Filed

Pursuant to Rule 424(b)(5)

Registration

Statement No. 333-281253

PROSPECTUS SUPPLEMENT

(To Prospectus dated August 5,

2024)

$1,500,000,000

Common Stock

WEC

Energy Group, Inc. may offer and sell shares of its common stock, having an aggregate offering price of up to $1,500,000,000, from

time to time through the sales agents named below under an equity distribution agreement. The equity distribution agreement provides that,

in addition to the issuance and sale of shares of our common stock through the sales agents acting as sales agents or directly to the

sales agents acting as principals, we also may enter into forward sale agreements under separate forward sale confirmations between us

and any sales agent or its affiliate. These entities, when acting in such capacity, are referred to herein as “forward purchasers.”

In connection with each forward sale agreement, the relevant forward purchaser (or its affiliate) will, at our request, attempt to borrow

from third parties and, through the relevant sales agent, sell a number of shares of our common stock equal to the number of shares that

underlie the forward sale agreement to hedge the forward sale agreement. Each of the sales agents, when acting as the agent for a forward

purchaser, is referred to herein as a “forward seller.”

We

will not initially receive any proceeds from the sale of borrowed shares of our common stock by a forward seller. We expect to receive

proceeds from the sale of shares of our common stock upon future physical settlement of the relevant forward sale agreement with the relevant

forward purchaser on dates specified by us on or prior to the maturity date of the relevant forward sale agreement. We expect to receive

aggregate cash proceeds equal to the product of the initial forward sale price under such forward sale agreement and the number of shares

of our common stock underlying such forward sale agreement, subject to the price adjustment and other provisions of such forward sale

agreement. If we elect to cash settle or net share settle a forward sale agreement, we may not (in the case of cash settlement) or will

not (in the case of net share settlement) receive any proceeds, and we may owe cash (in the case of cash settlement) or shares of our

common stock (in the case of net share settlement) to the relevant forward purchaser.

The

shares of our common stock offered hereby may be offered and sold in “at the market” offerings, including on the New York

Stock Exchange or otherwise, at market prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated

prices or by any other methods permitted by applicable law as agreed between the Company and the sales agents or forward sellers, as the

case may be. We will pay each of the sales agents a commission not to exceed 1.00% of the sales price per share of shares sold through

it as agent under the equity distribution agreement. The net proceeds that we will receive from such sales will be the gross proceeds

from such sales less the commissions and any other costs that we may incur in issuing the shares. See “Use of Proceeds” in

this prospectus supplement for further information. In connection with each forward sale agreement, the relevant forward seller will receive,

reflected in a reduced initial forward sale price payable by the relevant forward purchaser under its forward sale agreement, a commission

of up to 1.00% of the volume weighted average of the sales prices of all borrowed shares of our common stock sold during the applicable

period by it as a forward seller. The shares of our common stock will be sold through only one sales agent or one forward seller, as the

case may be, on any given day. See “Plan of Distribution” in this prospectus supplement for further information.

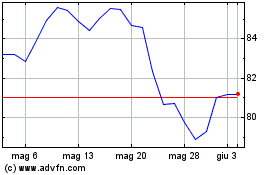

Our

common stock is listed and traded on the New York Stock Exchange under the symbol “WEC”. The last reported sale price of our

common stock on the New York Stock Exchange on August 5, 2024 was $88.19 per share.

Investing

in our common stock involves certain risks. See “Risk Factors” on page S-5 of this prospectus supplement.

Neither

the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these

securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the

contrary is a criminal offense.

| Barclays |

BofA Securities |

J.P. Morgan |

KeyBanc Capital Markets |

| |

| Mizuho |

MUFG |

RBC Capital Markets |

Wells Fargo Securities |

August 6, 2024

You should rely only

on the information contained or incorporated by reference in this prospectus supplement or the accompanying prospectus. We have not, and

the sales agents, forward purchasers and forward sellers have not, authorized anyone to provide you with different information. Neither

we nor the sales agents, forward purchasers or forward sellers are making an offer of these securities in any jurisdiction where the offer

is not permitted. You should assume that the information contained in this prospectus supplement and the accompanying prospectus or the

documents incorporated by reference is accurate only as of their respective dates. Our business, financial condition, results of operations

and prospects may have changed since those dates.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

|

SUMMARY

In this prospectus supplement, unless

the context requires otherwise, “WEC Energy Group,” “we,” “us” and “our” refer to WEC

Energy Group, Inc., a Wisconsin corporation, and not to the sales agents, forward purchasers and forward sellers.

The information below is only a summary

of more detailed information included elsewhere or incorporated by reference in this prospectus supplement and the accompanying prospectus.

This summary may not contain all of the information that is important to you or that you should consider before buying securities in this

offering. Please read this entire prospectus supplement and the accompanying prospectus, as well as the information incorporated herein

and therein by reference, carefully.

WEC Energy Group, Inc.

WEC Energy Group, Inc. was incorporated

in the State of Wisconsin in 1981 and became a diversified holding company in 1986. On June 29, 2015, we acquired 100% of the outstanding

common shares of Integrys Energy Group, Inc. and changed our name to WEC Energy Group, Inc.

Our wholly owned subsidiaries are primarily

engaged in the business of providing regulated electricity service in Wisconsin and Michigan and regulated natural gas service in Wisconsin, Illinois,

Michigan and Minnesota. In addition, we have an approximately 60% equity interest in American Transmission Company LLC (“ATC”),

a regulated electric transmission company. Through our subsidiaries, we also own majority interests in a number of renewable generating

facilities as part of our non-utility energy infrastructure business. At June 30, 2024, we conducted our operations in the six reportable

segments discussed below.

Wisconsin Segment: The

Wisconsin segment includes the electric and natural gas operations of Wisconsin Electric Power Company (“WE”), Wisconsin Gas

LLC (“WG”), Wisconsin Public Service Corporation (“WPS”), and Upper Michigan Energy Resources Corporation (“UMERC”).

At June 30, 2024, these companies served approximately 1.7 million electric customers and 1.5 million natural gas customers.

Illinois Segment: The

Illinois segment includes the natural gas operations of The Peoples Gas Light and Coke Company (“PGL”) and North Shore Gas

Company, which provide natural gas service to customers located in Chicago and the northern suburbs of Chicago, respectively. At June 30,

2024, these companies served approximately 1.1 million natural gas customers. PGL also owns and operates a 38.8 billion cubic feet natural

gas storage field in central Illinois.

Other States Segment: The

other states segment includes the natural gas operations of Minnesota Energy Resources Corporation, which serves customers in various

cities and communities throughout Minnesota, and Michigan Gas Utilities Corporation (“MGU”), which serves customers in southern

and western Michigan. These companies served approximately 0.4 million natural gas customers at June 30, 2024.

Electric Transmission Segment:

The electric transmission segment includes our approximately 60% ownership interest in ATC, which owns, maintains, monitors, and

operates electric transmission systems primarily in Wisconsin, Michigan, Illinois, and Minnesota, and our approximately 75% ownership

interest in ATC Holdco, LLC, a separate entity formed to invest in transmission-related projects outside of ATC’s traditional footprint.

