Treasury Metals Inc. ("Treasury" or the "Company") (TSX: TML) is

pleased to announce the results from recent trenching and sampling

on its wholly-owned Goliath Gold Project located about 20

kilometres east of the City of Dryden, Ontario. In addition, the

Company has filed on SEDAR, the National Instrument 43-101 ("NI

43-101") compliant Preliminary Economic Assessment ("PEA")

completed by independent consultant A.C.A. Howe International

Limited ("Howe") and originally announced July 13th, 2010. The full

report can be downloaded from SEDAR (www.sedar.com) and will be

posted on the Company's website (www.treasurymetals.com).

Trenching and Sampling

This Summer's work program included channel sampling on the Main

Zone of the Thunder Lake gold deposit, which was exposed by a 40

metre long trench. Sampling returned gold concentrations as high as

49.06 g/t Au over 0.55 metres. A total of 47 channel samples were

collected from 6 areas in the trench exposure and channel cuts were

made perpendicular to the strike of the Main Zone, at intervals of

approximately 5-10 metres along strike. Structural and geological

mapping was also completed over the exposed Main Zone.

Scott Jobin-Bevans, Treasury's President and CEO, commented,

"The main purpose of this trenching program was to expose the Main

Zone and enable our geological team to characterize the structural

aspects of the deposit as they relate to gold grade distribution.

By correctly interpreting the structures that host gold

mineralization at Goliath we can establish a pattern and better

target future drilling. With these results we can now confidently

project high-grade gold mineralization intersected at depth to the

surface, supporting our approach of open pit and underground mining

scenarios."

Preliminary Economic Assessment

Highlights:

-- Project has potential economic viability under base case assumptions

(US$850/oz gold).

-- Surface and underground mining operations with stand-alone

gravity/flotation milling complex.

-- Initial scenario contemplates 390,000 ounces Au recovered over 8 1/2

years at a production rate of 1,500 tonnes per day; average annual

recovery of 48,000 ounces Au.

-- At US$850 per oz (base case gold spot price): after-tax NPV@5% of $23

million and IRR of 15%.

-- At US$1,200 per oz (current gold spot price): after-tax NPV@5% of $91

million and IRR of 43%.

-- Estimated initial capital expenditure of $38 million; Life of Mine

capital expenditure of $59 million; and, payback period of 4 years at

US$850 per ounce gold, or 21/2 years at US$1,200 per ounce gold.

Howe concluded that:

-- Treasury should continue to advance the Project toward Pre-Feasibility.

-- Infill drilling to upgrade Inferred Resources to Indicated Resources,

aimed at increasing total gold ounces to be considered in future

economic/production models.

-- Collect material for further metallurgical test work to include gravity,

flotation and cyanidation mineral processing, optimised to confirm

recoveries used in the economic model.

-- Collect geotechnical information to be used for surface and underground

mine planning.

-- Optimization of economic model by investigating purchase of a used mill

instead of construction of new mill.

-- Initiation of Environmental Baseline studies as soon as possible.

Dr. Jobin-Bevans commented further, "The PEA has demonstrated

that our Goliath Gold Project has potential economic viability at

$850 gold and, as it contemplates only 35% of the contained ounces

in the current resource, shows tremendous upside. With a targeted

drilling program, we are planning to upgrade resources from

inferred to indicated through in-fill drilling, initiate

environmental baseline studies and complete further metallurgical

testing as recommended in the PEA. In addition, we plan to continue

building ounces along strike and to target other promising areas on

the greater than 45square kilometre Property. This Project is

located in an area with excellent infrastructure including access

to power, roads, services and labour and with this PEA we now have

a clear path toward pre-feasibility and permitting."

