Is A$100 a Share Cursed? -- Market Talk

17 Agosto 2015 - 4:19AM

Dow Jones News

24:02 GMT [Dow Jones] When biopharmaceuticals company CSL

(CSL.AU) shares earlier this month topped the A$100 mark, it

generated a flurry of interest and news articles. Yet Hugh Dive,

senior portfolio manager at Aurora Funds Management, suggests there

is something of a curse about the A$100 share price, if investors

care to look at past examples of Incitec Pivot (IPL.AU) and Rio

Tinto (RIO.AU) which both in past years rose above that hurdle but

then tumbled back down. Looking at CSL and using the current broker

consensus earnings numbers for the next three years, which Dive

says look far too high, and using a terminal growth rate of 2.5%

from 2026 to infinity, he says a share price of A$100 for implies a

compound growth rate of 9.4% between 2019 to 2025. "CSL is a good

company but this level of implied growth is far ahead of both the

company forecasts and indeed their addressable market of

plasma-derived therapies." CSL shares were last at A$93.15, having

slipped 7.6% from an Aug. 4 closing high of A$100.77.

(robb.stewart@wsj.com; Twitter: @RobbMStewart)

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

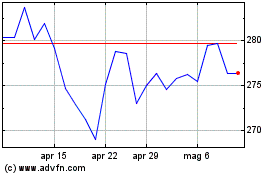

Grafico Azioni CSL (ASX:CSL)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni CSL (ASX:CSL)

Storico

Da Dic 2023 a Dic 2024

Notizie in Tempo Reale relative a CSL Limited (Borsa Australiana): 0 articoli recenti

Più CSL Ltd Articoli Notizie