MARKET COMMENT: S&P/ASX 200 Up 1.5% Amid High Yield, Defensives Surge

05 Marzo 2013 - 1:36AM

Dow Jones News

0006 GMT [Dow Jones] Australia's S&P/ASX 200 is up 1.5% at

5083.1 as high-yield and defensive stocks surge after Fed Vice

Chair Yellen reiterated commitment to U.S. quantitative easing

overnight. After steep declines Monday as China's share market

dived on increased curbs on property speculation, major banks are

up 2.1%-2.7%, Woolworths (WOW.AU) jumps 2.8%, CSL (CSL.AU) gains

0.3% ex-dividend and AMP (AMP.AU) surges 2.3% after trading

ex-dividend Monday. Defensive standouts include Amcor (AMC.AU), up

3.4%, while in the oil sector Woodside (WPL.AU) jumps 2.1%. BHP

(BHP.AU), Rio Tinto (RIO.AU) and Fortescue (FMG.AU) fall 0.1%-0.9%

after spot iron ore fell 1.2%. "We are still seeing strong support

on dips," says Macquarie Private Wealth investment adviser James

Rosenberg. "While there's been no significant upgrade in earnings

estimates after reporting season, the downgrades look to be behind

us, and that's giving investors a lot of confidence." He expects a

bounce in China's share market after Monday's 3.7% fall. "It was a

huge overreaction (Monday) to news that has been around for some

time." david.rogers1@wsj.com)

Contact us in Singapore. 65 64154 140; MarketTalk@dowjones.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

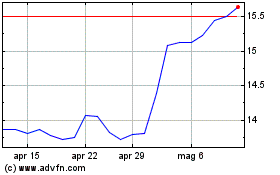

Grafico Azioni Amcor (ASX:AMC)

Storico

Da Ott 2024 a Nov 2024

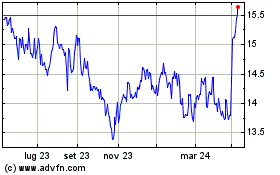

Grafico Azioni Amcor (ASX:AMC)

Storico

Da Nov 2023 a Nov 2024

Notizie in Tempo Reale relative a Amcor PLC (Borsa Australiana): 0 articoli recenti

Più Amcor Articoli Notizie