Injective (INJ) Bounces Back: Investor Momentum Sparks 12% Rally

09 Agosto 2024 - 2:30PM

NEWSBTC

Injective starts the day with a bang as INJ, the platform’s native

token gained over 12% in the past 24 hours. This can be attributed

to the market’s surprising rally, complemented by a market

cap that is up by over 6% after its dip earlier this week.

Related Reading: Dogecoin Price Looking Stronger – ‘Expect Massive

Gains’, Analyst Predicts The rally is also due to Injective’s

recent achievements that spur some buzz within and outside their

community. Investors might find some value on INJ as it continues

to grow and innovate. Utila Announces Support For Injective

Ecosystem Today, the institutional wallet and blockchain

infrastructure-focused Utila announced its support for the

Injective ecosystem. The move came after Utila acknowledged several

features that make it attractive for itself and for organizations

that use the platform. 🚀 Exciting News: Utila Now Supports

Injective 🌐⛓️ We’re thrilled to announce that Utila now supports

@injective , the blockchain built for finance, further expanding

your digital asset management capabilities. Renowned for its

plug-and-play infrastructure, Injective enables…

pic.twitter.com/Z64aGjIOmM — Utila (@utila_io) August 8, 2024

“Renowned for its plug-and-play infrastructure, Injective enables

the rapid deployment of sophisticated functionalities into

applications, encompassing decentralized trading, lending,

real-world assets (RWAs), and more,” stated Utila in their

announcement post on X. This will grow the Injective user

base to not only include retail investors and crypto enthusiasts.

It will help the platform grow more maturely, getting

institutional-level attention through the use of its robust network

while also benefiting from Utila’s strong security as well.

With interest in crypto increasing in traditional finance, the

growing convenience of onboarding crypto into their portfolios will

make a huge difference. This has occurred already, with more and

more crypto-based exchange-traded funds (ETFs) being announced

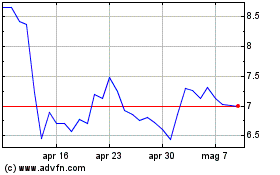

since then. INJ Trading At A Trendline Pointing Upward Looking at

INJ’s chart, the token is currently situated on its late-November

2023 level that preceded the December rally occurring that same

year. If it were to happen again, investors might see huge

gains in the long term as the market warms up for more

action. However, INJ bulls are facing slight resistance on

$18.02 as the candle flips red. This difficulty might slow the

bullish momentum, lowering volatility as the token floats between

$18.02 and $21.16. A slight pause might transpire in the short term

as bulls take advantage of the low volatility to gain momentum once

more. Related Reading: Polkadot Developments Show Strength,

Despite Coin’s 18% Loss As recession fears die down along the way,

bullishness in traditional finance might continue with major

indices like the S&P 500 and the Dow Jones spotted making gains

which has a huge upside probability in the long run. But analysts

like 8th Wonder believes that the current rally is a short squeeze

as the current movement is a classic squeeze: a sharp and short

uptick in price before being followed by a free fall. If the price

of major cryptocurrencies are in fact in a short squeeze, investors

will inevitably feel pain in the long run. Featured image

from Facts.net, chart from TradingView

Grafico Azioni Polkadot (COIN:DOTUSD)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Polkadot (COIN:DOTUSD)

Storico

Da Gen 2024 a Gen 2025