UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of

The Securities Exchange Act of 1934 (Amendment No.

)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant to §240.14a-12 |

FLANIGAN'S ENTERPRISES, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

FLANIGAN’S ENTERPRISES, INC.

5059 N.E. 18th Avenue

Fort Lauderdale, Florida 33334

NOTICE OF 2024 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD FRIDAY, FEBRUARY 23, 2024

To the Shareholders of Flanigan’s Enterprises, Inc.,

Please take notice that the 2024 Annual Meeting of

Shareholders of Flanigan’s Enterprises, Inc., a Florida corporation, (the “Company”), will be held on Friday,

February 23, 2024 at 10:00 a.m., local time, at our corporate headquarters, 5059 N.E. 18th Avenue, Fort Lauderdale, Florida

33334 to consider and act upon the following matters:

| (1) | To elect three directors of the Company to hold office until the year 2027 Annual Meeting and until their

successors are elected; and |

| (2) | To transact such other business as may properly come before the Annual Meeting or any postponement(s)

or adjournment(s) thereof. |

The foregoing items of business are more fully described

in the Proxy Statement accompanying this notice. All shareholders are invited to attend the meeting in person. Only shareholders of record

at the close of business on January 12, 2024 are entitled to notice of and to vote at the meeting or any postponement(s) or adjournment(s)

thereof. Any shareholder of the Company at the close of business on January 12, 2024, attending the meeting and entitled to vote may do

so in person, even if such shareholder returned a proxy.

Pursuant to rules promulgated by

the Securities and Exchange Commission, (the “SEC”), we have elected to provide access to our proxy materials for the Annual

Meeting of Shareholders to be held on February 23, 2024 by sending you the attached Proxy Statement, including the proxy card and our

2023 Annual Report to Shareholders, which is our most recently filed Annual Report on Form 10-K. The attached Proxy Statement, including

the proxy card and our 2023 Annual Report to Shareholders were first sent to shareholders on or about January 26, 2024. These documents

are also available at our website at www.flanigans.net under the link “Financial”. No online voting is available, however.

| |

By Order of the Board of Directors |

| |

|

| |

|

| |

Jeffrey D. Kastner |

| |

Secretary |

| |

Fort Lauderdale, Florida |

| |

January 26, 2024 |

WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL

MEETING, PLEASE COMPLETE, DATE AND RETURN THE ENCLOSED PROXY AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE, WHICH WILL ENSURE REPRESENTATION

OF YOUR SHARES. REGARDLESS OF THE NUMBER OF SHARES YOU OWN, YOUR VOTE IS IMPORTANT. NO POSTAGE NEED BE AFFIXED IF MAILED IN THE UNITED

STATES.

Important Notice Regarding the Availability

of Proxy Materials for the Annual Meeting of Shareholders to be held on February 23, 2024 – the Proxy Statement, including the Proxy

Card and our 2023 Annual Report to Shareholders are available at our website at www.flanigans.net

under the link “Financial.” No online voting is available, however.

FLANIGAN’S ENTERPRISES, INC.

5059 N.E. 18th Avenue

Fort Lauderdale, Florida 33334

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD FRIDAY, FEBRUARY 23, 2024

The Board of Directors of Flanigan’s Enterprises,

Inc., a Florida corporation (the “Company”), is furnishing this Proxy Statement to you in connection with our solicitation

of proxies to be used at our Annual Meeting of Shareholders (the “Annual Meeting”) to be held Friday, February 23,

2024, at 10:00 a.m., local time, or at any postponement(s) or adjournment(s) thereof, for the purposes set forth in this Proxy Statement

and in the accompanying Notice of Annual Meeting of Shareholders. The Annual Meeting will be held at our corporate offices at 5059 N.E.

18th Avenue, Fort Lauderdale, Florida 33334. The telephone number at that location is 954-377-1961. Unless the context indicates

otherwise, all references in this Proxy Statement to “we”, “us”, “our”, “Flanigan’s”

or the “Company” mean Flanigan’s Enterprises, Inc.

The date of this Proxy Statement is January 26, 2024

and it was first mailed on or about January 26, 2024 to shareholders entitled to vote at the Annual Meeting.

ABOUT OUR ANNUAL MEETING

What is the purpose of our Annual

Meeting?

At our Annual Meeting, shareholders will act upon

the matters outlined in the notice of meeting on the cover page of this proxy, including (i) the election of three directors for a term

of three years; and (ii) consideration of any other matters that may properly come before the meeting. In addition, our management will

report on our performance during fiscal year 2023 and respond to appropriate questions from shareholders.

What is included with these materials?

These materials include:

| · | This Proxy Statement for the Annual Meeting; and |

| · | Our 2023 Annual Report to Shareholders, which is our most recently filed

Annual Report on Form 10K for the year ended September 30, 2023, with exhibits as filed with the SEC on December 29, 2023. |

VOTING

Who can attend the meeting?

All shareholders as of the close

of business on January 12, 2024, (the “Record Date”), or their duly appointed proxies, may attend our Annual Meeting.

Even if you currently plan to attend our Annual Meeting, we recommend that you also submit your proxy as described below so that your

vote will be counted if you cannot attend our Annual Meeting.

If you hold shares in “street

name”, that is, through a broker or other nominee, you will need to bring a copy of your brokerage statement reflecting your stock

ownership as of the Record Date and check in with our Inspectors of Election at our Annual Meeting.

Who is entitled to vote at the meeting?

Only holders of our common stock

of record on the Record Date are entitled to receive notice of and to vote the common shares held by them on that date at our Annual Meeting,

or any postponement(s), adjournment(s) or continuation(s) of our meeting.

What are the voting rights of our

shareholders?

On the Record Date, there were 1,858,647

shares of our common stock outstanding, each of which is entitled to one vote with respect to each matter to be voted on at our Annual

Meeting. Therefore, if you owned 100 shares of our common stock on the Record Date, you may cast 100 votes for each matter properly presented

at the Annual Meeting.

What constitutes a quorum?

The presence at our Annual Meeting, in person or by

proxy, of the holders of a majority of the shares of our common stock outstanding as of the Record Date will constitute a “quorum”,

permitting our meeting to be held and action to be validly taken. If you submit a properly executed proxy card, even if you abstain from

voting or if you withhold your vote with respect to any proposal, you will be considered present for purposes of a quorum. If you hold

your shares in “street name” through a broker or other representative and the broker or representative indicates on the proxy

that it does not have discretionary authority as to certain shares to vote on a particular matter, (broker non-votes), the shares represented

by such broker non-votes will be counted in determining the presence of a quorum, but they will have no effect on the outcome of any proposal

on which we receive a broker non-vote.

If less than a majority of outstanding common shares

entitled to vote are represented at the meeting, a majority of the shares present at the meeting may adjourn the meeting to another date,

time or place, and notice need not be given of the new date, time or place if the new date, time or place is announced at the meeting

before an adjournment is taken.

Will my shares be voted if I do not

provide my proxy?

If your shares are held in an account

at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the “beneficial owner” of shares held

in “street name,” and a Notice was forwarded to you by that organization. A broker does not have the discretion to vote on

the election of directors. As a beneficial owner, you have the right to instruct your brokerage firm, broker, trustee or nominee how to

vote your shares. If you are a registered shareholder and hold your shares directly in your own name, your shares will not be voted unless

you provide a proxy or fill out a written ballot in person at the meeting.

How do I vote?

