Bitcoin Price Could Peak In 200 Days, Before US Recession In Mid-2025, Report Says

14 Novembre 2024 - 3:30AM

NEWSBTC

The current Bitcoin (BTC) rally could extend until mid-2025, with a

potential price peak before a US recession. Bitcoin Could Peak In

Mid-2025 Before US Recession A recent Copper Research report, a

recent crypto research firm, posits that the leading

cryptocurrency by market cap could extend its bullish momentum

until mid-2025. Related Reading: Bitcoin Data Reveals Bulls

Are Growing But Still Behind March 2024 Peak – Details As of

November 13, Bitcoin is on day 555 of its current market cycle, and

a price peak for the digital asset could arrive within the next 200

days. Notably, this peak may coincide with a potential US recession

forecasted for mid-2025. According to the report, Bitcoin’s market

cycles average 756 days. The starting point of these cycles is when

the annual average growth of Bitcoin’s market capitalization turns

positive, while the endpoint is when it hits a price peak. The

report marks the beginning of the current market cycle around

mid-2023, just before asset manager BlackRock filed for a BTC

exchange-traded fund (ETF). Should Bitcoin stay true to its

historical price patterns, the digital asset can hit its price peak

for this cycle sometime around mid-2025. The report cites estimates

by JPMorgan about the likelihood of a US recession in mid-2025. As

a result, BTC’s price peak might align with a potential US economic

downturn. Based on data from Treasury spreads, JPMorgan gives a 45%

chance of a potential US recession by mid-2025. The report

further highlights the gap between BTC’s price top and realized

volatility. For the uninitiated, realized volatility measures BTC’s

price fluctuations over a specific period, showing the standard

deviation of the asset’s returns from the market’s mean return.

BTC’s realized volatility currently stands at around 50%,

indicating that its volatility is only halfway to previous bull

market peaks. Another bullish technical indicator for the BTC price

trajectory is its filtered relative strength index (RSI). The

report reads: Currently, the RSI sits at 60 – well below previous

bull market highs – indicating considerable room for Bitcoin to

continue building momentum into the new year. BTC Could Rise

Further, But Caution Is Necessary The digital assets market has

been on a strong upward trend since pro-crypto Donald Trump’s

victory in the 2024 US presidential election. Related

Reading: Bitcoin ETFs See Historic Surge – Institutions Go Bullish

On BTC With $1.38 Billion Record Inflows Notably, the emerging

industry has witnessed its total market cap surge beyond $3

trillion for the first time since November 2021. The rise in total

crypto market cap – largely driven by BTC – is not surprising since

the Trump administration is speculated to establish a strategic

Bitcoin reserve akin to that of El Salvador under Nayib Bukele.

Bitcoin’s unprecedented price action has propelled the digital

asset’s total market cap beyond that of silver, solidifying it as

the 8th largest global asset by market cap in existence. With this

in mind, it will be interesting to see how BTC dominance (BTC.D)

behaves in the coming weeks, especially after facing rejection just

below the $90,000 level. Currently hovering slightly above 60%, a

fall in BTC.D could signal a capital rotation from BTC into

altcoins, potentially benefiting smaller-cap digital assets.

BTC trades at $87,767 at press time, up 1.1% in the past 24 hours.

The asset’s total market cap sits at $1.738 trillion. Featured

image from Unsplash, Chart from TradingView.com

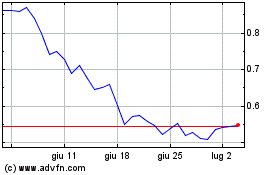

Grafico Azioni Mina (COIN:MINAUSD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Mina (COIN:MINAUSD)

Storico

Da Nov 2023 a Nov 2024