SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE

13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT

TO RULE 13d-2(a)

(Amendment No. 23)

AGEX THERAPEUTICS, INC.

(Name of Issuer)

Common Stock, par value $0.0001 per share

(Title of Class of

Securities)

00848H108

(CUSIP number)

David Gill

c/o Juvenescence Limited

1st Floor, Viking House

St Pauls Square, Ramsey

Isle of Man, IM8 1GB

+441624639393

(Name, Address and

Telephone Number of Person Authorized to Receive Notices and Communications)

March 15, 2023

(Date of Event Which

Requires Filing of this Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e),

13d-1(f) or 13d-1(g), check the following box ¨.

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7(b) for

other parties to whom copies are to be sent.

The information required on the remainder of this

cover page shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 or otherwise

subject to the liabilities of that section of the Act by shall be subject to all other provisions of the Act (however, see the

Notes).

| 1. |

NAME OF REPORTING PERSON

Juvenescence Limited |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) ¨ |

| 3. |

SEC USE ONLY

|

| 4. |

SOURCE OF FUNDS

WC |

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

Isle of Man |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH |

7. |

SOLE VOTING POWER

79,425,1551 |

| 8. |

SHARED VOTING POWER

0 |

| 9. |

SOLE DISPOSITIVE POWER

79,425,1551 |

| 10. |

SHARED DISPOSITIVE POWER

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

79,425,1551 |

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

78.7% |

| 14. |

TYPE OF REPORTING PERSON

CO |

1 Comprised of (i) 16,447,500 shares of Common Stock held directly by

Juvenescence US Corp., (ii) 3,670,663 shares of Common Stock that may be acquired on exercise of Warrants issued or to be issued in connection

with advances under the New Facility, (iii) 9,600,657 shares of Common Stock that may be acquired on exercise of Warrants issued or to

be issued in connection with advances under the A&R Secured Note, (iv) 12,364,760 shares of Common Stock that may be issued upon conversion

of outstanding amounts under the New Facility at the closing price of the Common Stock on March 17, 2023, (v) 21,885,625 shares of Common

Stock that may be issued upon conversion of outstanding amounts under the A&R Secured Note at the closing price of the Common Stock

on March 17, 2023 and (vi) 15,455,950 shares of Common Stock that may be issued upon conversion of outstanding amounts under the Spring

2023 Note at the closing price of the Common Stock on March 17, 2023 (capitalized terms are defined below).

| 1. |

NAME OF REPORTING PERSON

Juvenescence US Corp. |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) ¨ |

| 3. |

SEC USE ONLY

|

| 4. |

SOURCE OF FUNDS

WC |

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH |

7. |

SOLE VOTING POWER

16,447,500 |

| 8. |

SHARED VOTING POWER

0 |

| 9. |

SOLE DISPOSITIVE POWER

16,447,500 |

| 10. |

SHARED DISPOSITIVE POWER

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

16,447,500 |

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

43.3% |

| 14. |

TYPE OF REPORTING PERSON

CO |

SCHEDULE 13D

This amendment (the “Amendment”) amends and supplements

the beneficial ownership statement on Schedule 13D filed with the Securities and Exchange Commission on August 16, 2019 (as amended

by Amendment No. 1 filed April 6, 2020, Amendment No. 2 filed July 31, 2020, Amendment No. 3 filed October 7,

2020, Amendment No. 4 filed November 11, 2020, Amendment No. 5 filed January 12, 2021, Amendment No. 6 filed

February 9, 2021, Amendment No. 7 filed February 17, 2021, Amendment No. 8 filed May 11, 2021, Amendment No. 9

filed May 11, 2021, Amendment No. 10 filed September 14, 2021, Amendment No. 11 filed November 2, 2021, Amendment

No. 12 filed November 18, 2021, Amendment No. 13 filed December 13, 2021, Amendment No. 14 filed February 14,

2022, Amendment No. 15 filed February 22, 2022, Amendment No. 16 filed April 11, 2022, Amendment No. 17 filed

June 24, 2022, Amendment No. 18 filed August 23, 2022, Amendment No. 19 filed October 25, 2022, Amendment No. 20

filed December 15, 2022, Amendment No. 21 filed January 25, 2023 and Amendment No. 22 filed February 17, 2023,

the “Original Statement”). The Original Statement, as amended by this Amendment (the “Statement”) is filed on

behalf of Juvenescence Limited, an Isle of Man company (the “Reporting Person”), and relates to the shares of Common Stock

of AgeX Therapeutics, Inc., par value $0.0001 per share (the “Common Stock”).