You can vote in any of the following ways:

(1) To vote by mail:

| · | Mark, sign and date each proxy card that you receive; and |

| · | Return it in the enclosed prepaid envelope. |

(2) To vote in person if you are a registered shareholder:

| · | Attend our Annual Meeting; |

| · | Bring valid photo identification; and |

| · | Deliver your completed proxy card or ballot in person. |

(3) To vote in person if your shares are held in “street

name”:

| · | Attend our Annual Meeting; |

| · | Bring valid photo identification; and |

| · | Obtain a legal proxy from your bank or broker

to vote the shares that are held for your benefit, attach it to your completed proxy card and deliver it in person. |

Prior to the Annual Meeting, we will select one or

more Inspectors of Election. These Inspectors will determine the number of common shares represented at the meeting, the existence of

a quorum, the validity of proxies and will count the ballots and votes and will determine and report the results to us.

What does it mean if I get more than one proxy

card?

It means you hold shares registered in more than one

account. Please vote or provide a proxy for all accounts in one of the manners described above to ensure that all your shares are voted.

Can I change my vote after I return

my proxy card?

Yes, even after you have submitted

your proxy card you may change your vote at any time before the proxy is exercised by filing with our Secretary either a notice of revocation

or a duly executed proxy bearing a later date. The powers of the proxy holders will be suspended if you attend the meeting in person and

so request, although attendance at the meeting will not by itself revoke a previously granted proxy. If your shares are held in the name

of a broker or nominee (street name), you must follow the instructions of your broker or nominee to revoke a previously given proxy.

What are the Board’s recommendations?

The enclosed proxy is solicited

on behalf of our Board of Directors. Unless you give other instructions on your proxy card, the persons named as proxy holders on the

proxy card will vote in accordance with the recommendations of our Board of Directors. Our Board of Directors recommends a vote:

“FOR” the election of James

G. Flanigan, Christopher O’Neil and John P. Foster to serve on our Board of Directors for the next three years and until their successors

are elected.

Our Board of Directors does not foresee or have any

reason to believe that the proxy holders will have to vote for substitute or alternate board nominees. In the event that any nominee is

not available for election and a substitute nominee is designated by the Board of Directors, the proxy holders will vote as recommended

by the Board of Directors or, if no recommendation is given, in accordance with their best judgment.

What vote is required to approve each

item?

A plurality of the votes cast at

the meeting is required (a majority of the votes cast at the meeting which means that the number of shares voted “for” a Director’s

election exceeds the number of votes “against” that Director’s election) for the election of directors. A properly executed

proxy marked “WITHHOLD AUTHORITY” with respect to one or more directors will not be voted with respect to the director or

directors indicated, although it will be counted for purposes of determining whether there is a quorum. Shareholders do not have the right

to cumulate their votes for directors.

Other Items: For most other items which may properly

come before the meeting, the affirmative vote of a majority of the common shares present, either in person or by proxy and voting will

be required for approval, unless otherwise required by law.

If you sign your proxy card or broker voting instruction

card with no further information, your shares will be voted in accordance with the recommendations of our Board.

So far as our management is aware, no matters other

than those described in this Proxy Statement will be acted upon at our Annual Meeting. In the event any other matters properly come before

our Annual Meeting for a vote of shareholders, the persons named as proxies on the proxy card will vote in accordance with their best

judgment on such other matters.

Who pays for the preparation of the proxy statement and the cost

of soliciting votes for our Annual Meeting?

We will pay the cost of preparing,

assembling and mailing the proxy statement, notice of meeting and enclosed proxy card. In addition to the use of mail, our employees may

solicit proxies personally and by telephone. Our employees will receive no compensation for soliciting proxies other than their regular

salaries. We may request banks, brokers and other custodians, nominees and fiduciaries to forward copies of the proxy material to their

principals and to request authority for the execution of proxies and we may reimburse those persons for their expenses incurred in connection

with these activities. We will compensate only independent third party agents that are not affiliated with us to solicit proxies. At this

time, we do not anticipate that we will be retaining a third party solicitation firm, but should we determine, in the future, that it

is in our best interests to do so, we will retain a solicitation firm and pay for all costs and expenses associated with retaining this

solicitation firm.

How and when may I submit

proposals or director nominations for inclusion in the Proxy Statement for our 2025 Annual Meeting?

If you would like to submit a proposal for the 2025

Annual Meeting of Shareholders, it must be received by our Secretary, Jeffrey D. Kastner, at our corporate headquarters located at 5059

N.E. 18th Avenue, Fort Lauderdale, Florida 33334, at any time prior to September 28, 2024, [120 calendar days before the first

anniversary of this year’s proxy materials being mailed] and must otherwise comply with Rule 14a-8 under the Exchange Act, in order

to be eligible for inclusion in the proxy statement for that meeting, unless the date of the next annual meeting changes by more than

30 days from the date of this Annual Meeting, in which case notice must be received a reasonable time before mailing.

In general, advance notice of nominations of persons

for election to the Board or the proposal of business to be considered by the shareholders must be given to our Secretary not less than

120 days prior to the first anniversary of the date of the mailing of materials regarding the prior year’s annual meeting, which

mailing date is identified above in this Proxy Statement, unless the date of the next annual meeting changes by more than 30 days from

the date of this Annual Meeting, in which case notice must be received a reasonable time before.

A shareholder’s notice of nomination should

set forth: (i) as to each person whom the shareholder proposes to nominate for election or re-election as a director all information relating

to such person that is required to be disclosed in solicitations of proxies for election of directors, or is otherwise required, in each

case pursuant to Regulation 14A under the Exchange Act, (including such person’s written consent to being named in the proxy statement

as a nominee and to serving as a director, if elected); (ii) as to any other business that the shareholder proposes to bring before the

meeting, a brief description of the business desired to be brought before the meeting, the reason for conducting such business at the

meeting and any material interest to such business of such shareholder and the beneficial owner, if any, on whose behalf the nomination

or proposal is made; and (iii) as to the shareholder giving the notice and the beneficial owner, if any, on whose behalf the nomination

or proposal is made: (A) the name and address of such shareholder, as they appear on our books, and of such beneficial owner, (B) the

number of shares of common stock that are owned, (beneficially or of record), by such shareholder and such beneficial owner, (C) a description

of all arrangements or understandings between such shareholder and such beneficial owner and any other person or persons, (including their

names), in connection with the proposal of such business by such shareholder and any material interest of such shareholder and of such

beneficial owner in such business, and (D) a representation that such shareholder or its agent or designee intends to appear in person

or by proxy at the annual meeting to bring such business before the meeting.

You should review the information contained in this

Proxy Statement separately from our 2023 Annual Report to Shareholders. Our principal corporate offices are located at 5059 N.E. 18th

Avenue, Fort Lauderdale, Florida 33334, and our telephone number is (954) 377-1961. A list of shareholders entitled to vote at the Annual

Meeting will be available at our offices for a period of ten days prior to the meeting and at the meeting itself for examination by any

shareholder.

Where can I find the voting results?

The preliminary voting results will be announced at

the Annual Meeting. The final voting results will be tallied by the Inspectors of Election and published in the Company’s Current

Report on Form 8-K, which we are required to file with the SEC within four business days following the Annual Meeting. To view this Form

8-K online, go to our website www.flanigans.net under the link “Financial.”

Can shareholders and other interested parties

communicate directly with our Board? If so how?

Yes. You may communicate directly with one or more

members of our Board of Directors by writing to the Company’s Corporate Secretary, Flanigan’s Enterprises, Inc., 5059 N.E.

