KBC Ancora closes financial year 2019/2020 with a profit of EUR

60.8 million

Regulated information, Leuven, 28 August 2020 (17.40 hrs

CEST)

KBC Ancora closes financial year

2019/2020 with a profit of EUR 60.8 million

KBC Ancora recorded a profit of EUR 60.8

million in the financial year 2019/2020, equivalent to EUR 0.78 per

share. This compares with a profit of EUR 253.7 million in the

previous financial year. The full-year result was determined by the

income from the interim dividend received on the participating

interest in KBC Group (EUR 77.5 million), operating costs (EUR 2.2

million) and interest charges (EUR 14.5 million). The result in the

second half of the financial year was EUR -8.2 million, or EUR

-0.11 per share. As announced on 2 April 2020, the

Board of Directors of Almancora Société de gestion, statutory

director of KBC Ancora, decided not to distribute an interim

dividend in respect of the financial year 2019/2020 and not to

propose payment of a final dividend.

The Board of Directors of Almancora Société de

gestion, statutory director of KBC Ancora NV, hereby announces the

annual figures for the financial year ended 30 June 2020, subject

to the approval of the General Meeting of KBC Ancora Shareholders

to be held on 30 October 2020.

Abridged financial summaries and

notes1

Results for the financial

year

|

|

Financial year total (x EUR

1,000) |

2019/2020 per share (in EUR) |

Financial year

total (x EUR 1,000) |

2018/2019 per share (in EUR) |

|

Income |

77,561 |

0.99 |

271,353 |

3.47 |

|

Dividends from financial fixed assets |

77,516 |

0.99 |

271,307 |

3.46 |

|

Other income |

45 |

0.00 |

46 |

0.00 |

|

Expenses |

16,713 |

0.21 |

17,610 |

0.22 |

|

Cost of debt |

14,470 |

0.18 |

15,096 |

0.19 |

|

Services and sundry goods |

2,241 |

0.03 |

2,512 |

0.03 |

|

Other costs |

2 |

0.00 |

1 |

0.00 |

| Result after

taxes |

60,848 |

0.78 |

253,743 |

3.24 |

|

Number of shares in issue* |

|

78,301,314 |

|

78,301,314 |

* No instruments have been issued which could

lead to dilution.

KBC Ancora recorded a profit of EUR 60.8 million

in the financial year 2019/2020, compared with a profit of EUR

253.7 million in the previous financial year.Income (EUR 77.6

million) principally comprised the dividend received on the

participating interest in KBC Group (EUR 77.5 million). Expenses

(EUR 16.7 million) consisted mainly of the usual operating costs

(EUR 2.2 million) and interest charges (EUR 14.5 million).

Developments in the last six months of

the financial year 2019/2020

KBC Group did not distribute a final dividend in

respect of the financial year 2019. KBC Ancora decided not to

distribute an interim dividend in respect of the financial year

2019/2020, and not to propose payment of a final dividend.

In a press release dated 30 March 2020, KBC

Group announced that its Board of Directors had decided, in line

with the European Central Bank recommendation in relation to the

Covid-19 pandemic, not to propose a final dividend for the

financial year 2019. This was followed on 2 April 2020 by a press

release from KBC Ancora announcing that the Board of Directors of

Almancora Société de gestion, statutory director of KBC Ancora, had

decided not to distribute an interim dividend in respect of the

financial year 2019/2020 and not to propose a final dividend. The

press release also stated that the Board of Directors will propose

to the General Meeting of Shareholders in October 2020 to allocate

5% of the result to the legal reserve and to add the balance to the

available reserves. As a result KBC Ancora has a liquidity buffer

which can be used to meet its future financial obligations. These

decisions reflect the decision by the statutory director to adopt,

like KBC Group, a cautious stance in exceptional circumstances.

Participating interest in KBC Group, net debt

position and net asset value

KBC Ancora did not buy or sell any KBC Group

shares in the second half of the financial year, and holds

77,516,380 KBC Group shares.

The net asset value of the KBC Ancora share

corresponds to 0.99 times the price of the KBC Group share, less

the net debt2 per share. KBC Ancora’s net debt position as at 30

June 2020 stood at EUR 3.61 per share. The net debt position at the

end of the previous financial year amounted to EUR 4.39 per

share.