Economic Sensitivity

The base case considers the development of surface and

underground mining operations on the Thunder Lake gold deposit and

a stand-alone gravity/flotation milling complex at the Goliath Gold

Project. Howe concludes that under base case assumptions of 1,500

tonnes per day production and US$850 per ounce gold, and assuming

100% equity financing and an even exchange rate against the US$,

the Project has potential economic viability with an after-tax

Internal Rate of Return ("IRR") of 15%, a 5% discounted Net Present

Value ("NPV") of $23 million and an estimated payback period of

four years.

The following table summarizes the results of the PEA, assuming a production

rate of 1,500 tonnes per day:

-------------------------------------------------------

NPV

Gold Price (0%)(i) NPV (5%) NPV (10%)

(US$/oz) (CDN$M) (CDN$M) (CDN$M) IRR

-------------------------------------------------------

$850 $43 $23 $10 15%

-------------------------------------------------------

$1,000 $81 $52 $33 28%

-------------------------------------------------------

$1,200 $132 $91 $63 43%

-------------------------------------------------------

$1,400 $182 $129 $93 57%

-------------------------------------------------------

(i) Equivalent to cumulative after-tax profit.

The Preliminary Assessment includes inferred mineral resources that are

considered too speculative geologically to have the economic considerations

applied to them that would enable them to be categorized as mineral reserves

and there is no certainty that the Preliminary Assessment will be realized.

The PEA is an estimate of the economic viability of the Project

and does not contemplate the full spectrum of engineering and

regulatory factors, which would be required prior to making a

production decision. All amounts are in Canadian Dollars except the

gold price, which is quoted in US Dollars.

Proposed Mining Operations

As proposed, mining will initially be by surface methods with a

target production rate of 1,500 tonnes per day using standard

methods of drilling, blasting, and excavating using excavators and

truck haulage. Equipment for surface operations would be

leased.

Proposed development for underground mining will commence in

Year 1 with production commencing in Year 3. Access will be via a

decline with the portal located near the bottom of the first small

pit to be mined - currently the easternmost pit. In Year 3, the

surface production rate would drop to 750 tonnes per day, equal to

the underground production rate, for a combined production rate of

1,500 tonnes per day. Sublevel, long-hole stoping with delayed

backfill is recommended as the primary underground mining

method.

Proposed Mineral Processing

Previous work on the Property included an underground bulk

sample that was extracted in 1998. Howe notes that the head grade

of this historic composite sample was not representative of the

head grade currently being contemplated. It's Howe's opinion that

further metallurgical test work be completed. A conceptual mill

flowsheet is proposed that would involve gravity separation,

followed by flotation. This process has been initially selected as

the recovery method over gravity/cyanidation because of lower

capital costs and similar, if not lower, operating costs.

Mineral Resource Estimate - Updated

The PEA also includes an updated Mineral Resource Estimate

("Resource Estimate") for the Thunder Lake gold deposit, based on

diamond drilling completed as at December 2009. This Resource

Estimate does not take into account the results from the more than

10,300 metres completed in 2010 and does not incorporate potential

metal credits from silver and by-product metals of lead, zinc and

copper; these metals are also not included in the current PEA.

Resources were defined using a block cut-off grade of 0.5 g/t Au

for surface resources (less than 100 metres deep) and 2.0 g/t Au

for underground resources (greater than 100 metres deep). Surface

plus underground Indicated Resources total 3.4 million tonnes with

an average grade of 2.5 g/t Au, for 270,000 ounces. Surface plus

underground Inferred Resources total 10.6 million tonnes with an

average grade of 2.7 g/t Au, for 930,000 ounces. The Main Zone

contains the majority of resources from both categories and is the

primary target for underground mining. A summary of mineral

resources by resource category is as follows:

----------------------------------------------------------------

Block Cut- Tonnes Average Au Contained

off Grade Above Cut- Grade Au

Category (g/tonne) off (g/tonne) (ounces)