18th Avenue, Fort Lauderdale, Florida 33334. The Company’s Secretary will then forward all questions or comments directly

to our Board of Directors or a specific Director, as the case may be.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND

MANAGEMENT

The following table shows certain information as of

January 12, 2024 with respect to the beneficial ownership of our common stock by:

| (i) | each person or group known by us to beneficially own more than 5% of the outstanding shares of our common

stock; |

| (ii) | each of our current directors, including the nominees for director; |

| (iii) | each of the executive officers named in the Summary Compensation Table (the “Named Executive Officers”);

and |

| (iv) | all of directors and executive officers as a group. |

Percentage of beneficial ownership is calculated on

1,858,647 shares of our common stock outstanding as of January 12, 2024. Unless otherwise indicated, the address for each beneficial owner

is c/o Flanigan’s Enterprises, Inc., 5059 N.E. 18th Avenue, Fort Lauderdale, Florida 33334. The following table is based

upon information supplied by our officers, directors, principal shareholders and schedules 13D and 13G filed with the United States Securities

and Exchange Commission, (the “SEC”). The number of shares of our common stock is determined under the rules promulgated by

the SEC and the information does not necessarily indicate beneficial ownership for any other purpose. Under the SEC rules, beneficial

ownership includes any shares as to which the individual or entity has sole or shared voting power or investment power and also includes

any shares that the individual or entity has the right to acquire through the exercise of stock options or warrants and any references

in the footnotes to this table to shares subject to stock options or warrants refers only to stock options or warrants that are so exercisable.

For purposes of computing the percentage of outstanding shares of our common stock held by each person or entity, any shares that such

person or entity has the right to acquire are deemed to be outstanding, but are not deemed to be outstanding for the purpose of computing

the percentage ownership of any other person. Unless otherwise indicated in the footnotes to this table and subject to community property

laws where applicable, we believe that the shareholders named in this table have sole voting and investment power with respect to the

shares of our common stock indicated as beneficially owned. The inclusion in the table of any shares deemed beneficially owned does not

constitute an admission of beneficial ownership of those shares.

| Name and Address of Beneficial Owner |

Amount and Nature of

Beneficial Ownership |

Percent of

Class |

| |

|

|

|

| Current Named Executive Officers and Directors: |

|

|

|

| James G. Flanigan |

969,190 |

(1) (2) (3) |

52.1% |

| Patrick J. Flanigan |

144,264 |

(2) |

7.8% |

| Michael B. Flanigan |

31,712 |

(4) |

1.7% |

| August H. Bucci |

3,600 |

|

* |

| M.E. Betsy Bennett |

1,000 |

|

* |

| Jeffrey D. Kastner |

— |

|

— |

| Christopher O’Neil |

6,000 |

|

* |

| John P. Foster |

— |

|

— |

| Christopher J. Nelms |

— |

|

— |

All executive officers and directors as a group

(9 persons) |

1,017,072 |

(1)-(4) |

54.7% |

| |

|

|

|

| More than 5% Shareholders: |

|

|

|

Flanigan Family Stock Holdings, LLC

5059 N.E. 18th Avenue, Fort Lauderdale, FL 33334 |

741,796 |

(5) |

39.9% |

Jonathan Politano

18305 Biscayne Boulevard, Suite 400, Aventura, FL 33160

|

160,804 |

|

8.6% |

Motta–Flanigan LLC

2399 N.E. 28th Street, Lighthouse Point, FL 33064 |

138,694 |

(3) |

7.5% |

| (1) | Includes: (a) 741,796 shares owned of record by Flanigan Family Stock Holdings, LLC, a Florida limited

liability company (“FFSH”), of which James G. Flanigan (“JGF”) is a member. Pursuant to the Operating Agreement

of FFSH, JFG is the sole Manager of FFSH and has sole voting and sole investment power over such 741,796 shares; (b) 12,776 shares owned

by JFG’s spouse for which he has shared voting and investment power; and (c) 400 shares owned by JGF’s children over which

he has shared voting and investment power as their custodian. The FFSH Operating Agreement provides that upon the request of one or more

members of FFSH, JFG is required to sell the shares of Common Stock indirectly owned by such members upon the approval of a majority in

interest of the members of FFSH, provided, however, such shares are required to be first offered to the other members of FFSH on a pro

rata basis, and any shares remaining unsold are to be sold on the open market, in accordance with the procedures and at the prices set

forth in the FFSH Operating Agreement. |

| (2) | Includes 138,694 shares held of record by FFSH, over which JFG has shared investment power with Patrick

J. Flanigan, a member of FFSH. The FFSH Operating Agreement provides that Patrick Flanigan has the right from time to time to cause JFG

to sell up to a maximum of 138,694 shares of Common Stock owned by FFSH in increments of up to 6,934 shares by first offering such shares

to all other members of FFSH on a pro rata basis, and any shares remaining unsold are to be sold on the open market, in accordance with

the procedures and at the prices set forth in the FFSH Operating Agreement. |

| (3) | Includes 138,694 shares owned of record by Motta-Flanigan LLC, a Florida limited liability company (“MFC”).

Pursuant to the Operating Agreement of MFC, JGF, as the sole Manager of MFC, has sole voting power over such 138,694 shares, and shared

investment power over such shares with Patricia Ann Motta and James D. Motta, the trustees of a Motta family trust which is the sole member

of MFC except in the event all shares of the Company owned directly or indirectly by the Flanigan family (including any shares held of

record by FFSH) are being disposed of in one transaction, in which event JFG has sole investment power over such shares. |

| (4) | Includes (a) 1,000 shares owned by Michael B. Flanigan’s spouse over which he has shared voting

and investment power; and (b) 650 shares owned by his children for which Michael B. Flanigan has shared voting and investment power as

their custodian. |

| (5) | See footnotes 1 and 2. Represents shares owned of record by FFSH of which James G. Flanigan is a member

and its sole manager. The members of FFSH consist of James G. Flanigan, Michael B. Flanigan, Patrick F. Flanigan, Margaret F. Fraser and

family trusts of which several of the foregoing members are trustees. |

DELINQUENT SECTION 16(a) REPORTS

Under SEC rules, our directors, executive officers

and holders of more than 10% of our stock, if any, are required to file reports of ownership and changes in ownership of the Company securities

with the SEC, and also are required by SEC rules to furnish the Company with copies of all Section 16(a) forms they file. We have reviewed

copies of these SEC reports as well as other records and information. Based on such review, we believe that all reports were timely filed

during our fiscal year 2023.

PROPOSAL I - ELECTION OF DIRECTORS

Our By-Laws provide for a Board of Directors, which

consists of three classes of directors of three directors each. Three directors are to be elected to replace those of the class whose

terms expire this year. The three director nominees are James G. Flanigan, Christopher O’Neil and John P. Foster, each of whom are

nominated to be elected at the Annual Meeting to serve for a three-year term expiring in 2027 and until their respective successors are

elected and qualified. All of the nominees named herein are presently serving as members of our Board of Directors. We have no reason

to believe that any of the nominees, if elected, will be unable or unwilling to serve. If for any reason any nominee named is unable to

serve, the shares represented by all valid proxies will be voted for the election of a substitute nominee recommended by the Board of

Directors or the Board of Directors may reduce the size of the Board.

Nominees receiving the highest number of affirmative

votes cast, up to the number of directors to be elected, will be elected as directors. Unless you specify otherwise, the proxy holders

will vote the proxies for the above three nominees.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A

VOTE FOR THE ELECTION OF EACH OF THE NOMINEES. PROXY CARDS PROPERLY EXECUTED AND RETURNED WILL BE SO VOTED UNLESS CONTRARY INSTRUCTIONS

ARE INDICATED ON THE PROXY CARD.