Non-Utility Energy Infrastructure

Segment: The non-utility energy infrastructure segment includes the operations of W.E. Power, LLC (“We Power”), which

owns and leases electric power generating facilities to WE; Bluewater Natural Gas Holding, LLC (“Bluewater”), which owns underground

natural gas storage facilities in southeastern Michigan; and WEC Infrastructure LLC (“WECI”). WECI has acquired or agreed

to acquire majority interests in eight wind parks and three solar projects, capable of providing more than 2,300 megawatts of renewable

energy. Together, these projects represent approximately $3.5 billion of committed investments and have long-term agreements with unaffiliated

third parties. WECI’s investment in all of these projects either qualifies, or is expected to qualify, for production tax credits.

|

Corporate and Other Segment: The

corporate and other segment includes the operations of the WEC Energy Group holding company, the Integrys Holding, Inc. (“Integrys

Holding”) holding company, the Peoples Energy, LLC holding company, Wispark LLC (“Wispark”), and WEC Business Services

LLC (WBS”). Wispark develops and invests in real estate, primarily in southeastern Wisconsin. WBS is a wholly owned centralized

service company that provides administrative and general support services to our regulated entities. WBS also provides certain administrative

and support services to our nonregulated entities. This segment also includes Wisvest LLC, Wisconsin Energy Capital Corporation, and WPS

Power Development LLC, which no longer have significant operations.

For a further description of our business

and our corporate strategy, see our Annual Report on Form 10-K for the year ended December 31, 2023, as well as the other documents

incorporated by reference.

Our principal executive offices are

located at 231 West Michigan Street, Milwaukee, Wisconsin 53201. Our telephone number is (414) 221-2345. |

|

The Offering

|

| Issuer |

WEC Energy Group, Inc. |

| |

|

| Securities Offered |

Shares of our common stock, par value $0.01 per share, having

aggregate sales proceeds of up to $1,500,000,000. |

| |

|

| Use of Proceeds |

We plan to use the net proceeds from this offering to repay short-term debt and for other general corporate purposes. See “Use of Proceeds.” |

| |

|

| Dividend Policy |

We historically have paid quarterly dividends on our common stock. We review our dividend policy on a regular basis. Subject to any regulatory restrictions or other limitations on the payment of dividends, future dividends will be at the discretion of our board of directors and will depend upon, among other factors, earnings, financial condition and other requirements. |

| |

|

| Listing |

Our common stock is listed on the New York Stock Exchange under the symbol “WEC”. |

| |

|

| Accounting Treatment |

Before any issuance of shares of our common stock upon settlement of

any forward sale agreement, we expect that the shares issuable upon settlement of such forward sale agreement will be reflected in our

diluted earnings per share calculations using the treasury stock method. Under this method, the number of shares of our common stock used

in calculating diluted earnings per share is deemed to be increased by the excess, if any, of the number of shares that would be issued

upon full physical settlement of such forward sale agreement over the number of shares that could be purchased by us in the market (based

on the average market price of our common stock during the applicable reporting period) using the proceeds receivable upon full physical

settlement (based on the adjusted forward sale price at the end of the applicable reporting period).

Consequently, we anticipate there will be no dilutive effect on our

earnings per share except during periods when the average market price of shares of our common stock is above the applicable adjusted

forward sale price subject to increase or decrease based on the overnight bank funding rate, less a spread, and subject to decrease by

amounts related to expected dividends on shares of our common stock during the term of the relevant forward sale agreement. However, if

we decide to physically settle or net share settle any forward sale agreement, delivery of shares of our common stock to the relevant

forward purchaser on the physical settlement or net share settlement of the forward sale agreement would result in dilution to our earnings

per share. |

| |

|

|

Risk Factors |

Investing in our common stock involves risk, and prospective

investors should consider the risks and uncertainties described under the caption “Risk Factors” beginning on page S-5

of this prospectus supplement and in Item 1A. Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2023, which is incorporated by reference in this prospectus supplement and the accompanying prospectus. |

RISK FACTORS

Investing in our common

stock involves risk. In addition to the risks and uncertainties described below, please see the risk factors under the heading “Risk

Factors” in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2023, which is incorporated

by reference in this prospectus supplement and the accompanying prospectus. Before making an investment decision, you should carefully

consider these risks as well as other information contained or incorporated by reference in this prospectus supplement and the accompanying

prospectus.

Risks Relating to our Common Stock

The price of our common stock may fluctuate

significantly, which could negatively affect us and holders of our common stock.

The market price of our common stock may fluctuate

significantly from time to time as a result of many factors, including:

| · | investors’ perceptions of our prospects; |

| · | investors’ perceptions of us and/or the industry’s risk and return characteristics relative to other investment alternatives; |

| · | investors’ reactions to the press releases, other public announcements and filings with the SEC of WEC Energy Group and its

subsidiaries; |

| · | investors’ perceptions of the prospects of the energy and commodities markets; |

| · | differences between actual financial and operating results and those expected by investors and analysts; |

| · | changes in analyst reports, recommendations or earnings estimates regarding WEC Energy Group, other comparable companies or the industry

generally, and our ability to meet those estimates; |

| · | actual or anticipated fluctuations in quarterly financial and operating results; |

| · | changes in interest rates and/or the rate of inflation; |

| · | new laws or regulations or new interpretations of existing laws or regulations; |

| · | volatility in the equity securities market; and |

| · | sales, or anticipated sales, of our common stock, including sales pursuant to the equity distribution agreement, or sales of securities

that are convertible into or exchangeable for our common stock. |

Shares of our common stock are reserved for

issuance upon conversion of our outstanding 4.375% Convertible Senior Notes due 2027 and our 4.375% Convertible Senior Notes due 2029

(together, the “Convertible Notes”).

The conversion of some or all of the Convertible

Notes could dilute the ownership interests of existing shareholders, unless we satisfy any such conversions solely with cash, and conversions

of the Convertible Notes into shares of our common stock, or the perception that such conversions may occur, could adversely affect the

trading price of our common stock.

Settlement provisions contained in a forward

sale agreement could result in substantial dilution to our earnings per share or result in substantial cash payment obligations.

A forward purchaser will have the right to accelerate

a forward sale agreement that it enters into with us and require us to physically settle such forward sale agreement (with respect to

all or any portion of the transaction under such forward sale agreement that such forward purchaser determines is affected by the applicable

event described below) on a date specified by such forward purchaser if:

| · | in such forward purchaser’s commercially reasonable judgment, it or its affiliate is unable to hedge its exposure under such

forward sale agreement because (x) insufficient shares of our common stock have been made available for borrowing by securities lenders

or (y) the forward purchaser or its affiliate would incur a stock borrowing cost in excess of a specified threshold; |

| · | we declare any dividend, issue or distribution on shares of our common stock |

| o | payable in cash in excess of specified amounts, |

| o | that constitutes an extraordinary dividend under the forward sale agreement, |

| o | payable in securities of another company as a result of a spinoff or similar transaction, or |

| o | of any other type of securities (other than our common stock), rights, warrants or other assets for payment (cash or other consideration)

at less than the prevailing market price; |

| · | certain ownership thresholds applicable to such forward purchaser and its affiliates are exceeded; |

| · | an event is announced that if consummated would result in a specified extraordinary event (including certain mergers or tender offers,

as well as certain events involving our nationalization, a delisting of our common stock or change in law); or |

| · | certain other events of default or termination events occur, including, among others, any material misrepresentation made in connection

with such forward sale agreement or our insolvency (each as more fully described in each forward sale agreement). |

A forward purchaser’s decision to exercise

its right to accelerate the settlement of a particular forward sale agreement will be made irrespective of our interests, including our

need for capital. In such cases, we could be required to issue and deliver shares of our common stock under the physical settlement provisions

of that particular forward sale agreement irrespective of our capital needs, which would result in dilution to our earnings per share.

