Lloyd's of London Set for $6.5 Billion Coronavirus Payout

10 Settembre 2020 - 12:54PM

Dow Jones News

By Julie Steinberg

LONDON--Lloyd's of London, the 332-year-old U.K. insurance and

reinsurance market, is set to pay out up to 5 billion pounds,

equivalent to $6.5 billion, in coronavirus-related claims this

year, it said Thursday.

Lloyd's, a marketplace of insurance syndicates, is the latest in

a long list of global insurance entities experiencing contractions

amid a surge of claims this year due to the pandemic. Many insurers

are also facing losses in their investment portfolios from wild

stock markets and falling interest rates, while their solvency

ratios, a measure of financial strength, have fallen since the

start of the crisis.

Lloyd's reported a pretax loss of GBP438 million in the first

half of the year, with Covid-19 claims totalling GBP2.36 billion

after reinsurance recoveries. It had reported a pretax profit of

GBP2.32 billion in the year-earlier period. It warned earlier this

year of tough times to come, both for itself and the industry

broadly.

Despite the losses, Lloyd's said Thursday that its balance sheet

is in a strong position and that it has the wherewithal to

withstand the continuing impacts of the pandemic.

Moody's Investors Service earlier this week changed its outlook

on the global reinsurance sector to negative from stable, saying it

expected profitability at such firms to lag amid

coronavirus-related losses and crimped interest rates.

Write to Julie Steinberg at julie.steinberg@wsj.com

(END) Dow Jones Newswires

September 10, 2020 06:39 ET (10:39 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

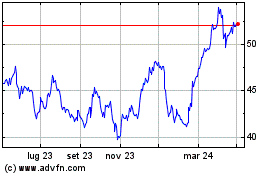

Grafico Azioni Lloyds Banking (LSE:LLOY)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Lloyds Banking (LSE:LLOY)

Storico

Da Mag 2023 a Mag 2024