Directors and Nominees

The following table sets forth information regarding

each of our directors, including the director nominees, and our executive officers. All of the nominees for director are currently serving

as directors of the Company and have consented to serve if elected by our shareholders. The following table is as of January 12, 2024.

| Name |

Director

Since |

Age as of

the Annual

Meeting |

Positions and Offices with the Company |

| James G. Flanigan |

1991 |

59 |

Chief Executive Officer, President, Director |

| Jeffrey D. Kastner |

1985 |

70 |

Chief Financial Officer, General Counsel, Secretary, Director |

| August H. Bucci |

2005 |

79 |

Chief Operating Officer, Executive Vice President, Director |

| Patrick J. Flanigan |

1991 |

63 |

Director |

| Michael B Flanigan |

2005 |

61 |

Director |

| M.E. Betsy Bennett |

2013 |

62 |

Director |

| Christopher O’Neil |

2006 |

58 |

Vice President of Package Operations, Director |

| Christopher J. Nelms |

2014 |

55 |

Director |

| John P. Foster |

2018 |

73 |

Director |

JAMES G. FLANIGAN joined our Board of Directors in

1991. Mr. Flanigan has been a Vice President and shareholder of Twenty Seven Birds Corporation, a franchisee of the Company since 1985.

Mr. Flanigan was elected President of the Company in 2002 and Chairman of the Board of Directors and Chief Executive Officer in 2005.

Mr. Flanigan is the son of our former Chairman of the Board of Directors and former Chief Executive Officer, Joseph G. Flanigan, and is

the brother of Directors, Patrick J. Flanigan and Michael B. Flanigan. We believe Mr. Flanigan’s experience as a franchisee combined

with his tenure with the Company qualifies him to serve on our Board of Directors.

JEFFREY D. KASTNER joined our Board of Directors in

1985. Mr. Kastner was employed by the Company as a corporate attorney from 1979-1982 and has been general counsel since 1982. Mr. Kastner

was Assistant Secretary of the Company from 1995-2004 and has been Secretary since 2004. In 2004, Mr. Kastner was elected Chief Financial

Officer of the Company. From 1983 through 2004, Mr. Kastner was the President of Jeffrey D. Kastner, P.A., a law firm engaged in the private

practice of law. Mr. Kastner received a Juris Doctor in Law in 1978 from the University of Florida, Gainesville, Florida. We believe Mr.

Kastner’s accounting, tax and legal training strengthens the Board’s collective knowledge, capabilities and experience and

qualifies him to serve on our Board of Directors.

AUGUST H. BUCCI joined our Board of Directors in 2005.

Mr. Bucci was employed by the Company as its Entertainment Director from 1978–1980; re-hired as Director of Advertising in 1984;

Supervisor of the Company’s out of state bars and nightclubs in 1985; Supervisor of Restaurants, Nightclubs and Bars in 1988; Director

of Operations – Restaurant Division in 1990; Vice President of Restaurant Operations in 2002; and Chief Operating Officer and Executive

Vice President in 2003. We believe Mr. Bucci’s varied experience as an employee of the Company qualifies him to serve on our Board

of Directors.

PATRICK J. FLANIGAN joined our Board of Directors

in 1991. Mr. Flanigan has been the President and sole shareholder of B. D. 43 Corp., a franchisee of the Company since 1985. Mr. Flanigan

has also been the President and sole shareholder of B.D. 15 Corp., the general partner of another franchisee since 1997. Mr. Flanigan

is the son of our former Chairman of the Board of Directors and former Chief Executive Officer, Joseph G. Flanigan, and is the brother

of Directors, James G. Flanigan and Michael B. Flanigan. We believe Mr. Flanigan’s experience as a franchisee combined with his

tenure with the Company qualifies him to serve on our Board of Directors.

MICHAEL B. FLANIGAN joined our Board of Directors

in 2005. Mr. Flanigan has been the President and shareholder of Twenty Seven Birds Corporation, a franchisee of the Company since 1985.

Mr. Flanigan is the son of our former Chairman of the Board of Directors and former Chief Executive Officer, Joseph G. Flanigan, and is

the brother of Directors James G. Flanigan and Patrick J. Flanigan. We believe Mr. Flanigan’s experience as a franchisee combined

with his tenure with the Company qualifies him to serve on our Board of Directors.

M. E. BETSY BENNETT joined our Board of Directors

in 2013. From 2002 through 2012, Mrs. Bennett was a principal of Bennett Consulting Services, Inc., an independent corporate financial

consulting firm she founded in 2002. From 2012 until 2015, Mrs. Bennett was the Chief Financial Officer of IC Intracom, an Oldsmar, Florida

based company engaged in the development and manufacture of PC peripherals, accessories and networking products under the Manhattan™

and Intellinet Network Solutions™ brands. From 2015 until 2018, Mrs. Bennett was the Chief Financial Officer of Mission Health Communities,

a private equity backed operator and/or manager of fifty long-term care facilities in five states. As of August 2018, Mrs. Bennett is

again a principal of Bennett Consulting Services, Inc., her independent corporate financial consulting firm. Mrs. Bennett received a Master's

Degree in accounting from the University of South Florida, Tampa, Florida and has been a certified public accountant in the State of Florida

since 1983. We believe Mrs. Bennett possesses particular knowledge and experience in a variety of areas, including accounting, finance

and tax which contributes to the Board’s composition and qualifies her to serve on our Board of Directors.

CHRISTOPHER O’NEIL joined our Board of Directors

in 2006. Employed in various capacities by the Company since 1998, as of 2003, Mr. O’Neil has been employed by the Company as a

Supervisor where his responsibilities include restaurant supervision and maintenance supervision. In 2013, Mr. O’Neil was elected

Vice President of the Company and in 2016 he was elected Vice President of Package Operations. We believe Mr. O’Neil’s varied

experience as an employee of the Company qualifies him to serve on our Board of Directors.

CHRISTOPHER J. NELMS joined our Board of Directors

in 2014. Mr. Nelms is a retired businessman who was the founder, sole owner and control person of Magazine Services of America, Inc.,

a magazine telemarketing company from 2000 through 2006. From 2011 through 2013, Mr. Nelms was the founder, majority owner and control

person of Brownbean Dynamics, LLC, another magazine telemarketing company. We believe Mr. Nelms’ business knowledge, capabilities

and experience enable him to provide us with valuable guidance and effective leadership in the oversight of our business operations and

qualifies him to serve on our Board of Directors.

JOHN P. FOSTER joined our Board of Directors in 2018.

Since 2006, Mr. Foster has been managing member of PathFinder Group (PFG), a Tampa based advisory firm serving family business and governmental

agencies. PFG focuses on enterprise risk management through strategic planning process improvement and the development of high performance

cultures. From 1996 through 2005, Mr. Foster was the Chief Executive Officer and Chairman of the Board of Directors of Alliance Computing

Technologies (ACT), a company which distributed computers internationally to the right to own industry. Mr. Foster received a Master’s

Degree in business administration from the University of Tampa. We believe Mr. Foster possesses particular knowledge and experience in

a variety of areas, including strategic planning and process improvement which contributes to the Board composition and qualifies him

to serve on our Board of Directors.

BOARD OF DIRECTORS STRUCTURE AND

COMPENSATION

Board of Director Structure and Committees

Our business, property and affairs are managed under

the direction of our Board of Directors, except with respect to those matters reserved for our shareholders. Our Board of Directors establishes

our overall corporate policies, reviews the performance of management in executing our business strategy and managing our day-to-day operations

and acts as an advisor to management. Our Board’s mission is to further the long-term interest of our shareholders. Members of the

Board of Directors are kept informed of our business through discussions with management, primarily at meetings of the Board of Directors

and its committees and through reports and analyses presented to them. Significant communications between our directors and management

may occur apart from these meetings.