We expect that settlement of any forward sale agreement

will generally occur no later than the date specified in the particular forward sale agreement. However, any forward sale agreement may

be settled earlier than that specified date in whole or in part at our option. We expect that each forward sale agreement will be physically

settled by delivery of shares of our common stock, unless we elect to cash settle or net share settle a particular forward sale agreement.

Upon physical settlement or, if we so elect, net share settlement of a particular forward sale agreement, delivery of shares of our common

stock in connection with such physical settlement or (to the extent we are obligated to deliver shares of our common stock) net share

settlement will result in dilution to our earnings per share.

In connection with any cash settlement or net share

settlement, we would expect the relevant forward purchaser or its affiliate to purchase shares of our common stock in secondary market

transactions over an unwind period for delivery to third-party stock lenders to close out its, or its affiliate’s, hedge position

in respect of that particular forward sale agreement (after taking into consideration any shares of our common stock to be delivered by

us to such forward purchaser, in the case of net share settlement) and, if applicable, in the case of net share settlement, to deliver

shares of our common stock to us to the extent required in settlement of such forward sale agreement. The purchase of shares of our common

stock in connection with the relevant forward purchaser or its affiliate unwinding its hedge positions could cause the price of our common

stock to increase (or prevent a decrease), thereby increasing the amount of cash we would owe to the relevant forward purchaser (or decreasing

the amount of cash that the relevant forward purchaser would owe to us) upon cash settlement or increasing the number of shares that we

are obligated to deliver to the relevant forward purchaser (or decreasing the number of shares that the relevant forward purchaser is

obligated to deliver to us) upon net share settlement of the particular forward sale agreement.

The forward sale price that we expect to receive

upon physical settlement of a particular forward sale agreement will be subject to adjustment on a daily basis based on a floating interest

rate factor equal to the overnight bank funding rate less a spread and will be decreased based on amounts related to expected dividends

on our common stock during the term of the particular forward sale agreement. If the overnight bank funding rate is less than the spread

for a particular forward sale agreement on any day, the interest factor will result in a reduction of the applicable forward sale price

for such day. If the volume-weighted average price at which the relevant forward purchaser (or its affiliate) purchases shares during

the applicable unwind period under a forward sale agreement is above the relevant forward sale price, in the case of cash settlement,

we would pay the relevant forward purchaser under such forward sale agreement an amount in cash equal to the difference or, in the case

of net share settlement, we would deliver to such forward purchaser a number of shares of our common stock having a value equal to the

difference. Thus, we could be responsible for a potentially substantial cash payment in the case of cash settlement of a particular forward

sale agreement. See “Plan of Distribution (Conflicts of Interest)-Sales Through Forward Sellers” in this prospectus supplement

for information on the forward sale agreements.

In case of WEC Energy Group’s bankruptcy

or insolvency, any forward sale agreement will automatically terminate, and we would not receive the expected proceeds from any forward

sales of our common stock.

If we or a regulatory authority with jurisdiction

over us institutes, or we consent to, a proceeding seeking a judgment in bankruptcy or insolvency or any other relief under any bankruptcy

or insolvency law or other similar law affecting creditors’ rights, or we or a regulatory authority with jurisdiction over us presents

a petition for our winding-up or liquidation, or we consent to such a petition, any forward sale agreement that is then in effect will

automatically terminate. If any such forward sale agreement so terminates under these circumstances, we would not be obligated to deliver

to the relevant forward purchaser any of our common stock not previously delivered, and the relevant forward purchaser would be discharged

from its obligation to pay the applicable forward sale price per share in respect of any of the shares of our common stock not previously

settled under the applicable forward sale agreement. Therefore, to the extent that there are any shares of our common stock with respect

to which any forward sale agreement has not been settled at the time of the commencement of any such bankruptcy or insolvency proceedings,

we would not receive the relevant forward sale price per share in respect of those shares.

FORWARD-LOOKING STATEMENTS

AND CAUTIONARY FACTORS

We have included or may

include statements in this prospectus supplement and the accompanying prospectus (including documents incorporated by reference) that

constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (“Securities

Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”). Any statements that

express, or involve discussions as to, expectations, beliefs, plans, objectives, goals, strategies, assumptions or future events or performance

may be forward-looking statements. Also, forward-looking statements may be identified by reference to a future period or periods or by

the use of forward-looking terminology such as “anticipates,” “believes,” “could,” “estimates,”

“expects,” “forecasts,” “goals,” “guidance,” “intends,” “may,”

“objectives,” “plans,” “possible,” “potential,” “projects,” “seeks,”

“should,” “targets,” “will” or similar terms or variations of these terms.

We caution you that

any forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors

that may cause our actual results, performance or achievements to differ materially from the future results, performance or achievements

we have anticipated in the forward-looking statements.

In addition to the assumptions

and other factors referred to specifically in connection with those statements, factors that could cause our actual results, performance

or achievements to differ materially from those contemplated in the forward-looking statements include factors we have described under

the captions “Cautionary Statement Regarding Forward-Looking Information” and “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023 and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024 and June 30, 2024, and under the caption “Factors Affecting Results, Liquidity, and Capital Resources” in the “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” section of our Annual Report on Form 10-K for the year ended December 31, 2023 and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024 and June 30, 2024, or under similar captions in the other documents we have incorporated by reference. Any forward-looking statement speaks only as

of the date on which that statement is made, and, except as required by applicable law, we do not undertake any obligation to update any

forward-looking statement to reflect events or circumstances, including unanticipated events, after the date on which that statement is

made.

USE OF PROCEEDS

We intend to use the net proceeds from the sale

of our common stock to repay short-term debt and for other general corporate purposes. At July 31, 2024, we had no outstanding short-term

debt. Pending disposition, we may temporarily invest the net proceeds of the offering not required immediately for the intended purposes

in U.S. governmental securities and other high quality U.S. securities or interest bearing deposit accounts.

We will not initially receive any proceeds from

the sale of borrowed shares of our common stock by the forward sellers, as agents for the forward purchasers, in connection with any forward

sale agreement as a hedge of the forward sale agreement. In the event of full physical settlement of a forward sale agreement, which we

expect to occur on or prior to the maturity date of such forward sale agreement, we expect to receive aggregate cash proceeds equal to

the product of the initial forward sale price under such forward sale agreement and the number of shares of our common stock underlying

such forward sale agreement, subject to the price adjustment and other provisions of the forward sale agreement. We intend to use any

cash proceeds that we receive upon physical settlement of any forward sale agreement, if physical settlement applies, or upon cash settlement

of any forward sale agreement, if we elect cash settlement, for the purposes provided in the immediately preceding paragraph. If, however,

we elect to cash settle or net share settle any forward sale agreement, we would expect to receive an amount of proceeds that is significantly

lower than the product set forth in the second preceding sentence (in the case of any cash settlement) or will not receive any proceeds

(in the case of any net share settlement), and we may owe cash (in the case of any cash settlement) or shares of our common stock (in

the case of any net share settlement) to the forward purchaser.