Based on the price of the KBC Group share on 30

June 2020 (EUR 51.06), the net asset value of one KBC Ancora share

amounted to EUR 46.94, and the KBC Ancora share (EUR 30.28) was

trading at a discount of 35.5% to its net asset value.

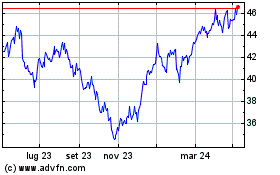

The following charts illustrate the movements in

the price of the KBC Group and KBC Ancora shares and the discount

of the KBC Ancora share to its net asset value.

|

Trend in KBC Group and KBC Ancora share price (July 2019 –

June 2020) |

Trend in discount of the KBC Ancora share to its net asset

value (July 2019 – June 2020) |

|

|

|

Result for the second half of the

financial year (FY) 2019/2020

|

|

2H FY total (x EUR 1,000) |

2019/2020 per share (in EUR) |

2H FY total (x EUR 1,000) |

2018/2019per share (in EUR) |

|

Income |

18 |

0.00 |

193,808 |

2.48 |

|

Dividends from financial fixed assets |

0 |

0.00 |

193,791 |

2.47 |

|

Other income |

18 |

0.00 |

17 |

0.00 |

|

Expenses |

8,263 |

0.11 |

8,757 |

0.11 |

|

Cost of debt |

7,235 |

0.09 |

7,519 |

0.10 |

|

Services and sundry goods |

1,027 |

0.01 |

1,237 |

0.02 |

|

Other costs |

1 |

0.00 |

1 |

0.00 |

| Result after

taxes |

-8,244 |

-0.11 |

185,051 |

2.36 |

|

Number of shares in issue |

|

78,301,314 |

|

78,301,314 |

KBC Ancora recorded a loss after tax of EUR 8.2

million in the second half of the year under review, or EUR 0.11

per share. In the same period in the previous financial year, KBC

Ancora recorded a profit of EUR 185.1 million.

As KBC Group did not distribute a final dividend

in respect of the financial year 2019, KBC Ancora received

virtually no income in the second half-year. Over the same period

in the previous financial year, KBC Ancora received dividends

amounting to EUR 193.8 million on its participating interest in KBC

Group.

Expenses in the second half-year (EUR 8.3

million) were EUR 0.5 million lower than a year earlier, and were

principally determined by the following factors:

- The usual operating expenses amounted to EUR 1.0 million, EUR

0.2 million less than in the same period in the previous financial

year. Of this total, EUR 0.8 million relates to costs incurred

within the cost-sharing agreement with Cera. Other costs consisted

among other things of listing fees and management costs.

- Cost of debt amounted to EUR 7.2 million, EUR 0.3 million less

than in the same period in the previous financial year. The

difference was due mainly to the reduction of EUR 32 million in

outstanding financial liabilities from May 2019.

Balance sheet as at 30 June

2020

| (x

EUR 1,000) |

30.06.2020 |

30.06.2019 |

30.06.2018 |

| BALANCE SHEET

TOTAL |

3,150,309 |

3,089,448 |

3,108,930 |

|

Assets |

|

|

|

| Fixed

assets |

3,088,253 |

3,088,253 |

3,088,253 |

| Financial fixed

assets |

3,088,253 |

3,088,253 |

3,088,253 |

| Current

assets |

62,057 |

1,195 |

20,678 |

|

Liabilities |

|

|

|

|

Equity |

2,805,737 |

2,744,889 |

2,732,313 |

| Contributed

capital |

2,021,871 |

2,021,871 |

2,021,871 |

| Legal

reserve |

75,175 |

72,132 |

59,445 |

| Other unavailable

reserves |

650,117 |

650,117 |

650,117 |

| Available

reserves |

57,806 |

0 |

0 |

| Profit (loss)

carried forward |

767 |

767 |

879 |

|

Creditors |

344,573 |

344,559 |

376,617 |

| Amounts falling

due after more than one year |

343,000 |

343,000 |

200,000 |

| Amounts falling

due within one year |

198 |

179 |

175,186 |

|

Accruals and deferred income |

1,374 |

1,380 |

1,431 |

Total assets stood at EUR 3.15 billion on 30

June 2020, EUR 60.8 million more than a year earlier.

