Here’s Why Bitcoin Price Crashed Below $54,000

07 Settembre 2024 - 10:30PM

NEWSBTC

The Bitcoin price dropped below $54,000 on September 6 as the

flagship crypto experienced a massive wave of sell-offs from

traders. This price decline was sparked by developments on the

macroeconomic side, which painted a bearish outlook for

Bitcoin. Related Reading: Cardano Bull Sees ADA Jumping

1,000% In An ‘Insane’ Rally Bitcoin Slides Following Weak Job

Report Bitcoin’s price retreated following a weak August job

report. Data from the US Bureau of Labor showed that the

unemployment rate fell to 4.2% while the labor market added 142,000

nonfarm payroll jobs. While the unemployment rate was in line with

expectations, the job additions were lower than the expected

164,000, initially estimated by market experts. This further

casts doubt on Bitcoin’s trajectory, considering how fragile the US

economy looks at the moment. This poses a threat to risk assets

like the flagship crypto. The bearish outlook for Bitcoin was

further heightened by the revisions to the July and June job

reports, which showed that the US added fewer jobs than was

initially reported in those months. Earlier, Bitcoin had

already had an unpleasant start to September, which is historically

very bearish for the leading crypto. NewsBTC reported that Bitcoin

had suffered a price crash earlier in the week due to the markets

still feeling the effects of the Yen carry trade and following

significant volatility in the US stock market, with over $1.05

million being wiped out on September 3. Macroeconomic factors

remain primarily responsible for Bitcoin’s recent bearish price

action and the broader crypto market, especially with a rate cut

from the US Federal Reserve still in the balance. It is worth

mentioning that the July job reports (the lowest job additions over

the last two years) and the Yen carry trade were responsible for

the August 5 market crash, which caused Bitcoin to drop below

$50,000. Interestingly, Arthur Hayes, the co-founder of the

BitMEX crypto exchange, stated that he expects Bitcoin to drop

below $50,000 this weekend, revealing that he had opened a short

position. A Rate Cut Looking More Unlikely For a while

now, the crypto market has been anticipating that the Fed will cut

interest rates at its next FOMC meeting, which will be held between

September 17 and 18. Bernstein analysts predicted that this move

would provide some form of bullish momentum for Bitcoin’s price.

However, a rate cut, especially by 50 basis points (bps), is now

unlikely following the release of the job data. Crypto commentator

The Kobeissi Letter highlighted in an X (formerly Twitter) post

that the odds for a 50bps have dropped to 23% on the prediction

markets. The Fed might no longer be in a hurry to cut rates since

the situation in the labor market isn’t as bad as it was initially

feared following the release of the July jobs report. Related

Reading: Aptos (APT) Dips 15% As New Innovations Fail To Spark

Momentum Whatever happens, crypto analysts like CryptoCon are

confident that the worst is almost over for Bitcoin. CryptoCon

recently noted that Bitcoin was mirroring its price action from the

2016 market cycle and suggested that the flagship crypto was

gearing up for its next leg up, which would take it to a new

all-time high (ATH). At the time of writing, Bitcoin is

trading at around $54,150, down almost 4% in the last 24 hours,

according to data from CoinMarketCap. Featured image from

EastMojo, chart from TradingView

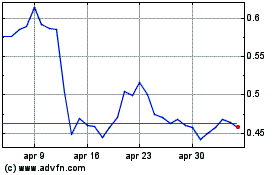

Grafico Azioni Cardano (COIN:ADAUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Cardano (COIN:ADAUSD)

Storico

Da Dic 2023 a Dic 2024