Market ‘Pricing In A Higher Fair Value’ For Bitcoin As Price Discovery Continues

13 Novembre 2024 - 7:30AM

NEWSBTC

Bitcoin (BTC) has performed remarkably over the past week, surging

30% since the November 5 US election. The flagship crypto surpassed

its March all-time high (ATH), recording a new high nearly every

day for the last seven days. Bitfinex analysts noted that the

market remains “relatively stable” despite increased speculative

activity. Related Reading: Bitcoin Closing In On $80,000 For

Record-Breaking Run After Trump Win Bitcoin ‘Fair Value’ Priced In

At Higher Levels Following Donald Trump’s victory last Tuesday, the

crypto market has seen a massive rally, surging to a market

capitalization of $3.05 trillion. Bitcoin has led the post-election

bullish run with a 30% price increase, nearing the $90,000 mark

earlier today. According to Bitfinex Alpha report, the rally

“highlights the positive reaction to the election outcome, with

investors positioning themselves for potential economic stimulus

and regulatory shifts.” During the March highs, BTC’s realized

profit volume reached its peak of $3.1 billion. Since then,

realized profit volumes have gradually decreased, “reaching an

equilibrium.” As the report noted, there’s been a reset in supply

and demand forces, which indicates, alongside the recent price

surge, that “the market is now pricing in a higher ‘fair value’ for

Bitcoin.” At the same time, the cryptocurrency continues its price

discovery. Moreover, profit-taking above $70,000 has been

significantly smaller than the past instances when Bitcoin traded

above this range, despite a structural increase in profit-taking.

Bitfinex analysts consider this to signal the “entry of a new wave

of demand into the market,” backed up by Spot Bitcoin

exchange-traded funds (ETFs) buying post-elections. Additionally,

it suggests that fresh investor interest “could drive further

upward momentum in the near term.” BTC Enters ‘A New Phase’ The

report highlighted record-breaking BTC ETFs’ inflows, around $2.28

billion in three days. This performance represented a significant

increase from the pre-election de-risking, which saw the

crypto-based investment products record their second-largest

single-day outflows. According to CoinShares data, Bitcoin ETFs

closed the US election week with $1.8 billion in inflows and

started this week with $1.1 billion in positive net flow. This

performance displays a resurgence in demand for the flagship crypto

as the market adjusts to BTC’s new price levels. Bitfinex analysts

explained that from March to August, there was significant supply

and insufficient sustained buying pressure to absorb it. The recent

demand surge suggests a notable shift as buying interest is

“absorbing selling pressure at all-time highs and stabilizing

market dynamics: Now we appear to be entering into a new phase

where the volume of profit-taking when BTC hits an all-time high is

notably lower, given the amount of fresh demand entering the market

post-election. This demand is helping to absorb the minor selling

pressure still present, suggesting a healthier market environment

and potential for further upward movement. Related Reading: Solana

(SOL) Records 3-Year High As Price Hits $220, Is $260 Next?

Meanwhile, Open Interest (OI) in Bitcoin futures and perpetual

contracts reached ATH, hitting $45.43 billion. The report explains

that this signals an increase in speculative activity but details

that the market remains “relatively stable” since OI and BTC prices

“are in equilibrium at elevated levels.” Ultimately, Bitfinex

anticipates some consolidation soon, with a potential pullback to

$77,000. A correction toward this level would close BTC’s CME gap

and strengthen Bitcoin’s position to climb even higher levels. As

of this writing, Bitcoin is trading at $86,225, a 5% increase in

the daily timeframe. Featured Image from Unsplash.com, Chart from

TradingView.com

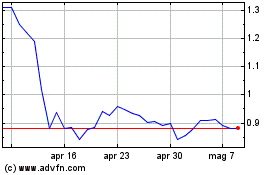

Grafico Azioni Flow (COIN:FLOWUSD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Flow (COIN:FLOWUSD)

Storico

Da Nov 2023 a Nov 2024