DESCRIPTION OF CAPITAL

STOCK

As of June 30, 2024, our authorized capital

stock consisted of:

| · | 650,000,000 shares of common stock, par value $0.01 per share; and |

| · | 15,000,000 shares of preferred stock, par value $0.01 per share. |

As of June 30, 2024,

there were 316,079,401 shares of common stock issued and outstanding and no shares of preferred stock issued and outstanding.

Common Stock

The following description

of our common stock is a summary and does not purport to be complete. It is subject to and qualified in its entirety by reference to our

Restated Articles of Incorporation, as amended (“Articles of Incorporation”), and Bylaws, as amended (“Bylaws”),

each of which is included as an exhibit to the registration statement of which this prospectus supplement forms a part. We encourage you

to read our Articles of Incorporation, our Bylaws and the applicable provisions of the Wisconsin Business Corporation Law (“WBCL”)

for additional information.

Voting Rights.

Each holder of common stock is entitled to one vote per share on each matter submitted to a vote at a meeting of stockholders, subject

to any class or series voting rights of holders of any preferred stock. The holders of common stock are not entitled to cumulate votes

for the election of directors.

Dividends.

The holders of common stock are entitled to receive such dividends as the Board of Directors (the “Board”) may from time to

time declare, subject to any rights of holders of preferred stock, if any is issued. Our ability to pay dividends primarily depends on

the availability of funds received from our utility subsidiaries and our non-utility subsidiaries. Various financing arrangements and

regulatory requirements impose certain restrictions on the ability of our subsidiaries to transfer funds to us in the form of cash dividends,

loans, or advances. All of our utility subsidiaries, with the exception of UMERC and MGU, are prohibited from loaning funds to us, either

directly or indirectly.

Liquidation Rights.

In the event of any liquidation, dissolution or winding-up of WEC Energy Group, the holders of common stock, subject to any rights of

the holders of any preferred stock, will be entitled to receive the remainder, if any, of our assets after the discharge of our liabilities.

Preemptive Rights.

Holders of common stock are not entitled to preemptive rights to subscribe for or purchase any part of any new or additional issue of

stock or securities convertible into stock.

Transfer Agent and

Registrar. Computershare, Inc. serves as transfer agent and registrar for our common stock.

Listing. Our

common stock is traded on the New York Stock Exchange under the trading symbol “WEC.”

Preferred Stock

Under the Articles of

Incorporation, our Board is authorized to divide the preferred stock into series, to issue shares of any series and, within the limitations

set forth in the Articles of Incorporation or prescribed by law, to fix and determine the relative rights and preferences of the shares

of any series so established, including the dividend rate, redemption price and terms, amount payable upon liquidation, and any sinking

fund provisions, conversion privileges and voting rights.

Certain Anti-Takeover Provisions in our Articles of Incorporation

and Bylaws

The Articles of Incorporation and Bylaws contain

provisions which may have the effect of discouraging persons from acquiring large blocks of WEC Energy Group stock or delaying or preventing

a change in control of WEC Energy Group. The material provisions which may have such an effect are:

| · | an anti-greenmail provision prohibiting the purchase of shares of common stock at a market premium from any person whom the Board

believes to be a beneficial owner of more than 5% of the outstanding shares of common stock unless such holder owned the shares for at

least two years, the purchase was approved by a majority of the combined voting power of the stockholders, or the purchase is pursuant

to a tender offer to all holders of common stock on the same terms; |

| · | a provision permitting removal of a director without cause only by at least an 80% stockholder vote; |

| · | authorization for the Board, subject to any required regulatory approval, to issue preferred stock in series and to fix rights and

preferences of the series, including, among other things, whether, and to what extent, the shares of any series will have voting rights

and the extent of the preferences of the shares of any series with respect to dividends and other matters; |

| · | advance notice procedures with respect to stockholder nominations of directors or stockholder proposals at a meeting of stockholders;

and |

| · | provisions permitting amendment of some of these and related provisions only by at least an 80% stockholder vote at a meeting. |

Anti-Takeover Effects of Wisconsin Law

Wisconsin law, under which we are incorporated,

contains certain provisions that may have antitakeover effects, The description set forth below is intended as a summary only. For complete

information you should review the applicable provisions of the WBCL and Section 196.795 of the Wisconsin Statutes, Wisconsin’s

public utility holding company law (“Wisconsin Public Utility Holding Company Law”).

Control Share Acquisitions. Wisconsin

law provides that, unless a corporation’s articles of incorporation provide otherwise, or otherwise specified by the board of directors,

the voting power of shares of a “resident domestic corporation” such as WEC Energy Group held by any person (including two

or more persons acting as a group) in excess of 20% of the voting power in the election of directors is limited (in voting on any matter)

to 10% of the full voting power of those shares. This restriction does not apply to shares acquired directly from a resident domestic

corporation, or in certain specified transactions, or incident to a transaction in which stockholders have approved restoration of the

full voting power of the otherwise restricted shares. WEC Energy Group has opted out of this statutory provision in its Articles of Incorporation.

Anti-Greenmail Provisions. Wisconsin

law restricts the ability of certain publicly held corporations, such as WEC Energy Group, to repurchase voting shares at above market

value from certain large stockholders, absent approval from the stockholders as a whole, unless an identical or better offer to purchase

is made to all owners of voting shares and securities which may be converted into voting shares. These provisions apply during a takeover

offer to purchases of more than 5% of the corporation’s shares from a person or group that holds more than 3% of the corporation’s

voting shares and has held the shares for less than two years.

Wisconsin law also provides that stockholder approval

is required for the corporation during a takeover offer to sell or option assets of the corporation which amount to at least 10% of the

market value of the corporation, unless the corporation has at least three independent directors (directors who are not officers or employees)

and a majority of the independent directors vote not to have this provision apply to the corporation.

The Articles of Incorporation require an 80% stockholder

vote for any amendment to the Articles of Incorporation that would have the effect of opting out of the anti-greenmail provision.

Fair Price Provisions. Wisconsin

law provides that in addition to any approval otherwise required, certain mergers, share exchanges or sales, leases, exchanges or other

dispositions involving a resident domestic corporation, such as WEC Energy Group, and any “significant shareholder” are subject

to a super-majority vote of stockholders unless certain fair price standards have been met. For this purpose a “significant shareholder”

is defined as either a 10% stockholder or an affiliate of the resident domestic corporation who was a 10% stockholder at any time within

the preceding two years. The super-majority vote that is required by the statute consists of:

| · | approval of 80% of the total voting power of the corporation, and |

| · | approval of at least 66 2/3% of the voting power not beneficially owned by the significant shareholder or its affiliates or associates. |

However, a supermajority vote is not required if the following “fair

price” standards are satisfied:

| · | the consideration is in cash or in the form of consideration used to acquire the greatest number of shares, and |

| · | the amount of the consideration equals the greater of: |

| o | the highest price paid by the significant shareholder within the prior two-year period; |

| o | in the case of a tender offer, the market value of the shares on the date the significant shareholder commences the tender offer;

or |

| o | the highest liquidation or dissolution distribution to which the stockholders would be entitled. |

The Articles of Incorporation require an 80% stockholder

vote for any amendment to the Articles of Incorporation that would have the effect of opting out of the fair price provisions.