----------------------------------------------------------------

Indicated

----------------------------------------------------------------

Surface 0.5 2,900,000 1.9 180,000

----------------------------------------------------------------

Underground 2.0 490,000 5.7 90,000

----------------------------------------------------------------

Subtotal,

Indicated 3,400,000 2.5 270,000

----------------------------------------------------------------

----------------------------------------------------------------

Inferred

----------------------------------------------------------------

Surface 0.5 5,400,000 1.1 190,000

----------------------------------------------------------------

Underground 2.0 5,200,000 4.4 740,000

----------------------------------------------------------------

Subtotal,

Inferred 10,600,000 2.7 930,000

----------------------------------------------------------------

Notes:

1. Cut-off grade for mineralised zone interpretation was 0.5 g/tonne.

2. Block cut-off grade for surface resources (less than 100 metres deep)

was 0.5 g/tonne gold.

3. Block cut-off grade for underground resources (more than 100 metres

deep) was 2 g/tonne gold.

4. Gold price was US$850 per troy ounce.

5. Zones extended up to 150 metres down-dip from last intercept. Along

strike, zones extended halfway to the next cross-section.

6. Minimum width was 2 metres.

7. Non-diluted resources.

8. Mineral resources that are not mineral reserves do not have demonstrated

economic viability.

9. A specific gravity (bulk density) value of 2.78 was applied to all

blocks (based on 30 samples).

10. Un-cut. Top-cut analysis of sample data suggested no top cut was needed

and removal of high grade outliers would not materially affect the

global block model grade.

The Resource Estimate, which uses a combination of historical

and current drilling results, includes 41 additional holes up to

drill hole TL09-86, drilled in late 2009 with results reported in

early 2010. The Resource Estimate was prepared by Doug Roy,

M.A.Sc., P.Eng., Associate Mining Engineer with Howe.

Qualified Person

Technical information related to the PEA contained in this news

release has been reviewed and approved by Doug Roy, an independent

Qualified Person as defined by NI 43-101, with the ability and

authority to verify the authenticity and validity of this data. The

report titled "Technical Report and Preliminary Economic Assessment

on the Goliath Gold Project", with an effective date of July 9th,

2010 has been prepared by Doug Roy, Patrick Hannon, Ed Thornton and

Ian D. Trinder of A.C.A. Howe International Limited.

About Treasury Metals

Treasury Metals Inc. is a Canadian mining company that is

focussed on expanding the Company's gold resources and developing

its 100% owned flagship Goliath Gold Project located in the Kenora

Gold District of northwestern Ontario. Treasury Metals obtains

significant royalty revenue from an NSR on Goldgroup Mining Inc.'s

Cerro Colorado Mine located in Mexico.

For additional information on Treasury Metals and its projects,

including updated technical information as it pertains to this news

release, please visit the Company's website at

www.treasurymetals.com.

Forward-looking Statements

Securities regulators encourage companies to disclose

forward-looking information to help investors understand a

company's future prospects. This press release contains statements

about our future financial condition, results of operations and

business. These are "forward-looking" because we have used what we

know and expect today to make a statement about the future.

Forward-looking statements usually include words such as may,

expect, anticipate, believe or other similar words. We believe the

expectations reflected in these forward-looking statements are

reasonable. However, actual events and results could be

substantially different because of the risks and uncertainties

associated with our business or events that happen after the date

of this press release. You should not place undue reliance on

forward-looking statements. As a general policy, we do not update

forward-looking statements except as required by securities laws

and regulations.

Contacts: Treasury Metals Inc. Scott Jobin-Bevans President and

CEO 1.416.214.4654 scott@treasurymetals.com Treasury Metals Inc.

Wanda Cutler Corporate Development Consultant 1.416.303.6460

wandajcutler@gmail.com

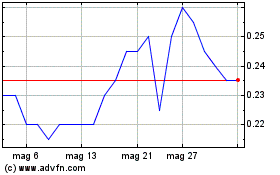

Grafico Azioni Treasury Metals (TSX:TML)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Treasury Metals (TSX:TML)

Storico

Da Lug 2023 a Lug 2024