Square’s Cash App Bitcoin Revenue Decreased 33% In Q3

05 Novembre 2021 - 7:52AM

NEWSBTC

The American-based payment company Square Inc. reported a drop in

Bitcoin revenue month over month from its Cash App during the third

quarter of 2021, the total amount being $1.82, overall, 11% up from

last year. Square has found profit in midst of the pandemic as many

users grew to need e-commerce services. The number of processed

transactions on the app during the third quarter went up 27% with a

total amount of $3.7 billion. The company is led by Jack Dorsey,

who also runs Twitter and is a big BTC enthusiast, currently aiming

to invest in the future of decentralization and new economic

systems. Square’s third quarter of 2021 had total net revenue of

$3.84 billion, 27% up from last year; $2.03 billion excluding BTC.

Its gross profit went up 43% year over year with $1.13 billion. The

revenue from transactions was $1.30 billion, up 40% since 2020.

However, bitcoin revenue and gross profit dropped compared to the

second quarter. The company stated the decrease is due to the

“relative stability in the price of bitcoin”. In the third quarter

of 2021, we recognized a loss of $7 million driven by the

adjustment to the revaluation of equity investments as well as a $6

million bitcoin impairment. Bloomberg reported what Chief Financial

Officer Amrita Ahuja at Square shared with them: Bitcoin

transactions through Cash App have grown tremendously over the past

two years, but Bitcoin revenue can be a deceiving metric. Square

reports all Bitcoin sales as revenue, which is why that number can

look very large and is dependent on things like price volatility.

Bitcoin gross profit, though, represents the money Square collects

via fees from Bitcoin transactions, and is a better reflection of

that part of Square’s business. Related Reading | Square’s

Cash App Reports $2.7B In Quarterly Bitcoin Revenue, A 200% Jump

After the Q3 earnings letter’s release, the company’s dropped 4.9%

in post-market trading. The Focus Is On Bitcoin (And International

Waters) Square’s earnings letter highlighted their agreement to

acquire the Afterpay platform “with more than 16 million consumers

and approximately 100,000 merchants as of June 2021.” Through this

transaction, we plan to unite two complementary businesses with a

shared focus on economic empowerment and financial inclusion. We

believe the combination will more deeply connect our Seller and

Cash App ecosystems, accelerate our strategic priorities, and allow

us to deliver even more compelling products and services for

consumers and merchants. The report also sheds light on other

projects and partnerships, such as the Cash App’s new offer to

teenagers, an important expansion of its demographics, and the SoFi

Stadium partnership. We believe our partnership with SoFi Stadium

serves as a testament to how we are now equipped to enable unique

commerce experiences and support the needs of complex multi-purpose

venue sellers. The App is currently focusing on expanding and

offering accessible and flexible commerce products to all. Results

show “an increased adoption of contactless payment options due to

the pandemic.” The company explained their focus remains on their

“international strategy of achieving product parity globally,

investing further into brand awareness, and launching in new

markets”. Square stated they are focusing on BTC rather than

bringing other cryptocurrencies into the Cash App. Earlier, Dorsey

had tweeted about Square’s intention in building an

energy-efficient and more accessible BTC mining system. “Square is

considering building a Bitcoin mining system based on custom

silicon and open source for individuals and businesses worldwide,”

Related Reading | Jack Dorsey: Square Could Build Bitcoin

Mining System

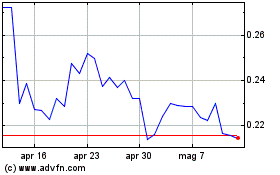

Grafico Azioni ICON (COIN:ICXUSD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni ICON (COIN:ICXUSD)

Storico

Da Nov 2023 a Nov 2024

Notizie in Tempo Reale relative a ICON (Criptovaluta): 0 articoli recenti

Più ICON Articoli Notizie