Business Combination Provisions.

Wisconsin law restricts resident domestic corporations, such as WEC Energy Group, from engaging in specified business combinations involving

an “interested stockholder” or an affiliate or associate of an interested stockholder. For this purpose an “interested

stockholder” is a stockholder who beneficially owns at least 10% of the voting power of the outstanding stock of the resident domestic

corporation, or is an affiliate or associate of the resident domestic corporation and beneficially owned at least 10% of the voting power

of the then outstanding stock within the preceding three years. The specified business combinations include:

| · | a merger or interest exchange; |

| · | a sale or other disposition of assets having a market value equal to at least 5% of the market value of the assets or outstanding

stock of the corporation or representing at least 10% of its earning power or income; |

| · | the issuance or transfer of stock or rights to purchase stock with a market value equal to at least 5% of the outstanding stock; |

| · | the adoption of a plan or proposal for liquidation or dissolution; |

| · | receipt by the interested stockholder or the interested stockholder’s affiliates or associates of a disproportionate direct

or indirect benefit of a loan or other financial benefit provided by or through the resident domestic corporation or its subsidiaries;

or |

| · | certain other transactions that have the direct or indirect effect of materially increasing the proportionate share of voting stock

beneficially owned by the interested stockholder or the interested stockholder’s affiliates or associates. |

For a period of three years following the date that the interested

stockholder becomes an interested stockholder, the resident domestic corporation is prohibited from engaging in any of the specified transactions

with the interested stockholder unless the specified transaction or the purchase of stock by the interested stockholder that made the

stockholder an interested stockholder is approved by the board of directors of the resident domestic corporation before the share acquisition

date. Following the three year period, a specified transaction is permitted only if:

| · | the acquisition of shares by the interested stockholder was approved by the board of directors of the resident domestic corporation

before the share acquisition date; |

| · | the specified transaction is approved by a majority of the voting stock of the resident domestic corporation that is not owned by

the interested stockholder; or |

| · | the consideration to be received by the corporation's stockholders satisfies the “fair price” provisions of the statute

as to form and amount. |

Wisconsin Public Utility Holding Company

Provisions. The Wisconsin Public Utility Holding Company Law provides that no person may take, hold or acquire, directly or indirectly,

more than 10% of the outstanding voting securities of a public utility holding company, with the unconditional power to vote those securities,

unless the PSCW has determined that the acquisition is in the best interests of utility consumers, investors and the public. Persons acquiring

10% or more of the voting securities of WEC Energy Group are subject to the provisions of the statute.

PLAN OF DISTRIBUTION

(CONFLICTS OF INTEREST)

We have entered into an

equity distribution agreement with Barclays Capital Inc., BofA Securities, Inc., J.P. Morgan Securities LLC, KeyBanc Capital Markets

Inc., Mizuho Securities USA LLC, MUFG Securities Americas Inc., RBC Capital Markets, LLC and Wells Fargo Securities, LLC, as sales agents,

Barclays Bank PLC, Bank of America, N.A., JPMorgan Chase Bank, N.A., KeyBanc Capital Markets Inc., Mizuho Markets Americas LLC, MUFG Securities

EMEA plc, Royal Bank of Canada and Wells Fargo Bank, National Association, as forward purchasers, and Barclays Capital Inc., BofA Securities, Inc.,

J.P. Morgan Securities LLC, KeyBanc Capital Markets Inc., Mizuho Securities USA LLC, MUFG Securities Americas Inc., RBC Capital Markets,

LLC and Wells Fargo Securities, LLC, as forward sellers. Under the equity distribution agreement, we may offer and sell over time and

from time to time shares of our common stock having an aggregate offering price of up to $1,500,000,000. Further, the equity distribution

agreement provides that, in addition to the issuance and sale of shares of our common stock by us through the applicable sales agent,

we may request that such sales agent, as a forward seller, use commercially reasonable efforts to sell, from time to time, shares of our

common stock borrowed by the applicable forward purchaser (or its affiliate) in connection with one or more forward sale agreements as

described below. In no event will the aggregate offering price of the shares of our common stock through the sales agents, each as an

agent for the Company, as principal and as a forward seller, exceed $1,500,000,000.

As agents, the sales agents

will not engage in any transactions that stabilize the price of our common stock. If we or any of the sales agents have reason to believe

that our common stock is no longer an “actively-traded security” as defined under Rule 101(c)(1) of Regulation M

under the Exchange Act, that party will promptly notify the others, and sales of common stock pursuant to the equity distribution agreement,

any terms agreement or any forward sale agreement will be suspended until in the reasonable judgment of both parties Rule 101(c)(1) or

another exemptive provision has been satisfied.

Under the terms of the

equity distribution agreement, we also may sell shares to one or more of the sales agents as principal for their own accounts or for accounts

of their customers at a price agreed upon at the time of sale. A sales agent may offer the shares of common stock sold to it as principal

from time to time through public or private transactions at market prices prevailing at the time of sale, at fixed prices, at negotiated

prices, at various prices determined at the time of sale or at prices related to prevailing market prices. If we sell shares to a sales

agent as principal, we will enter into a separate terms agreement with such sales agent and this agreement will be described in a separate

prospectus supplement.

The shares of common stock

offered hereby may be sold in “at the market” offerings, including on the New York Stock Exchange or otherwise, at market

prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated prices.

In addition, if agreed by us and the relevant selling

sales agents, some or all of the shares of common stock covered by this prospectus supplement may be sold through any other method permitted

by law, including:

| · | by means of ordinary brokers’ transactions (whether or not solicited); |

| · | to or through a market maker; |

| · | directly on or through any national securities exchange or facility thereof, a trading facility of a national securities association,

an alternative trading system or any other market venue; |

| · | in the over-the-counter market; |

| · | in privately negotiated transactions; or |

| · | through a combination of any such methods. |

We will deliver to the New York Stock Exchange

copies of this prospectus supplement and the accompanying prospectus pursuant to the rules of the New York Stock Exchange. Unless

otherwise required, we intend to report at least quarterly:

| · | the number of shares of our common stock sold through the sales agents under the equity distribution agreement (as described below

under “-Sales Through Sales Agents”); |

| · | the number of shares of our common stock sold through the sales agents under any terms agreement; |

| · | the number of borrowed shares of the Company’s common stock sold by the forward sellers, as agents for the forward purchasers,

in connection with forward sales agreements (as described below under “-Sales Through Forward Sellers”); and |

| · | the net proceeds to the Company and the compensation paid by the Company to the sales agents in connection with the transactions described

in the foregoing clauses. |

In connection with the sale of the common stock

on our behalf, each of the sales agents and forward purchasers may be deemed to be an “underwriter” within the meaning of

the Securities Act and the compensation paid to the sales agents and forward purchasers may be deemed to be underwriting commissions or

discounts. We have agreed in the equity distribution agreement to indemnify each of the sales agents and forward purchasers against certain

civil liabilities, including liabilities under the Securities Act, or to contribute to payments that the sales agents and forward purchasers

may be required to make because of any of those liabilities.