The number of KBC Group shares in portfolio

remained unchanged in the year under review. At the balance sheet

date, KBC Ancora held a total of 77,516,380 KBC Group shares. The

net book value of the KBC Group shares was unchanged, at EUR 39.84

per share. The stock market price of the KBC Group share on the

balance sheet date was EUR 51.06.

Debt remained virtually unchanged from the

position as at the balance sheet date in the previous financial

year (EUR 344.6 million, including financial debt of EUR 343

million). Current assets rose by EUR 60.9 million compared with a

year earlier, to stand at EUR 62.0 million.

After addition of the result carried forward

from the previous financial year (EUR 0.8 million), the result

available for appropriation amounted to EUR 61.6 million. As

announced on 2 April 2020, the Board of Directors of Almancora

Société de gestion, statutory director of KBC Ancora, decided not

to distribute an interim dividend in respect of the financial year

2019/2020 and not to propose a final dividend. The following

appropriation of profit will accordingly be proposed to the General

Meeting of Shareholders to be held on 30 October 2020:

- addition of EUR 3.0 million (5% of

the profit for the financial year) to the legal reserve;

- addition of EUR 57.8 million to the

available reserves

- carry-forward of the balance of EUR

0.8 million, or EUR 0.01 per share, to the next financial

year.

Notes on anticipated developments in the

financial year 2020/2021

Costs within the cost-sharing agreement with

Cera are expected to amount to approximately EUR 1.8 million. Total

interest charges for the financial year 2020/2021 are estimated at

approximately EUR 14.5 million. Other operating costs are likely to

be around EUR 0.8 million.

Barring exceptional or unforeseen circumstances,

KBC Group's dividend policy is to aim for a dividend payout ratio

(including the coupon on the outstanding Additional Tier-1

instruments) of at least 50% of the consolidated profit. In normal

circumstances, an interim dividend of EUR 1.00 per share will be

distributed in November each year, followed by a final dividend

after the Annual General Meeting of Shareholders.KBC Group

announced on 30 March 2020 that, in line with the recommendation by

the European Central Bank as a result of the Covid-19 pandemic, it

was withdrawing the proposal to the General Meeting of KBC Group on

7 May 2020 to distribute a final dividend of EUR 2.50 per share in

respect of 2019, and that an evaluation would be carried out in

October 2020 of whether all or part of this withdrawn final

dividend could be distributed later this year (2020) in the form of

an interim dividend. On 6 August 2020 however, following the most

recent recommendation from the European Central Bank (July 2020),

KBC Group announced that it would be unable to implement its usual

dividend policy. This means that no interim dividend will be paid

out in November 2020.

Information on the external audit of the

annual accounting data

The auditor, KPMG Réviseurs d’entreprises,

represented by Kenneth Vermeire, has issued an unqualified opinion

on the financial statements and has confirmed that the accounting

data included in this press release contain no obvious

inconsistencies compared with the financial statements.

---------------------------------

KBC Ancora is a listed company

which holds 18.6% of the shares in KBC Group and which together

with Cera, MRBB and the Other Permanent Shareholders is responsible

for the shareholder stability and further development of the KBC

group. As core shareholders of KBC Group, these parties have signed

a shareholder agreement to this effect.

Financial calendar:29 September

2020 Annual Report 2019/2020 available and notice

of Annual General Meeting

of Shareholders30 October

2020 Annual General

Meeting of Shareholders29 January

2021 Interim

financial report (1H)27 August

2021

Annual press release for the financial year 2020/2021

This press release is available in Dutch, French

and English on the website www.kbcancora.be.KBC Ancora Investor

Relations & Press contact: Jan BergmansTel.: +32 (0)16

279672E-mail: jan.bergmans@kbcancora.be or mailbox@kbcancora.be

1

KBC Ancora's reporting is based on Belgian GAAP.

2

Net debt is defined here as total liabilities less total assets

excluding financial fixed assets.

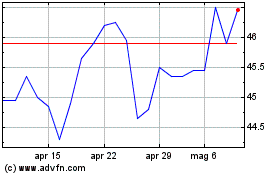

Grafico Azioni KBC Ancora (EU:KBCA)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni KBC Ancora (EU:KBCA)

Storico

Da Mag 2023 a Mag 2024