James G. Flanigan serves as our Chairman of our Board

of Directors as well as our Chief Executive Officer and President. The Board has determined that selecting our Chief Executive Officer

and President as Chairman of the Board of Directors is in the best interests of the Company and its shareholders because this leadership

structure promotes a unified vision for the Company, strengthens the ability of the Chief Executive Officer to develop and implement strategic

initiatives and facilitates our Board’s efficient functioning. The Board of Directors also believes the combination of Chairman

of the Board of Directors, Chief Executive Officer and President is appropriate in light of the independent oversight provided by the

Board and the Independent Committee. Although we have established an Independent Committee of the Board of Directors, consisting of all

of our independent directors, we have not designated any director as a “Lead Independent Director” because we believe the

independent directors on our Board have full access to and direct communication with management. The Board of Directors held a total of

four meetings during our 2023 fiscal year, which ended on September 30, 2023. Every director attended at least 75% of the total number

of meetings of the Board of Directors and at least 75% of all meetings of the committees of the Board of Directors on which the director

served. The Board of Directors has determined that we are a “controlled” company as defined by the NYSE AMERICAN and SEC rules

since more than 50% of our issued and outstanding common stock is owned by limited liability companies controlled by our Chairman of the

Board of Directors, common stock owned by our Chairman of the Board of Directors, his immediate family and other directors and officers.

As a “controlled’ company, the majority of the Board of Directors need not be independent and the Board of Directors has determined

that only M. E. Betsy Bennett, Christopher J. Nelms and John P. Foster are independent as defined by the NYSE AMERICAN and SEC rules.

The Board of Directors has overall responsibility

for the oversight of risk management of the Company. Day to day risk management is the responsibility of management. In addition, certain

of the risk oversight responsibility is administered through the three committees of the Board of Directors described below and the committees’

reports to the Board of Directors.

Audit Committee

The Audit Committee of the Board of Directors currently

consists of three independent directors, M.E. Betsy Bennett, Christopher J. Nelms and John P. Foster. This committee operates under a

written charter adopted by the Board of Directors, a copy of which is available on our website at www.flanigans.net under the link “Corporate

Governance” which committee annually reviews and assesses for adequacy. All of the committee members are independent as required

by applicable NYSE AMERICAN and SEC rules. The Board of Directors has determined that M.E. Betsy Bennett satisfies the definition of “audit

committee financial expert” as promulgated by the SEC by virtue of her educational and work experience as described above.

Report of Audit Committee

The following is the report of the Audit Committee

with respect to the Company’s audited financial statements for the year ended September 30, 2023. The information contained in this

report shall not be deemed “soliciting material” or otherwise considered “filed” with the SEC, and such information

shall not be incorporated by reference into any future filing under the Securities Act or the Exchange Act except to the extent that the

Company specifically incorporates such information by reference in such filing.

The Audit Committee held eight meetings during fiscal

year 2023. The Audit Committee meets separately with our Chief Financial Officer and our independent public accountants, Marcum, LLP,

at selected meetings. The Audit Committee oversees the financial accounting and reporting processes, system of internal control, audit

process and process for monitoring compliance with laws and regulations. The Audit Committee is responsible for, among other things, the

appointment of the independent auditors and the preparation of the report to be included in our annual proxy statement pursuant to rules

of the SEC.

Our management has primary responsibility

for the preparation, presentation and integrity of our financial statements and for the appropriateness of the accounting principles and

reporting policies that are used. Management is also responsible for testing the system of internal controls and reports to the Audit

Committee on any deficiencies found. Our independent auditors were responsible for auditing the financial statements and for reviewing

the unaudited interim financial statements and for expressing an opinion about whether our financial statements are fairly presented in

all material respects in conformity with accounting principles generally accepted in the United States. The Audit Committee’s responsibility

is to monitor and oversee these procedures.

The Audit Committee hereby reports as follows:

| 1. | The Audit Committee has reviewed and discussed the audited financial statements

with management and with the independent auditors, with and without management present. |

| 2. | The Audit Committee discussed with the independent auditors those matters required

to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (PCAOB). |

| 3. | The Audit Committee has received the written disclosures and the letter from our

independent auditors required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent auditors’

communications with the Audit Committee concerning independence and has discussed with the independent auditors the independent auditors’

independence. |

Based upon the review and discussion referred to in

paragraphs (1) through (3) above, the Audit Committee recommended to our Board of Directors and the Board approved, that the audited financial

statements be included in our Annual Report on Form 10-K for the fiscal year ended September 30, 2023 for filing with the SEC.

Members of the Audit Committee

M.E. Betsy Bennett, Chairperson Christopher

J. Nelms John P. Foster

Independent Committee

The members of the Independent Committee are all of

the independent directors, M.E. Betsy Bennett, Christopher J. Nelms and John P. Foster. The primary function of the Independent Committee

is to assist the Board of Directors on matters that may come before it requiring independent investigation and/or guidance. During our

fiscal year 2022, no matters were referred to the Independent Committee by the Board of Directors. This committee met once during our

fiscal year 2023.

Corporate Governance and Nominating Committee

The members of the Corporate Governance

and Nominating Committee are James G. Flanigan, M.E. Betsy Bennett and Christopher J. Nelms. This committee is responsible for nominating

individuals to serve as members of our Board of Directors and for establishing policies affecting corporate governance. Committee members,

M.E. Betsy Bennett and Christopher J. Nelms are considered independent as defined under applicable NYSE AMERICAN and SEC rules. The committee

will consider properly recommended shareholder nominations for directors. This committee operates under a written charter adopted by the

Board of Directors, a copy of which is available on our website at www.flanigans.net under the link “Corporate Governance.”

The committee’s policy is to identify and consider candidates for election as directors, including candidates recommended by our

shareholders. A shareholder may nominate a person for election as a director at an annual meeting of the shareholders only if written

notice of such shareholder’s intent to make such nomination has been given to the Company’s Corporate Secretary as described

in the applicable proxy statement for the previous year’s annual meeting of shareholders. Each written notice must set forth: (a) as

to each person whom the shareholder proposes to nominate for election as a director, (i) all information relating to such person

that is required to be disclosed in solicitations of proxies for election of directors in an election contest, or that is otherwise required,

in each case pursuant to and in accordance with Regulation 14A under the Securities Exchange Act of 1934, as amended, and (ii) such

person’s written consent to being named in the proxy statement as a nominee and to serve as a director if elected; and (b) as

to the shareholder making such nomination, (i) the name and address of such shareholder, as they appear on the Company’s books,

(ii) the class and number of shares of stock of the Company which are owned by such shareholder, (iii) a representation that

the shareholder is a holder of record of stock of the Company entitled to vote at such meeting and intends to appear in person or by proxy

at the meeting to propose such nomination, and (iv) a representation whether the shareholder intends or is a part of a group which

intends (y) to deliver a proxy statement and/or form of proxy to holders of at least the percentage of the Company’s outstanding

capital stock required to elect the nominee and/or (z) otherwise to solicit proxies from shareholders in support of such nomination.

The Committee will evaluate the suitability of potential candidates nominated by shareholders in the same manner as other candidates identified

to the Committee. For a further description of the process for nominating directors, see “About the Proxy Materials and the Annual

Meeting – How and when may I submit proposals or director nominations for inclusion in the Proxy Statement for the 2025 Annual Meeting?”

This committee met once during our fiscal year 2023.

Consideration

of Director Nominees

The Corporate Governance and Nominating Committee

utilizes a variety of methods for identifying and evaluating nominees for director. The committee regularly assesses the appropriate size

of the Board and whether any vacancies of the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated,

or otherwise arise, the Corporate Governance and Nominating Committee will consider various potential candidates for director. Candidates

may come to the attention of the committee through current Board members, shareholders or other persons. The committee has not paid fees

to any third party to identify, evaluate or to assist in identifying or evaluating, potential nominees, but may determine it necessary

in the future. These candidates will be evaluated at meetings of the Corporate Governance and Nominating Committee. Nominees recommended

by persons other than the current Board members or executive officers will be subject to the process described in “About the

Proxy Materials and the Annual Meeting – How and when may I submit proposals or director nominations for inclusion in the Proxy

Statement for the 2025 Annual Meeting?”