We estimate that total expenses of the offering

payable by us, excluding discounts and commissions payable to the sales agents under the equity distribution agreement, will be approximately

$551,400.

We have agreed to reimburse the sales agents, the

forward sellers and the forward purchasers for certain of their reasonable out-of-pocket expenses.

The offering of our common stock pursuant to the

equity distribution agreement will terminate upon the earliest of:

| · | the sale, under the equity distribution agreement, of shares of common stock having an aggregate offering price of $1,500,000,000;

and |

| · | termination of the equity distribution agreement, pursuant to its terms, by the sales agents or us. |

Sales Through Sales Agents

Subject to the terms and conditions of the equity

distribution agreement, the applicable sales agent will use its commercially reasonable efforts to sell, consistent with its normal trading

and sales practices, as our sales agent and on our behalf, all of the designated shares of our common stock on any trading day or as otherwise

agreed upon by us and the applicable sales agent. From time to time, we will submit orders to a sales agent relating to the shares of

common stock to be sold through such sales agent, which orders may specify any price, time or size limitations relating to any particular

sale. We will submit orders to only one sales agent relating to the sale of shares of the common stock on any given day. We may instruct

any sales agent not to sell shares of common stock if the sales cannot be effected at or above a price designated by us in any such instruction.

WEC Energy Group or any sales agent may suspend the offering of shares of the common stock by notifying the other party.

Settlement for sales of our common stock will occur,

unless we and the applicable sales agent agree otherwise, on the first trading day following the date on which any sales were made unless

another date shall be agreed to by the relevant parties, against payment to us. There is no arrangement for funds to be received in an

escrow, trust or similar arrangement. The obligation of any sales agent under the equity distribution agreement to sell shares of our

common stock pursuant to our instructions is subject to a number of conditions, which such sales agent reserves the right to waive in

its sole discretion.

Each sales agent will receive from us a commission

not to exceed 1.00% of the gross sales price per share of the common stock for any shares sold through it as our sales agent under the

equity distribution agreement with us. The remaining sales proceeds, after deducting transaction fees imposed by any governmental, regulatory

or self-regulatory organization in connection with the sales, will equal our net proceeds for the sale of such shares.

Sales Through Forward Sellers

From time to time during the term of the equity

distribution agreement, and subject to the terms and conditions set forth therein, we may enter into one or more forward sale agreements

with the applicable forward purchaser. In connection with each such forward sale agreement, we will deliver to the applicable forward

purchaser and the applicable forward seller related instructions requesting that the applicable forward seller execute sales of borrowed

shares of our common stock. Upon their receipt and acceptance, such forward purchaser (or its affiliate) will attempt to borrow, and such

forward seller will use commercially reasonable efforts to sell, the relevant shares of common stock on such terms to hedge such forward

purchaser’s exposure under that particular forward sale agreement. WEC Energy Group, such forward seller or such forward purchaser

may immediately suspend the offering of common stock at any time upon proper notice to the other.

We expect that settlement between the relevant

forward purchaser and the relevant forward seller of sales of borrowed shares of our common stock, as well as the settlement between the

relevant forward seller and buyers of such shares of common stock in the market, will generally occur on the first trading day following

each date the sales are made, unless another date shall be agreed to by the relevant parties. The obligation of the relevant forward seller

under the relevant equity distribution agreement to execute such sales of common stock is subject to a number of conditions, which each

forward seller reserves the right to waive in its sole discretion. In connection with each forward sale agreement, the relevant forward

seller will receive, reflected in a reduced initial forward sale price payable by the relevant forward purchaser under its forward sale

agreement, a commission equal to up to 1.00% of the volume weighted average of the sales prices of all borrowed shares of our common stock

sold during the applicable period by it as a forward seller. This commission rate is referred to as the forward selling commission.

The initial forward sale price per share under

each forward sale agreement will equal the product of (1) an amount equal to one minus the applicable forward selling commission

and (2) the volume weighted average price per share at which the borrowed shares of our common stock were sold pursuant to the equity

distribution agreement by the relevant forward seller to hedge the relevant forward purchaser’s exposure under such forward sale

agreement. Thereafter, the initial forward sale price will be subject to price adjustment as described below. If we elect to physically

settle any forward sale agreement by delivering shares of our common stock, we will receive an amount of cash from the relevant forward

purchaser equal to the product of the initial forward sale price per share under such forward sale agreement and the number of shares

of our common stock underlying such forward sale agreement, subject to the price adjustment and other provisions of such forward sale

agreement. Each forward sale agreement will provide that the initial forward sale price, as well as the sales prices used to calculate

the initial forward sale price, will be subject to adjustment based on a floating interest rate factor equal to the overnight bank funding

rate less a spread. In addition, the initial forward sale price will be subject to decrease by amounts related to the expected dividends

on our common stock during the term of the particular forward sale agreement. If the overnight bank funding rate is less than the spread

on any day, the interest rate factor will result in a daily reduction of the forward sale price.

Before any issuance of shares of our common stock

upon settlement of any forward sale agreement, we expect that the shares issuable upon settlement of such forward sale agreement will

be reflected in our diluted earnings per share calculations using the treasury stock method. Under this method, the number of shares of

our common stock used in calculating diluted earnings per share is deemed to be increased by the excess, if any, of the number of shares

that would be issued upon full physical settlement of such forward sale agreement over the number of shares that could be purchased by

us in the market (based on the average market price of our common stock during the applicable reporting period) using the proceeds receivable

upon full physical settlement (based on the adjusted forward sale price at the end of the reporting period). Consequently, we anticipate

there will be no dilutive effect on our earnings per share except during periods when the average market price of shares of our common

stock is above the applicable adjusted forward sale price subject to increase or decrease as described in the immediately preceding paragraph.

However, if we decide to physically settle or net share settle any forward sale agreement, delivery of the shares of our common

stock to the relevant forward purchaser on the physical settlement or net share settlement of the forward sale agreement would result

in dilution to our earnings per share.

Except under limited circumstances, we have the

right to elect physical, cash or net share settlement under any forward sale agreement. Although we expect to settle any forward sale

agreement entirely by delivering shares of our common stock in connection with full physical settlement, we may, subject to certain conditions,

elect cash settlement or net share settlement for all or a portion of our obligations under a particular forward sale agreement if we

conclude that it is in our interest to do so. For example, we may conclude that it is in our interest to cash settle or net share settle

a particular forward sale agreement if we have no then-current use for all or a portion of the net proceeds that we would receive upon

physical settlement. In addition, subject to certain conditions, we may elect to settle all or a portion of the number of shares of our

common stock underlying a particular forward sale agreement prior to the maturity date of the relevant forward sale agreement.

If we elect to physically settle any forward sale

agreement by issuing and delivering shares of our common stock, we will receive an amount of cash from the relevant forward purchaser

equal to the product of the forward sale price per share under that particular forward sale agreement and the number of shares of common

stock underlying the particular forward sale agreement. If we elect cash or net share settlement of any forward sale agreement, we would

expect the relevant forward purchaser or one of its affiliates to purchase shares of our common stock in secondary market transactions

over an unwind period for delivery to third-party stock lenders to close out its, or its affiliate’s, hedge position in respect

of that particular forward sale agreement (after taking into consideration any shares of our common stock to be delivered by us to such

forward purchaser, in the case of net share settlement) and, if applicable, in the case of net share settlement, to deliver shares of

our common stock to us to the extent required in settlement of such forward sale agreement.

