Will Bitcoin Tank If A Recession Hits, IMF Issues Warning

13 Ottobre 2022 - 3:29AM

NEWSBTC

The crypto market has been showing signs of decline recently as

prices of Bitcoin and other crypto assets keep dropping. With the

hikes in interest rates from most of the global central banks, the

global economy is getting tighter. The impact on both the crypto

and traditional markets is significantly devastating. Following the

events, the International Monetary Fund (IMF) warned about economic

decline. Furthermore, it speaks of a possible worse global

recession in 2023. This means that financial markets will go

risk-off, creating extreme fear for the markets. Related Reading:

Here’s Why SUSHI Is Down More Than 10% In The Last 24 Hours Hence,

there could be a drastic decline in the prices of crypto assets and

conventional stocks. BTC Price Correlates With Stocks? The price of

Bitcoin has depicted a strong correlation with equity assets for

more than a year. This is seen with most of the trends for BTC and

some stocks in most cases. Several factors and conditions have been

highlighted as explanations for the correlation. One of the stocks

with a solid link to Bitcoin is S&P 500. Bitcoin witnessed a

price drop during the global pandemic recession in 2020. This was

the same story for equity stocks. But as the economic conditions

gradually progressed positively, the system transited accordingly.

As a result, the crypto and equity markets sold off in December

2021 and May 2022. Most of the correlated trends could indicate the

performance of markets for securities once they hit a certain

liquidity threshold. But, conversely, it could suggest that

institutional fund has reached a sizable portion of capital

inflows. The price of Bitcoin could be tossed around firmly and

fiercely despite the causative factors of a declining economy.

However, the primary crypto asset could meet a drastic fall once

there’s a global recession. This will propel investors to pull out

their funds through massive sell-offs. BTC Could Offer Long-Term

Bullish Overview The price of Bitcoin will boost in a situation

with favorable intervention. For example, the US Federal Reserve

and other central banks globally could take the IMF warnings and

cut down rates to curb recession. Such a situation will create a

price rally for Bitcoin and other crypto assets. Also, equity

stocks will strive positively. Related Reading: Bitcoin Mining

Difficulty Adjustment May Force Miners To Dump Their BTC However,

there could still be hope even without the intervention of the

central banks. This means that a recession will emerge and pull

down the crypto market, with the price of BTC dropping. Such lower

prices could become an attractive entry point for some investors of

the crypto assets. Recall that the 2008 recession brought no

prominence to Bitcoin. But following its collapse in March 2020,

the primary cryptocurrency got a massive bull market that spiked

its dominance in the crypto market. From then, Bitcoin rallied far

above the equities and has been sustaining its stance. With the

overall outplay of events, Bitcoin depicts a bullish outlook on a

long-term basis. At press time, the BTC price is around $19,137,

indicating a drop over the past 24 hours. Featured image from

Pixabay and charts from TradingView.com

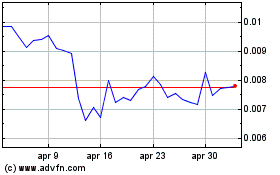

Grafico Azioni Amp (COIN:AMPUSD)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Amp (COIN:AMPUSD)

Storico

Da Apr 2023 a Apr 2024

Notizie in Tempo Reale relative a Amp (Criptovaluta): 0 articoli recenti

Più Amp Articoli Notizie