Capitalized terms used but not defined in this Amendment have the meanings

ascribed to them in the Original Statement. This Amendment amends the Original Statement as specifically set forth herein. Except as set

forth below, all previous Items in the Original Statement remain unchanged.

| Item 2. |

Identity and Background. |

Item 2 of the Original Statement is hereby amended and restated in

its entirety to read as follows:

(a)-(c) This Schedule 13D is being

jointly filed by (i) Juvenescence Limited (the “Juvenescence Limited”), a company incorporated in the Isle of Man, and

(ii) Juvenescence US Corp., a Delaware corporation (the “Subsidiary”), a wholly owned subsidiary of Juvenescence Limited.

Juvenescence Limited and the Subsidiary are sometimes also referred

to herein individually as a "Reporting Person" and collectively as the "Reporting Persons".

The address of the business office of each of the Reporting Persons

is c/o Juvenescence Limited, 1st Floor, Viking House, St Pauls Square, Ramsey, Isle of Man, IM8 1GB.

The principal business of each of the Reporting Persons is a biopharmaceutical

company focused on the discovery and development of therapeutics for ageing and age-related diseases.

Set forth on Schedule A, and incorporated herein by reference,

is the name, business address, present principal occupation or employment, and the name, principal business and address of any corporation

or other organization in which such employment is conducted, of each of the directors and executive officers of the Reporting Persons

as of the date hereof.

(d) Neither

the Reporting Persons nor, to either of its knowledge, any person named on Schedule A attached hereto has been convicted in a criminal

proceeding (excluding traffic violations or similar misdemeanors) during the last five years.

(e) Neither

the Reporting Persons nor, to either of its knowledge, any person named on Schedule A attached hereto, during the last five years,

was a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and, as a result of such proceeding,

was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject

to, federal or state securities laws or finding any violation with respect to such laws.

(f) The

citizenship of each person named on Schedule A attached hereto is set forth on such schedule.

| Item 5. |

Interest in Securities of the Issuer. |

Item 5 of the Original Statement is hereby amended and restated in

its entirety to read as follows:

(a) The

Reporting Persons beneficially owns an aggregate of 79,425,155 shares of Common Stock, representing (i) 16,447,500 shares of Common

Stock held directly by Juvenescence US Corp., (ii) 3,670,663 shares of Common Stock that may be acquired on exercise of Warrants

issued or to be issued in connection with advances under the New Facility (as defined below), (iii) 9,600,657 shares of Common Stock

that may be acquired on exercise of Warrants issued or to be issued in connection with advances under the A&R Secured Note (as defined

below), (iv) 12,364,760 shares of Common Stock that may be issued upon conversion of outstanding amounts under the New Facility at

the closing price of the Common Stock on March 17, 2023, (v) 21,885,625 shares of

Common Stock that may be issued upon conversion of outstanding amounts under the A&R Secured Note at the closing price of the Common

Stock on March 17, 2023 and (vi) 15,455,950 shares of Common Stock that may be issued upon

conversion of outstanding amounts under the Spring 2023 Note at the closing price of the Common Stock on March 17,

2023. This aggregate amount represents approximately 78.7% of the Issuer’s outstanding common stock, based upon 37,947,152

shares outstanding as of November 7, 2022, as reported on the Issuer’s Quarterly Report filed on Form 10-Q on November 10,

2022, and giving effect to the exercise of the Warrants and conversion of amounts outstanding under the A&R Secured Note, New Facility

and the Spring 2023 Note (and assuming the Amendment Caps do not apply).

(b) The information in Items

7 through 10 of each cover page is incorporated by reference into this Item 5(b).

(c) Except for Juvenescence

Limited’s transfer of 16,447,500 shares of the Issuer’s Common Stock to its wholly-owned subsidiary, Juvenescence US Corp

and the information set forth in Item 6, which is incorporated by reference into this Item 5(c), the Reporting Persons have effected no

transactions relating to the Common Stock during the past 60 days.

(d) - (e) Not applicable.

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

Item 6 of the Original Statement is hereby supplemented as follows:

On March 15, 2023, the Issuer and Juvenescence Limited entered

into a Secured Convertible Promissory Note (the “Spring 2023 Note”) pursuant to which Juvenescence Limited loaned to the Issuer

$10,000,000 on such date.