If the volume-weighted

average price at which the relevant forward purchaser (or its affiliate) purchases shares during the applicable unwind period under a

forward sale agreement is above the relevant forward sale price, in the case of cash settlement, we would pay the relevant forward purchaser

under such forward sale agreement an amount in cash equal to the difference or, in the case of net share settlement, we would deliver

to such forward purchaser a number of shares of our common stock having a value equal to the difference. Thus, we could be responsible

for a potentially substantial cash payment in the case of cash settlement. The purchase of shares of our common stock in connection with

the relevant forward purchaser or its affiliate unwinding its hedge positions could cause the price of the common stock to increase (or

prevent a decrease), thereby increasing the amount of cash we would owe to the relevant forward purchaser (or decreasing the amount of

cash that the relevant forward purchaser would owe us) upon cash settlement or increasing the number of shares of common stock that we

are obligated to deliver to the relevant forward purchaser (or decreasing the number of shares of common stock that the relevant forward

purchaser is obligated to deliver to us) upon net share settlement of the particular forward sale agreement. See “Risk Factors”

in this prospectus supplement.

A forward purchaser will

have the right to accelerate a forward sale agreement that it enters into with the Company and require the Company to physically settle

such forward sale agreement (with respect to all or any portion of the transaction under such forward sale agreement that such forward

purchaser determines is affected by the applicable event described below) on a date specified by such forward purchaser if:

| · | in such forward purchaser’s commercially reasonable judgment, it or its affiliate is unable to hedge its exposure under such

forward sale agreement because (x) insufficient shares of our common stock have been made available for borrowing by securities lenders

or (y) the forward purchaser or its affiliate would incur a stock borrowing cost in excess of a specified threshold; |

| · | we declare any dividend, issue or distribution on shares of our common stock |

| o | payable in cash in excess of specified amounts, |

| o | that constitutes an extraordinary dividend under the forward sale agreement, |

| o | payable in securities of another company as a result of a spinoff or similar transaction, or |

| o | of any other type of securities (other than our common stock), rights, warrants or other assets for payment (cash or other consideration)

at less than the prevailing market price; |

| · | certain ownership thresholds applicable to such forward purchaser and its affiliates are exceeded; |

| · | an event is announced that if consummated would result in a specified extraordinary event (including certain mergers or tender offers,

as well as certain events involving our nationalization, a delisting of our common stock or change in law); or |

| · | certain other events of default or termination events occur, including, among others, any material misrepresentation made in connection

with such forward sale agreement or our insolvency (each as more fully described in each forward sale agreement). |

A forward purchaser’s decision to exercise

its right to accelerate any forward sale agreement and to require us to settle any such forward sale agreement will be made irrespective

of our interests, including our need for capital. In such cases, we could be required to issue and deliver shares of our common stock

under the terms of the physical settlement provisions of the applicable forward sale agreement irrespective of our capital needs, which

would result in dilution to our earnings per share. In addition, upon certain events of bankruptcy, insolvency or reorganization relating

to us, the forward sale agreement will terminate without further liability of either party. Following any such termination, we would not

issue any shares and we would not receive any proceeds pursuant to the forward sale agreement.

Restrictions on Sales of Similar Securities

We have agreed not to directly or indirectly sell,

offer to sell, contract to sell, grant any option to sell or otherwise dispose of, shares of our common stock or securities convertible

into or exchangeable for shares of our common stock, warrants or any rights to purchase or acquire shares of our common stock for a period

beginning on the date a sales agent accepts instructions from us to sell shares and ending on the related settlement date of such shares,

without giving prior written notice to the applicable sales agent and the applicable sales agent suspending sales activity. The restriction

described in this paragraph does not apply to sales of:

| · | any shares of our common stock we offer or sell pursuant to the equity distribution agreement (including sales of borrowed shares

of our common stock by the forward sellers in connection with any forward sale agreement); |

| · | any shares of our common stock we issue upon physical settlement or net share settlement of any forward sale agreement; |

| · | shares of our common stock, options to purchase shares of our common stock or shares of our common stock issuable upon the exercise

of options or other rights pursuant to any employee or director stock option or benefit plan, stock purchase or ownership plan (whether

currently existing or adopted hereafter), or any dividend reinvestment plan or direct purchase plan, including, without limitation, the

WEC Energy Group Stock Plus Plan; |

| · | shares of our common stock issued upon conversion or settlement of securities, or the exercise of warrants, options or other rights

disclosed in our filings with the SEC; or |

| · | shares of common stock that we issue in connection with acquisitions of businesses, assets or securities of others. |

No Public Offering Outside of the United States

No action has been or will be taken in any jurisdiction

(except in the United States) that would permit a public offering of the shares of our common stock, or the possession, circulation, or

distribution of this prospectus supplement or the accompanying prospectus or any other material relating to us or the shares of our common

stock in any jurisdiction where action for that purpose is required. Accordingly, the shares of our common stock offered by this prospectus

supplement and the accompanying prospectus may not be offered or sold, directly or indirectly, and this prospectus supplement, the accompanying

prospectus and any other offering material or advertisements in connection with the shares of our common stock may not be distributed

or published, in or from any country or jurisdiction except in compliance with any applicable rules and regulations of any such country

or jurisdiction.

Other Relationships

The sales agents and their respective affiliates

are full service financial institutions engaged in various activities, which may include securities trading, commercial and investment

banking, financial advisory, investment management, principal investment, hedging, financing and brokerage activities. In the ordinary

course of their respective businesses, certain of the sales agents and their affiliates have provided, currently provide and may in the

future provide, investment banking, commercial banking, advisory and other services for us and our affiliates, for which they received

and will receive customary fees and expenses. Affiliates of each of the sales agents are lenders under our existing $1.5 billion credit

facility, WE’s existing $500 million credit facility, WPS’s existing $400 million credit facility, WG’s existing $350

million credit facility and PGL’s existing $350 million credit facility. To the extent we use the net proceeds from this offering

to repay indebtedness under our credit facilities, such affiliates may receive a portion of the net proceeds from this offering.

Conflicts of Interest

Certain of the sales agents or their affiliates

may hold a portion of the indebtedness that we may repay using all or a portion of the net proceeds from the sale of our common stock.

In addition, the forward purchasers will receive the net proceeds of any sale of borrowed shares of our common stock pursuant to this

prospectus supplement in connection with any forward sale agreement. Because certain sales agents or their affiliates may receive 5% or

more of the net proceeds from the sale of our common stock, any such sales agent would be deemed to have a “conflict of interest”

within the meaning of Financial Industry Regulatory Authority, Inc. (“FINRA”) Rule 5121. In the event of any such

conflict of interest, such sales agent would be required to sell the Company's common stock in accordance with FINRA Rule 5121. If

the sale of the Company's common stock is conducted in accordance with FINRA Rule 5121, such sales agent would not be permitted to

confirm a sale of our common stock to an account over which it exercises discretionary authority without the prior specific written approval

of the account holder.

