Survey Finds Almost 70% Of Ethereum Institutional Investors Engaged In ETH Staking

19 Ottobre 2024 - 3:00AM

NEWSBTC

Almost 70% of institutional investors in Ethereum (ETH) are

participating in ETH staking, with 60.6% of them using third-party

staking platforms. Ethereum Staking Landscape At A Glance According

to a report by Blockworks Research, 69.2% of institutional

investors holding Ethereum are engaged in staking the platform’s

native ETH token. Of these, 78.8% are investment firms and asset

managers. Related Reading: Ethereum Inflation Surge Casts Doubt On

“Ultrasound Money” Claim: Report Notably, slightly more than one

out of five institutional investors – or 22.6% – of the respondents

said that ETH or an ETH-based liquid staking token (LST)

constitutes more than 60% of their total portfolio allocation. The

report notes a seismic transformation in the Ethereum staking

landscape since the network transitioned from a proof-of-work (PoW)

to proof-of-stake (PoS) consensus mechanism during the Merge

upgrade. At present, there are close to 1.1 million on-chain

validators staking 34.8 million ETH on the network. Following the

Merge, Ethereum network participants were allowed to withdraw their

ETH only after the Shapella upgrade in April 2023. After the

initial phase of ETH withdrawals, the network has seen steady

inflows, indicating strong demand for ETH staking. At present,

28.9% of the total ETH supply is staked, making it the network with

the highest dollar value of staked assets, valued at over $115

billion. It’s worth noting that the annualized yield from staking

ETH is around 3%. As more ETH is staked, the yield decreases

proportionally. However, network validators can also earn

additional ETH through priority transaction fees during periods of

high network activity. Third-Party Staking Overshadows Solo Staking

Anyone can participate in ETH staking, either as a solo staker or

by delegating their ETH to a third-party staking platform. While

solo staking gives the staker full control over their ETH, it comes

with a high entry barrier of staking at least 32 ETH – worth more

than $83,000 at current market price of $2,616. Conversely, holders

can stake with as little as 0.1 ETH through third-party stakers but

must give up on some degree of control over their assets. Recently,

Ethereum co-founder Vitalik Buterin stressed the need to lower

entry requirements for ETH solo stakers to ensure greater network

decentralization. Currently, about 18.7% of stakers are solo

stakers. However, the trend shows that solo staking is losing

popularity due to the high entry threshold and the inefficiency of

locked capital. The report explains: Once locked in staking, ETH

can no longer be used for other financial activities throughout the

DeFi ecosystem. This means that one can no longer provide liquidity

to a variety of DeFi primitives, or collateralize one’s ETH to take

out loans against it. This presents an opportunity cost for solo

stakers, who must also account for the dynamic network reward rates

of staked ETH to ensure they are maximizing their risk-adjusted

yield potential. As a result, third-party staking solutions are

becoming more popular among ETH stakers. However, such platforms –

dominated by centralized exchanges and liquid staking protocols –

raise concerns about network centralization. Close to 48.6% of ETH

stakers leveraging third-party staking platforms are using just one

integrated platform such as Coinbase, Binance, Kiln, and

others. The report highlights key factors driving

institutional investors to use third-party platforms, including

platform reputation, supported networks, pricing, ease of

onboarding, competitive costs, and platform expertise. Related

Reading: Bitwise CIO Calls Ethereum The ‘Microsoft Of Blockchains’,

Can ETH Make A Comeback? Although the Ethereum staking ecosystem is

evolving, this growth has not yet been reflected in ETH’s price.

ETH has significantly underperformed against BTC for an extended

period, only recently gaining traction after the US Federal

Reserve’s (Fed) decision to cut interest rates. Nonetheless, some

crypto research firms remain optimistic about ETH’s potential

comeback against BTC later this year. As of press time, ETH is

trading at $2,616, up 0.8% in the past 24 hours. Featured image

from Unsplash, Charts from Blockworks Research and Tradingview.com

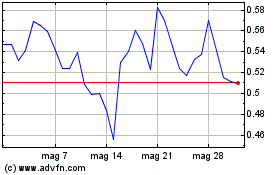

Grafico Azioni Sei (COIN:SEIUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Sei (COIN:SEIUSD)

Storico

Da Dic 2023 a Dic 2024