

|

| Trading Symbol |

GE 29

|

| Security Exchange Name |

NYSE

|

| 7.5% Guaranteed Subordinated Notes Due 2035 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

7 1/2% Guaranteed Subordinated Notes due 2035

|

| Trading Symbol |

GE /35

|

| Security Exchange Name |

NYSE

|

| 2.125% Notes Due 2037 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

2.125% Notes due 2037

|

| Trading Symbol |

GE 37

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ge_A0.875NotesDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ge_A1.875NotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ge_A1.500NotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ge_A7.5GuaranteedSubordinatedNotesDue2035Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ge_A2.125NotesDue2037Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

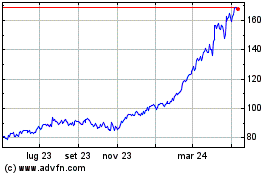

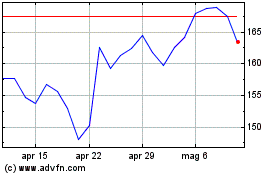

Grafico Azioni GE Aerospace (NYSE:GE)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni GE Aerospace (NYSE:GE)

Storico

Da Feb 2024 a Feb 2025