The outstanding principal

balance of the Spring 2023 Note will become due and payable on March 13, 2026 (the “Repayment Date”). In lieu of accrued

interest, the Issuer will pay Juvenescence Limited an origination fee in an amount equal to 7% of the loan funds disbursed to the Issuer,

which will accrue in two installments. The origination fee will become due and payable on the earliest to occur of (i) conversion

of the Spring 2023 Note into shares of the Issuer Common Stock, (ii) repayment of the Spring 2023 Note in whole or in part (provided

that the origination fee shall be prorated for the amount of any partial repayment), and (iii) the acceleration of the Repayment

Date of the Spring 2023 Note following an Event of Default as defined in the Spring 2023 Note.

If (a) the Issuer

and Serina Therapeutics Inc., an Alabama corporation (“Serina”), have not entered into a definitive merger agreement by June 13,

2023; (b) a merger between the Issuer and Serina is terminated or either party gives notice to terminate the merger agreement; or

(c) the merger is not consummated by March 13, 2024, then the Issuer may, after written notice to Juvenescence Limited, pay

and satisfy in full the principal balance and accrued origination fees under the Spring 2023 Note by tendering to Juvenescence Limited

that certain Convertible Promissory Note (the “Serina Note”) issued by Serina to the Issuer on March 15, 2023, pursuant

to the terms of a Convertible Note Purchase Agreement, dated March 15, 2023 (the “Serina Note Purchase Agreement”), between

the Issuer and Serina. and shares of capital stock of Serina, if any, that may have been issued to the Issuer upon conversion of the Serina

Note in whole or in part.

The Issuer may convert

the loan balance and any accrued but unpaid origination fee into the Issuer Common Stock or “units” if the Issuer consummates

a sale of Common Stock (or Common Stock paired with warrants or other convertible securities in “units”) in which the gross

sale proceeds are at least $10,000,000. If less than $25,000,000 is raised through the sale of Common Stock or units, the conversion price

per share or units shall be the lowest price at which shares or units are sold. If at least $25,000,000 is raised, the conversion price

per share shall be 85% of the “Market Price” of the Issuer Common Stock determined as provided in the Spring 2023 Note.

Juvenescence Limited

may convert the outstanding principal amount of the Spring 2023 Note plus the accrued origination fee into the Issuer Common Stock at

the market price per share of the Issuer Common Stock. Juvenescence Limited may not convert the Spring 2023 Note to the Issuer Common

Stock before the earlier of (i) a merger between the Issuer and Serina, and (ii) March 13, 2024. Any conversion of the

Spring 2023 Note into the Issuer Common Stock is subject to certain restrictions to comply with applicable requirements of the NYSE American

where the Issuer Common Stock is listed.

The outstanding principal

amount of the Spring 2023 Note and the accrued origination fee may become immediately due and payable prior to the Repayment Date if an

Event of Default as defined in the Spring 2023 Note occurs. Events of Default under the Spring 2023 Note include: (a) the Issuer

fails to pay any principal amount payable by it in the manner and at the time provided under and in accordance with the Spring 2023 Note;

(b) the Issuer fails to pay any other amount payable by it in the manner and at the time provided under and in accordance with the

Spring 2023 Note or the Security Agreement described below or any other agreement executed in connection with the Spring 2023 Note (the

other “Juvenescence Loan Documents”) and the failure is not remedied within three business days; (c) the Issuer fails

to perform any of its covenants or obligations or fail to satisfy any of the conditions under the Spring 2023 Note or any other Juvenescence

Loan Document and, such failure (if capable of remedy) remains unremedied to the satisfaction of Juvenescence (in its sole discretion)

for 10 business days after the earlier of (i) notice requiring its remedy has been given by Juvenescence to the Issuer and (ii) actual

knowledge of the failure by senior officers of the Issuer; (d) if any indebtedness of the Issuer in excess of $100,000 becomes due

and payable, or a breach or other circumstance arises thereunder such that Juvenescence is entitled to declare such indebtedness due and

payable, prior to its due date, or any indebtedness of the Issuer in excess of $25,000 is not paid on its due date; (e) the Issuer

stops payment of its debts generally or ceases or threatens to cease to carry on its business or is unable to pay its debts as they fall

due or is deemed by a court of competent jurisdiction to be unable to pay its debts as they fall due, or enters into any arrangements

with its creditors generally; (f) if (i) an involuntary proceeding (other than a proceeding instituted by Juvenescence Limited

or an affiliate of Juvenescence Limited) shall be commenced or an involuntary petition shall be filed seeking liquidation, reorganization

or other relief in respect of the Issuer and any subsidiary, or of all or a substantial part of its assets, under any federal, state or

foreign bankruptcy, insolvency, receivership or similar law now or hereafter in effect or (ii) an involuntary appointment of a receiver,