In evaluating nominations for candidates for membership

on our Board of Directors, the Corporate Governance and Nominating Committee will seek to achieve a balance of knowledge, experience and

capability on the Board and to address the following membership criteria. Members of the Board should have the highest professional and

personal ethics and values. They should have broad experience at the policy-making level in business, government, education, technology

or public interest. They should be committed to enhancing shareholder value and should have sufficient time to carry out their duties

and to provide insight and practical wisdom based on experience. Their service on other boards of public companies should be limited to

a number that permits them, given their individual circumstances, to perform responsibly all of their directors’ duties. We believe

that the backgrounds and qualifications of our directors, considered as a group, should provide a composite mix of experience, knowledge

and abilities that will best allow our Board to fulfill its responsibilities. Although we may do so in the future, to date, we have not

considered diversity in identifying nominees for director. All nominees for director included on the Company’s proxy card are currently

serving as Directors of the Company.

Shareholder Communications and Director Attendance

at Annual Shareholder Meetings

Our Board welcomes communications from shareholders

and has adopted a procedure for receiving and addressing such communications. Shareholders may send written communications to the entire

Board or individual directors, addressing them to Flanigan’s Enterprises, Inc., 5059 N.E. 18th Avenue, Fort Lauderdale,

Florida 33334, Attention: Corporate Secretary. All such communications will be forwarded to the full Board of Directors or to any individual

director or directors to whom the communication is directed unless the communication is clearly junk mail or a mass mailing, a business

solicitation, advertisement or job inquiry, or is unduly hostile, threatening, illegal or similarly inappropriate, in which case the Company

has the authority to discard the communication or take appropriate legal action regarding the communication.

Recognizing that director attendance at the Company’s

annual meeting of shareholders can provide shareholders with an opportunity to communicate with members of the Board of Directors, it

is the policy of the Board of Directors to strongly encourage, but not require, the members of the Board to attend such meetings. All

of our directors attended the 2023 Annual Meeting of Shareholders.

Our policies regarding shareholder

communications and director attendance, (which may be modified from time to time), can be found on our website at www.flanigans.net under

the link “Corporate Governance.”

Director Compensation

Members of our Board of Directors who are employed

by the Company presently receive no additional remuneration for acting as directors. We compensate our non-employee directors at the rate

of $25,000 per year and the Chairperson of our Audit Committee an additional $10,000 per year, plus $1,000 for each Board of Directors

meeting and committee meeting attended. In addition, we also reimburse Directors for reasonable out-of-pocket expenses incurred in connection

with their attendance at Board of Director meetings. Four regularly scheduled Board of Director meetings are typically held during the

fiscal year.

The following table sets forth the compensation paid

by us during our fiscal year 2023 to our non-employee directors:

Director Compensation Table

| Name |

Fees

Earned

or Paid in

Cash ($) |

Stock

Awards |

Option

Awards |

Non-Equity

Incentive Plan

Compensation |

Non-qualified

Deferred

Compensation

Earnings |

All Other

Compensation |

Total

($) |

| Christopher J. Nelms |

34,000 |

0 |

0 |

0 |

0 |

0 |

34,000 |

| Patrick J. Flanigan |

29,000 |

0 |

0 |

0 |

0 |

0 |

29,000 |

| Michael B. Flanigan |

29,000 |

0 |

0 |

0 |

0 |

0 |

29,000 |

| M.E. Betsy Bennett |

42,500 |

0 |

0 |

0 |

0 |

0 |

42,500 |

| John P. Foster |

33,000 |

0 |

0 |

0 |

0 |

0 |

33,000 |

EXECUTIVE COMPENSATION

We do not have a compensation

committee. Our Board of Directors is responsible for establishing and administering our policies governing the compensation of our executive

officers, who are appointed by our Board of Directors. Because more than 50% of our issued and outstanding common stock is owned by limited

liability companies controlled by our Chairman of the Board of Directors, outstanding common stock owned by our Chairman of the Board

of Directors and his immediate family and other officers and directors of the Company, we are a “controlled” company as defined

by the NYSE AMERICAN and SEC rules and thus we are not required to have either (i) a compensation committee comprised of independent directors,

or (ii) a majority of our independent members of our Board determine or recommend to our Board, the compensation levels of our executive

officers.

The primary objective of our

executive compensation program is to attract, motivate and retain the executive talent needed to facilitate our business strategies and

long-range plans and to optimize shareholder value in a competitive environment.

Our Board of Directors employs the following principles

to provide an overall framework for the compensation of our executive officers:

| · | reward outstanding performance; |

| · | motivate executive officers to perform to the fullest of their abilities;

|

| · | tie a significant portion of executives’ total compensation to our

annual and long-term financial performance and the creation of incremental shareholder value; |

| · | offer compensation opportunities that attract and motivate the best talent;

and |

| · | retain those with leadership abilities and skills necessary for building

long-term shareholder value. |

Compensation Categories

Our Board of Directors considers

all elements of compensation when determining total compensation and the individual components of total compensation. Our Board of Directors

allocates total compensation between currently paid and long-term compensation, cash and non-cash compensation. Our Board of Directors

believes that each of these compensation categories provides incentives and rewards that address different elements of the compensation

program’s objective and when considered together serve to achieve our overall compensation objectives. The Board of Directors’

decisions regarding compensation policies and decisions were not affected by the results of the say on pay vote at our 2022 Annual Shareholders

Meeting. Our Board of Directors examines each of these factors in determining the basis for allocating compensation to each different

form of award, such as the relationship of the award to the achievement of our long-term goals, management’s exposure to downside

equity performance risk and the analysis of cost to the Company versus expected benefit to the executive. As part of this analysis, our

Board of Directors believes that a meaningful portion of each executive’s compensation should be placed at-risk and linked to the

accomplishment of specific results that are expected to lead to the creation of value for our shareholders from both the short-term and

long-term perspectives.

Our Board of Directors believes

that currently paid cash compensation provides our executives with short-term rewards for success in achieving individual and Company

performance goals. Currently paid cash consideration includes base salary and annual cash incentive bonuses. Our Board of Directors believes

that providing executives with competitive currently paid cash consideration is the central element of attracting, retaining and motivating

high quality executives.

Our Board of Directors believes

that currently paid non-cash compensation provides our executives with the same benefits as currently paid cash compensation. Items of

currently paid non-cash compensation for certain executive officers include a Company provided vehicle or car allowance, Company sponsored

health insurance and other non-cash benefits.

Compensation Elements

Our executive compensation program consists primarily

of the following elements:

Base Salary

Base salary is used to recognize the experience, skills,

knowledge and responsibilities required of our executive officers in their roles. When establishing the 2023 base salaries of our executive

officers other than the Chief Executive Officer, the Board of Directors considered a number of factors, including the seniority of the

individual, the functional role of the position, the level of the individual’s responsibility, the historical base salary of the

individual and recommendations from the Chief Executive Officer. The Board of Directors considered these same factors in establishing

the base salary of the Chief Executive Officer, as well as additional factors such as the Chief Executive Officer’s industry experience

and profile. In addition, the Board of Directors considered competitive market practices with respect to these salaries, although it did

not set base salaries according to specific benchmarking standards.

The salaries of our executive

officers are reviewed on an annual basis, as well as at the time of promotion or other changes in responsibilities and modified for merit,

the general performance of the Company, the executive’s success in meeting or exceeding individual performance objectives and if

significant corporate goals were achieved. If necessary, the Board of Directors also realigns base salaries with market levels for the

same positions in companies of similar size to the Company represented in the compensation data it reviews.

