Bitcoin Hits $76,000 All-Time High As Market Reacts To Fed’s Interest Rate Cuts

07 Novembre 2024 - 11:21PM

NEWSBTC

Bitcoin (BTC), the leading cryptocurrency by market capitalization,

surged to a new all-time high of $76,800 buoyed by the recent US

presidential election which saw Donald Trump secure another term in

the White House and a more favorable monetary policy from the US

Federal Reserve (Fed). Fed’s Second Consecutive Rate Cut On

Thursday, the Federal Reserve announced its decision to cut its

benchmark overnight lending rate by 25 basis points to a target

range of 4.50%-4.75%, adding to the bullish sentiment surrounding

crypto prices. This marks the second consecutive rate cut,

following a half-percentage point reduction in September. The

unanimous vote at this meeting, which included participation from

Governor Michelle Bowman, reflects a shift in the Fed’s approach to

balancing inflation control with labor market support. Related

Reading: CNBC Projects Bitcoin Could Hit $100,000 Before

Presidential Inauguration – Details In its post-meeting statement,

the Federal Open Market Committee (FOMC) noted a revised assessment

of economic risks, indicating that the outlook for achieving

employment and inflation goals is now seen as balanced, a departure

from the previous month’s more optimistic stance. Crypto analyst

Doctor Profit commented on the recent surge in both stock and

crypto markets, suggesting that the price increases were in

anticipation of the Fed’s rate cut. He predicts that continued rate

cuts in the coming quarters could further drive up prices for both

stocks and cryptocurrencies. Positive Trends For Bitcoin And

Ethereum Post-Election In an exclusive interview with NewsBTC,

Nansen’s Principal Research Analyst, Aurelie Barthere, highlighted

that Bitcoin rise above its previous all-time high, coupled with

high trading volumes, signals a strong positive momentum in the

market. The analyst noted a period of “de-risking” in the

run-up to the election, likely influenced by unfavorable polls for

Trump, but observed a subsequent rush to “re-risk” as confidence

returned following the election result, further evidenced by the

rise in prices. Related Reading: Solana Breaks Above Key Resistance

– Top Analyst Sets $300 Target Barthere also pointed out that the

Republican victory in the House of Representatives could further

amplify this rally. However, she cautioned that profit-taking may

occur in the coming weeks as new policies are tested, particularly

regarding the potential political pressure on the US SEC chair to

step down. The analyst pointed out that Ethereum is also gaining

traction as expectations rise for a resurgence in decentralized

finance (DeFi). Barthere noted an interesting uptick in

the ETH/BTC price ratio, accompanied by significant net inflows

into Ethereum exchange-traded funds (ETFs), totaling $52 million on

the day of the election results. The analyst suggests that

these continued inflows into the recently approved ETF market are

seen as indicative of broader retail interest in the second largest

cryptocurrency, which she ultimately believes has yet to see

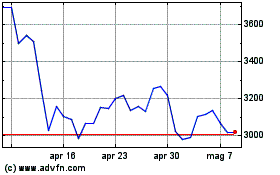

significant adoption. At the time of writing, Bitcoin was trading

at $76,629, up nearly 10% in the seven-day time frame. Similarly,

ETH has also seen significant gains, rising 14% in the same period

to reach a current price of $2,885. Featured image from DALL-E,

chart from TradingView.com

Grafico Azioni Ethereum (COIN:ETHUSD)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Ethereum (COIN:ETHUSD)

Storico

Da Gen 2024 a Gen 2025