trustee, custodian, sequestrator, conservator or similar official for the Issuer or a subsidiary or for a substantial part of its assets

occurs (other than in a proceeding instituted by Juvenescence or an affiliate of Juvenescence), and, in any such case, such proceeding

shall continue undismissed and unstayed for sixty (60) consecutive days without having been dismissed, bonded or discharged or an order

of relief is entered in any such proceeding; (g) it becomes unlawful for the Issuer to perform all or any of its obligations under

the Spring 2023 Note or any authorization, approval, consent, license, exemption, filing, registration or other requirement of any governmental,

judicial or public body or authority necessary to enable the Issuer to comply with its obligations under the Spring 2023 Note or to carry

on its business is not obtained or, having been obtained, is modified in a manner that precludes the Issuer or its subsidiaries from conducting

their business in any material respect, or is revoked, suspended, withdrawn or withheld or fails to remain in full force and effect; (h) the

issuance or levy of any judgment, writ, warrant of attachment or execution or similar process against all or any material part of the

property or assets of the Issuer or a subsidiary if such process is not released, vacated or fully bonded within 60 calendar days after

its issue or levy; (i) any injunction, order, judgment or decision of any court is entered or issued which, in the opinion of Juvenescence

Limited, materially and adversely affects, or is reasonably likely so to affect, the ability of the Issuer or a subsidiary to carry on

its business or to pay amounts owed to Juvenescence Limited under the Spring 2023 Note; (j) the Issuer, whether in a single transaction

or a series of related transactions, sells, leases, licenses, consigns, transfers or otherwise disposes of any material portion of its

assets (with any such disposition with respect to any asset or assets with a fair value of at least $250,000 being deemed material), other

than (i) certain permitted investments, (ii) sales, transfers and dispositions of inventory in the ordinary course of business,

(iii) any termination of a lease of real or personal property that is not necessary in the ordinary course of the Issuer’s

business, could not reasonably be expected to have a material adverse effect and does not result from the Issuer’s default,

and (iv) any sale, lease, license, consignment, transfer or other disposition of assets that are no longer necessary in the ordinary

course of business or which has been approved in writing by Juvenescence Limited; (k) any of the following shall occur: (i) the

security and/or liens created by the Security Agreement or any other Juvenescence Loan Document shall at any time cease to constitute

valid and perfected security and/or liens on any material portion of the collateral intended to be covered thereby; (ii) except for

expiration in accordance with its terms, the Security Agreement or any other Juvenescence Loan Document pursuant to which a lien is granted

by the Issuer in favor of Juvenescence Limited shall for whatever reason be terminated or shall cease to be in full force and effect;

(iii) the enforceability of the Security Agreement or any other Juvenescence Loan Document pursuant to which a lien is granted by

the Issuer in favor of Juvenescence Limited shall be contested by the Issuer or a subsidiary; (iv) the Issuer shall assert that its

obligations under the Spring 2023 Note or any other Juvenescence Loan Document shall be invalid or unenforceable; or (v) a loss,

theft, damage or destruction occurs with respect to a material portion of the collateral; (l) there is any change in the financial

condition of the Issuer and its subsidiaries which, in the opinion of Juvenescence Limited, materially and adversely affects, or is reasonably

likely so to affect, the ability of the Issuer to perform any of its obligations under the Spring 2023 Note; and (m) any representation,

warranty or statement made, repeated or deemed made or repeated by the Issuer in the Spring 2023 Note, or pursuant to the Juvenescence

Loan Documents, is incomplete, untrue, incorrect or misleading in any material respect when made, repeated or deemed made.

The Spring 2023 Note

includes certain covenants that among other matters such as financial reporting: (i) impose financial restrictions on the Issuer

while the Spring 2023 Note remains unpaid, including restrictions on the incurrence of additional indebtedness by the Issuer and its subsidiaries,

except that the Issuer’s wholly-owned subsidiary Reverse Bio will be permitted to incur debt convertible into equity not guaranteed

or secured by the assets of the Issuer or any other the Issuer subsidiary, and the restrictions on the incurrence of indebtedness applicable

to Reverse Bio will end if it raises more than $15,000,000 in debt or equity by May 14, 2023; (ii) require that the Issuer use

loan proceeds and funds that may be raised through certain equity offerings only for research and development work, professional and administrative

expenses, and for general working capital; and (iii) prohibit the Issuer from making additional investments in other entities including

subsidiaries, subject to certain permitted investments in Reverse Bio and Serina, unless the Issuer obtains the written consent of Juvenescence

Limited to a transaction that otherwise would be prohibited or restricted.