Annual Incentive Bonuses

Our variable compensation program

includes eligibility for annual performance-based and discretionary cash bonuses for senior management, including our executive officers.

In all cases, the amount of the cash bonus is impacted by our results of operations. The awards of variable compensation to the Chief

Executive Officer and our executive officers are reflected in the Summary Compensation Table below.

Employee Benefit Plans

We provide group life and health

insurance plans for our hourly and salary employees. We also maintain a 401(k) retirement plan for our hourly and salary employees. Pursuant

to the plan, participants may elect to make pre-tax contributions to the plan, subject to certain limitations imposed under the plan and

the Internal Revenue Code of 1986, as amended. In addition, we may make periodic discretionary contributions to the plan.

Other Benefits and Perquisites

We provide the opportunity for

our executive officers to receive certain perquisites and general health and welfare benefits. We offer these benefits to provide an additional

incentive for our executives, to remain competitive in the general marketplace for executive talent and to enable our executives to better

focus on their performance. We have or may provide the following personal benefits and perquisites to our executive officers:

| · | eligibility to participate in our health, dental,

vision, disability insurance and life insurance programs; |

| · | a Company provided vehicle or car allowance,

along with the reimbursement of expenses related to operating, maintaining and insuring the vehicle; and |

| · | eligibility to participate in our 401(k) retirement

plan, subject to certain limitations imposed under the plan and the Internal Revenue Code of 1986. |

Stock Ownership Guidelines

We have not implemented stock ownership guidelines

for our executive officers. We will continue to periodically review best practices and re-evaluate our position with respect to stock

ownership guidelines.

The following table sets forth information regarding

the compensation paid or distributed for services rendered by our principal executive, our principal financial officer and our other executive

officers whose total compensation exceeded $100,000 (collectively the “Named Executive Officers”) for services rendered in

all capacities to us during the years indicated. For purposes of this table, compensation paid or distributed in one fiscal year may include

payment of bonuses accrued in a prior fiscal year.

Summary Compensation Table

| | |

| |

| | |

| | |

| | |

| | |

| | |

Non-Qualified | | |

| | |

| |

| | |

| |

| | |

| | |

| | |

| | |

Non-Equity | | |

Deferred | | |

All Other | | |

| |

| | |

| |

| | |

| | |

Stock | | |

Option | | |

Incentive Plan | | |

Compensation | | |

Compensation | | |

Total | |

| Name and Principal Position | |

Year | |

Salary | | |

Bonus(3) | | |

Awards | | |

Awards | | |

Compensation | | |

Earnings | | |

(2) | | |

(1)(4) | |

| James G. Flanigan | |

2023 | |

$ | 145,000 | | |

$ | 1,425,000 | | |

$ | | | |

$ | | | |

$ | | | |

$ | | | |

$ | 65,000 | | |

$ | 1,635,000 | |

| Chairman of the Board and | |

2022 | |

| 145,000 | | |

| 1,598,000 | | |

| | | |

| | | |

| | | |

| | | |

| 65,000 | | |

| 1,808,000 | |

| Chief Executive Officer | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Jeffrey D. Kastner | |

2023 | |

| 140,000 | | |

| 839,000 | | |

$ | | | |

$ | | | |

$ | | | |

$ | | | |

$ | | | |

$ | 979,000 | |

| Chief Financial Officer, | |

2022 | |

| 140,000 | | |

| 1,239,000 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 1,379,000 | |

| General Counsel and Secretary | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| August Bucci | |

2023 | |

| 140,000 | | |

| 839,000 | | |

$ | | | |

$ | | | |

$ | | | |

$ | | | |

$ | | | |

$ | 979,000 | |

| Chief Operating Officer and | |

2022 | |

| 140,000 | | |

| 1,239,000 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 1,379,000 | |

| Executive Vice President | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Christopher O’Neil | |

2023 | |

| 329,000 | | |

| | | |

$ | | | |

$ | | | |

| | | |

$ | | | |

$ | | | |

$ | 329,000 | |

| Vice President of Package | |

2022 | |

| 306,000 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 306,000 | |

| Operations | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| (1) | This table does not include incidental personal benefits of a limited nature. Although the amount of such

benefits and extent to which they are related to job performance cannot be ascertained specifically, we have concluded that the aggregate

per Named Executive Officer does not exceed $10,000. |

| (2) | Represents the amount of the premium paid by the Company for life insurance on Mr. Flanigan’s life,

($65,000 – 2023 and $65,000 – 2022), the beneficiary of which has been designated by Mr. Flanigan. |

| (3) | Includes annual performance based bonus amounts during our fiscal year 2022 equal to 14.75% (for James

G. Flanigan) and 2.625% (for each of Jeffrey D. Kastner and August Bucci) of our annual income, before income taxes, depreciation and

amortization, which exceeds $650,000, excluding extraordinary items. These amounts are typically paid within 45 days after the end of

our fiscal year and for our fiscal years ended 2023 and 2022, amounted to $1,425,000 and $1,598,000 paid to Mr. Flanigan; and $294,000

and $569,000 paid to each of Messrs. Kastner and Bucci. |

Also includes annual performance based

bonus amounts payable to each of Messrs. Kastner and Bucci equal to 5% of our pre-tax net income before depreciation and amortization

from our Company owned restaurants and our share of the pre-tax net income before depreciation and amortization from the restaurants owned

by the limited partnerships where we are the general partner and our share of the pre-tax income before depreciation and amortization

from the restaurant owned by an unaffiliated third party that we manage. The majority of these amounts are typically paid within 45 days

after the end of the fiscal year, with the balance typically paid within 120 days of the end of our fiscal year and for our fiscal years

ended 2023 and 2022 amounted to $545,000 and $670,000 paid to each of Messrs. Kastner and Bucci.

| (4) | Does not include any limited partnership distributions made by any of the affiliated limited partnerships

or any franchise or management fees paid by franchises, which are affiliated with any of the Named Executive Officers. See “Related

Party Transactions”. |

Outstanding Equity Awards

We do not have any plan that provided for stock options.

Pension Benefits

During our fiscal year 2010, we instituted a limited

retirement plan/death benefit whereby employees with at least thirty-five (35) years of employment with the Company receive upon their

death or retirement a one-time lump sum payment equal to the lesser of (i) 15% of their last annual Form W-2 earnings; or (ii) $10,000.

During our fiscal year 2018, we instituted a limited

retirement plan/death benefit whereby supervisors with at least twenty-five (25) years of employment with the Company receive upon their

death or retirement a one-time lump sum payment equal to $20,000.

With the exception of the above, we do not have any

other plans that provide for payments or other benefits at, following, or in connection with, retirement.

Nonqualified Deferred Compensation

We do not have any plan that provided for deferred compensation.

No Employment Agreements or Other Arrangements

The Named Executive Officers are employed at will.

