CREDIT AGRICOLE SA: Indosuez Wealth Management, a subsidiary of

Crédit Agricole S.A., finalises the acquisition of Degroof

Petercam, of which it becomes majority shareholder alongside CLdN

Cobelfret, its historical shareholder

Press release

Paris, Brussels, 4 June 2024

Indosuez Wealth Management, a subsidiary

of Crédit Agricole S.A., finalises the acquisition

of Degroof Petercam, of which it becomes majority shareholder

alongside CLdN Cobelfret, its historical shareholder

The transaction, which has obtained the required

approvals from the banking and competition authorities, allows

Degroof Petercam teams to join forces with Indosuez Wealth

Management, creating a European leader in wealth management. It

strengthens Crédit Agricole's presence in Belgium and will generate

significant synergies with its various business lines.

The foundation of a European leader in

wealth management This acquisition is amongst the most

significant transactions in the industry in the past 10 years in

Europe. Indosuez Wealth Management, which has supported its clients

for more than 150 years, is now present in 16 territories, mainly

in Europe, as well as in Asia Pacific and the Middle East. With

approximately ~200 billion euros1 in client assets, nearly 1.6

billion euros1 net banking income and 4,500 employees, the new

group will form a European leader in wealth management.

An enhanced value proposition and a

continuum of services for high-net-worth clients and families,

entrepreneurs, professional investorsIndosuez Wealth

Management's clients will benefit from an enhanced value

proposition leveraging on the complementary expertise of the two

entities:

- Degroof Petercam’s advisory

services to entrepreneurs, investment advice and fund offerings in

particular ESG, and its fund servicing capabilities;

- the extensive range of services of

Indosuez Wealth Management including structured products, private

equity and real estate, as well as its financing capacity and

international network.

This value proposition and service continuum

includes Advisory, Financing, Investment Solutions, Fund servicing,

Technology and Banking Solutions as well as access to Crédit

Agricole Group's international network, expertise and financing

capabilities. The enhanced ESG offering enables clients to meet

their growing demand across all asset classes, management

approaches (advisory, discretionary) and financing.

Teams committed to working every day in

the interest of clients and society A team of 4,500

employees now embodies the Group's client, human and societal

projects. This alliance will provide each employee with new

development and career opportunities within Crédit Agricole Group,

the world's 10th largest bank with diverse expertise and a presence

in over 46 countries worldwide.

Jacques Prost, Chief Executive Officer

of the Indosuez group: ‘I am delighted to welcome Degroof

Petercam's teams and extensive expertise to our Group today. This

acquisition is a transformative and exciting project that reshapes

our scope and establishes a European leader in wealth management.

It enhances our value proposition with one of the most

comprehensive offerings in the market for all our wealthy private

clients and families, entrepreneurs and professional investors. It

allows us to generate significant synergies with the different

activities of the Crédit Agricole Group. Now that this union has

become a reality, all our teams across our regions will unite to

pool our strengths, shape this new entity and write a new chapter

in our collective history.’

Hugo Lasat, Chief Executive Officer of

Degroof Petercam:‘With the complementary expertise of the

two entities combined with the power of the network and the

financial capabilities of Indosuez Wealth Management, we will be

able to go further in supporting our clients. Indosuez will

leverage the strengths and the teams at Degroof Petercam and DPAM.

We take pride in the progress we’ve made with the support of our

historical shareholders and thanks to the commitment of our team

for which I am grateful. This alliance opens up great prospects and

opportunities for both clients and staff members.’

For Christian Cigrang, Chairman of the

Board of Directors of CLdN Cobelfret: ‘Founded in 1871 and

1875 respectively, Degroof Petercam and Indosuez share an

exceptional historical heritage and contribute to economic

prosperity in their respective markets. The integration of Degroof

Petercam with Indosuez, a subsidiary of Crédit Agricole S.A.,

brings significant growth prospects offered by a global player,

while maintaining its entrepreneurial identity and anchoring in the

markets where it operates.’

