Safaricom and Mastercard have signed a partnership to accelerate

the adoption of payment acceptance and cross-border remittance

services in Kenya. This collaboration is set to benefit over

636,000 merchants using M-PESA, Safaricom’s leading mobile money

service.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240919122413/en/

(L-R Back): Shehryar Ali, SVP and Country

Manager for East Africa & Indian Ocean Islands at Mastercard;

Lenin Oyuga, Head of Telco Commercial and Partnerships, Middle East

and Africa (MEA) at Mastercard; Aliya Khanbhai, Tribe Lead for Next

Financial Services Wealth and Insurance at Safaricom Plc; and

Victor Odada, Head of M-Pesa Payments at Safaricom Plc. (L-R

Front): Amnah Ajmal, Executive Vice President, Market Development,

EEMEA at Mastercard and Esther Waititu, Chief Financial Services

Officer at Safaricom Plc. The executives signed an agreement

between Mastercard and Safaricom Plc that will enhance payment

acceptance and cross-border remittance services to over 636,000

M-PESA merchants in Kenya. (Photo: AETOSWire).

Kenya’s payment acceptance market continues to grow, with mobile

wallet payments driven by M-PESA showing a 12.7% CAGR between 2020

and 2024. Leveraging M-PESA’s extensive merchant network and

Mastercard’s global payment infrastructure, this partnership will

make more seamless, secure, and scalable payment solutions

available to merchants, enabling them to serve customers across

global markets. The partnership will also boost remittance

services, streamlining cross-border transactions efficiently.

“We are proud to partner with Safaricom to build an inclusive

digital economy that works for everyone, everywhere. We will enable

the merchants to grow and contribute to the Kenyan economy,”

said Amnah Ajmal, Executive Vice President, EEMEA,

Mastercard.

By embedding Mastercard’s omnichannel acceptance solutions

across M-PESA’s merchant space, the partnership is scaling digital

payments across Kenya. Furthermore, by integrating Mastercard’s

infrastructure, Safaricom will enhance cross-border money

transfers, providing faster, more reliable transfers, while

advancing its ability to support merchants in accepting digital

payments.

“This collaboration with Mastercard unlocks new opportunities

for M-PESA merchants, aligning with our mission to deliver

innovative, customer-centric products. By combining our expertise

with Mastercard’s global acceptance network, we are enabling

businesses to provide more efficient and frictionless payment

solutions to their customers, both in Kenya and beyond,” said

Esther Waititu, Chief Financial Services Officer, Safaricom

Plc.

Safaricom and Mastercard are committed to foster innovation and

financial inclusion within Kenya’s evolving digital landscape. The

first initiatives are expected to roll out in the coming months,

advancing Safaricom’s journey toward securing its acquiring license

and providing merchants with cutting-edge digital payment

solutions.

About Mastercard (NYSE: MA) www.mastercard.com

Mastercard is a global technology company in the payments

industry. Our mission is to connect and power an inclusive, digital

economy that benefits everyone, everywhere by making transactions

safe, simple, smart and accessible. Using secure data and networks,

partnerships and passion, our innovations and solutions help

individuals, financial institutions, governments and businesses

realize their greatest potential. With connections across more than

210 countries and territories, we are building a sustainable world

that unlocks priceless possibilities for all.

About Safaricom

Safaricom is the leading telecommunication company in East

Africa. Our purpose is to transform lives by connecting people to

people, people to opportunities, and people to information. We keep

over 41 million customers connected and play a critical role in

society, supporting over one million jobs both directly and

indirectly. Our total economic value was estimated at KES 362

billion ($3.2 billion) for the 12 months through March 2021.

Listed on the Nairobi Securities Exchange and with annual

revenues of close to KES 264 billion ($2.9 billion) as at March

2021. Safaricom provides connectivity through a wide range of

technology, 2G, 3G, 4G and 5G in aggregate, covering over 99% of

Kenya’s population.

We run the world’s largest mobile payment system and Africa’s

largest Fintech, M-PESA, the world’s first mobile money transfer

system. By empowering over 28 million customers to transact, save

or borrow money through their mobile phones, M-PESA has driven

financial inclusion in Kenya to more than 82% of the adult

population from a low of 25% and generated over KES 82.65 billion

($826 million) in revenue as at FY21.

Our subsidiary, Safaricom Telecommunications Ethiopia, plans to

deploy a world-class network and services by mid-2022 to contribute

to Ethiopia’s digital transformation.

Safaricom is an equal opportunity employer, actively recruiting

staff from different backgrounds reflecting the communities that we

serve. We are committed to equal gender representation at all

levels. Our target is to achieve 50:50 senior management gender

parity by 2025.

As part of our ongoing commitment to the Sustainable Development

Goals (SDGs), we continue to work towards improving energy and

resource efficiency in our network and facilities to reduce carbon

emissions and fuel consumption. We remain committed to becoming a

Net Zero carbon-emitting company by 2050.

For more details, please visit www.safaricom.co.ke

For news, please visit:

https://www.safaricom.co.ke/about/media-center/publications/press-release

For media-ready photos, visit:

https://www.flickr.com/photos/safaricom_pr

*Source: AETOSWire

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240919122413/en/

Kanyi L. Mwangi, Communications Director

Kanyi.Mwangi@mastercard.com

Safaricom PR & Corporate Communications Phone:

+254722005211 PRComms@Safaricom.co.ke

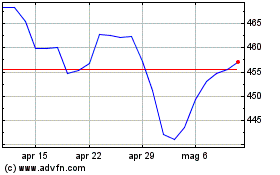

Grafico Azioni MasterCard (NYSE:MA)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni MasterCard (NYSE:MA)

Storico

Da Gen 2024 a Gen 2025