Based on the Company’s philosophy that its executive compensation program should be simple and directly linked to performance, the

compensation program for the Named Executive Officers does not include any of the following pay practices:

| • | Cash payments in connection with a change in control of the Company; |

| • | Supplemental executive retirement benefits. |

PAY VERSUS PERFORMANCE

The following table sets forth information on pay

versus performance including the relationship between executive compensation actually paid. As the Company does not have an equity compensation

plan, there are no adjustments needed from the compensation in the Summary Compensation Table and compensation actually paid.

| (a) | |

(b) | |

(c) | |

(d) | |

(e) | |

(f) | |

(g) |

| Year | |

Summary

Compensation

Table Total for

PEO (1)(2) | |

Compensation

Actually Paid to

PEO (1)(2) | |

Average

Summary

Compensation

Table Total for

Non-PEO Named

Executive

Officers (1)(3) | |

Average

Compensation

Actually Paid to

Non-PEO

Named

Executive

Officers (1)(3) | |

Value of

Initial Fixed

$100

Investment

Based on

Total

Shareholder

Return ($) | |

Net Income ($) |

| 2023 | |

$ | 1,635,000 | | |

$ | 1,635,000 | | |

$ | 762,333 | | |

$ | 762,333 | | |

$ | 133.58 | | |

$ | 5,416,000 | |

| 2022 | |

| 1,808,000 | | |

| 1,808,000 | | |

| 1,021,333 | | |

| 1,021,333 | | |

| 102.83 | | |

| 9,049,000 | |

| (1) | This table does not include incidental personal benefits of a limited nature. Although the amount of such

benefits and extent to which they are related to job performance cannot be ascertained specifically, we have concluded the aggregate per

Named Executive Officer does not exceed $10,000. |

| (2) | PEO for all periods presented is James G. Flanigan. |

| (3) | Non-PEO Named Executive Officers for all periods presented are Jeffrey D. Kastner, August Bucci, and Christopher

O’Neil. |

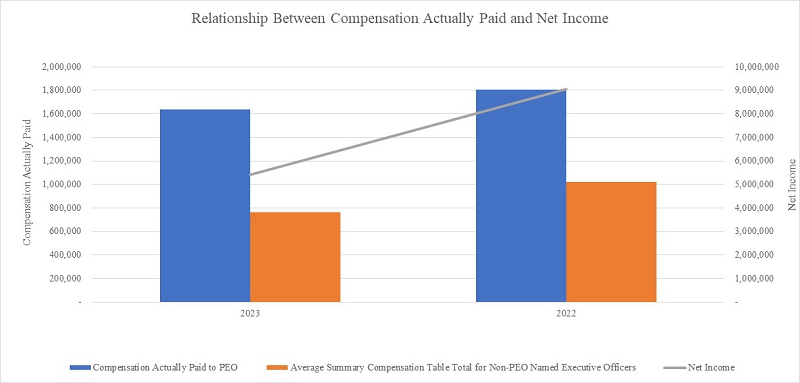

The following graphs set forth the relationships

between compensation actually paid to the PEO and the average compensation actually paid to our non-PEO NEOs as compared to the performance

metrics of total shareholder return and net income.

RELATED PARTY TRANSACTIONS

Affiliated Franchises

Coconut Grove, Florida

James G. Flanigan, our Chairman of the Board

of Directors, Chief Executive Officer and President of the Company, and Michael B. Flanigan, a member of our Board of Directors and James

G. Flanigan’s brother, are each a 35.24% owner of a company which has a franchise arrangement with us for the operation of a restaurant,

with adjacent package liquor store located in Coconut Grove, Florida. James G. Flanigan manages the day-to-day business operations of

this franchised location. During fiscal year 2023, this franchised location’s operations generated $19,745,000 in gross revenues

and paid to us $445,000 in franchise fees.

Pompano Beach, Florida

Patrick J. Flanigan, brother to both James

G. Flanigan and Michael B. Flanigan and a member of our Board of Directors, owns 100% of a company which has a franchise arrangement with

us for the operation of a combination restaurant/package liquor store located in Pompano Beach, Florida. Patrick J. Flanigan manages the

day-to-day business operations of this franchised location. During fiscal year 2023, this franchised location’s operations generated

$8,083,000 in gross revenues and paid to us $189,000 in franchise fees.

Deerfield Beach, Florida

Our officers and directors collectively own

30% of the shareholder interest of a company which has a franchise arrangement with us for the operation of a restaurant located in Deerfield

Beach, Florida. The shareholder interest of James G. Flanigan’s family represents an additional 60% of the total invested capital

in this franchised location. The Company manages the day-to-day operations of this franchised location. During fiscal year 2023 this franchised

location’s operations generated $5,291,000 in gross revenues and paid to us $159,000 in franchise fees and $40,000 in management

fees.

Fort Lauderdale, Florida

Patrick J. Flanigan is the sole general partner

and a 25% limited partner in a limited partnership which has a franchise arrangement with us for the operation of a restaurant located

in Fort Lauderdale, Florida. Patrick J. Flanigan manages the day-to-day operations of this franchised location. The Company is a 25% limited

partner in this limited partnership and officers and directors of the Company (excluding Patrick J. Flanigan) own an additional 31.9%

limited partnership interest in this franchised location. During fiscal year 2023, this franchised location’s operations generated

$4,897,000 in gross revenues and paid to us $147,000 in franchise fees.

Affiliated Limited Partnerships

Surfside, Florida

We are the sole general partner and a 46% limited

partner in this limited partnership which has owned and operated a restaurant in Surfside, Florida under our “Flanigan’s Seafood

Bar and Grill” service mark since March 6, 1998. An additional 33.3% limited partnership interest is collectively beneficially owned

by our officers and directors or their families. During fiscal year 2023, this location’s operations generated $6,008,000 in gross

revenues and we received $104,000 in distributions from this limited partnership.

Kendall, Florida

We are the sole general partner and a 41% limited

partner in this limited partnership which has owned and operated a restaurant in Kendall, Florida under our “Flanigan’s Seafood

Bar and Grill” service mark since April 4, 2000. An additional 28.3% limited partnership interest is collectively beneficially owned

by our officers and directors or their families. During fiscal year 2023, this location’s operations generated $11,751,000 in gross

revenues and we received $286,000 in distributions from this limited partnership.

West Miami, Florida

We are the sole general partner and a 27% limited

partner in this limited partnership which has owned and operated a restaurant in West Miami, Florida under our “Flanigan’s

Seafood Bar and Grill” service mark since October 11, 2001. An additional 32.7% limited partnership interest is collectively beneficially

owned by our officers and directors or their families. During fiscal year 2023, this location’s operations generated $9,526,000

in gross revenues and we received $242,000 in distributions from this limited partnership.

Wellington, Florida

We are the sole general partner and a 28% limited

partner in this limited partnership which has owned and operated a restaurant in Wellington, Florida under our “Flanigan’s

Seafood Bar and Grill” service mark since May 27, 2005. An additional 22.4% limited partnership interest is collectively beneficially

owned by our officers and directors or their families. During fiscal year 2023, this location’s operations generated $7,340,000

in gross revenues and we received $144,000 in distributions from this limited partnership.

Pinecrest, Florida

We are the sole general partner and a 45% limited

partner in this limited partnership which has owned and operated a restaurant in Pinecrest, Florida under our “Flanigan’s

Seafood Bar and Grill” service mark since August 14, 2006. An additional 20.2% limited partnership interest is collectively beneficially

owned by our officers and directors or their families. During fiscal year 2023, this location’s operations generated $9,016,000

in gross revenues and we received $269,000 in distributions from this limited partnership.

Pembroke Pines, Florida

We are the sole general partner and a 24% limited

partner in this limited partnership which has owned and operated a restaurant in Pembroke Pines, Florida under our “Flanigan’s

Seafood Bar and Grill” service mark since October 29, 2007. An additional 23.8% limited partnership interest is collectively beneficially

owned by our officers and directors or their families. During fiscal year 2023, this location’s operations generated $6,428,000

in gross revenues and we received $68,000 in distributions from this limited partnership.

Davie, Florida

We are the sole general partner and a 49% limited

partner in this limited partnership which has owned and operated a restaurant in Davie, Florida under our “Flanigan’s Seafood

Bar and Grill” service mark since July 29, 2008. An additional 12.3% limited partnership interest is collectively beneficially owned

by our officers and directors or their families. During fiscal year 2023, this location’s operations generated $7,399,000 in gross

revenues and we received $230,000 in distributions from this limited partnership.