Bitcoin Will Reach A New All-Time High This Week, Matrixport Head Of Research Says

04 Marzo 2024 - 4:00PM

NEWSBTC

Bitcoin saw an incredible month in February, adding over $18,000 to

its value in a single month. This outperformance has now carried on

into the month of March, which has seen the Bitcoin price cross the

$65,000 mark for the first time since 2021. As BTC trades in the

green, expectations remain that the performance will continue.

Bitcoin Shows Strong Fundamentals In a new report shared with

NewsBTC via email, the head of research at Matrixport, Markus

Thielen, put forward that the Bitcoin price was headed for another

all-time high this week. This report highlighted the BTC price

performance over the last year, as well as in February, in which

the price rose a total of $18,615 in a single month. Additionally,

the analyst pointed out that despite the slowdown in Bitcoin Spot

ETFs that were seen toward the end of February, it hasn’t affected

BTC’s bullishness by much. Related Reading: $906 Million Worth Of

Ethereum Leave Exchanges Last Week – ETH To $4,000? The crypto

analyst explains that institutional buying is not just happening in

the United States either. There has also been a large uptick in

buying volume across other countries, including the likes of Korea

where volumes have reached near $8 billion for five consecutive

days. Interestingly, the buying is not just limited to Bitcoin

either as there are also inflows into altcoins and meme coins.

Furthermore, the anticipation of Hong Kong launching its own Spot

Bitcoin ETF, as well as BlackRock taking the plunge and launching a

Bitcoin ETF in Brazil, also proves that there is a lot of demand.

So despite the decreased inflows that were seen last week, Thielen

explains that if Grayscale’s outflows keep dropping, reaching

between $0-$100 million, then he expects further rally for the

Bitcoin price. Thielen also pointed out that the Untied States debt

is growing exponentially and Bitcoin now offers better macro upside

compared to gold. This plays into the bullish potential of BTC

going forth. “ Previously we have shown that 30-40% of the Bitcoin

ETF inflows appear to come out of Gold ETFs and with $80bn of

assets-under-management, those re-allocation flows can continue. We

have also shown numerous times that Bitcoin has become a better

macro asset than Gold as Bitcoin’s reaction function towards

changes in interest rate expectations, announcement of

wars/conflicts, etc., has become superior (we backtested this).”

BTC Price Headed For New All-Time High Among the factors driving

the Bitcoin price identified by the analyst was a significant

decrease in the amount of over-the-counter (OTC) BTC available for

large institutions. Spot Bitcoin issuers such as BlackRock tend to

utilize these OTC desks for purchases in order to reduce the impact

of their buying on the price. However, these OTC sellers have

reported that their balances have dropped 80% in the last year from

around 10,000 BTC to less than 2,000 BTC. Related Reading: Crypto

Exchange Says Cardano Price Can Reach $165, Here’s When Thielen

also points out that the same trend is seen in exchanges where

balances have declined across trading platforms such as Binance and

Coinbase. Both of these, which are currently the Bitcoin trading

powerhouses of the world, saw a total of 48,000 BTC leave their

balances in a month. Given these developments, the crypto analyst

explains that investors are not price-sensitive at this time. So,

the expectation for this week is that Bitcoin makes a new all-time

high. If this happens, then the market could see BTC tap $70,000

this week. BTC price surpasses $65,000 | Source: BTCUSD on

Tradingview.com Featured image from Capital.com, chart from

Tradingview.com

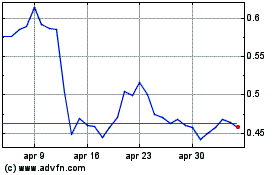

Grafico Azioni Cardano (COIN:ADAUSD)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Cardano (COIN:ADAUSD)

Storico

Da Apr 2023 a Apr 2024