BHP Annual Profit Falls by 58% on Weaker Commodity Prices

22 Agosto 2023 - 1:17AM

Dow Jones News

By Rhiannon Hoyle

Mining giant BHP Group on Tuesday said its annual profit more

than halved versus a year earlier, when it had benefited from the

sale of its oil-and-gas business and commodity prices at or near

record highs.

BHP, the world's biggest miner by market value, reported a net

profit of $12.92 billion for its fiscal year through June, down

from a profit of $30.90 billion in the same period a year earlier.

The year-prior result included an exceptional gain of $7.1 billion,

largely because of the merger of its petroleum unit with

Australia's Woodside Energy.

Analysts expected a profit of roughly $13.30 billion, according

to a Visible Alpha consensus compiled from 15 forecasts.

Directors declared a final dividend of 80 U.S. cents a share,

taking the miner's full-year payout to $1.70 a share. Analysts

expected a total dividend around $1.72 a share.

The miner said full-year dividend was still its third-largest

ordinary dividend on record.

BHP said its underlying profit, a closely watched measure that

strips out some one-time items, totaled $13.42 billion, down from

$23.82 billion the year prior.

"Our financial results for the year were strong, underpinned by

reliable production together with capital and cost discipline as we

managed lower commodity prices and inflationary pressures," said

Chief Executive Mike Henry.

Earnings were weighed by weaker commodity prices, which fell on

concerns about economic growth in China, the largest buyer of many

metals and minerals, and the outlook for developed countries after

sharp increases in interest rates.

In China, a drawn-out real estate crunch is especially worrying

for miners, given the importance of the sector to the country's

economy and metals demand. Another batch of disappointing economic

data for July, and a policy response that has so far underwhelmed,

has prompted a number of global investment banks to lower forecasts

on China's full-year growth rate.

"In the near term, China's trajectory is contingent on the

effectiveness of recent policy measures," Henry said.

The miner was paid 12% less for its copper last fiscal year

versus the year-prior period, and 18% less for iron ore, the key

ingredient in steel.

The average price for its metallurgical coal, also used to make

steel, was down by 22% year-on-year, after surging in 2022 in big

part due to supply concerns after Russia's invasion of Ukraine

disrupted trade flows.

Its own production was mostly higher. BHP produced more copper,

iron ore, nickel and thermal coal than the year-earlier period. Its

output of steelmaking coal was flat year-on-year.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

August 21, 2023 19:02 ET (23:02 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

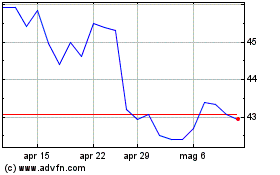

Grafico Azioni BHP (ASX:BHP)

Storico

Da Mar 2024 a Apr 2024

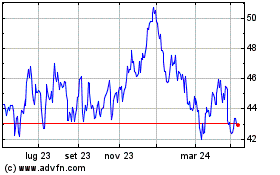

Grafico Azioni BHP (ASX:BHP)

Storico

Da Apr 2023 a Apr 2024