Next steps CA Indosuez now

controls 65% of the capital of Bank Degroof Petercam alongside CLdN

Cobelfret, which holds nearly 20% of the capital. CA Indosuez will

shortly submit a filing with the Belgian financial services and

markets authority (FSMA) with the intention of launching a

voluntary public takeover bid for the shares held by the minority

shareholders of Bank Degroof Petercam. A specific press release in

relation thereto is available on the website of CA Indosuez.

* * * * *

The impact on Crédit Agricole S.A. 's CET1 ratio

following the transaction will amount to approximately 30 basis

points. This transaction is expected to generate additional net

income group share after synergies of +150 to +200 million euros by

2028.

* * * * *

Press contacts Group Indosuez:

Jenny Sensiau - jenny.sensiau@ca-indosuez.com -

+33 7 86 22 15 24Arnaud Denis - a.denis@degroofpetercam.com - +32

478 99 82 37

About the Indosuez Wealth Management Group

Indosuez Wealth Management is the global wealth

management brand of the Crédit Agricole Group, the world’s 10th

largest bank by balance sheet (The Banker 2023).For more than 150

years, Indosuez Wealth Management has supported major private

clients, families, entrepreneurs and professional investors in

managing their private and professional assets. The bank offers a

tailormade approach that enables each of its clients to preserve

and develop their wealth in line with their aspirations. Its teams

offer a continuum of services and offerings including Advisory,

Financing, Investment Solutions, Fund servicing, Technology and

Banking Solutions.Indosuez Wealth Management has nearly 4,500

employees in 16 locations around the world: In Europe (Germany,

Belgium, Spain, France, Italy, Luxembourg, the Netherlands,

Portugal, Monaco and Switzerland), Asia Pacific (Hong Kong SAR, New

Caledonia and Singapore), the Middle East (Dubai, Abu Dhabi) and

Canada (representative office).With approximately €200 billion in

client assets, the Indosuez Group is one of the European leaders in

wealth management.www.ca-indosuez.com

About CLdN CobelfretCLdN

Cobelfret is a diversified consortium owned by the Cigrang family,

based mainly in Luxembourg, Singapore and London and active in

shipping, port handling, logistics, real estate and the financial

sector. www.cldn.com www.cobelfret.com

About Degroof PetercamFounded

in 1871, Degroof Petercam is a Belgian-rooted reference investment

house built on more than 150 years of integrated financial

knowledge. Private and institutional investors, as well as

corporates trust us for our strong investment convictions and for

our continuum of services in private banking, asset management,

investment banking and fund servicing.On December 31, 2023, total

assets amounted to 74.3 billion euros. More than 1,500 experts are

committed to our clients through offices in Belgium, Luxembourg,

France, Switzerland, Spain, the Netherlands, Germany, Italy, Hong

Kong and Canada.As employer and investor, we create responsible

prosperity for all by opening doors to opportunities and

accompanying its clients with expertise. Owned by CLdN Cobelfret

(20%) and Indosuez Wealth Management (65%), Degroof Petercam

benefits from the vast expertise and action scope of the

international network of Indosuez Wealth Management and the Crédit

Agricole group, the world's 10th largest

bank.www.degroofpetercam.comDegroof PetercamTrust. Knowledge.

1 Pro forma combined figures 2023

- 2024 06 04 PR Indosuez finalises the acquisition of Degroof

Petercam

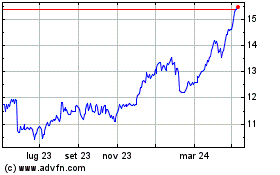

Grafico Azioni Credit Agricole (BIT:1ACA)

Storico

Da Ott 2024 a Nov 2024

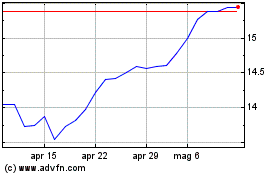

Grafico Azioni Credit Agricole (BIT:1ACA)

Storico

Da Nov 2023 a Nov 2024