The Issuer has entered

into an Amended and Restated Security Agreement (the “Security Agreement”) that amends the February 14, 2022 Security

Agreement between the Issuer and Juvenescence and adds the Spring 2023 Note to the obligations secured by the Security Agreement. The

Security Agreement grants Juvenescence Limited a security interest in substantially all of the assets of the Issuer, including a security

interest in shares of the Issuer subsidiaries that hold certain assets, as collateral for the Issuer’s loan obligations. If an Event

of Default occurs, Juvenescence Limited will have the right to foreclose on the assets pledged as collateral.

On March 14, 2023,

Juvenescence Limited transferred 16,447,500 shares of the Issuer’s Common Stock to its wholly-owned subsidiary, Juvenescence US

Corp.

On March 13, 2023,

Juvenescence Limited and the Issuer entered into a Third Amendment to the New Facility, to extend to March 30, 2024 the repayment

date for the outstanding principal balance of the loans under the New Facility.

SIGNATURES

After reasonable inquiry and to the best of their knowledge and belief,

the undersigned certify that the information set forth in this Statement is true, complete and correct.

Date: March 22, 2023

| JUVENESCENCE LIMITED |

|

| |

|

|

| By: |

/s/ Gregory

H. Bailey |

|

| Name: |

Gregory H. Bailey |

|

| Title: |

Executive Chairman |

|

Date: March 22, 2023

| JUVENESCENCE US CORP. |

|

| |

|

|

| By: |

/s/ David Gill |

|

| Name: |

David Gill |

|

| Title: |

Vice President and Treasurer |

|

Schedule A

Set forth below is the name, the principal occupation

or employment, the name and principal business address of the corporation or other organization through which such employment is conducted,

and the citizenship of each director and executive officer of the Reporting Person.

| Name and Position |

|

Principal Occupation or

Employment |

|

Principal Business Address |

|

Citizenship |

|

Gregory Bailey

Director of Juvenescence Ltd. |

|

Executive Chairman,

Juvenescence Ltd |

|

c/o Juvenescence Limited

1st Floor, Viking House

St Pauls Square, Ramsey

Isle of Man, IM8 1GB |

|

Canada |

James Mellon

Director of Juvenescence Ltd. |

|

Deputy Chairman,

Juvenescence Ltd |

|

c/o Juvenescence Limited

1st Floor, Viking House

St Pauls Square, Ramsey

Isle of Man, IM8 1GB |

|

Great Britain |

Declan Doogan

Director of Juvenescence Ltd. |

|

Director,

Juvenescence Ltd |

|

c/o Juvenescence Limited

1st Floor, Viking House

St Pauls Square, Ramsey

Isle of Man, IM8 1GB |

|

United Kingdom & United States |

Richard Marshall

Chief Executive Officer of Juvenescence Ltd. |

|

Chief Executive Officer,

Juvenescence Ltd |

|

c/o Juvenescence Limited

1st Floor, Viking House

St Pauls Square, Ramsey

Isle of Man, IM8 1GB |

|

Great Britain |

Denham Eke

Director of Juvenescence Ltd. |

|

Managing Director,

Burnbrae Group |

|

c/o Juvenescence Limited

1st Floor, Viking House

St Pauls Square, Ramsey

Isle of Man, IM8 1GB |

|

Great Britain |

|

David Gill

Chief Financial Officer of Juvenescence Ltd.

Vice President, Treasurer and Director of Juvenescence US Corp. |

|

CFO,

Juvenescence Ltd |

|

c/o Juvenescence Limited

1st Floor, Viking House

St Pauls Square, Ramsey

Isle of Man, IM8 1GB |

|

United Kingdom |

|

Earl Alexander Pickett

President and Director of Juvenescence US Corp. |

|

Managing Director,

Juvenescence Ltd |

|

c/o Juvenescence Limited

1st Floor, Viking House

St Pauls Square, Ramsey

Isle of Man, IM8 1GB |

|

United States |

|

Colin Watts

Vice President, Secretary and Director of Juvenescence US Corp. |

|

Executive Chairman,

Juvenescence Life |

|

c/o Juvenescence Limited

1st Floor, Viking House

St Pauls Square, Ramsey

Isle of Man, IM8 1GB |

|

United States |

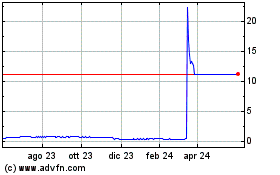

Grafico Azioni AgeX Therapeutics (AMEX:AGE)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni AgeX Therapeutics (AMEX:AGE)

Storico

Da Dic 2023 a Dic 2024