DOCUMENTS INCORPORATED BY REFERENCE

We file annual, quarterly

and current reports, as well as registration and proxy statements and other information, with the SEC. Our SEC filings (File No. 001-09057)

are available to the public over the Internet at the SEC’s website at http://www.sec.gov as well as on our website, www.wecenergygroup.com.

The information contained on, or accessible from, our website is not a part of, and is not incorporated in, this prospectus supplement

or the accompanying prospectus.

The SEC allows us to “incorporate

by reference” into this prospectus supplement and the accompanying prospectus the information we file with the SEC, which means

we can disclose important information to you by referring you to those documents. Please refer to “Where You Can Find More Information”

in the accompanying prospectus. Any information referenced this way is considered to be part of this prospectus supplement and the accompanying

prospectus, and any information that we file later with the SEC will automatically update and supersede this information. At the date

of this prospectus supplement, we incorporate by reference the following documents that we have filed with the SEC, and any future filings

that we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act until we complete our sale of the securities

to the public:

| · | Our Current Reports on Form 8-K and 8-K/A, as applicable, filed January 8, 2024 (solely with respect to Item 2.06), January 19, 2024, March 12, 2024, May 13, 2024, May 22, 2024, May 23, 2024, May 28, 2024, June 5, 2024, July 8, 2024 and August 6, 2024. |

Information furnished

under Items 2.02 or 7.01 of any Current Report on Form 8-K will not be incorporated by reference into this prospectus supplement

or the accompanying prospectus unless specifically stated otherwise. We will provide, at no cost, to each person, including any beneficial

owner, to whom this prospectus supplement and the accompanying prospectus are delivered, a copy of any or all of the information that

has been incorporated by reference into, but not delivered with, this prospectus supplement and the accompanying prospectus, upon written

or oral request to us at:

WEC Energy Group, Inc.

231 West Michigan Street

P. O. Box 1331

Milwaukee, Wisconsin 53201

Attn: Ms. Margaret C. Kelsey,

Executive Vice President, General Counsel and Corporate Secretary

Telephone: (414) 221-2345

PROSPECTUS

WEC ENERGY GROUP, INC.

Common Stock

Preferred Stock

Debt Securities

Depositary Shares

Purchase Contracts

Units

WEC Energy Group, Inc.

may issue and sell the securities described in this prospectus to the public in one or more offerings in the amounts authorized from time

to time.

This prospectus describes

some of the general terms that may apply to these securities. The specific terms of any securities to be offered and any other information

relating to a specific offering, will be set forth in a prospectus supplement. We urge you to read this prospectus and the applicable

prospectus supplement, together with any documents we incorporate by reference, carefully before you make your investment decision.

We may offer and sell

these securities to or through one or more underwriters, dealers and agents, or directly to purchasers, on an immediate, continuous or

delayed basis. The supplements to this prospectus will provide the specific terms of the plan of distribution. This prospectus may not

be used to offer and sell securities unless accompanied by a prospectus supplement.

Our common stock is quoted

on the New York Stock Exchange under the symbol “WEC.”

See “Risk Factors”

on page 1 of this prospectus and “Risk Factors” contained in any applicable prospectus supplement and documents incorporated

by reference for information on certain risks related to the purchase of these securities.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus

is August 5, 2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

Unless

we otherwise indicate or the context otherwise requires, in this prospectus, “we,” “us,” “our” and

“WEC Energy Group” refer to WEC Energy Group, Inc.

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (“SEC”) utilizing

a “shelf” registration process. Under this shelf process, we may issue and sell to the public the securities described in

this prospectus in one or more offerings.

This

prospectus provides you with only a general description of the securities we may issue and sell. Each time we offer securities, we will

provide a prospectus supplement to this prospectus that will contain specific information about the particular securities and terms of

that offering. In the prospectus supplement, we will describe specific terms of the securities to be offered, the use of proceeds from

the sale of such securities, the plan of distribution for the securities and other information regarding the offering. The prospectus

supplement may also add to, update or change information contained in this prospectus.

If

there is any inconsistency between the information in this prospectus and any prospectus supplement, you should rely on the information

in the prospectus supplement. Please carefully read this prospectus and the applicable prospectus supplement, in addition to the information

contained in the documents we refer you to under the heading “WHERE YOU CAN FIND MORE INFORMATION.”

RISK FACTORS

Investing

in the securities of WEC Energy Group involves risk. Please see the “Risk Factors” described in Item 1A of our Annual

Report on Form 10-K for the year ended December 31, 2023, which is incorporated by reference in this prospectus. Before making

an investment decision, you should carefully consider these risks as well as other information contained or incorporated by reference

in this prospectus.

FORWARD-LOOKING STATEMENTS

AND CAUTIONARY FACTORS

We

have included or may include statements in this prospectus or in any prospectus supplement (including documents incorporated by reference)

that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended

(the “Securities Act of 1933”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act of 1934”). Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, goals, strategies,

assumptions or future events or performance may be forward-looking statements. Also, forward-looking statements may be identified by reference

to a future period or periods or by the use of forward-looking terminology such as “anticipates,” “believes,”

“could,” “estimates,” “expects,” “forecasts,” “goals,” “guidance,”

“intends,” “may,” “objectives,” “plans,” “possible,” “potential,”

“projects,” “seeks,” “should,” “targets,” “will,” or similar terms or variations

of these terms.

We

caution you that any forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties

and other factors that may cause our actual results, performance or achievements to differ materially from the future results, performance

or achievements we have anticipated in the forward-looking statements.

In

addition to the assumptions and other factors referred to specifically in connection with those statements, factors that could cause our

actual results, performance or achievements to differ materially from those contemplated in the forward-looking statements include factors

we have described under the captions “Cautionary Statement Regarding Forward-Looking Information” and “Risk Factors”

in our Annual Report on Form 10-K for the year ended December 31, 2023 and our Quarterly Reports on Form 10-Q for the quarters

ended March 31, 2024 and June 30, 2024, and under the caption “Factors Affecting Results, Liquidity, and Capital Resources”

in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of our Annual

Report on Form 10-K for the year ended December 31, 2023 and our Quarterly Reports on Form 10-Q for the quarters ended

March 31, 2024 and June 30, 2024, or under similar captions in the other documents we have incorporated by reference. Any forward-looking

statement speaks only as of the date on which that statement is made, and, except as required by applicable law, we do not undertake any

obligation to update any forward-looking statement to reflect events or circumstances, including unanticipated events, after the date

on which that statement is made.

WEC ENERGY GROUP, INC.

WEC

Energy Group, Inc. was incorporated in the State of Wisconsin in 1981 and became a diversified holding company in 1986. On June 29,

2015, we acquired 100% of the outstanding common shares of Integrys Energy Group, Inc. and changed our name to WEC Energy Group, Inc.

Our

wholly owned subsidiaries are primarily engaged in the business of providing regulated electricity service in Wisconsin and Michigan and

regulated natural gas service in Wisconsin, Illinois, Michigan and Minnesota. In addition, we have an approximately 60% equity interest

in American Transmission Company LLC (“ATC”), a regulated electric transmission company. Through our subsidiaries, we also